Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

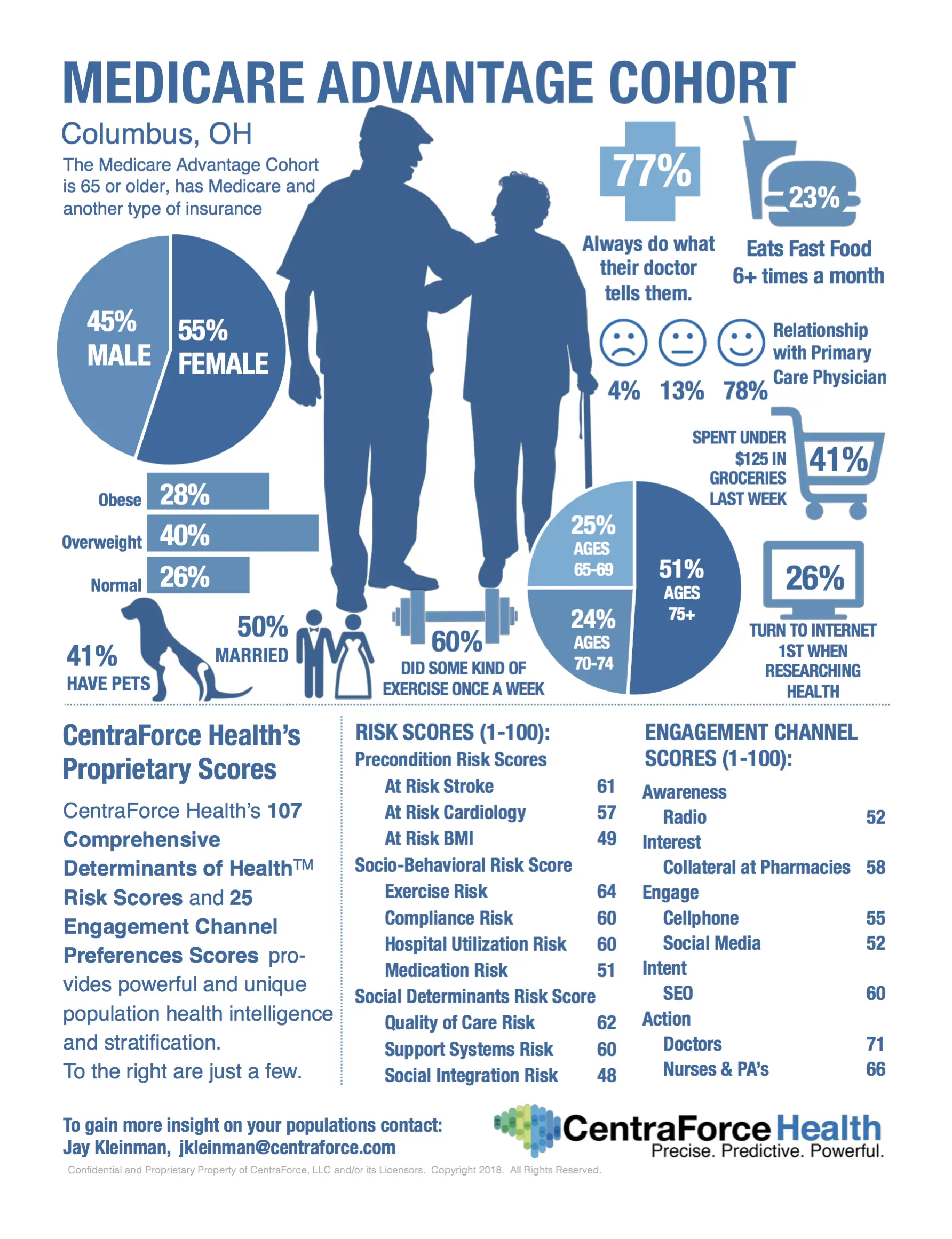

What Is A Medicare Advantage Plan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

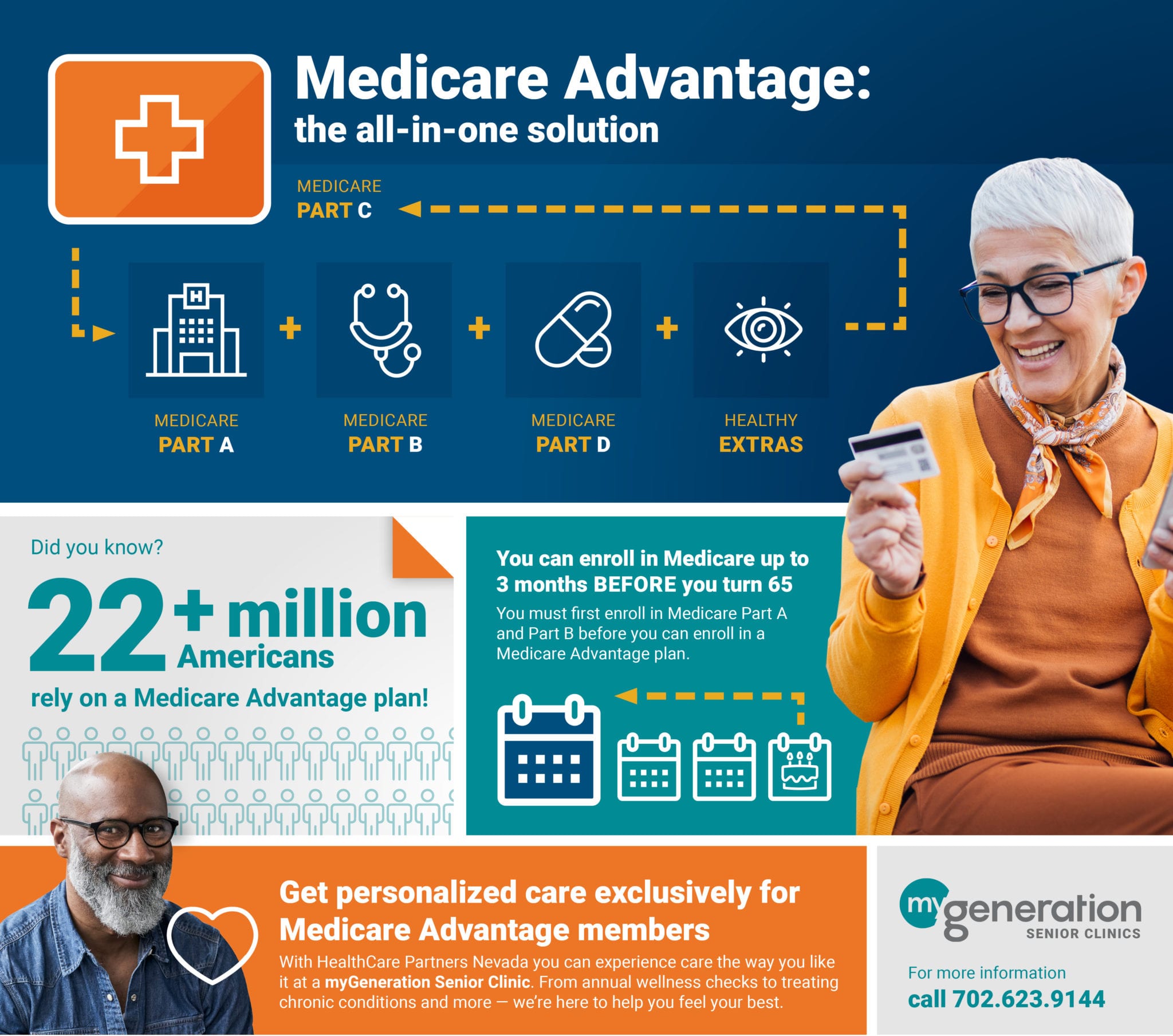

Medicare Advantage is a bundled alternative to Original Medicare. Private insurers that offer Medicare Advantage plans contract with the federal government to provide health insurance benefits to people who qualify for Medicare.

In 2021, about four in 10 people eligible for Medicare are in Medicare Advantage plans.

Other Medicare Health Plans

Some types of Medicare health plans that provide health care coverage aren’t Medicare Advantage Plans but are still part of Medicare. Some of these plans provide

coverage, while most others provide only Part B coverage. Some also provide

These plans have some of the same rules as Medicare Advantage Plans. However, each type of plan has special rules and exceptions, so contact any plans you’re interested in to get more details.

Don’t Miss: Does Medicare Pay For In Home Hospice Care

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

What Does Medicare Part A Cover

Medicare Part A covers inpatient care in a hospital or skilled nursing facility, although not custodial or long-term care. Part A also helps pay for hospice care and some home health care. Medicare Part A has a deductible and coinsurance, which means patients pay a portion of the bill. There’s no coinsurance for the first 60 days of inpatient hospital care, for example, but patients typically pay $389 per day in 2022 for the 61st through 90th day of hospitalization, and more after that.

Recommended Reading: Does Part B Medicare Cover Dental

How To Enroll In A Medicare Advantage Plan

Once youve done your research and found a Medicare Advantage plan that fits your needs, there are various ways to enroll:

-

Use Medicares Plan Finder to find the plan in your area. Click on Enroll.

-

Go to the plans website to see if you can enroll online. Contact the plan to get a paper enrollment form. Fill it out and return it to the plan provider.

You will need your Medicare number and the date your Medicare Part A and/or Part B coverage started. You must be enrolled in Medicare Parts A and B before you can buy a Medicare Advantage plan.

Keep in mind that you can only enroll in a Medicare Advantage plan during your Initial Enrollment Period or during the Open Enrollment Period from Oct. 15 to Dec. 7. Once youre enrolled in a Medicare Advantage plan, you can switch plans during Medicare Advantage Open Enrollment from Jan. 1 to March 31 each year.

Medicare Costs Vs Private Insurance Costs

How do Medicare costs compare to private insurance? Medicare Part A is usually free. Part B costs $148.50 per month for most enrollees in 2021. You can delay purchasing Part B if your private insurance is less expensive. You can even bundle this with a Part D prescription drug plan and a Medicare Supplement policy.

What you need to consider is not only the comparison of monthly premiums, but potential out-of-pocket costs. This is where supplemental policies shine. They dramatically limit out-of-pocket expenses depending on what plan you choose

How does Medicare Compare with My Employer-Sponsored Plan?

If you only have Original Medicare, you will find many gaps between the plan and the employer plan you had. But if you bundle that with a Part D prescription drug plan and a Medicare Supplement policy , your coverage will be similar. Often there will be fewer out-of-pocket expenses depending on the type of supplement policy you purchase.

How Does Private Insurance and Medicare Work together?

Are you wondering how private insurance and Medicare work together? If you have private insurance along with Medicare, the two insurance carriers follow a coordination of benefits. This process helps them decide which insurer will pay first.

If the employer plan has 20 or more employees, the group plan will usually pay first. If the employer plan has fewer than 20 employees, Medicare will usually pay first.

Choosing Private Insurance

Medicare Supplement Plans

Plan A

Plan B

Plan C

Plan D

Recommended Reading: Does Medicare Pay For Vitamins

What Does Plan B Cost

The cost of Medigap policies can vary significantly depending on which company is selling the policy. Coverage in some states is more expensive than in others. Even within a state, Medigap premiums can vary depending on the region.

Some companies offer discounts for women, non-smokers or married couples for those who pay yearly discounts, for using electronic funds transfer or discounts for multiple policies.

How Common Are Medicare Ppo Plans

There were 618 Medicare PPO plans available in 2018, which represented about 28 percent of all available Medicare Advantage plans.1 As of 2018, every state except Alaska, Delaware, Minnesota, New Hampshire, North Dakota and Wyoming offered at least one local or regional Medicare PPO plan.

In 2017, more than 6.2 million people were enrolled in a local or regional Medicare PPO plan, which represented more than a third of all Medicare Advantage plan holders.2

Also Check: Does Medicare Cover Dementia Care Facilities

How Do You Sign Up For Medicare

Most people are automatically enrolled in Part A and Part B if they:

- Get retirement benefits from Social Security or the Railroad Retirement Board. You are enrolled the first day of the month you turn 65.

- Are younger than 65 and have been getting disability benefits from Social Security or the Railroad Retirement Board for 24 months.

If you qualify for automatic enrollment, you will be sent your Medicare card 3 months before you turn 65 or your 25th month of disability.

You need to apply to get Part A and Part B benefits if you aren’t getting Social Security or railroad benefits.

You also need to sign up if you have end-stage renal disease. Medicare covers dialysis treatment for people who have permanent kidney failure.

You can get more information and sign up for Medicare by calling the Social Security office at 1-800-772-1213 or by applying online at www.socialsecurity.gov/medicareonly.

Penalty for late enrollment

If you don’t sign up for Parts A and B when you are first eligibleâby the first day of the month you turn 65âyou may pay a higher premium than if you had signed up then. A penalty also may apply for late enrollment in Part D, depending on how long you went without drug coverage.

What Is Home Health Care

In general, home health care is any health care or medical service that takes place in someoneâs home. It can often be cheaper than hospital treatment. Medicare home care benefits people who.

- Donât live near a hospital or health center

- Are recovering from surgery, an injury, a stroke, or another health issue

- Have trouble walking and moving

- Donât have family or other caregivers available 100% of the time

Don’t Miss: How Do I Get Dental And Vision Coverage With Medicare

Medicare Costs And Fees

There are costs and fees associated with Medicare. These include premiums, deductibles and coinsurance. You may also pay penalties for waiting to enroll in Medicare Part B.

Most people dont have to pay a premium for Medicare Part A because they paid for it through years of payroll taxes while they worked.

Definitions to know include:

- Your monthly payment in exchange for coverage.

- Deductible

- The amount you have to pay for medical care or prescriptions before Medicare Part A, Part B, Part D or your Medicare Advantage plan starts to pay.

- Coinsurance

- A cost you may be required to pay for your share of medical services after paying any deductibles. Its usually measured as a percentage of the bill.

- Lifetime Reserve Day

- Additional days Medicare pays for when you are in a hospital for more than 90 days. You have 60 of these for your entire lifetime. Medicare pays all covered costs, except coinsurance, for each of these days you use.

The chart below shows how much you would have to pay while on Medicare.

Out-of-Pocket Medicare Costs in 2022

You Are Not Automatically Enrolled In Medicare

Many people think you automatically get Medicare when you turn 65, but thats not true. To get Medicare coverage, you must enroll through the Social Security Administration. You can enroll on the Social Security website, by calling Social Security at , or by visiting your local Social Security office in person.

Also Check: Where Can I Go To Sign Up For Medicare

How Does Medicare Work

With Medicare, you have options in how you get your coverage. Once you enroll, youll need to decide how youll get your Medicare coverage. There are 2 main ways:

- Original Medicare

-

Original Medicare includes Medicare Part A and Medicare Part B . You pay for services as you get them. When you get services, youll pay a

deductible

at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan .

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn’t cover, like emergency medical care when you travel outside the U.S.

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Read Also: What’s The Medicare Deductible

Know The Timeline And Important Deadlines

The annual open enrollment period from October 15 to December 7 is the one time that most people can make changes to their Medicare coverage. But you dont need to wait for October to roll around before you start investigating plan options. “Get started early, says Murdoch. It’s always better to have enough time to do the research you need.”

During open enrollment, you can:

-

Join a new Medicare Advantage plan

-

Switch from original Medicare to a Medicare Advantage plan

-

Switch from a Medicare Advantage plan to original Medicare

-

Switch Part D plans

You can make as many changes as you want. The plans you end up with will take effect January 1. If you’re newly eligible for Medicare, keep in mind that your initial enrollment period starts 3 months before the month you turn 65 and lasts 3 months afterward. It’s best to start your health plan search well before your 65th birthday so you can enroll promptly and start the benefits as soon as possible. That will help you avoid a gap in coverage.

Also, if youre buying Medicare supplement insurance for the first time, be sure to do it within your first 6 months of eligibility. During that period, you can buy Medigap without having to go through medical underwriting.

Medicare Has Four Parts:

- Part A Medicare Part A generally includes hospital insurance that pays for inpatient hospital stays, care in a skilled nursing facility, hospice care, and home healthcare. Most people dont have to pay a monthly Part A premium because they or their spouse paid Medicare taxes while they were working.

- Part B With Medicare Part B, you will have coverage for medically-necessary services, including doctors services, outpatient care, clinical laboratory services, home healthcare, outpatient hospital services, blood services, and some other medical services that arent covered by Medicare Part A. Medicare Part B is optional and the Medicare beneficiary will generally pay a premium for this.

- Part C Medicare Advantage plans are offered by Medicare-approved private insurance companies and are an alternative to Original Medicare since they include all benefits and services covered under Part A and Part B. If you join a Medicare Advantage Plan, youll still have Medicare but youll get your Medicare Part A and Medicare Part B coverage from the Medicare Advantage Plan, not Original Medicare. Medicare pays a fixed amount for your coverage each month to the companies offering Medicare Advantage Plans. .

- Part D Medicare drug plans help you pay for medically necessary brand-name and generic prescription drugs at participating pharmacies in your area. The plans are administered by Medicare-approved private insurance companies.

| Submit your review |

Also Check: When Can You Enroll In Medicare Part D

Does Private Medicare Have Group Numbers

Original Medicare is not group coverage and therefore has no corresponding group number. But private Medicare plans may have a group number associated with the plan.

Private Medicare insurance includes:

- Medicare Part C . These plans provide all the same benefits as Medicare Part A and Part B while also typically offering some additional coverage for things not found in Original Medicare like dental, vision, prescription drugs and more.

- Medicare Part D . Medicare Part D provides coverage for prescription medications, which is a benefit not covered by Original Medicare.

- Medicare Supplement Insurance . Medicare Supplement Insurance works alongside your Original Medicare coverage by picking up the cost of certain deductibles, copayments, coinsurance and other out-of-pocket costs associated with Medicare Part A and Part B.

Members of these plans may see a group number on their card that corresponds with their coverage. Instead of being grouped by company as you might in an employer-sponsored plan, beneficiaries of private Medicare plans may be grouped by area and plan type.

What Is The Best Medicare Replacement Plan

The best Advantage plan for you depends on your needs. Indeed, it also depends on if you would benefit from enrolling in an Advantage plan at all. When making a decision, consider how much the downsides to Medicare Advantage plans would affect you.

Some people find the networks restrictive, and they pay more than they save in copays outside their network. On the other hand, others who dont need to visit many doctors enjoy having one plan for all their needs and spending less than they would for a Medigap plan.

If youre considering enrolling in an Advantage plan, be sure to go with a top-rated carrier. Also, ensure that youre familiar with how the plan youve chosen works.

Also Check: When Do Medicare Premiums Start

How Much Does Medicare Cost

Original Medicare

Original Medicare is divided into Part A and Part B .

- Part A helps pay for inpatient hospital care, some skilled nursing care, home health care and hospice care.

- Part B helps pay for doctor services, outpatient hospital care, durable medical equipment, home health care not covered by Part A, and other services. Medicare was never intended to pay 100% of medical bills. Its purpose is to help pay a portion of medical expenses. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, and services not covered by Medicare. The amounts of deductibles and copayments change at the beginning of each year.

Part A – Monthly Premium

If you are eligible, Part A is free because you or your spouse paid Medicare taxes while you were working. You earn Social Security “credits” as you work and pay taxes. For each year that you work, you earn 4 credits.

| $471 | $499 |

You are 65 or older, and you receive or are eligible to receive full benefits fr om Social Security or the Railroad Retirement Board

You are under 65, and you have received Social Security disability benefits for 24 months You are under 65, and you have received Railroad Retirement disability benefits and you meet Social Security disability requirements You or your spouse had Medicare-covered government employment You are under 65 and have End-Stage Renal Disease