How To Get More Out Of Your Medicare Coverage

We covered the basics of how to apply for Medicare Part A and Part B, but of course thats not all there is to Medicare.

- Medicare Part D covers prescription medications.

- Medicare Advantage offers Original Medicare plus additional benefits, provided by private insurers.

- Medicare Supplement plans cover the costs Original Medicare wont with an additional monthly premium.

No matter your need, there is no shortage of options when it comes to Medicare. We’re here to help you navigate those options so you can find the best plan.

Check out our Medicare Guide if you’re looking for a more comprehensive explanation of your Medicare benefits.

Signing Up For Medicare Part A And Part B

If youre collecting Social Security benefits, youll automatically enroll in Medicare Part A and Part B upon turning 65. However, if youre not automatically enrolled, the best time to enroll in Medicare Part A is during your initial enrollment period.

If you worked a minimum of ten years while paying Medicare taxes, you can receive Medicare Part A premium-free. So, regardless of whether youre still working when you become eligible for Medicare, it makes sense to get Medicare Part A as soon as you can. This will help keep your out-of-pocket hospital inpatient costs to a minimum.

With Medicare Part B, you have different enrollment options. Medicare Part B medical insurance requires every beneficiary to pay a monthly premium. Therefore, if you have health coverage at age 65, you may delay Medicare Part B without penalties unless you lose creditable coverage before getting Medicare Part B.

Common reasons beneficiaries delay Medicare Part B include:

- Health insurance through a previous employer

- To remain with spousal coverage, if available, as Medicare Part B premiums are based on income reported two years prior

- Union coverage

- Employer coverage

How Do You Apply By Phone

Call 772-1213 or TTY 325-0778 between 7 a.m. and 7 p.m. from Monday through Friday.5 Keep in mind that this process takes longer because forms have to be mailed to you, which you then complete and send back. At peak times, applying for Medicare by phone could take a month or more.

If you worked at a railroad, you can enroll in Medicare by calling the Railroad Retirement Board at 772-5772 or TTY 751-4701, 9AM 3:30PM, Monday Friday.

Don’t Miss: Does Medicare Cover Eye Exams For Glaucoma

How To Apply For Medicare: The Basics

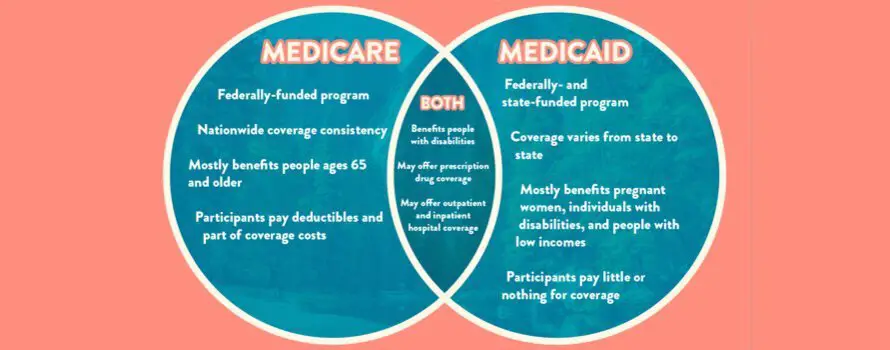

Original Medicare is made up of two parts: Part A and Part B.

Part A is known as hospital insurance and covers services like a room, meals, nursing services, and treatment in a hospital or skilled nursing facility. Most people do not have to pay premiums for Part A because of the payroll taxes paid during their working career.

Part B is known as medical insurance and covers services like tests, services performed by doctors , preventive services like flu shots, and much more. Part B is covered by a monthly premium, set by law each year.

Although Medicare is its own entity, all applications for Original Medicare go through the United States Social Security Administration. You can apply for Medicare in one of three ways:

- Online: This method is the easiest and quickest way to apply, taking ten to thirty minutes.

- : If you want to talk to a human but from the convenience of your home.

- In person: If your situation is complicated, you dont wish to mail important documents, or you prefer speaking to someone face-to-face.

Ssa Benefits And Medicare

So lets go back to how your full retirement age and Medicare may interact. The biggest thing is that in the past, at age 65, you both got your SSA benefits and became Medicare eligible. This meant you could use your SSA benefits to help pay for Medicare. However, with the full retirement age being at least a year or more past 65, you need to think carefully about when you take your SSA benefits if you want to use them for Medicare costs.

Read Also: What Is Medicare Id Number

Medicare Eligibility Due To Specific Illnesses

In addition to the above ways to qualify for Medicare health insurance, you may also be eligible if you have one of the following diseases:

- End-stage renal disease. To qualify, you must need regular dialysis or a kidney transplant, and your coverage can begin shortly after your first dialysis treatment. If you receive a transplant and no longer require dialysis, youll lose Medicare eligibility.

- Amyotrophic lateral sclerosis. Also known as Lou Gehrigs Disease, patients diagnosed with this terminal disease gain immediate Medicare eligibility.

Medicare Late Enrollment Penalties

If youre not automatically enrolled in Medicare and you dont apply on time, you may face late enrollment fees:

-

Medicare Part A: If you must buy Part A and you dont purchase it during your initial enrollment period, you may owe 10% more than the monthly premium for twice the time period you didnt sign up.

-

Medicare Part B: If you dont sign up for Part B during your initial enrollment period, your monthly premium increases 10% for each 12-month period that you went without Part B coverage. This is a permanent penalty as long as you have Part B.

-

Medicare Part D: If you go without Medicare drug coverage or other creditable prescription drug coverage for 63 or more days once your initial enrollment period ends, you’ll be assessed a permanent penalty for as long as you have Medicare drug coverage. The penalty is calculated as 1% of the national base beneficiary premium multiplied by the number of full months you werent covered. Your exact penalty amount is recalculated each year.

Read Also: Can I Sign Up For Medicare Part B Online

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Requalifying For Medicare At 65

If you become eligible for Medicare before you turn 65 due to disability or one of the above diagnoses, youll requalify again when you reach age 65. When you do, youll have another Initial Enrollment Period and all the benefits of a newly eligible Medicare recipient, such as a Medicare Supplement Enrollment Period.

Also Check: Does Medicare Part C Cover

What Are My Insurance Options If I Cannot Get Medicare At Age 62

If you dont qualify for Medicare, you may be able to get health insurance coverage through other options:

- Employer-provided insurance

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Hes passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

Medicare Supplement Plan Eligibility

Like Medicare Advantage, Medicare supplemental insurance often called Medigap because it fills in the out-of-pocket coverage gaps in Medicare Parts A and B is also purchased from private insurers.

Medigap helps cover copayments, coinsurance and deductibles from Medicare Part A and Part B.

You must meet one of these qualifications to be eligible for Medigap coverage:

- You must be 65 or older.

- You have been diagnosed with Lou Gehrigs disease.

- You have been entitled to Social Security or U.S. Railroad Retirement Board disability payments for at least 24 months.

- You have been diagnosed with end-stage renal disease, requiring regular dialysis or a kidney transplant.

Recommended Reading: Can You Get Medicare If You Work Full Time

What If You Worked 10 Years Or Less

Most people will qualify for coverage by paying Medicare and Social Security taxes for 10 years through any combination of employers. Youll need to have spent 10 years doing taxable work to enroll in Medicare Part A for free. If youve worked for less than 10 years in the US, youll need to pay monthly premiums for Medicare Part A.

However, if your spouse who is 62 or older has enough quarterly credits or receives Social Security benefits, then youll still qualify. You may also be able to qualify based on your spouses work record if youre widowed or divorced.

How Old Do You Have To Be To Get Medicare Part D

To enroll in Medicare Part D, you must be enrolled in Medicare Part A. Thus, the age requirement for Medicare Part A will inherently become the age requirement for Medicare Part D.

This means, you will need to be at least age 65 or qualify for Medicare Part A based on disability status to enroll in Medicare Part D.

Don’t Miss: Do You Apply For Medicare Through Social Security

Can You Delay Medicare Enrollment Even If You Are Eligible

The short answer here is yes, you can choose when to sign up for Medicare. Even if you get automatically enrolled, you can opt out of Part B since it requires a monthly premium. But there are good reasons to join on time when you first become eligible.

A Delay In Coverage Can Result In Increased Costs, Especially Long Term

First, signing up during your initial eligibility window guarantees that you have coverage sooner. Waiting to enroll in Medicare until after your 65th birthday can mean waiting for effective coverage for up to three months after you turn 65. Three months might not sound like a long time, but when you need medical care or prescription drugs, that 3-month gap can be expensive.

If you dont sign up at all during your initial eligibility window, then youll have to wait until the general enrollment period to enroll, which runs from January 1 through March 31 each year. Coverage then starts in July.

Heres An Example Scenario:

- You turn 65 in June, but you choose not to sign up for Medicare during your IEP .

- In October, you decide that you would like Medicare coverage after all. Unfortunately, the next general enrollment period doesnt start until January.

- You sign up for Parts A and B in January.

- Your coverage starts in July, over a full year from when you turned 65.

Penalty Fees For Not Enrolling On Time

Signing Up For Medicare

Follow the steps below if you need to actively enroll in Medicare.

If you decide to enroll in Medicare during your Initial Enrollment Period, you can sign up for Parts A and/or B by:

- Visiting your local Social Security office

- Mailing a signed and dated letter to Social Security that includes your name, Social Security number, and the date you would like to be enrolled in Medicare

- Or, by applying online at www.ssa.gov

If you are eligible for Railroad Retirement benefits, enroll in Medicare by calling the Railroad Retirement Board or contacting your local RRB field office.

Keep proof of when you tried to enroll in Medicare, to protect yourself from incurring a Part B premium penalty if your application is lost.

- Take down the names of any representatives you speak to, along with the time and date of the conversation.

- If you enroll through the mail, use certified mail and request a return receipt.

- If you enroll at your local Social Security office, ask for a written receipt.

- If you apply online, print out and save your confirmation page.

Related Answers

You May Like: When Can I Get My Medicare

When Should You Apply For Medicare If You Have Employer Health Coverage

Most people should sign up for Medicare Part A when theyre first eligible because it rarely costs anything. But some people delay enrolling in Part B because they dont want to pay the monthly premium. The decision usually depends on the type of health coverage you already have.

You can put off enrolling in Part B at age 65 if you have group health coverage through your or your spouses job and the employer has at least 20 employees.6 Youll be able to enroll with no penalty during the Special Enrollment Period that follows the end of your employers insurance. You can also choose to enroll in Part B while still insured and pay the premium.

If your employer has fewer than 20 employees, you should apply for Part A and Part B as soon as youre eligible.7

Be sure to talk to your employers benefits administrator about how signing up for Medicare will affect your coverage or Health Savings Account .8 You cannot contribute to an HSA if you have Medicare Part A. Your administrator can help you time the beginning and end of your coverage through work and your new health insurance so theres no gap in your coverage.

When your group coverage is ending, youll need to complete documentation and submit it to your Social Security office. If you have questions, ask Social Security.

When Should You Apply For Medicare

In most cases, you should apply for Medicare as soon as you’re eligible. The initial enrollment period starts three months before the month you turn 65, includes your birth month, and extends three months past the month you turn 65, giving you a seven-month window to apply. Your Part B coverage will likely be delayed if you enroll the month you turn 65 , so apply early to avoid a gap in coverage.

Medicare imposes a hefty late enrollment penalty if you enroll in Part B or D after the initial enrollment period and don’t qualify for a special enrollment period . You might qualify for a SEP if you have coverage, including creditable drug coverage from an employer or a union . Medicare does not charge a late enrollment penalty for enrolling in a Medicare Advantage plan or Medicare Supplement plan after IEP. But it’s best to apply for Medigap as soon as you’re eligibleif you apply within the first six months of having Part B coverage, you can’t be denied a Medigap policy or be required to pay more because of health conditions. Here’s how enrollment works depending on whether or not you already receive Social Security benefits.

If you already receive Social Security benefits:

You should also check out the Medicare Enrollment Booklet which contains clear, concise information about both Medicare Part A and Part B.

If you are not yet receiving Social Security benefits:

When to get prescription drug coverage:

You May Like: How Can I Get A Medicare Card

How Do I Sign Up For Medicare

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Youll be automatically enrolled in Medicare at age 65 if youre already receiving Social Security. If you arent receiving those benefits, you can enroll in one of three ways:

-

Apply for Medicare online at Social Securitys website.

-

Contact your local Social Security office.

The online application typically takes less than 10 minutes. The Social Security Administration has suspended face-to-face service in local offices due to the COVID-19 pandemic, so no in-person visits are possible at this time. It’s planning to reopen some offices later in 2022, but most Medicare enrollment is quick and easy online.

When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

Don’t Miss: What Is Medicare Catastrophic Coverage

How Much Is Medicare Part A 2020

In 2020, the Medicare Part A premium can be as high as $458 per month. Lets say Geralds wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

You May Like: Does Medicare Pay For Inogen Oxygen Concentrator