Costs And Coverage From ‘original’ Medicare

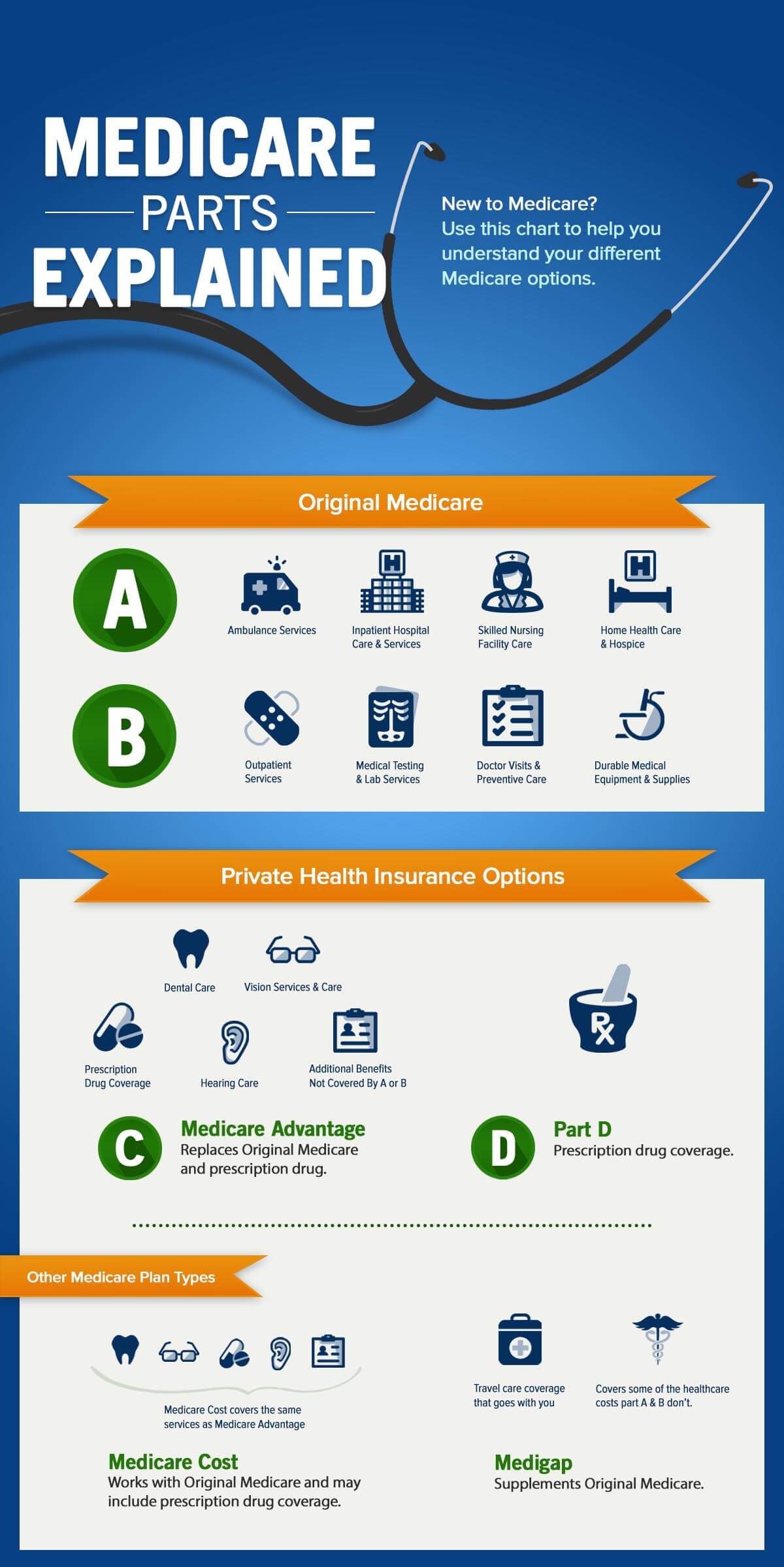

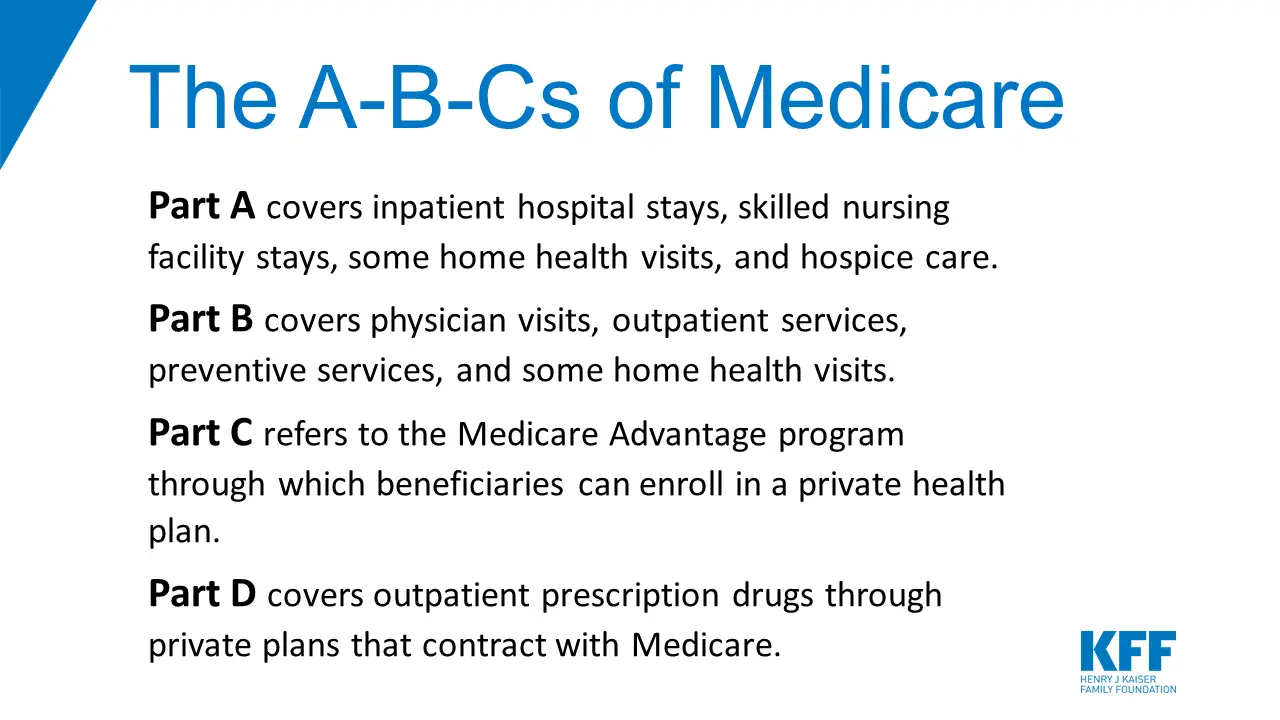

The basic form of Medicare is known as “original” or “traditional” Medicare. Both names refer to Medicare Parts A and B.

Part A, Medicare’s “hospital insurance,” covers hospital care and some home health services. Most people don’t pay premiums for Part A, but you do face a $1,408 deductible in 2020 when you’re admitted to a hospital.

Once a hospital stay stretches past 60 days, patients also must pay coinsurance of $352 per day.

Part B, Medicare’s “medical insurance,” covers doctor visits, tests, preventive screenings, outpatient surgical care, some medical equipment, physical therapy and mental health services.

But you have to meet a $198 deductible, and then Part B picks up only 80% of those costs. “Beneficiaries are responsible for the other 20%, with no limit,” says Roberts.

Part B also comes with premiums, starting at $144.60 per month in 2020. You can be required to pay more if your income surpasses some thresholds. Medicare has five higher premium levels for seniors at higher incomes, going all the way up to $491.60 per month.

Wellcare Medicare Part D Plans Reviews And Ratings

Wellcares Medicare Part D and Medicare Advantage plans are rated by the Centers for Medicare and Medicaid Services . Other ratings and ranking entities provide insight into Wellcares parent company, Centene, or Wellcares health plans as a whole. See how Wellcare stacks up against other health insurance providers.

Care Management Appears Somewhat Better For Beneficiaries In Medicare Advantage Plans Than For Beneficiaries In Traditional Medicare

Self-management of conditions. Across both types of Medicare coverage, most people age 65 and older said they felt confident they could manage and control their own health conditions . A somewhat larger share of people with diabetes in Medicare Advantage plans than people with diabetes in traditional Medicare felt confident they could manage their health conditions.

Among people age 65 and older with a health condition, a somewhat larger, though not statistically significantly different, share of those in Medicare Advantage plans than those in traditional Medicare that said they had a treatment plan for their condition. A larger share of Medicare Advantage enrollees said that a health care professional had given them clear instructions about symptoms to monitor and had discussed their priorities in caring for the condition .

Self-care among people with diabetes. Among beneficiaries with diabetes, no significant difference was observed by type of Medicare coverage in the proportion reporting their blood sugar was under control .9 While a larger share of SNP enrollees with diabetes engaged in self-care behaviors than their counterparts in other Medicare Advantage plans or traditional Medicare, the differences did not meet the statistical test for significance .

You May Like: Who Is Entitled To Medicare Part A

Switching Back To Original Medicare

While you can save money with a Medicare Advantage Plan when you are healthy, if you get sick in the middle of the year, you are stuck with whatever costs you incur until you can switch plans during the next open season for Medicare. At that time, you can switch to an Original Medicare plan with Medigap. If you do, keep in mind that Medigap may charge you a higher rate than if you had enrolled when you first qualified for Medicare.

Most Medigap policies are issue-age rated policies or attained-age rated policies. This means that when you sign up later in life, you will pay more per month than if you had started with the Medigap policy at age 65. You may be able to find a policy that has no age rating, but those are rare.

What Is A Medicare Advantage Plan

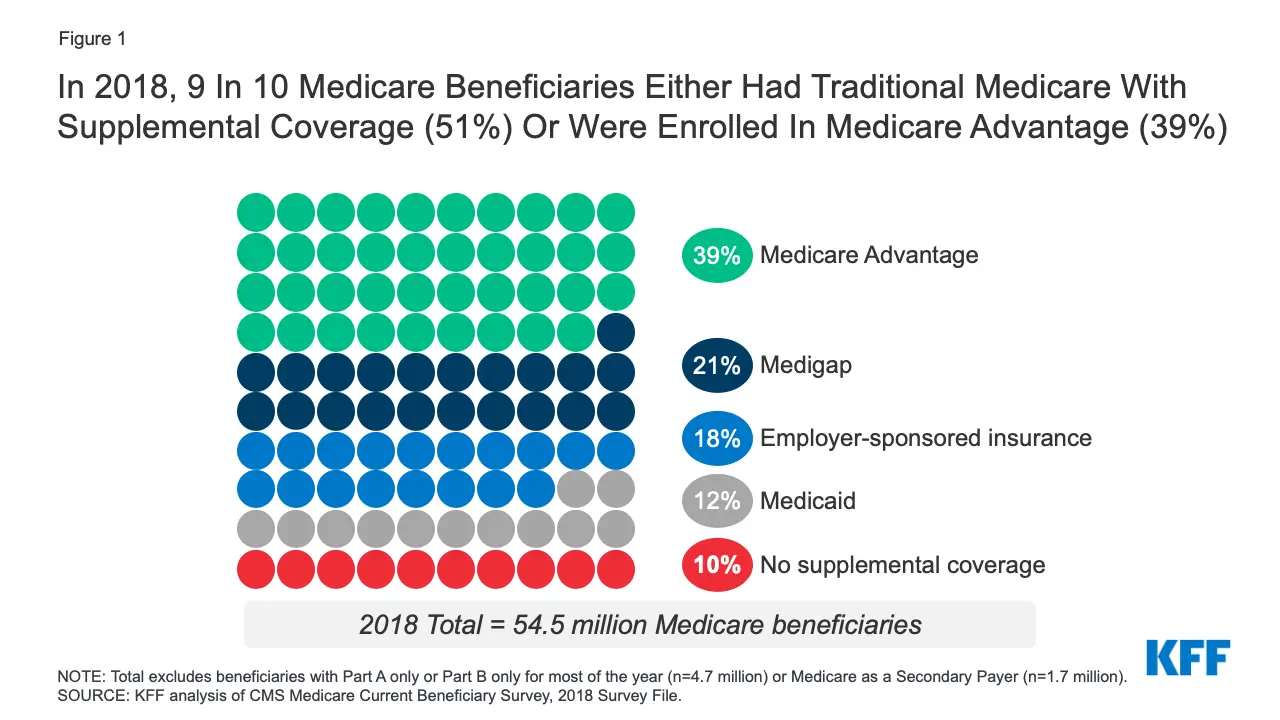

Enrollment in Medicare Advantage plans has doubled over the last 20 years, with 39% of Medicare enrollees enrolled in Medicare Advantage during 2020, according to the Kaiser Family Foundation. But what is a Medicare Advantage plan? If traditional Medicare doesnât meet your needs, an Advantage plan could be an excellent alternative.

Don’t Miss: Does Medicare Cover Ear Cleaning

How Do I Choose A Plan

The right plan for you will depend on your budget and healthcare needs.

For example, if you take multiple prescriptions, you might want to purchase a comprehensive Part D plan with a low deductible. If you know youll need vision care services, you might want to select a Medicare Advantage plan that offers vision coverage.

The options available to you will depend on your city, region, or state, but most areas have a variety of plans to choose from at different price points.

Tips for selecting plans that meet your needs

- Assess your current and potential healthcare needs. Are there doctors, facilities, or medications that you cant compromise on for your care? This may impact your policy choice, particularly when deciding between original Medicare and Medicare Advantage.

- Consider your income. If you have a fixed or limited income, paying monthly premiums may be difficult. However, if you need care that only Medicare Advantage would cover, this might be a good option to save costs in the long run.

- Look for cost savings programs. You may qualify for certain programs to help with your costs, including Medicaid and Extra Help.

- Find the right plan. Use Medicares plan finder tool to compare available Medicare Advantage plans in your area. You can search by prescription drugs you need, as well as covered providers and services.

Why Most Seniors Will Want More Than Original Medicare

There are two big problems with trying to make it on Medicare Parts A and B alone:

First, original Medicare doesn’t cover many of the essentials, including prescriptions, dentures, eyeglasses or hearing aids.

And second, original Medicare’s out-of-pocket costs have no cap. Many common health conditions require a significant amount of care and your 20% share of the outpatient costs under Part B can be colossal.

So, most seniors will want to look into some other options, which include going deeper into the Medicare alphabet.

Also Check: What Is A Medicare Special Needs Plan

Coverage Choices For Medicare

If you’re older than 65 and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn’t happen automatically. However, if you already get Social Security benefits, you’ll get Medicare Part A and Part B automatically when you first become eligible .

There are two main ways to get Medicare coverage:

How Can I Enroll In Medicare Advantage

The specific Medicare Advantage plans available to you depend on where you live. You can enroll in Medicare Advantage when you initially become eligible for Medicare, or during each subsequent Medicare Advantage Open Enrollment Period after that. Open enrollment extends from January 1 through March 31 every year. You can also switch back to Original Medicare during this period.

Additionally, the Centers for Medicare & Medicaid Services notes that you may also be able to enroll during a Special Enrollment Period if you:

- Have recently moved

Also Check: Does Medicare Cover Refraction Test

Finding Part D Drug Insurance

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings .

If you dont take many prescription drugs, look for a plan with a low monthly premium. All plans must still cover most drugs used by people with Medicare. If, on the other hand, you have high prescription drug costs, check into plans that cover your drugs in the donut hole, the coverage gap period that kicks in after you and the plan have spent $4,430 on covered drugs in 2022.

What Are The Two Main Medicare Coverage Options

Traditional Medicare

- Traditional Medicare covers Part A and Part B .

- Individuals also have the option to add Part D coverage for prescription drugs alongside their Part A and B coverage if they choose.

- Under Traditional Medicare, there is no annual limit on out-of-pocket costs. To help with the cost of coverage, individuals in traditional Medicare can buy Medicare Supplemental Insurance , which is extra insurance available from a private company. Medicare beneficiaries with limited income and resources may qualify for supplemental coverage under Medicaid.

Medicare Advantage , also referred to as Part C

- As a coverage alternative to traditional Medicare, beneficiaries have the option to enroll in Medicare Advantage.

- MA plans are run by private health insurers that follow the rules set by the Medicare program and are then paid by Medicare to provide services.

- Unlike traditional Medicare, MA plans usually include Part D as part of a bundle with Part A and Part B.

- Under MA, annual out-of-pocket costs are limited. Once an enrollee reaches the MA plans limit, the plan pays 100 percent of the cost of covered services for the remainder of the year.

Also Check: How To Compare Medicare Supplement Plans

Compare Insurance Quotes And Save Money

Did you know that you could be saving some serious money just by switching insurance companies?

Its true. You could be paying way less for the same coverage. All you need to do is look for it.

But dont waste your time hopping around to different insurance companies. Use a website called SmartFinancial to see all of your options at once.

SmartFinancial will provide you with a tailor-made list of possible policies from all major and most relevant insurance carriers.

The Parts Of Medicare

The different parts of Medicare help cover specific services:

Part A: Hospital Insurance

Medicare beneficiaries automatically receive the Part A hospital benefit that covers inpatient hospital services, skilled nursing facilities, home health services and hospice care.

Part B: Medical Insurance

Part B is a supplemental insurance package that helps pay for the cost of services by healthcare professionals such as psychologists, outpatient hospital services, medical equipment and supplies and other health services and supplies. Individuals must enroll to receive Part B benefits once enrolled in Part B they are charged a monthly premium.

Part C: Medicare Advantage Plans

Part D: Prescription Drug Coverage

Medicares Part D Prescription Drug Plan is optional for beneficiaries. Those who choose not to enroll when first eligible may face a penalty when enrolling in a Part D plan at a later date.

Read Also: Is Everyone Eligible For Medicare

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

Medicare Doesn’t Cover Routine Vision Care

Medicare generally doesnt cover routine eye exams or glasses . But some Medicare Advantage plans provide vision coverage, or you may be able to buy a separate supplemental policy that provides vision care alone or includes both dental and vision care. If you set aside money in a health savings account before you enroll in Medicare, you can use the money tax-free at any age for glasses, contact lenses, prescription sunglasses and other out-of-pocket costs for vision care.

You May Like: How Do I Sign Up For Medicare Supplemental Insurance

Medicare Doesn’t Cover Prescription Drugs

Medicare doesnt provide coverage for outpatient prescription drugs, but you can buy a separate Part D prescription drug policy that does, or a Medicare Advantage plan that covers both medical and drug costs. You can sign up for Part D or Medicare Advantage coverage when you enroll in Medicare or when you lose other drug coverage. And you can change policies during open enrollment season each fall. Compare costs and coverage for your specific medications under either a Part D or Medicare Advantage plan by using the Medicare Plan Finder.

Why Choose A Medicare Advantage Plan

There are a many of benefits to enrolling in Medicare Advantage. For example, Medicare Advantage plans often:

- Offer additional services, such as prescription drug coverage, vision, dental, hearing, memberships to health and wellness programs, and other benefits not provided by traditional Medicare

- Focus on wellness and improved health outcomes

- Have defined annual out-of-pocket limits for medical care

- In all cases, eliminate the need for Medicare supplemental plans, which typically cover gaps in original Medicare, such as co-payments and deductibles

Medicare Advantage plans are an alternative to original Medicare coverage. They include all the benefits of original Medicare with additional benefits.

Recommended Reading: How To Sign Up For Aetna Medicare Advantage

Are There Different Types Of Medicare Advantage Plans

Many people like the flexibility that Medicare Advantage plans provide. Unlike Original Medicare, which is the same for everyone, there are several different Medicare Advantage options you may be eligible for. Some of the popular ones include:

- Health Maintenance Organizations . These plans usually have the lowest premiums and out-of-pocket costs, however, you may be required to get all your health care from providers in the plans network. Many HMOs include coverage for prescription drugs and other routine health benefits.

- Special Needs Plans are a type of HMO that limits enrollment to people with certain conditions, or who live in a nursing facility, or are eligible for both Medicare and Medicaid.

- Preferred Provider Organizations *. PPOs let you see any provider who accepts your plan, but your costs are much lower if you use in-network providers. You can often find plans that include Part D prescription drug coverage.

- Private Fee-for-Service plans . With PFFS plans, you can get health care from any provider who accepts the terms of your plan. However, doctors are not required to accept your plan even if they participate in the Medicare program. Youll need to ask each time you get care, even if youve used the provider in the past.

Not every type of plan may be available where you live, and plan benefits and premiums vary. Keep these questions in mind when you evaluate the Medicare Advantage plans youre eligible for:

The Alternatives To Original Medicare

Medicare Part C, also known as Medicare Advantage, is a private insurance alternative to traditional Medicare that often includes additional benefits, such as vision, dental or drug coverage.

Medicare Advantage plans do have annual out-of-pocket limits, typically $6,700 if you stick within your plan’s network of medical providers.

When you’re enrolled in Medicare Advantage, you’re still responsible for paying your Part B premiums. There might be an additional monthly premium amount for Part C, though not always.

Part D is the way to add prescription drug coverage to original Medicare. Part D drug plans are offered by private insurance companies and cost an average of $32.74 per month in 2020, though prices vary by location.

Seniors will usually benefit most from choosing a Part C Medicare Advantage plan or going with original Medicare plus Part D prescription coverage and yet another option: Medicare supplement insurance.

Supplement plans also known as Medigap pay the steep out-of-pocket costs from original Medicare and might even cover medical expenses when you travel outside the U.S. But Medigap doesn’t provide coverage for vision, dental or hearing care, or prescriptions.

As with Parts C and D, Medigap plans are sold by private insurance companies, and different insurers can charge vastly different premiums for very similar plans. So it really pays to shop around and find the best price.

Don’t Miss: How Much Does Medicare Pay For Physical Therapy In 2020

If Your Income Is High Or Very Low Or You’re Feeling Lucky You Might Be Able To Rely On Traditional Medicare Here’s Why Most People Don’t

Only 19% of Original Medicare beneficiaries have no supplemental coverage .

- Supplemental coverage can help prevent major expenses.

If youre approaching Medicare eligibility, youve probably heard about the various private-coverage options that are available to replace or supplement Medicare. These plans are popular, but are they necessary?

If you shun private coverage, can you get by on Original Medicare without purchasing supplemental coverage or using a Medicare Advantage plan?

The answer is: It depends.

What Is Original Medicare

En español | Original Medicare, also known as traditional Medicare, works on a fee-for-service basis. This means that you can go to any doctor or hospital that accepts Medicare, anywhere in the United States, and Medicare will pay its share of the bill for any Medicare-covered service it covers. You pay the rest, unless you have additional insurance that covers those costs. Original Medicare provides many health care services and supplies, but it doesnt pay all your expenses.

When you first sign up for Medicare Part A and Part B, Social Security automatically enrolls you in original Medicare. If you prefer to receive your care from a private Medicare Advantage plan, such as an HMO or PPO, instead of the original program, you must actively enroll in a plan thats offered in your area. If you prefer to stay in original Medicare, you can get prescription drug coverage by joining a private Part D drug plan for an additional premium and you can also choose to buy private supplemental insurance to cover some of your out-of-pocket costs in the original program.

Read Also: When Is The Next Medicare Open Enrollment

What Is Medicare Advantage

Medicare Advantage is private health insurance for people eligible for Medicare. It offers similar benefits to Original Medicare âincluding funding the cost of medical testing, hospital care, and doctorâs appointments. Many plans also cover additional services that Original Medicare does not cover, such as dental and vision care or alternative and complementary medicine.

There are many different types of Medicare Advantage plans, including Special Needs Plans for groups of people with similar medical needs. However, most plans use a health maintenance organization model. With this model, you must seek care from providers within the planâs care network to have coverage.

Many Medicare Advantage recipients find that an Advantage plan offers more comprehensive coverage than Original Medicare. A 2021 United Health study found that, on average, Medicare Advantage recipients pay 40% less in health costs than Original Medicare enrollees. Out-of-pocket costs vary significantly, though, and the amount you end up paying depends on which services you need and what your particular plan covers.