What Is The Donut Hole

The donut hole refers to a gap in coverage, during which you may have to pay more for your prescriptions drugs. Some members may have supplemental coverage to help lower prescription drug costs. Heres a look at how the donut hole works:

Once you and your drug plan spend $4,020, you enter the donut hole or coverage gap.

While in the donut hole, you may pay 25% of the total cost of brand name drugs and up to 25% of the total cost of generic drugs until your total costs reach $6,350.

After you reach $6,350, your plan will contribute more toward your prescription drug costs.

* All dollar amounts reflect 2020 Medicare policies.

Several factors determine how much you will pay for your prescriptions.

Your payments may vary throughout the year, depending on how much you have already spent on prescription drugs. Your cost-sharing will depend upon the benefit phase you have reached in your coverage.

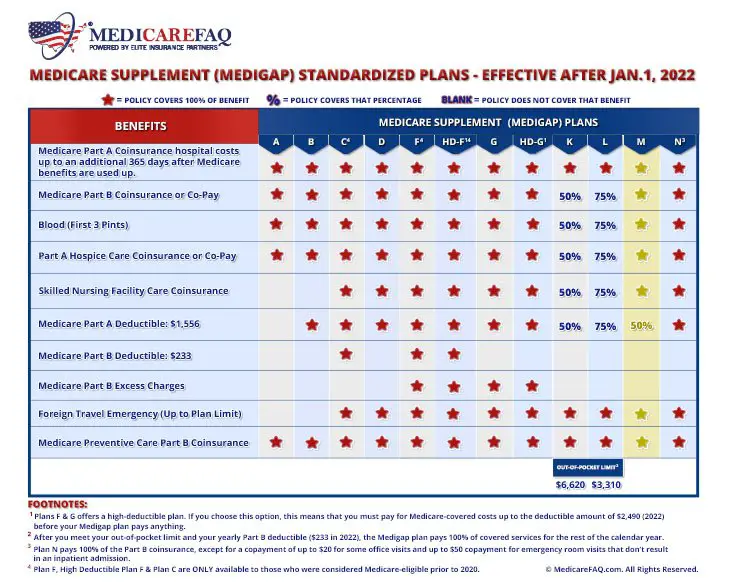

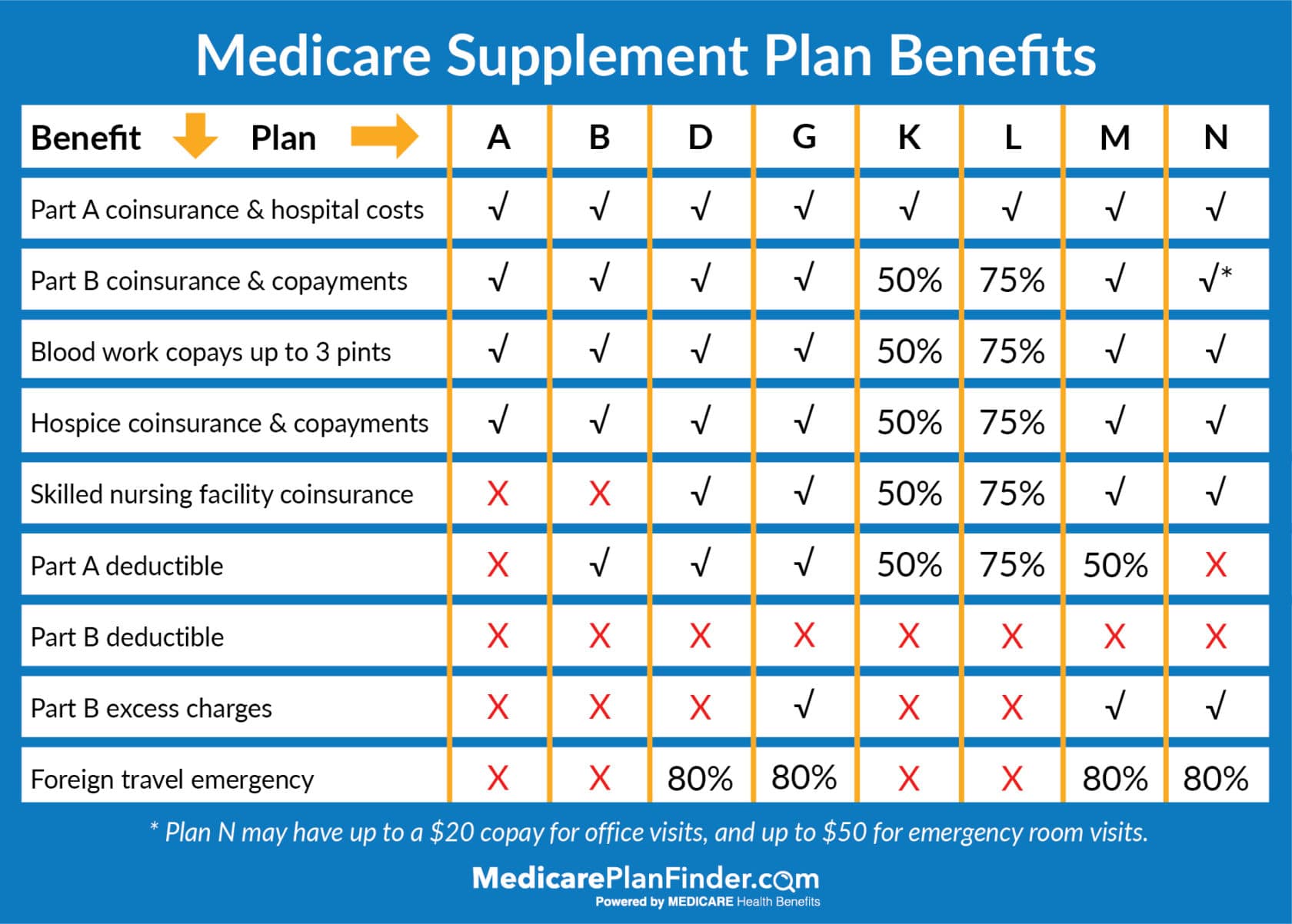

What Does Medicare Supplement Plan F Cover

Medicare Supplement Plan F is one of the most popular Medicare Supplement Insurance plans because it offers the most comprehensive coverage of the currently available Medicare Supplement insurance plans.

Medicare Supplement Plan F covers the most amount of benefits compared to the other Medicare Gap plans. Plan F covers the gap in coverage associated with Parts A and B. This plan enables someone to be able to visit a doctors office or hospital to receive approved treatment and walk out without paying anything, virtually eliminating all out of pocket costs.

Plan F also includes coverage for other Medicare-approved expenses not associated with Parts A or B. This includes foreign travel emergencies and skilled nursing facility coinsurance. Importantly, Plan F is one of only two plans that include coverage for Medicare Part B excess charges.

Medicare Supplement Plans For Cancer Treatment

Original Medicare coverage for cancer treatment does come with costs you need to pay, such as the coinsurance and deductibles mentioned above. If youre enrolled in Medicare Part A and Part B, you may be able to sign up for a Medicare Supplement plan to help pay for Original Medicares out-of-pocket costs associated with your cancer treatment. Different Medigap plans pay for different amounts of those costs, such as copayments, coinsurance, and deductibles.

You May Like: Does Medicare Cover Gastric Bypass Revision

What Is A Medigap Policy

A Medigap policy is health insurance sold by private insurance companies to fill the gaps in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan does not cover. If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay their share of covered health care costs.

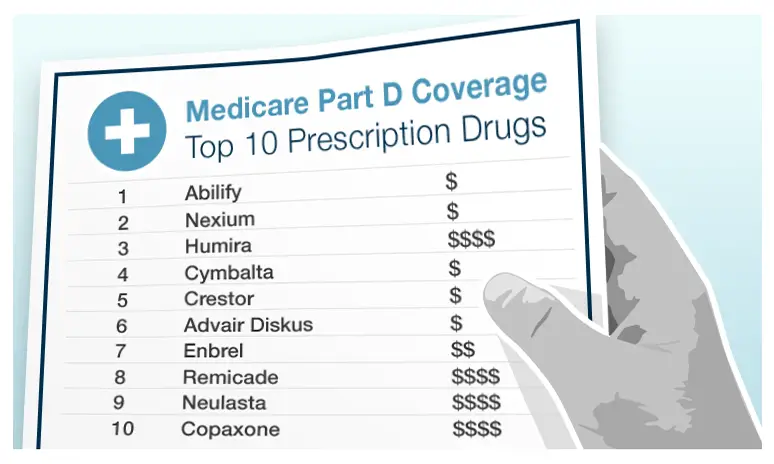

Does Medicare Cover Enbrel

Enbrel is a biologic DMARD that belongs to a class of drugs known as TNF inhibitors.

If your doctor prescribes Enbrel, youll inject yourself weekly. Because you take Enbrel at home, it falls under Part D. According to Enbrels website, the medications list price is $1,389 per week for a 50 mg dose.

Although Enbrel offers a copay card to help reduce costs. It claims that 76% end up costing less than $50 a month, while the other 24% cost $469 a month. The amount you pay depends on the specifics of your prescription plan. If you have a limited income, you may qualify for extra help with prescription costs.

Read Also: Does Medicare Advantage Plan Replace Part B

Learn More About Medicare Coverage Options

Medicare Advantage plans replace Medicare Part A and Part B and combine their benefits into one plan. Many Medicare Advantage plans also include prescription drug coverage.

Learn more about Medicare Advantage plans in your area and find a plan that fits your coverage needs and your budget.

Find Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

1 Cubanski, Juliette Damico, Anthony. Medicare Part D: A First Look at Prescription Drug Plans in 2020. . Kaiser Family Foundation. Retrieved from www.kff.org/medicare/issue-brief/medicare-part-d-a-first-look-at-prescription-drug-plans-in-2020.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Find A $0 Premium Medicare Advantage Plan Today

1 Badger, Cary. The Rise of Over-the-Counter Programs in Medicare Advantage Plans. . HealthScape. Retrieved from https://healthscape.com/insights/the-rise-of-over-the-counter-otc-benefits-in-medicare-advantage.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Don’t Miss: Does Medicare Cover Handicap Ramps

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period in the fall. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

What Are Part B Excess Charges

Medicare Part B excess charges happen when theres a difference between what Medicare will pay for medical services and what your doctor decides to charge for that same service.

Medicare sets approved payment amounts for covered medical services. Some doctors accept this rate for full payment, whereas others dont.

If your doctor doesnt accept the rate in the Medicare fee schedule as full payment, they are allowed under federal law to charge up to 15 percent more than the approved rate. The amount above the Medicare-approved rate is the excess charge.

With Medicare, you are responsible for paying any excess charges. Some people choose Medigap Plan G to assure that these fees are covered and avoid any unexpected costs after receiving medical care.

You May Like: What Do You Need To Sign Up For Medicare

When Your Coverage Starts

For existing Medicare enrollees, from October 15 to December 7 of each year, you can join, switch, or drop a plan.

For the current open enrollment, your coverage will begin on January 1, 2022.

There are separate enrollment periods each year for initial enrollment and Medicare Advantage enrollment.

To sign up, go on the Medicare.gov website.

If you are on Medicare now, here’s more information on the open enrollment period going on until Tuesday, December 7.

Plus, we outline the advantages and disadvantages of Medicare.

Medicare Costs To Know

Fighting cancer and living as a survivor can be a long road. Along the way, youll come across several different Medicare costs youll have to pay. Understanding these costs can help you build a budget and get the most out of your treatment plan. Here are the charges youll want to know:

- Deductible: The amount you need to pay before Medicare will pay its portion. There are separate deductibles for Part A, Part B and Part D.

- Premium: the monthly fee you pay for your policy. Medicare Parts A, B and D all have monthly premiums that vary based on your situation. Some insurance companies offer $0 Medicare Advantage plans.

- Copayment: is a flat-rate that has been agreed upon by the insurance company and healthcare provider for medical services. You typically pay the copay out of pocket to your doctor or provider.

- Coinsurance: The percentage you pay for medical services after youve met your deductible. Generally, coinsurance for Original Medicare is 20% of the approved costs.

Heres how these terms apply to Medicare and chemotherapy:

Recommended Reading: What Is The Difference Between Medicare Supplemental And Advantage Plans

Joining A Medicare Drug Plan May Affect Your Medicare Advantage Plan

If you join a Medicare Advantage Plan, youll usually get drug coverage through that plan. In certain types of plans that cant offer drug coverage or choose not to offer drug coverage , you can join a separate Medicare drug plan. If youre in a Health Maintenance Organization, HMO Point-of-Service plan, or Preferred Provider Organization, and you join a separate drug plan, youll be disenrolled from your MedicareAdvantage Plan and returned to Original Medicare.

You can only join a separate Medicare drug plan without losing your current health coverage when youre in a:

- Private Fee-for-Service Plan

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

Read Also: What Is Uhc Medicare Advantage

How Does Medicare Cover Cancer Treatment

How Medicare pays for cancer treatment depends on the type of treatment you need and where you get your cancer treatment.

According to the National Cancer Institute, your doctor may treat your cancer in one or more of the following ways:

You generally must meet your Part A and Part B deductibles before Medicare pays its share for cancer treatment, and in most cases, there is a 20% coinsurance amount for covered charges under Part B.

NEW TO MEDICARE?

D Appeals And Grievances

Coverage Determinations and Exceptions

All Part D plans must have an appeal process through which members can challenge a denial of drug coverage. The Part D appeals process is based on and similar to the Part C appeals process.

Denials of drug coverage by a PDP or MA-PD are called coverage determinations. For example, a coverage determination may be issued by the plan if the drug is not considered medically necessary or if the drug was obtained from a non-network pharmacy. It is necessary to have a coverage determination in order to initiate an appeal. A doctors supporting statement is not required for this type of appeal, but it may be helpful to submit one. If the request for coverage is denied, the member may proceed to further levels of appeal, including redetermination by the plan, reconsideration by an Independent Review Entity , Administrative Law Judge review, the Medicare Appeals Council , or federal district court.

One type of coverage determination is called an exception request. An exception request is a coverage determination that requires a medical statement of support in order to proceed to appeal. There are two types of exceptions that may be requested:

Formulary Exceptions This type of exception is requested because the member:

- needs a drug that is not on the plans formulary,

- requests to have a utilization management requirement waived for a formulary drug).

What to do When a Drug is Denied at the Pharmacy

The Medical Statement

Grievances

You May Like: What Age Does Medicare Eligibility Start

Medigap Plans Can Help Pay Original Medicare Costs For Covered Medicine

An additional way to save money on medication through your Medicare coverage is with a Medicare supplement plan.

These plans are used in combination with Original Medicare to provide coverage for out-of-pocket costs such as deductibles, copayments and coinsurance.

For example, if Medicare Part B covered your medicine used for cancer treatments, you would typically have to pay out of pocket for your Part B coinsurance costs. All 10 of the standardized Medigap plans available in most states help pay for these costs.

A licensed agent can help you decide on a Medicare option that works for you. Call today to speak with a licensed agent and compare the Medigap plans that are available where you live.

How Can I Maximize My Prescription Drug Benefits

If you want to get the most out of your prescription drug benefits, check with your plan to see what extras it offers.

- Use in-network pharmacies. Find out which pharmacies are in your network and if using a preferred pharmacy can save you money.

- Order 90-day supplies. Some plans will offer incentives if you order a 90-day supply of medicine. Even if the price is the same, itll mean fewer trips to the pharmacy and less chance youll miss a refill.

- Opt for home delivery. Your plan may offer a home delivery option for prescription drugs. Check to see if theres an incentive for ordering your medication through the mail. For example, some Medicare Advantage plans through Aetna offer lower costs on mail-order prescriptions as a way to keep members compliant with their medication.

Research your plan options thoroughly based on your prescription drug needs, costs and convenience. You dont want to be saddled with unnecessary drug expenses, so finding the right plan for you at the right price means one less thing youll have to worry about.

Also Check: Do You Have To Resign Up For Medicare Every Year

Introduction To Medicare Part D

This section constitutes an introduction to Part D. For more detailed information on any of the topics in this section, please click on the links within the topics. There, you will also find relevant legislative, statutory and CFR citation.

Prior to 2006, Medicare paid for some drugs administered during a hospital admission , or a doctors office . Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. This Act is generally known as the MMA.

The Part D drug benefit helps Medicare beneficiaries to pay for outpatient prescription drugs purchased at retail, mail order, home infusion, and long-term care pharmacies.

Unlike Parts A and B, which are administered by Medicare itself, Part D is privatized. That is, Medicare contracts with private companies that are authorized to sell Part D insurance coverage. These companies are both regulated and subsidized by Medicare, pursuant to one-year, annually renewable contracts. In order to have Part D coverage, beneficiaries must purchase a policy offered by one of these companies.

The costs associated with Medicare Part D include a monthly premium, an annual deductible , co-payments and co-insurance for specific drugs, a gap in coverage called the Donut Hole, and catastrophic coverage once a threshold amount has been met.

What Are Medicareadvantage Plans

MedicareAdvantage plans are private managed care plans that provide the standard Medicare benefits plus additional supplemental benefits for a monthly fee. These plans may include prescription drug coverage, even after January 1, 2006, if the benefits are similar to the new Medicare benefit. MedicareAdvantage participants may even receive a subsidy for their prescription drug benefits in most cases.

Read Also: How Much Is Premium For Medicare

Can I Be Dropped From My Medigap Policy

If you bought your policy after 1990, the policy is guaranteed renewable. This means your insurance company can drop you only if you stop paying your premium, you are not truthful about something under the policy or the insurance company goes bankrupt. Insurance companies in some states may be able to drop you if you bought your policy before 1990. If this happens, you have the right to buy another Medigap policy.

How Much Do Prescription Drugs Cost With Original Medicare

Original Medicare doesn’t typically cover retail prescription drugs. If Part A or Part B does cover your medicine, you should expect the following costs:

-

For prescription drugs received in a doctors office or pharmacy, Medicare Part B enrollees will typically be responsible for 20% of the Medicare-approved amount for the drug . Drugs that are received by a hospital outpatient require a copayment that can vary in cost.

-

Medicare Part A covers certain prescription drugs related to pain relief and symptom control during hospice care. These drugs require a copayment of no more than $5.

A Medicare Supplement Insurance plan can help cover these out-of-pocket Medicare costs.

Also Check: How Do I Apply For Medicare In Ohio

Medicare Part D Plans And Some Medicare Advantage Plans Cover Medicine

Medicare Part C and Part D also offer drug coverage in various forms.

-

Medicare Part D consists of an optional collection of prescription drug plans that can be used in combination with Original Medicare.

Each drug plan will vary in regards to the drugs that are covered, the amount at which they are covered and the overall cost of the plan. Medicare Part D plans may come with premiums, deductibles, copayments and coinsurance.As mentioned above, you can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

-

Medicare Part C, also known as Medicare Advantage, is a collection of plans that offer the same coverage as Original Medicare while also offering additional benefits that vary by plan.

Some of the added Medicare Advantage plan benefits may include Medicare Part D coverage for medicine. Medicare Advantage plans may also come with their own out-of-pocket costs that can vary from insurer to insurer.