A Brief History Of Medicare: Medicare Advantage

The Development of Medicare Advantage

The roots of Medicare Advantage go back to the 1970s. At that time, beneficiaries could receive managed care through private insurance companies. It was not until 1997 that the program, then called Medicare Choice, became official with the passing of the Balanced Budget Act.

In 2003, Medicare Part D was created and Medicare Choice plans were renamed to Medicare Advantage plans. Prior to 2003, Medicare did not offer coverage on prescription medications. This new addition allowed beneficiaries to get their health and prescription coverage through a single plan using one ID card.

How is Medicare Advantage Different from Original Medicare?

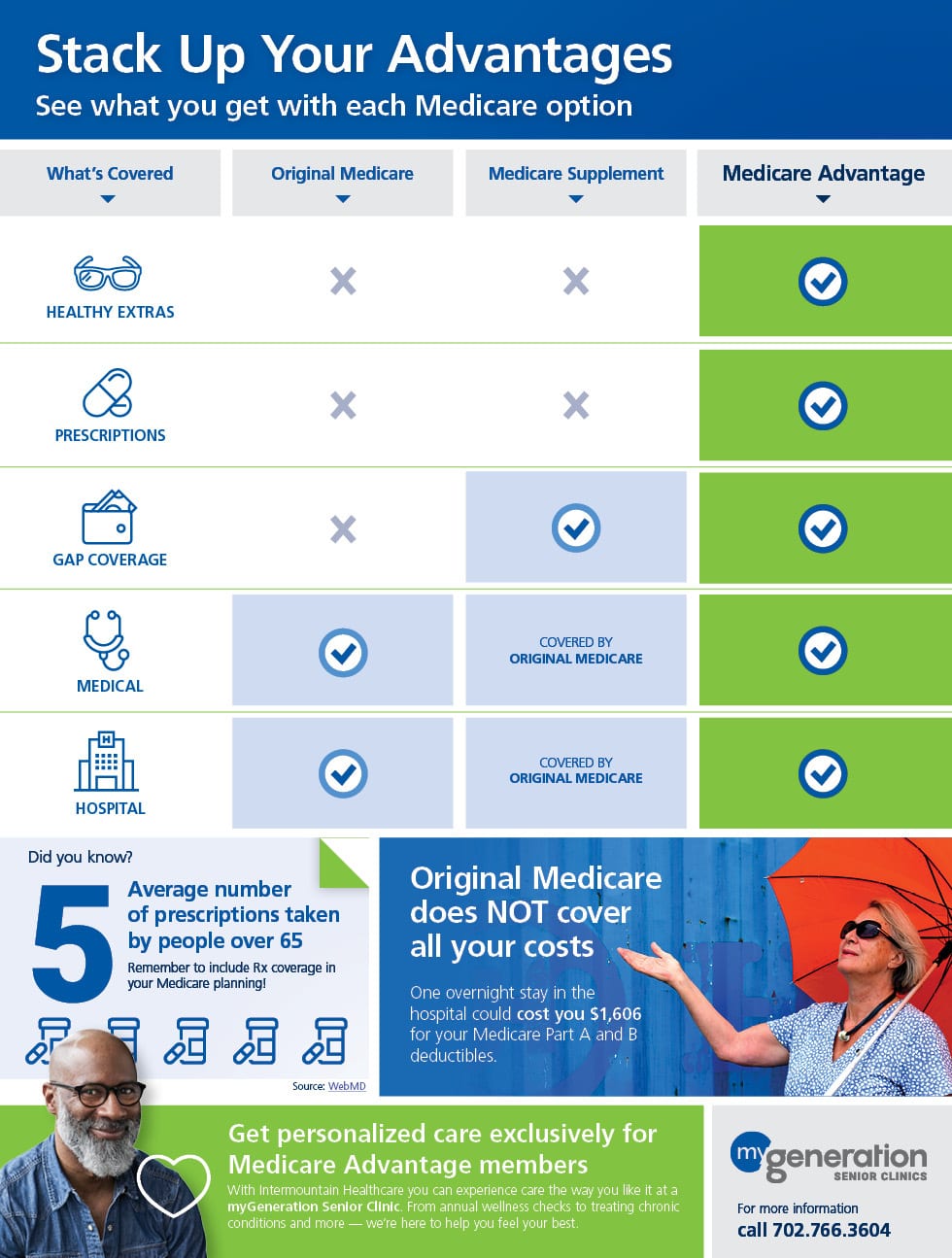

Unlike Original Medicare, which is government insurance, Medicare Advantage plans are administered by private insurance companies. These plans cover the same benefits of Original Medicare and typically include extra coverage such as out-of-pocket maximums, minimal dental or hearing coverage, and fitness benefits. Most Medicare Advantage plans also include prescription drug coverage.

Read more about Original Medicare.

The Future of Medicare Advantage

The Medicare Advantage program looks very different today than it did in 2003. Like any new program, it went through changes and growing pains. But over the years, we began to see increasing stability in Medicare Advantage. According the Kaiser Foundation, there were 17.6 million Americans enrolled on Medicare Advantage plans.

Early Attempts At National Health Insurance

Discussions of a federal health care system began decades before Medicares inception.

In the 1930s, President Franklin Delano Roosevelt decided not to add health care to his Social Security proposal because he feared it would be too controversial and might hinder the passage of other legislation.

President Harry Truman picked up the fight during his administration and took things a step further with a plan to protect a greater number of Americans.

Medicare for All may seem like a new idea, but Truman proposed national health insurance for every American in 1945, and again in 1949.

Millions of our citizens do not now have a full measure of opportunity to achieve and enjoy good health. Millions do not now have protection or security against the economic effects of sickness. The time has arrived for action to help them attain that opportunity and that protection. Harry Trumans 1945 speech to Congress

Truman insisted that he was not in favor of socialized medicine noting that the American people want no such system.

But like modern efforts to expand the federal governments role in health care, Trumans attempts were met with staunch opposition.

The American Medical Association and other special interest groups launched expensive lobbying campaigns to kill the bill.

The efforts were successful. By 1950, Trumans latest proposal was dead.

The idea of a smaller, more targeted program for people aged 65 and older began to emerge in the late 1950s.

Does Advantage Have A Leg Up

Under President Trump, some critics contend, the Centers for Medicare and Medicaid Services, which administers Medicare, has become a cheerleader for Advantage plans at the expense of original Medicare.

Advocates and some lawmakers have complained about bias in educational and outreach materials on enrollment, and in public statements about Advantage by the agencys administrator, Seema Verma.

One flare-up was provoked by a draft release of the 2019 Medicare & You handbook, an important annual guide mailed to all enrollees and made available online. Advocates and some lawmakers criticized language describing Advantage as a less expensive alternative to original Medicare. But despite the data on patients average spending, no figures are available on their specific out-of-pocket costs.

We know absolutely nothing about what people actually pay for services, Dr. Neuman of Kaiser said. If someone is really sick and uses a lot of covered services, they could pay less with traditional Medicare coupled with a Medigap policy than they would in a Medicare Advantage plan, even after taking into account Medigap premiums.

The handbooks language was revised before its final release, but communications from the Centers for Medicare and Medicaid Services during last falls Medicare enrollment period do appear to promote Advantage plans.

There does seem to be a strong philosophical preference for private insurance over public programs in this administration, Dr. Neuman said.

You May Like: Does Mutual Of Omaha Offer Medicare Advantage Plans

D Appeals And Grievances

Coverage Determinations and Exceptions

All Part D plans must have an appeal process through which members can challenge a denial of drug coverage. The Part D appeals process is based on and similar to the Part C appeals process.

Denials of drug coverage by a PDP or MA-PD are called coverage determinations. For example, a coverage determination may be issued by the plan if the drug is not considered medically necessary or if the drug was obtained from a non-network pharmacy. It is necessary to have a coverage determination in order to initiate an appeal. A doctors supporting statement is not required for this type of appeal, but it may be helpful to submit one. If the request for coverage is denied, the member may proceed to further levels of appeal, including redetermination by the plan, reconsideration by an Independent Review Entity , Administrative Law Judge review, the Medicare Appeals Council , or federal district court.

One type of coverage determination is called an exception request. An exception request is a coverage determination that requires a medical statement of support in order to proceed to appeal. There are two types of exceptions that may be requested:

Formulary Exceptions This type of exception is requested because the member:

- needs a drug that is not on the plans formulary,

- requests to have a utilization management requirement waived for a formulary drug).

What to do When a Drug is Denied at the Pharmacy

The Medical Statement

Grievances

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

Read Also: Can We Apply For Medicare Online

Which President Started Social Security And Medicare

President Lyndon B. JohnsonsMeeting this need of the aged was given top priority by President Lyndon B. Johnsons Administration, and a year and a half after he took office this objective was achieved when a new program, Medicare, was established by the 1965 amendments to the social security program.

The Solvency Of The Medicare Hi Trust Fund

This measure involves only Part A. The trust fund is considered insolvent when available revenue plus any existing balances will not cover 100 percent of annual projected costs. According to the latest estimate by the Medicare trustees , the trust fund is expected to become insolvent in 8 years , at which time available revenue will cover around 85 percent of annual projected costs for Part A services. Since Medicare began, this solvency projection has ranged from two to 28 years, with an average of 11.3 years. This and other projections in Medicare Trustees reports are based on what its actuaries call intermediate scenario but the reports also include worst-case and best-case projections that are quite different .

Don’t Miss: How Can I Get My Medicare Card Number

Paying For A Chiropractor With Medicare

Legislation has been introduced in the U.S. House of Representatives to increase Medicare coverage of chiropractic services. The Chiropractic Medicare Coverage Modernization Act would grant Medicare recipients access to various chiropractic services. Under the legislation, a patient would have rights to all Medicare-covered benefits.

To find a chiropractor that accepts Medicare, you can search Medicare.gov and click on Find & compare nursing homes, hospitals & other providers near you. From there, you can search by provider type and type in chiropractic under the name and keyword search. When you search by location, youll receive information about whether the provider charges the Medicare-approved amount and accepts Medicare.

Did You Know: At least a quarter of people enrolled in Medicare have supplemental policy coverage. Read my guide to help you find the Best Medigap Plan D.

Matching Plans To Lifestyles

Which plan works best for you depends largely on your financial situation and your typical healthcare usage the services and items that you usually need or that you are likely to need. Both of these factors influence how restrictive a network youre likely to be able to tolerate. Another major consideration is whether you prefer plans that have low upfront costs or low costs over time. Plans with low upfront costs tend to have low premiums and deductibles. Whereas plans with low costs over time tend to have low out-of-pocket spending limits.

More Resources for Information and Advice If you want further information on evaluating plans, you can benefit from reading Who Should Consider Medicare Advantage? This article will help you decide if Medicare Advantage is right for you, and it can also provide information on plans that might suit you. The article How to Compare Medicare Advantage Plans additionally contains more details on each plan type. If reading more still isnt helping you make your choice, it may be the right time to get the expert advice that a State Health Insurance Assistance Program counselor can provide free of charge.

You May Like: Does Medicare Pay For Inogen Oxygen Concentrator

S For Using The Plan Finder Tool

To check which plans are in your area, you can use the Medicare Health Plan Finder. If you wish, you can create an account, log in, and return to saved plan searches later if youre not able to make your selection in one day.

Step 1: Select Search PreferencesTo begin your search for a plan, either create an account or click log in as a guest. Next, select Medicare Advantage from the menu provided, enter your zip code in the box that pops up, and click continue. Now youll be asked if you get help with your costs from one of several programs select not sure if necessary. Youll then be given the option to see the costs of specific drugs on different plans. This will be useful to you if you have regular prescriptions. The drug costs question is the final prompt youll receive before youll be shown a list of local Medicare Advantage plans.

Step 2: Examine Coverage DetailsWhen you first look at the plans, you may just want to scroll through them all to see the range of costs and types in your area. Once you have a sense of whats available, begin looking at the coverage offered in individual plans by clicking plan details. Here you can evaluate the copays/coinsurance of specific tests, office visits, and hospital stays, including for extra services like drug coverage, dental coverage, and more. Youll also find contact information for the plan in this section.

Reason : They Make You Get A Referral

In the case of HMO plans and some PPO plans, this is true. According to the Kaiser Family Foundation, nearly all Medicare Advantage plan enrollees are in plans that require prior authorizationPrior authorization is a process used by health plans to control healthcare costs. Most HMO plans and some PPO plans require authorization before receiving certain treatments, medical services, or prescription drugs…. for some services. Health plans are in the business of making money and this is one of the primary ways they have to control costs.

By the way, Congress implemented a similar cost-saving measure with Medicare supplement insuranceMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage….. As of 1 January 2020, new Medicare beneficiaries cannot buy a Medigap plan that covers the Part B deductible. The hope is that this change will reduce unnecessary doctor visits.

Also Check: Does Medicare Plan F Cover International Travel

The Majority Of Medicare Advantage Enrollees Are In Plans That Receive High Quality Ratings And Related Bonus Payments

Figure 11: Share of Medicare Advantage Enrollees Required to Receive Prior Authorization, by Service, 2020

In 2020, more than three-quarters of Medicare Advantage enrollees are in plans with quality ratings of 4 or more stars, an increase from 2019 . An additional 4 percent of enrollees are in plans that were not rated because they were part of contracts that had too few enrollees or were too new to receive ratings. Plans with 4 or more stars and plans without ratings are eligible to receive bonus payments for each enrollee the following plan year. The share of enrollees in plans with 3 stars declined by half from 6 percent in 2019 to 3 percent in 2020.

For many years, CMS has posted quality ratings of Medicare Advantage plans to provide beneficiaries with additional information about plans offered in their area. All plans are rated on a 1 to 5-star scale, with 1 star representing poor performance, 3 stars representing average performance, and 5 stars representing excellent performance. CMS assigns quality ratings at the contract level, rather than for each individual plan, meaning that each plan covered under the same contract receives the same quality rating most contracts cover multiple plans.

President Lyndon B Johnson Signs Medicare Into Law

When Johnson was elected in 1964, he was determined to pass sweeping social reforms on level with the New Deal.

Health insurance for seniors was at the top of his list.

Our older people are likely to be hospitalized three times as often as younger people, but their income is less than half of that for people under 65, Johnson said during a White House briefing January 1964.

On July 30, 1965, Johnson signed Medicare into law at a public ceremony in Independence, Missouri. Former President Truman was by his side.

After signing the Social Security Amendments of 1965, Johnson turned to Truman, now 81, and proclaimed him the real daddy of Medicare.

Truman also became the first person to enroll in the program.

Once the festivities ended, the real work began.

Wilbur Cohen, undersecretary of Health, Education and Welfare, said the task of enrolling millions of Americans into the new system in less than a year was like planning the invasion of Normandy.

We did a better job of preparation than we did for almost any other program, Cohen said.

When Medicare services launched July 1, 1966, more than 19 million Americans aged 65 and older enrolled.

We think this program is just. We think this program is necessary. We think this program makes sense. And we think this program is going to be the law of the land. President Lyndon Johnson at a White House press briefing January 15, 1964 a year-and-a-half before the passage of Medicare.

It proved to be a powerful motivator.

Read Also: What Is The Cost Of Part D Medicare For 2020

Medicare Advantage Plans Coverage For Some Services And Procedures May Require Doctors Referral And Plan Authorizations

Medicare Advantage plans try to prevent the misuse or overuse of health care through various means. This might include prior authorization for hospital stays, home health care, medical equipment, and certain complicated procedures. Medicare Advantage plans often also require your primary care doctors referral to see specialists before they will pay for services.

Do Medicare Replacements Follow Medicare Guidelines

Medicare Advantage Plans Must Follow CMS Guidelines In the United States, according to federal law, Part C providers must provide their beneficiaries with all services and supplies that Original Medicare Parts A and B cover. They must also provide any additional benefits proclaimed in their Part C policy.

Recommended Reading: How To Purchase Medicare Insurance

When Did Medicare Start And Why

- Learn about the history of Medicare, the federally protected health insurance program, and the severe societal and financial problems that inspired its creation.

Ensuring access to inpatient and outpatient medical care, a wide range of specialists and diagnostic services, Medicare currently insures more than 61 million Americans or more than 18% of the population. Medicares coverage continues to expand to give beneficiaries access to the latest testing and treatment options for various conditions. But who thought of Medicare and when did Medicare start? Take a trip into history to learn about Medicares inception.

What About The Medicare Advantage Give Back Benefit

The give-back benefit allows some Medicare Advantage plans to offer plan members a rebate on their monthly Medicare Part B premium. Beneficiaries with a give-back plan receive the benefit through Social Security. No direct payments are allowed.

The technical term for the benefit is Medicare Part B premium reduction. When you enroll in one of these plans, the insurance carrier pays some or all of your premium. In the evidence of coverage document the plan is required to provide, you will find a section titled Part B Premium Buy-Down. This is where you will find the amount the plan contributed towards your Part B premium.

Plans with a give-back benefit are becoming more popular, but they are still not widespread. The largest companies offering these plans include Aetna, Cigna, and Humana. Give-back amounts range from as little as $.10 to as much as the full $170.10 standard Part B premium.

If you pay your own Part B premium you are eligible for a give-back plan. If you have full or partial Medicaid, including aid through a Medicare Savings Program, you are not eligible.

Don’t Miss: Does Medicare Cover Home Sleep Apnea Test