Pros And Cons Of Aarp Unitedhealthcare Medicare Advantage

|

Pros |

|

|

There is a good selection of plans in most areas, including a flexible HMO-POS plan. |

In some areas, customer service gets below average marks. |

|

There is a large national provider network. |

Although there are many 4 and 4.5 star plans, the average Medicare star rating is 3.9. |

|

The $0 premium and $0 deductible plans are available in most areas. |

PPO plan premiums are slightly higher than average in some areas. |

|

Most plans include Part D plus generous extra benefits, including dental, vision, nurse hotline, and fitness membership. |

Other Types Of Medicare Advantage Plans

If you want more freedom in health care providers or payment options, there are two other types of Medicare Advantage plans to consider.

Private Fee-For-Service plans

PFFS plans may or may not have a doctor/provider network, but cover any doctor or provider who accepts Medicare. If the plan doesn’t include prescription drug coverage, you can also enroll in a stand-alone Part D plan separately.

Medical Savings Account plans

MSA plans combine a high-deductible health plan with a special savings account. Medicare deposits funds that are withdrawn tax free to pay for qualified health care services. You can see any doctor or provider you choose. MSA plans don’t cover prescription drugs, but you can enroll in a stand-alone Part D plan separately.

Not all plans are available in all areas.

Most Medicare Advantage Enrollees Are In Plans Operated By Unitedhealthcare Humana Or Bluecross Blueshield Affiliates In 2019

Figure 4: Medicare Advantage Enrollment by Firm or Affiliate, 2019

Medicare Advantage enrollment is highly concentrated among a small number of firms. UnitedHealthcare and Humana together account for 44 percent of all Medicare Advantage enrollees nationwide, and the BCBS affiliates account for another 15 percent of enrollment in 2019. Another four firms account for another 22 percent of enrollment in 2019. For the third year in a row, enrollment in UnitedHealthcares plans grew more than any other firm, increasing by about 520,000 beneficiaries between March 2018 and March 2019. CVS purchased Aetna in 2018 and the combined company had the second largest growth in Medicare Advantage enrollment in 2019, increasing by also about 520,000 beneficiaries between March 2018 and March 2019.

Recommended Reading: What Is The Medicare Supplement Plan

Nearly Four Out Of Five Medicare Advantage Enrollees Are In Plans That Require Prior Authorization For Some Services

Figure 9: Share of Medicare Advantage Enrollees Required to Receive Prior Authorization, by Service, 2019

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly four out of five Medicare Advantage enrollees are in plans that require prior authorization for some services in 2019. Prior authorization is most often required for relatively expensive services, such as inpatient hospital stays, skilled nursing facility stays, and Part B drugs, but infrequently required for preventive services. Beginning in 2019, Medicare Advantage plans can also require enrollees to use step therapy for Part B drugs, meaning that they are required to try some specific drugs before they receive approval to try other drugs. In contrast to Medicare Advantage plans, traditional Medicare does not generally require prior authorization for services, and does not require step therapy for Part B drugs.

What Do Medicare Advantage Plans Cover

Medicare Advantage plans are required to offer all the benefits included in Original Medicare . These plans combine coverage for hospital and doctor visits all in one plan. Many Medicare Advantage plans also include prescription drug coverage . You may also find plans that offer additional benefits like routine eye and dental care coverage not offered by Original Medicare. Learn more about Medicare Advantage dental benefits

Recommended Reading: Does Medicare Cover Laser Therapy

What Is The Difference Between A Medigap Plan And Medicare Advantage

The difference between a Medigap plan and a Medicare Advantage plan boils down to two main factors: cost and coverage. The Medicare Advantage plan can be cheaper, but the Medigap plan does offer the ability to pick and choose the coverage you want, whereas in most cases the Medicare Advantage plan has a set coverage scope. Medicare Advantage is still a Medicare plan it just offers a bit more all at once than Original Medicare does, as it includes prescription coverage, and in most cases coverage for vision, dental, or hearing. Medigap coverage has more individual options, but the prices can rack up for each type of supplemental coverage.

How To Shop And Compare The Best Medicare Advantage Plans

Step 1: If You Are Eligible, Enroll in Original Medicare

Original Medicare is the basic Medicare offered to everyone 65 or older, or people who qualify on a basis other than age . You may be enrolled in Original Medicare automatically, or you may have to sign up if youre 65, or almost 65, and do not get Social Security.

Step 2: Find a List of Medicare Advantage Plans Available in Your State or ZIP Code

Plans, coverage, and costs can vary by state and even county, depending on your location and the availability of local insurers near you.

Step 3: Determine Which Coverage/Features Are Most Important to You

Plan features can vary by plan and company. For example, you may want to check if out-of-network care is covered or even if the plan has a copay for prescription medication.

Step 4: Compare the Difference in Cost Among Medicare Advantage Plans

If you dont want to make an account or are just looking for estimates, you can select Continue without logging in. Keep in mind that some companies require more personal information than others before theyll give you an estimate.

Different companies can offer different prices for two people on the same plan, depending on age and gender, so its worth doing some research about what your specific costs may be.

Step 5: Consider Talking to a Broker or Consultant

Step 6: Sign Up

Don’t Miss: Can I Enroll In Medicare Online

Best User Experience: Humana

-

Relatively limited educational information available on website

-

Unable to make payments via app

-

Several different types of plans can be overwhelming

Humana has an A- ranking from AM Best, indicating its strong financial state. We chose Humana for the Best User Experience because when you are comparing plans, Humana gives you the opportunity to choose what kind of plans you want to see whether its medical coverage only, prescription drugs only, or a plan that includes both. Once youve decided that, you can select the type of plan: HMOs, which are often offered without a premium but apply only for in-network providers PPOs or Private Fee-for-Service plans that offer in- and out-of-network coverage but with higher costs or the option to see all plans you qualify for.

The process is streamlined and straightforward, giving you the choice to enter your doctors name or prescription medication information to get an accurate estimate, all without having to register for an account, wait for an email, or input a lot of personal information. Humana provides recommended plans based on your situation, including listing coverage, premiums, specialists, and prescription costs.

Best For Simplicity And Clarity: Blue Cross Blue Shield

Blue Cross Blue Shield

-

No estimates available on the main page

-

Must go to individual plan websites for local details

-

No Medicare Advantage coverage in Mississippi and Wyoming

If you want Medicare information broken down clearly and in a straightforward manner, Blue Cross Blue Shield is the best company to go through for Medicare Advantage. We chose it primarily for features such as its Medicare Advantage Plans document, available for anyone to view on its website without having to enter any personal information. It gives a detailed look into the company’s plan offerings, explaining what types of plans are offered in which state, and who to contact if you want to enroll.

For example, in Florida, you have the option of going through multiple PPOs and HMOs as well as a HMO -D-SNP. Each of these options is sponsored by Florida Blue. Each organization may offer different plans and the plans can differ by ZIP code within the state too. So it’s important you gather information about the plans in your specific area.

The basic website is clean and easy to navigate, but its a little more complicated to actually get an estimate.

However, Blue Cross Blue Shield is actually an association of 35 independent insurance companies, not a single insurer. To get the details of your specific options, youll have to track down the BCBS affiliate in your market. Beware: BCBS affiliation may not be obvious from its name or how its commonly referred to, such as Anthem or Highmark.

Read Also: Who Can Get Medicare Part D

Unitedhealthcare Offers Several Types Of Medicare Special Needs Plans

Medicare Special Needs Plans are special Medicare Advantage plans that can offer some additional benefits to help support an eligible beneficiarys specific health or budget needs.

With each type of Medicare SNP plan from UnitedHealthcare, you are generally required to receive care and medical services from providers in your plan network. Some plans allow you to receive out-of-network care, but it may come with higher out-of-pocket costs.

UnitedHealthcare offers several different types of Medicare SNP plans:

- Dual Eligible Plans

Not all plans are available in all areas.

The Majority Of Medicare Advantage Enrollees Are In Plans That Receive High Quality Ratings And Related Bonus Payments

Figure 10: Distribution of Medicare Advantage Enrollees by Plan Star Rating, 2015-2019

In 2019, more than two-thirds of Medicare Advantage enrollees are in plans with quality ratings of 4 or more stars, a decrease from 74 percent in 2018. An additional 2 percent of enrollees are in plans that were not rated because they were part of contracts that had too few enrollees or were too new to receive ratings. Plans with 4 or more stars and plans without ratings are eligible to receive bonus payments for each enrollee the following plan year . The share of enrollees in plans with 2.5 stars nearly doubled from 3 percent in 2018 to 6 percent in 2019.

For many years, the Centers for Medicare and Medicaid Services has posted quality ratings of Medicare Advantage plans to provide beneficiaries with additional information about plans offered in their area. All plans are rated on a 1 to 5-star scale, with 1 star representing poor performance, 3 stars representing average performance, and 5 stars representing excellent performance. CMS assigns quality ratings at the contract level, rather than for each individual plan, meaning that each plan covered under the same contract receives the same quality rating .

Recommended Reading: Is Keystone 65 A Medicare Advantage Plan

Best In Educational Content: Aetna

Aetna

-

Fewer plans available

-

No app available for payments

We like Aetna because of the care and tone it takes regarding educational information on its website. Before even getting into the particular coverage available, you have the option to learn more about the plan types , so that you can make well-informed decisions. Aetna also offers Dual-eligible Special Needs Plans for people who qualify for Medicare and Medicaid, which allow for the coverage offered by Original Medicare along with additional special benefits like non-emergency transportation, meal programs, over-the-counter medicine coverage, or help to stop smoking.

Searching for coverage and finding what you need is easy. Aetna offers the benefit of guiding you through the process to receive recommendations when you answer questions such as: ZIP code, what type of coverage needs you have, and any other health coverage options you are enrolled in. You can also manually review your options.

Not every plan type may be available in your location, so check your ZIP code through Aetnas website. Aetna offers a variety of plan types with a range of premiums.

Enrollment In Medicare Advantage Has Nearly Doubled Over The Past Decade

Figure 1: Total Medicare Advantage Enrollment, 1999-2019

In 2019, one-third of all Medicare beneficiaries 22 million people are enrolled in Medicare Advantage plans, similar to the rate in 2017 and 2018. Between 2018 and 2019, total Medicare Advantage enrollment grew by about 1.6 million beneficiaries, or 8 percent nearly the same growth rate as the prior year. The Congressional Budget Office projects that the share of beneficiaries enrolled in Medicare Advantage plans will rise to about 47 percent by 2029.

Don’t Miss: Does Medicare Cover Dexa Scan

Unitedhealthcare Connected For Mycare Ohio

UnitedHealthcare Connected® for MyCare Ohio is a health plan that contracts with both Medicare and Ohio Medicaid to provide benefits of both programs to enrollees. If you have any problem reading or understanding this or any other UnitedHealthcare Connected® for MyCare Ohio information, please contact our Member Services at from 7 a.m. to 8 p.m. Monday through Friday for help at no cost to you.

Si tiene problemas para leer o comprender esta o cualquier otra documentación de UnitedHealthcare Connected® de MyCare Ohio , comuníquese con nuestro Departamento de Servicio al Cliente para obtener información adicional sin costo para usted al de lunes a viernes de 7 a.m. a 8 p.m. .

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How To Check Medicare Status Online

Aarp Medicare Advantage Ppo

PPO plans have lower out-of-pocket costs when you use network providers, but you have the flexibility to see any provider that accepts your plan anywhere in the country. PPO plans usually include:

- Part D prescription drug coverage

- Dental, vision, and hearing coverage

- 24/7 nurse hotline and virtual doctor visits

- Fitness membership

Understanding Part D Costs

Even though most plans include Part D prescription drug coverage, there is usually a separate deductible for Part D. The maximum is set by CMS , but AARPs deductibles are typically lower.

Medications in lower formulary tiers are usually exempt from the deductible.

AARP plans typically use a five-tiered formulary:

- Tier 1: Preferred generic drugs

- Tier 2: Nonpreferred generic drugs

- Tier 3: Preferred brand-name drugs

- Tier 4: Nonpreferred brand-name drugs

- Tier 5: Specialty prescription drugs

In a typical plan, there is no deductible for medications in tiers 1, 2, and 3, and a deductible of $50 to $100 for tiers 4 and 5.

Don’t Miss: Does Medicare Pay For Mens Diapers

How Do Aarp Unitedhealthcare Medicare Advantage Plans Compare To Other Insurance Providers

The HMO plans tend to offer lower-than-average yearly maximums for out-of-pocket spending, making these an affordable choice. There are other major carriers that offer low-cost HMO plans, too. What AARP UnitedHealthcare does well is offer the element of choice and flexibility through their PPO and HMO-POS plans, while still keeping costs low.

UnitedHealthcare’s customer service tends to be better than many competitors as well. Most of the company’s complaints involve services covered and the ease and speed with which members can obtain information or appointments. It should be noted that this challenge seems to be consistent across the spectrum of AARP UnitedHealthcare’s Medicare Advantage plans.

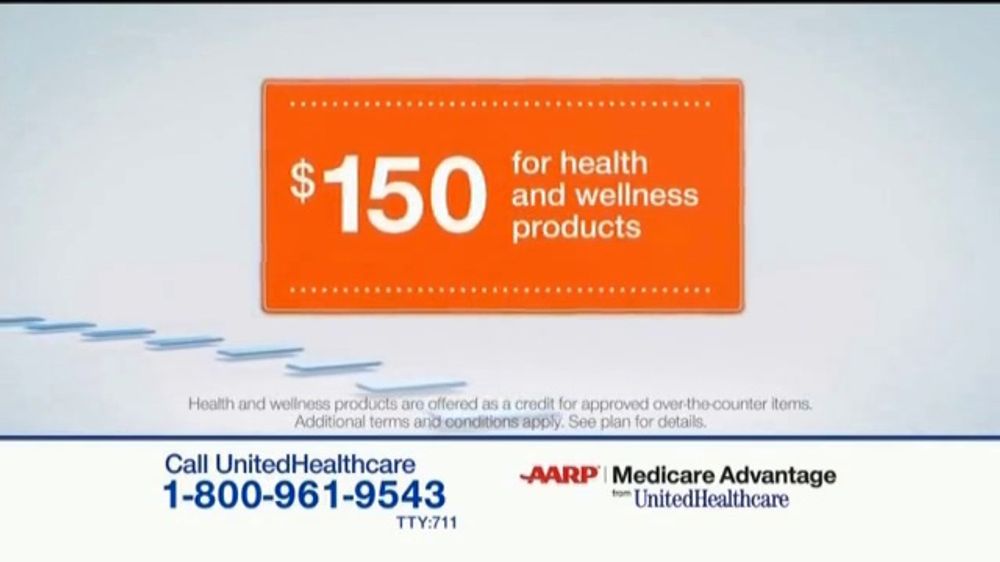

Aarp Unitedhealthcare And Expanded Medicare Advantage Benefits

In 2018, the Centers for Medicare and Medicaid Services approved a list of new supplemental benefits for Medicare Advantage plans. These benefits are designed to help people age safely at home.

UnitedHealthcare was one of the first insurers to add some of these new benefits to their Medicare Advantage plans. Many AARP Medicare Advantage plans include one or more of these optional supplemental benefits at no additional cost:

- Nonmedical transportation

- Allowance for over-the-counter medications and devices

- Personal emergency response system

In addition, most AARP UnitedHealthcare Medicare Advantage plans include the new insulin savings program which caps copays for insulin at $35 in all four stages of prescription drug coverage.

Recommended Reading: How Do Zero Premium Medicare Plans Work

Unitedhealthcares 2022 Medicare Plans Shaped By Consumer Expectations For Value Choice And Experience

-

90% of eligible consumers to have access to pharmacy benefits with $0 tier 1 retail copays nearly 80% to have access to a plan with no Rx deductible

-

98% of members will have stable or improved benefits in 2022 and most will see stable or reduced Medicare Advantage premiumsi, including nearly 3 million members with $0 premiums

-

Expanding access to the nations largest Medicare Advantage provider network to connect more people to quality, supported care when and where they need it

-

Increasing access to $0 Rx retail copays and healthy food benefit for D-SNP members

MINNETONKA, Minn., October 01, 2021—-UnitedHealthcare® today introduced its 2022 Medicare Advantage and prescription drug plans, offering expanded access to plans with differentiated value, simple and affordable benefit design and an unparalleled member experience all defined by what consumers say matters to them most.

Currently, more than 7.3 million peopleii are enrolled in UnitedHealthcare Medicare Advantage plans. In 2022, the company will expand its service area to reach 94% of Medicare consumers nationwide and maintain the industrys largest Medicare Advantage footprint including 3.1 million more people in 276 additional counties with access to a standard plan.

With deliberate emphasis on lowering prescription drug costs, improving core and ancillary benefits, and driving an exceptional member experience, highlights of UnitedHealthcares 2022 Medicare Advantage plans include:

Investments in Rx Coverage

Best For Bonuses: Aarp

-

No mobile app for payments

-

Higher out-of-pocket maximums

Nearly all of the Medicare Advantage plans offered by AARP come with plenty of extras, such as dental exams, vision and eyewear coverage, foot coverage, along with Renew Active, a Medicare fitness program with a gym membership, and an online brain health program.

In addition, AARP offers low copays for specialist visits, such as visits to an oncologist or a cardiologist, provided theyre in-network. It also offers a variety of Medicare Advantage plans and has an incredible amount of detailed educational information about Medicare and Medicare Advantage plans on its website, including the option to receive a free Medicare guide via email. However, the out-of-pocket maximums can be a bit on the high side, normally several thousand dollars.

Not only does AARP offer the ability to make your payments with your Social Security benefits, but it actually gives the option to have it automatically withdrawn from them, which gives you one less thing to worry about. The Social Security Administration will automatically deduct your Medicare Part B payment from your benefits, and AARP has the ability to do the same for your Medicare Advantage plan.

Read Also: What Is The Extra Help Program For Medicare