You Automatically Get Medicare When You Turn 65

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

What Happens If You Don’t Enroll In Part A

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How To Sign Up For Medicare Heres What You Need To Know

You can enroll in Medicare Part A and/or Medicare Part B in the following ways:

- Online at www.SocialSecurity.gov.

- In person at your local Social Security office.

If you worked at a railroad, enroll in Medicare by contacting the Railroad Retirement Board at 1-877-772-5772 . You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative.

Also Check: Can You Have A Health Savings Account With Medicare

The Basics On Signing Up

Medicare enrollment in Part A and Part B is automatic if you have claimed Social Security benefits before your 65th birthday your Medicare card will arrive in the mail and coverage begins the first day of the month in which you turn 65. There is no premium charged for Part A in most cases, and you may be able to turn down Part B at that point without incurring late-enrollment penalties if you are still working and receive your primary insurance through work.

If you have not yet applied for Social Security, signing up for Medicare requires proactive steps to avoid problems.

Medicare offers an Initial Enrollment Period around your 65th birthday. If you miss that window, you will be subject to a late enrollment surcharge equal to 10 percent of the standard Part B premium for each 12 months of delay a penalty that continues forever. That can really add up. In 2017, 1.3 percent of Part B enrollees paid penalties , according to the Congressional Research Service. On average, their total premiums were 31 percent higher than what they would have been.

Medicares prescription drug program comes with a much less onerous late enrollment penalty, equal to 1 percent of the national base beneficiary premium for each month of delay. In 2019, the base monthly premium is $33.19, so a seven-month delay would tack $2.32 onto your plans premium.

Late enrollment also exposes you to significant gaps while waiting for Medicare coverage.

Consequences Of Canceling Part B

If you have a gap in coverage, the Medicare program could tack late-enrollment penalties onto your Part B premiums if you re-enroll in coverage again later. Avoid this pitfall by working with your human resources department to ensure that your companys insurance is indeed creditable . You may need to provide documentation of creditable coverage during your Part B cancellation interview.

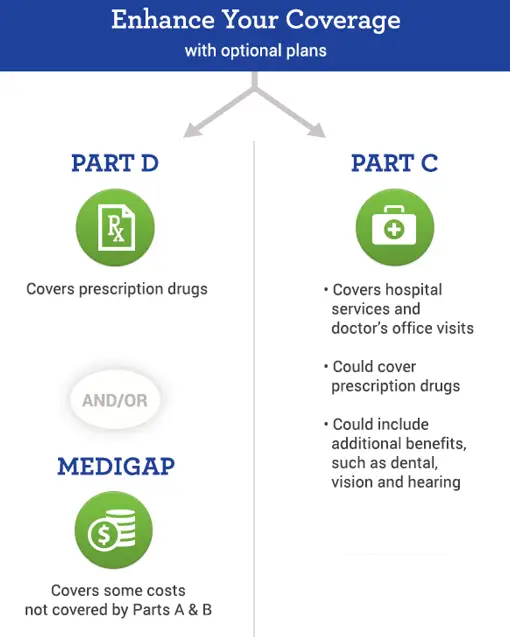

A gap in coverage could also adversely affect your health if you avoid seeing the doctor because you dont have health insurance. And you may have to go without other forms of coverage too. Without Part B, you cant enroll in other parts of Medicare, such as Part D prescription drug coverage, Medicare Supplement , or Medicare Advantage. These gaps will remain until you re-enroll in Part B again later.

Also Check: How Much Does Medicare Pay For Funeral Expenses

If You Are Under 65 With A Disability:

If you have received SSA disability benefits for at least 24 months or you have end-stage renal disease , you may be eligible for Medicare before age 65.

You should sign up for Medicare Parts A and B when you are first eligible. As your primary coverage, Medicare pays your eligible expenses and your state insurance pays secondary. If you do not enroll in Medicare, you will pay most or all of the amount that Medicare would have paid. SSA may also assess a late enrollment penalty if you attempt to enroll at a later date.

Once youve enrolled in Medicare

Call ERS to provide us with the information located on your Medicare ID card. ERS will confirm your enrollment in Medicare Parts A and B and start the process to enroll you in the HealthSelectSM Medicare Advantage Plan, preferred provider organization , administered by UnitedHealthcare.

Retirees and/or dependents with end-stage renal disease are eligible to enroll in HealthSelect MA PPO only after their 30-month coordination period with Medicare has ended.

If you dont provide your Medicare information to ERS

Enrollees in HealthSelect MA PPO and HealthSelect Secondary continue to pay Medicare Part B premiums to the SSA.

HealthSelect MA PPO and HealthSelect Secondary enrollees also are enrolled in HealthSelectSM Medicare Rx Part D prescription drug coverage administered by UnitedHealthcare. There is no additional premium for this coverage through the GBP.

Sign Up For A Mymedicaregov Account

After you sign up for Medicare, you can create a MyMedicare.gov account to manage your coverage.

With your MyMedicare.gov account, you can:

- Get details about the plans youre enrolled in and what they cover.

- Update your personal information.

Creating an account on MyMedicare.gov is quick and easy.

How to Sign Up for MyMedicare.gov

Don’t Miss: Does Medicare Pay For Tdap Shot

How To Enroll In Medicare

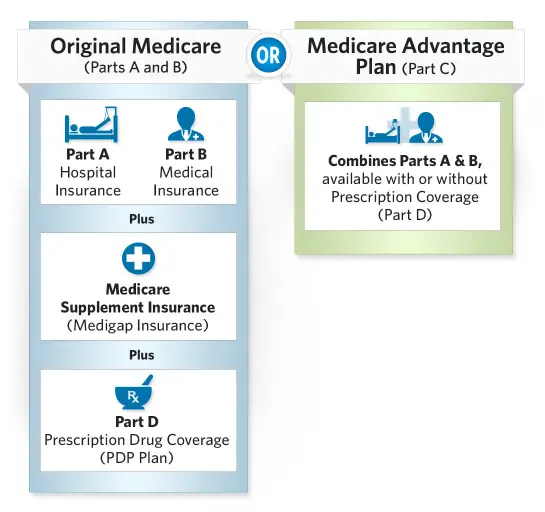

Enrolling in Medicare is easy once you understand how to do so. It’s important to know that how you enroll in Medicare Part A and Part B is different from how you enroll in Medicare Advantage , Part D or Medicare supplement insurance.

See the table below for a quick overview of how to enroll in a Medicare or Medigap plan and read on for how-to steps for both Original Medicare and the three kinds of Medicare and Medigap plans.

Original Medicare Medicare Advantage plan Medicare Prescription Drug plan Medicare Supplement Insurance plan How to Enroll

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office.

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Enroll directly in the plan e.g., on the plans website

Original Medicare

How to Enroll

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office.

Medicare Advantage plan

How to Enroll

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Medicare Prescription Drug plan

How to Enroll

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Medicare Supplement Insurance plan

Enroll directly in the plan e.g., on the plans website

When To Enroll In Medicare If I Am Receiving Retirement Benefits

If youâre already collecting Railroad Retirement Board or Social Security retirement benefits when you turn 65, you will automatically be enrolled in Medicare Part A and Medicare Part B if you sign up for Medicare Part B at the time you sign up for retirement benefits.

If you live outside of the 50 United States or D.C. , you will automatically be enrolled in Medicare Part A, but will need to manually enroll in Medicare Part B.

You May Like: How Much Does Medicare Part B Cost For A Couple

Disability & Medicare Eligibility And Enrollment What You Need To Know In 2022

Some people can qualify for Medicare due to disability. In this case, if you have a qualifying disability, you are eligible for Medicare even if you are not yet age 65. To find out if your disability qualifies for disability benefits or for Medicare, youll need to speak with Social Security directly, but in general, you become eligible the 25th month of receiving Social Security Disability Insurance benefits .

If you have a qualifying disability, you must first file for disability benefits through Social Security before you can even be considered eligible for Medicare due to disability. Approval of the request by Social Security is an important first step. It is also important to note that these benefits are different from Supplemental Security Income benefits, and that SSI benefits do not qualify you for Medicare.

How Long Do You Have To Be On Medicare If You Are Disabled

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

Recommended Reading: What Is A Medicare Health Plan

If You Are Under Age 65 And Disabled:

If you are under age 65 and disabled, and have been entitled to disability benefits under Social Security or the Railroad Retirement Board for 24 months, you will be automatically entitled to Medicare Part A and Part B beginning the 25th month of disability benefit entitlement. You will not need to do anything to enroll in Medicare. Your Medicare card will be mailed to you about 3 months before your Medicare entitlement date. , you get your Medicare benefits the first month you get disability benefits from Social Security or the Railroad Retirement Board.) For more information about enrollment, call the Social Security Administration at 1-800-772-1213 or visit the Social Security web site. See also Social Security’s Medicare FAQs.

For more information, see Medicare.gov

Does Medicare Cover Prescription Drugs

Medicare prescription drug coverage is available to everyone with Medicare. Private companies provide this coverage. You choose the Medicare drug plan and pay a monthly premium. Each plan can vary in cost and specific drugs covered. If you decide not to join a Medicare drug plan when youre first eligible, and you dont have other creditable prescription drug coverage, or you dont get Extra Help, youll likely pay a late enrollment penalty. You may have to pay this penalty for as long as you have Medicare drug coverage.

Don’t Miss: Does Medicare Cover Ct Scans

Effects Of Other Coverage

It is your responsibility to keep ORS informed of any changes that may affect your own and your dependents eligibility and/or coverage, so be sure to notify ORS when anyone on your insurance has coverage under another insurance plan. You can do this in miAccount or by sending in a completed Insurance Enrollment/Change Request R0452C) form. Enrolling in another health or prescription drug plan may result in termination of your retiree coverage for you, your spouse, and enrolled dependents. If you arent sure if youll be affected, send a secure message to an ORS representative using Message Board.

If you and your spouse are both Michigan public school retirees and enrolled with the same carrier, you will be covered together under one contract.

What Is The Medicare Part B Late

If you do not sign up for Medicare Part B when you are first eligible, you may need to pay a late enrollment penalty for as long as you have Medicare. Your monthly Part B premium could be 10% higher for every full 12-month period that you were eligible for Part B, but didnât take it. This higher premium could be in effect for as long as you are enrolled in Medicare. For those who are not automatically enrolled, there are various Medicare enrollment periods during which you can apply for Medicare. Be aware that, with certain exceptions, there are late-enrollment penalties for not signing up for Medicare when you are first eligible.

One exception is if you have health coverage through an employer health plan or through your spouseâs employer plan, you can delay Medicare Part B enrollment without paying a late-enrollment penalty. This health coverage must be based on current employment, meaning that COBRA or retiree benefits arenât considered current employer health coverage.

Read Also: Does Medicare Cover Bed Rails

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment for its services, some people may find it difficult to pay for the monthly costs associated with this portion of Medicare. Those with limited incomes, in particular, may wonder if there are cost assistance programs in place to help mitigate the financial burden.

In fact, there are a few ways that you can reduce your monthly premiums, or at least make your healthcare more affordable using different programs. One such way is to enroll in a Medicare Savings Program. Run by individual states in conjunction with Medicare, Medicare Savings Plans help you pay for medical costs associated with deductibles, coinsurance and copayments, in some cases. There are four Medicare Savings Programs available, but only three of them relate to Medicare Part B. They are:

The Qualified Medicare Beneficiary Program

- The Qualifying Individual Program

- The Specified Low-Income Medicare Beneficiary Program

Each program has its own eligibility requirements. For example, members of the QI Program must apply every year for assistance. Acceptance is based on a first-come, first-served basis, with priority given to past recipients. You also wont qualify for the QI Program if you receive Medicaid benefits. If you think that you qualify for one of these programs or need financial assistance, then you should contact the Medicaid program in your state to find out more information.

Are You Automatically Enrolled In Medicare When You Turn 65

Yes. If you are receiving Social Security, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. Social Security will send you sign-up instructions at the beginning of your initial enrollment period, three months before the month of your 65th birthday.

You May Like: Do You Have To Get Medicare At 65

How Do I Change My Medicare Coverage

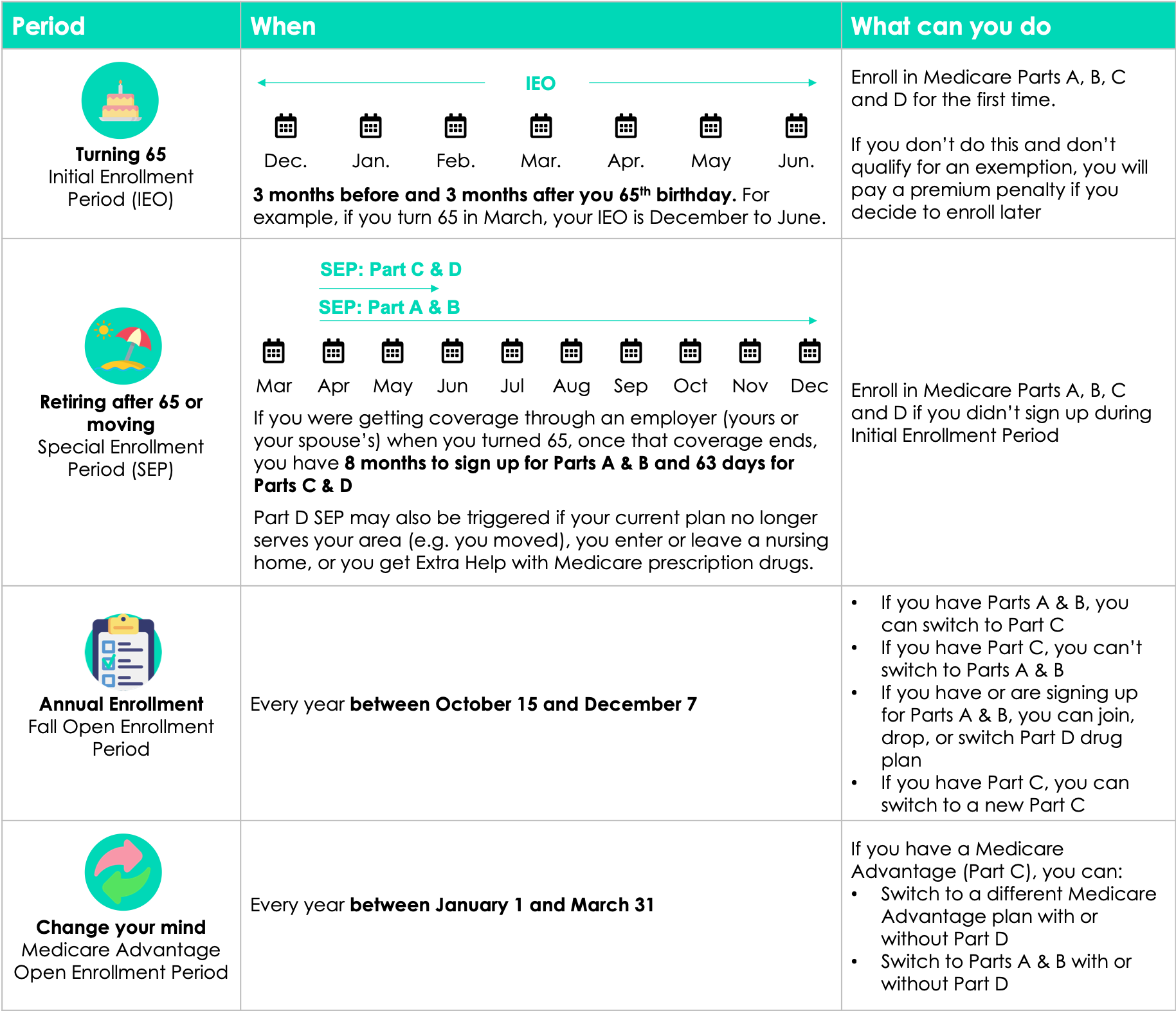

Your Medicare choices are not set in stone after the first time you enroll. You can make changes to your Medicare coverage during a few special Medicare enrollment periods.

- The Medicare Annual Enrollment Period , October 15 December 7

- The Medicare Advantage Open Enrollment Period, January 1 March 31

- The Medicare Special Enrollment Period for qualifying life events dates vary based on qualifying event

Learn how to make changes to your Medicare coverage during these three time periods:

If You Are Turning 65 And Retired:

If you are no longer an active employee, you should sign up for Medicare Parts A and B as soon as you are eligible. Medicare pays your eligible medical expenses and your state insurance pays secondary. If you do not enroll in Medicare, you will pay most or all of the amount that Medicare would have paid. If you delay enrollment in Medicare, SSA may also assess a late enrollment penalty if you attempt to enroll at a later date.

Once youve enrolled in Medicare

Call ERS to provide us with the information located on your Medicare ID card. ERS will confirm your enrollment in Medicare Parts A and B and start the process to enroll you in the HealthSelectSM Medicare Advantage Plan, preferred provider organization , administered by UnitedHealthcare.

Important: Until ERS receives your Medicare information, we cannot begin the process to enroll you in HealthSelect MA PPO. Plan ahead: The process can take 30 to 60 days before your HealthSelect MA PPO coverage begins. During this time, you will be enrolled in HealthSelectSM Secondary. If you need to access medical benefits while enrolled in HealthSelect Secondary, you will be charged a $200 deductible.HealthSelect MA PPO is a Medicare Part C plan that combines Medicare Parts A and B with your state health insurance. It provides additional group benefits you may not receive with Medicare alone and covers most or all of your medical expenses.

If you dont provide your Medicare information to ERS

Also Check: How Do I Get A Lift Chair Through Medicare

How To Apply For Medicare Through Social Security

Apply online: The easiest way to complete the Medicare enrollment application is online at ssa.gov. Its convenient to sign up from home. You can start and stop the application and save your information. After you submit your application, youll get a receipt to print and keep. You can also check the status of your application.

Apply in person: Visit your local Social Security office. You can find the nearest office with the Social Security office locator. They recommend that you make an appointment.

Apply by phone: Call Social Security at 800-772-1213 .

Medicare General Enrollment Period

If you did not enroll during the IEP when you were first eligible, you can enroll during the General Enrollment Period. The general enrollment period for Original Medicare is from January 1 through March 31 of each year. Keep in mind that you may have to pay a late enrollment penalty for Medicare Part A and/or Part B if you did not sign up when you were first eligible.

Don’t Miss: What Age Do You File For Medicare

When Is The Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period is a limited annual enrollment period. It goes from January 1 â March 31 every year. During this time, you can:

- Switch Medicare Advantage plans, if you already have a Medicare Advantage plan

- Disenroll from your Medicare Advantage plan and return to Original Medicare.

You cannot use this period to make most other coverage changes. However, if you decide to drop your Medicare Advantage plan, you can also use this period to join a stand-alone Medicare prescription drug plan, since Original Medicare doesnât include prescription drug coverage.

Outside of the Annual Election Period and the Medicare Advantage Open Enrollment Period, you cannot generally make changes to your Medicare Advantage plan unless you qualify for a Special Election Period.