Are There Gaps In Medigap Coverage

Yes. Medigap plans are designed to cover some or all of the out-of-pocket expenses for services that Medicare covers. But with limited exceptions for care received outside the U.S., they do not cover care thats not covered at all by Medicare. The list of expenses that Medigap policies dont cover includes long-term care in a nursing home, vision and dental care, hearing aids, eyeglasses, private-duty nursing care, or prescription drugs.

Also, Medigap policies arent compatible with the following types of coverage:

- employer or union plans veterans benefits

- Indian health services

- Medicaid .

Finally, Medigap policies are for individuals only not for couples or families. So if you and your spouse are both eligible for Medicare, youll each need to select an individual Medigap plan.

How Much Will Medicare Cost Me Per Month In 2022

Do you know how much Medicare will cost you each month in 2022?

Planning for retirement is really important, and if youâre going to be living off of a fixed income, you need to be aware of your expected insurance costs.

So, how much will Medicare cost you in 2022?

B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2022 standard premium for Part B is $170.10 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $17.01 per month to your Part B premium.

You May Like: How Old To Be Covered By Medicare

What Is Medicare Supplemental Insurance

Medicare supplemental insurance plans cover the costs that youre responsible for with Original Medicare. These policies are offered by private insurance companies and are on top of your Part A and Part B benefits. Supplement insurance policies offer a predictable monthly expense versus the unknown cost of visiting a doctor or going into the hospital.

Original Medicare insurance policies are offered by the government to provide medical insurance for senior citizens through Part A and Part B policies. Unfortunately, these policies do not pay for all of the costs of covered medical services and supplies. Medicare supplemental insurance fills in these gaps to help pay for some of the remaining health care costs.

Medigap insurance policies help pay for co-payments, co-insurance amounts and deductibles. Additionally, some Medigap policies cover medical care when you travel outside the U.S. Traditional Medicare policies do not cover international medical care.

Will I Have To Wait For My Medigap Policy To Take Effect

An insurer cant make you wait for your coverage to start, but it can make you wait for coverage of a pre-existing condition and may also refuse to cover your out-of-pocket costs for that pre-existing condition for up to six months during a pre-existing conditionwaiting period. That said, if you recently had creditable coverage or if you have guaranteed issue Medigap protection you may be able to shorten or avoid entirely the waiting period.

For more information about Medigap, read Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Read Also: Can You Switch Back To Medicare From Medicare Advantage

What Is The Best Medicare Supplement

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

For instance, Plan G is good for people who want very few medical bills and are willing to pay about $190 each month. This can give you peace of mind so that you won’t be surprised by unexpected medical costs. However, if you expect your out-of-pocket medical costs to be less than the plan’s annual cost of about $2,280, then a cheaper Supplement plan may be more cost-effective.

Note that because of a recent legislation change, Plans C and F are not available for new enrollees. Below you can find a chart of the level of coverage and 2022 monthly premium ranges for all of the Medicare Supplement plans. The Medigap plan names are along the top, and on the left are the coverage categories.

| Plan A |

|---|

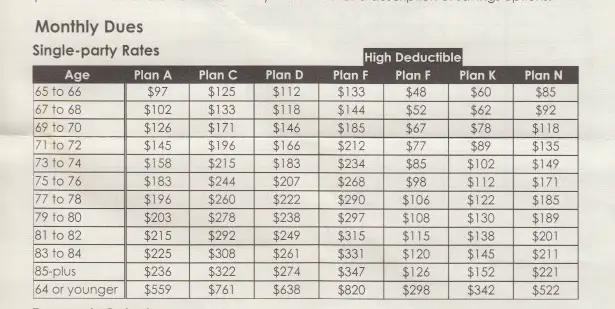

Do Medicare Supplement Plans Go Up With Age

Unlike plans based on community-rated pricing or issue-age pricing, your premium goes up as you get older. Although Medicare Supplement insurance plans based on attained-age pricing may be the least expensive initially, they can end up becoming the most expensive of the three pricing models over time.

Recommended Reading: How Do I Become A Medicare Provider

Why Is Medigap So Expensive

How Much is Medigap in California? … While the birthday rule is beneficial, it’s also a factor in the higher costs of Medigap. Birthday rules also apply in four other states, but California’s cost of living is higher, as are Medigap premiums in the state. California doesn’t have community rating laws.

Medicare Select Insurance Policies

Medicare SELECT policies are a type of Medicare Supplement insurance sold by a few private insurance companies. A Medicare SELECT policy is one of the 8 standardized supplement policies.

It differs from Medicare Supplement insurance because you are expected to use a network of hospitals associated with the insurance company. In return, you will usually pay lower premiums. Also, in order to enroll in a Medicare SELECT plan, you must live within the service area of a network facility.

Also Check: Does Medicare Pay For Tummy Tuck

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

How Much Does The Average Medicare Supplement Plan Cost In 2022

The table below displays the average cost of Medicare Supplement Insurance Plan G and Plan F by age.1

Based on our analysis, we noted several key takeaways:

-

Medicare Supplement Insurance Plan F premiums in 2022 are lowest for beneficiaries at age 65 and highest for beneficiaries at age 85 .

-

Medigap Plan G premiums in 2022 are lowest for beneficiaries at age 65 and highest for beneficiaries at age 85 .

| Average Monthly Cost of Plan F | Age in Years |

|---|---|

| $235.87 |

Recommended Reading: Does Medicare Part D Cover Sildenafil

Are Medicare Supplement Insurance Plans Worth It

Depending on the average cost of Medicare Supplement Insurance plans in your area, you may wonder if the benefits are worth the premium costs.

When deciding whether or not to enroll in a Medigap plan, consider some of the potential costs that you may face without the protection of a Medigap plan.

Health care costs can be unpredictable and unexpected. Having a Medicare Supplement Insurance plan can make your health care spending more predictable, which can help you better budget for your care.

Underwriting And Medigap Guaranteed Issue Rights

Depending on when you sign up for a Medicare Supplement Insurance plan, you may be subject to medical underwriting.

Underwriting is the process by which an insurance company assesses your current health and your health history to determine your Medigap plan costs. If you are in poor health, the insurance company may deem you to be a higher risk, and they may charge you more for your Medigap plan. If your health history is too high risk for the insurance company, they may choose to deny you coverage.

If you enroll during your Medigap Open Enrollment Period , Medicare Supplement Insurance companies cannot use medical underwriting to determine your plan costs.

Your Medigap Open Enrollment Period is a six-month period that begins when you are at least 65 and enrolled in Medicare Part B. If you enroll in a Medigap plan after your Medigap Open Enrollment Period, insurance companies reserve the right to utilize medical underwriting to determine your plan premium or if they will offer you coverage at all.

The ability to enroll in a Medigap plan without medical underwriting is called a Medigap guaranteed issue right. In addition to your Medigap OEP, there are several Medigap guaranteed issue rights that allow you to sign up for a Medigap plan without medical underwriting.

Read Also: Does Medicare Pay For Soclean

Best Medicare Supplement Plans For 2022

Plan G is the most comprehensive Medigap policy in 2022, but it’s also one of the more expensive Medicare Supplement plans, averaging $190 per month.

Find Cheap Medicare Plans in Your Area

Medicare Supplement policies, also called Medigap, can prevent unexpected medical bills. Without a Medigap plan, Original Medicare policyholders will find tracking deductibles can be cumbersome and paying for regular medical treatment out of pocket can be expensive. The best Medicare Supplement plan for you will depend on your health and budget.

To get a Medicare quote over the phone, call 855-915-0881 TTY 711 to speak with a licensed agent today!

Agents available Monday-Friday 9am-8pm EST

Is Medigap Plan G Better Than Plan F

While there can be a sizable difference in average premiums between Plan F vs. Plan G, there’s only a small difference in benefits these two plans offer.

-

Plan F provides coverage each of the 9 possible benefits that the 10 standardized Medigap plans can offer, including the Medicare Part B deductible.

-

Plan G does not cover the Medicare Part B deductible, but it offers coverage for all of the same out-of-pocket Medicare costs that Medigap Plan F covers.

Medigap Plan F and Plan G are the two most popular Medigap plans.2

In 2022, the Part B deductible is $233 per year.

The $233 annual deductible equates to around $19.00 per month.

This means that a Plan G with a premium of no more than $19.00 per month more than a Plan F option could actually serve as a better value, provided you meet the entire Part B deductible.

Important: Plan F is not available to new Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you already had Medicare before that date, you can still enroll in Plan F if the plan is available in your area.

Below, Medicare expert John Barkett talks more about this and other Medicare changes.

Don’t Miss: Does Medicare Cover In Home Care For Seniors

How Much Does A Medicare Supplement Insurance Plan Cost

- Medigap helps to pay for some of the healthcare costs that arent covered by original Medicare.

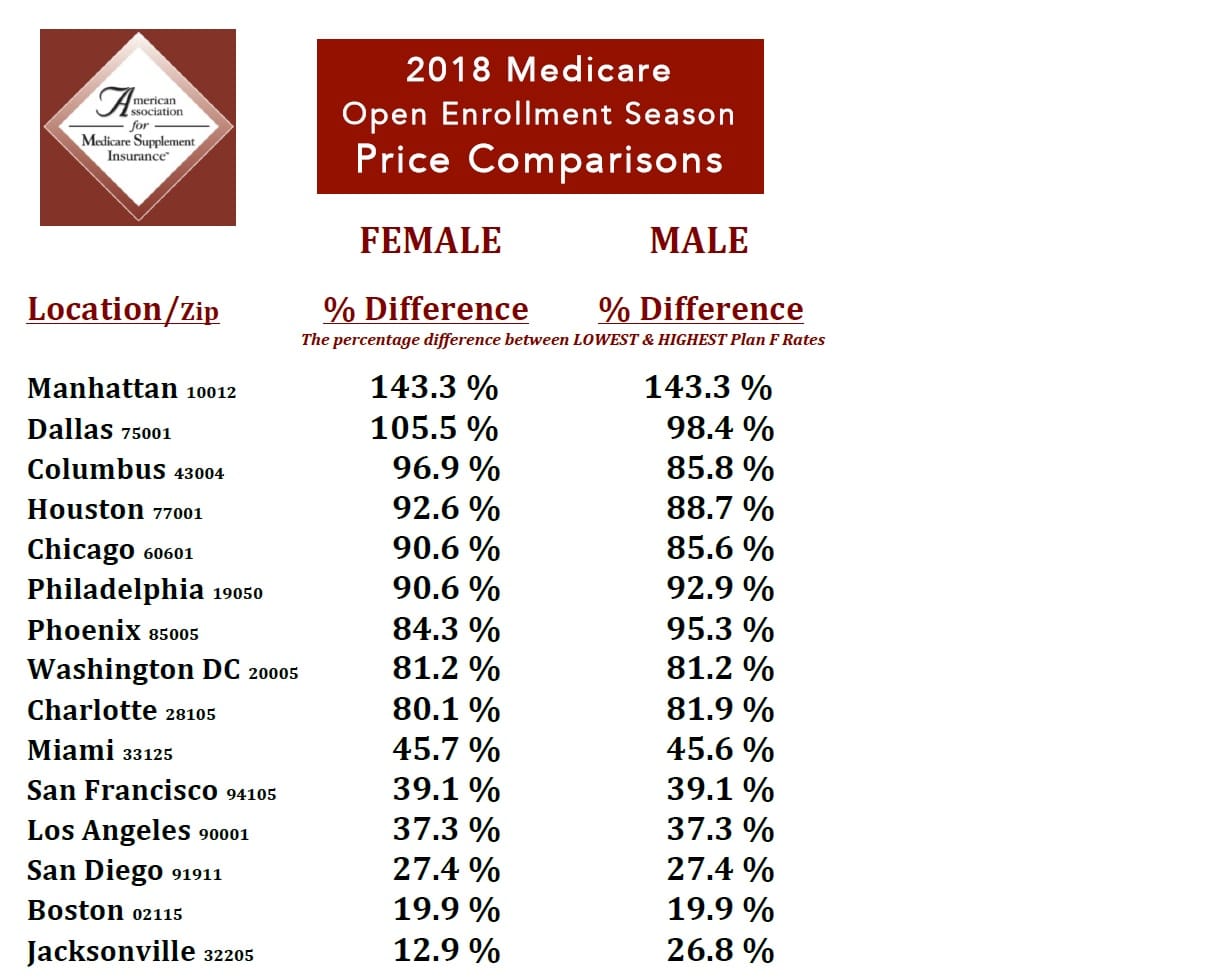

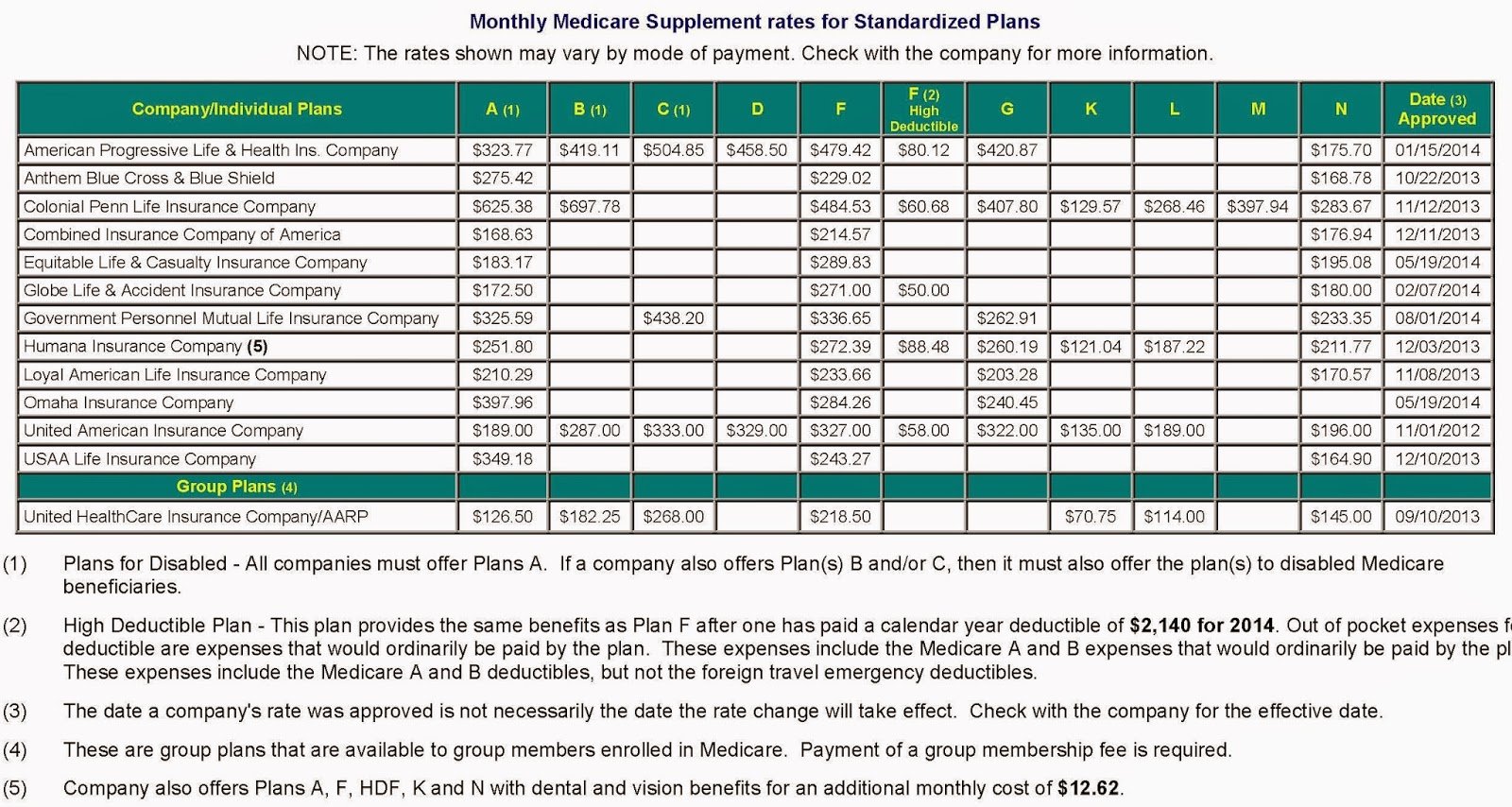

- The costs youll pay for Medigap depend on the plan you choose, your location, and a few other factors.

- Medigap usually has a monthly premium, and you may also have to pay copays, coinsurance, and deductibles.

Medicare supplement insurance policies are sold by private insurance companies. These plans help pay for some of the healthcare costs that arent covered by original Medicare. Some examples of the costs that may be covered by Medigap include:

- deductibles for parts A and B

- coinsurance or copays for parts A and B

- excess costs for Part B

- healthcare costs during foreign travel

- blood

The cost of a Medigap plan can vary due to several factors, including the type of plan you enroll in, where you live, and the company selling the plan. Below, well explore more about the costs of Medigap plans in 2021.

So what are the actual costs associated with Medigap plans? Lets examine the potential costs in more detail.

Medicare Advantage Vs Medicare Supplement Insurance The Differences

While both these insurance products help protect you from high out-of-pocket medical expenses, there are many differences between them. Some of the major differences include:

- All Medicare Advantage plans have required cost sharing, while Medicare Supplement insurance often has little or zero cost sharing.

- Since Medicare Supplement Insurance works with Original Medicare, there are no networks or referrals needed. This means that you can see any doctor in the country who takes Medicare patients.

- Medicare Advantage usually has lower premiums than Medicare Supplement insurance.

- Most people are guaranteed enrollment in Medicare Advantage during any valid enrollment period. With Medicare Supplement insurance, you may need to apply for coverage, and you can be denied under certain circumstances.

The two biggest differences between Medicare Supplement and Medicare Advantage are coverage and cost sharing.

Medicare Advantage plans do not allow for nationwide coverage. Instead, they allow you to receive care only in the plans service area, which is usually a county, although some Advantage plans are valid throughout multistate regions. Emergency or urgent care is covered anywhere in the United States.

With many Medicare Supplement insurance plans, youll have very little or no cost sharing during the year. Your Medigap plan covers the amounts that you would have paid. In exchange for lower out-of-pocket spending, youre paying a higher monthly premium for Medigap coverage.

Don’t Miss: Can I Get Glasses With Medicare

What Is The Average Cost Of Medicare Supplement Insurance Plan F

by Christian Worstell | Published January 26, 2022 | Reviewed by John Krahnert

Medicare Supplement Insurance Plan F offers the most benefits of any of the 10 standardized Medigap plans available in most states.

Some Medicare beneficiaries might assume that Plan F is also the most expensive, but an examination of the average cost of Medigap plans reveals otherwise.

How Much Are Medicare Supplement Insurance Premiums

If you have Original Medicare, you may be interested in purchasing a Medicare Supplement insurance policy to help with the costs Original Medicare may not cover.

A Medicare Supplement insurance policy is a type of supplemental insurance policy that is sold by private insurance companies.1 It is designed to cover some of the out-of-pocket expenses, like copayments, coinsurance, and deductibles that Original Medicare does not cover.1 In order to be eligible for a Medical Supplement insurance policy, you must first be enrolled in Medicare Part A and Medicare Part B.1

There are many different insurance companies that sell Medicare Supplement insurance policies, and there are several different plans to choose from.

How much can you expect to pay for a Medicare Supplement insurance policy?

Don’t Miss: How To Apply For Medicare By Phone

Medicare Part C Costs

If you choose to get Medicare Part C, which is also calledâ¯Medicare Advantage , you are replacing Medicare Parts A and B. Often times, MA plans also include a drug benefit, so you also replace Part D.

However,â¯you still must pay the $170.10 monthly premium for Medicare Part B.

MA premiums vary, depending on which type of plan you choose, which area youâre in, and other similar factors.â¯In general, MA premiums are quite low, and sometimes theyâre even $0.â

While the monthly premium is very low or even $0, there are some things to consider before opting in to an MA plan.â¯You can read about the pros and cons of Medicare Advantage here.

Making The Right Choice

If youre torn about which direction to go, consider these questions:

- What premium amount can you afford?

- Do you mind needing referrals to see specialists and get diagnostic testing?

- Do you travel frequently or have homes in different states?

If youre on a budget or dont mind utilizing a network of providers, Medicare Advantage may work well for you. On the other hand, if you can afford the premiums and want access to any doctor in the country, or if you travel a lot, Medicare Supplement insurance might be the best option for you.

Also Check: What Does Medicare Part B Cover 2020

Is There A Best Time To Purchase A Medigap Policy

The best window of time in which to buy a Medigap policy begins on the first day of the month in which youre at least 65 and enrolled in Medicare A and B . This is the start of your initial enrollment period, and it lasts for six months. Under federal rules, Medigap coverage in every state is guaranteed during this window.

If youre eligible for Medicare because of a disability, the majority of the states offer at least some sort of guaranteed issue enrollment periods for those under 65. So it pays to research your states health care regulations. .

If you wait to buy a policy until after your initial enrollment period, your carrier generally has the option of denying the application or charging a higher premium based on the companys underwriting requirements, as there is no federal requirement that Medigap plans be guaranteed-issue outside of the initial enrollment window and very limited special enrollment periods. But states can set their own regulations for Medigap plans:

Check with your state SHIP or your states Department of Insurance for more information about state-based regulations regarding Medigap.