Small Networks Of Doctors

Medicare Advantage plans also come with much smaller networks of doctors compared to Medigap plans. Medigap will pay for all providers across the United States who accept Medicare assignment. Always check an Advantage plans provider directory before you enroll to confirm ALL your doctors are in the plans network.

Also, be aware that your doctor is free to leave the plans network at any time of the year. Unfortunately, you will still be stuck in that plan until the next Annual Enrollment Period. So, youll either need to pay 100% of your medical costs or find a new doctor in your plans network.

What Benefits Can I Expect On Medicare Advantage

Medicare Advantage covers everything that original Medicare covers. However, Advantage plans also cover hearing, vision, and dental careâwhich arenât covered under original Medicare. Depending on the plan, Medicare Advantage may also cover things like gym memberships, transportation, and adult day-care.

New to Medicare Advantage plans in 2020, non-medical needs like meal delivery, home air cleaners, and home modifications are now covered by many plans.

My Meds Are Cheap Do I Really Need A Medicare Part D Drug Plan

Editors Note: Journalist Philip Moeller, who writes widely on aging and retirement, is here to provide the answers you need. Phil is the author of the new book, Get Whats Yours for Medicare, and co-author of Get Whats Yours: The Revised Secrets to Maxing Out Your Social Security. Send your questions to Phil.

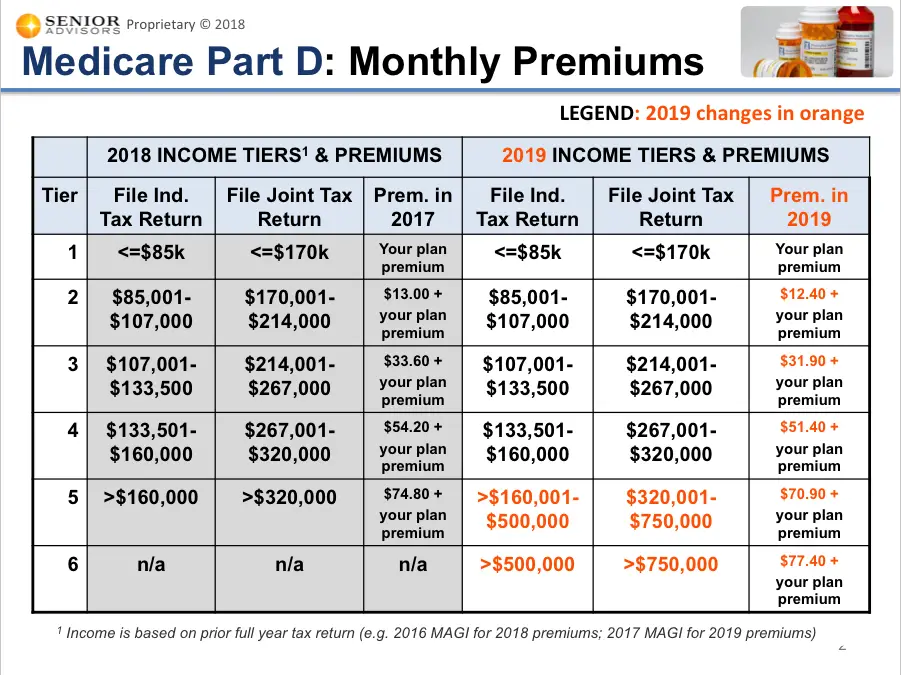

Bill: I am relatively healthy and on a $4 per month blood pressure medication. I have decided on traditional Medicare plus a Medigap letter plan N. Id also sign up for an inexpensive Part D drug plan except my income is high enough to trigger Medicares high-income surcharge. So I plan on skipping Part D. If I develop a need for hugely expensive meds, then Id immediately sign up for a 5-star rated drug plan and then pay the late-enrollment penalty. Do you see any problem with this? I am a retired physician.

Phil Moeller: This is a clever work-around, although I am not a fan of gaming the system, and I see your strategy as doing just that. The late-enrollment penalty for Part D would tack on 1 percent to your Part D premium for each month youre late in enrolling. The average Part D premium is less than $40 a month, and many plans charge less. So doing a little math, even signing up five years late would boost that hypothetical premium by 60 percent, costing you an extra $24 a month for the rest of your life.

Don’t Miss: What Is Aetna Medicare Advantage Plan

America’s Foremost Disability Expert

3 Things You Must Know About Social Security Disability Claims

Are you eligible?

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Is Cvx On Coinbase

At what age will a person normally enroll with an insurance carrier under a Part C Medicare Advantage Plan? People can enroll in Original Medicare if they are 65 years of age or older and are a citizen of the United States or have been a legal permanent resident for at least 5 years. Specific rules apply to those younger than 65 who have certain illnesses or disabilities. Read more about eligibility under the age of 65 here.

You May Like: How Do You Get Credentialed With Medicare

Is Medicare Advantage A Good Deal

Whether Medicare Advantage is a good deal depends on who you ask. Some additional coverage is better than none. If youre on a limited budget and cant afford the monthly premiums for a Medigap plan, then an Advantage plan with sufficient coverage for your health needs is a good deal.

If you need to use your benefits often, then it may not be such a good deal. Your cost-sharing will quickly add up and could easily exceed a years worth of Medigap premiums.

Should I Get A Medicare Part C Plan

Enrollment in Medicare Part C plans has been growing, largely because Advantage plans offer more benefits than standard Medicare plans. Medicare Advantage plans usually arenât the best option for low-income recipients because they can often qualify for other Medicare savings programs. Medicare Advantage also isnât generally necessary if youâre still receiving employer-sponsored coverage.

Pros of Medicare Part C

-

Provides coverage for services Original Medicare does not, like vision or dental

-

Usually offers prescription drug coverage

-

Caps out-of-pocket expenses, unlike traditional Medicare

Cons of Medicare Part C

-

Likely have to pay two premiums, one for Medicare Part B and one for your Advantage Plan

-

Many types of individual plans, each with their own rules on the coverage and costs for using out-of-network providers

-

Your network of available health care providers is smaller than with Original Medicare plans

-

Not all in-network providers are necessarily accepting new patients

-

Canât be used in conjunction with employer-sponsored health care benefits that supplement Original Medicare

Also Check: What Is Medicare Dual Complete

Does Social Security Automatically Deduct Medicare

Yes. In fact, if you are signed up for both Social Security and Medicare Part B the portion of Medicare that provides standard health insurance the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Part D included in Medicare Advantage? Most Medicare Advantage Plans include Medicare prescription drug coverage . In addition to your Part B premium, you usually pay one monthly premium for the plans medical and prescription drug coverage. Plan benefits can change from year to year.

Does Medicare cover dental?

Dental services

Medicare doesnt cover most dental care . Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is not covered by Medicare? Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.

When Can I Enroll

You should know that you dont have to enroll in Medicare Part C coverage. If youre on Medicare and you choose not to enroll in Part C, you will continue to receive your Medicare Part A and/or Part B benefits, as well as any drug coverage you may have from a stand-alone drug plan. If you do decide to enroll in Medicare Advantage, there are different enrollment periods in which you may do so. These include specific dates during the year, when you turn 65, or when you are under 65 and have a disability. Below are 4 types of enrollment periods for Medicare Advantage plans.

Recommended Reading: Can I Transfer My Medicare To Another State

Why Does Zip Code Affect Medicare

Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans will vary according to region. This is where your zip code matters in terms of Medicare eligibility.

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.

What is the most popular Medicare Advantage plan? AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Is Medicare Worth It 10 Pros And Cons Of The Health Coverage Program

ByKathryn Rosenbergpublished 16 October 20

Should you sign up for Medicare coverage? We run through the program’s benefits and limitations to help you decide.

Medicare is a federal health program that helps cover the healthcare costs for people aged 65 and over, and for younger people with an approved medical condition or disability. While that sounds straightforward at first, it gets a little more complex when you delve into the details. Original Medicare offers Part A, B and D, as covered in our guide to the best Medicare Part D plans , so you will find plenty of coverage choices.

Plan C, also referred to as Medicare Advantage, enables you to combine Plan A and Plan B alongside Plan D, but it lacks the flexibility of Original Medicare. Why? Because, when picking from among the best health insurance companies , you might be limited by where you live.

To ensure youre making the right choice for your coverage needs, here we run through Medicares pros and cons to help you decide whether its right for you.

If you’re looking for Medicare coverage, we recommend Assurance for comparing quotes based on your needs. Check them out and get a cheaper Medicare deal today.

You May Like: Can An Employer Pay For Medicare Premiums

Medicare Advantage Dental Policies

One exception to the dental exclusions under Original Medicares parts A and B is Medicare Advantage. Commonly referred to as Part C, these types of policies are offered by private insurance companies and are intended to cover all of the same basic expenses participants receive under the Original Medicare plan.

Many Medicare Advantage plans do offer dental coverage, according to Medicare.gov, though the exact benefits provided varies based on the plan chosen.

Additionally, these plans can be:

- HMOs

- PFFS Plans

- SNP

The type of plan chosen depends on what benefits youd like to receive, the cost of the plan, and any coinsurance or copayments that would apply.

Medicare Part C Basics

First, the basics. Medicare is a federal program that guarantees health insurance for people age 65 or older, people under 65 with certain disabilities, and people of any age with End-Stage Renal Disease requiring dialysis or kidney transplant.

Medicare is comprised of four distinct programs. Medicare recipients may choose to obtain their health care either through the “Original” Medicare Parts A and B or through private insurance plans, called Medicare Advantage Plans , under Medicare Part C. Medicare Part D provides prescription drug coverage.

Under Part C, Medicare Advantage Plans must offer its enrollees, at a minimum, the same Medicare-eligible health care services available to beneficiaries under Original Medicare Parts A and B. In addition, MA Plan enrollees are entitled to additional services not generally available to beneficiaries under Original Medicare without additional charge to the enrollee. This may include coverage for vision, dental, or hearing services. In exchange for receiving the additional coverage at no extra charge, the enrollee is generally required to obtain health care services from providers within the MA Plan’s network. MA Plan enrollees are covered for out-of-network care, however, when they require emergency and/or urgent care.

For those who don’t want managed care, an alternative to an MA Plan is to buy Medigap insurance to pay for services not covered by Medicare.

Don’t Miss: Does Medicare Cover Continuous Glucose Monitoring Systems

What Are The Advantages And Disadvantages Of Buying A Medicare Advantage Plan

The biggest benefit of buying a Medicare Advantage plan is the “bundling” concept. You get Part A and Part B and, in most cases, Part D, which is coverage for prescription drugs. Some plans also allow for further coverage, such as dental or vision. There are some disadvantages of Medicare Advantage Plans to keep in mind before rushing into a Medicare Advantage plan.

With Medicare Advantage, you’ll trade some of the flexibility you have when you piece together supplemental coverage, and you’ll have to live by the insurance company’s rules. So make sure you do your research and think about whether convenience and cost are more important to you than flexibility.

The Right Medicare Plan Can Save You Hundreds Of Dollars Each Month

See your options to find savings.

What You Need to KnowMedicare beneficiaries still face a coverage gap for…

Updated: December 21st, 2021ByKate Ashford×

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Our mission is to provide information that will help everyday people make better decisions about buying and keeping their health coverage. Our editorial staff is comprised of industry professionals and experts on the ACA, private health insurance markets, and government policy. Learn more about our content.

You May Like: Does Medicare Pay For Eye Exams

What About Medicare For All

Medicare for All, also known as universal or single-payer healthcare, is a concept youve heard about but might not know exactly how it works. There are different versions and proposals, but at its core, it means that nearly all Americans would have access to the type of government-funded healthcare currently provided only to those over 65 or disabled.

In some Medicare for All proposals, all Americans would be covered by the government program and private health insurance would be limited to offering only supplemental insurance for procedures not covered by the government program such as elective plastic surgery or hearing aids. Other versions maintain the private insurance industry but provide the government program as an option.

Rules For Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

Each Medicare Advantage Plan can charge different

. They can also have different rules for how you get services, like:

- Whether you need areferralto see a specialist

- If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care

These rules can change each year.

Also Check: What Is The Difference Between Medicare & Medicaid

Is Part D Worth It

For most people, the answer is yes, Medicare Part D is worth it. Although understanding the coverage gap can be a bit difficult at first, Part D is a simple and affordable plan that will be worthwhile for you to look into during your initial enrollment period.

If you want more information about Medicare Part D, reach out to a trusted insurance professional.

Pro: It Offers Several Coverage Options

Medicares customizable offerings and coverage options enable you to design a health care plan thats right for you. Medicare Advantage, known as Plan C, is sold by private insurance companies and combines Plan A and Plan B plus the additional benefits of Plan D into one easy to manage bundle.

If you stick with the Original Medicare you can complement it with a Medigap plan to protect yourself against any out-of-pocket expenses incurred while on Part A and Part B.

Read Also: Which Glucometer Is Covered By Medicare

What Else Do You Pay For When You Have Medicare Part C

When considering your Medicare expenses, there are two costs to consider in addition to your monthly premium.

Coverage for dental, vision or hearing varies. These benefits may be included in a Part C plan, which means you’d have no additional cost. You could also have to pay a fee to add this coverage or purchase a stand-alone plan.

A cheaper policy is less likely to include these benefits, and the extra costs can add up. For example, in addition to a $15 Part C plan, you could pay an extra $25 per month for dental coverage and $15 for vision, bringing your total to $55 per month. If you want these coverages, compare the total cost of a cheap policy with add-ons to a more comprehensive policy with a higher price. You may pay less overall by choosing a bundled plan that includes dental and vision coverage.

Average Medicare Part C Costs

There are some different costs associated with Medicare Part C plans. Your costs may look different depending on your coverage, plan type, and whether you receive any additional financial assistance.

Below is a small sample of Medicare Part C plan costs from major insurance providers in cities around the United States:

| Plan name |

|---|

Also Check: What Is The Monthly Charge For Medicare