What Are Medicare Supplement Plans

While Original Medicare covers many of the most basic health needs that you are likely to encounter during your retirement years, the coverage provided by Medicare Part A and Part B are far from comprehensive. In fact, some of the most common health needs encountered by older Americans including vision, dental, and hearing care are not covered by Original Medicare.

Medicare Supplement plans are sold by private insurance companies as an optional add-on to Original Medicare.

These plans are particularly popular among Medicare enrollees who desire assistance in covering costs not covered by Original Medicare. These costs include things such as deductibles, coinsurance, and copays.

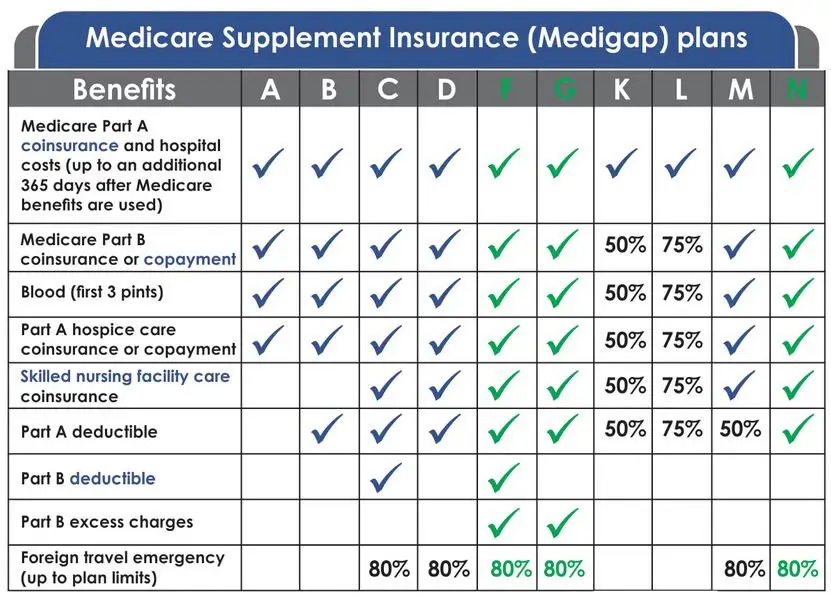

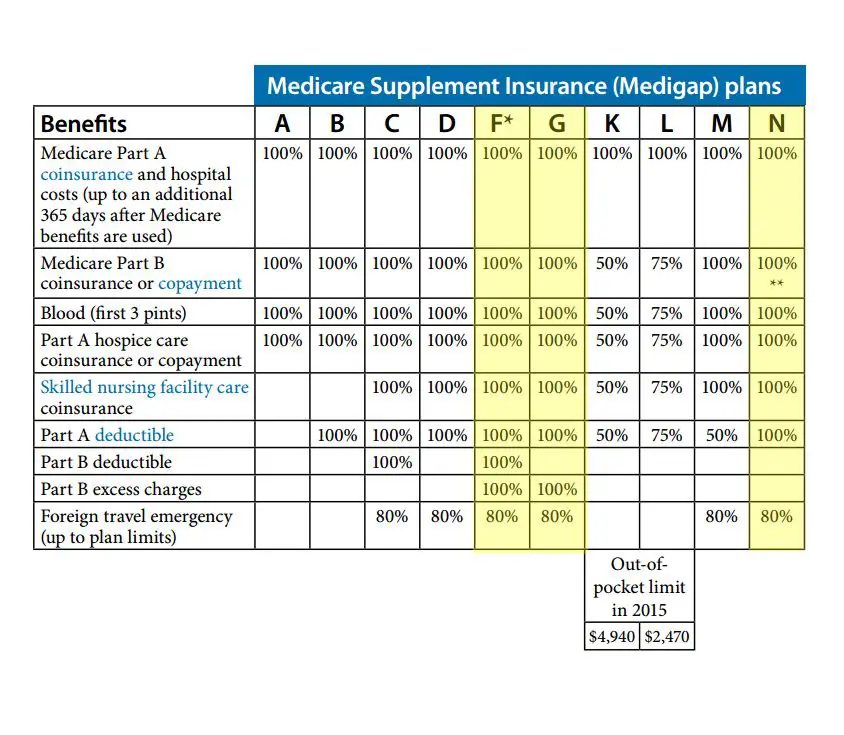

In 2021, there are a total of 10 Medicare Supplement plans available on the market in most states, all of which are designated by lettered names ranging from A to N.

You may not be able to buy these plans F and C if you qualified for Medicare on or after January 1, 2020. If you already have one of these plans, you wont have to give it up.

While the costs associated with these plans can vary from carrier to carrier, the benefits provided under each plan of the same type are standardized by the federal government. This means that if you and your spouse each enrolled in Medicare Supplement Plan B coverage under different insurance companies, you may pay different premiums, but your coverage will be identical.

What Is The Difference Between A Medicare Supplement Plan And Medicare Advantage

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

A Medicare Supplement plan cannot be used to cover costs from an Advantage plan in fact, its illegal for anyone to try to sell you a Medicare Supplement policy while you’re enrolled in an Advantage plan unless you’re switching back to Original Medicare. If youre unhappy with your Advantage plan and switch back to a Medicare Original Plan , you then become eligible for Medicare Supplement insurance.

How Medicare Works With Tricare

TRICARE For Life is TRICAREs optional health plan that is designed for military members and retirees who are also Medicare beneficiaries.

In the U.S. and U.S. territories, Medicare serves as the primary coverage for people enrolled in both programs, and TRICARE offers secondary coverage.

This means that Medicare will receive your medical bill first and pay its share of qualified medical costs before forwarding the remaining charges to TRICARE. TRICARE then pays the remainder of covered services. In some cases, you may be left with no out-of-pocket expenses for qualified care.

If you receive care in locations outside of the U.S. and U.S. territories, TRICARE becomes the primary payer, and Medicare offers secondary coverage. The process outlined above then works in reverse order, with Medicare covering any qualified costs after TRICARE has paid its share.

In all cases, TRICARE acts as the primary payer for any services that Medicare does not cover, as long as TRICARE provides coverage for that service.

Under TRICARE For Life, you may receive care from each of the following health care providers:

You May Like: What’s The Eligibility For Medicare

What Are The Differences Between Medicare Supplement Plan N Vs Plan G

Medicare SupplementPlan G offers more protection than Plan N. There are two areas that Plan Gcovers, that Plan N doesnt.

Plan N doesntcover:

- Excess Charges: This an additional cost that some providerscharge. Most healthcare providers that accept Medicare also accept Medicareassignment, which is the cost that Medicare states theyll pay for a givenservice. If the provider wants to be paid more, they can bill you for excesscharges, which can only be up to an additional 15% of the original cost.

- Copayments: With Plan N, youll beresponsible for copays of up to $20 for some office visits, or up to $50 if yougo to the emergency room but arent admitted as an inpatient.

In addition to thedifferences in coverage between Plan N and Plan G, the cost of the plans tendsto vary as well. Premiums for each plan can vary by the carrier that offers it,but Plan G is typically more expensive than Plan N because it offers a higherlevel of coverage. However, while Plan Gusually has higher premiums, it could save you money in the long run. Forinstance, if you go to the emergency room a few times throughout the year, orif you need to visit your doctors office for treatment regularly, your out-of-pocketcosts with Plan N could easily add up and cost you more than if you hadselected Plan G.

Silverscript Medicare Prescription Drug Plans

There are three different plans available with SilverScript. The Choice, the Plus plan, and the SmartRx plan.

All policies are a great option, depending on the medications you take, one could be more beneficial to you than the other.

For example, someone with a few generics would find the Plus plan to be more insurance than necessary.

On the contrary, a person with many brand name drugs could find the Plus plan is more suitable than the Choice policy.

SilverScript Network Pharmacies

The preferred pharmacies with SiverScript vary depending on which policy you have. For those with the Choice plan, there are fewer options.

For example, the Choice plan preferred pharmacies are CVS, Walmart, and thousands of community-based independent drug stores.

Then, the Plus plan includes CVS, Walmart, Publix, Kroger, Albertsons, as well as many grocery stores and retailers.

CVS Caremark Mail Order pharmacy is an option with your plan, so if you want to skip driving to the pharmacy, you can!

SilverScript Reviews

Both plans offer $0 copays for preferred generics at preferred pharmacies during the initial coverage phase.

SilverScript is one of the largest Part D insurers. They have 24/7 customer service, online tools, and medication programs to keep you on track.

The only downside I can think of, they only offer two plans. Many of the other top companies have at least three options.

Recommended Reading: How Much Does Medicare Part A And B Cover

When Is The Best Time To Buy A Plan

The Medicare Supplement Open Enrollment period starts on the 1st day of the 1st month in which youre age 65 or older and enrolled in Medicare Part B. In some states, you can buy a plan on the 1st day youre enrolled in Medicare Part B, even if youre not yet 65.

If you meet certain criteria, such as applying during your Medicare Supplement Open Enrollment Period, or if you qualify for guaranteed issue, a company cant use your medical history to determine your eligibility. Rules in some states may vary.

What Is The Best Medicare Supplement Plan For 2022

The best Medicare Supplement plans for 2022 include Plan F, Plan G, and Plan N. When it comes to finding the best Medicare Supplement plans for 2022, theres no one size fits all option.

Many different factors go into deciding which Medicare Supplement plan is the best. The best choice for your neighbor may not be the best choice for you.

Read Also: How Old To Be Eligible For Medicare

How To Choose The Top Medicare Supplement Company In Your Area

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2022, and when you use our agents, you get your cake and eat it too!When you enroll in a policy through us, you get the benefits of a low-cost plan with elite customer service.Our agents can access the most popular Medigap plans for you! So, instead of calling each company for a quote, you dial one agent, and they quote you on all the top carriers. Getting all your quotes in one phone call is going to save you time and money.Are you considering buying a Medicare Supplement plan? Call our agents at the number above to get the best coverage in your area.Don’t have time to call today? Fill out an online rate comparison form, and an agent will call you to discuss the top Medicare Supplement companies in your area.

Plan N: Best Medicare Supplement Plan For Cost

Cost is always important when shopping for health insurance, and some consumers will even place it as their top priority.

High-deductible Plan G and high-deductible Plan F are typically the two lowest-cost Medigap plans available. Each of these plans requires beneficiaries to meet an annual deductible before the Medigap plan coverage kicks in. In 2021, the deductible for high-deductible Plan F and high-deductible Plan G is $2,370.

This means that in exchange for a much lower monthly premium, you agree to pay up to $2,370 in 2021 for your covered services before your Medigap plan will cover most the rest of your out-of-pocket Medicare costs for the rest of the year.

Either of these plans can be a good fit for a beneficiary who doesnt expect to use many medical services during the year and who wants to save money each month on their Medigap premiums.

Plan N is also a good plan to consider if you want a plan with lower monthly premiums. Plan N pays for most out-of-pocket Medicare costs, including 100% of your Medicare Part B coinsurance costs. The main exception is that you pay a copay of up to $20 for some of your doctors office visits and a copay of up to $50 if you visit the emergency room but arent admitted to the hospital for inpatient care.

These low but predictable copays allow insurance companies to typically offer Plan N at a lower monthly rate than some other Medigap plans.

Don’t Miss: Does Medicare Pay For Teeth Implants

The Medicare Supplement Plans Comparison Chart: Compare Medigap Benefits Side By Side

by Christian Worstell | Published April 29, 2021 | Reviewed by John Krahnert

There are 10 standardized Medicare Supplement Insurance plans that are available in most states. These plans are labeled Plan A, B, C, D, F, G, K, L, M and N. When shopping for the best Medigap plan for your needs, it can help to compare Medigap quotes.

Final Thoughts On Supplemental Medicare

Medicare can be confusing and understanding exactly what type of supplemental coverage you need can be even more frustrating and time-consuming. However, like most other types of insurance, the best way to make sure that youre getting the best rate possible is to request as many quotes as you can.

Every health insurance company uses its own unique formula to determine how much youll pay in monthly premiums, so its possible to get five totally different quotes from five different insurance companies.

Dont be afraid to shop around for coverage and ask any agents you speak to how you can lower your premium health insurance providers have a hefty financial incentive to sign on qualified users, so theres usually a few discounts that can be found for you if youre debating between two providers.

A valuable resource for consumers is the Medicare Insurance agency directory hosted by the American Association for Medicare Supplement Insurance. Use it to find local Medicare insurance agents in your area. Access is completely free and also private.

Read Also: Are Medicare Advantage Premiums Deducted From Social Security

What Coverage Is Included Under Medicare Supplement Plan F

One of the more popular options among enrollees, Plan F is very similar to Plan C. However, it does offer one additional benefit: 100 percent of excess Part B charges. As mentioned above, this plan type is being phased out, along with Plan C. As such, those who became eligible after January 1, 2020, will not be able to purchase coverage under Plan F.

Medicare Supplement Plans In Wisconsin

Wisconsin standardizes its Medicare Supplement Insurance very differently. For one thing, there is only one major Medigap policy available, the Basic plan.

This plan covers basic benefits:

-

Part A coinsurance for inpatient hospital services

-

Part B coinsurance for outpatient medical services

-

First three pints of blood

-

Part A coinsurance or copayment for hospice care

It also covers coinsurance for stays in skilled nursing home facilities under Part A, as well as 175 days per lifetime in inpatient mental health care, and 40 visits/year for home health care .

Beneficiaries can add riders to their policy to make it fit their needs better. The riders available are:

-

100% Part A deductible

Don’t Miss: Does Medicare Offer Dental Plans

Best User Experience: Humana

-

Some of the deductibles run higher than other plans

-

Lack of detailed educational information about each plan’s coverage

-

Not available in all 50 states

Humana’s website offers easy-to-use, self-explanatory content that makes the process of finding the best Medicare Supplement policy simple and straightforward. Each plans coverage details are clearly displayed by ZIP code, without needing to enter your personal information into the site. You can also request an in-person appointment with a Humana Medicare agent.

You can compare specific plans if you enter your personal data, and Humana also provides a PDF with detailed plan information by state. Deductibles for some Humana plans are a little higher than other carriers. Humana covers every state with the same basic plans, including Parts A, B, C, F, G, K, L, and N. Plan F has an additional high-deductible option.

Humana earns an A- with AM Best for financial health. The MyHumana app is available from both Google Play and Apple’s App Store.

Humana is waiving out-of-pocket costs for in-network primary care, outpatient behavioral health, and telehealth visits effective May 1 through the end of 2020.

Best Overall Medicare Supplement For New Enrollees: Plan G

Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible â $203 a year for 2021 â before insurance benefits will begin to pay out.

However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473. Therefore, you should weigh the cost of this monthly premium with your potential medical expenses for the year.

Also Check: Does Medicare Cover Cancer Treatment Centers Of America

Do I Want Help With Part B Costs

Plan G will help pay your Part B excess charge . And while all Medicare Supplement plans offer some coverage for Part B coinsurance and copayments, Plan K only covers 50%, and Plan L covers 75%. Plan N covers these costs 100%, with the exception of a $20 office visit copay or $50 emergency room copay in certain situations.

Top 5 Rated Medicare Prescription Drug Plans For 2022

Home / FAQs / Medicare Part D/ Top 5 Part D Plans

When choosing Part D coverage, its important to know which is the best Medicare prescription drug plan for 2022. Also, by knowing what to expect, you can stay ahead of the game.

Drugs can be costly, and new brand-name drugs can be the most expensive. With age, youre more likely to require medications.

Medicares standalone Part D plan can cover you. Part D plans have a monthly premium that insurance companies determine.

There may be several plans as well as companies to choose from in your state. Policies vary by county, so moving may warrant a plan change.

Read Also: Where To Send Medicare Payments

How To Shop And Compare Medicare Supplement Plan G

When you sign up for Medicare, or during Open Enrollment, you must first decide if you want to be on Original Medicare or Medicare Advantage. Original Medicare has a nationwide network of providers but has fixed benefits. Medicare Advantage plans are based on a local network of providers but can offer additional benefits. If you sign up for Original Medicare, you are eligible for a Medicare Supplement Plan.

Medicare Advantage Vs Medicare Supplement: Other Things To Consider

Many types of Medicare Advantage plans, specifically Health Maintenance Organizations and Special Needs Plans , have networks of providers. Generally you must get care from an in-network provider in order for your care to be covered. Networks are designed to keep costs low, which could be an advantage to beneficiaries. On the other hand, you may also feel that a network restricts you from getting care from a provider you like.

However, you dont need to worry about networks in the case of an emergency. Generally Medicare Advantage plans include covered emergency medical care costs.

To start saving with a Medicare Advantage or Medicare Supplement plan in your area, enter your zip code on this page.

The product and service descriptions, if any, provided on these Medicare.com Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Also Check: Does Medicare Cover Laser Surgery

How Do I Identify Which Medigap Plan I Need

When picking a Medigap plan, think about both your current and future healthcare needs. Its important to choose carefully, because theres no guarantee youll be able to switch plans later.

The official CMS Medigap comparison table will help you figure out which policy best fits your situation. The policies differ in their coverage of deductibles, skilled nursing care, excess charges, and healthcare during foreign travel.

All the plans cover Medicare Part A hospital costs, and none of the available plans cover Medicare Part B deductible . That means your choice comes down to your priorities on these possible expenses:

-

Part A deductible

-

Out-of-pocket limits

-

Skilled nursing facility care

If you want a lower monthly premium, feel comfortable with a high-deductible plan, and tend to use few healthcare services, consider Plans K and L. They are the only plans that have out-of-pocket limits. For 2021, the Plan K limit is $6,220. For Plan L, its $3,110. After youve paid your Part B deductible and spent the out-of-pocket limit, Plans K and L cover 100% of covered services for the rest of your policy year.

If you travel outside of the U.S. and need emergency coverage, you may prefer Plans D, G, M, and N, which cover 80% of your costs .

If youre looking for 100% coverage of hospice and skilled nursing, services that are often valuable at the end of life, Plans D, G, M, and N are solid choices.

If you want complete coverage of the Part A deductible , you should avoid: