Monthly Medicare Premiums For 2021

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $88,000 Married couples with a MAGI of $176,000 or less | 2021 standard premium = $148.50 |

| Your plan premium + $77.10 |

How Did Medicare Part D Plan Costs Change In 2021

Although Part D plans are sold by private insurance companies, they must abide by certain cost rules determined by the CMS.

The CMS applied these rules for certain 2021 Part D costs:

- The maximum annual Part D plan deductible will be $445 in 2021 .

- The Part D plan initial coverage limit will be $4,130 in 2021.

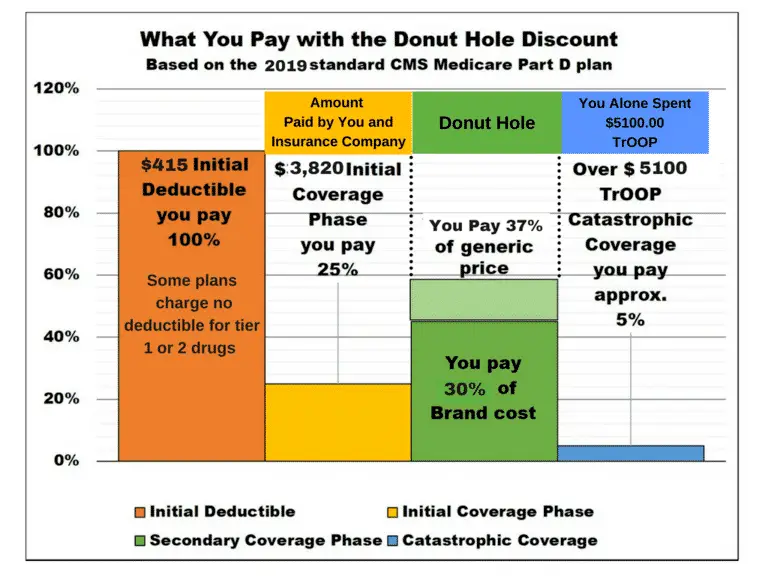

- Once you and your Part D plan have spent $4,130 on prescription drug costs in 2021, you will enter the Part D donut hole coverage gap. During the coverage gap, your plan limits how much it will pay for your prescription drug costs.While you are in the donut hole in 2021, you will pay 25 percent of the cost of brand name drugs and generic drugs until you reach the catastrophic coverage stage.

- Once you reach the maximum annual out-of-pocket spending limit of $6,550 in 2021, you enter the catastrophic coverage stage. In this coverage stage, youll only pay a small coinsurance or copayment amount for your covered drugs.

Are you looking for Medicare prescription drug coverage?

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

How Much Did Medicare Part A Premiums Go Up In 2021

Most people do not pay a premium for Part A, but those that do must pay either $259 or $471 per month in 2021, depending on how many years they paid Medicare taxes.

The follow list shows how the Medicare Part A premium has changed in recent years.

- 2021 = $259 or $471 per month

- 2020 = $252 or $458 per month

- 2019 = $240 or $437 per month

- 2018 = $232 or $422 per month

- 2017 = $227 or $413 per month

- 2016 = $226 or $411 per month

- 2015 = $224 or $407 per month

- 2014 = $234 or $426 per month

You May Like: How Much Medicare Is Taken Out Of Social Security Check

How Social Security Determines You Have A Higher Premium

Social Security uses the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $176,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $88,000, youll pay higher premiums , for an idea of what you can expect to pay).

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, well apply an adjustment automatically to the other program when you enroll. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

Issues For The Future

The Medicare drug benefit has helped to reduce out-of-pocket drug spending for enrollees, which is especially important to those with modest incomes or very high drug costs. But in the face of rising drug prices, more plans charging coinsurance rather than flat copayments for covered brand-name drugs, and annual increases in the out-of-pocket spending threshold, many Part D enrollees are likely to face higher out-of-pocket costs for their medications.

Policymakers are currently debating several proposals to control drug spending by Medicare and beneficiaries. Several of these proposals address concerns about the lack of a hard cap on out-of-pocket spending for Part D enrollees, the significant increase in Medicare spending for enrollees with high drug costs, prices for many drugs rising faster than the rate of inflation, and the relatively weak financial incentives faced by Part D plan sponsors to control high drug costs. Such proposals include allowing Medicare to negotiate the price of drugs, restructuring the Part D benefit to add a hard cap on out-of-pocket drug spending, requiring manufacturers to pay a rebate to the federal government if their drug prices increase faster than inflation, and shifting more of the responsibility for catastrophic coverage costs to Part D plans and drug manufacturers.

Topics

Read Also: What Age Can You Start To Collect Medicare

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Not Penalized For Life

If your income two years ago was higher and you dont have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, when your income comes down in the following year, your IRMAA will also come down automatically. Its not the end of the world to pay IRMAA for one year.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

Read Also: Does Medicare Cover Bed Rails

How Much Does Medicare Part D Cost In 2021

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2020 plans, the additional costs will be based on your 2018 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $445 in 2021, up from $435 in 2020.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the âdonut holeâ here.

Paying More For The Medicare Part B Premium

Most people enrolled in Medicare pay $148.50 in 2021 for their Part B premium. That amount is actually only about 25% of the total cost. The government comes in and pays a substantial portion â about 75% â of the total Part B premium.

Social Security uses your most recent federal tax return to determine whatâs called your modified adjusted gross income . If youâre filing jointly with your spouse and your MAGI is greater than $176,000, youâre going to pay more than $148.50 per month for your Medicare Part B. This is also true if your MAGI is greater than $88,000 and you file your taxes using a different status.

In other words, if you have a high income, the government is going to pay less, and youâre going to pay more.

There are several tiers depending on how much you make and how you file your taxes. Each tier adds more to your Part B premium, and the amount is based on a percentage.

Those percentages are 35%, 50%, 65%, 80%, and 85% of the total Medicare Part B premium. For example, if youâre in the highest tier, the government pays 15% of the Part B premium and you pay 85%.

If youâre married and live with your spouse but file your taxes separately, the tiers are a little bit different:

- Individuals who make between $88,000-$412,000 pay an additional $326.70 per month

- Individuals who make more than $412,000 pay an additional $356.40 per month

You May Like: Why Is My First Medicare Bill So High

Help With Medicare Part D Costs

If you have a low income, you might qualify for help paying your Medicare Part D costs through Medicares Extra Help program. If you qualify, youll generally pay a maximum of $2.95 per generic drug prescription and $7.40 per brand-name drug prescription. These are 2016 amounts, and they apply only to medications that your Medicare Prescription Drug Plan covers.

If you qualify for certain Medicare Savings Plans described above , youre automatically eligible for Extra Help.

How Do I Pay My Medicare Part B Premium If Im Not On Social Security

If youre not collecting Social Security benefits, youll receive a bill for your Part B premium. This bill is called a Medicare Premium Bill. You can also select to have the Part B premium deducted from an annuity.

You can pay directly from a bank account by utilizing your online bill payment service. If you arent comfortable with that you can pay by check, money order, credit as well as a debit card.

You can do this by simply sending the payment to Medicare Premium Collection Center. PO Box 790355. St.Louis, MO 63179-0355

If the credit or debit card you use only has month and year, leave the day field blank on the payment coupon.

You must submit payments with the form filled out on the bottom. When the bottom portion is incomplete, payment may not be processed.

Be sure to sign the payment form before submitting it to the address above.

Don’t Miss: Does Medicare Offer Dental Plans

Minimum Essential Coverage And Tax Penalties

Q. Who is required to have Minimum Essential Coverage ? A. All U.S. citizens living in the United States are required to have health coverage or insurance that meets the Affordable Care Act’s definition of Minimum Essential Coverage . Otherwise, you may have to pay a tax penalty called the “shared responsibility provision.” Citizens required to have MEC also include:

- Children –

- Each child in a family must have MEC or the adult claiming the child as a dependent may have to pay the penalty.

- Senior Citizens –

- Aside from Medicaid, Medicare Parts A and C qualify as MEC.

- Foreign Nationals and Resident Aliens –

- You are required to have MEC if you have been in the U.S. long enough during a calendar year to qualify as a resident alien for tax purposes. If you have to file a tax return, but have not been in the U.S. long enough to be considered a resident alien, you are not required to have MEC.

- U.S. Citizens Living Abroad –

- You are required to have MEC unless you have not been physically present in the United States for at least 330 full days within a 12-month period or if you are considered a bona fide resident of a foreign country for an entire taxable year.

If you don’t file a tax return, you can also apply for the exemption using forms available at healthcare.gov .

Where Can I Get More Information

Does income affect Medicare may not be your only question. If not, the good news is that you can usually track down the information you need online. The best resource is your my Social Security account. This is where youll get some answers specific to your own Medicare payments.

To ask about Medicare premiums or any other Social Security- or Medicare-related topic, your local Social Security office can be a great resource. But you can also pick up the phone and call 1-800-772-1213, or 1-800-325-0778 if you have difficulty hearing. The SSA answers calls on weekdays from 7 a.m. to 7 p.m., but you can also get information via the automated service after hours.

You May Like: Are Medicare Advantage Plans Hmos

Related Training & Materials

Frequently Asked Questions about Medicare Part A and B “Buy-in” : The main policy questions, & responses, submitted to CMS to date on the updated Manual for State Payment of Medicare Premiums released on September 8, 2020.

Five Key Policy Topics From the Updated Manual on State Payment of Medicare Premiums: CMS designed this webinar for state policy staff to introduce five key policy topics addressed in the updated Manual for State Payment of Medicare Premiums released on September 8, 2020.

Overview of the CMS State Buy-In File Exchange: A webinar, with associated slides, available as a resource to support states moving to daily exchange submission.

About The Medicare Savings Program

Indiana helps eligible, low-income beneficiaries pay for Medicare with the Medicaid program. Medicaid is a health care program that helps pay for medical services for people who meet specific requirements.

You may be eligible depending on your income and the value of things you own :

| $2,706 | $11,960 |

Assets are things you own, such as checking and savings accounts, certificates of deposit, cash value of life insurance, stocks and bonds. Some things you own don’t count toward your asset limit, such as your home and furnishings, your car, burial plots, and, at least $1,500 in life insurance.

These limits are guidelines. The only way to know for sure if you are eligible is to apply.

You May Like: How Much Is Medicare B Deductible

Medicare Part D Costs By Income Level

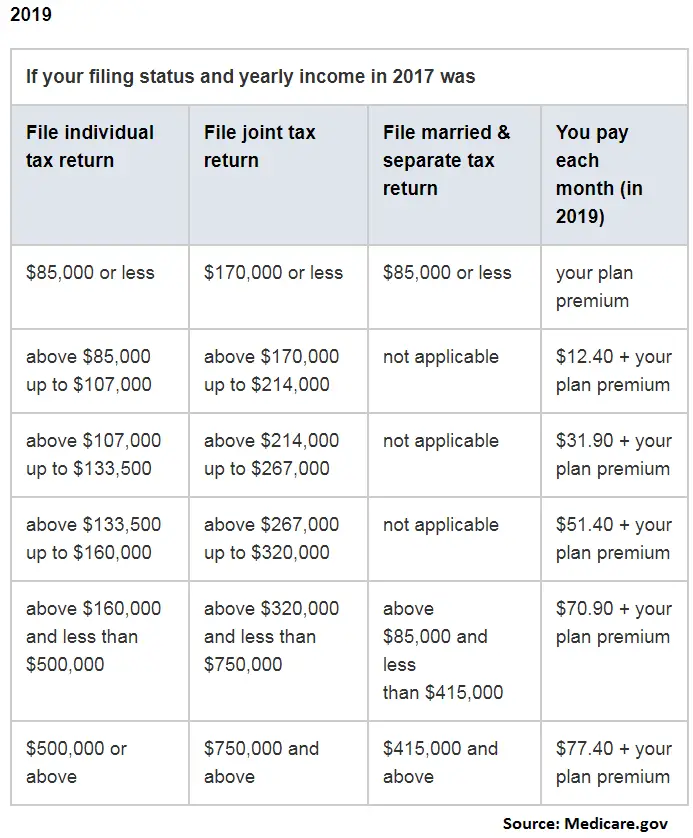

Like Medicare Part B, Medicare Part D prescription drug plans use the IRMAA to determine plan premium costs by income level.

2021 Medicare Part D plan premiums, based on income level from 2019, are as follows:

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $412,000 |

$77.10 + your plan premium |

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage.

Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Are you looking for Medicare prescription drug coverage?

You can compare Medicare drug plans available where you live and if you’re eligible enroll in a Medicare prescription drug plan online.

Find Medicare drug plans in your area

Or call 1-800-557-6059TTY Users: 711 24/7 to speak with a licensed insurance agent.

Q How Long Will My Medicaid Benefits Remain Active

A. Medicaid is based on month to month eligibility. However, your benefits are redetermined on a yearly basis by DMMA to confirm whether you still remain eligible for the program you are receiving. Certain Medicaid programs require you to report changes in your situation within 10 days of the change. One example of a change that must be reported is new employment.

Recommended Reading: Does Medicare Pay For Mens Diapers

How Does Selling Our Home Affect Medicare

Ruth California: I understand that profit from the sale of your home affects income, which, in turn, can result in a surcharge for Medicare premiums. But does it make any difference if you immediately put all or part of that income into the purchase of another home?

Phil Moeller: Medicares high-income surcharges are based on taxable income. So, the answer to your question depends on whether the proceeds from the sale flow through to you as taxable income.

I am not a tax expert, but I believe people have a one-time exemption that permits them to sell their principal residence without adverse tax consequences.

And if you roll over the proceeds from your old home into a new one, only the net amount of the gain on the sale of your prior home would be taxable. You should confirm my advice with a tax accountant.

Also, the high-income surcharge lasts only for one year. For example, someone with high income in 2019 would see this reflected on their tax return filed in 2020 and would pay the surcharge during 2021. If their income declined in 2020, the surcharge would disappear in 2022.