How Do I Apply For Medicare In Hawaii

You can apply for Medicare in Hawaii through the Social Security Administration, either by phone or online.

Not sure which plan is right for you? HealthMarkets can make it easy. Our FitScore® can recommend and compare plans to help you find the one that fits your needs at no additional charge to you. You could even discover that you might qualify for Extra Help, a program that helps you pay less for prescription drug coverage. Over 47% of Medicare-eligible Hawaii residents who applied were deemed eligible for Extra Help in 2020.5

Get your FitScore and begin comparing Medicare plans today.

46980-HM-0121

When Should I Enroll In Medicare Part B

Medicare eligible retirees must enroll in Medicare Part B to continue to be covered under an EUTF retiree medical and/or prescription drug plan. A spouse/civil union or domestic partner who is enrolled as a dependent under an EUTF retiree medical and/or prescription drug plan must also enroll in Medicare Part B when they become eligible for Medicare, regardless of whether they are retired or actively employed.

EUTF Retirees and their Covered Dependents Reaching Age 65Contact the Social Security Administration or CMS and Medicaid Services three months prior to your 65th birthday to initiate enrollment into Medicare Part B. EUTF will send a courtesy letter to retirees and their eligible spouse/partner three months prior to their 65th birthday also reminding you to enroll into Medicare Part B. Start the Medicare enrollment process as soon as you become eligible and submit appropriate documents to the EUTF in order to continue your EUTF retiree medical and/or prescription drug coverage.

Medicare Resources In Hawaii

Getting support can help when youre making Medicare decisions. Hawaii has numerous locations where enrollees can receive help through the State Health Insurance Program . Hawaii SHIP has counselors throughout the state that work with local nonprofits and public health agencies, as well as Area Agencies on Aging , to provide seniors with Medicare information.

Don’t Miss: Does Medicare Part C Cover

Tips For Enrolling In Medicare In Hawaii

Think carefully about your healthcare needs before selecting a plan. If you think you may have higher healthcare costs or need additional coverage, a Medicare Advantage plan may be a better option than original Medicare.

If youre considering a Medicare Advantage plan, review the available plans carefully for:

- a network of doctors and facilities you prefer

- affordable monthly premiums, deductibles, coinsurance, and copays

- star ratings that reflect high quality care and patient satisfaction

An Office Visit Is Worth Your Time

Many people find that visiting the SSA office is the best way to get the help they need, and this is especially true of people who are unfamiliar with computers or the internet. The Claims Specialists are trained to answer questions about the process, and are there to help you with the most common reasons people visit the office: Social Security Disability applications, retirement benefits, and Social Security cards.

Its worth the time to go to the field office, but be sure to make an appointment, come prepared, ask questions, and find out what your next move is.

Don’t Miss: Does Aetna Follow Medicare Guidelines

How Many Hawaiians Are Enrolled In Medicare

As of July 2020, 280,006 Hawaii residents nearly 20 percent of the states population were enrolled in Medicare.

For most Americans, filing for Medicare is part of turning 65. But Medicare coverage is also available to people under the age of 65 who have been receiving disability benefits for at least two years, or who have ALS or end-stage renal disease. Nationwide, 85 percent of Medicare beneficiaries are eligible due to being at least 65 years old, while the other 15 percent are under 65.

Hawaii has the smallest percentage of disabled Medicare beneficiaries of any state in the country just 9 percent Hawaiis Medicare beneficiaries are under 65 and eligible due to a disability . The other 91 percent of Hawaiis Medicare beneficiaries have age-related eligibility.

Who Qualifies For Medicare In Hawaii

Heres what it generally takes to be eligible for Medicare in Hawaii. The same is true for the other states.

- Be an American citizen or legal permanent resident of at least five years in a row.

- Be age 65 or older.

- Qualify for Medicare before age 65 if you have certain disabilities. In most cases, you have to receive Social Security disability benefits for 24 months in a row before you qualify for Medicare.

You May Like: Can A 60 Year Old Get Medicare

Medicare Enrollment And Active Employment

If you are covered under an EUTF or HSTA VB active employee plan, you are not required to enroll in Medicare. Medicare enrollment is only required for coverage under EUTF and HSTA VB retiree plans. If during your retirement, you are actively employed and covered by another employers health plan, you will still be required to enroll in Medicare Part B in order to continue coverage under the EUTF or HSTA VB retiree medical and/or prescription drug plans. If you are a dependent enrolled in an EUTF or HSTA VB retiree medical and/or prescription drug plan and are eligible for Medicare Part B, you are required to enroll in Medicare Part B even if you are still actively working.

Am I Eligible For Medicare In Hawaii

Hawaii residents who are 65 or older and a legal US resident may be eligible for Medicare. If youre a resident under 65 with certain health conditions, you may be eligible too. And with Medicare Advantage, you can receive more benefits than Original Medicare offers.

Medicares varied options have different levels of eligibility. If you have any questions or concerns regarding your eligibility for Medicare plans, including Aetna Medicare Advantage, make the call. A friendly, licensed agent can help.

Recommended Reading: Does Medicare Cover Autologous Serum Eye Drops

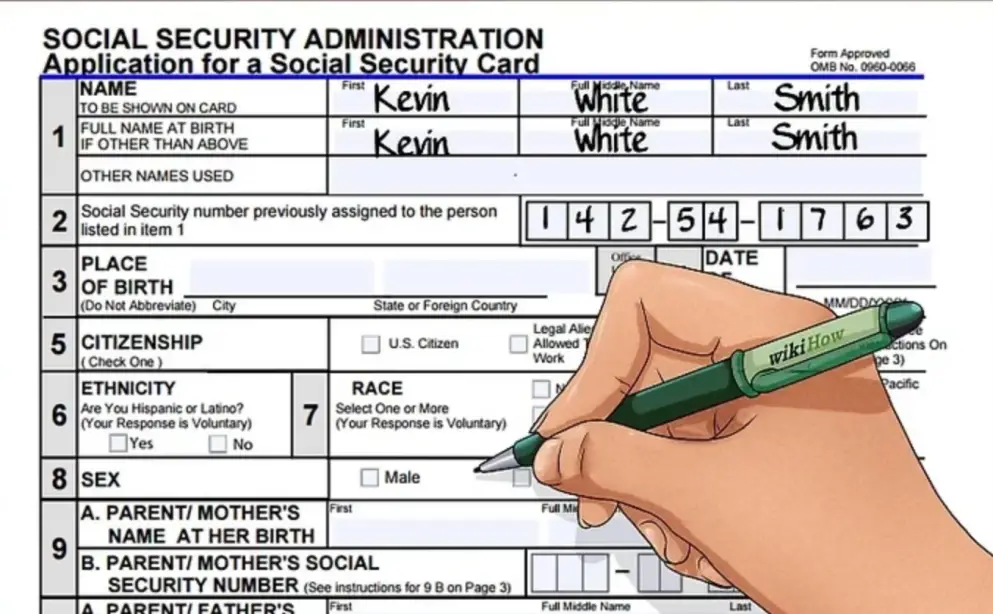

Where To Apply For Medicaid In Hawaii In Person

If you do not know how to apply for Medicaid, you may visit the nearest Med-QUEST Division eligibility office in person. They will help you fill out your Medicaid application or refer you to a DHS Application Counselor to explain your options to you.

When you visit the County Office, you should be ready with the information you need to apply for Medicaid. You will need the names, birth dates and Social Security numbers of any family members who live with you.

As stated before, applicants who are enrolled in another health insurance policy may still qualify for Medicaid. If you have a job, bring a recent pay statement or W-2 form to verify your income. Discover all of the steps you must take when applying for Medicaid by .

To Qualify For Medicare You Need To Get Disability Benefits From:

- Social Security

- Railroad Retirement Board

Youll automatically get Part A and Part B after you get disability benefits for 24 months. Well mail you a welcome package with your Medicare card.

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If you live in Puerto Rico or outside the U.S.

Don’t Miss: Does Medicare Pay For Medical Alert Bracelets

Hawaii Medicare Plan Finder

Our Medicare Plan Finder tool allows you to search through some of the plans available in Hawaii so that you can make educated choices regarding your healthcare. Our licensed agents can then be available to help answer your questions and help you sort through all of your options for Medicare in Hawaii.

How Do I Chose A Medicare Advantage Plan In Hawaii

The first thing you may consider is what kind of coverage you want. Prescription drug coverage may be important to you but not fitness benefits, for example. Different Medicare Advantage plans in Hawaii offer different coverage for benefits not covered by Original Medicare. If a certain benefit is offered by Original Medicare, all Medicare Advantage plans must generally also cover it.

The next thing you may consider is plan cost. Medicare Advantage plans in Hawaii may have monthly premiums, which is the amount you pay to have the plan. Some Medicare Advantage plans have monthly premiums as low as $0, but you must continue to pay your Medicare Part B premium. Another cost is a deductible, which is the amount you pay out of pocket before the plan begins to pay. Some Medicare Advantage plans in Hawaii may have $0 deductibles. Another cost is copayment or coinsurance, or the amount you pay when you use a service. A doctor office visit, ambulance service, or emergency room visit all may have separate copays. Some Medicare Advantage plans in Hawaii may charge $0 copays for certain services.

A third thing you may consider is the type of plan you want. Plans vary in the way that you access primary care doctors, specialists, and use networks. Medicare Advantage plans are usually managed-care plans such as:

Also Check: How Much Does Medicare Cost Me

Aetna Medicare Insurance For Hawaiians

Feeling the sand between your toes while walking in your slippers, taking a bite of your malasadas on the beachits all second nature in the Aloha State. When you reach a certain age, it also comes naturally to get Medicare coverage. In Hawaii, there are over 200,000 residents receiving Medicare benefits.* No matter which island of Hawaii you call home, call to see if you can enroll today and make Medicare a natural part of your life with Aetna Medicare.

*Kaiser Family Foundation

To learn more about the available Medicare benefits in your area, call to talk to a licensed agent about Aetna Medicare.

Medicare Plan Options In Hawaii

Residents of Hawaii have multiple Medicare plans to choose from. Many are tiered to help Hawaiians find the plan that is best suited to your lifestyle and medical needs. For example, seniors and individuals with disabilities who dont need much coverage can apply for Original Medicare. Hawaiis Medicare Advantage program might be a better option if you need more comprehensive insurance. Some Medicare policies offer additional prescription drug add-ons or supplementary coverage.

Read Also: Does Medicare Cover Oral Surgery Biopsy

About Medicare In Hawaii

Medicare beneficiaries in Hawaii can receive their coverage through Original Medicare, Part A and Part B, and add additional coverage in the form of a stand-alone Medicare Part D Prescription Drug Plan and/or a Medicare Supplement insurance plan. They may also enroll in a Medicare Advantage plan , which provides their Original Medicare coverage by offering all the benefits included under Part A and Part B , and could also include routine vision, dental, and even prescription drug coverage.

If you choose to enroll in a Medicare Advantage plan in Hawaii, you will continue to pay your Medicare Part B premium.

What Are Alternatives To Medicare Advantage

- Original Medicare, which includes Part A and B only.

- Original Medicare with a Medigap policy that covers out-of-pocket expenses for Part A and B services.

- Original Medicare with a Medigap plan and a Part D plan.

Medicare Advantage plans are similar to Original Medicare with a Medigap policy and a Part D plan, but there are differences. One advantage to MA plans is that they bundle all policies, eliminating the need to manage multiple plans. You would buy coverage from private insurers for either option.

Also Check: Does Medicare Supplement Cover Drugs

What Does Part D Cost In Hawaii

When you enroll in a Medicare Part D Plan, you should expect to pay:

- Monthly premium: This is the monthly amount you pay for your plan.

- Annual deductible: This is the amount that you pay before the plan starts paying its share. The maximum deductible in 2021 is $445.

- Coinsurance or copayments: This is the amount that you pay when filling a prescription. Coinsurance is a percentage of the drug cost whereas copayments are a fixed price range. In both cases, your share of costs is 25 percent, with your plan paying the other 75 percent.

Medicare Part D plans follow tiered pricing, with the least expensive medications on the bottom tiers and specialty and other high-priced drugs on the top tiers. There may be anywhere between three and seven levels to a Part D plan’s drug tier.

Part D plan options vary according to where you live. Compare costs and coverage carefully to find the best plan that fits both your needs and your budget.

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

You May Like: Do I Need Medicare If I Have Other Insurance

Types Of Medicare Advantage Plans

There are numerous options available to seniors seeking Medicare Advantage coverage in Hawaii, although the plans and providers are relatively limited when compared to other states. Beneficiaries can choose between a Preferred Provider Organization and a Health Maintenance Organization . Special Needs Plans , which include prescription drug coverage, are available to those who meet strict eligibility requirements. Plan availability varies between counties, and Medicare Advantage members who move to a different county within Hawaii may be required to switch their MA plan.

Preferred Provider Organizations

Approximately 62% of Medicare Advantage members in Hawaii have coverage through PPOs. The cost of PPO plans are generally higher than HMO plans however, PPO members can access out-of-network service providers while maintaining some coverage. In order to pay the lowest available co-pays, PPO members need to see in-network doctors and specialists. Unlike with Medicare Plan C coverage through an HMO, PPO members can usually self-refer to specialists, rather than seeing their primary care provider for a referral.

Health Maintenance Organizations

Special Needs Plans

How To Enroll In Medicare

Enrolling in Medicare is easy once you understand how to do so. It’s important to know that how you enroll in Medicare Part A and Part B is different from how you enroll in Medicare Advantage , Part D or Medicare supplement insurance.

See the table below for a quick overview of how to enroll in a Medicare or Medigap plan and read on for how-to steps for both Original Medicare and the three kinds of Medicare and Medigap plans.

Original Medicare Medicare Advantage plan Medicare Prescription Drug plan Medicare Supplement Insurance plan How to Enroll

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office.

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Enroll directly in the plan e.g., on the plans website

Original Medicare

How to Enroll

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office.

Medicare Advantage plan

How to Enroll

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Medicare Prescription Drug plan

How to Enroll

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Medicare Supplement Insurance plan

Enroll directly in the plan e.g., on the plans website

Read Also: Does Medicare Cover A1c Test

What Hawaii Medicare Plans Are Available

Once you’re eligible for Medicare, you can choose from different health insurance plans to get the coverage that best meets your needs.

Close to 147,500 Hawaiians are enrolled in Original Medicare, which is the government’s basic health insurance plan to pay for medically necessary services. Original Medicare includes:

- Part A hospital insurance for hospital, skilled nursing, hospice and some home health care

- Part B medical insurance for preventing, diagnosing and treating illnesses and medical conditions

Original Medicare is delivered through the federal government and doesn’t include supplemental benefits like prescription drugs and dental care. If you want benefits beyond Original Medicare, you can purchase coverage through a private insurance company.

Here are some of the Medicare options sold by private insurers in Hawaii:

When Can I Enroll

There are three primary Medicare enrollment periods:

Initial Enrollment Period

If youre turning 65 soon and enrolling in Medicare for the first time, you have the month of your 65th birthday and a three-month grace period before and after your birthday known as the Initial Enrollment Period.

Annual Enrollment Period

Already have Original Medicare and want to upgrade your coverage by switching to a Medicare Advantage plan? Make the switch during the Annual Enrollment Period which starts October 15th and ends December 7th every year.

Special Enrollment Period

Under some circumstances, you may be able to enroll in a Medicare plan during a Special Enrollment Period. For example, you may be able to enroll in coverage or switch plans if youve recently moved to an area where your current plan is not covered. Talk to one of our licensed agents today to see if your special circumstance applies.

You May Like: Is Medicare A Federal Program