Enroll In Dental Coverage

Current Medicare Advantage-Prescription Drug Plan members can sign up using the Optional Supplemental Dental HMO or PPO plan enrollment form and send it to us at the address provided on the enrollment form.

If you have any questions about applying for dental coverage, you can call to speak with a Blue Shield of California Medicare adviser. Hours of operation are 8 a.m. to 8 p.m. seven days a week, from October 1 through March 31, and 8 a.m. to 8 p.m., weekdays from April 1 through September 30.

1The Optional Supplemental Dental HMO plan is not available to Blue Shield AdvantageOptimum Plan , Blue Shield AdvantageOptimum Plan 1 , Blue Shield AdvantageOptimum Plan 2 , Blue Shield TotalDual Plan , Blue Shield Inspire and Blue Shield Coordinated Choice Plan members, Blue Shield Inspire members in Alameda County and Blue Shield 65 Plus members in the San Luis Obispo and Santa Barbara Counties. Refer to the plan Summary of Benefits for additional information.

2The Optional Supplemental Dental PPO plan is not available to Blue Shield AdvantageOptimum Plan , Blue Shield AdvantageOptimum Plan 1 , Blue Shield AdvantageOptimum Plan 2 , Blue Shield TotalDual Plan , Blue Shield Inspire and Blue Shield Coordinated Choice Plan members. Refer to the plan Summary of Benefits for additional information.

3Dental providers in California are available through a contracted dental plan administrator. Network numbers are as of June 2019.

Recommended Reading: What Medicare Plans Do I Need

Medicare Advantage Part B Drugs Coverage

Find our Medicare Part B drug coverage policies here. These policies apply to healthcare professional administered injectables .

This website is owned and operated by USAble Mutual Insurance Company, d/b/a Arkansas Blue Cross and Blue Shield. Arkansas Blue Cross and Blue Shield is an Independent Licensee of the Blue Cross and Blue Shield Association and is licensed to offer health plans in all 75 counties of Arkansas.

Linking disclaimer

IE support ending soon

Your Answers Point Toward A Medicare Advantage Plan

The recommended plan is the best fit based on a few questions. There are other personal circumstances that may change this recommendation, including receiving employer sponsored retiree benefits or having specific medical circumstances to consider. Please note that CMS will impose a penalty if you do not have prescription drug coverage . We strongly encourage you review all options with an agent before applying.

Based on your responses, you may want to explore Medicare Advantage, which rolls your Medicare-related coverage into a single plan with lower monthly premiums. Learn more about our partner, NextBlue of North Dakota PPO, and view plan information.

Rather talk to an agent? Call TTY 771.

Don’t Miss: Does Medicare Pay For Stem Cell Treatment

What Are Blue Cross Blue Shield Medicare Advantage Plan Options

Blue Cross Blue Shield features a wide array of Medicare Advantage Plan options, including HMOs, regional PPOs, PPOs, and Private fee-for-service plans. Monthly premiums and deductibles vary, depending on which type of plan you choose. All plans, including those with no monthly premium, have coverage for services such as vision, dental, and hearing, and some plans have Essential Extras that you can choose from to customize your coverage further.

These are some of the 2022 plans that you may choose from in Marion County, IL :

Blue Cross Blue Shield Medicare Advantage Plans

| Plan Name |

|

$10,000 in and out of network combined |

*Based on pricing in Indianapolis, IN

Find Dental Care In 3 Easy Steps

Select Dental Providers under My Health Plan in the navigation bar. In the search field, you can enter a specialty, dentist, facility, or procedure. You can also refine your search by location, specialty, distance, gender, and more.

Click Search. Your results will be displayed by distance, starting with the providers closest to you.*

*The Find a Doctor tool will typically search based on your current location. If you wish to search in another area, click on My Location and type in the city or zip code.

Read Also: Does Medicare Cover Varicose Vein Treatment

Don’t Miss: Does Medicare Cover Chiropractic X Rays

Does Blue Cross Blue Shield Cover Chiropractic Care

Does Blue Cross Blue Shield Cover Chiropractic Care. Does my plan cover chiropractic work? Bcbsnc will provide coverage for chiropractic services when they are determined to be medically necessary because the medical criteria and.

Wed be happy to check on your benefits for chiropractic care. Most blue cross and blue shield of minnesota health plans cover chiropractic care when it is part of an active treatment plan. An active treatment plan means you are receiving care to treat a specific injury.

Source: stinkopals.blogspot.com

The medicare advantage plans offer the following coverage: An active treatment plan means you are receiving care to treat a specific injury.

Bcbsnc will provide coverage for chiropractic services when they are determined to be medically necessary because the medical criteria and. There may be review screens (numbers of visits.

Source: stinkopals.blogspot.com

An active treatment plan means you are receiving care to treat a specific injury. Blue cross blue shield insurance may cover spravato depending on your specific health plan and diagnosis status.

Source: for-coffee1.blogspot.com

And many of these home health care benefits may be covered by a medicare advantage plan from blue cross blue shield. Most blue cross and blue shield of minnesota health plans cover.

Source: www.360istanbuleast.com

Available Part D Prescription Drug Plans

While many of Blue Cross Blue Shields Medicare Advantage plans include Part D drug coverage, the company also sells stand-alone Part D prescription drug plans, also known as PDPs. These plans, which are meant to accompany Medicare Part A and Medicare Part B, don’t provide medical coverage.

All states offering a stand-alone prescription drug plan have both a basic and an enhanced option. For instance, if you live in Grand Rapids, Michigan, you have the option of the following two PDPs from Blue Cross Blue Shield of Michigan:

-

Prescription Blue PDP Select.

Heres an example of how they compare:

|

Plan feature |

|

|---|---|

|

$35. |

$40. |

*For a one-month supply of a covered Part D prescription drug at a preferred retail pharmacy after meeting any applicable deductible.

These plans differ by premium, by the drugs they cover, by the costs associated with each tier of drugs and by the pharmacies that are in their network of preferred retailers. To find the best drug plan for you, consider plans that offer the lowest costs for your regular prescriptions and preferred pharmacies.

Read Also: How Much Is Medicare Plan B

Pros And Cons Of Blue Cross Blue Shield Medicare Plans

| What we like about Blue Cross Blue Shield Medicare plans: | The drawbacks of Blue Cross Blue Shield Medicare plans: |

|---|---|

|

|

Blue Cross Blue Shield Medicare Advantage

Private health insurance companies provide seniors with Medicare Advantage plans. We want to tell you about Blue Cross Blue Shield Medicare Advantage and how it might be able to benefit you and save you seem serious money on medical care.

If you are paying for a medical insurance plan right now, there is a chance that it isnt covering you properly. Maybe you feel like you are being covered, but once you take a look at how much you are paying for out of pocket each year or you look at the prices of some other insurance plans, you may change your mind. Medicare Advantage plans are designed to give seniors a powerful set of coverage that they can use to have peace of mind about their healthcare. Then, they wont have to worry if they will be covered enough by their insurance plan, and they wont have to wonder if they can afford the trip to the doctors office.

That is a concern for seniors who have a lot of health issues. They worry that the doctors visit or hospital stay will be too expensive, and instead of going to get the care they need, they simply stay home and tough it out. This can lead to serious health problems, and it is not advisable, and with the right insurance coverage, this kind of scenario can become a thing of the past.

Read Also: Do You Need Additional Insurance With Medicare

Blue Cross Blue Shield

BlueCross BlueShield – sometimes known as Anthem or BCBS – is one of the most well-known brands in the insurance industry. Their rates for Medicare Supplement Plans tend to fall right in the middle of the spectrum, but one big advantage is that you can see exact quotes and even sign up for your coverage online. Unfortunately, the BBB gives the company a low rating, keeping them from a higher ranking among the insurers andbrokers we evaluated.

Pros And Cons Of Blue Cross Blue Shield Medicare Advantage Plans

| What we like about Blue Cross Blue Shield Medicare Advantage Plans | The drawbacks of Blue Cross Blue Shield Medicare Advantage Plans |

|

|

Also Check: What Is Medical Vs Medicare

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Bluecross Totalsm Medicare Advantage Preferred Provider Organization

PPO plans offer the savings of a provider network, but with the flexibility to choose out-of-network care, if you desire. Youll pay low out-of-pocket costs when you seek care within our network. But you can choose other doctors, as well. You have travel freedom with health coverage in 47 states, the District of Columbia and 1 territory through the out-of-state travel network, as well as worldwide emergency care.

Don’t Miss: Are You Eligible For Medicare If You Never Worked

Where Are Blue Cross Blue Shield Medicare Advantage Plans Available

Blue Cross Blue Shield is the third-largest Medicare Advantage provider in the country, with plans in 2,190 counties across 47 states and Puerto Rico. The company’s Medicare prescription drug plans are available in 42 states.

Pro Tip: If this is your first time choosing a Medicare Advantage plan, check out our 2022 guide to Medicare Advantage.

Blue Cross Blue Shield Is A Popular Choice For Medicare Advantage Plans

BCBS is a massive company, yet they operate through smaller regional affiliate companies to provide a local touch to the communities they serve. Anthem, Regency, and Hallmark are a few of their well-known affiliated companies, all under the BCBS umbrella.

Although many insurance carriers sell Medicare Advantage, three dominant companies issue most policies. Blue Cross Blue Shield is one of them.

A recent reportshows market share of the three biggest Medicare Advantage Companies.

- Blue Cross Blue Shield

- Humana Medicare Advantage

In total, these three carriers have 56% market share. This didnt happen overnight. These three companies have a long track record of offering the most policy value combined with low premium rates. Although there are many carriers to choose from, its likely that your best policy will come from one of these three.

Recommended Reading: Does Medicare Pay For Contrave

Most Comprehensive Coverage: Aarp

AARPs Medicare Advantage plans, for the most part, all come with preventative dental coverage, and many of those plans also come with comprehensive dental care coverage as well.

-

Preventative dental care comes with most plans, to cover cleanings, x-rays, etc.

-

Many plans also come with comprehensive dental care

-

Generally low premiums

-

Some plans have a $500 maximum yearly limit for comprehensive dental care

-

Some plans give yearly maximum coverage amount for preventative and comprehensive dental combined

Its nice to feel secure with your insurance. Thats what AARP providesno matter what plan you choose, your pearly whites are covered. Most plans come with at least preventative dental care covered, and most also include comprehensive care covered, though at a yearly maximum cap. That means you may not need to pay anything at the dentist, depending on the procedure youre having done. However, if you think youll be having more intensive work done that would exceed the annual maximum, it may be best to look into plans that have more detailed, broader coverage options available. The PPO Plan A offers the most comprehensive coverage with a $40 deductible and $1,500 in annual coverage. The PPO Plan B offers a lower monthly premium but a $90 deductible and $1,000 in annual coverage.

Recommended Reading: Does Medicare Pay For Home Care Services

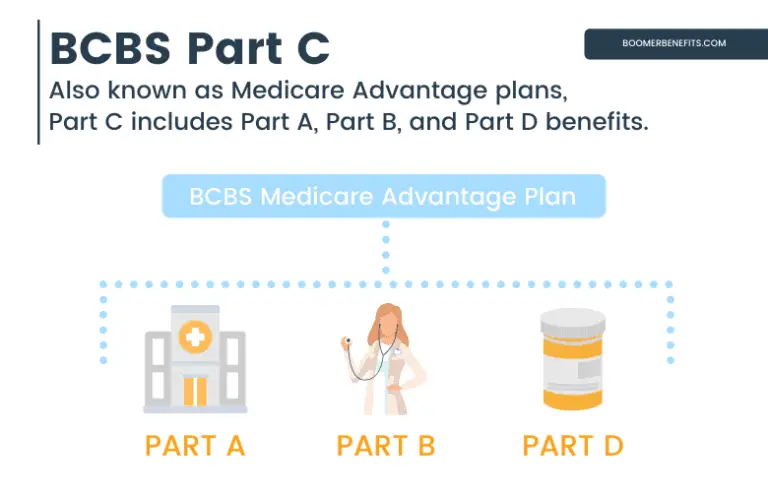

Medicare Advantage Also Known As Medicare Part C Provides A Complete Package From One Source

Plans include your government-issued benefitsMedicare Part A and Part Bplus additional benefits you might otherwise purchase on your own from private insurance companies. For example, Medicare Advantage plans often include things like:

- Prescription drug coverage

- National and international travel coverage

- Health management assistance

Read Also: Why Am I Paying For Medicare

Uhc Vs Blue Cross Blue Shield: Part D And Medicare Supplement Plans

UnitedHealthcare and Blue Cross Blue Shield each offer three different Medicare Part D plans to give beneficiaries a variety of cost and coverage options.

UnitedHealthcares Part D plan lineup includes:

- MedicareRx Walgreens

- MedicareRx Saver Plus

- MedicareRx Preferred

Blue Cross Blue Shield also offers three Part D plans with names that vary by state. For instance, they may be MedicareRx Value, Enhanced or Essential plans , or MedicareRx Standard, Plus or Enhanced . Blue Cross Blue Shield Part D plans also provide various combinations of premium and deductible levels.

However, while UnitedHealthcare sells all three of its Part D plans in each state, Blue Cross Blue Shield only sells two plans in certain states.

Should You Sign Up For Blue Cross Medicare Plans

Blue Cross may not offer you a lot of extra benefits. However, it can afford to give you lower rates compared to its competitors. Regarding its Medicare plans, you will find that it sells a variety of them.

But before you start comparing BCBS Medicare plans, make sure that you are eligible to get one. You can only enroll if you are 65. If you are turning 65 this year, then you must wait three months before your 65th birthday to sign up. After this period, you can enroll three months after turning 65.

You should also check your current insurance plan to ensure that your Medicare plans dont conflict with one another.

If you choose BCBS, you will enjoy its excellent customer service and low prices. Use our site to find out how low its prices are compared to other insurance providers.

When you compare Blue Cross Blue Shield Medicare plans using our site, you will find that its costs are not the cheapest. But the rates are still lower than the rates of other major providers. Furthermore, the prices will not change for 2021. But if the company decides to make a change, we will update our site to give you the latest pricing. You must come back, again and again, to find out whether or not BCBS lineup of plans has changed.

Is this insurance provider your best option? It really depends on how much you can afford. It also hinges on whether or not it offers the kind of coverage that you need and if the plan offers real value to your medical situation.

You May Like: How Much Does Medicare Cost Me

Help Me Choose A Plan

Not sure what you need? Answer a few questions to help you decide. Get started

Now that youve picked a plan, its time to enroll.

File is in portable document format . To view this file, you may need to install a PDF reader program. Most PDF readers are a free download. One option is Adobe® Reader® which has a built-in screen reader. Other Adobe accessibility tools and information can be downloaded at

You are leaving this website/app . This new site may be offered by a vendor or an independent third party. The site may also contain non-Medicare related information. In addition, some sites may require you to agree to their terms of use and privacy policy.

Bluecross Total Valuesm Medicare Advantage Ppo

Our $0 PPO plan offers the savings of a provider network, but with the flexibility to choose out-of-network care, if you desire. Youll pay low out-of-pocket costs when you seek care within our network. But you can choose other doctors, as well. You have travel freedom with health coverage in 47 states, the District of Columbia and 1 territory through the out-of-state travel network, as well as worldwide emergency care, all with a $0 premium.

Also Check: How Much Is Medicare Cost For 2020

Blue Cross Part D Options

Medicare Part D plans cover your prescription drugs. Some Medicare Advantage plans through Blue Cross offer prescription drug coverage. However, if the plan does not offer coverage, you can choose a standalone prescription drug plan.

Blue Cross offers standard and premier plans in the prescription drug category as well as, Plus, Enhanced, Preferred, Select, and more prescription drug policy options. Each will feature a formulary or list of medications the plan covers and a range of costs. You can check these lists or formularies to be sure any plan you consider includes the medications you take.