What Plans Provide Gap Coverage

A Part D drug plan or Part C Medicare Advantage plan may include gap coverage, though these plans arent available everywhere and may have a higher premium. Plans are available by location, if you dont live in the service area, youre not eligible for that policy.

Online you can compare the total annual cost of your medications with all the plans in your area to find your most affordable option. You can even see if youre expected to hit the gap based on your prescriptions, the pharmacy you use, and the available policy.

If youre unsure how to compare plans or want an expert opinion, working with an insurance agent is a great way to discover the most cost-effective plan for you.

During Your Initial Enrollment Period

This lasts for seven months, of which the fourth one is the month in which you turn 65. For example, if your 65th birthday is in June, your IEP begins March 1 and ends Sept. 30.

To avoid late penalties and delayed coverage, you need to sign up for Medicare during your IEP in these circumstances:

- You have no other health insurance

- You have health insurance that you bought yourself

- You have retiree benefits from a former employer

- You have COBRA coverage that extends the insurance you or your spouse received from an employer while working

- You have veterans benefits from the Department of Veterans Affairs health system

- Youre in a nonmarital domestic relationship with someone of the same or opposite sex and you are covered by his or her employer insurance

If you enroll during the first three months of your IEP, your Medicare coverage begins on the first day of the month you turn 65 . If you sign up during the fourth month, coverage begins on the first day of the following month. But if you leave it until the fifth, sixth or seventh month, coverage will be delayed by two or three months. For example, if your birthday is in June and you sign up in September , coverage will not begin until Dec. 1.

Tips For Getting Retirement Ready

- A financial advisor can be a big help in figuring out how medical expenses will affect your retirement. Finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free financial advisor matching tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Medical costs arent the only expenses youll need to grapple with in retirement. Think about where youll want to retire to see how cost of living could impact your lifestyle. SmartAssets cost of living calculator can help you figure out your costs so youll know how much youll need to save. And our retirement calculator can help you see if youre on track with those savings.

You May Like: What’s Wrong With Medicare Advantage

When Does Medicare Advantage Coverage Start

The date your Medicare Advantage plan starts depends on the enrollment period and your eligibility. Those turning 65 and enrolling in Medicare can select a Medicare Advantage plan up to three months before the effective date.

When you pre-enroll in your plan, you save yourself from scrambling. Starting Medicare is one thing you do not want to procrastinate.

Many people change plans during the Annual Enrollment Period. If you make a change during this window, your policy will begin on January 1 of the following year.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Recommended Reading: Is Synvisc Covered By Medicare In Australia

Delaying Medicare Parts A & B

If you qualify to delay both Medicare Parts A & B, you can do so without penalty as long as you enroll within eight months of either losing your employer coverage or ceasing to work, whichever comes first. You will enroll during a Special Enrollment Period and will need to also provide written proof of creditable drug coverage to avoid Part D penalties.

Also Check: Does Medicare Cover Adult Daycare

How Old Do You Have To Be To Get Medicare

Home / FAQs / General Medicare / How Old Do You Have To Be To Get Medicare

When you think about Medicare, the first thing that comes to mind is typically retirement. Those who have Medicare are often of an age old enough for retirement. However, this is not always the case. Medicare not only covers those who have retired from the workforce, but also those disabled or who meet other specific criteria.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

So, how old do you have to be to get Medicare?

Below, we review the age for you to get Medicare and how you may qualify for coverage and not even know yet.

If My Spouse Is 65 And Im 62 How Can That Affect My Spouses Medicare Costs

Traditional Medicare refers to Part A and Part B. Almost everyone has to pay a Part B monthly premium. But most people donât have to pay a Part A monthly premium.

For Medicare Part A, your monthly premium amount depends on how long you or your spouse worked and paid taxes.

If youâve worked at least 10 years while paying Medicare taxes, you donât pay a monthly premium for your Medicare Part A benefits. But if you havenât worked, or worked less than 10 years, you may pay a premium.

Hereâs where your spouse might benefit from your work history, or vice versa. Say youâre age 62 or older, and your spouse is 65. Your Medicare-eligible spouse has worked for less than 10 years. You, on the other hand, arenât eligible for Medicare yet at age 62, but youâve worked at least 10 years while paying taxes.

Well, tell your spouse he or she owes you a grand night out on the town. Because of your work history, your spouse will qualify for premium-free Part A.

So, to summarize with an example:

- Bob is 65 years old. Heâs on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

Read Also: Will Medicare Pay For An Mri

When Is Trail The Best Choice

We prefer the simplicity and depth-of-coverage Medicare Supplements offer seniors. You get to utilize the Original Medicare benefits youâve been paying into for years.

While we do recommend a Medicare Supplement to the majority of retired teachers we meet, there are always going to be exceptions.

If you take a rare, very expensive medication, weâd encourage you to stay on TRAILâs Medicare Advantage plan. As you saw earlier, their drug coverage is very simple and very good. The most youâd ever pay for a drug is a $100 copay. Youâre probably not going to find another drug plan out there like it.

The other scenario is if youâre covered through the VA. One of our clients is eligible for 100% coverage through the VA. He kept the TRAIL plan, because he knew if he ran into a scenario where he wasnât covered, he could always fall back on the VA. He could go to the VA hospital in Jacksonville if the TRIP option left him hanging.

So those are the two most common situations where weâd recommend you stay on TRAIL: you have a very expensive drug or you also get coverage through the VA.

Recommended Reading: How Do I Get Part A Medicare

Medicare Faqs And Information To Consider

Automatic Enrollment:

If you are already receiving Social Security benefits, Railroad Retirement benefits, or Federal Retiree benefits, your enrollment in Medicare is automatic. Your Medicare card should arrive in the mail shortly before your 65th birthday. Check the card when you receive it to verify that you are entitled to both Medicare Parts A and B.

Initial Enrollment Period:

If you are not eligible for Automatic Enrollment, contact the Social Security Administration at 800-772-1213 or enroll online at www.socialsecurity.gov, or visit the nearest Social Security office to enroll in Medicare Part A and Medicare Part B. You have a seven month window in which to enroll in Medicare without incurring a penalty. If youre not automatically enrolled in premium-free Part A, you can sign up for it once your Initial Enrollment Period starts. Your Part A coverage will start six months back from the date you apply for Medicare, but no earlier than the first month you were eligible for Medicare. However, you can only sign up for Part B during the times listed below.

General Enrollment Period:

- General Enrollment Period for Medicare Parts A & B

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

Read Also: Do I Have To Use Medicare When I Turn 65

When I Turn 65 How Do I Get Medicare

Signing up for Medicare Visiting your local Social Security office. Calling Social Security at 800-772-1213. Mailing a signed and dated letter to Social Security that includes your name, Social Security number, and the date you would like to be enrolled in Medicare. Or, by applying online at www.ssa.gov.

Medicare Requirements Impacting Your Calpers Health Coverage

If youre Medicare eligible and you lose your Part A and/or Part B, youll be disenrolled from the CalPERS Medicare health plan. Your disenrollment from Part A and/or Part B may result in cancellation of your CalPERS health coverage.

CMS requires members to live in the approved plan service area and list a residential address. Post Offices Boxes are not permitted. If CalPERS is unable to verify your permanent residential address, your enrollment may be subject to cancellation, or you may be administratively enrolled in a Medicare Supplement plan to continue your CalPERS health coverage.

CMS must approve your enrollment in a Medicare Advantage plan and Medicare Part D plan. CalPERS and/or your CalPERS Medicare health plan may contact you to obtain additional information required by CMS to complete your enrollment. If youre contacted for additional information, respond immediately to protect your health coverage.

You may be enrolled in only one Medicare Advantage plan at one time, as well as one Medicare Part D plan at one time. If youre enrolled in a CalPERS Medicare health plan and later enroll in another Medicare health plan, youll be disenrolled from the previous Medicare health plan.

Recommended Reading: Can You Sign Up For Medicare Anytime

Recommended Reading: Is Smart Vest Covered By Medicare

Signing Up For Medicare

Follow the steps below if you need to actively enroll in Medicare.

If you decide to enroll in Medicare during your Initial Enrollment Period, you can sign up for Parts A and/or B by:

- Visiting your local Social Security office

- Mailing a signed and dated letter to Social Security that includes your name, Social Security number, and the date you would like to be enrolled in Medicare

- Or, by applying online at www.ssa.gov

If you are eligible for Railroad Retirement benefits, enroll in Medicare by calling the Railroad Retirement Board or contacting your local RRB field office.

Keep proof of when you tried to enroll in Medicare, to protect yourself from incurring a Part B premium penalty if your application is lost.

- Take down the names of any representatives you speak to, along with the time and date of the conversation.

- If you enroll through the mail, use certified mail and request a return receipt.

- If you enroll at your local Social Security office, ask for a written receipt.

- If you apply online, print out and save your confirmation page.

Related Answers

Your First Chance To Sign Up

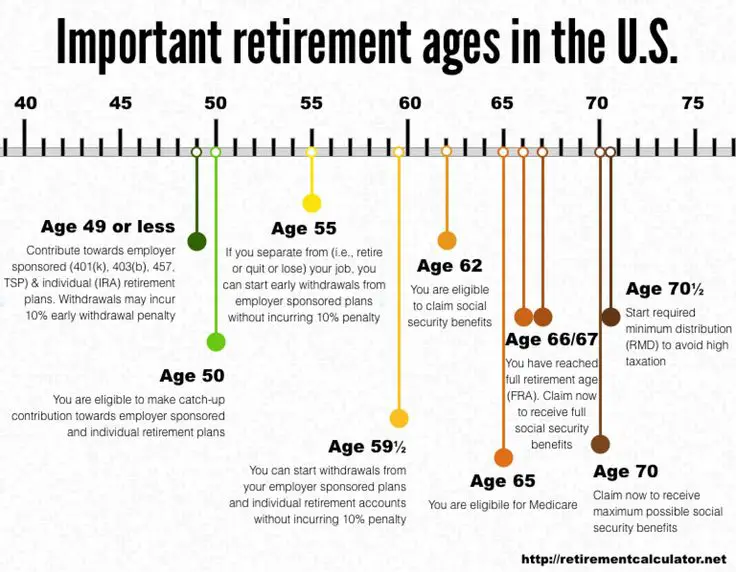

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Also Check: How Do I Find A Medicare Advocate

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

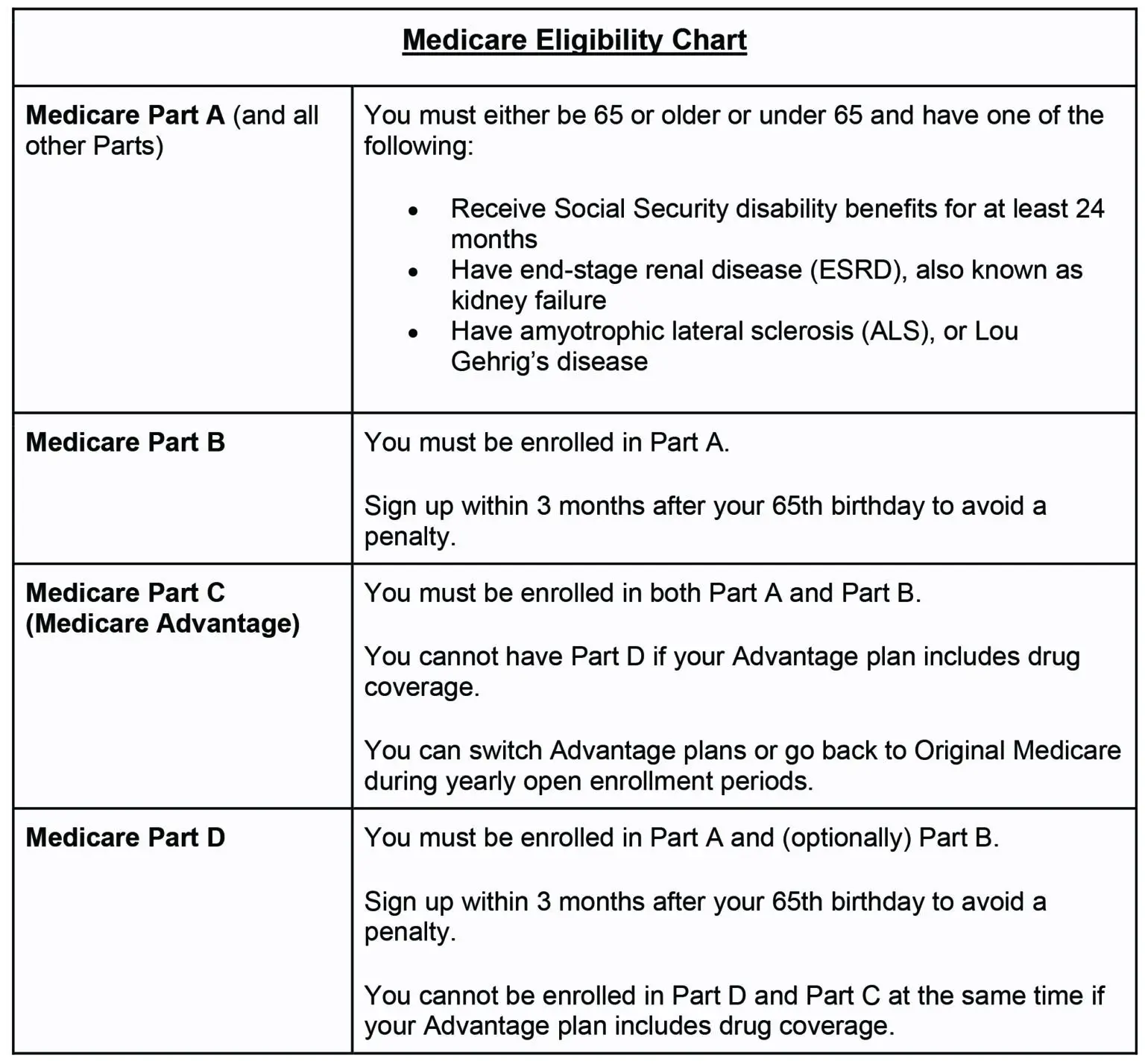

How Old Do You Have To Be To Get Medicare Part D

To enroll in Medicare Part D, you must be enrolled in Medicare Part A. Thus, the age requirement for Medicare Part A will inherently become the age requirement for Medicare Part D.

This means, you will need to be at least age 65 or qualify for Medicare Part A based on disability status to enroll in Medicare Part D.

Read Also: Does Medicare Pay For Inr Home Testing

After You Apply For Medicare

No matter how you applied, once your application is complete, the Social Security office will send you a copy of the information it has on record regarding your application. Be sure to double-check this document for any mistakes, as this is your chance to correct it.

Some time later, youll get your Medicare card via mail, so be on the lookout for envelopes from the Social Security office.

You May Like: When Can You Get Medicare Health Insurance

In General It’s 65 But You Might Be Eligible Sooner

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

When you think of Medicare, you probably assume that its for people of retirement age. Thats true, but the program covers more than just those who have worked all their life. You might be eligible right now and not know it. While most beneficiaries are people aged 65 or older, others receive these services at a younger age due to a qualifying disability.

Read Also: What Is Aarp Medicare Complete

How Does Medicare Work With My Job

Keep in mind that:

- Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security .

- If you have a Health Savings Account, you and your employer should stop contributing to it 6 months before you sign up for Part A to avoid a tax penalty.

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Don’t Miss: What Is An Advantage Plan With Medicare

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .