Does Medicare Coverage Change If You Return To Work

Today, its not uncommon for people who leave the workforce around Medicare eligibility age to return to work later on. In fact, its estimated that by 2026 about 30 percent of people ages 65 through 75, and 11 percent of people 75 and older, will be working1.Maybe its a passionate side-gig, a part-time job or youve gone back full-time. In any case, when you go back to work, what does that mean for your Medicare coverage?

How Do You Qualify For Medicare Early If You Have A Disability

If you have a disability, you may be eligible for Medicare if youâre younger than 65 and:

- You have been collecting Social Security disability benefits for at least 24 months. In this case, youâll likely be automatically signed up for Medicare coverage starting in month 25.

- You have end-stage renal disease . You wonât be automatically signed up for Medicare, though. Youâll still need to contact Social Security or visit their website to enroll.

- You have amyotrophic lateral sclerosis , also known as Lou Gehrigâs disease. If you have ALS, youâll be automatically signed up for Medicare the same month your Social Security disability benefits start.

I Am About To Turn 65 My Spouse Is 60 And Still Working We Are Both Covered Under Her Employers Health Plan Do I Have To Do Anything With Regard To Medicare This Year

A person with group health coverage through a current employer may be able to delay enrolling in Part A and Part B until that coverage ends, and wont face penalties for enrolling later, but only if the employer has 20 or more employees. If your wifes employer has at least 20 employees, you may want to enroll in Part A but delay enrollment in Part B until your group coverage through your spouses employer plan ends.

If you are already receiving Social Security benefits, you will be automatically enrolled in Part A and Part B when you turn 65. If you do not want to pay a premium for Part B benefits now because you have comparable coverage under your spouses employer plan, you will need to let Social Security know that you want to delay Medicare Part B enrollment. You can contact Social Security about this beginning three months before you turn 65. Otherwise, Medicare will assume you want to enroll in Part B and the monthly premium will be automatically deducted from your Social Security check.

If the employer has fewer than 20 employees, you should sign up for Part A and Part B when youre first eligible or you will face late enrollment penalties.

If you do delay Part B enrollment because you are covered under your wifes plan, remember to sign up for Part B once her coverage ends. That way, youll have continuous coverage and wont face a late enrollment penalty for Part B.

Also Check: Does Medicare Pay For A Registered Dietitian

Hold Off Drawing Social Security

Drawing Social Security earlier than full retirement age reduces your monthly payment, so conventional wisdom says you should wait until full retirement age to claim if possible.

With longer lifespans, it becomes more important to consider delaying Social Security, says Christine Russell, senior manager of retirement and annuities for TD Ameritrade.

If you plan both to earn income and draw Social Security between the ages of 62 and when you reach full retirement age, take note: For that period of time, your Social Security benefits will drop by $1 for every $2 earned above $17,640, and $1 for every $3 earned above $46,920. These deductions stop after you reach full retirement age.

Are There Penalties If I Do Not Sign Up For Medicare By A Certain Time

It depends. The enrollment period for Medicare lasts seven months. It begins three months prior to your 65th birthday and lasts for three months after your 65th birthday. There are opportunities to sign up after this window, but you risk being charged permanently higher premiums, unless you qualify for a special enrollment period. If you are still covered by a group health plan provided by your or your spouse’s employer when you turn 65, you may qualify for a special enrollment period.

Don’t Miss: Which Is Better Original Medicare Or Medicare Advantage Plan

Can I Delay Signing Up For Medicare Part B

If you have medical coverage through an employer, or youre covered under your spouses employer plan, you can delay enrolling in Medicare Part B, which covers medical services, without paying a penalty. Many people dont enroll in Medicare Part B until they stop working.

Once youre not covered under your employer plan , youll have eight months to enroll in Medicare Part B without paying a penalty.

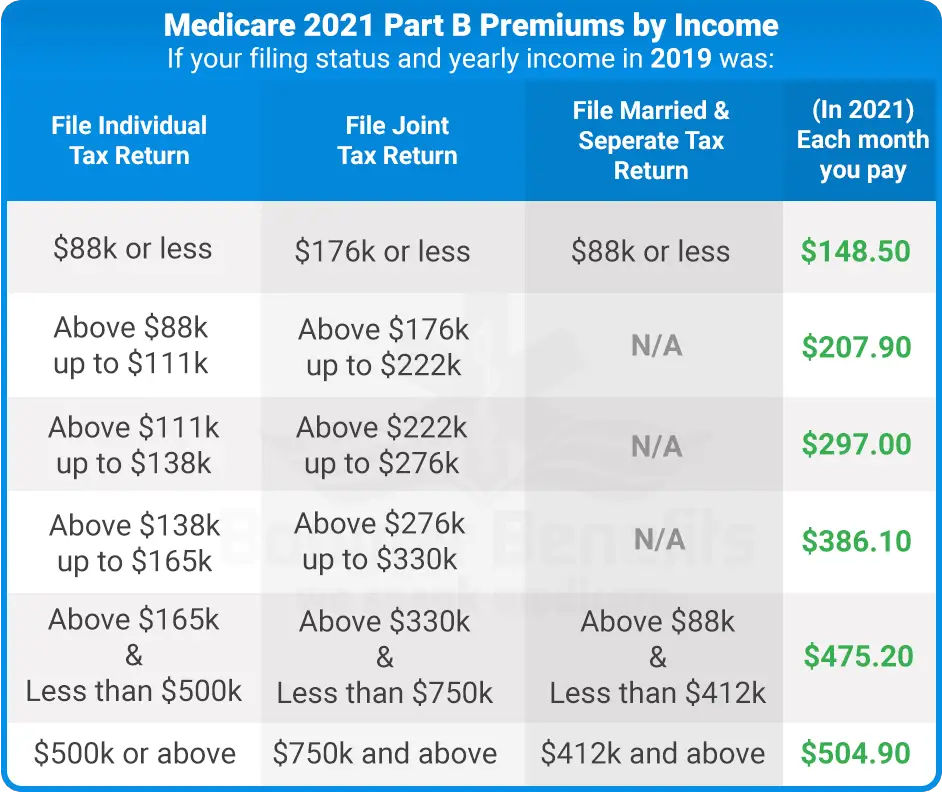

How Much Will I Pay For Premiums In 2023

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $97,000 in a given year.

For Part D, youll pay the premium for the plan you select. Depending on your income, youll also pay an additional amount to Medicare.

The following table shows the income brackets and IRMAA amount youll pay for Part B and Part D in 2023:

| Yearly income in 2021: single | Yearly income in 2021: married, joint filing | 2022 Medicare Part B monthly premium | 2023 Medicare Part D monthly premium |

|---|---|---|---|

| $97,000 | |||

| $560.50 | your plans premium + $76.40 |

There are different brackets for married couples who file taxes separately. If this is your filing situation, youll pay the following amounts for Part B:

- $164.90 per month if you make $97,000 or less

- $527.50 per month if you make more than $97,000 and less than $403,000

- $560.50 per month if you make $403,000 or more

Your Part B premium costs will be deducted directly from your Social Security or Railroad Retirement Board benefits. If you dont receive either benefit, youll get a bill from Medicare every 3 months.

Just like with Part B, there are different brackets for married couples who file separately. In this case, youll pay the following premiums for Part D:

- only the plan premium if you make $97,000 or less

- your plan premium plus $70.00 if you make more than $97,000 and less than $403,000

- your plan premium plus $76.40 if you make $403,000 or more

You can request an appeal if:

Also Check: How Do I Add Prescription Coverage To Medicare

Things You Should Know About Working Past 65

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Continuing to work past the traditional retirement age gives many the opportunity to add more money to their nest egg and delay Social Security, which will bump up their eventual benefits check. In May, 21.9% of Americans ages 65 and older were working, compared with 19.5% in May 2020, according to a study released in June by MagnifyMoney, which analyzed U.S. Census Bureau Household Pulse Survey data.

Its important to know how working affects your Medicare benefits, Social Security and tax situation. Here are some things to understand about staying in the workforce later in life.

How Does Medicare Work With Employer Insurance

When you have both Medicare and employer coverage, the size of your employer will determine how your Medicare benefits will coordinate with your employer coverage. If you become eligible for Medicare at age 65 while working for an employer with 20 or more employees, your group plan will be primary, and Medicare will be secondary.

In this scenario, most seniors choose to sign up for Medicare Part A because it is premium-free for those who pay Medicare tax for sufficient quarters. Additionally, if you are currently collecting Social Security Income, you will automatically enroll in Medicare Part A. After 24 months, you cannot collect Social Security Income benefits without signing up for Medicare Part A.

If you require care at a hospital, your Medicare Part A benefits will lower your costs. For example, imagine your employers group insurance has a $4,000 hospital deductible. In this case, it makes sense to enroll in Medicare Part A for a lower deductible.

For your outpatient and prescription drug coverage, a group health plan from an employer with 20 or more employees is creditable coverage. Coverage creditable for Medicare safeguards you from paying late enrollment penalties for Medicare Part B and Part D when you enroll in the future.

Read Also: Does Medicare Pay For Dental Services

The Benefits Of Signing Up For Medicare While Working

According to the U.S. Bureau of Labor Statistics, more than 25% of Americans age 65 to 74 were still in the workforce in 2021. That means that millions of newly eligible people must make a tough decision on when to enroll in Medicare. Even if you have health coverage through an employer, there are benefits to signing up while still employed.

Does Owning A Home Affect Medicare

Asked by: Miss Verna Lebsack IV

Medicare, as a rule, does not cover long-term care settings. So, Medicare in general presents no challenge to your clear home title. … If you are likely to return home after a period of care, or your spouse or dependents live in the home, the state generally cannot take your home in order to recover payments.

Read Also: What Is A Medicare Card

Can An Employer Pay Medicare Premiums

Can my employer pay my Medicare premiums? Employers can’t pay employees’ Medicare premiums directly. However, they can designate funds for workers to apply for health insurance coverage and premium payments with a Section 105 plan. … This requires the company’s payment plan to integrate with the group insurance plan.

Do I Need To Keep Medicare If Returning To Work

Well it depends. If youre going back to work and can get employer health coverage that is considered acceptable as primary coverage, you are allowed to drop Medicare and re-enroll again without penalties. If you drop Medicare and dont have creditable employer coverage, youll face penalties when getting Medicare back.

Before you decide to drop any part of Medicare, there are some things youll want to think about, especially as some choices could end up being costly.

-

Pre-Existing Conditions:If you decide to drop Medicare Part B, youll also have to drop a Medigap plan if you have one. This could make it difficult to enroll in another later on as your pre-existing health conditions will be considered when applying.

-

Health Savings Accounts :If you decide to drop Part Asay you wanted to do so to contribute to an HSA from your new employer if you do, you could end up having to repay the government for medical services Medicare covered as well as repaying any Social Security benefits money you were getting.

-

Premium Payments:If you are currently paying premiums for Part A, you cannot disenroll from Part B without also disenrolling from Part A1.

Additionally, should you decide to disenroll from Medicare, youll likely have to talk with Social Security directly either in-person or on the phone. The Administration requires that you consult with one of their officials while you fill out the Part B disenrollment form.

Recommended Reading: How Much Is Medicare Copay For A Doctor’s Visit

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Can I Delay Medicare Part B After I Retire

Once you retire, employer coverage is no longer creditable for Medicare. Suppose your employer allows you to remain on group benefits through a retiree program. In this case enrolling in Medicare Part B will avoid the late enrollment penalty.

Once you retire and choose to keep Medicare and employer coverage, Medicare Part B will become primary. Thus, your employer coverage will be secondary. Once retired, many seniors find it more suitable to drop employer coverage and enroll in a Medicare Supplement plan.

Don’t Miss: When Can I Apply For Medicare In California

Employer Coverage And Medicare Part D

If your employer group insurance includes creditable prescription drug coverage, you can delay Medicare Part D enrollment with no penalty. In this way, it is similar to Medicare Part B.

Having Medicare with this coverage may not be helpful when you have prescription drug benefits through your employer, as the coverages will not work together. Always compare your group insurance to the benefits and cost of Original Medicare + a Medicare Supplement plan + Medicare Part D. Often, it is more cost-efficient and beneficial to leave group insurance and enroll in Medicare, adding a Medicare Supplement plan and a Medicare Part D plan.

Special Enrollment Period For Enrolling Back Into Medicare After Leaving Work Coverage

Medicares Special Enrollment Period will grant you two full months to enroll in Medicare after leaving your employers insurance, even if you already had Medicare, previously. Even better, you will not have to pay any late-enrollment fees or penalties.

You may also want to get a Medigap Plan , for which you will have 63 days and guaranteed issuance, meaning the insurance companies have to approve your application regardless of any current or past health issues.

Don’t Miss: What Is My Medicare Number Provider

Can You Take Employer Coverage Again When On Medicare

If you return to work for an employer who offers health insurance, you can take it. You are allowed to have both Medicare and employer coverage, and you can use them together. One will act as primary coverage and one will act as secondary.

The only thing to keep in mind is that when you have Medicare and an employer plan, you cannot contribute to a health savings account if its offered.

Is There A Tax Penalty When Using An Hsa With Medicare

All the money you contribute to an HSA is pretax. As long as youre eligible, youll be able to contribute to your HSA and not pay taxes on that money. However, you wont be eligible anymore once youre enrolled in Medicare.

Youll pay tax penalties if your HSA contributions and your Medicare enrollment overlap. The amount of penalty youll pay depends on the situation. Scenarios you might encounter include:

- Youll be subject to back taxes on any contributions made after your Medicare enrollment date. Your contributions will be added back into your taxable income for the year.

- Your contributions after youre enrolled in Medicare might be considered excess by the IRS. Excess contributions will be taxed an additional 6 percent when you withdraw them.

- Youll pay back taxes plus an additional 10 percent tax if you enroll in Medicare during your HSA testing period. An HSA testing period is the full year after you enroll in an HSA midyear if you make the maximum contributions when you first sign up. So, if you signed up for an HSA in July 2017 and contributed a full years amount, your testing period would have ended in January 2019.

Lets look at some examples of how this might play out:

You May Like: Does Medicare Cover Home Care Aides

When Can You Actually Lose Your Medicare Coverage

There are two main times that you can straightforwardly lose Medicare coverage. The first is if you have Medicare as the result of a disability and you are no longer medically disabled. Medicare disability coverage is restricted to those who are currently dealing with a disability. This is a rare situation, since most disabilities that qualify dont simply go away.

If you are under 65 and have a disability, and also qualify for Medicare and then return to work, you will be able to keep your coverage without paying premiums for Part A for 8 and a half years. After that, you can still keep your coverage, but will have to pay a premium. This situation can get a bit more complex, and the full details are available from Medicare.gov.

Second, you can lose Medicare coverage if you enroll in a health savings account. We’ll discuss this in more detail below.

Your Social Security Benefits Could Be Taxable

Your modified adjusted gross income matters here. As your MAGI increases above a certain threshold , a greater percentage of your benefits is subject to income tax, to a maximum of 85%.

For details, see IRS Publication 915, “Social Security and Equivalent Railroad Retirement Benefits,” or consult with a tax advisor.

Recommended Reading: Does Blue Cross Blue Shield Offer A Medicare Advantage Plan

The Lowdown On The Best And Most Cost

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

Planning for retirement includes obtaining appropriate and affordable healthcare coverage. In that respect, for Americans 65 and older, any conversation about health care must include Medicare. Eligibility at age 65 means that health insurance becomes more affordable.

When you retire, its important to understand how Medicare works and how you can get the best and most cost-effective coverage. Many retirees wonder how to determine whether they need all four parts of Medicare. Questions about Medicare costs, supplemental insurances, and enrollment periods often arise as well.