How Do I Sign Up For Medicare Part B If I Already Have Part A

If you are already enrolled in Medicare Part A and you would like to enroll in Part B under the Special Enrollment Period , you can apply online at Apply for Medicare Part B Online during a Special Enrollment Period. You can upload your application and documents that verify your group health plan coverage through your employer.

You can also fax or mail your completed CMS-40B, Application for Enrollment in Medicare Part B and the CMS-L564, Request for Employment Information enrollment forms and evidence of employment to your local Social Security office. If you have questions, please contact Social Security at 1-800-772-1213 .

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employer’s signature.

- Also submit one of the following forms of secondary evidence:

- Income tax returns that show health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Medicare Part D Costs

Monthly premium: The Part D monthly premium varies by plan .

Late enrollment penalty:

You may owe a late enrollment penalty if, for any continuous period of 63 days or more after your Initial Enrollment Period is over, you go without one of these:

- A Medicare Prescription Drug Plan

- A Medicare Advantage Plan or another Medicare health plan that offers Medicare prescription drug coverage

In general, youll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

Deductibles, copayments, & coinsurance:The amount you pay for Part D deductibles, copayments, and/or coinsurance varies by plan. Look for specific Medicare drug plan costs, and then call the plans youre interested in to get more details.

Is Medicare Part B Free

Medicare Part B premiums may change from one year to another contingent upon your financial circumstances. For some individuals, the premium is consequently deducted from their Social Security benefits. The standard month-to-month Part B premium: $148.50 in 2021. Moreover, in the event that your pay surpasses a specific sum, your premium could be higher than the standard premium, as there are diverse premiums for various pay levels.

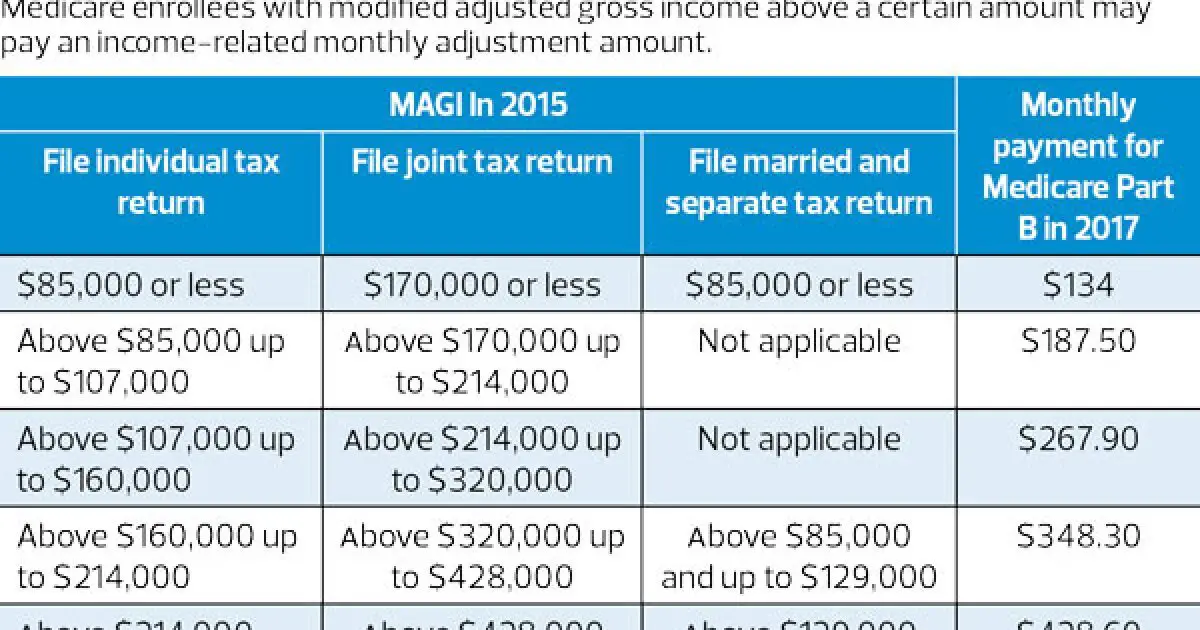

In case you are getting Social Security, Railroad Retirement Board, or government retirement benefits, your Part B premium will be deducted straightforwardly from your month-to-month benefit. If not, you will be sent a bill at regular intervals. The tables given above show the Medicare Part B month-to-month premium sums, in view of your detailed pay. These sums might change every year. A late enrollment penalty might be appropriate on the off chance that you didnt pursue Medicare Part B when you were first qualified. In addition to this, your month-to-month premium might be 10% higher for every year-long time frame that you were qualified in but didnt try out Part B.

You May Like: What Is Blue Cross Blue Shield Medicare Advantage

How Much Is Taken Out Exactly

There is no standard amount that is taken out of your Social Security check when you sign up for Medicare. Instead, the amount deducted depends on several factors. Each part of Medicare has a different cost. On top of this, Part C and Part D are offered by private plans, which means their monthly premiums vary even more.

Although there are standard monthly premiums for Part A and Part B, the amount changes slightly each year. There are also additional costs that you may have to pay depending on your income level. We discuss these in more detail below.

To find out how much will be taken from your check, you need to refer to some specific parts of Medicare.

What Is The Part B Premium Reduction Plan

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage, youll see a section that says Part B premium buy-down this is where you can see how much of a reduction youll get. Although, your agent or the customer service number on the back of your card can also tell you about the coverage.

Don’t Miss: Where Do You Apply For Medicare

Find Cheap Medicare Plans In Your Area

Medicare Part B provides coverage for medical needs such as outpatient care and doctor visits. This health insurance policy and Medicare Part A combine to make up what is known as Original Medicare. Eligibility for the federal health insurance program requires you to be over the age of 65, to have a disability or to have a life-threatening disease.

In 2021, the standard monthly premium for Part B is $148.50, which is either deducted from your Social Security benefits or paid out of pocket. Part B coverage makes sense for most individuals due to its cheap monthly premiums, but you should evaluate your current health insurance coverage before enrolling in the federal plan.

How Will I Know How Much My Medicare Part B Premium Will Be

The Social Security Administration or the Railroad Retirement Board, if that applies to you will tell you how much your Part B premium will be. Heres a table that may help you to know what to expect, particularly if your income is above a certain level.

If your income falls into one of four higher-income categories based on your 2019 tax return, in most cases youll pay more than the standard Medicare Part B premium. The amounts listed below reflect the Income Related Monthly Adjustment Amount, or IRMAA. To determine your Part B premium, the Social Security administration looks to your income tax returns from two years ago .

Here is a chart of Medicare Part B premiums for 2021, including IRMAA amounts, if applicable. Please note that your actual premium may be different depending on your individual circumstances.

| Your reported tax income in 2019 | Your 2021 Part B premium |

Recommended Reading: How Much Medicare Is Taken Out Of Social Security Check

Medicare Part A Costs

Monthly premium: Most people dont pay a monthly premium for Part A . If you buy Part A, youll pay up to $458 each month in 2020. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $458. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $252.

Late enrollment penalty:

If you dont buy it when youre first eligible, your monthly premium may go up 10%.

Medicare Part D Prescription Drug Coinsurance

Your Medicare Part D plans design will determine your 2021 coinsurance.

There is a standard deductible of $445 for all Part D prescription drug plans, but after that, the amount of your coinsurance is set by the insurer through which you purchased your Part D coverage. You should check with your Part D insurance provider to find out what your coinsurance will be.

Also Check: How Often Does Medicare Pay For A1c Blood Test

How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $148.50 for Part B premiums in 2021. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2021 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2021 is $203.

Medicare Part B Premium

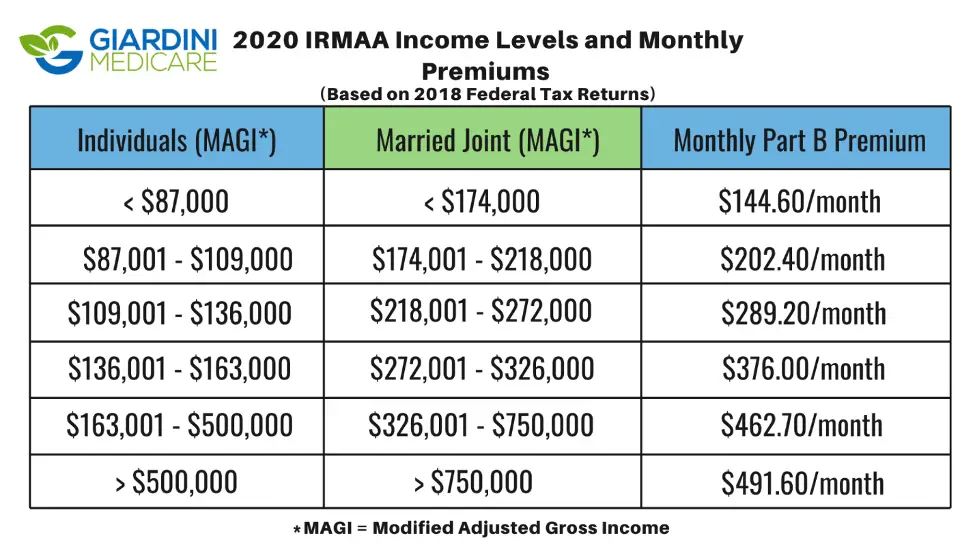

The Medicare Part B standard premium went up in 2021 to $148.50 from $144.60 a month in 2020. The CMS cited rising prices for doctor administered medications as the driving force behind the hike. People with higher incomes may have to pay higher prices.

Medicare Part B uses a complex formula to determine the amount of your monthly premium. The cost is based on your modified adjusted gross income. Thats adjusted gross income plus any tax-exempt interest reported on your most recent tax return.

The formula also takes into account whether you filed an individual tax return, a joint return or you were married but filed separately.

2021 Medicare Part B Premiums

| Filed an Individual Tax Return | Filed a Joint Tax Return | Medicare Part B Premium for 2021 |

|---|---|---|

| $88,000 or less |

Recommended Reading: How To Get New Medicare Card Without Social Security Number

Collection Of The Part B Premium

Part B premiums may be paid in a variety of ways.59 If an enrollee is receiving Social Security or Railroad Retirement benefits,60 the Part B premiums must, by law, be deducted from these benefits. Additionally, Part B premiums are deducted from the benefits of those receiving a Federal Civil Service Retirement annuity.61 The purpose of collecting premiums by deducting them from benefits is to keep premium collection costs at minimum. This withholding does not apply to those beneficiaries receiving state public assistance through a Medicare Savings Program because their premiums are paid by their state Medicaid program.

Part B enrollees who do not receive monthly Social Security, Railroad Retirement, or Civil Service Retirement benefits, or assistance through a Medicare Savings Program, pay premiums directly to CMS.62

How Much Are Part D Irmaa Surcharges

For Part D, the IRMAA amounts are added to the regular premium for the enrollees plan .

Note that if you are a Medicare Advantage policy member and that plan includes prescription drug benefits then both Part B and Part D IRMAAs are added to the plan premium .

The following income levels trigger the associated IRMAA surcharges in 2021 .

| Table 2. Part D 2021 IRMAA |

|---|

| Individual |

Source: CMS

You May Like: Can You Get Medicare Advantage Without Part B

B Premium Can Be Limited By Social Security Cola But That Wasnt An Issue For Most Beneficiaries In 2020 Or 2021

In 2021, most enrollees pay $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 and in 2019 . But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees.

B Premium Reduction Give Back Plans

The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isnt available in all areas. Those with this plan may see a higher amount on their Social Security check, depending on their Part B premium payment method.

Read Also: Is Silver Sneakers Part Of Medicare

B Deductible Also Increased For 2021

Medicare B also has a deductible, which increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20% of the Medicare-approved cost for Part B services. But supplemental coverage often covers these coinsurance charges.

For people who became eligible for Medicare before the start of 2020, there are Medigap plans available that cover the Part B deductible, in addition to coinsurance charges. But those plans are no longer available for Medicare beneficiaries who became eligible for Medicare after the end of 2019.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

What Doesnt Medicare Part B Cover

Medicare Part B doesnt cover every possible medical expense. Heres a partial list of what Part B doesnt generally cover.

- Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B.

- Some tests and services that your doctor might order or recommend for you. If your doctor wants you to have lab tests, or any services beyond your standard annual wellness visit, you might want to ask whether Medicare covers them. Medicare Part B might cover some of these services.

- Routine dental care

- Routine vision care

- Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting.

- Hearing aids

- 24-hour home health care

- Long-term care, such as you might get in a nursing home. If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesnt generally cover it.

Some of these services, such as routine dental and vision care, might be covered under a Medicare Advantage plan.

Also Check: When Is Open Enrollment For Medicare

How Much Has Medicare Cost You So Far

Some would think that since you have paid into the Medicare fund all your working years, the cost of Medicare would be free, right? I mean, come on, you paid on average, 1.45% of your annual income into the Medicare fund and your employer matched that! If you were self-employed, then you paid both the employee and employer tax, for a total of 2.9%.

So, for the average American, you and your employer combined paid about $1,537 per year into the Medicare fund . So how much does Medicare cost? Well, the Medicare tax started in 1966 at a smaller rate of 0.7%, so it is a little complicated to do the math, but Medicare has already costed you in the form of payroll taxes. Between you and your employer , the total amount paid into Medicare on your behalf might be well over $40,000.

But I know that is not what you are asking.

The Secure Act And Irmaa

Further complications have been introduced as a result of the SECURE Act , which was enacted in late 2019. The SECURE Act has a number of different features such as allowing IRA contributions after age 70½ if youre still earning an income and it extends the minimum age that one must receive RMDs from 70½ to 72. Note that those who are already at least 70½ must continue to receive RMDs.

The reason this may be important is that it is possible that delaying receiving RMDs may also reduce IRMAA if your Modified Adjusted Gross Income is close to the limits stated in Tables 1 and 2.

The reason this is important is that people withdraw from qualified funds such as a 401, IRA, or 403, and these funds are taxable, once they are transferred to your individual checking, savings or brokerage account . The amount distributed is added to your taxable income, so exercise caution when youre receiving distributions from qualified funds. This additional income will increase your Modified Adjusted Gross Income, and may subject you to higher Medicare Part B and Medicare Part D premiums.

Further, non-qualified funds must also be tracked because of the way that mutual funds capital gains and dividend distributions are made. At the end of every year, many mutual funds distribute capital gains or dividends to those with mutual fund holdings. As a result, people can unknowingly earn more income as a result of investments, and the result can be higher Medicare premiums.

You May Like: What States Have Medicare Advantage Plans

How Is My Income Used In My Irmaa Determination

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 , but as discussed below, theres an appeals process if your financial situation has changed.

For 2022 , the IRMAA surcharges are projected to start at $91,000 for a single individual and $182,000 for a married couple.

You will receive notice from the Social Security Administration to inform you if you are being assessed IRMAA.

The income used to determine IRMAA is a form of Modified Adjusted Gross Income , but its specific to Medicare. The Modified Adjusted Gross Income is different from your Adjusted Gross Income, because some people have additional income sources that have to be added to their AGI in order to determine their IRMAA-specific MAGI.

Its important to understand that MAGI for calculating IRMAA isnt the same as the normal MAGI that you might be accustomed to for non-healthcare purposes, nor is it exactly the same as MAGI for calculating premium tax credits and Medicaid/CHIP eligibility under the Affordable Care Act. Table 1 in this Congressional Research Service brief is useful in seeing how MAGI is determined for IRMAA calculations.