Medicare Costs Went Up In 2022

The reductions come after more significant increases in costs for 2022, compared to 2021. Then. the premium went up 14.5%, or $21.60. The annual Part B deductible increased $30 in 2022, compared to 2021.

CMS said the 2022 increases were attributed to rising health care costs and expected spending on the newly approved Alzheimers drug, Aduhelm. Aduhelms price tag was then put at $56,000 per person each year. However, drug maker Biogen later cut the annual price to $28,200. And Medicare decided to cover the drug only for people with diagnoses of mild cognitive impairment due to Alzheimer’s who are participating in clinical trials.

According to CMS, lower-than-planned spending on both Aduhelm and other Part B items and services resulted in much larger reserves in the Part B account of the Supplementary Medical Insurance Trust Fund, which can be used to limit future Part B premium increases.

CMS also announced that starting next year, certain Medicare enrollees who are 36 months post kidney transplant, and therefore are no longer eligible for full Medicare coverage, can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. The premium in 2023 will be $97.10.

Why Pay For Part C Or Part D Coverage

With just Part A and Part B coverage, you may still have to spend a large amount of money on your health services and prescriptions, especially if your medical needs are significant .

Part C and D plans cover a lot of costs not included under Parts A and B. They can actually save you money, even though your monthly premiums are usually a little bit higher when you choose Part C and Part D plans.

If youre looking for a solution to keep your expenses as low as possible, its a good idea to consider a Medicare Advantage or Medigap health plan.

For more information, download our Welcome to Medicare Guide, which will help you understand your choices even better, and can answer a lot of questions you might still have.

Independence Blue Cross is a subsidiary of Independence Health Group, Inc. independent licensees of the Blue Cross and Blue Shield Association, serving the health insurance needs of Bucks, Chester, Delaware, Montgomery, and Philadelphia counties of Pennsylvania.

Sitemap | Legal | Privacy & other policies

Independence complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability, or sex. Independence does not exclude people or treat them differently because of race, color, national origin, age, disability, or sex. View our documentation for more information and to request language assistance services.

Every year, Medicare evaluates plans based on a 5-Star rating system.

What Does A Medicare Cost Plan Cover

Under a Medicare Cost plan, beneficiaries keep their Medicare Part A and/or Medicare Part B coverage but also have access to a network of providers through the Cost plan.

Whats covered under your Medicare Cost plan largely depends on your county and state, as benefits can vary largely between them. For example, in certain counties in Minnesota, some plans offer acupuncture coverage and an eyewear allowance. Meanwhile, in Iowa, one of the handful of plans available includes a fitness membership that gives access to more than 20,000 gyms across the country.

Some other benefits that may be covered by a Medicare Cost plan include:

You May Like: What Is The Penalty For Dropping Medicare Part D

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

What Are The Main Differences Between A Medicare Advantage Plan And A Medicare Cost Plan

The table below helps illustrate the main differences between a Medicare Advantage plan and a Medicare cost plan.

| Medicare Advantage Plan | Medicare Cost Plan | |

| Enrollment | To enroll in a Medicare Advantage plan you must have both Medicare Part A and Part B. | You can enroll in a Medicare Cost plan even if you only have Medicare Part B. |

| When to enroll | You can generally only enroll in, switch, or disenroll from Medicare Advantage during certain times of the year. Learn more about Medicare Advantage enrollment periods. | You can enroll in a Medicare Cost plan anytime the plan is accepting new members and you can leave at any time and return to Original Medicare. |

| Coverage | Medicare Advantage covers both hospital care and medical care . | Some types of Medicare Cost plans only cover Part B benefits, so you might need to enroll in Medicare Part A for hospital coverage. If you have this type of Medicare Cost plan and donât have Medicare Part A, you may not be covered for hospital care. |

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Read Also: How To Apply For Medicare Without Social Security

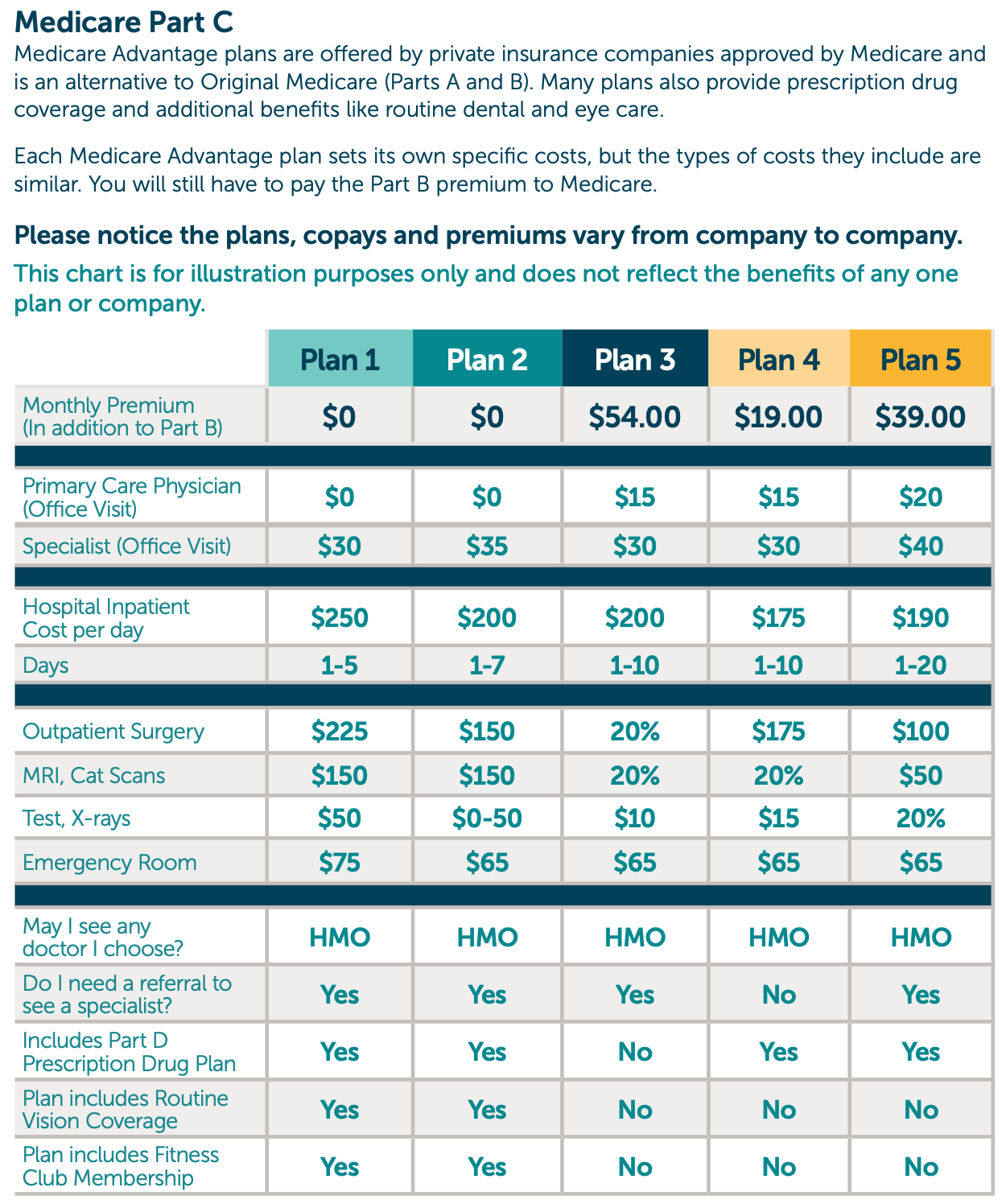

What Is A Medicare Advantage Plan

Medicare Advantage is also called Medicare âPart C.â With Medicare Advantage, youâll get your Medicare Part A and Medicare Part B through a private company and not through Original Medicare. Medicare Advantage plans also often provide coverage for Medicare Part D, prescription drugs, which Original Medicare usually doesnât cover. In addition, Medicare Advantage plans often offer extra benefits not generally covered by Original Medicare, such as vision, hearing, and sometimes dental. You must continue to pay your Medicare Part B premium.

Medicare beneficiaries with end-stage renal disease are now able to enroll in Medicare Advantage.

What Are My Options

Medicare beneficiaries have two options to select from:1) Original Medicare covers benefits on a fee-for-service basis and is managed by the federal government. This option offers the ability to add a Medicare supplemental policy to help pay your share of the out-of-pocket costs of Medicare-covered services. Also, Medicare Part D prescription drug coverage can be purchased.2) Medicare Advantage is managed by private insurance companies with government-approved contracts that cover Medicare benefits. Medicare Part D prescription drug coverage can be purchased or may be included in some Medicare Advantage plans.

You should receive information in the mail from your insurer or the Centers for Medicare & Medicaid Services on new enrollment options for Medicare coverage in 2019.

Read Also: How Do I Know If I Have Original Medicare

Factors That Can Influence Cost

The coverage offered by each Medicare Advantage plan may differ. While a Medicare Advantage plan by law must cover the same benefits as Medicare Part A and Medicare Part B, benefits like prescription drugs, dental, vision and hearing can be covered at varying degrees .

Also, as with the cost of many products and services, the differing local and regional market where you live can have an effect on the cost of Medicare Advantage plan available to you.

Aside from the benefits offered and where you live, there are several additional factors that can influence the cost of a Medicare Advantage plan, such as:

What Are The Parts Of Medicare

Medicare is comprised of four parts. Parts A and B are controlled by CMS. Parts C and D are managed by private insurance companies.

- Part A covers hospital stays, skilled nursing care, hospice, and home health visits.

- Part B covers doctor visits, outpatient services, and other medical expenses not covered by Part A.

- Part C takes care of many expenses not covered under Medicare Parts A and B and are provided through private insurance companies. These health plans, such as HMOs or PPOs, cover all of your Part A and Part B benefits as well as preventive care. They may also cover extras such as prescription drug coverage, vision, hearing, dental, and gym memberships.

- Part D covers the generic and brand-name prescriptions included on a health plan’s drug formulary list.

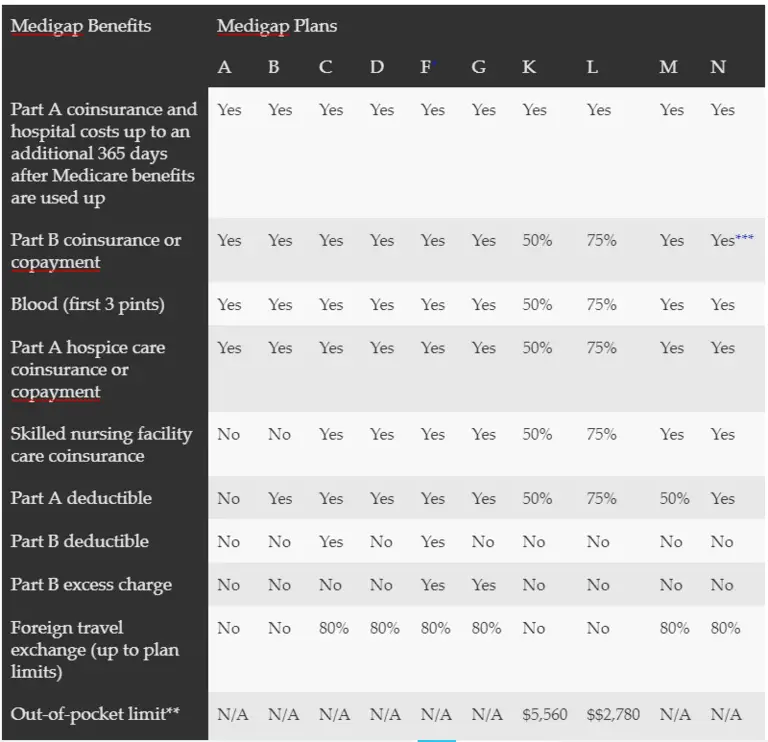

Medigap plans provide additional insurance that helps with some or all of the out-of-pocket costs youre left with after Original Medicare pays its share.

Recommended Reading: Is Medical Assistance The Same As Medicare

Since 2015 The Highest Share Of Medicare Advantage Enrollees Are In Plans That Receive High Quality Ratings

For many years, CMS has posted quality ratings of Medicare Advantage plans to provide beneficiaries with additional information about plans offered in their area. All plans are rated on a 1 to 5-star scale, with 1 star representing poor performance, 3 stars representing average performance, and 5 stars representing excellent performance. CMS assigns quality ratings at the contract level, rather than for each individual plan, meaning that each plan covered under the same contract receives the same quality rating most contracts cover multiple plans.

In 2022, nearly 9 in 10 Medicare Advantage enrollees are in plans with a rating of 4 or more stars, an increase from 2021 and the highest share enrolled since 2015. An additional 3 percent of enrollees are in plans that were not rated because they are in a plan that is too new or has too low enrollment to receive a rating. Plans with 4 or more stars and plans without ratings are eligible to receive bonus payments for each enrollee the following plan year. The star ratings displayed in the figure above are what beneficiaries saw when they chose a Medicare plan for 2022 and are different than what is used to determine bonus payments.

Other Medicare Health Plans

Some types of Medicare health plans that provide health care coverage aren’t Medicare Advantage Plans but are still part of Medicare. Some of these plans provide

coverage, while most others provide only Part B coverage. Some also provide

These plans have some of the same rules as Medicare Advantage Plans. However, each type of plan has special rules and exceptions, so contact any plans you’re interested in to get more details.

Don’t Miss: How To Find My Medicare Claim Number

A Small Share Of Medicare Advantage Enrollees In Individual Plans Have Access To Special Supplemental Benefits For The Chronically Ill But A Larger Share Of Enrollees In Snps Have Access To These Benefits

Beginning in 2020, Medicare Advantage plans have also been able to offer extra benefits that are not primarily health related for chronically ill beneficiaries, known as Special Supplemental Benefits for the Chronically Ill . The majority of plans do not yet offer these benefits. Fewer than half of all SNP enrollees are in plans that offer some SSBCI. The share of Medicare Advantage enrollees who have access to SSBCI benefits is highest for food and produce , meals , transportation for non-medical needs , and pest control .

Most Medicare Advantage Enrollees Have Access To Some Benefits Not Covered By Traditional Medicare In 2022 And Special Needs Plan Enrollees Have Greater Access To Certain Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare. The cost of these benefits may be covered using rebate dollars paid by CMS to private plans. In recent years, the rebate portion of federal payments to Medicare Advantage plans has risen rapidly, totaling $432 per enrollee annually for non-Medicare supplemental benefits, a 24% increase over 2021. The rise in rebate payments to plans is due in part to incentives for plans to document additional diagnoses that raise risk scores, which in turn, generate higher rebate amounts that make it possible for plans to provide extra benefits. Plans can also charge additional premiums for such benefits, but most do not do this. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered primarily health related but CMS expanded this definition, so more items and services are available as supplemental benefits.

Read Also: What Does Ship Stand For In Medicare

Who Can Answer My Questions

If you have questions you should call the Senior LinkAge Line a trusted, unbiased resource sponsored by the Minnesota Board on Aging. The Senior LinkAge Line can help you navigate the Medicare plan choices for 2019 so you can select the option that best meets your healthcare coverage needs. All Medicare beneficiaries are encouraged to review their Medicare health and prescription drug coverage during open enrollment in the fall.

Senior LinkAge Line: 1-800-333-2433 or www.seniorlinkageline.com

Who Is A Good Candidate For A Medicare Cost Plan

Medicare Cost Plans can be ideal for beneficiaries who spend a lot of time traveling. Because Medicare Advantage plans generally limit you to a network of participating providers, you may find yourself outside of your coverage area while traveling.

But because Medicare Cost Plans use Medicare Part A and Part B coverage for out-of-network services, these beneficiaries may still receive covered care almost anywhere they go within the U.S. and U.S. territories.

You May Like: How Do I Apply For Medicare In Missouri

What Is The Average Cost Of Medicare Advantage Plans By State

As you can see in the chart below, the average cost of a Medicare Part C plan can vary significantly from one state to another.

In fact, plan prices and availability can vary by county or service area.

2021 Average Costs of Medicare Advantage Prescription Drug Plans| State | |

|---|---|

| 20% | $276.17 |

Working with a licensed insurance agent can help you find a plan in your area that suits your health care needs.

To shop for Medicare Advantage plans in your area or to learn more about the costs associated with this type of coverage, call today to speak with a licensed insurance agent. Or you can compare plans for free online.

Compare Medicare plan costs in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

1 MedicareAdvantage.com’s The Best States for Medicare in 2021 report. .

2 Digiacomo, Robert. Is dental insurance worth the cost? . Bankrate. Retrieved from https://www.bankrate.com/finance/insurance/dental-insurance-1.aspx.

Medicare Part B And Part D Inflation Rates

In many cases prescription drugs covered by Medicare had price increases greater than the rate of inflation from 2019 to 2020. Under the new law, drug manufacturers are now required to pay annual rebates to Medicare if they increase prices of Part D medications above an allowable inflation rate. Similarly, beginning in 2023, manufacturers will be required to pay quarterly rebates if the prices of certain Part B drugs exceed a quarterly inflation-adjusted price.

To minimize Medicare Part D premiums, starting in 2024, the national base premium cannot increase more than 6% annually. This means, that your Medicare Part D premiums might not go up as quickly as they previously have. However, it is good to keep in mind that base premiums are only one part of what you pay. Other factors in determining premium costs are

- Which Insurance company you select

- Which Plan you are on

Don’t Miss: Does Medicare Become Your Primary Insurance

Availability Of Medicare Cost Plans

Historically, cost plans offered a managed care option in rural areas of the country where few Medicare Advantage options existed.

In 2018, about 600,050 Americans in 14 states and the District of Columbia were enrolled in Medicare cost plans, according to the Kaiser Family Foundation.

While cost plans have offered a kind of best of both worlds hybrid option to beneficiaries, the plans are now being phased out by the federal government.

Since Medicare Advantage launched in the late 1990s, its reach has expanded significantly, nearly doubling from 10.5 million enrollees in 2009 to 22 million enrollees in 2019.

On Jan. 1, 2019, the U.S. government eliminated Medicare cost plans in counties where two or more Medicare Advantage plans competed the prior year.

The sunsetting of Medicare cost plans has significantly impacted some communities more than others.

According to a Minnesota Star Tribune report, Minnesotans accounted for more than half of all cost plan membership in 2018 about 400,000 out of 630,587 people that year.

North Dakota and South Dakota are now the two states with the most cost plan beneficiaries in 2019, according to the Kaiser Family Foundation.

Do You Really Need Medicare Supplemental Insurance

The answer to this question really depends on your specific situation. If you typically visit the doctor often and are required to pay numerous copays throughout the year, then Medicare Supplemental insurance might be a good idea. Similarly, if you receive regular medical treatments that require out-of-pocket costs like coinsurance amounts, then a Medigap policy might be right for you. However, if you rarely visit the doctor, then the monthly premiums associated with a Medigap plan might cost you more than your normal medical expenses would cost.

You can always check with a licensed insurance agent in your local area who can help you explore plan options and determine whether this coverage is right for you. Remember that you might also decide to enroll in a Part C Medicare Advantage plan instead. Many of these plans have low or no premium and an out-of-pocket limit for your medical insurance. Advantage plans are also managed by private insurance companies, so they can set their own rules for costs and coverage, as long as they provide at least the same coverage as Original Medicare.

You May Like: Is A Bone Density Test Covered By Medicare