How Do I Shop For A Medigap Policy

There are a few ways to find out what policies are available in your area.

-

Enter your ZIP code on the Medicare search tool to see which plans are offered in your state.

-

Contact your State Health Insurance Assistance Program to find out which insurance companies sell Medigap policies in your state. Ask for a Medigap rate comparison shopping guide. This program can provide free help in choosing a suitable Medigap policy.

Shop around at a few insurance companies and compare their prices for your preferred plan. In its guide to choosing a Medigap policy, CMS suggests you ask each company these questions:

-

Are you licensed in my state?

-

Do you sell the Medigap plan Im interested in?

-

Do you use medical underwriting for this Medigap plan?

-

Is there a waiting period for pre-existing conditions?

-

Is this policy priced using community rating, issue-age rating, or attained-age rating?

-

Whats the premium based on my age?

-

Has the premium for this Medigap policy increased in the last 3 years? If so, how much?

-

Are there any discounts or additional benefits?

Once youve chosen a company, youre ready to fill out your application for your Medigap policy.

Remember that, as mentioned above, new Medigap policies dont cover prescription drugs. For drug coverage, you will probably need to enroll in Medicare Part D.

Recommended Reading: What Is Medicare Premium Assistance

Need Medigap Or Medicare Advantage

If you want to reduce your costs with an Original Medicare plan, then buying a Medigap policy can cover your deductibles, coinsurance payments. Dental, vision and hearing will not be covered by Original Medicare and Medigap. If you want all the additional coverages not offered under Original Medicare, consider buying a Medicare Advantage Plan.

SmartFinancial can help you shop and narrow down your options to those that meet your coverage needs and budget. Enter your zip code, answer a few questions and you can receive your free quotes within minutes. You can also call 855.214.2291.

About the Author

Dan Marticio is an insurance specialist for SmartFinancial. His past experience writing in small business and personal finance verticals has earned him bylines on prominent fintech brands, including LendingTree, ValuePenguin, Fundera, The Balance, and NerdWallet. His guides always aim to assist everyday consumers and entrepreneurs make informed decisions about their finances and business.

Original Medicare: Parts Coverage And Exclusions

The federal government designed Medicare to provide affordable healthcare to people in the United States, including people aged 65 years or older as well as younger people with certain health conditions.

According to the Centers for Medicare and Medicaid Services, there were more than 60 million enrollees in the Medicare program in 2019.

Medicare has various parts and options for healthcare coverage. Original Medicare combines Part A and Part B . After an individual pays the deductible, Medicare pays a share of healthcare costs.

This article looks at the details of original Medicare, eligibility, enrollment options, and costs.

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan:

- Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments.

- Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

- Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Federally funded Medicare has four parts covering various healthcare services. In general, the program is for older people in the U.S., although younger people with disabilities or some medical conditions may also be eligible for Medicare.

The program consists of:

Don’t Miss: Is Blue Cross Blue Shield A Medicare Advantage Plan

Explore Our Plans And Policies

Medicare Advantage Policy Disclaimers

All Cigna products and services are provided exclusively by or through operating subsidiaries of Cigna Corporation. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. All clinical products and services of the LivingWell Health Centers are either provided by or through clinicians contracted with HealthSpring Life & Health Insurance Company, Inc., HealthSpring of Florida, Inc., Bravo Health Mid-Atlantic, Inc., and Bravo Health Pennsylvania, Inc. or employees leased by HS Clinical Services, PC, Bravo Advanced Care Center, PC , Bravo Advanced Care Center, PC and not by Cigna Corporation. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. All pictures are used for illustrative purposes only.

Cigna contracts with Medicare to offer Medicare Advantage HMO and PPO plans and Part D Prescription Drug Plans in select states, and with select State Medicaid programs. Enrollment in Cigna depends on contract renewal.

Medicare Supplement Policy Disclaimers

Medicare Supplement website content not approved for use in: Oregon and Texas.

AN OUTLINE OF COVERAGE IS AVAILABLE UPON REQUEST. We’ll provide an outline of coverage to all persons at the time the application is presented.

American Retirement Life Insurance Company, Cigna National Health Insurance Company and Loyal American Life Insurance Company do not issue policies in New Mexico.

Exclusions and Limitations:

Is Signing Up For Medicare Mandatory

In some cases, yes.

If you have coverage under the Affordable Care Act, COBRA through a past employer or TRICARE for retired military members, youre required to enroll in Medicare when you turn 65.

You may not have to sign up for Medicare right away if youre still working and enrolled in your employers group health plan coverage or if your spouse is still working and youre covered under their plan. But be sure to check with your employer. Some companies will require you to enroll in Part A and Part B and use your employer insurance as secondary coverage.

Be sure youre very clear on the rules. The penalties for late enrollment are steep and, in some cases, can increase your Medicare costs for the rest of your life.

Robin Hartill is a certified financial planner and a senior editor at The Penny Hoarder. Rachel Christian is a senior writer and Certified Educator in Personal Finance.

Read Also: Does Medicare Cover Psychological Therapy

General Fund Revenue As A Share Of Total Medicare Spending

This measure, established under the Medicare Modernization Act , examines Medicare spending in the context of the federal budget. Each year, MMA requires the Medicare trustees to make a determination about whether general fund revenue is projected to exceed 45 percent of total program spending within a seven-year period. If the Medicare trustees make this determination in two consecutive years, a funding warning is issued. In response, the president must submit cost-saving legislation to Congress, which must consider this legislation on an expedited basis. This threshold was reached and a warning issued every year between 2006 and 2013 but it has not been reached since that time and is not expected to be reached in the 20162022 window. This is a reflection of the reduced spending growth mandated by the ACA according to the Trustees.

Medicare Part A B C And D: What You Need To Know

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

Medicare Parts A, B, C, and D are the four distinct types of coverage available to eligible individuals. Each Medicare part covers different healthcare-related costs. While Medicare Part A and Medicare Part B are administered by the Centers for Medicare and Medicaid Services , Medicare Part C and Medicare Part D are managed by private insurance companies.

Medicare is similar to the health insurance coverage youve probably had with an employer or an individual policy. It can cover doctor visits, inpatient and outpatient hospital care, prescription drugs, and lab tests. Depending on the plan you choose, your Medicare plan can also cover dental and vision, if you like.

Heres a brief overview of each of the parts of Medicare.

You May Like: How To Bill Medicare For Home Health Services

How Many Parts Of Medicare Are There

You might be wondering, How many parts of Medicare are there? Medicare is actually made up of four parts: A, B, C, and D. Heres a quick overview of what these Medicare parts cover.

Medicare Part A is hospital insurance .

Medicare Part B is medical insurance .

Medicare Part C is also known as Medicare Advantage. It includes Parts A and B, which are the hospital insurance and medical insurance portions of Medicare coverage. Most Medicare Advantage plans also have prescription drug, vision, and dental coverage.

Medicare Part D is prescription drug coverage .

For more complete details on the parts of Medicare, view Medicare Parts A, B, C, and D.

Want to explore your Medicare options and see what plans work for your needs and budget? Compare plans with HealthMarkets today.

MULTIPLAN_HM_HOWMANYPARTSMEDICARE_2021_M

Find Coverage that Fits Your Needs and Budget

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

Top Stories

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE 24 hours a day/ 7 days a week to get information on all of your options.

This information is not a complete description of benefits. Call the Plans customer service phone number for more information.

46513-HM-1020

46513-HM-1020

Costs And Funding Challenges

Over the long-term, Medicare faces significant financial challenges because of rising overall health care costs, increasing enrollment as the population ages, and a decreasing ratio of workers to enrollees. Total Medicare spending is projected to increase from $523 billion in 2010 to around $900 billion by 2020. From 2010 to 2030, Medicare enrollment is projected to increase dramatically, from 47 million to 79 million, and the ratio of workers to enrollees is expected to decrease from 3.7 to 2.4. However, the ratio of workers to retirees has declined steadily for decades, and social insurance systems have remained sustainable due to rising worker productivity. There is some evidence that productivity gains will continue to offset demographic trends in the near future.

The Congressional Budget Office wrote in 2008 that future growth in spending per beneficiary for Medicare and Medicaidthe federal governments major health care programswill be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costswhich will be difficult, in part because of the complexity of health policy choicesis ultimately the nations central long-term challenge in setting federal fiscal policy.

Read Also: Can I Get Lap Band Surgery On Medicare

Medicare Part A: Hospital Insurance

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,556 deductible in 2022.

Services covered under Part A may include surgeries, inpatient care in hospitals, skilled nursing facilities, hospice care, home healthcare services, and inpatient care in a religious non-medical healthcare institution.

This sounds straightforward, but it’s not. For example, Part A covers in-home hospice care but does not cover a stay in a hospice facility.

Additionally, if you’re hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each day’s expenses. If you’re admitted to the hospital multiple times during the year, you may need to pay a deductible each time.

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

The 2022 Part-B premium is $170.10 per month

Recommended Reading: Does Medicare Cover Private Home Care

Don’t Miss: Does Medicare Cover A Yearly Physical

Medicare Advantage Plans: Common Elements

- All plans have a contract with the Centers for Medicare and Medicaid Services .

- The plan must enroll anyone in the service area that has Part A and Part B, except for end-stage renal disease patients.

- Each plan must offer an annual enrollment period.

- You must pay your Medicare Part B premium.

- You pay any plan premium, deductibles, or copayments.

- All plans may provide additional benefits or services not covered by Medicare.

- There is usually less paperwork for you.

- The Centers for Medicare and Medicaid Services pays the plan a set amount for each month that a beneficiary is enrolled.

The Centers for Medicare and Medicaid Services monitors appeals and marketing plans. All plans, except for Private Fee-for-Service, must have a quality assurance program.

If you meet the following requirements, the Medicare Advantage plan must enroll you.

You may be under 65 and you cannot be denied coverage due to pre-existing conditions.

- You have Medicare Part A and Part B.

- You pay the Medicare Part B premium.

- You live in a county serviced by the plan.

- You pay the plans monthly premium.

- You are not receiving Medicare due to end-stage kidney disease.

Another type of Medicare Managed Health Maintenance Organization is a Cost Contract HMO. These plans have different requirements for enrollment.

What Is Medicare Part C

Medicare Part C, also called Medicare Advantage, includes the coverage benefits of Medicare Parts A and B. Medicare Part C plans can also offer prescription drug benefits and other additional coverage . In total, Medicare Part C can cover things like:

- Medicare Part A

- Medicare Part B

- Medicare Part D

- Health and wellness programs

Read Also: How To Sign Up For Medicare Gov

Other Parts Of Medicare That Cover Hospitalization Costs

Although Part A is generally known as hospital insurance, other parts of Medicare may also cover some of the costs of a hospital stay.

These may include:

- Part B. Generally, Medicare Part B doesnt cover costs for inpatient care, but it may cover services that occur before or after inpatient care. Part B covers doctors appointments, emergency room visits, urgent care visits, lab work, X-rays, and many other outpatient services.

- Part C .Medicare Advantage plans are sold by private insurance companies and include the services covered under parts A and B. They may also cover prescription drugs, dental care, or vision care.

- Medicare supplement insurance . These plans help you pay for out-of-pocket healthcare costs and fees from Part A and Part B, such as copays, coinsurance, and deductibles. Medigap plans are sold by private insurance companies, so coverage and costs vary by plan, provider, and location.

From year to year, there may be slight variations in coverage and costs for Medicare Part A. For 2022, the main changes are related to costs, including the deductible and coinsurance amounts.

B Doctor And Outpatient Services

This part of Medicare covers doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation and other outpatient services.

Unlike Part A, Part B involves more costs, and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouses health plan. But if you dont have other insurance and dont sign up for Part B when you first enroll in Medicare, youll likely have to pay a higher monthly premium for as long as youre in the program.

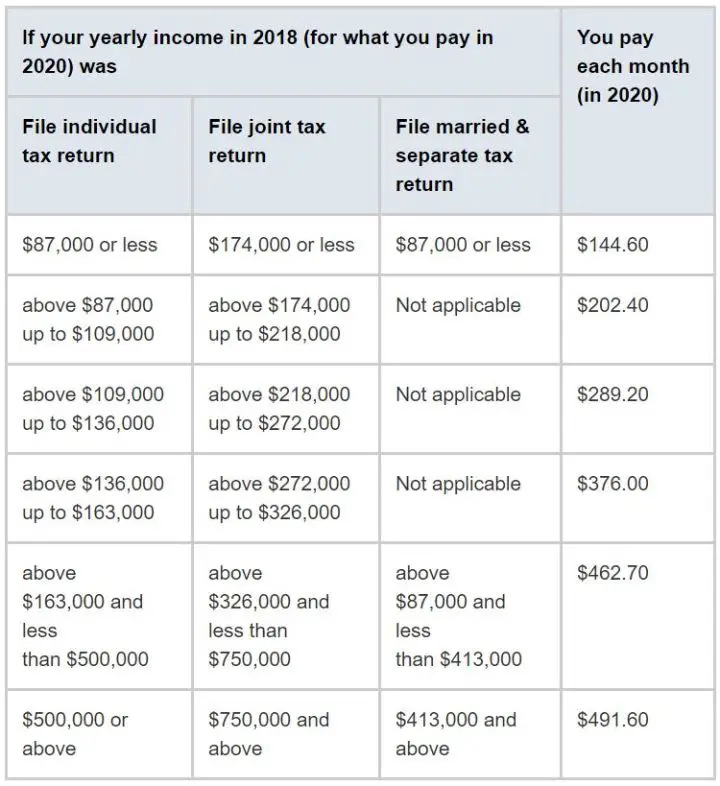

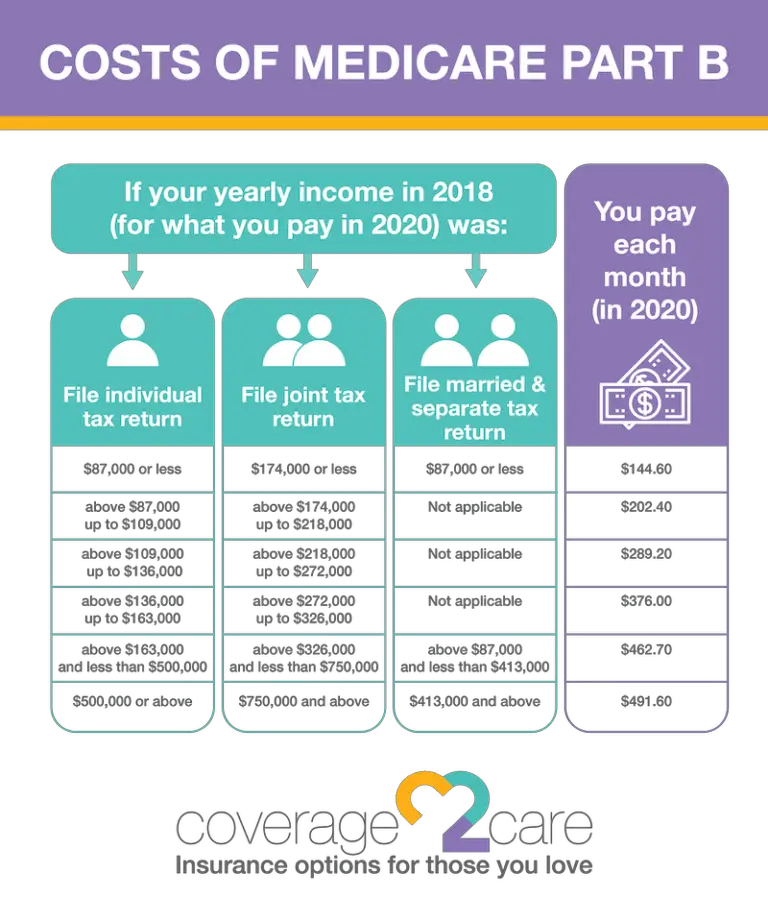

The federal government sets the Part B monthly premium, which is $170.10 for 2022. It may be higher if your income is more than $91,000.

Youll also be subject to an annual deductible, set at $233 for 2022. And youll have to pay 20 percent of the bills for doctor visits and other outpatient services. If you are collecting Social Security, the monthly premium will be deducted from your monthly benefit.

Also Check: Does Medicare Pay For Glucometer

What Are My Costs

- Original Medicare

-

- For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance.

- You pay a premium for Part B. If you choose to join a Medicare drug plan, youll pay a separate premium for your Medicare drug coverage .

- Theres no yearly limit on what you pay out of pocket, unless you have supplemental coveragelike Medicare Supplement Insurance .

- Medicare Advantage

-

- Out-of-pocket costs varyplans may have different out-of-pocket costs for certain services.

- You pay the monthly Part B premium and may also have to pay the plans premium. Plans may have a $0 premium or may help pay all or part of your Part B premium. Most plans include Medicare drug coverage .

- Plans have a yearly limit on what you pay out of pocket for services Medicare Part A and Part B covers. Once you reach your plans limit, youll pay nothing for services Part A and Part B covers for the rest of the year.

Medicare Part B: Medical Services

Purchasing Medicare Part B affords you coverage for several types of medical services, including :

-

Alcohol misuse screenings and counseling: Covers up to four face-to-face counseling sessions each year.

-

Ambulance services: Includes ground ambulance transportation to a hospital or other healthcare facility.

-

Bariatric surgery: Pays for gastric bypass surgery, laparoscopic banding surgery or some other type of procedure related to morbid obesity.

-

Preventative services: Flu shots, glaucoma tests and screenings for HIV and Hepatitis B and C and other types of services that detect early signs of illness are covered.

-

Acupuncture: Covers up to 12 acupuncture visits for eligible chronic low back pain.

-

Chemotherapy: Covers chemotherapy appointments in a doctor’s office, freestanding clinic or hospital outpatient setting.

-

Chiropractic services: Covers treatment to your spine by a chiropractor.

-

Chronic care management: Covers treatment for chronic conditions . This can include a comprehensive care plan, medication and other support.

-

Colorectal cancer screening: Covers tests to identify precancerous growths and other early signs of cancer. Covered screening tests may include colonoscopies, fecal occult blood tests and flexible sigmoidoscopies.

-

Continuous Positive Airway Pressure devices: You may qualify for a three-month trial of CPAP therapy if you’ve been diagnosed with obstructive sleep apnea.

4 Parts Of Medicare – Compare Quotes

Also Check: When Can Someone Enroll In Medicare