Best For Nationwide Availability: Blue Cross Blue Shield Medicare Supplement Insurance

Service area: 50 states and Washington, D.C.

Medigap plans offered: A, B, C, D, F, G, K, L, M and N .

Standout feature: Theres at least one Blue Cross Blue Shield company serving every state, so wherever you are, its likely that there are BCBS Medigap plans available to you.

Blue Cross Blue Shield is a collective of 34 companies. Together, BCBS companies make up about 42% of the U.S. health insurance market. BCBS companies offer Medicare Supplement Insurance everywhere in the country, but because each of the companies functions independently, plan offerings, pricing, and other details will vary.

Pros

-

In some locations, BCBS companies offer all 10 Medigap plan types to qualifying applicants.

-

BCBS tied for the top score on the American Customer Satisfaction Index for health insurers.

-

BCBS companies offer Medigap policies in all 50 states and Washington, D.C.

Cons

-

Prices, plan types, extras and member experiences can vary depending on your local BCBS company.

-

Both Medigap Plan A and Plan N were at least 50% more expensive than the markets best prices, on average, in quotes obtained by NerdWallet.

-

BCBS offers Medicare Select plans that are cheaper than the standard versions, but you have to stay in-network.

Who Are The Established Top Medicare Supplement Companies

AARP / United Health Group

AARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories.3 AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

Ratings: The company has an A- or Excellent financial strength rating from insurance credit rating agency AM Best4 and satisfactory quality ratings from the National Committee for Quality Assurance .5

Special benefits: Enrollees enjoy gym memberships, nurse helpline, and dental, vision, and hearing discounts.6

Mutual of Omaha

Mutual of Omaha, the second-largest Medicare supplement insurer, launched its Medicare supplement insurance program in 1966, which is the year the Medicare program began. The companys Medicare supplement plans covered 1.4 million people in 2020.7

Ratings: Mutual of Omaha enjoys an A+ financial rating from AM Best, the best available.8

Special benefits: As a mutual company, the enrollees own the company. That means youll get a share of the profits annually. Other benefits include a discount of up to 12% for people who live with someone older than age 60, whether they are a Mutual of Omaha customer or not.9 Plans in some, but not all areas, offer dental and vision assistance, exercise benefits, and a nurse hotline.

CVS / Aetna

Ratings: It has an AM Best rating of A or excellent11 and NCQA gives the company satisfactory quality ratings.12

Health Care Service Corp.

Blue Cross Blue Shield

BlueCross Blue Shield is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don’t have to worry about sorting through health insurance information that doesn’t apply to you.

Information-filled, but confusing layout

If you’re looking for an online quote, you may have a hard time spotting where to start. The BCBS site for Medigap coverage is full of information you may or may not need: terms to know, enrollment periods, and so on. To get a quote, look on the right side of the page where it says Enter Zip Code and Find Coverage.

Finding the online quotes

From there, it’ll take you to another page that asks you to fill in your information to talk to a Medicare Health Benefit Advisor or to call them directly . However, if you look carefully, you’ll spot links that say Browse or Find a Plan that let you get an initial idea of pricing online before you reach out to BlueCross Blue Shield.

Help Me feature

On that page, you can either choose to View All Plans or select Help Me Find a Plan. If you already know which Medicare Supplement Plan interests you, choose the first option. If you need some guidance and are willing to answer a few questions, the second choice will walk you through which available plans are a good fit.

Simple process

Discounts available

Middle of the road premiums

Start your application online

BBB ratings vary by state

Highly regarded by the experts

Overall good choice

Read Also: What Does Part A And B Of Medicare Cover

This Means That If You Wait 12 Months To Enroll In Part D It Will Be 12% Higher

Wait 3 years? 36% higher.

For this reason, it generally makes sense to at least get a “placeholder”plan – the cheapest plan on the market to avoid the penalty.

Of course, it’s also important to get the protection that entails.

For information on the process and timing of enrolling for Medicare and supplement go here!

There is no cost for our assistance and no question is too small.

Be well!

How Much Does Medicare Supplement Plan G Cost

We looked at the monthly cost for Medicare Supplement Plan G for male and female 65-year-old non-smokers in El Paso County, Texas and Miami-Dade County, Florida. In Texas, monthly premiums for standard Plan G started at $107 and $96, respectively, while in Florida, monthly premiums started at $237 and $222.

Also Check: What Is Medicare Hospital Insurance

Never Pay A Doctor Copay Again

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

This means zero out-of-pocket for you at the doctors office.

So when you are asking which Medicare plan is best, its pretty easy to see why so many people think Plan F is the best Medicare Supplement plan.

How We Picked The Best Medicare Supplement Providers

To determine the best Medicare Supplement providers for 2023, the Forbes Health editorial team evaluated all insurance companies that offer plans nationwide in terms of:

- How many states in which they provide coverage

- The number of Medigap plan types they offer

- Whether they offer Part D coverage specifically

- Whether they can provide additional coverage beyond whats required of Medigap plans by federal regulations

- A.M. Best rankings in terms of financial health

- J.D. Power rankings in terms of consumer feedback

We focused exclusively on providing general summaries of the companies and their reputations. In order to provide specific plan recommendations accurately, its important to take into account the ZIP code and demographic details of the individual seeking insurance coverage. To do so, we recommend using Medicare.govs plan finder tool or seeking the expertise of an independent, agnostic insurance agent.

Don’t Miss: What Age Can You Begin Medicare

Are Medigap And Medicare Advantage The Same

Although the names sound similar, Medicare Supplemental plans are not Medicare Advantage plans. Medicare Advantage plans are ways to get Medicare benefits, while a Medigap policy only supplements Original Medicare. If you have a Medicare Advantage Plan, its illegal for anyone to sell you a Medigap policy unless youre switching back to Original Medicare.3

From the Pros: Some Medicare Advantage plans cover extras, such as dental, vision, and prescriptions. If youre deciding between Medigap and Medicare Advantage, visit our Medigap and Medicare Advantage comparison guide.

How To Compare And Pick The Best Medicare Supplement Plan

The world of Medicare often feels alien to new enrollees.

DIfferent ways of saying everything and a literal alphabet soup of options .

Then there’s the whole question of which plan to pick in order to fill the rather large holes of Medicare..especially the 20% coinsurance which has no cap.

Let’s walk through the process and really understand how to compare the plans available.

The networks and benefits are standardized by the law so it then becomes a question of pricing and carrier.

We’ll look into that as well.

Here are topics we’ll cover:

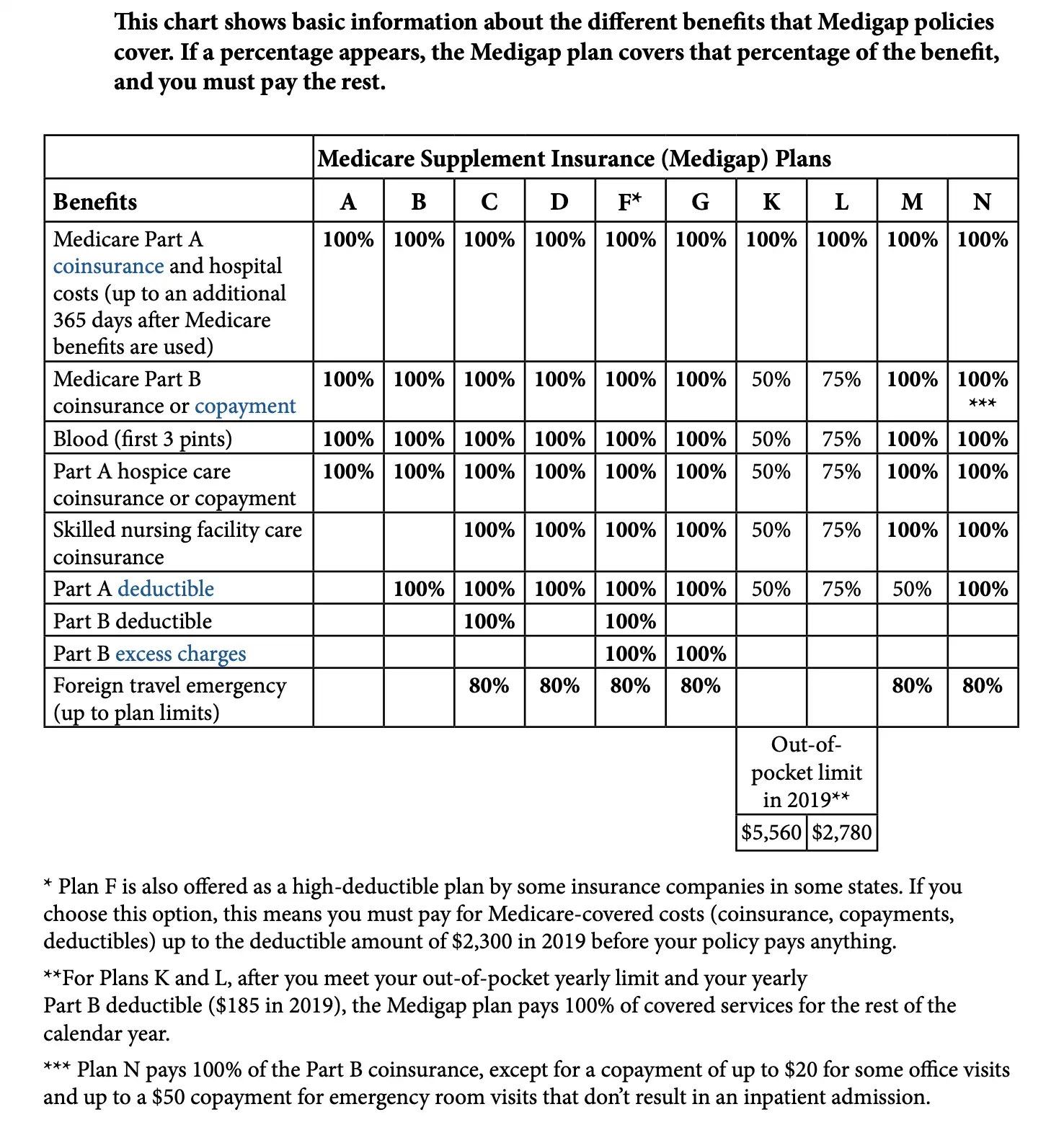

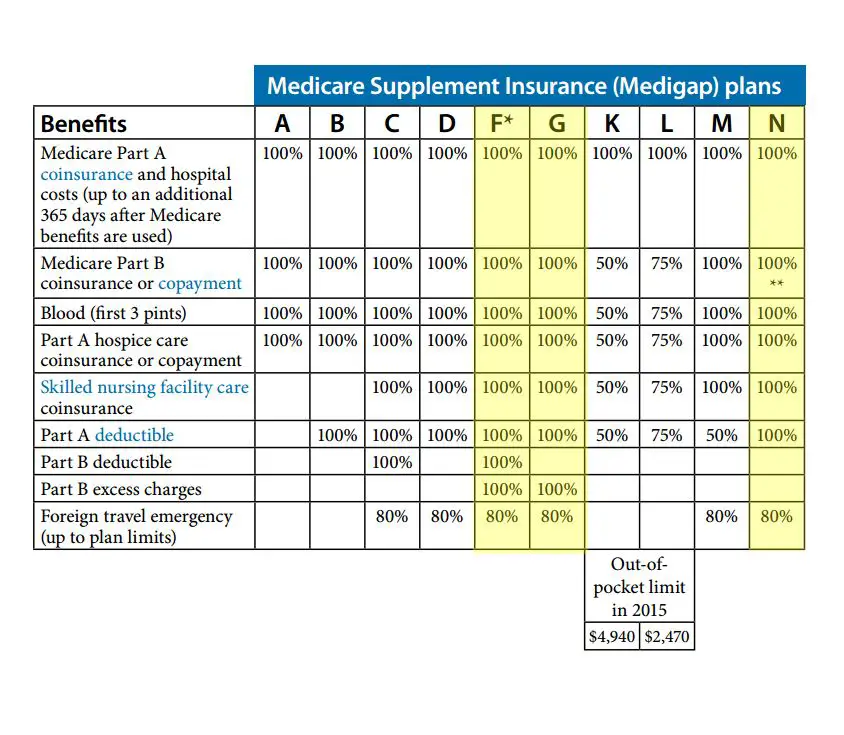

- What does Medicare not coverWhat are the different benefits offered by supplement plansWhat is the most popular medicare supplement planThe importance of excess

You May Like: Who Is Eligible For Medicare Extra Help

Choose A Regular Or High

High-deductible plans will pay your Medicare out-of-pocket costs after you pay an annual deductible, which is set at $2,700 for 2023. These plans will have lower monthly premiums than a regular plan. You will need to decide if paying higher monthly payments makes more sense financially than paying higher costs when you need care.

What Is Our Methodology

We selected the health insurance companies with the highest market share and reviewed them by financial strength, customer satisfaction, and other factors, such as what makes these plans so popular.

We also offer information on the companies, including financials, customer satisfaction, complaints, geographic reach, and pricing.

Read Also: How Does A Medicare Supplement Plan Work In General

Ask If Your Doctor Accepts Assignment

Assignment is an agreement between doctors and other health care providers and Medicare. Doctors who accept assignment charge only what Medicare will pay them for a service. You must pay any deductibles, coinsurance, and copayments that you owe.

Doctors who dont accept assignment may charge more than the Medicare-approved amount. You are responsible for the higher charges. You also might have to pay the full cost of the service at the doctors office, and then wait to be reimbursed by Medicare.

Use your Medicare Summary Notice to review the charges. You get a Medicare Summary Notice each quarter. If you were overcharged and werent reimbursed, follow the instructions on the notice to report the overcharge to Medicare. The notice will also show you any deadlines to complain or appeal charges and denied services. If you are in original Medicare, you can also look at your Medicare claims online at MyMedicare.gov.

Medicare has a directory of doctors, hospitals, and suppliers that work with Medicare. The Physician Compare directory also shows which providers accepted assignment on Medicare claims.

Best For Financial Strength: State Farm

-

Highest possible financial strength rating from AM Best

-

Far fewer complaints than expected with the NAIC

-

Limited information without an agent

-

Pricing is about average

State Farm has an A++ financial strength rating from AM Best, which is the highest rating available. This means the company is highly unlikely to default on its financial obligations and has a superior ability to pay claims. Whats more, the company had an average complaint index of 0.1 over the last three years, indicating far fewer complaints than expected given the companys size. This suggests that State Farm customers are generally satisfied with their policies.

However, pricing is about average for Plan G policies, and the company doesnt offer all plan types, including high-deductible Plan G. And while other companies offer extra benefits and discounts with their plans, State Farm doesnt advertise similar programs. Information about State Farms Medigap plans is very limited in general, and youll need to speak with an agent to get a quote.

Also Check: Is Kardia Mobile Covered By Medicare

Best For Member Satisfaction: Mutual Of Omaha Medicare Supplement Insurance

Service area: Every state except Massachusetts, plus Washington, D.C.

Medigap plans offered: A, F, G and N .

Standout feature: Members file significantly fewer complaints about Medigap policies from Mutual of Omaha than other insurers. The same very low complaint rate holds true when averaged across all of Mutual of Omahas insurance products.

Unlike many Medigap insurers, Mutual of Omaha doesnt sell Medicare Advantage or other health insurance plans. Its insurance offerings are meant to complement your main health insurance, such as Medicare Supplement Insurance, life insurance and long-term care insurance. It doesnt offer as many plan types as some competitors, but member satisfaction is high. Available discounts might make Mutual of Omaha plans more affordable than those from some competitors.

Pros

-

Members file complaints at rates about 62% below the average for all Medigap insurers on the market.

-

Mutual of Omaha sells Medicare Supplement Insurance in every state but Massachusetts.

-

A discount of up to 12% for some applicants living with another adult is larger than many other providers offer.

Cons

-

For new Medicare beneficiaries, only Medigap plans A, G and N are available in most states.

-

Mutual of Omaha spends less on member benefits and more on overhead than the average Medigap insurer.

-

It can be challenging to find some information on Mutual of Omahas website.

» MORE: Read our review of Mutual of Omaha Medicare Supplement Insurance

Find A Medicare Supplement Plan Thats Right For You

A Medicare Supplement Insurance plan, also called a Medigap plan, is a separate policy that supplements your coverage from Original Medicare Part A and Part B.

When comparing Medicare Supplement Insurance plans, its important to note that the government decides what benefits each plan offers, so coverage remains the same across all companies. For example, the basic benefits youll receive if you purchase Medicare Supplement Plan G from Cigna are the exact same basic benefits youll receive if you purchase a Medicare Supplement Plan G from a different insurance company.

Before you compare plans, you might find it helpful to review the basics of Medicare Supplement Insurance and .

Recommended Reading: How To Get Medical Equipment Through Medicare

Finding The Best Alzheimers Care Available

If youve looked into the question what is Medicare Supplement insurance and researched D, F, and C, you still might find that it doesnt cover all your needs. In that case, its best to also look into long-term care insurance outside of Medicare/Medigap. Unfortunately, Medicare and Medigap simply dont offer the comprehensive coverage that Alzheimers patients typically need, so it can be tough for patients, families, and caregivers to afford care even with government help.

With that said, its important to look into your choices, learn more about your Medicare Supplement options and determine if youre going to enroll in Original Medicare, a Medicare Supplement plan, long-term care insurance, or maybe even all three.

Whats important is that Alzheimers patients and their families and caregivers are protected and not worried about the finances. They need to simply focus on the care and ensure that patients are receiving the best coverage possible for the rest of their lives.

If youre ready to look further into the question, What is Medicare Supplement insurance? and research Medicare Supplement plans for Alzheimers, use Ensurems Medicare Supplement Quote tool.

BLOG2019_006

What Is The Open Enrollment Period

The open enrollment period is six months from the date a beneficiary is enrolled in Medicare Part B. During the open enrollment period, a person under 65 and on Medicare disability is only able to purchase Medicare supplement insurance Plans A, D or G. This is a special North Carolina law.

During the open enrollment period, the applicant is guaranteed to be issued a policy. Premiums may be higher for Medicare disability beneficiaries than for Medicare beneficiaries 65 or older. The insurance company may impose a pre-existing condition waiting period, but it cannot be longer than six months. This would include any health condition diagnosed or treated six months prior to the Medicare supplement application. If a person has prior creditable coverage, the waiting period must be waived. Creditable coverage is when the beneficiary has been covered by insurance or Medicaid for six months prior to the effective date of the Medicare supplement insurance policy. When a Medicare disabled beneficiary turns 65 years old, he or she will have a new six-month open enrollment period and be able to purchase any of the standardized Medicare supplement insurance.

For those persons that are retroactively enrolled in Medicare Part B due to a retroactive eligibility decision made by the Social Security Administration, the application must be submitted within a six-month period beginning with the month in which the person receives notification of the retroactive eligibility decision.

Read Also: What Is Bernie Sanders Plan For Medicare For All

Plan B: Best Medicare Supplement Plan For Basic Benefits

Some beneficiaries just want a basic Medigap plan with no thrills. Medigap Plan B checks that box, with coverage for three types of out-of-pocket Medicare costs that Medicare beneficiaries may be more likely to face that can add up quickly:

- Medicare Part A deductible

- Medicare Part A coinsurance

- Medicare Part B coinsurance

Having those three areas covered means you will likely avoid some of the biggest potential Medicare charges you could face. This can help many beneficiaries enjoy some peace of mind with a simple plan that has everything they need and nothing they dont.

How Does Medicare Supplement Insurance Work

Medicare Supplement Insurance helps you pay for the gaps in Medicare coverage. Once Medicare pays its share of the services you are receiving, Medigap will help you pay the rest.

If your Part B policy says it covers 80% of a doctors visit, Medicare will pay that. Medigap kicks in for the other 20%. Lets suppose your Medigap Plan says that it will pay 75% of your Part B coinsurance. That means you will only pay one-quarter of the total cost of your doctors visit.

Heres an example with numbers: if the doctors visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5. If you didnt have Medigap, you would be responsible for paying the entire $20 that were left over after Medicare paid its share.

Depending on the plan you select, Medicare Supplement Insurance can help you pay for the Part A and Part B deductibles. It can also help you pay for medical expenses if you have a medical emergency outside of the United States.

Recommended Reading: How Do I Apply For Medicare In Missouri

Most Affordable Medicare Supplement Plans

There is no one-size-fits-all Medicare Supplement plan. Every person enrolling in Medigap has varying health needs and budgets.

It is no secret that the Supplement plans come with the most affordable monthly premiums. Depending on your state, high-deductible Medicare Supplement Plan F or Plan G will cost anywhere from $40-$80 each month.

However, when you look at overall spending with the high-deductible Medicare Supplement plans, you may find you have a more affordable option. If you enroll in a high-deductible Medigap plan, you must meet the full deductible amount before you receive any coverage. Thus, if you have major surgery or require hospitalization, you will pay most of the cost out-of-pocket.

Regarding overall cost, the most affordable Medicare Supplement plan for most people is Medigap Plan G. This plan has a mid-range monthly premium compared to other Medicare Supplement plans. However, the out-of-pocket costs allow it to be one of the lowest-cost plans when you combine premium and out-of-pocket amounts. Aside from your monthly premium, all you are responsible for out-of-pocket with this plan is the Medicare Part B deductible.