What Is Considered Early Retirement Age

Editor’s Note: This story originally appeared on Personal Capital.

The common definition of early retirement is any age before 65 thats when you qualify for Medicare benefits.

Currently, men retire at an average age of 64, while for women the average retirement age is 62.

Retiring before the traditional age of 65 can feel exciting and give you something to look forward to. So, whether youre wanting to do some traveling, take up new hobbies, or simply start a new chapter in your life youre going to need to have a retirement plan.

Even if youre one of the lucky few who dont want or plan to retire, understanding whats possible is very important as you enter the later stages of life.

How Do I Get Full Medicare Benefits

If youve worked at least 10 years while paying Medicare taxes, there is no monthly premium for your Medicare Part A benefits. But if you havent worked, or worked less than 10 years, you may qualify for premium-free Part A when your spouse turns 62, if she or he has worked at least 10 years while paying Medicare taxes. However, to be eligible for Medicare, you need to be 65 years old. You also need to be an American citizen or legal permanent resident of at least five continuous years.

So, to summarize with an example:

- Bob is 65 years old. Hes on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

Medicare Eligibility At Age 65

- You are at least 65 years old

- You are a U.S. citizen or a legal resident for at least five years

In order to receive premium-free Part A of Medicare, you must meet both of the above requirements and qualify for full Social Security or Railroad Retirement Board benefits, which requires working and paying Social Security taxes for at least 10 full years .

Learn more about Medicare eligibility at and before age 65 by referring to this helpful chart and reading more information below.

Read Also: How Many Parts Medicare Has

How Retirement Benefits Work

You paid social security taxes your entire working life. The money you contribute during your working years goes towards benefits for people who have already retired, people who are disabled, people who have lost working family members, and dependents of beneficiaries.

That surprises some people as they think the money withheld from their paychecks is held in a personal account for later use. Any unused money will go into the Social Security fund that pays monthly benefits to you and your family when you are eligible to begin receiving retirement benefits.

Social Security replaces a percentage of the income you earned based on your lifetime income. The portion that is replaced is based on your 35 years of highest earnings.

What If You Still Work

You can work and receive Medicare disability benefits for a transition period under Social Security’s work incentives and Ticket to Work programs.

There are three timeframes to understand. The first, the trial work period, is a nine-month period during which you can test your ability to work and still receive full benefits. The nine months don’t have to be consecutive. The trial period continues until you have worked for nine months within a 60-month period.

Once those nine months are used up, you move into the next time framethe extended period of eligibility. For the next 36 months, you can still receive benefits in any month you aren’t earning “substantial gainful activity.”

Finally, you can still receive free Medicare Part A benefits and pay the premium for Part B for at least 93 months after the nine-month trial periodif you still qualify as disabled. If you want to continue receiving Part B benefits, you have to request them in writing.

If you’re disabled, you may incur extra expenses that those without disabilities do not. Expenses such as paid transportation to work, mental health counseling, prescription drugs, and other qualified expenses might be deducted from your monthly income before the determination of benefits, which mayallow you to earn more and still qualify for benefits.

Read Also: Does Medicare Pay For Teeth Implants

What Is The Perfect Retirement Age

It may be the quintessential retirement question in all of human history, When should I retire? You ask the retirement gods of Valhalla to help you find the answer you seek. But the quest for the perfect retirement age only produces more questions.

It used to be that 65 was the magic retirement age. From the time President Franklin D. Roosevelt signed the Social Security program into law on August 14, 1935, until 1983, being 65 meant a full Social Security benefit. But in those days, life expectancy was much shorter and people lived, on average, 12 years after they retired.

People began living longermuch longer. The governments response was to raise the age at which retirees could receive a full Social Security payout. So, from 1983 to 2000, Full Retirement Age was raised to a minimum of 66 and a maximum of 67, all dependent on when you were born. Under the new regulations, if you claim Social Security before your Full Retirement Age, you receive a permanently reduced Social Security benefit.

There are also some key ages and events to factor in as you search for your perfect retirement age.

The reality is, there is no one-size-fits-all perfect age to hang up your career. But there are some things to consider:

Finding your perfect retirement age may also depend on where you live. A study by GoBankingRates found that in most states, people are leaving the workforce before they hit 67 years old.

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Don’t Miss: Does Medicare Pay For Inogen Oxygen Concentrator

Can I Continue To Work After Full Retirement Age

Yes, and you can earn as much as you want without facing any penalties or negatively affecting the amount youll receive in Social Security benefits when you do decide to take them.

Since your benefits are based on your 35 highest-earning years, working after full retirement age could actually increase your benefits if you are a high-earner. Even if you begin collecting benefits, the Social Security Administration will recalculate your average wage to account for any new income.

Those who began collecting Social Security benefits prior to full retirement age but then decided to continue working will be subject to the retirement earnings test . This test checks to see if your earnings exceed a limit. If your earnings exceed the current limit, you will temporarily lose some or all of your Social Security benefits. At the time you reach full retirement age, those benefits are recalculated, and youll receive most of that money back.

Democrats Push Bill To Lower Medicare Eligibility Age To 60

House Democrats have introduced legislation that would lower Medicare eligibility to age 60, down from 65.

And if the Improving Medicare Coverage Act were to become law, the ripple effects would be numerous, said Jae Oh, author of Maximize your Medicare.

Among other things, the proposed law could potentially cut the cost of someones health insurance from $900 a month to just $160 a month if they were between the ages of 60-65. Plus, it could potentially cut how much someone spends on health care annually by 75%.

This potential law could also have positive effects for businesses. Employees might be more likely to switch to Medicare and opt-out of their employers health insurance, according to Oh.

However, there will likely be pushback from health care providers, according to Oh. When a patient uses Medicare, the health care providers are typically compensated at a lower rate. Health care providers also have less flexibility to negotiate their prices under Medicare, compared to private or employer-based health insurance

Could you see hospitals, for example, hospital systems trying to resist a wholesale change of Medicare eligibility age? asked Oh. very possible.

While it is impossible to look into the future and see how the Senate will vote on this, it will be important to keep an eye on this as it can revolutionize Medicare.

For more, read:

You May Like: Does Medicare Cover Hepatitis A Vaccine

Can It Be A Good Idea To Delay Enrollment In Either Social Security Or Medicare

It often pays to delay Social Security past full retirement age, because in doing so, you get to accrue credits that boost your benefits by 8 percent a year up until age 70. Therefore, if you dont need the income from those benefits right away, you could conceivably sign up for Medicare at 65 and then wait another five years before filing for Social Security.

There are also scenarios where it might pay to get on Social Security before enrolling in Medicare. If, for example, youre still working and have access to a heavily or fully subsidized health plan through your job, you may not have a need for Medicare. On the other hand, you might want your Social Security benefits to supplement your income, pay for travel, or help put your grandkids through college.

Remember, health coverage under Medicare doesnt necessarily come cheap. Between premiums, deductibles, and coinsurance, you might find that your out-of-pocket costs are substantially lower under a group health plan, in which case it pays to stick with it as long as you can.

Whats The Retirement Age Now

Your retirement age depends on

- What year you were born

- Whether you want full benefits or reduced benefits

You may have heard that the traditional retirement age was 65. Its true that 65 was the full retirement age for many years. In fact, 65 is still the full retirement age if you were born in 1937 or before.

Don’t Miss: How Do I Get Dental And Vision Coverage With Medicare

How Does My Retirement Age Affect My Medicare Benefits

You can generally still get Medicare benefits at age 65 even if you havent reached your SSA retirement age.

You typically dont need to apply for Social Security benefits to get your Medicare coverage. Read about how to apply for Medicare.

As you plan for retirement, you may be thinking about what type of Medicare coverage you want. You can start comparing plans today just enter your zip code in the box on this page.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Whats Full Retirement Age

Full retirement age means the age at which you start receiving your full Social Security Administration retirement amount. You may receive more or less than your full retirement amount if you start receiving benefits before or after your full retirement age.

You can generally start getting SSA benefits as young as 62 years old. But youll get a reduced monthly benefit. On the other hand, you can usually decide to delay your SSA retirement benefits, and then youll get a higher amount. Heres an example. Suppose you were born in 1943.

If you start getting SSA retirement benefits at:

- 62 youll generally get less money per month. Since you were born in 1943, youll get 25% less per month.

- 66 this is your full retirement age if you were born in 1943. Youll typically get 100% of your retirement benefits.

- 70 In most cases, youll get a higher monthly benefit. If you were born in 1943, youll generally get 8% more per year than if you had started your SSA benefits at age 66.

If you delay these benefits past age 70, your benefit will not keep increasing.

Also Check: Should I Enroll In Medicare If I Have Employer Insurance

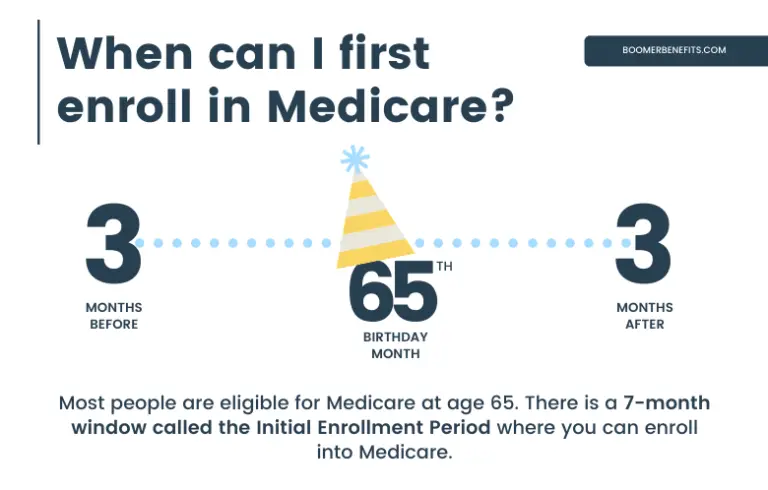

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

When Can You Take Money Out Of 401s And Iras

Your contributions to retirement plans are designed to provide income for later life. So, although you can technically access your money before you retire, this could incur penalty charges if you use it before the set minimum age. This is currently 59 ½ for 401s and IRAs. There are some exceptions you can, for example, make penalty-free 401 hardship withdrawals and take cash out of an IRA/Roth IRA with no additional charges in certain circumstances.

Don’t Miss: How To Get Replacement Medicare Id Card

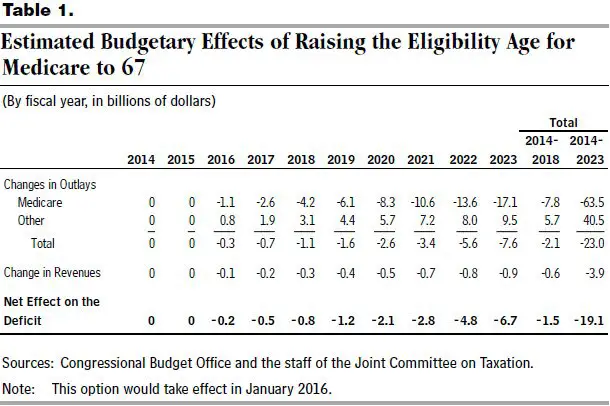

What May Happen If The Full Retirement Age Goes Up

As the full retirement age gradually increases to 67, the early eligibility age of 62 does not change, according to today’s rules.

That results in larger benefit reductions for those who claim benefits between 62 and their full retirement age, the congressional report found.

If the full retirement age was pushed higher, there could be adjustments to prevent those who claim earlier from getting even lower benefits.

For example, if the full retirement age increases to 69 from 67 and at the same time the early eligibility age remains at 62, monthly benefits claimed at that age would see an even bigger actuarial reduction from 30% to 40%, according to the report.

Meanwhile, the delayed benefit credit for waiting to claim until age 70 would drop to 8% from 24%.

One way to reduce the effect of claiming early would be to also raise the early eligibility age. But that would create difficulties for workers who are unable to work between 62 and the new age at which they would be eligible for benefits, the report said.

Raising the full retirement age on its own also comes with a host of other concerns. While life expectancies have increased and older workers’ health and job prospects generally have improved, that is not true across the board.

As a result, low-wage and less-educated workers could be put in a vulnerable spot. The change could also prompt more people to try to claim Social Security disability benefits, which would further stress the system’s solvency.

Early Retirement Comes With Challenges

There’s a reason most people continue to work until traditional retirement ages, and it isn’t because they love their jobs. Retiring early comes with serious financial challenges.

The primary challenge is ensuring that you have enough assets to provide an acceptable level of income throughout your remaining years. The average lifespan in the U.S. is just under 79 years. For someone who retires at 55, that means they need to save up at least 24 years’ worth of income. Healthier individuals who plan on living beyond the age of 79 will need to save up even more.

On the other hand, if you work until you reach age 70, your savings will only need to provide for a much shorter time frame.

You can use various retirement income calculators, including several Social Security benefits calculators, to help you create a projection. You can also use the services of a qualified financial advisorideally someone who specializes in retirement income planning.

Also Check: Does Medicare Cover Skin Removal

Applying For Disability Benefits

A person aged 65 or older isnt the only one who qualifies for Medicare. If youre eligible for Social Security Disability Insurance , youre also eligible for Medicare. However, theres a 24-month wait for benefits. That means once youve been approved for disability benefits, youll have to wait two full years to see Medicare benefits.

Once approved, youll get at least seven years and nine months of continuous Medicare health insurance as long as your qualifying disabling condition persists. You can also buy premium Medicare A, as well as Medicare B, at the same rates paid by uninsured eligible retired beneficiaries.