Am I Eligible For Medicare Part B

Anyone who is eligible for premium-free Medicare Part A is eligible for Medicare Part B by enrolling and paying a monthly premium. If you are not eligible for premium-free Medicare Part A, you can qualify for Medicare Part B by meeting the following requirements:

- You must be 65 years or older.

- You must be a U.S. citizen, or a permanent resident lawfully residing in the U.S for at least five continuous years.

You may also qualify for automatic Medicare Part B enrollment through disability. If you are under 65 and receiving Social Security or Railroad Retirement Board disability benefits, you will automatically be enrolled in Medicare Part A and Part B after 24 months of disability benefits. You may also be eligible for Medicare Part B enrollment before 65 if you have end-stage renal disease or amyotrophic lateral sclerosis .

How Much Will A Medicare Plan Cost

If you choose a Medigap plan you will pay anywhere between $85-$150 per month, depending on where you live. This will provide you with nearly 100% coverage, protecting you against the high medical costs that come with just having Original Medicare and no plan.

If you choose a Medicare Advantage plan, expect a range between $0 $100 per month and these plans often include prescription coverage . Most plans are less than $50 per month and are often $0 premium.

Before you choose a plan it is important to compare rates. Contact us at for a no-obligation plan comparison. We offer both Medicare Advantage, Medicare Supplement plans and Part D plans.

The Daily Journal Of The United States Government

Legal Status

This site displays a prototype of a Web 2.0 version of the daily Federal Register. It is not an official legal edition of the Federal Register, and does not replace the official print version or the official electronic version on GPOs govinfo.gov.

The documents posted on this site are XML renditions of published Federal Register documents. Each document posted on the site includes a link to the corresponding official PDF file on govinfo.gov. This prototype edition of the daily Federal Register on FederalRegister.gov will remain an unofficial informational resource until the Administrative Committee of the Federal Register issues a regulation granting it official legal status. For complete information about, and access to, our official publications and services, go to About the Federal Register on NARA’s archives.gov.

Legal Status

You May Like: Does Medicare Cover Varicose Vein Treatment

How Much Does Part B Cost

The Social Security Act sets out the Medicare premiums, deductibles, and copays each year.

An individualâs income determines what they will pay for their Medicare Part B monthly premium. For individuals with an income below $88,000, the standard premium is $148.50 in 2021, with an annual deductible of $203.

According to the Centers for Medicare and Medicaid Services, about 7% of Medicare Part B beneficiaries will pay a higher income adjusted premium.

Other Medicare Charges Also Rising

The annual Part B deductible will rise $30 next year to $233, up from this year’s $203.

For Medicare Part A, which covers hospitalization and some nursing home and home health care services, the inpatient deductible that patients must pay for each hospital admission will increase by $72 in 2022 to $1,556, up from $1,484 this year. Almost all Medicare beneficiaries pay no Part A premium. Only people who have not worked long enough to pay their share of Medicare taxes are liable for Part A premiums.

Open enrollment for Medicare began Oct. 15 and continues through Dec. 7. During this period, beneficiaries can review their coverage and decide whether to make changes.

Dena Bunis covers Medicare, health care, health policy and Congress. She also writes the Medicare Made Easy column for the AARP Bulletin. An award-winning journalist, Bunis spent decades working for metropolitan daily newspapers, including as Washington bureau chief for the Orange County Register and as a health policy and workplace writer for Newsday.

Editor’s note: This story has been updated to include additional information.

More on Medicare

Recommended Reading: How To Opt Back Into Medicare

A Notice Of Medicare Part B Monthly Actuarial Rates Monthly Premium Rates And Annual Deductible

The Medicare Part B monthly actuarial rates applicable for 2021 are $291.00 for enrollees age 65 and over and $349.90 for disabled enrollees under age 65. In section II.B. of this notice, we present the actuarial assumptions and bases from which these rates are derived. The Part B standard monthly premium rate for all enrollees for 2021 is $148.50.

The following are the 2021 Part B monthly premium rates to be paid by beneficiaries who file either individual tax returns , or joint tax returns.

| Beneficiaries who file individual tax returns with income: | Beneficiaries who file joint tax returns with income: | Income- related monthly adjustment amount | Total monthly premium amount |

|---|

2. Monthly Actuarial Rate for Enrollees Age 65 and Older

The monthly actuarial rate for enrollees age 65 and older is one-half of the sum of monthly amounts for the projected cost of benefits and administrative expenses for each enrollee age 65 and older, after adjustments to this sum to allow for interest earnings on assets in the trust fund and an adequate contingency margin. The contingency margin is an amount appropriate to provide for possible variation between actual and projected costs and to amortize any surplus assets or unfunded liabilities.

3. Monthly Actuarial Rate for Disabled Enrollees

4. Sensitivity Testing

5. Premium Rates and Deductible

| Greater than or equal to $412,000 | 356.40 | 504.90 |

Medicare Part B And Coinsurance/copayments

You usually pay a 20% coinsurance amount for covered services. If your doctor or health care provider accepts assignment for a covered service, you would pay the Part B deductible along with 20% of the Medicare-approved amount for services rendered. Accepting assignment means that your doctor will not charge you more than the Medicare-approved amount for the covered service. You would still be responsible for cost-sharing.

Don’t Miss: Why Choose Medicare Advantage Over Medigap

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

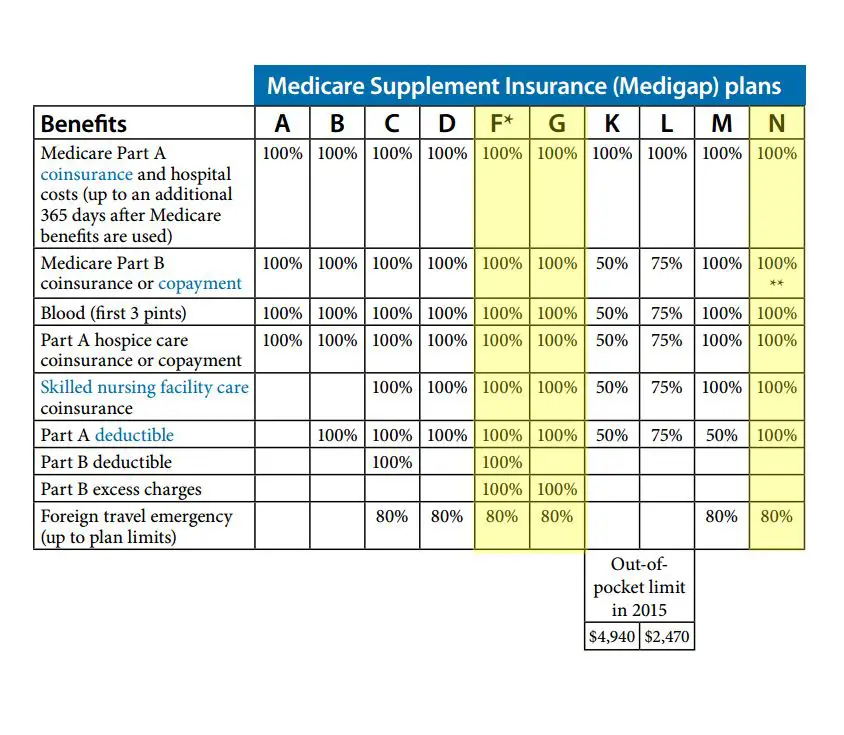

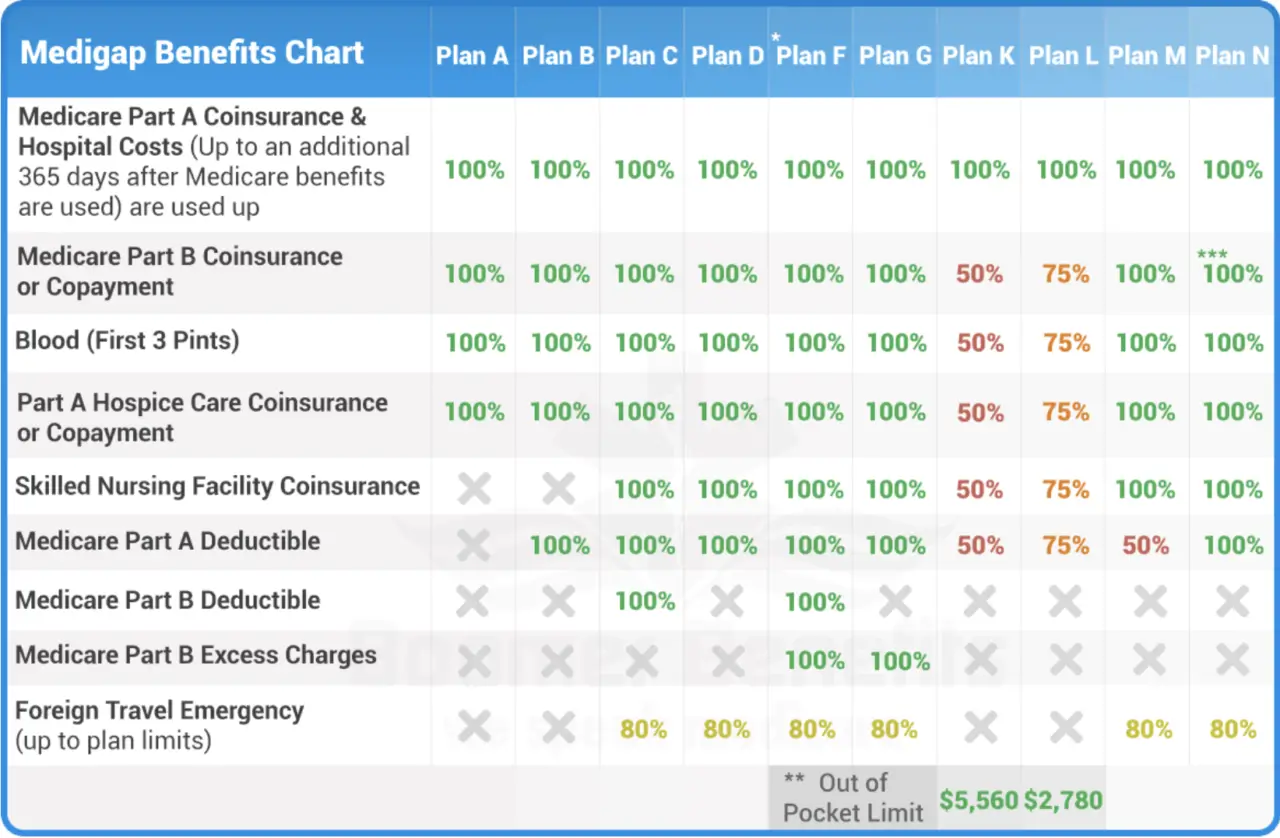

What Is The Average Cost Of Medicare Supplement Insurance

The average premium paid for a Medicare Supplement Insurance plan in 2019 was $125.93 per month.3

Its important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medicare Supplement Insurance plans help pay for some of the out-of-pocket expenses youll face when you use Medicare Part A and Part B benefits. Medigap plans are sold by private insurance companies.

These costs can include certain Medicare deductibles, coinsurance, copayments and other charges.

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover.

Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

| 80% | 80% |

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Don’t Miss: Who Is Eligible For Medicare In Georgia

What Are The Different Types Of Medicare

There are four types of Medicare: A, B, C, and D. Part A covers payments for treatment in a medical facility. Part B covers medical services including doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatments. Part C, also known as Medicare Advantage, seeks to cover any coverage gaps. Part D covers prescription drug benefits.

The Cares Act Of 2020

On March 27, 2020, President Trump signed into law a $2 trillion coronavirus emergency stimulus package called the CARES Act. It expands Medicares ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover tele-health services.

- Increases Medicare payments for COVID-19related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Don’t Miss: Are Medical Alert Systems Covered By Medicare

Medicare Part C: Medicare Advantage

Also known as Medicare Advantage, Part C is an alternative to traditional Medicare coverage. Coverage normally includes all of Parts A and B, a prescription drug plan , and, depending on your choice of a Medicare Advantage plan, other possible benefits.

Part C is administered by Medicare-approved private insurance companies that collect your Medicare payment from the federal government.

Depending on the plan, you may or may not need to pay an additional premium for Part C. You still need to pay your Medicare Part B premium. You don’t have to enroll in a Medicare Advantage plan, but for many people, these plans can be a better deal than paying separately for Parts A, B, and D. Beneficiaries will still pay separate premiums if they don’t choose to have the Part “C/D” premium taken out of their Social Security check.

If you’ve been pleased by the coverage of a Health Maintenance Organization , you might find similar services using a Medicare Advantage plan.

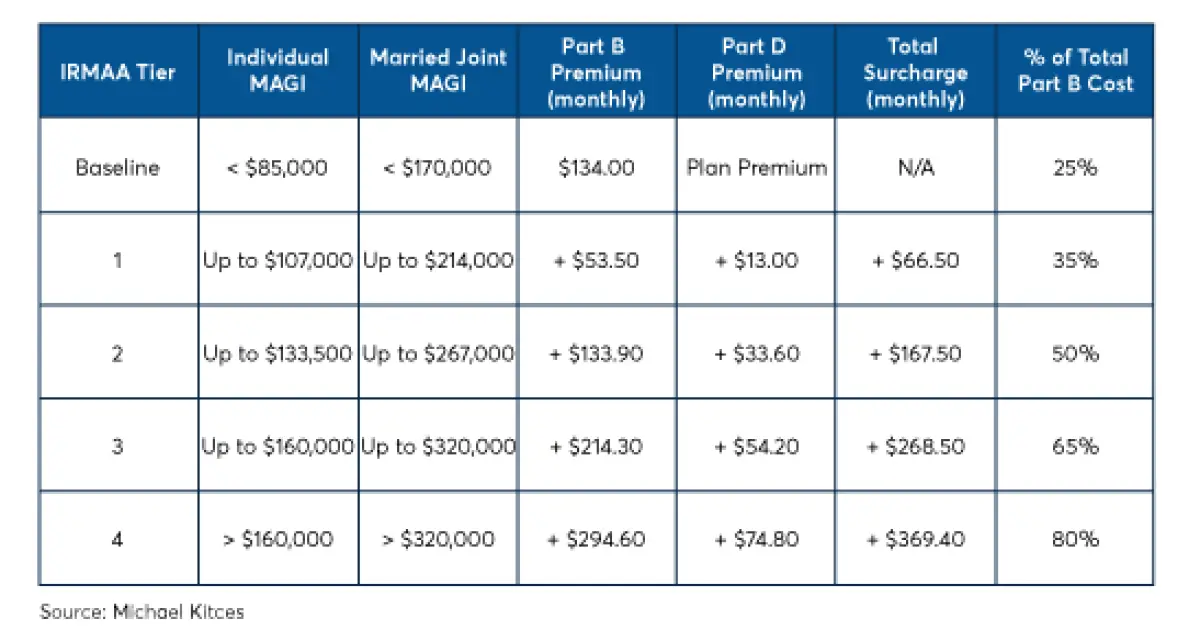

What Is The Monthly Premium For Medicare Part B

The standard Medicare Part B premium for medical insurance in 2021 is $148.50.Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits. Social Security will send a letter to all people who collect Social Security benefits that states each persons exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most. Depending on their income, these higher-income beneficiaries will pay premiums that amount to 35, 50, 65, or 80 percent of the total cost of coverage. You can get details at Medicare.gov or by calling 1-800-MEDICARE .

More Information

Recommended Reading: Does Medicare Cover Hiv Medication

Why Are Some Medicare Advantage Plans Free

Some MA plans charge no premium, and may even pay for part or all of your Part B premium, also called the Medicare Part B premium reduction. The way plans can do this comes down to how much it costs them to provide services, and to a lesser extent, the plans star rating. But its not entirely up to the individual planthe process is highly regulated.

Every year, Medicare Advantage plans determine how much it will cost to provide care for their members. They submit this amount, or bid, to the Centers for Medicare and Medicaid Services , which then reviews the bid against a benchmark. This benchmark is calculated based on average Medicare spending per beneficiary for a specific region or area. If the plans bid falls below the benchmark, the plan is not allowed to charge a premium.

These plans also receive a rebate from the CMS. Its value is determined by how much lower the plans bid is relative to the benchmark, and by the star-rating that plan hasMA plans with a higher star rating get a bigger rebate. MA plans can then use rebate dollars to further reduce member costs. In addition to providing premium-free MA plans, helping to pay for Part B premiums is one way to reduce member costs.

Another way MA plans can reduce costs, and thereby their bid, is by contracting with in-network providers to provide discounted services to members.

How Do I Qualify For The Part B Premium Giveback Benefit

You may qualify for a premium reduction if you:

- Are enrolled in Medicare Part A and Part B

- Do not already receive government or other assistance for your Part B premium

- Live in the zip code service area of a plan that offers this program

- Enroll in an MA plan that provides a giveback benefit

This means anyone with Medicaid or other forms of assistance that pay the Part B premium cannot enroll in one of these Medicare Advantage plans.

You May Like: When Does Medicare Part D Start

Does My Health Play Any Role In My Costs

No. If youre enrolled in Original Medicare , your health wont play a role in how much you pay for your Medicare coverage. Part A is determined by how long you paid Medicare taxes. For Part B, all enrollees pay the same deductible while premiums are calculated using income and whether you signed up on time.

Medicare Program Medicare Part B Monthly Actuarial Rates Premium Rates And Annual Deductible Beginning January 1 2021

A Notice by the Centers for Medicare & Medicaid Services on

Document Details

Information about this document as published in the Federal Register.

- Printed version:

- The premium and related amounts announced in this notice are effective on January 1, 2021.

- Effective Date:

Document Details

Document Statistics

- Page views:

- as of 12/27/2021 at 4:15 am EST

Document Statistics

Enhanced Content

Relevant information about this document from Regulations.gov provides additional context. This information is not part of the official Federal Register document.

- Docket Number:

- Medicare Part B Monthly Actuarial Rates, Premium Rates, and Annual Deductible Beginning January 1, 2021

- Docket RIN

Enhanced Content

This document has been published in the Federal Register. Use the PDF linked in the document sidebar for the official electronic format.

-

Enhanced Content – Table of Contents

This table of contents is a navigational tool, processed from the headings within the legal text of Federal Register documents. This repetition of headings to form internal navigation links has no substantive legal effect.

Enhanced Content – Table of Contents

Enhanced Content – Submit Public Comment

Enhanced Content – Submit Public Comment

Enhanced Content – Read Public Comments

Enhanced Content – Read Public Comments

Enhanced Content – Sharing

Enhanced Content – Document Print View

Enhanced Content – Developer Tools

You May Like: Do Medicare Advantage Plans Have Dental Coverage

Is Medigap Plan B And Medicare Part B The Same

You may have heard of Part B, its common to get these two confused however, simplifying the information can help. Medicare has a way of making things as clear as mud. Part B and Plan B are two separate things.

Plan B is a Medicare Supplement policy that helps beneficiaries with healthcare costs. Youll use the word plan when referring to a Medigap plan.

- Was this article helpful ?

What Is The Part B Premium Reduction Benefit

When you’re enrolled in Medicare Part B, you must pay a monthly premium of $170.10. The giveback benefit, or Part B premium reduction, is when the Part C Medicare Advantage plan reduces the amount you pay toward that premium. Your reduction could range from less than $1 to the full premium amount.

Even though you’re paying less for the monthly premium, you don’t technically get money back. Instead, you just pay the reduced amount and are saving the amount you’d normally pay.

If your premium comes out of your Social Security check, your payment will reflect the lower amount. If you don’t pay that way, the giveback benefit would be credited to your monthly statement. Instead of paying the full $148.50, you’d only pay the amount with the giveback benefit included.

For example, if you typically pay $170.10 per month but your MA plan’s giveback benefit is $50, you don’t get $50 back each month. Instead, you’d only pay $120.10 per month, keeping that $50 in your wallet. If your plan offers a full $170.10 refund, you wouldn’t have a Part B monthly premium to pay.

Recommended Reading: What Is The Best Medicare Advantage Plan In Washington State

Using Medigap To Pay Medicare Deductibles

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles.

These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia. There are different standardized plans for Minnesota, Massachusetts and Wisconsin.

Each plan has a letter for a name. Some of these plans may cover all or a portion of your Part A deductible.

Medigap Plan Coverage of Part A Deductibles

| A |

|---|

Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.com’s The Best States for Medicare report.

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Also Check: What Does Medicare Part A And B Not Cover