Its Time For Medicare Open Enrollment

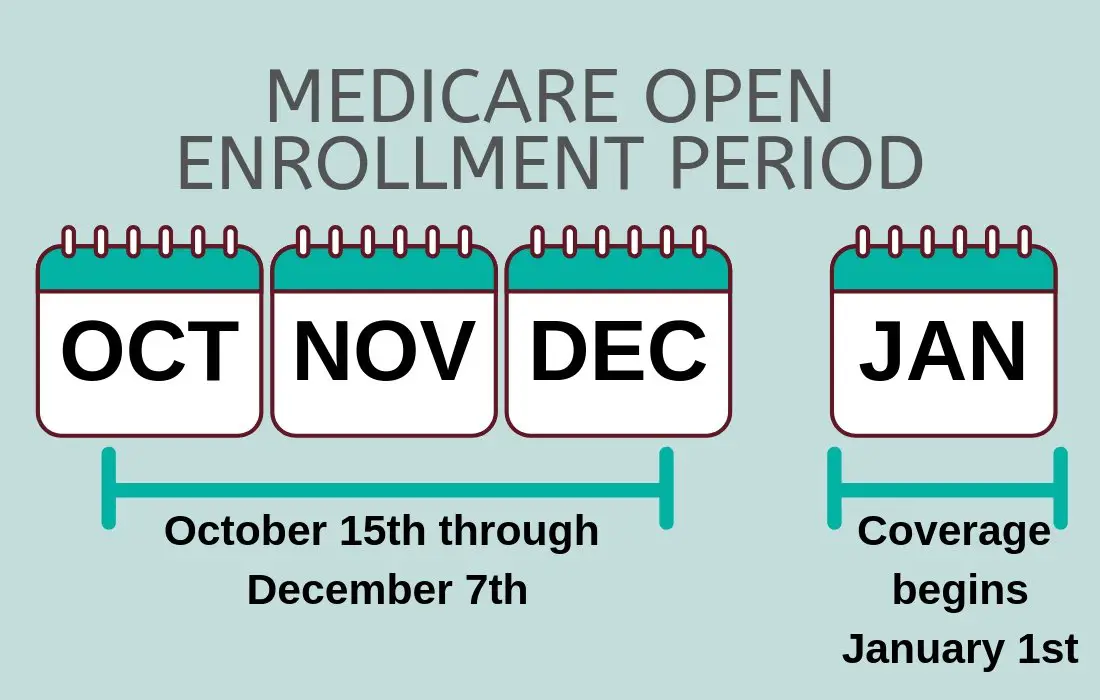

The annual Medicare Open Enrollment period began on October 15. For those currently enrolled in Medicare, this is the time to make changes to your plan. As financial advisors, we recommend you review your Medicare coverage now to see if it still fits your needs for the coming year. Any changes you make will be effective beginning January 1, 2022.

In addition to deciding whether to change from Original Medicare to a Medicare Advantage Plan, you can make changes to your Medigap policy and Part D Prescription Drug Plan. If you have Medicare but have never enrolled in a Medigap plan or Prescription Drug Plan, you can enroll at this time as well.

What Is The Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period is when Medicare Advantage plan members can change plans. It runs from January 1 to March 31.

The changes you can make during Medicare Advantage Open Enrollment are similar to those you can make during the Medicare Annual Enrollment Period. It basically gives you another opportunity to get the coverage you want and need.

You Do Not Check Your Annual Notice Of Change

Medicare Advantage plans and Part D plans are run by insurance companies. The federal government requires them to cover certain services. That said, they can change what other services they cover and who provides them.

Once a year, they will send out an Annual Notice of Change. This document outlines what changes are coming in the new year regarding costs and coverage.

Check to make sure that there are no changes in your plan that could affect your care, including:

- Will your doctors be in your network next year?

- Are any medications you take being taken off your formulary or being moved to a higher tier ?

- Will the cost of your deductibles, coinsurance, and copayments change, and how much more could you end up paying?

Recommended Reading: What Age Can You Start To Collect Medicare

Reasons People Leave Or Switch Part D Plans

- The new plan formulary moved your medications to a different tier

- The plan will drop one of your drugs completely

- Your monthly premium increased

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

You Do Not Look Into Medicare Advantage Supplemental Benefits

If you need certain services, especially dental, hearing, and vision coverage, you may want to consider a Medicare Advantage plan. Original Medicare does not cover them, but many people on Medicare need dentures, hearing aids, and eyeglasses.

The Centers for Medicare & Medicaid Services recently allowed Medicare Advantage plans to expand what types of benefits they could offer.

In 2019, they extended what they considered primarily healthcare-related benefits. These could include adult daycare services, medical alert devices, rideshare services for health appointments, and even carpet cleaning for people with asthma.

In 2020, they added services specifically for people who had chronic conditions. Not all of those benefits had to be primarily healthcare-related. They included possible coverage for services like acupuncture, food and produce, pest control for the home, and subsidies for utilities like electricity, gas, and water.

Read Also: Can I Get Medicare If I Have Cancer

How Do People Know If They Need To Change Plans

People in a Medicare health or prescription drug plan should always review the materials their plans send them, like the Evidence of Coverage and Annual Notice of Change . If their plans are changing, they should make sure their plans will still meet their needs for the following year. If theyre satisfied that their current plans will meet their needs for next year and its still being offered, they dont need to do anything.

Fall Medicare Open Enrollment Part D Prescription Drug Plans

If youre enrolled in Original Medicare , you can enroll in a stand-alone Medicare Part D Prescription Drug Plan during the Fall Medicare Open Enrollment period, which is the same time period described above . You need to live within the service area of the plan. You can make other coverage changes during the Fall Medicare Open Enrollment Period, such as:

- Switch from one Medicare Part D Prescription Drug plan to another.

- Drop your Medicare prescription drug coverage completely.

If you decide to drop your Medicare prescription drug coverage, be aware that if you go without this coverage for 63 days in a row or longer, you could face a Medicare Part D late-enrollment penalty if you decide to enroll again at a later date.

Recommended Reading: Will Medicare Pay For My Nebulizer

Medicare Part D Prescription Drug Coverage

2021 Part D premiums:

- The average premium for Medicare Part D coverage is about $38/month in 2021. There continue to be a wide range of Part D plan options available. Premiums for Part D plans start as low as about $7/month in 2021, down from a low of about $13/month in 2020. On the higher end, plans can have premiums of up to $100/month or more, so there is a great deal of variation in price and benefits across the available plans.

- High-income enrollees pay a higher Part D premium. The threshold for high-income began to be indexed as of 2020. The income threshold for 2021 is $88,000 for a single person and $176,000 for a couple. Its expected to increase to $91,000 and $182,000 as of 2022 .

Part D deductible:

- Maximum of $480 in 2022, up from $445 in 2021. .

Part D out-of-pocket costs after deductible:

- Not to exceed 25% of the cost of brand-name and generic costs.

- There is no longer a donut hole in terms of the maximum amount that enrollees can be charged when they fill prescriptions. But the donut hole still exists in terms of how insurers design their coverage , how total drug costs are counted, and who covers the bulk of the cost of the drugs .

- After a beneficiarys costs reach the catastrophic coverage threshold , additional out-of-pocket costs are capped at the greater of 5% of the cost of the drug or a copay of $3.95 for generics and $9.85 for brand-name drugs.

Learn more about Medicare Part D.

What Does Medicare Open Enrollment Mean

Medicare enrollment typically begins at age 65, or under the age of 65 if an individual qualifies because of certain permanent disabilities. Many eligible individuals are surprised to learn that they only have a limited amount of time each year to make major changes to their Medicare coverage.

This period of time is known as Medicares Annual Enrollment Period . It occurs between October 15 and December 7 each year. After the Annual Enrollment Period ends, most Medicare recipients will need to wait until the next period to make changes to a plan unless they participate in the Medicare Advantage Open Enrollment Period or qualify for a Special Enrollment Period due to certain life events.

What Can Be Changed During the Annual Enrollment Period?Each year, Medicare insurance recipients are given a chance to evaluate their coverage options. This is often important as medical needs change with time. If someone has Original Medicare, they can switch to a Medicare Advantage plan during this period, potentially easing the financial burden of healthcare costs. Likewise, AEP allows Medicare recipients to either opt into Part D coverage or make changes to existing Part D coverage. If a Medicare recipient did not sign up for Part D coverage initially and chooses to make the switch during open enrollment, a penalty may apply.

Related articles:

Read Also: Do You Have To Pay For Part B Medicare

Medicare Open Enrollment Starts Oct 15 Heres What To Know For 2022

Medicares fall enrollment period runs through Dec. 7 and is a time for people to review their coverage. But researchers say few take the opportunity and may wind up with unanticipated costs.

Medicares annual fall enrollment period, which runs Oct. 15 through Dec. 7, is a time for seniors to review their coverage and make changes for the coming year.

Although there arent any major updates to Medicare for 2022, the COVID-19 pandemic has been a reminder that it is critically important to have an insurance plan that meets your needs.

For many, the pandemic has brought on lifestyle changes, such as retiring or moving to be closer to family, since travel has been discouragedto limit the spread of the virus. Others may simply be more keenly aware of how much health care costs and concerned about being caught without the right plan, should they get sick.

Its so important people take their time to do their research, said Chris Orestis, president of Retirement Genius, a company that advises seniors on retirement and Medicare enrollment. They get the opportunity to make the adjustments when their needs have changed.

» READ MORE: Medicare open enrollment 2022 questions answered

Yet a majority of people with Medicare do not review their coverage during open enrollment, according to a new analysis of 2019 Medicare data by the Kaiser Family Foundation.

Medicare members may also want to consider how their plan covers services related to COVID-19:

What Changes Can You Make During Medicare Open Enrollment

During Medicare open enrollment, you can review your existing coverage and make changes to it. Specifically, you can switch from:

- Original Medicare to a Medicare Advantage plan.

- A Medicare Advantage plan to Original Medicare.

- One Medicare Advantage plan to another.

- One Medicare Part D drug plan to another.

You can also do the following during the Medicare open enrollment period in 2022 :

- Join a Part D drug plan.

- Drop your Part D coverage.

You May Like: Does Medicare Pay For Assistance At Home

What Is Medicare Open Enrollment

Medicare open enrollment also known as the annual election period or annual coordinated election period refers to the annual period during which Medicare plan enrollees can reevaluate their coverage whether its Original Medicare with supplemental drug coverage, or Medicare Advantage and make changes if they want to do so.

During Medicare open enrollment, a beneficiary can:

- switch Medicare Advantage plans, switch from Medicare Advantage back to Original Medicare or vice versa,

- switch from one Part D plan to another, or

- drop Medicare Part D coverage entirely.

But the annual open enrollment does not apply to Medigap plans, which are only guaranteed-issue in most states during a beneficiarys initial enrollment period, and during limited special enrollment periods.

Medicare open enrollment begins on October 15 and ends on December 7, with changes effective on January 1.

Starting in 2019, beneficiaries were able to utilize another open enrollment period that only applies to people who have coverage under Medicare Advantage plans. The Medicare Advantage open enrollment period runs from January 1 to March 31, and allows Medicare Advantage enrollees to either switch to Original Medicare or switch to a different Medicare Advantage plan.

Enrollees are only allowed to make one change during this three-month window they cant switch to a Medicare Advantage plan in February and then switch to a different one in March, for example.

What Is The Medicare Special Enrollment Period

If you meet the criteria for a Medicare special enrollment period , you’ll be able to change your Medicare Advantage, Original Medicare or Medicare Part D plans. Qualifying situations include moving, having other coverage options, becoming eligible for Medicaid and more.

Medicare.gov has very specific rules about special enrollment periods and what Medicare changes you can make during what qualifying event. Below are the guidelines for some of the most common special enrollment circumstances.

| Special enrollment qualification | What Medicare changes you can make |

|---|---|

| Moved to a new address with different plan options | Return to Original Medicare or change coverage with Medicare Advantage or Medicare Part D |

| Changed eligibility for employer, union or COBRA coverage | Join or drop Medicare Advantage or Medicare Part D |

| Youâre eligible to be dual enrolled in Medicare and Medicaid | Enroll, cancel or change Medicare Advantage plan or Medicare Part D |

| You have or recover from a severe or disabling condition | Enroll or cancel a Medicare Chronic Care Special Needs Plan |

| A 5-star Medicare plan becomes available in your area | You can join the 5-star Medicare Advantage or Medicare Part D plan |

| You qualify for Medicaid, State Pharmaceutical Assistance or Medicare Extra Help | You can enroll, cancel or change your Medicare Advantage or Medicare Part D enrollment several times during the year |

Also Check: How Much Can I Make On Medicare

What Changes Can Be Made During Medicare Annual Enrollment

âCameron: Say you just have the original Medicare during the open enrollment season. Do you have the option to switch to a Medicare Advantage plan or to get a Medicare Supplement plan during the open enrollment period?

âAri: The annual enrollment period, which is October 15 to December 7, is when you can leave original Medicare and choose a Medicare Advantage plan. The deadline does not apply to someone who wants a supplement.

Someone who wants a supplement can choose to try to get a supplement. I say try because it varies by state as to the eligibility and enrollment conditions. In 46 states, normally, if you’re on original Medicare and you’re outside of your window for guaranteed issue, there would be some type of health history questions about your health history that might apply. They’re not scary. There are only seven to 10 questions typically. But that said, you do need to answer them in order to obtain a supplement, if interested. And that annual enrollment period does not apply to a supplement.

The annual enrollment period does apply, however, to those who want a stand alone prescription drug plan. So Medicare Advantage, stand alone prescription drug planâ annual enrollment period applies. The annual enrollment period is October 15 to December 7.

Working With Insurance Agents

If the guide above still incites a wave of panic or you just dont want to wade through these waters alone, you can seek additional assistance from an insurance agent or advisor. But know that not all agents are the same.

Some agents, often referred to as independent or agnostic agents, have access to all available plans in your area, are licensed to sell all of those plans and receive the same commission no matter which plan you choose. It is their job to sell you health insurance coverage, and they do benefit from that sale, but because every sale carries equal weight for their bottom line, they are more likely to approach the plan selection process with your best interests in mind.

Other agents might only have relationships with specific carriers or receive higher sales commissions from those carriers when they sell certain plans. If you choose to work with one of these agents, be aware of these limitations and inherent biases.

To find an advisor or agent in your area who can show you all plans relevant to you and help you make your selection, search a phrase like independent Medicare advisors and carefully review the options that appear. You can also look for the phrase first-tier, downstream related or entity , says Rich. Such organizations operate under significant oversight, are regulated with audits and phone call recordings, and prioritize keeping your personal information private, he says.

Read Also: When Can You Apply For Part B Medicare

Medicare Supplement Insurance Coverage

Medicare Supplement Insurance, also known as Medigap, helps beneficiaries pay out-of-pocket expenses associated with Original Medicare, including your copays, deductibles, and coinsurance. If youâre struggling with out-of-pocket costs, consider a Medicare supplement plan.

To apply for a Medigap plan, you must already be enrolled in Original Medicare. Once you enroll in Medicare Part B, you will have a six-month period to enroll in Medigap plans. You can also enroll in a Medigap plan during the standard Medicare open enrollment. Itâs possible to cancel and enroll in a new Medigap plan at any time during the year, but insurers arenât required to accept you for a new plan outside of the Medigap enrollment period.

When Does Medicare Open Enrollment End

Medicare Open Enrollment ends December 7, 2021, so dont wait until the last minute to review your Medicare plan and make changes. A good resource to look at is the Medicare.gov website and in particular, this blog post from their website, Get Ready for Medicares Open Enrollment, which you can access here on the Medicare website.

Don’t Miss: When Can I Enroll For Medicare Part B

How To Choose A Medicare Advantage Plan

If you’re interested in a Medicare Advantage plan, rather than Original Medicare, you can choose from one of the following:

- Private Fee-for-Service plans

- Special Needs Plans

Less common types of Medicare Advantage plans include HMO Point of Service plans and Medicare Medical Savings Accounts plans. The main difference between all these plans is in whether you’re able to see out-of-network providers, whether a referral is required to see a specialist, and how much you’ll pay.

When comparing Medicare Advantage plans, you’ll want to consider what doctors are available, how much you’ll pay out of pocket, and what benefits are included. Medicare offers a plan finder tool that can help you search for and compare Part C plans.