If You Have A Disability

If youve been receiving either Social Security disability benefits or railroad retirement board disability benefits for at least 24 consecutive months, youre eligible to enroll in Medicare at any time, no matter your age.

If you have amyotrophic lateral sclerosis or end stage renal disease , youre also eligible for Medicare at any time, independent of your age.

Primary And Secondary Payers

Your Medicare and private insurance benefits are coordinated, which means they work together. Typically, a primary payer will pay insurance claims first and a secondary payer will only kick in for costs not covered by the primary payer. The secondary payer may not pay all of the remaining uncovered costs, and you may be responsible for any additional balance.

In many instances, if you are age 65 and covered by either a retiree plan or a plan with fewer than 20 employees, then Medicare is your primary payer and private insurance is your secondary. If this is your situation, you should enroll in Part A and B, along with D if your private insurance plan doesnt have creditable prescription drug coverage.

If youre covered by a plan with 20 or more employees, Medicare is often the secondary payer. Medicare may pay costs that your employers plan doesnt.

Penalty Fees For Late Enrollment

Medicare charges penalty fees for those who do not enroll in their Initial Enrollment Period, or they do not qualify for an exception due to employer insurance or other coverage.

Unless a person qualifies for a special exception, they will pay a monthly premium that is 10% higher for every 12-month period they were eligible for Medicare but did not sign up.

A person can qualify for a Medicare plan before 65 years of age if they meet certain criteria:

- They have end stage renal disease and need dialysis or are on the kidney transplant list.

- They have amyotrophic lateral sclerosis .

- Their doctor confirms that they have a disability.

An estimated 6.2 million people qualify for Medicare because they are disabled, according to the Medicaid and CHIP Payment and Access Commission. However, significantly fewer people use these benefits.

A doctor may declare a disability for people due to several types of medical conditions, including:

- Intellectual or developmental disabilities: These might include Down syndrome, cerebral palsy, or autism.

- Physical conditions: Traumatic brain injury, severe back injuries, or quadriplegia qualify as disabilities.

- Severe behavioral or psychological disorders: People with bipolar disorder or schizophrenia can qualify for Medicare early.

A doctor must submit paperwork to Medicare, declaring that a person has a disability. The individual may have a waiting period before they qualify for full Medicare benefits.

Recommended Reading: Do You Have Dental With Medicare

What Is The Initial Enrollment Period For Part C

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

Enrolling In Original Medicare

If youre already receiving Social Security or Railroad Retirement Board benefits and youre a U.S. resident, the federal government automatically enrolls you in both Medicare Part A and Medicare Part B at age 65. Youll receive your Medicare card in the mail about three months before you turn 65, and your coverage will take effect the first of the month you turn 65.

Medicare Part B has a monthly premium, which will be deducted from your Social Security or Railroad Retirement check. The standard Part B premium is $148.50/month in 2021, and is expected to increase in 2022. For the upcoming year, CMS doesnt finalize the new Part B premium until fairly late in the year, but the Medicare Trustees Report projects a Part B premium of $158.50/month for 2022 .

You can opt out of Part B and avoid the premiums, but its generally only a good idea to do that if youve got health insurance from your current employer or your spouses current employer, and the employer has at least 20 employees.

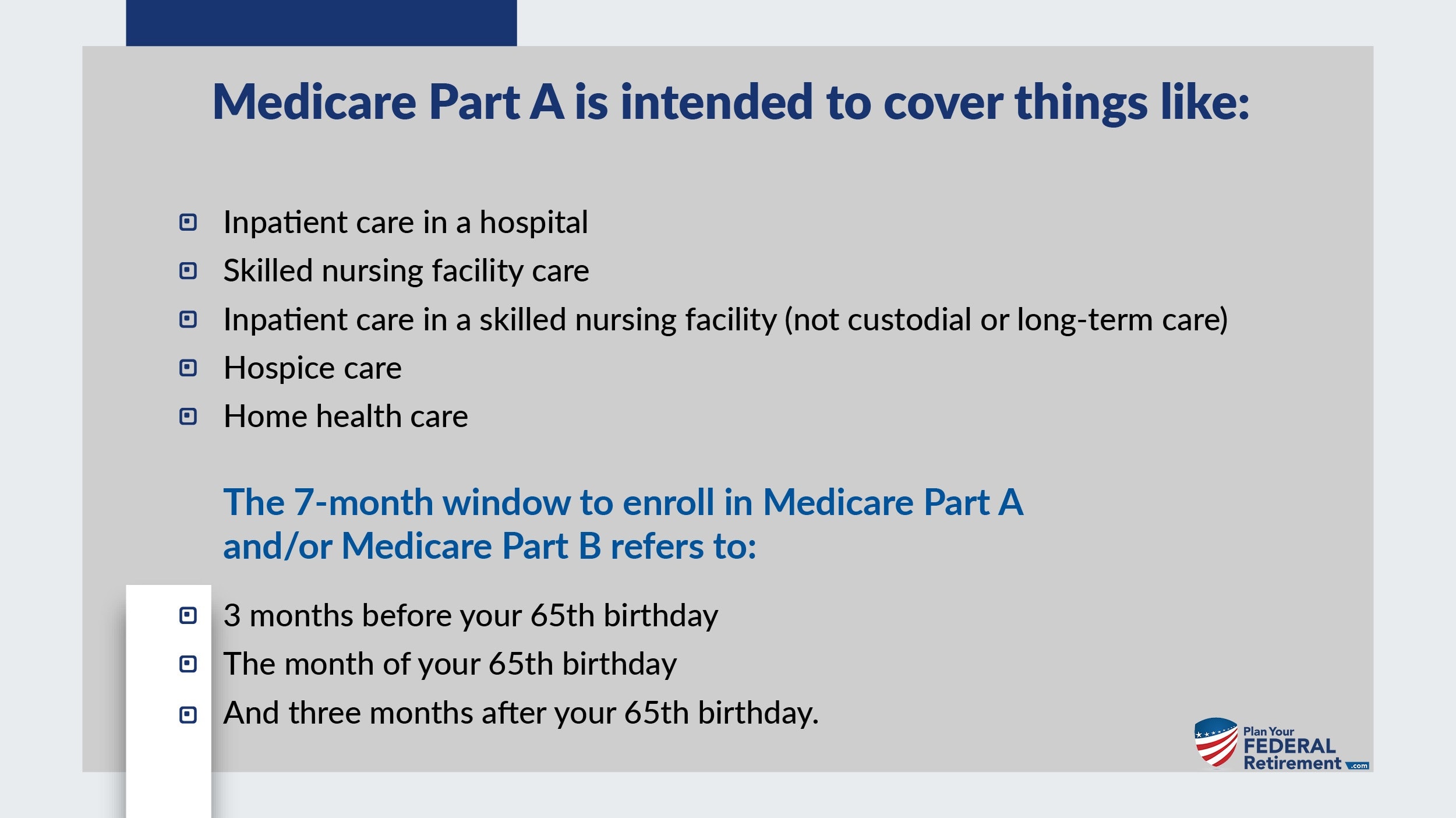

If you are turning 65, but youre not yet receiving Social Security or Railroad Retirement benefits, you wont be automatically enrolled in Original Medicare. Instead, youll be able to enroll during a seven-month enrollment period that includes the three months before your birth month, the month you turn 65, and the three following months. So if youll be 65 on July 14, your open enrollment period will be April through October.

Recommended Reading: When Can I Start Collecting Medicare Benefits

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

When Do I Sign Up For Medicare Advantage

Before you sign up for Medicare Advantage, make sure you weigh the pros and cons of Medicare Advantage vs. Medicare Supplements. If you choose to sign up for Medicare Advantage, you can do so during your IEP.

If you missed your IEP, you can join during the Medicare Annual Enrollment Period. For those currently enrolled in a Medicare Advantage plan, you also have another opportunity to make changes during the Medicare Advantage Open Enrollment Period.

You May Like: Does Medicare Cover Disposable Briefs

Medicare Open Enrollment: What You Cant Do

The annual Medicare open enrollment period does not apply to Medigap plans, which are only guaranteed issue in most states during a beneficiarys initial enrollment period, and during limited special enrollment periods.

If you didnt enroll in Medicare when you were first eligible, you cannot use the fall open enrollment period to enroll. Instead, youll use the Medicare general enrollment period, which runs from January 1 to March 31.

Medicares general enrollment period is for people who didnt sign up for Medicare Part B when they were first eligible, and who dont have access to a Medicare Part B special enrollment period. Its also for people who have to pay a premium for Medicare Part A and didnt enroll in Part A when they were first eligible.

If you enroll during the general enrollment period, your coverage will take effect July 1.

Learn more about Medicares general enrollment period.

When Do I Get My Medicare Card

In most circumstances, youll get a Medicare I.D. card several weeks after your initial application. However, waiting times can be up to 90 days. If you are automatically enrolled in Medicare because you already get Social Security benefits, you will receive your I.D. card two months before turning 65.

Recommended Reading: How To Order A Medicare Card

What Happens If I Miss My Initial Enrollment Window For Medicare

If you missed your Initial Enrollment Period 7-month window for one reason or another, you could still enroll in during the General Enrollment Period. Keep in mind, if you enroll during the annual GEP, your Medicare will not start until July 1st.

Therefore, you could have a gap in coverage. If you didnt maintain creditable coverage, youd be subject to an endless Part B penalty.

How To Choose A Medicare Advantage Plan

If you’re interested in a Medicare Advantage plan, rather than Original Medicare, you can choose from one of the following:

- Private Fee-for-Service plans

- Special Needs Plans

Less common types of Medicare Advantage plans include HMO Point of Service plans and Medicare Medical Savings Accounts plans. The main difference between all these plans is in whether you’re able to see out-of-network providers, whether a referral is required to see a specialist, and how much you’ll pay.

When comparing Medicare Advantage plans, you’ll want to consider what doctors are available, how much you’ll pay out of pocket, and what benefits are included. Medicare offers a plan finder tool that can help you search for and compare Part C plans.

Don’t Miss: Does Aarp Medicare Supplement Insurance Cover Hearing Aids

Continue Learning About Medicare

Important: This content reflects information from various individuals and organizations and may offer alternative or opposing points of view. It should not be used for medical advice, diagnosis or treatment. As always, you should consult with your healthcare provider about your specific health needs.

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

2 months after you sign up |

|

2 or 3 months after you turn 65 |

3 months after you sign up |

Read Also: How Much Is Medicare B Cost

What Changes Can You Make During Medicare Open Enrollment

During Medicare open enrollment, you can review your existing coverage and make changes to it. Specifically, you can switch from:

- Original Medicare to a Medicare Advantage plan.

- A Medicare Advantage plan to Original Medicare.

- One Medicare Advantage plan to another.

- One Medicare Part D drug plan to another.

You can also do the following during the Medicare open enrollment period in 2022 :

- Join a Part D drug plan.

- Drop your Part D coverage.

Or Older And Still Working

If you are 65 or older, currently employed, and get health care coverage through your employer, you can wait to sign up for Medicare until you retire or your coverage with your employer expires. You have an 8-month window to sign up for Medicare in this scenario. This is considered a Special Enrollment Period.

You May Like: Does Medicare Cover Chronic Pain Management

Scenario #: You Are Under 65 And On Medicare Disability

If you are already receiving Social Security disability benefits, you will be automatically enrolled into Medicare Part A and Part B after you have been receiving disability benefits for 24 months.

You do not have to sign up for Medicare if you are receiving Social Security disability. You will receive your red, white and blue Medicare card in the mail before your 25th month of disability.

What Is Medicare Open Enrollment

Medicare open enrollment is a designated window of time each year when individuals can make changes to their Medicare coverage.

Open enrollment is primarily for people who already have Medicare. New applicants should sign up during their initial enrollment period, which starts three months before they turn 65 and ends three months after the month they turn 65. If they miss their initial enrollment period, they can sign up during open enrollment.

The fall open enrollment period for Medicare begins Oct. 15 and runs through Dec. 7 in 2021. This enrollment period is open to people who are covered by:

- Medicare Part A

- Medicare Part B

- Original Medicare

A separate Medicare open enrollment period applies to people who are covered by a Medicare Advantage plan . The open enrollment period for Medicare Advantage plans runs from Jan. 1 to March 31 each year.

Also Check: How To Change Medicare Direct Deposit

Medicare Comes In Two Parts

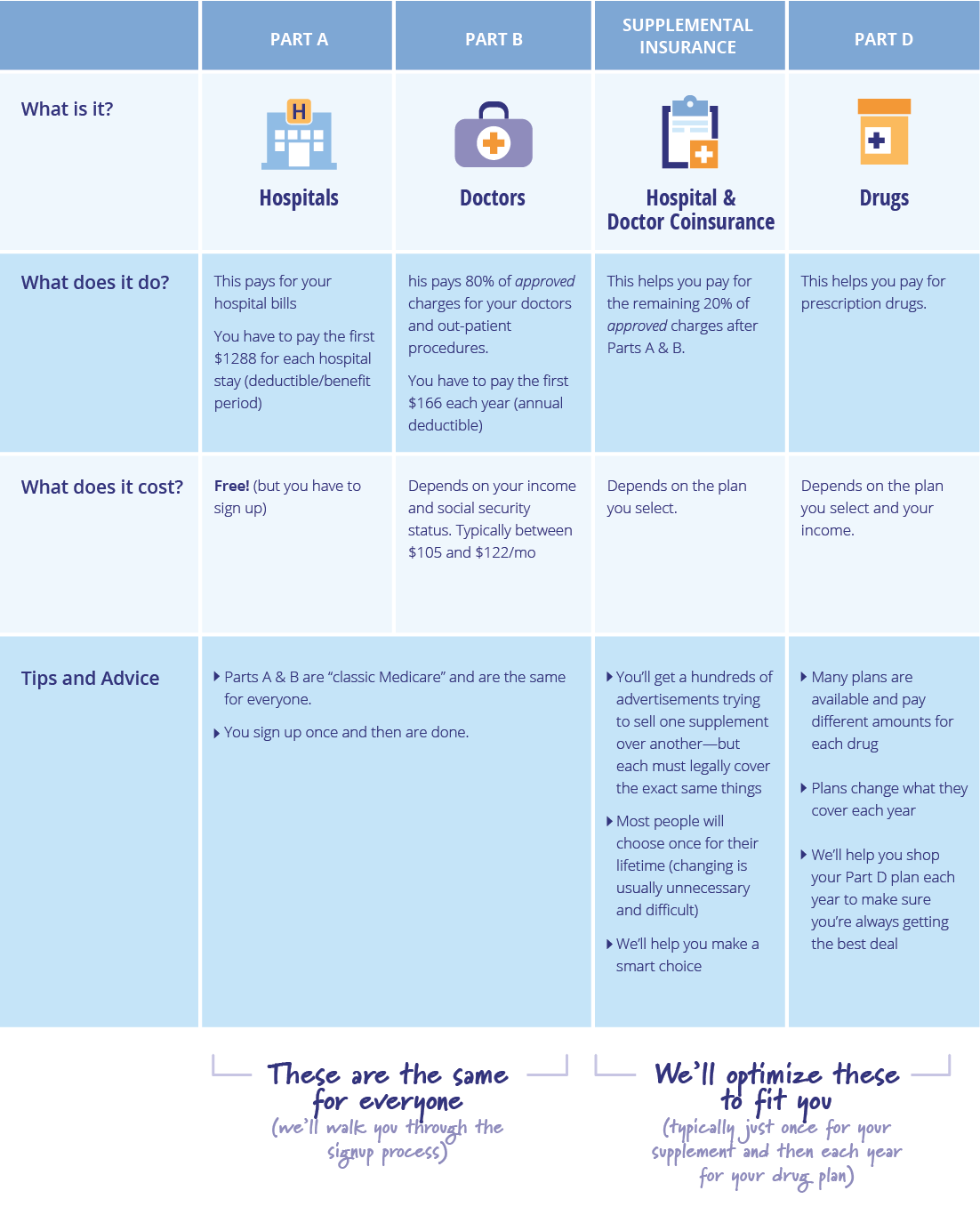

Medicare, the government-sponsored health insurance program for those age 65 and older is the primary source of most retirees’ health coverage. For that group, Medicare covers over 60 percent of medical expenses, compared to less than 20 percent that private insurance covers. Most people are automatically enrolled at age 65 in Medicare’s hospital insurance component, also called Medicare Part A. It comes at no cost as long as you or your spouse paid Medicare taxes during your working years.

The medical insurance component under Medicare is called Part B, and it covers the services of your doctor, outpatient hospital care, physical and occupational therapy and even some home health care. But unlike Medicare Part A, Part B isn’t free. For 2019, monthly premiums can range from about $135 to as much as $325 for singles earning over $500,000 and up to $460 for marrieds earning over $750,000.

But here’s the catch: You must enroll during your “special enrollment period” or “initial enrollment period.” If you delay signing up for Medicare when you’re initially eligible to do so, you cold incur a delayed enrollment penalty of 10 percent for every 12 months you were eligible to enroll in Medicare Part B but didn’t.

If you delay enrolling for two years, you would pay 20 percent more per month for the rest of your life for Part B coverage.

When Does Medicare Supplement Open Enrollment For 2022 Begin And End

There are no yearly open enrollment periods or deadlines for Medicare Supplement plans like there are for other kinds of Medicare coverage.

Instead, you can buy or change MedSup or Medigap policies any time you want. Most people do so during a six-month Medigap open enrollment period, though. This period starts the same month you enroll in Medicare Part B.

If you wait until after your Medigap open enrollment period to buy or change this type of coverage, you may not be able to find an insurance company that will sell it to you. And even if you do, you might pay a lot more for it.

Read Also: Does Medicare Cover You When Traveling Abroad

When Is The Medicare Part D Annual Election Period:

If you did not enroll in prescription drug coverage during IEP, you can sign up for prescription drug coverage during the Annual Election Period that runs every year from October 15 to December 7.

During AEP, you can:

- Sign up for a Medicare prescription drug plan.

- Drop a Medicare prescription drug plan.

- Join a Medicare Advantage plan that includes prescription drug coverage.

- Switch from a Medicare Advantage plan that doesnt include prescription drug coverage to a Medicare Advantage plan that does .

Outside of the Part D Initial Enrollment Period and the Annual Election Period, usually the only time you can make changes to prescription drug coverage without a qualifying Special Election Period is during the Medicare Advantage Open Enrollment Period but only if you are dropping Medicare Advantage coverage and switching back to Original Medicare. The Medicare Advantage Open Enrollment Period runs from January 1 to March 31.

Medicare Part A and Part B do not include prescription drug coverage, and if you switch back to Original Medicare during the Medicare Advantage Open Enrollment Period, you will have until March 31 to join a stand-alone Medicare prescription drug plan.

If You Miss Your Window

If you dont enroll in Medicare A and/or B during your seven-month open enrollment window, youll have a chance to enroll during the general open enrollment period, which runs from January 1 to March 31 each year. If you enroll during that window, your coverage will take effect on July 1.

But theres a penalty for late enrollment in Medicare Part B, amounting to a 10 percent premium increase for each full 12 month period that you could have been enrolled in Medicare B but werent this penalty continues for as long as youre enrolled in Medicare, so its best to enroll when youre first eligible. The penalty for late enrollment in Part B does not apply if you had creditable coverage from an employer-sponsored plan during the time that you delayed enrollment in Part B. When that employer-sponsored coverage ends, youll have an eight-month window during which you can enroll in Part B, without a penalty.

But if you delay Part B enrollment to save money on premiums, without having coverage from a current employer in place, youll likely be subject to the late enrollment penalty when you do enroll during the general enrollment period in a future year.

You May Like: What’s The Medicare Deductible

You Are Also Eligible For Medicaid

There are Medicare plans specifically designed for people who are eligible for both Medicaid and Medicare. Dual Special Needs Plan are a special kind of Medicare Advantage Plan that combine Parts A, B and D Medicaid, and extra benefits such as dental and vision.

Your Medicare coverage choices need to fit your health needs, lifestyle and budget. You will have a chance to review your coverage, and make changes each year during the Medicare Annual Enrollment Period, Oct. 15 Dec. 7.

Sign Up for Your Medicare GuideYou’ll get timely emails with important information to help you navigate your Medicare Initial Enrollment Period as smoothly as possible.

*Required fields

Thank you for signing up! You’ll receive an email with a link to your free Medicare information guide shortly.

I Did Not Enroll In Medicare When I Turned 65 And Was First Eligible Can I Sign Up Later

En español | Your initial enrollment period for Medicare lasts for seven months, of which the fourth is the one in which you turn 65. For example, if your birthday is in June, your IEP begins March 1 and ends Sept. 30. If you miss signing up for Medicare during your IEP or if you deliberately postponed enrollment because you receive health coverage from a current employer you have two options to sign up, depending on your situation:

Special Enrollment Period

If you are covered under a group health plan provided by an employer for which you or your spouse actively works, you have the right to delay enrollment in Medicare until the employment or the coverage ends whichever happens first. The whole time that you have this coverage, and for up to eight months after it ends, counts as a special enrollment period during which you can sign up for Medicare without risking late penalties. While active employment continues, you can specify the date on which you want Medicare coverage to begin, up to three months in advance. Otherwise, your coverage begins on the first day of the month after you enroll.

If you need Medicare prescription drug coverage, you will not be hit with late penalties if you join a Part D drug plan within two months of the employer drug coverage ending.

General Enrollment Period

If you need Medicare prescription drug coverage, you can sign up with a Part D drug plan during April, May or June in order to begin coverage on July 1.

Also Check: Are Motorized Wheelchairs Covered By Medicare