Tips For Traveling With Medicare

If you are planning to travel to another state and have Original Medicare, look up some doctors offices, health clinics and hospitals convenient to where youll be staying and find out if they accept Medicare insurance.

If you will be traveling and you have a Medicare Advantage or Medicare Part D plan, contact your plan carrier or consult the plans directory of network providers to see where you may be able to receive coverage during your travels.

How To Change Your Address With Medicare

If you are a Medicare beneficiary and move to another state, you can change your address that’s on file with Medicare by contacting the Social Security Administration .

Here are some ways you can contact the SSA:

- Visit the SSA website and submit an address change notice through the website.

- Visit your local SSA office in person.

Your Part D Prescription Drug Plan

If you have a standalone Part D plan for prescription drug coverage, you’ll need to sign up for a new one in your new state of residence.

“The Part D benefits may be different in another state,” Roberts said. “Even if the plan has the same name, you still have to switch because those plans are state-specific.”

You get two months to do that otherwise you would need to wait until the next open enrollment and could be penalized for having no acceptable prescription drug coverage. Those penalties are 1% of the national base premium for each full month that you didn’t have coverage.

You May Like: Do I Need To Keep Medicare Summary Notices

There Are Advantages To Using Our Network Of Doctors And Hospitals In Michigan

- You’ll save money We negotiate with physicians, hospitals and pharmacies to get a discount for members of Priority Health Medicare Advantage plans.

- You’ll see excellent doctors and hospitals We track the safety and quality ratings of hospitals and primary care physicians. You’ll receive your care from some of the most respected physicians and medical facilities anywhere.

- No referrals necessary Our plans don’t require you to get a referral to see a specialist in our network.

Get Answers To Your Medicare Questions

If you want more information about where you can use your Medicare plan and how to ensure you have the coverage you need when moving or traveling to another state, speak with a licensed insurance agent who can help answer your questions.

Explore Medicare Advantage plan benefits in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Read Also: Are Medicare Supplement Plans Worth It

If Youre Transitioning Into Or Out Of Inpatient Care

If youve been hospitalized as an inpatient and move out of state after discharge, your Medicare benefits wont be disrupted.

Hospitalization and inpatient care are covered under Medicare Part A, which is part of original Medicare and required to be a part of every Medicare Advantage plan.

While you may still need to switch your Medicare Advantage plan once you move, your Medicare Part A benefits will be covered either way.

What Are The Medicare Dual Residency Requirements

You must enroll in Medicare only in the state in which you primarily reside. Your primary residence is where you live most of the time. Its where you hold your drivers license, register to vote, and file taxes.

Yet, your coverage will work as long as you visit practitioners who accept Medicare assignment. Fortunately, this list includes almost all practitioners in the United States.

Read Also: What Age Does A Person Qualify For Medicare

Are There Limitations To Medicines Received From A Pharmacy

Sometimes your doctor may need to submit additional documentation so we can process your reimbursement payment request. This can happen if you get:

- A drug that isnt on our drug list

- A drug thats subject to coverage requirements or limits

NOTE: HMO plans do not have out-of-network benefits. If you are on an HMO plan, there is no coverage for out-of-network claims. Therefore, you will be responsible for 100% of the dispensing pharmacys charges.

Can I See A Doctor In Another State With Medicare

With Original Medicare , you can see doctors anywhere in the United States, as long as they accept Medicare.

If you travel or move to another state, your Original Medicare coverage goes with you. The same is true if you move to or travel to Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa and the Northern Mariana Islands.

If you have a Medicare Supplement Insurance plan , a Medicare Advantage plan or a Medicare Part D prescription drug plan, this guide can help explain what you need to do to use your Medicare plan in another state.

Also Check: What Is Medicare Part A And B

Traveling To Another State

If youre traveling to another state and fall ill, you may be out of luck Medicaid wont cover the cost of services in a state that isnt your home state. Generally, you can only use your Medicaid coverage out-of-state if you encounter a true life-threatening emergency that requires immediate care .

That said, sometimes, pre-approved treatment at an out-of-state facility is covered by Medicaid, but only when proper authorization is obtained. Similarly, Medicaid coverage may kick in if you receive treatment in an out-of-state facility that borders yours, and in which residents of your state routinely seek care. Again, you must make sure Medicaid will cover such care before pursuing it, or you risk getting stuck with the associated bills.

Maurie Backman has been writing professionally for well over a decade, and her coverage area runs the gamut from healthcare to personal finance to career advice. Much of her writing these days revolves around retirement and its various components and challenges, including healthcare, Medicare, Social Security, and money management.

Some Medicare Advantage Plans Offer Travel Benefits

Some Medicare Advantage plans provide special coverage for travelers. These benefits may be called visitor or travel benefits, depending on the plan. Seniors who are enrolled in these plans may be able to use their coverage outside of their home state.

Visitor or travel benefits may vary between plans. Coverage may only be available in certain areas, and the plan may not cover some types of care. To learn what travel or visitor benefits their plan offers, seniors can check their Evidence of Coverage. This document provides detailed information about covered services. They can also call their plan for more details.

Eldercare Financial Assistance Locator

- Discover all of your options

- Search over 400 Programs

Recommended Reading: Does Medicare Cover New Patient Visit

Top Rated Assisted Living Communities By City

Original Medicare can be used in all 50 states, as well as in the District of Columbia, American Samoa, Guam, the Northern Mariana Islands, Puerto Rico and the Virgin Islands. The same isnt true for Medicare Advantage plans. These plans have defined service areas and may not cover out-of-state care, with the exception of emergency and urgent care situations.

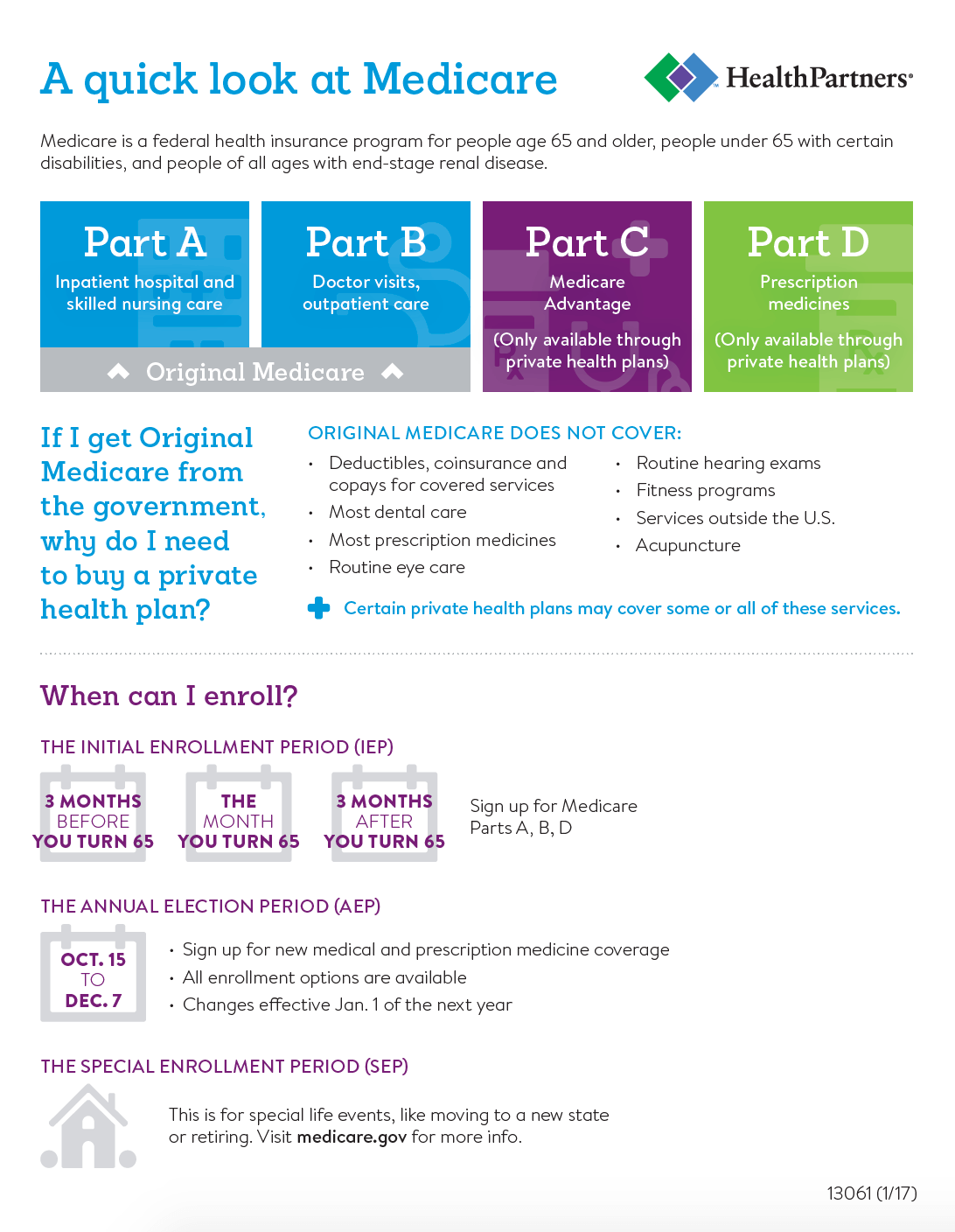

Using Medicare Advantage Or Medicare Part D In Another State

Medicare Advantage and Medicare Part D prescription drug plans are both sold by private insurance companies.

Medicare Advantage plans can come in a few different forms that can determine how the plan may be used in another state.

Two popular types of Medicare Advantage plans include:

- Health Maintenance Organization plansHealth Maintenance Organization plans feature a network of providers who participate in the plan. These networks can be local or regional, so they can span multiple states in some cases. In order to use the plans benefits, you must visit one of these participating providers. Be sure to check with your plan to ensure you can use your Medicare Advantage HMO plan in another state.

- Preferred Provider Organization plansPreferred Provider Organization plans also feature a network of participating providers, but they typically have fewer restrictions than HMO plans on which providers you may see. You may pay more to receive care outside of your Medicare Advantage PPO network.Also be sure to check with your plan provider to ensure you can use your Medicare plan in another state.

Many Medicare Part D plans may feature a network of pharmacies. Some plans include regional or national networks, while other plans may have more localized networks.

Don’t Miss: Do You Have To Pay For Part B Medicare

Traveling With Medicare Advantage Or Part D

When it comes to Medicare Advantage or Part D plans, traveling can get tricky. Unlike Original Medicare, Medicare Advantage and Part D plans can be limited by the plans service area, and if you leave it, your plan may not cover you. Some Medicare Advantage plans may offer travel coverage , but the costs could vary depending on the plans rules about in-network versus out-of-network providers.

For Medicare Advantage and Part D plans, youll want to contact your plan provider to understand your options while traveling nationally or internationally.

How To Use Original Medicare In Other States

Original Medicare consists of Medicare Part A and Medicare Part B . Original Medicare is the federally-administered portion of Medicare that is provided by the government.

Both Medicare Part A and Part B may be used in any U.S. state or U.S. territory, including Puerto Rico, Guam, the U.S. Virgin Islands, the Mariana Islands and American Samoa.

It should be noted, however, that just because you can use Original Medicare all over the U.S. doesnt mean that its necessarily accepted by every health care provider.

Each provider may have one of three arrangements with Medicare:

Don’t Miss: Which Medicare Plans Cover Silver Sneakers

Using Medicare Advantage Plans Outside Of The Us

While some Medicare Advantage plans can be used out of state, these plans usually dont provide coverage outside of the U.S. Seniors who are traveling out of the country may choose to purchase travel medical insurance.

In limited circumstances, Medicare Advantage plans provide coverage outside of the U.S. For example, if seniors are traveling between Alaska and another state and must pass through Canada, Medicare may pay for emergency care provided in a Canadian hospital. Medicare also pays for medical care seniors receive on cruise ships, provided the ship is in U.S. territorial waters.

Can You Have Medicare And Dual Residency

You can have Medicare while living in two states, but youll choose one location as your primary residence. There will be some Medicare plans that benefit you more than others when you have multiple homes.

Some retired people choose to reside in two different locations. An example is living in New York for half the year and staying in Florida for the colder half.

The last thing you want to worry about when enjoying the snowbird lifestyle is whether your health coverage is comprehensive. So, well walk you through what you need to know about Medicare while living in more than one state.

You May Like: Does Medicare Cover Ct Scans

Changing Medicare Advantage Plans When Moving

Moving is a change that qualifies you for a Special Enrollment Period. The Special Enrollment Period will allow you to change your Medicare Advantage plan, only when you are moving out of your current plans service area. So, if youre moving down the street, you likely wont qualify for a plan change.

How To Submit A Paper Claim For Prescription Medicines

To submit a paper claim, go to Humana.com/individual-and-family-support/tools/member-forms/ download the Prescription Drug Claim Form , PDF opens new window, and follow the instructions in the form.

Once complete, mail the completed form and Receipt to:

Humana Pharmacy SolutionsLexington, KY 405124140

Read Also: What Does Original Medicare Mean

Tips For Medicare Advantage And Moving To Another State

Advantage plans have doctor networks these networks may vary from county to county. Since policies vary by county, moving will likely result in a necessary plan change.

If you have a Part C plan, upon moving, you can elect to go back to Original Medicare, or you may be able to enroll in a Medigap plan. Although, if you wish to select a new Part C plan, thats an option.

The Cares Act Of 2020

On March 27, 2020, President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expanded Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19ârelated hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19ârelated services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Recommended Reading: Why Sign Up For Medicare At 65

Medigap Outside Of The Us

Medigap plans may offer coverage for medical services or supplies a person receives outside the U.S or when traveling.

If a person has a Medigap plan, their coverage may include emergency non-U.S. medical care when traveling, applicable if the medical incident occurs during the first 60 days of the trip, and if original Medicare does not cover the care.

It may also include 80 percent of costs, after a person has met the yearly deductible. The 80 percent coverage relates to some kinds of necessary emergency care provided outside the U.S.

It may be important for an individual to note that currently, Medigap non-U.S. emergency coverage has a lifetime limit of $50,000.

How To Change Medicare Supplement Insurance Plans If Youre Moving Out Of State

While you generally dont have to change your Medicare Supplement insurance coverage when you move, you may decide you want to. Also, in some cases it may be necessary. Although most states offer the same 10 Medicare Supplement insurance plans, the specific plans available in your location may vary, since insurance companies arent required to sell every plan. If youre moving to a different state, you may have other Medicare Supplement insurance plans available in your new location that werent offered previously.

Keep in mind that if youre moving to Wisconsin, Massachusetts, or Minnesota, these states offer different standardized plans than the rest of the country, and you may be interested in enrolling in one of their state-specific plans. However, its important to note that once you drop your Medicare Supplement insurance plan, you may not be able to get it back.

Read Also: Is Medicare Plan B Mandatory

Plans With Private Insurance Companies

Private insurance companies administer:

- Medicare Advantage plans

- prescription drug plans

If a private insurance company administers a persons Medicare plan, they will need to directly contact the plan provider to change their address.

Most companies provide an option for contacting them online, by phone, or by mail.

Not all plans are available by all insurers in all states or counties. Upon moving, it may be necessary for an individual to change their insurance provider, plan, or both. This could bring different benefits and rules.

Settlement Guide: How To See A Doctor In Australia

When we are sick the first point of contact is often the family doctor. Family doctors are commonly referred to as general practitioners or GPs in Australia. All Australian citizens, permanent residents and certain visa holders can access Medicare, which provides free or subsidised treatment by doctors and specialists.

General practitioners see all patients on a wide range of health issues from mental to chronic illnesses as well as for regular health checks.

Seeing a doctor requires booking an appointment in advance, although in urgent but non-life-threatening situations, a GP can usually see a patient immediately.

Melbourne-based GP and Vice President of the Australian Medical Association Dr Tony Bartone explains.

You can see a doctor without a Medicare card. However youll be expected to complete a private form or account for that treatment. If you do have a Medicare card, the Medicare card will cover a certain amount of the fees.

Not all general medical services are covered by Medicare.

Essentially any normal presentation to a general practitioner is covered by Medicares rebates. Sometimes, some services are not, services which do not fall within a health service definition, so a lot of preventative screening and a lot of other cosmetic procedures, for example, do not fall under the coverage of Medicare rebate schedule.

Some doctors accept Medicare benefit as full payment for a service.

The GP also refers the patient to specialists for further treatment.

Read Also: Will Medicare Pay For A Roho Cushion