Aetna Medicare Advantage Snps And Dsnps

SNP stands for Special Needs Plan and are generally limited to people with specific diseases or other characteristics. Medicare Advantage SNP plans may orient their offerings including benefits and covered prescription drugs, to specifically meet the needs of the special group they serve. An Aetna Medicare Advantage plan called DSNP is a Dual Special Needs Plan or Dual-Eligible Special Needs Plan and is generally only available to people who have both Medicare and Medicaid.

Aetnas Medicare Plans: Medicare Advantage Plan Types

Aetnas Medicare Advantage plans include a wide variety to suit different needs and preferences. Aetnas Medicare health plan options vary by location and may include all or some of the following types:

- Aetnas HMO plans: Aetnas HMO plans typically require you to use provider networks to be covered . Youll also need a referral from your primary care doctor to see a specialist.

- Aetnas HMO-POS plans: This is a hybrid of two of Aetnas Medicare Advantage plans. Aetnas HMO-POS plans work like a standard HMO in most ways. However, youre allowed to use some out-of-network providers for a higher cost, similar to a PPO.

- Aetnas PPO plans: With an Aetnas PPO plan, youll generally save money if you use network providers. However, you have the flexibility to go out of network, usually for higher copayments and coinsurance costs. You dont need a referral for specialist care.

- Aetnas SNP : Medicare Special Needs Plans target people with special health or situational needs, such as those who have chronic conditions, live in an institution, or have both Medicare and Medicaid . Aetnas Medicare Advantage plans for dual eligibles may offer specialized coordination services or provider networks to help you manage your health-care benefits.

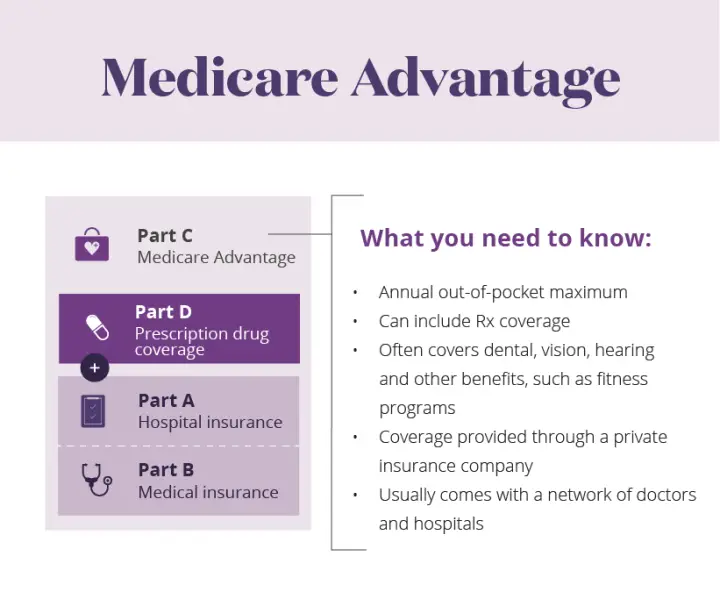

What Medicare Advantage Plans Does Aetna Have

You may have heard that Medicare Advantage plans are an alternative way to get your Medicare benefits from a private insurance company. As the name suggests, Medicare Advantage plans may have some advantages that Original Medicare doesnt have, including additional benefits and coverage. You also never have to worry that your Medicare Advantage coverage will be inferior to Original Medicare. Medicare Advantage plans are required to cover at least everything that Original Medicare covers, with the exception of hospice care, which is still covered by Medicare Part A.

You May Like: Is Balloon Sinuplasty Covered By Medicare

Benefits Summary When You Select Aetna Medicare Advantage

Table of rates.If Medicare Parts A & B are not your primary coverage , you will be responsible for the deductible and coinsurance. For coverage details on the Aetna Advantage plan without Medicare, please visit our plan brochure. Please see the Medicare Advantage plan benefits guide for coverage details on the Aetna Medicare Advantage Plan.

Aetna is the brand name used for products and services provided by one or more of the Aetna group of subsidiary companies, including Aetna Life Insurance Company and its affiliates .

Aetna Resources For LivingSM is the brand name used for products and services offered through the Aetna group of subsidiary companies . The EAP is administered by Aetna Behavioral Health, LLC. and in California for Knox-Keene plans, Health and Human Resources Center, Inc.

This is a brief description of the features of this Aetna health benefits plan. Before making a decision, please read the Plan’s applicable Federal brochure. All benefits are subject to the definitions, limitations, and exclusions set forth in the Federal brochure.

All Aetna plans include discounts on eyewear, LASIK eye surgery, gym memberships, massage therapy, acupuncture, weight-loss programs and more.

For information about our plans available through the Federal Employees Dental and Vision Insurance Program , please visit our Dental PPO Plan site or our Aetna Vision Preferred site.

Aetna Medicare Advantage Plans Review

Fact checked Reviewed by: Leron Moore, Medicare consultant –

Is Aetna Medicare Advantage Plan a good fit for you?

Aetna offers a wide range of health care plans for older adults, including Preferred Provider Organization and Health Maintenance Organization, at a competitive monthly rate.

Aetna, an award-winning health insurance company, was founded in 1853 in Hartford, Connecticut, and is a subsidiary of CVS Health Corporation. Its the third-largest health insurance provider in the nation, with approximately 22.1 million members. It offers affordable monthly premiums and low copays, and it has consistently positive customer feedback. By reviewing Aetnas available plans and assessing its benefits and drawbacks, you can determine whether Aetna is right for you.

Recommended Reading: How Many Parts Medicare Has

Reason : You Are More Likely To See A Nurse Practitioner Than A Doctor

In many cases this is true. HMO and PPO health plans use a method called capitation to pay providers. A capitated contract pays a provider in the plans network a flat fee for each patient it covers. Under a capitated contract, an HMO or managed care organization pays a fixed amount of money for its members to the health care providerA person or organization thats licensed to give health care. Doctors, nurses, and hospitals are examples of health care providers…..

For this reason, many primary care group practices use nurse practitioners and aides to reduce their costs so they can see as many patients as possible. These healthcare workers are supervised by a physician.

Competition: Aetna Vs Highmark

Highmark is the No. 2-rated Medicare Advantage plan in the J.D. Power 2021 U.S. Medicare Advantage Survey, with a score of 834 out of 1,000 compared with Aetna’s 795. Despite the appeal of signing up for the top-ranked Medicare Advantage for customer satisfaction, Highmark’s limited geographic footprint puts it at a disadvantage relative to a plan the size and scale of Aetna’s.

If you live in one of the states where Highmark operates , you might opt for the better-ranked plan. Anywhere else, though, Highmark won’t be an option.

| 4.2 |

Aetnas Medicare membership and the plans they offer are growing. Through their corporate relationship with CVS Health, they have the opportunity to create innovative programs and expand their member benefits. They offer comprehensive extra benefits and clear educational content. Their financial performance is strong, but their customer satisfaction ratings are middle-of-the-road, which could affect your experience as a member.

Recommended Reading: Does Aetna Medicare Advantage Cover Dental

Eligibility For The Initial Coverage Election Period

To sign up for a Medicare Advantage plan:

- You must have both Medicare Part A and Part B

- You must permanently reside in the service area of the plan and

- In most cases, you cant have end-stage renal diseaseEnd-Stage Renal Disease , also known as kidney failure, is a condition that causes you to need dialysis or a kidney transplant. People with ESRD are eligible for Medicare coverage regardless of age…. .

Most commonly, youre eligible for Medicare Part A and Part B:

- At age 65.

- As of your 25th month of disability benefits.

- As of the first month that you start receiving disability benefits based on amyotrophic lateral sclerosis .

If you are electing to join a Special Needs Plan, you will have other eligibility criteria. A Special Needs Plan is a special type of Medicare Advantage plan for people with certain financial or healthcare needs.

Switch Your Plan Not Your Doctor

Though you have a new plan option, chances are you may be able to continue seeing your doctors. This is because this plan is the Aetna Medicare Plan with an extended service area . This is a type of Medicare Advantage plan. With this type of plan you pay the same cost for any doctor or hospital, according to the costs listed on the plan benefits summary. The provider must be eligible to receive Medicare payment and accept the Aetna plan.

- Instructions on how to use Aetna Medicare Advantage provider search »

-

- Step 1: After clicking on Find your provider, choose 2022 Medicare plans you through your employer

- Step 2: Enter your home zip code OR city, state then select from the drop-down

- Step 3: Choose select plan to find providers

- Step 4: Choose Medicare Advantage with Prescription Drug plan

- Step 5: Under PPO section Select Aetna Medicare Plan with Extended Service Area *

- Step 6: Then choose medical and click continue to find care at the bottom right of your screen to find providers

*As a member of the Aetna Medicare Plan with an Extended Service Area , you can receive services from any provider that is eligible to receive Medicare payment and is willing to treat you. Your cost share will be the same as in-network care. Out-of-network providers are under no obligation to treat Aetna members, except in emergency situations.

Read Also: Does Medicare Pay For Eyeglasses For Diabetics

Health Maintenance Organization Point Of Service Plans

HMO-POS plans are very similar to HMO plans as they require individuals to have a primary care provider and are cost-efficient. However, they often provide greater flexibility when it comes to getting referrals for specialists or seeing providers that are out-of-network.

Note: To learn more about HMO-POS plans, visit this source. To find an Aetna HMO-POS plan near you, visit this source.

What Are Aetna Medicare Advantage Plan Options

Aetna has five major Medicare Advantage Plans, although the options available to you may vary based on your location. Of these plans, four of them are PPOs, and one is an HMO. With HMOs, youre required to choose a primary care physician and get health care services from in-network providers. Because these plans are limited in their coverage, the premiums are typically affordable. In general, PPO plans offer greater flexibility, allowing you to see out-of-network providers and specialists without obtaining referrals. These plans typically have higher premiums.

While some of Aetnas Medicare Advantage Plans have no deductible, other plans have deductibles of up to $1,000. The cost to see your primary care doctor ranges from $10 to $20, and the copay for specialists is $45 across all plans.

Compare these five Aetna Medicare Advantage Plan options:

| Aetna Medicare Advantage Plans |

|---|

|

Don’t Miss: What Does Cigna Medicare Supplement Cover

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Reason : They Make You Get A Referral

In the case of HMO plans and some PPO plans, this is true. According to the Kaiser Family Foundation, nearly all Medicare Advantage plan enrollees are in plans that require prior authorizationPrior authorization is a process used by health plans to control healthcare costs. Most HMO plans and some PPO plans require authorization before receiving certain treatments, medical services, or prescription drugs…. for some services. Health plans are in the business of making money and this is one of the primary ways they have to control costs.

By the way, Congress implemented a similar cost-saving measure with Medicare supplement insuranceMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage….. As of 1 January 2020, new Medicare beneficiaries cannot buy a Medigap plan that covers the Part B deductible. The hope is that this change will reduce unnecessary doctor visits.

Recommended Reading: Why Have I Not Received My Medicare Card

Aetna Health Maintenance Organizations

HMO Medicare Advantage is a plan where there is a network of facilities, healthcare providers, and doctors who have a partnership with the insurance company in this case, Aetna Medicare Solutions. The beneficiary typically selects a primary care physician which they work with. The PCP takes care of your healthcare issues and helps you with referrals when you need a specialist opinion, advice, or to take tests for additional healthcare.

This Medicare Advantage plan covers the cost for facilities, doctors, and hospitals within the network. However, this is not something to worry about. With over 200,000 doctors and specialists and 1900 hospitals in the Aetna network, you wont have a problem finding a primary healthcare physician in your area for your convenience. Also, the limit to healthcare providers within the network does not apply when there is an emergency, and care is urgently required. In that case, you may use a doctor or facility closest to you that may be in or outside the network.

Most of Aetnas HMO plans include fitness benefits through SilverSneakers, prescription drug coverage , dental, vision and hearing coverage and over-the-counter benefits which allows you to get OTC items at no cost. All Aetna HMO plans cover ER and urgent care coverage worldwide and there is a limit on your out-of-pocket cost for medical care annually.

Reason : Hospitalization Costs More Not Less

In many cases and with many plans, this is true.

In fact, a recent Kaiser Family Foundation study shows that half of all Medicare Advantage enrollees would incur higher costs than beneficiaries in traditional MedicareOriginal Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage. Part B is medical coverage…. for a 5-day hospital stay. Thats shocking, but given the rising cost of hospitalization, its also understandable.

This fact also underscores the need to carefully scrutinize Medicare Advantage plans annually so you are not surprised by the bills. Ambulance, emergency room, diagnostic, hospitalization, and inpatient medication copays add up very fast.

IMPORTANT: If you are getting your Medicare benefits for the first time, and you have a chronic health condition that necessitates frequent care, pay careful attention to Medicare Advantage hospitalization costs. If you can get a Medicare supplement during your Medicare supplement guaranteed-issue rights period, your hospitalization costs over time will generally be lower.

You May Like: Will Medicare Pay For An Inversion Table

Available Part D Prescription Drug Plans

While many of Aetnas Medicare Advantage plans include Part D drug coverage, the company also sells stand-alone Part D prescription drug plans. These plans, which are meant to accompany Medicare Part A and Medicare Part B, don’t provide medical coverage.

Aetna offers three stand-alone Medicare prescription drug plans in 2022, with average monthly premiums that range from $7.08 to $68.97:

-

SilverScript SmartRx: Average premium of $7.08. Offers Tier 1 generic drug coverage with a $0 deductible and $1 copays.

-

SilverScript Choice: Average premium of $30.78. Offers Tier 1/Tier 2 coverage of generic and brand-name drugs with a $0 deductible, and with $0 copays for Tier 1.

-

SilverScript Plus: Average premium of $68.97. Offers gap coverage and a $0 deductible for all tiers, plus a $0 copay for Tier 1 drugs and $2 copay for Tier 2 drugs.

Aetna offers three stand-alone Medicare prescription drug plans in 2021, with average monthly premiums that range from $7.15 to $69.52:

-

SilverScript SmartRx: Average premium of $7.15. Offers Tier 1 generic drug coverage with a $0 deductible and $0 copays. This is the lowest-cost stand-alone drug plan nationwide.

-

SilverScript Choice: Average premium of $28.49. Offers Tier 1/Tier 2 coverage of generic and brand-name drugs with a $0 deductible, and with $0 copays for Tier 1.

-

SilverScript Plus: Average premium of $69.52. Offers gap coverage and a $0 deductible for all tiers, plus a $0 copay for Tier 1 drugs and $2 copay for Tier 2 drugs.

Aetna Medicare Advantage Hmo

POS stands for point of service. With an Aetna Medicare Advantage HMO-POS plan you have more choice of providers than a traditional HMO plan. This generally means that you can see out-of-network providers but you may pay more. Like a traditional HMO, you generally must select a primary care provider.

To look for Aetna Medicare Advantage plans in your area, enter your ZIP code on this page.

Participating physicians, hospitals and other health care providers are independent contractors and are neither agents nor employees of Aetna. The availability of any particular provider cannot be guaranteed, and provider network composition is subject to change. See Evidence of Coverage for a complete description of plan benefits, exclusions, limitations and conditions of coverage. Plan features and availability may vary by service area.

Out-of-network/non- contracted providers are under no obligation to treat Aetna members, except in emergency situations. Please call Aetnas customer service number or see your Evidence of Coverage for more information, including the cost- sharing that applies to out-of-network services.

Also Check: Who Provides Medicare Advantage Plans

Join Our Medicare Advantage Quality Incentive Program

This program includes ways to promote early detection and assessment of chronic conditions. You’ll provide the care your patients need, while earning incentives. You can participate if you are a primary care physician with 50 to 749 attributed Aetna Medicare Advantage members and are not participating in another Aetna/Coventry value-based contract or program.

Cost Of Aetna Ma Plan

A variety of factors are included when considering the cost of any MA plan such as monthly premiums, deductibles, out-of-pocket costs, copayments, and coinsurance. The cost of ones Aetna Medicare Advantage plan is dependent on where one lives, which plan one chooses, and what ones specific health needs are.

In 2022, Aetna is expanding its $0-premium plans to approximately 84% of their Medicare Advantage beneficiaries. Regardless of specific Aetna plan costs, all MA plan beneficiaries are required to pay their Part B premium which is projected to be approximately $158.50 per month in 2022.

Note: To learn more about costs associated with Aetnas Medicare Part C plans, visit this source. To learn more about Aetnas plan changes in 2022, visit this source.

You May Like: Which Of The Following Is True Regarding Medicare Supplement Policies