What Is Thedifferencebetween A Medicare Advantage Plan And A Medigap Plan

You will notice that the first bullet point says that Medicare Advantage plans are not a kind of Medigap plan. This can be confusing since both are a way to handle the lack of coverage that Medicare Parts A and B come with. Luckily, the difference isnt as hard as it may seem. To put it simply, Medicare Advantage plans are another way to get traditional Medicare . On the other hand, Medigap works with your traditional Medicare coverage. There are plenty more differences when it comes to the benefits, costs, and how they work but this is just the basic difference.

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

Medicare Advantage Vs Medicare Supplement

Medicare supplementplans help a person cover some of the healthcare expenses that traditionalMedicare does not include. Some people also refer to these plans as Medigap.

As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

Plans in Wisconsin, Minnesota, and Massachusetts are also different from the traditional Medigap plans.

Medicare supplementplans can help cover several costs, including:

- copayments for parts A and B

- up to 3 pints of donated blood

- coinsurance for skilled nursing facilities

- yearly out-of-pocket expenses

Peoplewith concerns about steep out-of-pocket expenses may choose a Medigap plan. Asa general rule, a person cannot have a Medicare Advantage plan and a Medigap plan at the same time.

You May Like: What Age Can You Start To Collect Medicare

Original Medicare Vs Medicare Advantage: How To Choose

Choosing between Original Medicare and Medicare Advantage is tough. Find out how they compare.

Everyday Health may earn a portion of revenue from purchases of featured products.

Your decision regarding Medicare plans will make all the difference in how you get your healthcare and how much youll pay for it.

The year you turn 65 is marked by a big decision. This is the year that youll need to enroll in one of many Medicare options.

The two main ways to get coverage are through Original Medicare and Medicare Advantage . Since your choice will affect what doctors you are approved to see, what services you receive, and how much youll pay, theres a lot on the line.

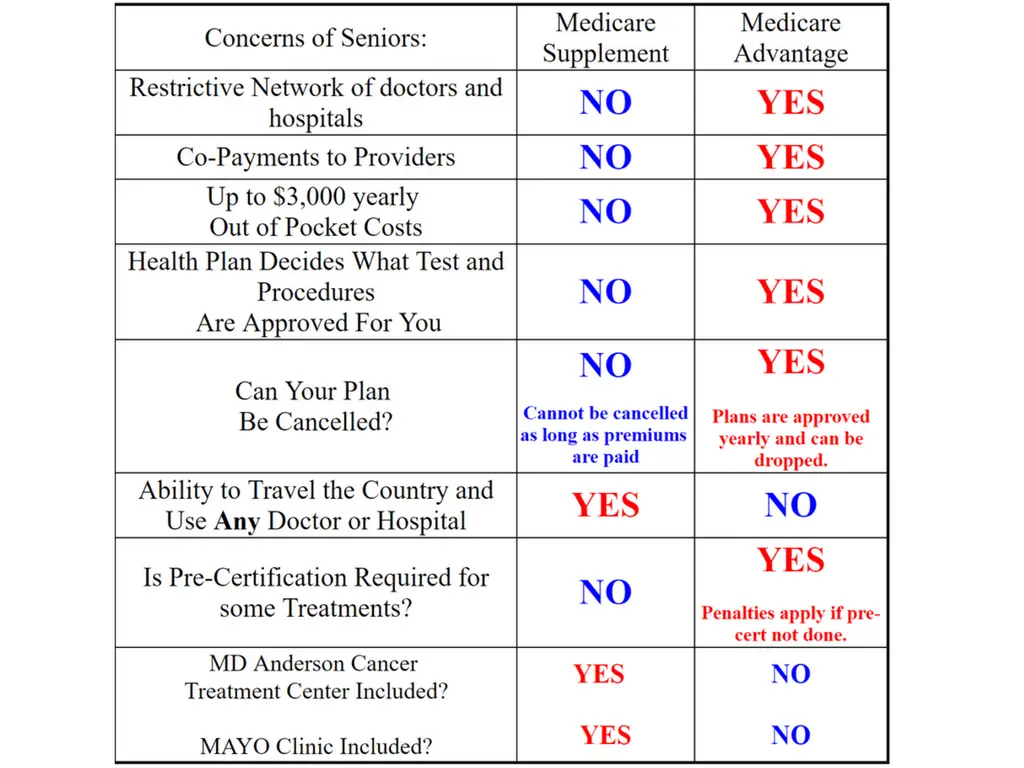

Reasons To Choose Medigap Plan G Vs Medicare Advantage Plan

Why Choose a Medicare

Medicare Choices at Age 65: Why a Medicare Supplement Plan G is often the best option. Strong financial pressures exist for most private health insurance companies to initially direct new enrollees to a Medicare Advantage plan. A Medicare Supplement Plan G is a much better choice for many. .

Five Freedoms of a Medicare Supplement Plan G

FREEDOM 1: With a Medicare Supplement Plan G , one can see any doctor that accepts Medicare. With a Medicare Advantage plan, one can usually only see a provider who is on the approved list of doctors for the HMO or PPO.

FREEDOM 2: With a Medicare Supplement Plan G, one can go to any of the vast number of hospitals or facilities that accept Medicare. With a Medicare Advantage plan, one can only go to a hospital or facility on the HMO or PPO list.

FREEDOM 3: With a Medicare Supplement Plan G, no specialist referral is needed. One can go directly to see a specialist without a referral. With a Medicare Advantage HMO plan, a referral is usually required before seeing a medical specialist.

FREEDOM 4: Freedom from many of the payment hassles of constant copays and out-of-pocket expenses that are part of Medicare Advantage plans.With a standardMedicare Supplement Plan G, there is asmall deductible per year and $203 is the total out-of-pocket cost for the entire year.

2.High Deductible Plan G vs. standard Plan G

* Medical Supplement deductibles are indexed to inflation and the deductible increases with inflation each year.

Recommended Reading: Should I Enroll In Medicare If I Have Employer Insurance

All Medicare Plans Include

Regardless of what plan you get if you are enrolled in Medicare then you are entitled to some basic benefits:

- Medical services to diagnose and treat diseases, illnesses, and injuries

- Necessary medical equipment or devices indicated by a doctor such as wheelchairs, walkers, oxygen, and prosthetic devices.

- Preventative care includes routine physical exams, screening tests, and most vaccines and immunizations

*Medicare does not cover prescription drugs, routine, vision, dental, or hearing care or pay for long-term care.

You can add Medicare Part D which is a private insurance plan that covers prescription drugs to original Medicare. It may include an annual monthly fee .

âYou canât beat the price and rich benefits offered by Medicare Advantage plans. They are typically offered at zero monthly premium and very little out-of-pocket cost for the member. Most Medicare Advantage programs cover prescription drugs, hearing vision, dental, and often offer fitness options in addition to the traditional health benefits provided by Medicare Parts A or B.,â said Jim.

Should You Choose Medicare Advantage Or Use Medigap To Supplement Your Original Medicare Plan

Thats the big question most people have when deciding what health coverage is best. The correct answer, for most people, comes down to cost and what they can afford. To explain costs, we first need to answer the question, what is Original Medicare?

Original Medicare coverage has two parts. Medicare Part A offers hospital coverage. Medicare Part B is medical coverage. When you have Medicare Parts A and B, Medicare pays about 80 percent of your major medical costs and you pay the remainder out-of-pocket. To cover some or all of the 20 percent gap, you can buy a Medigap plan.

If you dont have Medicaid or Medicare retiree benefits from an employer, Medicare Advantage can be an expensive option. This is particularly true if you have one or more chronic health conditions that require regular care. Private insurance companies are in the business to make money, and they do so by charging you a deductible or copay when you use a service.

If you are a super healthy senior, and you rarely see your doctor for anything more than your annual wellness exam, Medicare Advantage is an excellent medical insurance option. Healthy seniors save through low monthly premiums and minimal copayments. Plus, most plans include additional benefits, including dental care and a prescription drug plan .

Recommended Reading: Which Medicare Plans Cover Silver Sneakers

How To Decide Between Medicare And Medicare Advantage

ââJim Pittman

Director of Medicare Advantage Communications – Ochsner Health Plan and Liz Miller Communication Manager GetSetUp

Deciding between Medicare and Medicare Advantage does not have a one size fits all kind of answer. There are a lot of factors that go into these decisions. For more extensive research customized to your needs, we suggest you go to Medicare.gov where you can read about each plan in-depth and compare the benefits of plans specific to your area. All you have to do is put in your zip code and then find the plans that are available where you live and you can compare the benefits side by side.

Jim Pittman the Director of Medicare Advantage Communications – Ochsner Health Plan has worked in health and managed care for over 30 years and says that medicare choices are unique to each individual.

âSometimes plans might offer richer benefits in one local area and not be available in other regions. While the total cost for care might still be $0, you want to make sure you get a plan that offers a network of providers that you are confident can handle your care and covers your prescription medications and all of your health and wellness needs.â said Jim.

Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

Read Also: What Is Medicare Part G

Medicare Vs Medicare Advantage: Differences

Both Medicare and Medicare Advantage will fund most basic health costs, including doctor’s visits and hospital stays. The specific cost of each plan, as well as the out-of-pocket copays and other costs, vary. Some key differences between the two programs include:

- Original Medicare includes Medicare Part A and Part B only. People who want prescription drug coverage must purchase a Medicare Part D plan. Medicare Advantage often includes Part D, and may offer coverage for services original Medicare will not cover.

- You can use original Medicare at any doctor or hospital that accepts the program. Medicare Advantage programs may limit you to specific in-network providers.

- Out-of-pocket costs with Medicare Advantage plans are usually lower.

- The government sets prices for various services offered under original Medicare plans. With a Medicare Advantage plan, you may pay a different rate based on the rate negotiated by the insurer. This rate may be higher or lower than the original Medicare rate.

Which Is Better Original Medicare Or Medicare Advantage

There is no solid answer to this question. The best medicare plan is a personal decision based on each individualâs needs and the options that might be available to them. Sometimes the best plan for you might not meet the needs of your spouse, friends, or family. Thatâs why it is important to research, compare benefit options, cost and networkâ and consider key factors such as :

- Your work history and thus qualifications for Medicare benefits

- Your tax deductibles that can be applied to Medicare

- Your health

- Your living and traveling requirements

- The healthcare providers in each planâs network

- If you want your health care to focus on problems and/or prevention

Regardless there is good news you can change your plan annually during enrollment from Oct. 15- Dec. 7 so if your life circumstances change, you move, or you have better options available there is time to update!

Also Check: Does Medicare Cover Bed Rails

Enrolling In Medicare Advantage

Seniors who enroll in Part A and B Medicare are eligible to choose a Medicare Advantage plan during one of the offered enrollment periods. The Initial Enrollment Period includes your 65th birth month and the three months before and after, adding up to seven months in total. If you decline Part B coverage during this time, you are ineligible for Medicare Advantage but can sign up during the Initial Coverage Election Period once Part B is elected. There is also an annual enrollment period called Fall Open Enrollment. This period lasts from October 15 through December 7 each year and allows seniors the opportunity to switch between plans or make plan changes.

When youre ready to enroll, you must choose a provider that covers the area you live in. You can shop for a Medicare Advantage provider online through the governments Medicare website or you can call a representative at 1-800-MEDICARE at any time. The website allows you to compare several plans available to you so you can make the best choice for your circumstances. Make sure to note whether prescriptions are included under the plan and what the maximum out-of-pocket expense is for each year.

You have a few enrollment options once youve made your decision:

Eldercare Financial Assistance Locator

- Discover all of your options

- Search over 400 Programs

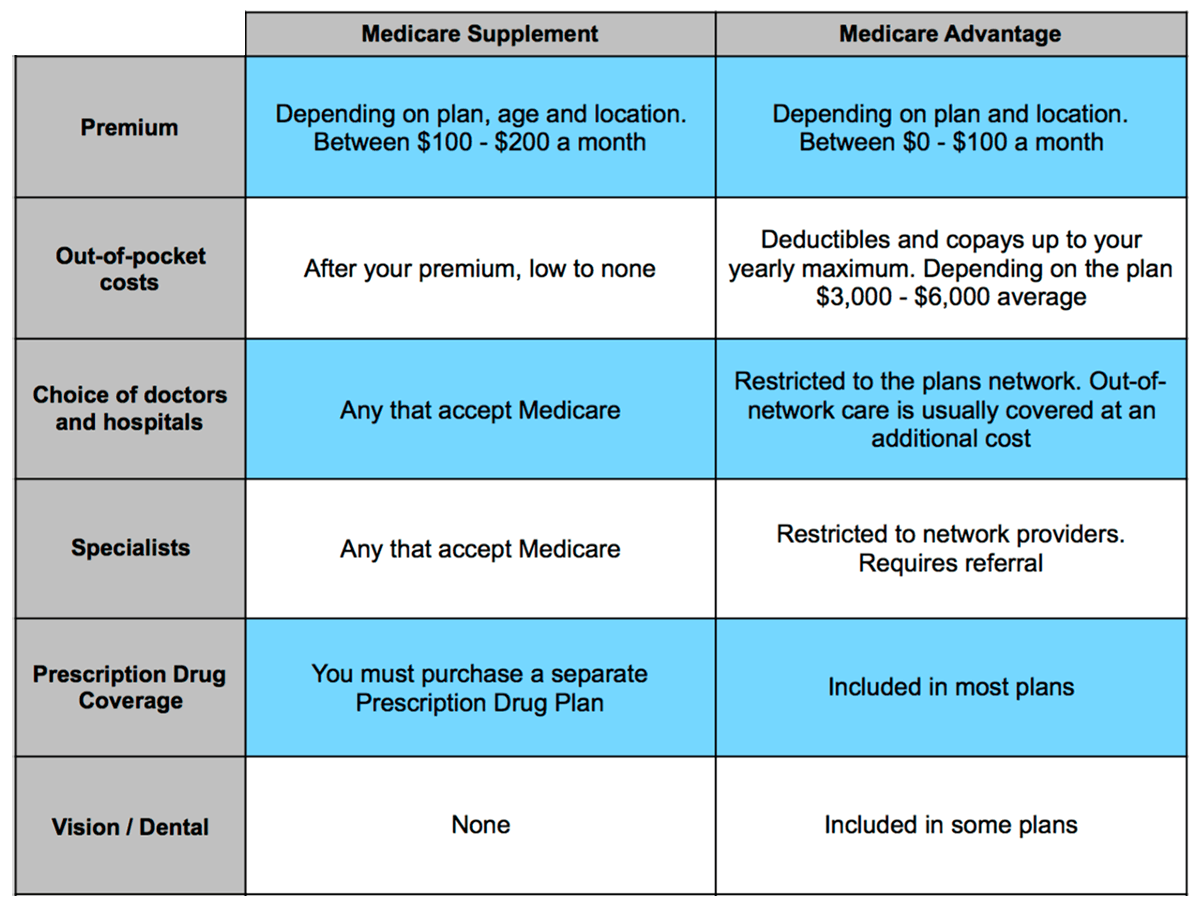

Medicare Advantage Vs Medicare Supplement: Plan Costs

It may seem obvious that many people would want either a Medicare Advantage plan or a Medicare Supplement insurance plan for the added benefits and the protection from out-of-pocket costs. However, both these types of plans may come with additional costs. You may have to spend money to save money, which is how most types of insurance generally work.

Premiums: A premium is an amount you pay monthly to have insurance, whether or not you use covered services. Some Medicare Advantage plans have premiums as low as $0 a month. However, you still must pay your Medicare Part B premium.

Most Medicare Supplement insurance plans also have monthly premiums. The premium you pay generally depends on the plan you select and your location.

Deductibles: A deductible is an amount you pay before your insurance begins to pay. A higher deductible means you will generally pay more out of pocket before your insurance kicks in. Sometimes insurance plans with lower premiums have higher deductibles.

Don’t Miss: How Much Medicare Is Taken Out Of Social Security Check

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

Medicare Requires Providers To Use Abns To Communicate Patient Financial Responsibilities Ma Plans Do Not

Medicare requires that providers use Advance Beneficiary Notices of Noncoverage to notify Medicare beneficiaries that Medicare may not cover the therapy services that they are electing to receive. As this is a Medicare-only form, its only appropriate for original Medicare patients. For patients with MA coverage, youll want to reach out to the payer to learn its requirements for handling patient responsibility.

There you have it: the rules for Medicare vs. Medicare Advantage. If youre wondering how all the Medicare variantsoriginal , Advantage, Supplemental , and Prescription work, check out this post.

Stay on top of the latest rehab therapy tips, trends, and best practices with our weekly blog digest.

Don’t Miss: Does Medicare Cover Cosmetic Surgery

The Cares Act Of 2020

On March 27, 2020, President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expands Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19-related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19-related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Medicare Requires Providers To Adhere To The 8

As we explained here, The 8-Minute Rule governs the process by which rehab therapists determine how many units they should bill to Medicare for the outpatient therapy services they provide on a particular date of service. In short, the 8-Minute Rule requires that therapists provide direct, one-on-one therapy for at least eight minutes to bill Medicare for a time-based code. While some commercial insurance companies also require that providers adhere to the 8-Minute Rule, others use the Substantial Portion Methodology , and still others allow for either. While both calculation methods require at least eight minutes of direct treatment per code, there is no cumulative component to SPM, so if your leftover minutes come from a combination of services, you cannot bill for any of them unless one individual service totals at least eight minutes. That said, in some cases, you might be able to bill for more units using SPM, so if the MA plan doesnt have a preference, then it may behoove you to run the calculations for both.

Recommended Reading: When Can You Get Medicare Health Insurance

Can You Switch Between Original Medicare And Medicare Advantage

As a final note, no matter which option you decide is right for you, you can switch from Original Medicare to Medicare Advantage or vice versa. The two main times you can switch are the Medicare Annual Enrollment Period and the Medicare Special Enrollment Period for qualifying life events, if you qualify.

There Are Four Parts To Medicare

- Part A– Medicare Part A covers hospital care. You are protected during short-term stays in hospitals and for services like Hospice. You also get limited coverage for some in-home healthcare services and skilled nursing facility care.

- Medicare Part B– Medicare Part B covers doctor’s appointments, urgent care visits, preventative care, and medical equipment.

- Part C– Medicare Part C is also known as Medicare Advantage. These plans combine the coverage of Parts A, B, and Part D into a single plan. Private insurance companies offer Medicare Advantage plans that are overseen by Medicare.

- PDP or Medicare Part D– Medicare offers drug coverage through Part D, AKA PDP . These are stand-alone plans that only cover your medications. Private insurance companies offer Part D plans, not the Federal Government.

Read Also: How To Get A Lift Chair From Medicare

Original Medicare Vs Medicare Advantage: Whats The Difference

In order to understand the differences between the two programs, its important to understand how each one works.

Original Medicare, Part A and Part B:

Original Medicare is administered by the federal government, and there are two parts to this program:

- Part A, which is also called hospital insurance, covers eligible costs for your care as an inpatient in a hospital or skilled nursing facility. It also may cover hospice care.

- Part B is your medical insurance and generally covers outpatient services such as doctor visits, outpatient tests, home health care, durable medical equipment, and certain preventive services.

Under Original Medicare, you can get care from any doctor, hospital, or other provider who accepts Medicare. Heres more details on costs and coverage associated with Original Medicare:

If you want prescription drug coverage and you are enrolled in Original Medicare, youll need to purchase a separate stand-alone Medicare Part D Prescription Drug Plan.

Medicare Advantage

One of the major differences between Original Medicare vs. Medicare Advantage is that the Medicare Advantage program is administered by private insurance companies approved by Medicare to offer benefits. This means that premiums are set by the individual insurance companies and can vary depending on the plan you choose and other variables, although youll continue to pay your Part B premiums in addition to any premium your plan requires.

Medicare Advantage plans coverage information: