What Are My Costs

- Original Medicare

-

- For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance.

- You pay a premium for Part B. If you choose to join a Medicare drug plan, youll pay a separate premium for your Medicare drug coverage .

- There’s no yearly limit on what you pay out of pocket, unless you have supplemental coveragelike Medicare Supplement Insurance .

- Medicare Advantage

-

- Out-of-pocket costs varyplans may have different out-of-pocket costs for certain services.

- You pay the monthly Part B premium and may also have to pay the plan’s premium. Plans may have a $0 premium or may help pay all or part of your Part B premium. Most plans include Medicare drug coverage .

- Plans have a yearly limit on what you pay out of pocket for services Medicare Part A and Part B covers. Once you reach your plans limit, youll pay nothing for services Part A and Part B covers for the rest of the year.

Most Popular Medicare Advantage Company: Aarp/unitedhealthcare

- Customer satisfaction is below average

- 22% more complaints than a typical company

- Those who need expensive or ongoing medical care should be careful to avoid plans with a high out-of-pocket maximum

Full details about AARP/UHC Medicare Advantage

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with 27% of all enrollment. Plans are well rated and have affordable premiums and add-on benefits, a valuable combination that could account for the company’s popularity.

The plans may not be as highly rated as those from Kaiser Permanente, but they are still rated above average while also being priced affordably at about $21 per month.

AARP Medicare Advantage plans are administered by UnitedHealthcare , which offers good benefits and a wide network of providers. There’s also the option to get a PPO plan for better access to out-of-network care.

The company stands out for its broad range of add-on programs and discounts including vision, dental, free gym memberships, mental fitness and a credit toward over-the-counter products. These programs can be especially useful for those who want to stay healthy on a budget.

When Can You Sign Up

You can enroll in a Medicare Advantage plan during the following windows:

-

During your initial enrollment period.

-

Each year during Medicare’s open enrollment from Oct. 15 to Dec. 7.

-

From Jan. 1 to March 31, during Medicare Advantage open enrollment, you can switch from one Medicare Advantage plan to another .

If you’re switching plans, youll be automatically unenrolled from your old plan once your new one starts.

If you have any questions about the process, you can reach the folks at Medicare at 800-MEDICARE , or you can find information at Medicare.gov.

You May Like: What Age Is Medicare Free

What Does Medicare Advantage Cover

Medicare Advantage usually covers all three Medicare Parts:

- Medicare Part A: Covering hospitalizations. You usually wont pay a premium for this, however, its possible you wont qualify for premium-free Part A. If so, you can buy it.

- Medicare Part B: Covers medical insurance . Every Medicare Advantage enrollee pays a monthly premium for Part B.

- Medicare Part D: Covers prescription drug coverage. You pay for Part D coverage, and youll have extra out-of-pocket costs throughout the year. Only some Medicare Advantage plans offer this coverage.

Weve covered the basics of Medicare Advantage, but you have more choices to make when it comes to choosing a plan. It can get confusing, which is why well walk you through what to consider before making your decision.

Determine Your Budget And Potential Healthcare Costs

One of the most important things to consider when choosing the best Medicare Advantage plan is how much it will cost you. The find a plan tool lists the following cost information with the plans:

- monthly premium

- in- and out-of-network out-of-pocket max

- copays and coinsurance

These costs can range from $0 to $1,500 and above, depending on your home state, the plan type, and the plan benefits.

To get a starting estimate of your yearly costs, consider the premium, deductible, and out-of-pocket max. Any deductible listed is the amount that youll owe out-of-pocket before your insurance begins to pay out. Any out-of-pocket max listed is the maximum amount that you will pay for the services throughout the year.

When estimating your plan costs, consider these costs plus how often you will need to refill prescription drugs or make office visits.

If you require specialist or out-of-network visits, include those potential costs into your estimate as well. Dont forget to consider that your amount may be lower if you receive any financial assistance from the state.

Read Also: Who Qualifies For Medicare Part C

Why Would A Person Choose A Ppo Over An Hmo

You might choose a PPO in place of an HMO for Medicare coverage for convenience. With a PPO, you can choose which doctors youd like to see and your healthcare facilities. You dont necessarily need to name a primary care doctor, and you may not need a referral to see a specialist. HMO plans, by comparison, tend to be much more stringent with which providers you can use.

What’s The Best Medicare Advantage Plan In 2022

For 2022, Kaiser Permanente has the overall best-rated Medicare Advantage plans.

The best Medicare Advantage policy for you will depend on how well the plan’s costs and coverage match your needs.

Medicare Advantage, also known as Medicare Part C, is a bundled health plan that provide medical benefits that are at least as good as Original Medicare . In many cases, plans also include coverage for prescription drugs, dental and vision, making them a great way to simplify your insurance.

| $7 | 11% |

Average star rating is out of a maximum of five stars, monthly cost of 2022 plans is sourced from Medicare.gov, and popularity is the market share percentage.

Each insurer will have its pros and cons. Even our best overall pick isn’t the best for everyone because of its higher costs and limited availability. On the other hand, if you have specialized health care needs, then you could prioritize a plan with a large network of medical providers, which may give you better access to specialists. And if you’re looking for cheap coverage, keep in mind that there might be some trade-offs in terms of the plan’s benefits.

The general rule of thumb is that a cheaper plan will have trade-offs such as higher costs each time you get health care or poor customer service. A more expensive plan may give you better coverage, but the high monthly bill may not be worth it for those who are on a tight budget or who don’t need much medical care.

Read Also: Does Medicare And Medicaid Cover Dentures

How Much Does A Medicare Advantage Plan Cost

The cost of a Medicare Advantage plan may also vary by zip code, the services covered, and the type of care model it uses .

In 2022, the average monthly premium for a Medicare Advantage plan is $62.66 per month. But many Medicare Advantage beneficiaries pay no premium for their Medicare Advantage plan.

How can a Medicare Advantage plan offer a $0 premium? you may ask.

The answer is that Medicare Advantage plan carriers are paid by the Federal government to take on Medicare beneficiaries. Many plan carriers have been able to realize some operational efficiencies by doing things such as restricting the use of high-cost providers.

Questions To Consider When Choosing A Medicare Advantage Plan

Before enrolling in an MA plan such as a Health Maintenance Organization , find out as much information as you can about the plan. If possible, talk to people who are enrolled in the plan and ask your doctor about it.

Be sure to find out the answers to these questions:

Physicians

- Are there specific physicians you want to see? If so, are they in the plans network of providers ?

- Do the physicians you want to see participate in a different MA plan than the one youre considering? If so, which one? How much will your plan charge if you want to see physicians outside the plans network?

- If youre considering a Private Fee-for-Service plan, will your physicians accept that plans payment terms?

Part D Prescription Drug Benefits

- Does the MA plan include Part D drug benefits? Note: Several MA plans such as certain PFFS or HMO plans, do not offer Medicare Part D benefits.

- If the plan includes Part D benefits, does it cover the prescription drugs you are currently taking? Check the plans formulary to find out what is available to you at what cost.

Medigap

- Do you already have a Medigap policy? If so, you wont need to keep it if you enroll in an MA plan. A Medigap plan only pays benefits while you are in Original fee-for-service Medicare.

Take your time. Do not feel pressured to sign on with any plan this is your choice and you should take the time to get all the facts. However, you must make a decision before the end of any enrollment period that may apply.

Don’t Miss: How Old Before You Qualify For Medicare

Best Medicare Advantage Provider: Kaiser Permanente

- Can have higher monthly costs

- Only offered in eight states and Washington, D.C.

- Less flexibility to pick your doctor because plans are paired with Kaiser health facilities

Full details about Kaiser Permanente Medicare Advantage

Kaiser Permanente is the best Medicare Advantage provider because plans are consistently rated 5 out of 5 stars on Medicare.gov.

Kaiser Permanente’s Medicare Advantage plans are good for those who are willing to pay for a more expensive plan in order to get affordable medical care and good benefits. In general, enrollees will spend less on health services while having the predictable, but more expensive, monthly cost of the Medicare Advantage plan.

Even though a typical policy costs more than $50 per month, many plans have a $0 deductible, so you get the cost-sharing benefits as soon as you enroll. The copayments for medical care are also affordable, and with the sample plans we reviewed, a doctor visit could cost $15, an X-ray could cost $25 and a trip to the emergency room could cost $90.

Importantly, Kaiser’s Medicare plans have a limited provider network because the Medicare Advantage plans are paired with Kaiserâs medical centers and hospitals. This can be a helpful way to streamline your care because you can manage your health records and insurance coverage through the same online portal.

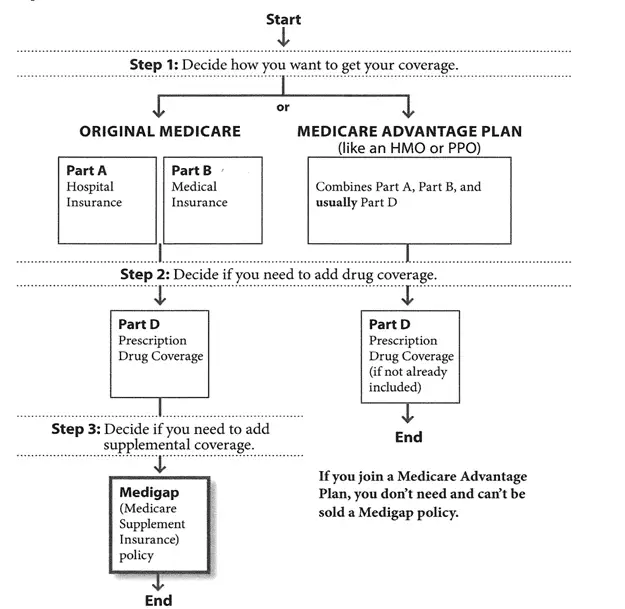

How To Choose A Medicare Plan Type

There are a few considerations to keep in mind as you begin searching for Medicare Supplemental insurance. First and foremost, there are two types of Medicare plans. You need to understand the difference between a Medicare Supplement and a Medicare Advantage plan.

They are not the same in fact, they work very differently. Once you understand how each plan works ask yourself some of these questions to help you filter down to which kind of plan might best suit you:

- Do your important physicians participate in any Medicare Advantage plans, or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

- Do you travel out of the area frequently? If so, you might find Original Medicare with a Medicare Supplement to be a good fit for you since you can use it for any doctor or hospital in the nation that accepts Medicare.

- What is your risk tolerance? If you have a year of heavy health spending, do you have enough savings to spend the possible out-of-pocket maximum that a Medicare Advantage plan might require?

- How about peace of mind? Are you a person who will sleep better at night if you have a lower premium and just pay for services as you go? If so, you might be a good candidate for a Medicare Advantage plan. By contrast, if you tend to worry about unexpected expenses, a Medicare Supplement could give you the peace of mind of knowing exactly what medical spending you will incur regardless of your health.

Read Also: Does Medicare Require Prior Authorization For Specialist

Original Medicare Vs Medicare Advantage: Providers

A final key difference to consider when choosing between Original Medicare and a Medicare Advantage plan is what health care providers you can see.

With Original Medicare you can go to any hospital and see any doctor or provider within the U.S. who accept Medicare. You do have limited coverage in foreign countries, though.

With Medicare Advantage, most plans have a network of doctors and providers you can see. If you go outside the plans network, its likely youll have to pay more to do so. However, emergency and urgent care are covered nationwide. You also have limited coverage in foreign countries, though some plans may offer special foreign coverage or travel benefits.

Health Maintenance Organization Hmo Plans

Health Maintenance Organizations are the most popular Medicare Advantage plans in Texas. These plans have a network you must stay in to get coverage, and youll choose a primary care doctor from this network.

HMOs are typically very affordable, often with $0 monthly premiums.

- Affordable out-of-pocket costs

- Choose your primary doctor in-network

- May include prescription coverage

- Low monthly premiums sometimes $0 per month

Also Check: How Much Is Medicare Part B Now

Medicare Advantage Plan Enrollment For 2023

If you currently have a Medicare Advantage plan and are wanting to enroll in a different one, then you will need to wait until the Medicare open enrollment period in most cases.

This period runs from October 15th December 7th. Any enrollment change you make for a Medicare Advantage plan during this period will be effective on January 1st of the following year.

Can You Switch Between Original Medicare And Medicare Advantage

As a final note, no matter which option you decide is right for you, you can switch from Original Medicare to Medicare Advantage or vice versa. The two main times you can switch are the Medicare Annual Enrollment Period and the Medicare Special Enrollment Period for qualifying life events, if you qualify.

Footnote

Read Also: How Much Is Medicare Going Up

Tip : Know Your Medicare Options

In a nutshell, you can choose Original Medicare or a Medicare Advantage plan. This chart offers a helpful overview of the differences between them.

- Original Medicare does not include prescription drug coverage

- Most Part C plans include coverage for prescription drugs

Plan choice flexibility

- Option to change the plan each year during the Annual Election Period, which runs from Oct. 15Dec. 7

Keep in mind

When reviewing your options and comparing plans, here are some important things to look out for:

Cost

How much will you pay for premiums, deductibles, coinsurance and copayments?

Doctors and hospitals

Does the plan have a network? Do the healthcare providers you use accept the plan? Are your doctors in the plans network?

Benefits

Does the plan include prescription drug coverage or coverage for vision, dental and hearing care? Are these benefits important to you?

Your health history

How often have you needed care over the past few years? Are you fairly healthy or do you have a chronic condition that requires ongoing care? Do you anticipate that your healthcare needs will increase or stay about the same in the near future?

Research Cms Star Ratings

The CMS has implemented a 5-star rating system to measure the quality of health and drug services provided by Medicare Advantage and Medicare Part D plans. Every year, the CMS releases these star ratings and additional data to the public.

The CMS ratings can be a great place to start when shopping around for the best Medicare Advantage plan in your state. Consider researching these plans for more information on what coverage is included and how much it costs.

To see all available Medicare Part C and D 2022 star ratings, visit CMS.gov and download the 2022 Part C and D Medicare Star Ratings Data.

Don’t Miss: Does Medicare Cost Me Money

Does A Plan Cover Doctors Facilities Other Providers I Want

Most Medicare Advantage plans have provider networks, so youll need to find out whether the doctors, hospitals and outpatient clinics you want to use are covered. The Plan Details page in Plan Finder may include a link to the plans provider network. If so, search or scroll down to Provider Costs.

In many cases, that link goes to the plans website, where you may find a searchable provider database. After you narrow the possibilities, you should call a plans customer service number and ask your doctors whether they participate in the plan or plans youre interested in to reconfirm what you saw online.

Be sure to ask about a specific plan by name. Some Medicare Advantage insurers offer several plans with different provider networks.

Also find out how your Medicare Advantage plan will treat your use of an out-of-network provider:

- Some health maintenance organizations pay nothing for out-of-network providers except for emergencies.

- Some preferred provider organizations cover out-of-network providers, but charge higher copayments and have higher out-of-pocket spending limits for out-of-network care.

This is important to know if you end up wanting to see a specialist thats not in the plans network or if you travel and need to go to a doctor while away from home. The Benefits & Costs section for each plan on Plan Finder lists the in-network copayments for each type of care and the out-of-network copayments if covered.

Which Medicare Advantage Plan Has The Best Dental Coverage

Medicare Advantage plans from AARP/UnitedHealthcare have some of the best dental benefits. You’ll get coverage for a wide network of dentists. Plus, routine or preventive services are free if you stay in-network. However, comprehensive dental coverage varies for the $0 plans. Some plans may cap their dental benefits, only paying $1,000 per policy year. Others don’t have a cap but instead have lower cost-sharing benefits, meaning you’ll spend more for each dental service.

You May Like: What Percentage Does Medicare Part A Cover