Medicare Part C Costs

If you choose to get Medicare Part C, which is also called Medicare Advantage , you are replacing Medicare Parts A and B. Often times, MA plans also include a drug benefit, so you also replace Part D.

However, you still must pay the $148.50 monthly premium for Medicare Part B.

MA premiums vary, depending on which type of plan you choose, which area youâre in, and other similar factors. In general, MA premiums are quite low, and sometimes, theyâre even $0.â

While the monthly premium is very low or even $0, there are some things to consider before opting an MA plan. You can read about the pros and cons of Medicare Advantage here.

Other Medicare Part A Costs

Whether you pay a monthly premium for your Medicare Part A or not, there are other costs associated with Part A as well. These costs will vary depending on things like the type of facility youre admitted to and the length of your stay.

These additional out-of-pocket costs may include:

- Deductibles.Deductibles are the amount you need to pay before Part A starts covering the costs of your care.

- Copays. Copayments, or copays, are a fixed amount that you have to pay for a medical item or service.

- Coinsurance.Coinsurance fees are the percentage that you pay for services after youve met your deductible.

What Will Medicare Part B Cost In 2022

Next year, the standard Part B premium will be $170.10 a month. That’s an increase of $29.60 from 2021. It’s also a huge jump compared to recent increases.

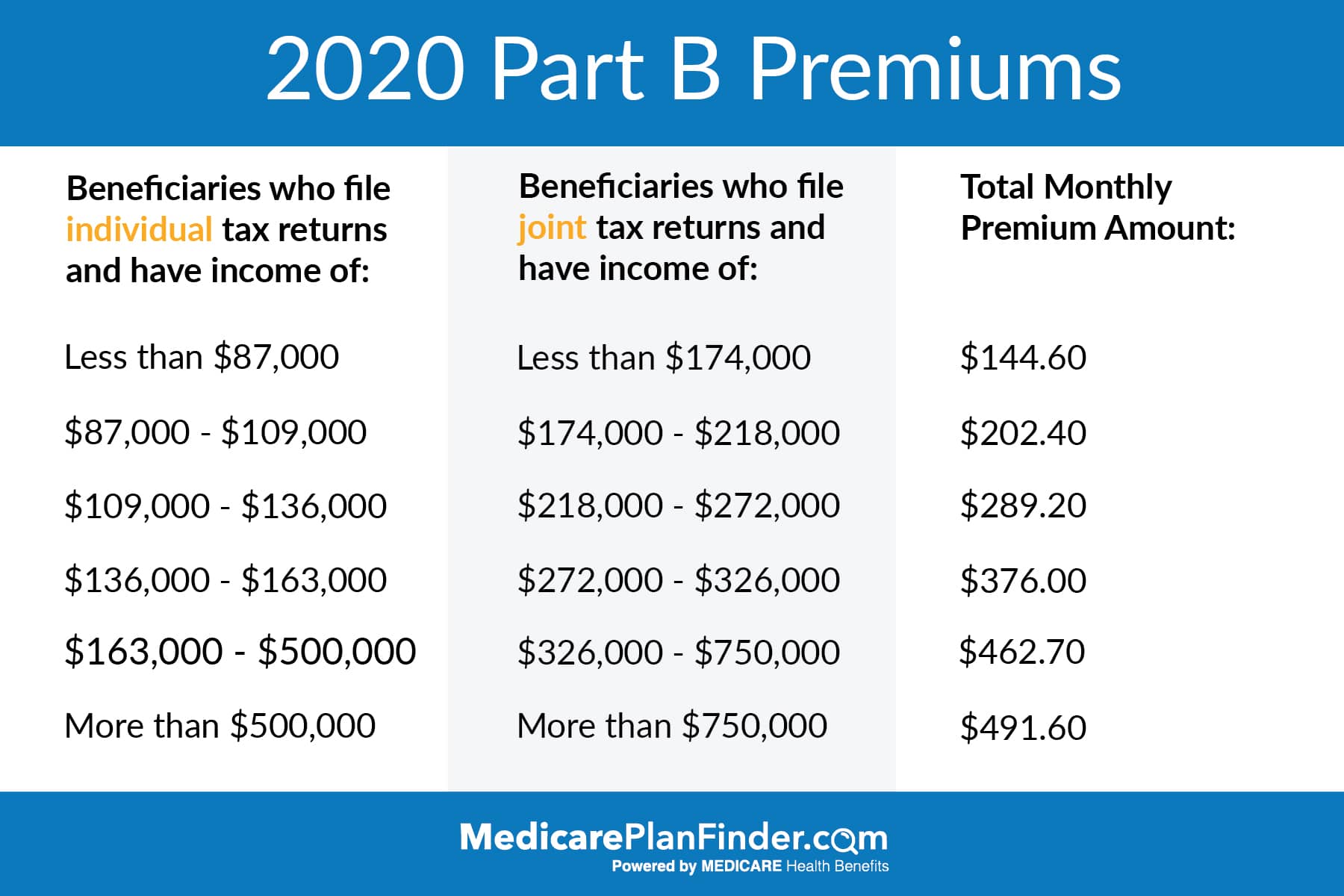

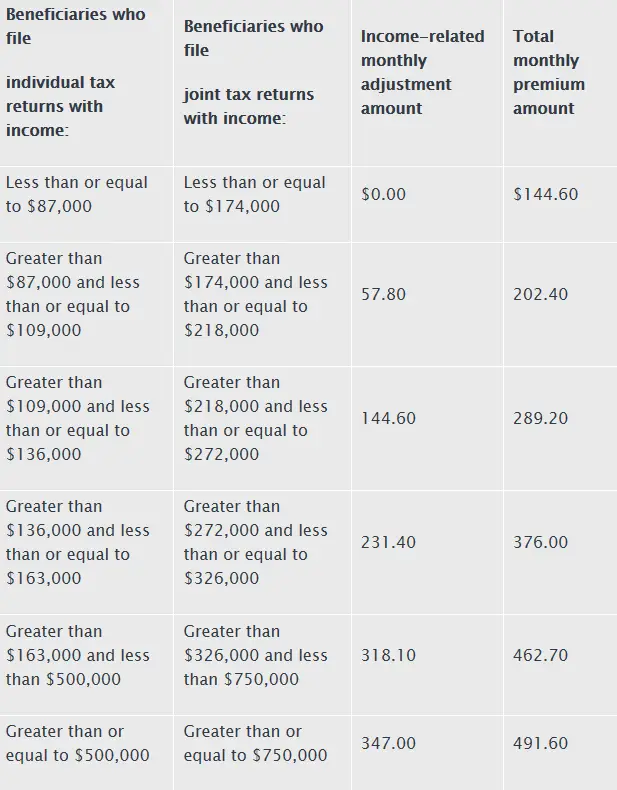

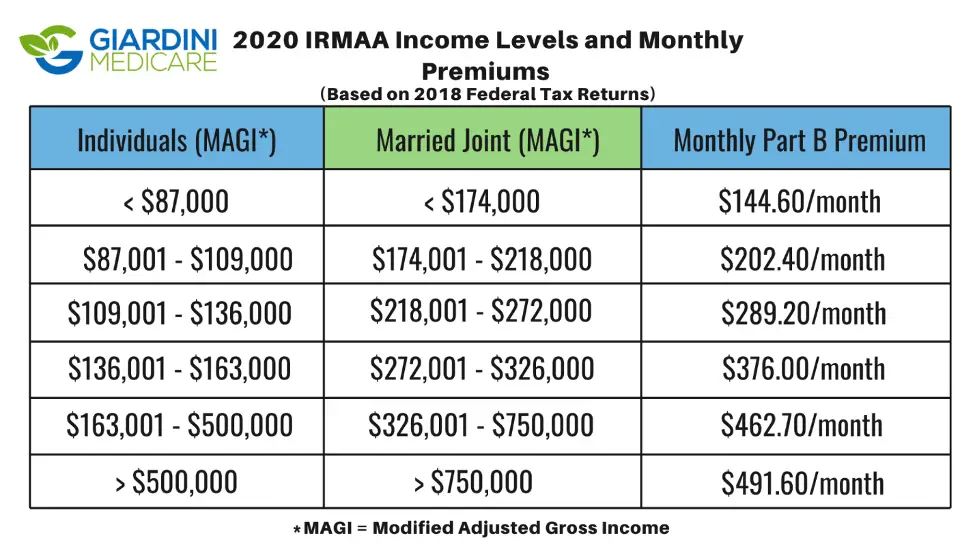

For context, in 2020, the standard Part B premium was $144.60, which represented an increase of $9.10 a month from 2019. And, as mentioned, the standard premium in 2021 was $148.50, an increase of just $3.90 a month from 2020.

Not only is this year’s Part B premium spike substantial, but it’s also well more than what the Medicare trustees estimated in their annual report released in August. Back then, they were pointing to a standard Part B premium of $158.50 a month.

It’s also worth noting that while the standard Part B premium is rising to $170.10 a month in 2022, higher earners will pay a lot more. And by “higher earners,” we’re talking about individuals with a 2020 income above $91,000 or joint tax filers with a 2020 income above $182,000.

You May Like: Will Medicare Pay For A Patient Lift

What Is Covered By Medicare Part A

Put as simply as possible, Part A is the more generic parts of what you would assume health insurance is for, so aspects relating to any time you might spend in hospital. These therefore include inpatient care in hospital, skilled nursing facility care, nursing home care, hospice care and home health care.

How Much Does The Average Medicare Supplement Plan Cost In 2020

The table below displays the average cost of Medicare Supplement Insurance Plan G and Plan F by age.1

Based on our analysis, we noted several key takeaways:

-

Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 and highest for beneficiaries at age 85 .

-

Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 and highest for beneficiaries at age 85 .

| Average Monthly Cost of Plan F | Age in Years |

|---|---|

| $235.87 |

Read Also: Where Do I File For Medicare

Plans Have Variable Benefits

Even though the same set of services is covered by Medicare Part C and Original Medicare, the level of benefits with Medicare Part C may vary.

For example, Original Medicare benefits are standardized, and youll usually pay 20% of the cost for doctor services. On the other hand, a Medicare Part C plan will have a specified copayment or coinsurance for each covered service. With one plan, a medical service could cost just $10, and if you have the same medical service with another plan, you could pay 40% of the bill.

Because of this variability, it’s important to choose a health plan that has strong coverage for your expected health needs. For example, if you expect to need a joint replacement in the upcoming year, compare plans based on their inpatient hospitalization benefits and access to physical therapy.

Plans Provide Additional Coverage

Part C plans frequently include benefits in addition to what Original Medicare offers. This can include more preventive care, auxiliary health care services and discount programs. As a part of their unified coverage, most plans also include prescription drug coverage, adding in the benefits that would normally be offered through a separate Part D plan.

| Medical service |

|---|

Cost-sharing benefits on top of Part A and B

Read Also: Is Dental Care Included In Medicare

How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $148.50 for Part B premiums in 2021. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2021 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2021 is $203.

How Much Does Medicare Advantage Cost

Medicare Advantage plans are private, Medicare-approved health insurance plans that provide Part A and Part B coverage, and may also include other types of coverage, such as vision or dental. The costs of these plans varies, depending on the benefits provided. Each plan offers different coverage and associated premiums, deductibles, and copay. Participants must also pay their Part B premium, along with the adjustment for high earners, if applicable.

Average premiums for 2022 are expected to drop to $19 a month.9

Recommended Reading: How To Change Medicare Direct Deposit

Medicare Advantage Msa: A Special Type Of $0 Premium Plan

Another type of Medicare Advantage plan thats available is the Medical Savings Account plan. This plan is different because its designed to not include Medicare Advantage premiums at all. This $0 premium is not because the insurance company is passing on savings to plan members. As with all Medicare Advantage plans, you still pay your Part B premiums when you enroll in a MSA plan.

The trade off with not having a monthly premium is that MSA plans have a high deductible. The deductible is the amount of Medicare-covered services you must pay for out-of-pocket before the plan starts paying for covered services. The money that goes into your MSA can be used to pay your deductible and other healthcare costs.

How Much Does Medicare Cost

The total cost of Medicare for you will depend on what parts and plans you select for your coverage. Costs will vary greatly depending on your work history, monthly premiums and deductibles. Below is an overview of what you could be paying on a monthly basis in premiums for Medicare coverage:

| Medicare plan | |

|---|---|

| $148.50 | |

| Part C | |

| $7$95 | |

| Medicare Supplement | $62$784 |

Premiums for Part C and D are based on an individual in New York state.

Also Check: When Do You Sign Up For Medicare

What Is Part D Coinsurance

There are four payment stages or Part D policyholders.

- Your annual deductible: For 2022, it can be up to $480 per year. You pay this entirely out of pocket.

- Initial coverage, where youll pay your share of copay or coinsurance until the total amount spent on drugs reaches $4,430.

- The coverage gap , where you pay 25% of all costs until youve paid $7,050 out of pocket.

- Catastrophic coverage: For the rest of the year, youll owe 5% coinsurance or $3.95 for generic drugs and $9.85 for brand drugs, whichever is greater.

How Much Does Medicare Part A Cost

The Medicare program is made up of several parts. Medicare Part A together with Medicare Part B make up whats referred to as original Medicare.

Part A is considered hospital insurance. It helps to cover some of your costs at various medical and healthcare facilities when youre admitted as an inpatient. Some people will be automatically enrolled in Part A when they become eligible. Others will have to sign up for it through the Social Security Administration.

Most people who have Part A wont have to pay a premium. However, there are other costs, such as deductibles, copays, and coinsurance you may have to pay if you need hospital care.

Here is what you need to know about the premiums and other costs related to Medicare Part A.

Most people who enroll in Medicare Part A will not pay a monthly premium. This is called premium-free Medicare Part A.

You are eligible for premium-free Part A if you:

- have paid Medicare taxes for 40 or more quarters during your life

- are age 65 or older and eligible for or currently collecting Social Security or Railroad Retirement Board retirement benefits

- are under age 65 and eligible to collect Social Security or RRB disability benefits

Read Also: How Do I Find My Medicare Card Number Online

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Costs You May Pay With Medicare

Medicare Part B and most Medicare Part C, Part D and Medigap plans charge monthly premiums. In some cases, you may also have to pay a premium for Part A. A premium is a fixed amount you pay for coverage to either Medicare or a private insurance company, or both.

Youll also pay a share of the cost for your care, while your Medicare or Medigap coverage will pay the rest. There are three methods of cost sharing:

- DeductibleA set amount you pay out of pocket for covered services before Medicare or your plan begins to pay.

- CopayA fixed amount you pay at the time you receive a covered service or benefit. For example, you might pay $20 when you visit the doctor or $12 when you fill a prescription.

- CoinsuranceThe amount you may be required to pay as your share for the cost of a covered service. For example, Medicare Part B pays about 80% of the cost of a covered medical service and you would pay the rest.

Don’t Miss: How Old Before You Qualify For Medicare

Learn More About Medicare Advantage Plans With Healthmarkets

With HealthMarkets FitScore®, you can search, compare, and apply for Medicare Part C plans available in your area from leading health insurance companies. You can even add prescription drugs to compare Medicare Advantage premiums for plans that include Part D coverage. After answering a few questions, youll have a personalized list of top Medicare Advantage plan recommendations available in your area. Also, well continuously compare plans and notify you if a better option for your needs comes available. Its fast, simple, and comes at no extra cost. Find a Medicare Advantage plan today!

46585-HM-1020

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or you may contact your local Social Security office to file your appeal. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services at 1-800-MEDICARE to make a correction. Social Security receives the information about your prescription drug coverage from CMS.

Don’t Miss: Does Medicare Pay For Stem Cell Knee Replacement

A Final Thought About The Cost Of Supplemental Insurance For Medicare

Enrolling in the best Medicare supplement plan for you is all about balancing risk vs. reward. The risk is those big 20 percent gaps that Medicare does not cover. The biggest being the 20 percent gap in your inpatient care in a hospital setting and a nursing facility. Plans F, G, and N cover these out-of-pocket costs completely. If your health isnt excellent, playing around with these costs can get very expensive.

If you have a chronic condition that is not prone to hospitalization or frequent visits to a specialist, and you need to save some money, then you should explore cost-saving options with your insurance agent. Plan N does not cover Excess Charges, like Plan G, but it costs a lot less. Also, dont forget that Medicare covers your annual preventive care visits.

The reward in choosing the best Medigap plan for you is that you get to keep a little more money in your pocket. But, please consider this simple advice. Is saving a few dollars now worth the potential risk of being denied a plan with more coverage later? You see, unlike Medicare Advantage plans, which cant turn you down, Medigap insurance carriers can. If you dont pass their medical underwriting process, they will not issue you a policy.

Get the most coverage you can without being wasteful.

If you qualify for Medicare and don’t know where to start

Rittenhouse’s Mother Gives Eyebrow

The federal government announced a large hike in Medicare premiums Friday night, blaming the pandemic but also what it called uncertainty over how much it may have to be forced to pay for a pricey and controversial new Alzheimer’s drug.

Recommended Reading: What Does Medicare Part B Include

Medicare Part D Costs

For a Medicare Part D plan, also called a Prescription Drug Plan , the monthly cost varies depending on the prescriptions you take.

The average monthly premium for a Medicare Part D plan is around $30 per month in 2021.

If you do take medications, youâll have other costs, like a deductible, copays, and coinsurance.

We recommend you follow our Medicare Part D Cheat Sheet to determine your actual drug plan costs. You can do this directly on Medicare.gov.

Watch A Video To Learn More About Medicare Costs

NOTE: Video does not contain audio

Video transcript

An animated white speech bubble appears over an animated character’s yellow and blue head.ON SCREEN TEXT: What are the costs you could pay with Medicare?

The speech bubble and character fall away. Blue text appears surrounded by animated dollar signs on a light blue background.

ON SCREEN TEXT: There are four kinds of costs you may pay with all Medicare plans.

The text and dollar signs fall away. Darker blue text appears surrounded by animated calendars on a light blue background.

ON SCREEN TEXT: 1 Premiums A fixed amount you pay to Medicare, a private insurance company, or both. Premiums are usually charged monthly and can change each year.

ON SCREEN TEXT: January June February April May

The text and calendars fall away. Darker blue text appears above an animated piggybank graphic on a light blue background.

ON SCREEN TEXT: 2 Deductibles A set amount you pay out of pocket for covered health services before your plan begins to pay.

The text and piggybank fall away. Darker blue text appears surrounded by animated green and white circles on a light blue background.

ON SCREEN TEXT: 3 Co-payments A fixed amount you pay when you receive a service covered by Medicare. Your plan pays the remaining amount.

The text and circles fall away. A white and green circle splits in two, the white half falling to the left and the green to the right. Darker blue text emerges in the center of the screen on a light blue background.

You May Like: Is It Medicaid Or Medicare

Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

How Much Coverage Can I Get With A Medigap Plan

Now that weve talked about the need for supplemental insurance, lets discuss how Medigap plan coverage works. As its name implies, Medigap covers the gaps in Original Medicare. These gaps include deductibles, copayments, coinsurance, blood, and foreign travel. Medigap covers these gaps through 10 different plans. Each plan is standardized and given a letter code . This makes Medigap super easy. Simply pick the plan with the outpatient, inpatient, nursing facility, and travel coverage you want and go shopping here or on Medicare.gov to find an insurer in your area that offers the plan.

The plan with the most coverage is Medicare Plan F. This plan offers full coverage on all of the gaps in Medicare. So, if you have a Plan F policy, and the health services you use are all Medicare-approved, you pay nothing out of pocket. However, be aware that this plan is only available to people who turned age 65 before 1 January 2020. The same is true with Plan C , also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare ….).

Recommended Reading: Who Pays The Premium For Medicare Advantage Plans