Medicare Part B: Doctors And Tests

Medicare Part B covers a long list of medical services including doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatment.

You’re not required to enroll in Part B if you have “” from another source, such as an employer or spouse’s employer. If you don’t enroll and you don’t have creditable coverage from another source, you may have to pay a penalty if you enroll later.

You pay a monthly premium for Part B. In 2022, the standard cost is $170.10, up from $148.50 in 2021. If you’re on Social Security, this may be deducted from your monthly payment.

The annual deductible for Part B is $233 in 2022. Once you meet the deductible, you pay 20% of the Medicare-approved cost of the service, provided your healthcare provider accepts Medicare assignment. But beware: There is no cap on your 20% out-of-pocket expense.

For example, if your medical bills for a certain year were $100,000, you could be responsible for up to $20,000 of those charges, plus the charges incurred under Part A and D umbrellas. There is no lifetime maximum.

Kathryn B. Hauer, MBA, CFP®, EA, a financial advisor with Wilson David Investment Advisors in Aiken, S.C., and author of Financial Advice for Blue Collar America, explains:

On the other hand, you pay nothing for most preventive services, such as diabetes screenings and flu shots, if you receive those services from a provider who accepts Medicare assignment.

What Does Medicare Part A And Part B Cover

Original Medicare

- Hospice care

- Some home health care

You can enroll in Part A once you turn 65. If you’re already collecting Social Security disability benefits, you’ll be automatically enrolled in Part A.

Part B

- Some preventive services

Medicare pays 80 percent of approved charges and you pay about 20 percent.

Part B is optional because you have to pay a monthly premium and meet a deductible before Medicare will pay benefits.

Medicare Part A + Medicare Part B = Original Medicare

Part B complements your Part A coverage to provide coverage both in and out of the hospital. In fact, Part A and Part B were the first parts of Medicare created by the government. This is why the two parts together are often referred to as Original Medicare. Additionally, most people who do not have additional coverage through a group plan generally sign up for Parts A and B at the same time.

To learn more about Original Medicare, go to “Unpacking Original Medicare: What Parts A and B cover and when to consider a Medicare Supplement plan.”

Recommended Reading: How Much Medicare Is Taken Out Of Social Security Check

Medicare Advantage Part C

What it helps cover:

- Medicare Advantage plans are required by law to provideat minimumthe same coverage, benefits and rights provided by Original Medicare Part A and Part B, with the exception of hospice care.

- Many Medicare Advantage plans also choose to offer prescription drug coverage, as well as coverage for routine dental, vision and hearing benefits, to compete for your business.

What it costs:

- Medicare Advantage plans are offered by private insurance companies contracted by the federal government, so they vary in cost, coverage, deductibles and copays.

- Many Medicare Advantage plans offer affordable or $0 dollar premiums plus a variety of coverages and benefits not offered by Original Medicare .

Medicare Part A Hospital Coverage

- What Medicare Part A covers: Part A covers expenses associated with hospital care. It includes coverage for services like nursing care and hospital stays. It also covers some hospital-related care that takes place outside a hospital setting. For example, skilled nursing care after you leave the hospital.

- What Medicare Part A costs: You generally wont have to pay a monthly premium for Medicare Part A if you or your spouse paid Medicare payroll taxes for 40 quarters or more. But you do need to pay deductibles before Medicare will cover any hospitalization costs.

Also Check: How To Apply For Medicare Insurance

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Comparison With Private Insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes. In effect, Medicare is a mechanism by which the state takes a portion of its citizens’ resources to provide health and financial security to its citizens in old age or in case of disability, helping them cope with the enormous, unpredictable cost of health care. In its universality, Medicare differs substantially from private insurers, which must decide whom to cover and what benefits to offer to manage their risk pools and ensure that their costs do not exceed premiums.

Medicare also has an important role in driving changes in the entire health care system. Because Medicare pays for a huge share of health care in every region of the country, it has a great deal of power to set delivery and payment policies. For example, Medicare promoted the adaptation of prospective payments based on DRG’s, which prevents unscrupulous providers from setting their own exorbitant prices. Meanwhile, the Patient Protection and Affordable Care Act has given Medicare the mandate to promote cost-containment throughout the health care system, for example, by promoting the creation of accountable care organizations or by replacing fee-for-service payments with bundled payments.

Don’t Miss: How To Find Someone’s Medicare Number

Do I Need Each Part Of Medicare

Many beneficiaries wonder if they need each part of Medicare. The answer is different for everyone. For the most part, the answer is, yes.

If you want inpatient coverage, or coverage for when you end up in the hospital, then you need Part A. If you want outpatient coverage, or coverage for your doctors visits, preventive exams, testing, etc, then you need Part B.

If you can afford the out of pocket expenses in the form of cost-sharing that falls under both Part A and Part B, then you do not need additional supplemental coverage. However, cost-sharing can quickly add up, especially in the case you become sick. In addition, if you become sick, you may be denied any supplemental coverage in the future.

When it comes to supplemental coverage, you have the choice between Medigap and Part C. If you cannot afford the above cost-sharing mentioned, then you need either Medigap or Part C.

When it comes to Part D, if you take any prescription medications, or may in the future, then you need Part D. Otherwise, you will have no coverage for your prescriptions if you only have Part A and Part B.

- Was this article helpful ?

When Can I Enroll In Medicare Part B

If you are receiving retirement benefits before age 65 or qualify for Medicare through disability, generally youâre automatically enrolled in Medicare Part A and Part B as soon as you become eligible.

If you do not enroll during your initial enrollment period and do not qualify for a special enrollment period, you can also sign up during the annual General Enrollment Period, which runs from January 1 to March 31, with coverage starting July 1. You may have to pay a late enrollment penalty for not signing up when you were first eligible.

If youâre not automatically enrolled, you can apply for Medicare through Social Security, either in person at a local Social Security office, through the Social Security website, or by calling 1-800-772-1213 from 8AM to 7PM, Monday through Friday, all U.S. time zones.

Keep in mind that once you are both 65 years or older and have Medicare Part B, your six-month Medigap Open Enrollment Period begins. This is the best time to purchase a Medicare Supplement insurance plan because during open enrollment, you have a âguaranteed-issue rightâ to buy any Medigap plan without medical underwriting or paying a higher premium due to a pre-existing condition**. Once you are enrolled in Medicare Part B, be careful not to miss this one-time initial guaranteed-issue enrollment period for Medigap.

Read Also: Does Medicare Cover Tooth Extraction

How Does Original Medicare Work

Original Medicare is a federal health care program made up of both Medicare Part A and Part B . Its a fee-for-service plan, which means you can go to any doctor, hospital, or other facility thats enrolled in and accepts Medicare, and is taking new patients.

Medicare was set up to help people 65 and older. In 1972, Medicare became available to people with disabilities and End-Stage Renal Disease/kidney failure.

What Is Medicare Part C

If youve heard of Medicare Advantage, youve heard of Medicare Part C.

Part C consists of Medicare-approved plans sold by private insurance companies. These Medicare Advantage plans typically package the hospital and health insurance benefits of Parts A and B with prescription drug coverage.

There are important tradeoffs to consider when deciding between Original Medicare and a Part C plan.

A Medicare Advantage plan often requires you to use doctors in the plans network, and youll probably need a referral to see a specialist.

But Medicare Part C plans usually pay for services not covered by Original Medicare, such as vision, dental and hearing care, and may have lower out-of-pocket costs.

Medicare Advantage plans come with different premiums, deductibles, copayments and coinsurance, so shop around to see how they compare to each other and to Original Medicare.

Don’t Miss: Does Medicare Provide Life Insurance

What Is Medicare Part B

Medicare Part B is medical insurance that pays for doctor visits, screenings and other outpatient services and supplies. Youll pay a monthly premium and have a deductible and coinsurance payments.

The standard Part B premium is $170.10 a month in 2022, but you could pay more, depending on your income and if you didnt sign up when you first became eligible.

The annual Part B deductible is $233. After meeting the deductible, youll pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment. Youll pay nothing for other services, such as preventative care.

Medicare Part A B C And D: Whats The Difference

Selecting a Medicare plan can be overwhelming. Understand which plans cover which services so you can make the best choice for you.

Open enrollment happens every year from the middle of October to the middle of December. It is the period of time when you can make changes to your Medicare coverage. You can enroll in a new Medicare prescription drug plan, switch from Original Medicare to a Medicare Advantage plan or change Medicare Advantage plans.

When youâre first selecting a Medicare plan, you may be faced with an overwhelming number of choices. One of the most challenging parts of understanding Medicare is how the different parts fit together.

This article describes the differences between Original Medicare and Medicare Advantage . It also explains how Part D fits into the different plans. Youâll also learn what else to keep in mind as you are picking a plan.

Recommended Reading: Does Medicare Pay For Stem Cell Treatment

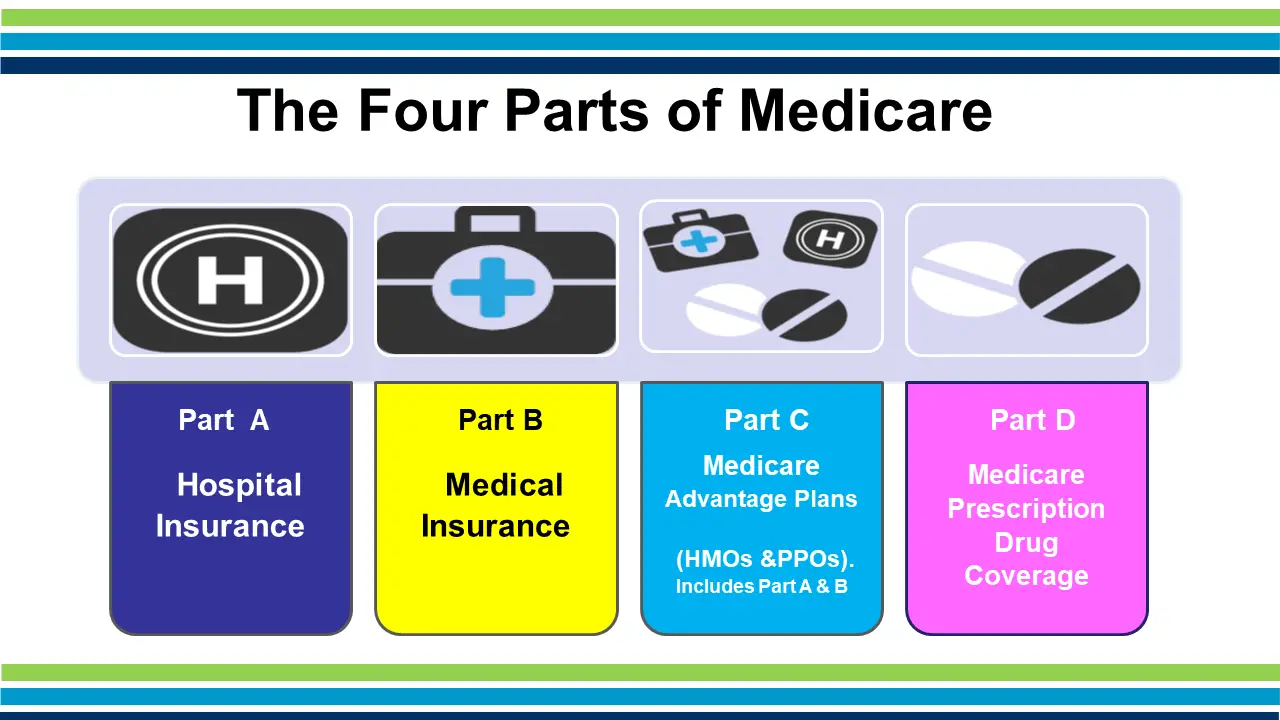

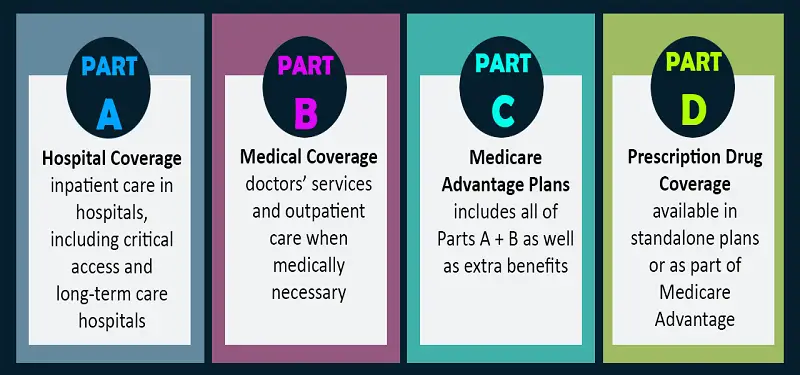

What Do Medicare Parts A B C And D Mean

Who is this for?

If you’re new to Medicare, this information will help you understand the different parts and what they do.

There are four parts of Medicare. Each one helps pay for different health care costs.

Part A helps pay for hospital and facility costs. This includes things like a shared hospital room, meals and nurse care. It can also help cover the cost of hospice, home health care and skilled nursing facilities.

Part B helps pay for medical costs. This is care that happens outside of a hospital. It includes things like doctor visits and outpatient procedures. It also covers some preventive care, like flu shots.

Parts A and B together are called Original Medicare. These two parts are run by the federal government. Find out more about what Original Medicare covers in our Help Center.

Part C helps pay for hospital and medical costs, plus more. Part C plans are only available through private health insurance companies. Theyre called Medicare Advantage plans. They cover everything Parts A and B cover, plus more. They usually cover more of the costs youd have to pay for out of pocket with Medicare Parts A and B. Part C plans put a limit on what you pay out of pocket in a given year, too. Some of these plans cover preventive dental, vision and hearing costs. Original Medicare doesnt.

You can see a list of the Medicare Advantage plans we offer and what they cover.

What You Need To Know About Medicare Parts A B C And D

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in ouradvertiser disclosure. We may receive commissions on purchases made from our chosen links.

There are four parts of Medicare: Part A, Part B, Part C, and Part D. In general, the four Medicare parts cover different services, so it’s essential that you understand the options so you can pick your Medicare coverage carefully.

Don’t Miss: Does Medicare Pay For A Caregiver In The Home

Medicare Part A B C And D: What You Need To Know

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

Medicare Parts A, B, C, and D are the four distinct types of coverage available to eligible individuals. Each Medicare part covers different healthcare-related costs. While Medicare Part A and Medicare Part B are administered by the Centers for Medicare and Medicaid Services , Medicare Part C and Medicare Part D are managed by private insurance companies.

Medicare is similar to the health insurance coverage youve probably had with an employer or an individual policy. It can cover doctor visits, inpatient and outpatient hospital care, prescription drugs, and lab tests. Depending on the plan you choose, your Medicare plan can also cover dental and vision, if you like.

Heres a brief overview of each of the parts of Medicare.

How Much Does Medicare Part A Cost

If you or your spouse have worked at least 40 calendar quarters in any job where you paid Social Security taxes, you do not have to pay a premium for Part A.

- Premium: $0 per month

- 2020 Deductible: $1,408 for each benefit period

The 2020 Medicare Part A premium for those who do not qualify for $0 premiums is either $252 or $458 per month, depending on how long you worked and paid Medicare taxes.

You May Like: Can You Still Get Medicare Plan F

Why Are Some Of Medigaps Plan Names Identical To Medicares Parts

The other Medicare program name that aptly describes its function is Medigap, also known as Medicare supplement insurance. It fills in the gaps, taking care of deductibles and copayments for enrollees who have original Medicare .

Medigap plans arent the same as Medicares four major parts . But the 10 federally standardized Medigap plans, first introduced in 1992, make up an alphabet soup of redundancy and potential confusion: A, B, C, D, F, G, K, L, M, and N.

That means, in most states, you can buy Medigap Plan A or B to protect you from out-of-pocket costs from Medicare Parts A and B. Of course, you can also buy a Medigap Plan G in many states to shield you from Medicare Parts A and B costs and so on.

But you can no longer buy Medigap Plans E, H, I, or J. If you already have any of those four plans, you can keep them, but they have been closed to new buyers since 2010. As some Medigap plans are restricted, typically by new laws, insurance agents may encourage existing enrollees to switch to newly created plans. These new plans may be more affordable and often come with letter names from further down the alphabet.

Government programs rarely take their cues from flashy tech or car companies. But imagine if the naming culture of private enterprise had influenced Medicare supplement insurance so youd now have a choice of a Medigap Tiger or Jaguar plan instead.

-

Platinum

-

Bronze

Will Medicare Cover All Of My Needs

Original Medicare may not be enough to cover all your needs if you require certain coverage. If your coverage needs are more robust, then you may want to consider enrolling in an MA plan instead of Original Medicare.

Purchasing Medicare Part B affords you coverage for several types of medical services.

Unless you buy Medicare Advantage , you will not have vision, hearing and dental coverage. Even with Medigap, not all costs and services will be covered under Original Medicare. Be sure to compare plans to ensure that all your coverage needs are met.

Also Check: How Do Zero Premium Medicare Plans Work

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .