How Much Does Medicare Cost At Age 65

The United States national health insurance program known as Medicare has been providing people with health care insurance coverage since 1966. Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

The U.S. government has set the age of eligibility for Original Medicare Parts A and B at 65. And, while most people enroll at this age, others continue working and choose to stay on their employers insurance plan until the time they retire.

If your 65th birthday is coming up and you are planning to enroll for your Medicare benefits, you may be wondering what your costs will be. Here is a look at what you pay for Medicare insurance at the age of 65.

What Medicare costs do you have at age 65?The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

Part A

If you are not receiving Social Security benefits three months before your 65th birthday, you must sign up for Part A during your initial enrollment period which lasts for a period of seven months based on your 65th birth month.

There is no monthly premium for Part A if you meet the following requirements for premium-free Part A:

You are currently receiving retirement benefits from either the SSA or the RRB.

You have not applied for SS or RRB benefits yet, but you are eligible for them.

Days 1 60: $0 coinsurance per benefit period

Part B

Total 2022 Monthly Medicare Costs

When we total up all of your monthly Medicare costs, hereâs what you can expect.

If you decide to use Original Medicare with a Medicare Supplement and a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B â

- Get a quoteâ¯for your Medicare Supplement

- An average of $30 for your drug plan

If you decide to use a Medicare Advantage plan that includes a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B

- A very low monthly premium for the MA plan

If you decide to get the Lasso Healthcare MSA and a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B

- $0 premium for the MSA plan

- An average of $30 for your drug plan

For extra help, use the interactive Medicare Cost Worksheet to determine how much you will pay each month for Medicare.

Related Reading

How To Apply For Medicare Part B

If you are already receiving Social Security benefits when you turn 65, you will automatically be signed up for Medicare Part A and Medicare Part B by the Social Security program. Your Part B premium will be deducted from your retirement benefit each month.

If you are not yet collecting Social Security at age 65, you can apply for Medicare coverage online at the Social Security website. You will be billed for your Medicare Part B premium quarterly. You can pay for this with a credit card, debit card or a bank transfer.

To avoid any potential missed payments, you might want to consider enrolling in Medicare Easy Pay, which will automatically deduct your premiums from a bank checking or savings accounts.

If you are still working at age 65 and continue to have coverage through your workplace plan, you may want to delay starting your Medicare Part B coverage. Joanne Giardini-Russell, whose insurance firm specializes in helping people navigate Medicare choices, notes that even if you automatically signed up at 65 because you were already receiving Social Security benefits, you could then opt out, if that made sense.

I often see people who just accept enrollment and start paying the premium, even though they dont need to just yet, says Giardini-Russell.

Before making that choice, be sure to consult a Medicare insurance pro to make sure you are in fact eligible to delay, or you could be slapped with a permanent penalty premium when you do eventually sign up for Part B.

You May Like: Is It Mandatory To Take Medicare At 65

About Humana Part D Plans In 2022

Humana Part D Plans are designed to help cover and reduce the cost of your prescriptions . There are two ways to obtain Humana Part D benefits:

A Humana Part D Plan can also be called a Humana Rx Plan or Humana Drug Plan. Technically, all are correct, but if you ask Medicare, its Medicare Part D.

Every Humana Drug Plan has a formulary, which provides a list of covered drugs and the tier of the drug. A tier is set by the company and can vary from plan to plan and company to company. Simply put, the tier of the drug impacts the cost you pay. The higher the tier, the more you pay.

Humana Part D plans allow you to fill prescriptions at your local pharmacy or have them delivered in the mail, your choice!

You May Like: Does Medicare Part A Or B Cover Prescriptions

Medicare Part D Prescription Drug Plans

Like Part C plans, Part D plans are also offered by private insurance companies. Part D plans offer prescription drug coverage, and you can purchase them if you have Original Medicare or a Medicare Advantage plan that doesnt cover prescription drugs.

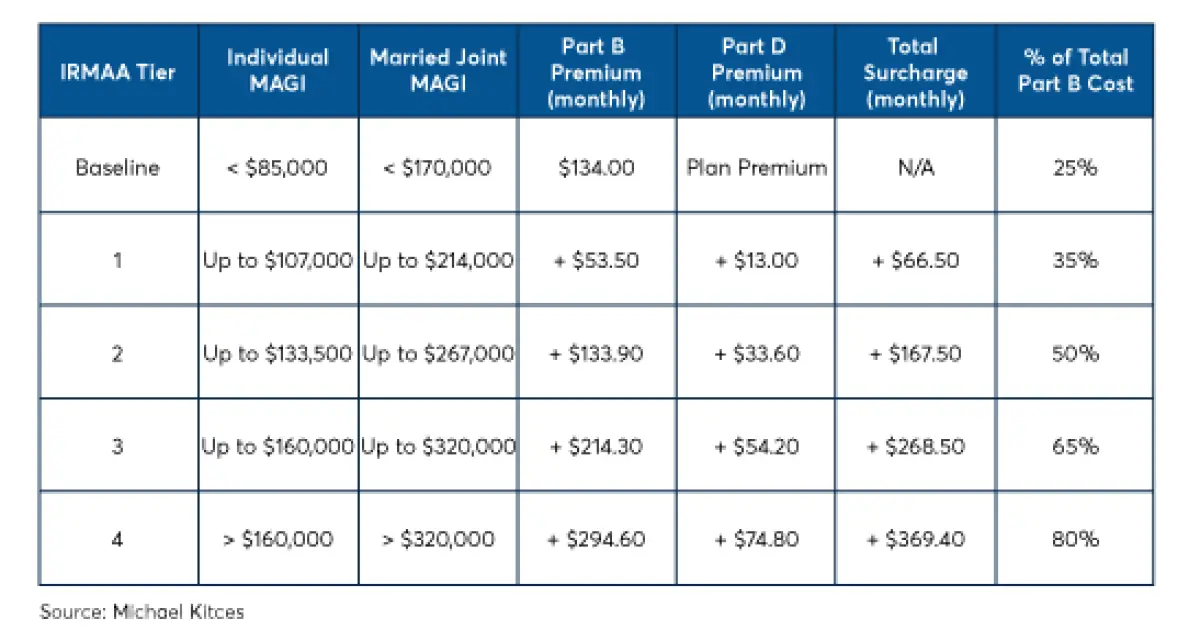

Like Part C, Part D premiums will vary, and you will have to get a quote to check the price. However, Part D plans also have something known as the Income-Related Monthly Adjustment Amount, or IRMAA. This is an amount that you will pay to the federal government each month in addition to your monthly premium, depending on your income.

See the chart above to see what surcharge you owe for Part D if you’re a high-earner.

Also Check: Does Medicare Cover Dental Bridges

What Is The 2022 Medicare Part B Deductible

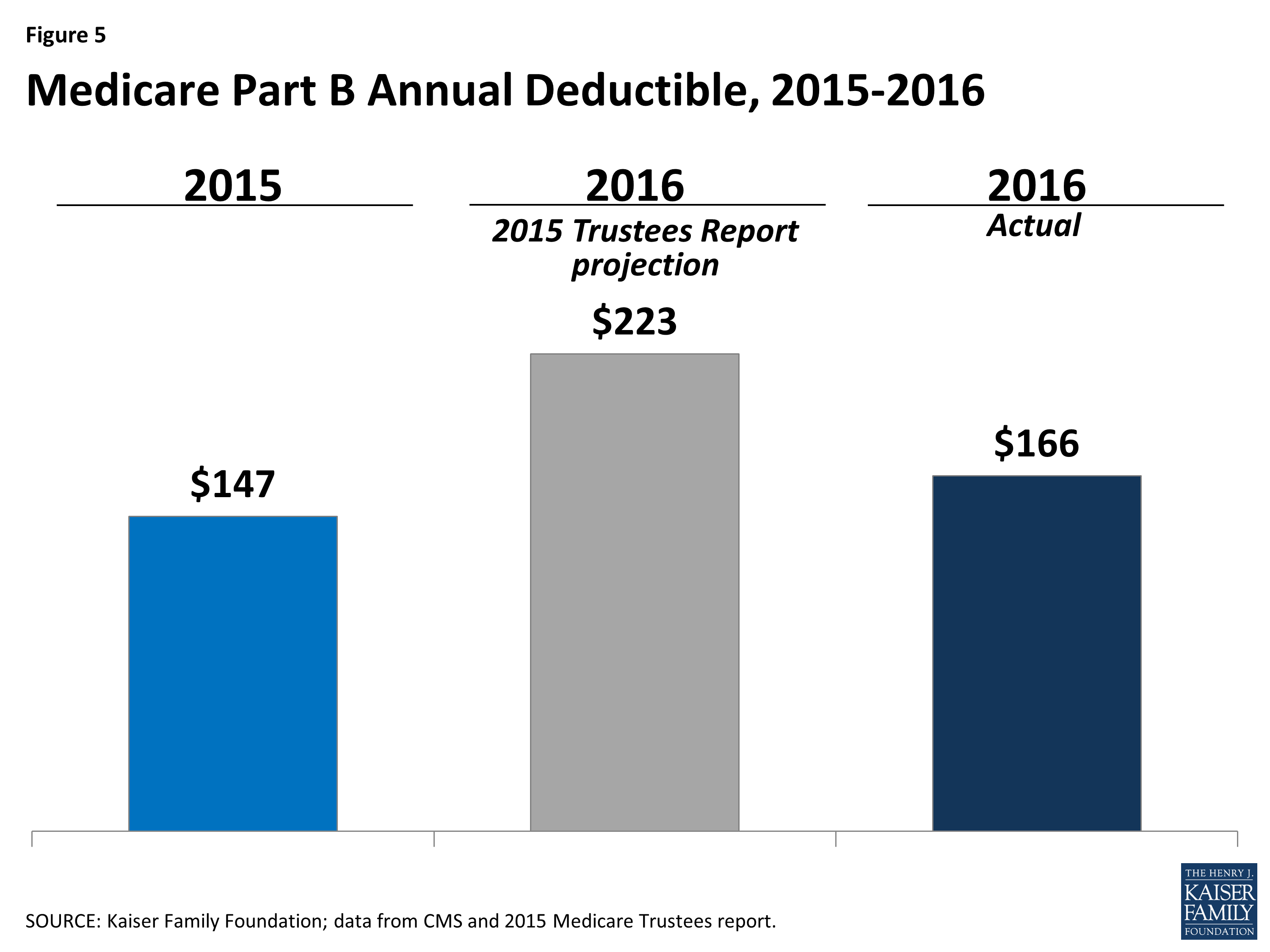

The rate for the 2022 Part B deductible is $233 per year . This is an increase of $30 per year from the 2021 Part B deductible

Premiums for Medicare Part C and Medicare Part D are on an opposite trajectory. While Medicare Part A and Part B premiums have historically gone up nearly every year, premiums for private Medicare plans have been dropping in recent years. In 2022, the average Medicare Advantage premium is $62.66 per month, though many Medicare Advantage plans feature $0 monthly premiums.

Standalone Part D plans have an average monthly premium of $47.59 per month in 2022.

B Deductible Also Increased For 2021

Medicare B also has a deductible, which increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20% of the Medicare-approved cost for Part B services. But supplemental coverage often covers these coinsurance charges.

For people who became eligible for Medicare before the start of 2020, there are Medigap plans available that cover the Part B deductible, in addition to coinsurance charges. But those plans are no longer available for Medicare beneficiaries who became eligible for Medicare after the end of 2019.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

You May Like: Does Medicare Cover Skin Removal

Also Check: How To Get Medicare Premiums Reduced

What Is The Average Cost Of Medicare Supplement Insurance

The average premium paid for a Medicare Supplement Insurance plan in 2019 was $125.93 per month.3

Its important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medicare Supplement Insurance plans help pay for some of the out-of-pocket expenses youll face when you use Medicare Part A and Part B benefits. Medigap plans are sold by private insurance companies.

These costs can include certain Medicare deductibles, coinsurance, copayments and other charges.

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover.

Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

| 80% | 80% |

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

Don’t Miss: Does Medicare Cover Breast Prosthesis

Turning Age 65 And Medicare Enrollment With Gic Health Coverage

When to enroll in Medicare Part A and Part B if you have GIC health coverage

This depends on your employment status with the state or a participating GIC municipality:

If you do not enroll in, cancel, or do not pay Medicare Part B within the required time, or cancel Part B and re-enroll at a later date, you will be ineligible for health coverage through the GIC. Also, you may be subject to pay federal government penalties.

Also Check: How Do Zero Premium Medicare Plans Work

B Premiums And Social Security

You cannot be expected to pay more for Medicare if there is not also a proportionate rise in Social Security benefits. The holds harmless provision of the Social Security Act protects recipients from paying higher Medicare Part B premiums if those premiums will cause their Social Security benefits to be lower than they were the year before.

Simply put, increases in Part B premiums cannot exceed the annual cost-of-living adjustment for Social Security.

In those cases, the Medicare Part B premium will be decreased to maintain the same Social Security benefit amount. However, keep in mind that the holds harmless provision does not apply to Medicare Part D. If the Medicare Part D Income-Related Monthly Adjustment Amount increases, a beneficiary may still see a decrease in their overall Social Security benefits.

Not everyone is eligible for the holds harmless provision. Only people in the lowest income category who have already been on Medicare Part B and have had their premiums directly deducted from their Social Security checks for at least two months in the past year are considered. Beneficiaries new to Medicare and people on Medicaid will be subjected to the current premium rate.

The Social Security cost-of-living adjustment for 2022 is 5.9%. This is estimated to be an additional $92 per month for the average recipient. This amount would be able to cover the rise in Medicare premiums in the new year.

For those who are dual eligible, Medicaid will pay their Medicare premiums.

You May Like: When Do I Receive Medicare

Saving Money On Medicare

Despite some of the costs of Medicare, there are ways to save money and maximize your coverage.

46890-HM-0121

Eligibility For Medicare Part B

In general, Medicare is available to U.S. citizens and permanent legal residents who:

- Are age 65 or older

- Are under age 65 and have a disability

- Have end-stage renal disease

- Have amyotrophic lateral sclerosis, also called Lou Gehrig’s disease.

When you are first eligible for Medicare, you have a seven-month Initial Enrollment Period to sign up for Part A and/or Part B. If you’re eligible when you turn 65, you can sign up during the seven-month period that:

- Starts three months before the month you turn 65

- Includes the month you turn 65

- Ends three months after the month you turn 65

If you don’t sign up for Part B when you are first eligible, you could be stuck paying a late enrollment penalty of 10% for each 12-month period when you could have had Part B but didn’t enroll.

However, you may choose to delay enrolling in Part B if you already have health coverage. Check Medicare’s website to find out more.

You May Like: When Can I Apply For Medicare In California

How Much Does Medicare Part C Cost In 2022

The premium for Medicare Part C â also called Medicare Advantage â depends on your plan and the insurer, since these health plans are provided by private insurance companies.

Deductibles, copays and coinsurance for Medicare Part C vary by plan. However, there is a limit to how much you can spend on out-of-pocket expenses. After that limit, your Medicare Part C plan will pick up all the remaining cost of covered health care services. The out-of-pocket limit for Medicare Advantage canât exceed $7,550 a year for in-network services. That means you could save more money if you have a lower out-of-pocket expenses limit. The limit is $11,300 for out-of-network services.

The average out-of-pocket limit for Medicare Advantage enrollees was $5,059 in 2019, according to the Kaiser Family Foundation.

Learn more about Medicare Part C.

What Is The Part A Premium

If you or your spouse paid Medicare taxes while working for 40 quarters or more, you are eligible for Premium-free Part A, which means you dont owe any monthly premiums for coverage. If you paid Medicare taxes for 30-39 quarters, youll pay $274 per month in 2022 those whove paid less than 30 quarters in Medicare taxes will pay $499 a month in premiums.1

You May Like: Is Eye Care Covered Under Medicare

How Much Does Medicare Cost In 2021

Most people can get Medicare Part A for a zero-dollar premium Medicare Part B has a standard monthly premium of $148.50 in 2021.1 Medicare Part C has an average monthly premium of $21 in 2021,2 and Medicare Part D stand-alone plans are projected to have an average monthly premium of $41.3

There are four different parts of Medicare labeled A and B , C and D . Each comes with its own set of expenses. Lets take a closer look with a detailed breakdown of the costs associated with each part of Medicare.

Is Medicare Free At 65

Though you are eligible for premium-free Part A if you are over the age of 65 and if you or your spouse has been paying Medicare taxes for the past 10 years, Medicare is not free. Additionally, there is a late enrollment fee of 10% of the premium for each part of Medicare for those who enroll after age 65.

Read Also: Does Aetna Follow Medicare Guidelines

Medicare Part C Costs

If you choose to get Medicare Part C, which is also calledâ¯Medicare Advantage , you are replacing Medicare Parts A and B. Often times, MA plans also include a drug benefit, so you also replace Part D.

However,â¯you still must pay the $170.10 monthly premium for Medicare Part B.

MA premiums vary, depending on which type of plan you choose, which area youâre in, and other similar factors.â¯In general, MA premiums are quite low, and sometimes theyâre even $0.â

While the monthly premium is very low or even $0, there are some things to consider before opting in to an MA plan.â¯You can read about the pros and cons of Medicare Advantage here.