Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

Many Medicare SNPs cover most of the qualified health care costs for beneficiaries. All SNPs must include prescription drug coverage.

Some Medicare SNPs are designed for people who are dual-eligible, meaning they are eligible for both Medicare and Medicaid. These plans are commonly called Dual-Eligible Special Needs Plans .

Medicare Advantage Special Needs Plans can also cater more specifically to the needs of people with specific medical conditions, such as:

- Dependence issues with alcohol or other substances

- Autoimmune disorders

- Chronic lung disorders

Some SNPs can also be available to people who live in a long-term care facility such as a nursing home.

Recommended Reading: Can I Submit A Claim Directly To Medicare

Best Medicare Supplement Insurance Company

I suggest reading my companion article on this subject, titled Best Medicare Supplement Insurance Company

When I evaluate an insurance company I am looking for a company with solid financials that offers price stability over the long run. As you know, when you retire and no longer have a paycheck you need to have price stability and predictability in order to budget your expenses. Surprise price increases in your health insurance can wreak havoc on your budget. So, before I make a recommendation to my clients I look at these things

1. How long has the company been offering Medicare supplement plans?2. What is the AM Best Financial Rating?3. Their pricing history, philosophy and loss ratio.4. Does the Medicare supplement insurance company rely on Brand Loyalty or a fraternal identity to market insurance?5. Does the company have a national presence or is it a local or regional company?6. Last but not least Are there any industry changes that can impact the insurance company?Lets go over each of these briefly.

6. Last but not least Are there any industry changes that can impact the insurance company? I can write about this subject for pages. Suffice it to say that at this time that some companies are making changes to their corporate structure that can leave the individual consumer stranded in a plan that is closed to new customers. The result is shockingly high price increases, seemingly from nowhere. This too is easy to avoid if you understand the industry.

List Of Medicare Supplement Insurance Companies

The Medicare Supplement Insurance information listed below shows the companies that are currently or actively offering Medicare Supplement Insurance policy plans for individuals and/or groups under 65 years of age and over 65, along with the company’s reported explanations and consumer contact information . The company’s name is a hyperlink to the respective company’s website for additional information.

For more Medicare Supplement Insurance information, please select Guide to Medicare Supplement.

Recommended Reading: Is It Mandatory To Have Medicare Part D

Comparing Medicare Supplement Insurance Companies

The list below includes some of the companies that sell Medicare Supplement Insurance plans in select states across the U.S.

Please note that our guide is meant to be informational and to help you as you start finding the right plan and plan carrier for your needs. Some of the companies listed below may not offer Medigap plans in your area, and you may find a Medicare Supplement carrier in your area that fits your need and isnt on this list.

This list identifies several of the top 10 insurance companies in no particular order.

- Medico Insurance Company

Its important to keep in mind that although each companys plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

In other words, Medigap Plan A sold by one company will include the same essential benefits as Medigap Plan A sold by any other insurance company. Their costs and the availability of the types of plans, however, may vary.

Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state.

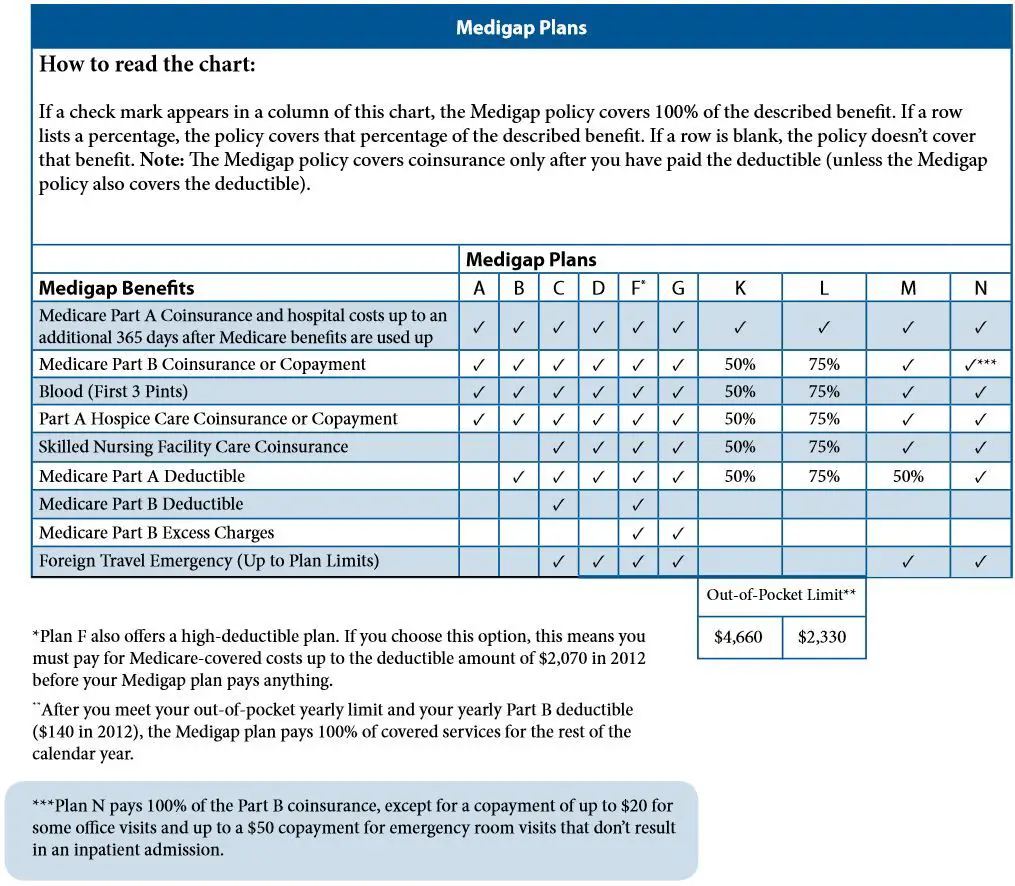

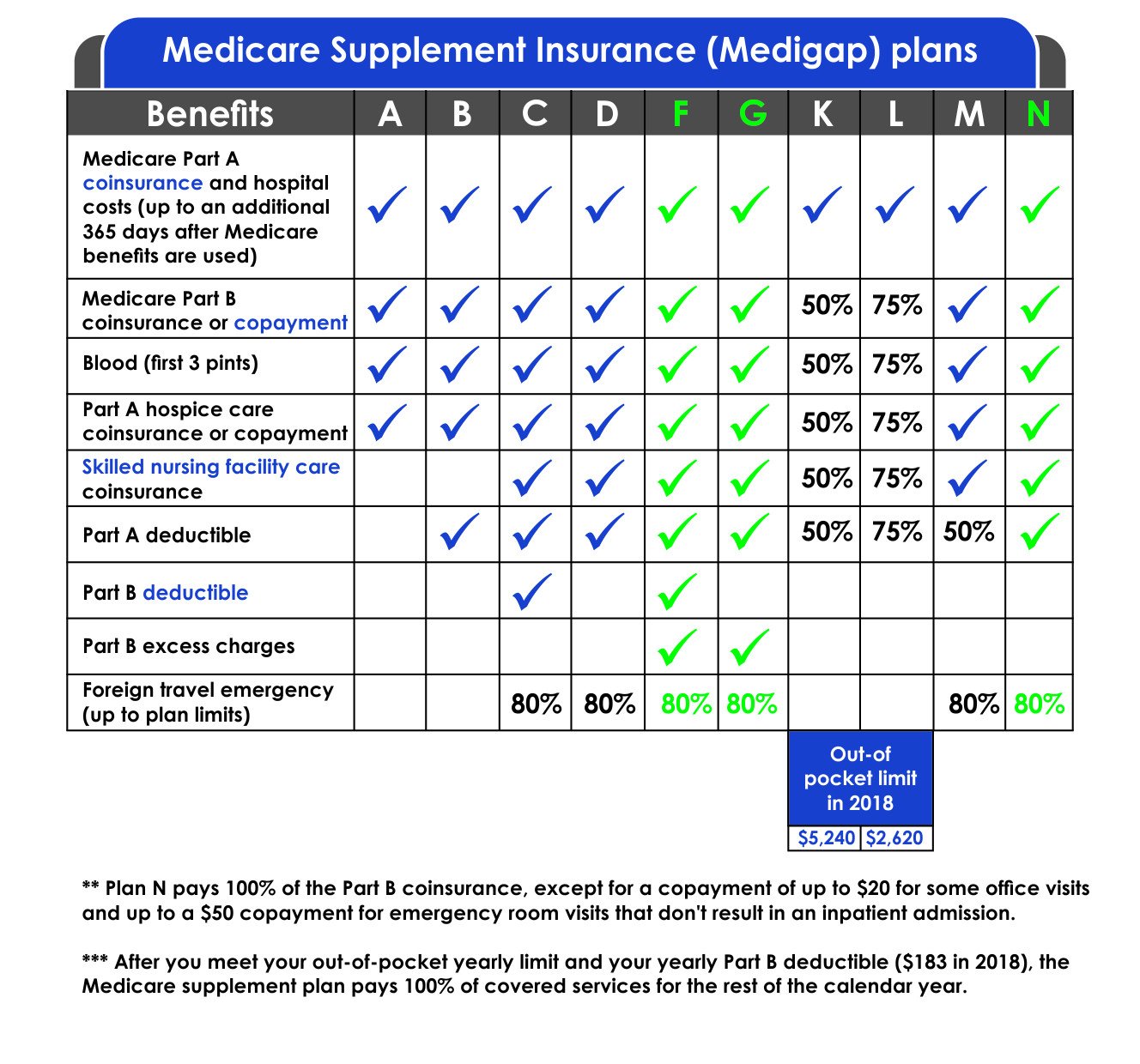

You can use the chart below to compare each type of 2022 standardized Medicare Supplement plan.

| 80% | 80% |

What Is A Medicare Supplement Deductible

You may know the word deductible from other types of insurance you already have, such as auto insurance. A deductible is an amount you pay before your insurance plan begins to pay. Some Medicare Supplement plans pay the Medicare Part A hospital deductible, but make you pay the Medicare Part B medical deductible. Some plans cover neither the Part A nor the Part B deductible and you will be responsible for those costs out of pocket.

Medicare Supplement high deductible plan F* may charge a lower monthly premium than other plans. However, this low premium may be attached to a high deductible, meaning you must pay a significant amount out of pocket before your Medicare Supplement plan pays anything.

Don’t Miss: Does Medicare Cover Annual Gyn Exam

How To Join A Drug Plan

Once you choose a Medicare drug plan, here’s how to get prescription drug coverage:

- Enroll on the Medicare Plan Finderor on the plan’s website.

- Complete a paper enrollment form.

When you join a Medicare drug plan, you’ll give your Medicare Number and the date your Part A and/or Part B coverage started. This information is on your Medicare card.

Consider All Your Drug Coverage Choices

Before you make a decision, learn how prescription drug coverage works with your other drug coverage. For example, you may have drug coverage from an employer or union, TRICARE, the Department of Veterans Affairs , the Indian Health Service, or a Medicare Supplement Insurance policy. Compare your current coverage to Medicare drug coverage. The drug coverage you already have may change because of Medicare drug coverage, so consider all your coverage options.

If you have other types of drug coverage, read all the materials you get from your insurer or plan provider. Talk to your benefits administrator, insurer, or plan provider before you make any changes to your current coverage.

You May Like: Can I Draw Medicare At 62

How Does Medicare Supplement Insurance Work

Medicare Supplement Insurance helps you pay for the gaps in Medicare coverage. Once Medicare pays its share of the services you are receiving, Medigap will help you pay the rest.

If your Part B policy says it covers 80% of a doctors visit, Medicare will pay that. Medigap kicks in for the other 20%. Lets suppose your Medigap Plan says that it will pay 75% of your Part B coinsurance. That means you will only pay one-quarter of the total cost of your doctors visit.

Heres an example with numbers: if the doctors visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5. If you didnt have Medigap, you would be responsible for paying the entire $20 that were left over after Medicare paid its share.

Depending on the plan you select, Medicare Supplement Insurance can help you pay for the Part A and Part B deductibles. It can also help you pay for medical expenses if you have a medical emergency outside of the United States.

Three Tips To Save On Medicare

Additional tips for saving on Medicare coverage include:

- See if you qualify for Extra Help. This program helps those with limited income and resources pay Medicare prescription drug program costs. These may include premiums, deductibles and coinsurance. Social Security Administration estimates that Extra Help can save about $5,000 per year on Part D prescription drug costs.

- Enroll in a Medicare savings program. Medicare has four savings programs run by the individual states. Such programs help cut the cost of Medicare premiums and other costs. Call your state Medicaid program to find out if youre eligible.

- See if you are eligible for Medicaid. If your income is low enough, you might qualify for this coverage. Call your state Medicaid program to see if you are eligible for the low-income program.

There are many other ways to save. For example, enrolling in a Medicare Advantage program may offer additional benefits that can save you money depending on your care needs. Shopping around and comparing these plans can get you the best deal.

Also, remember that enrolling on time for certain programs such as Medicare Parts A, B and D might help you avoid higher costs in the future in the form of late-enrollment penalties.

You May Like: How To Apply For Low Cost Health Insurance

Don’t Miss: Where To Get A New Medicare Card

Services Medicare Doesnt Cover

- Most long-term care. Medicare only pays for medically necessary care provided in a nursing home.

- Custodial care, if its the only kind of care you need. Custodial care can include help with walking, getting in and out of bed, dressing, bathing, toileting, shopping, eating, and taking medicine.

- More than 100 days of skilled nursing home care during a benefit period following a hospital stay. The Medicare Part A benefit period begins the first day you receive a Medicare-covered service and ends when you have been out of the hospital or a skilled nursing home for 60 days in a row.

- Homemaker services.

- Most dental care and dentures.

- Health care while traveling outside the United States, except under limited circumstances.

- Cosmetic surgery and routine foot care.

- Routine eye care, eyeglasses , and hearing aids.

How Much Do Medicare Supplement Insurance Plans Usually Cost

The next factor in determining the best Medicare Supplement insurance plan for you is cost. Keep in mind that different insurance companies may charge different premiums for the same policy. Medicare Supplement insurance plans are rated or priced in 3 ways.

- The first way, âcommunity-rated,â does not depend on age. People of different ages pay the same premium. Premiums may go up because of inflation and other factors but not because of your age.

- The second way, âissue-age-rated,â sets the rate depending on the age of the person when he or she purchases the policy. Premiums may go up because of inflation and other factors but not because of your age.

- The third way, âattained-age-rated, sets a premium at your current age and continues to go up as you get older. Premiums may also go up because of inflation and other factors.

Other factors may influence the price of the policy, such as if the health insurance company offers discounts to non-smokers or married people and if it uses medical underwriting. Medical underwriting could use a pre-existing health condition as a basis for charging a higher premium.

Once you understand your eligibility, what benefits you want covered, and pricing differences, you will be able to determine what the best Medicare Supplement insurance plan is for you.

Read Also: What Is The Disadvantage Of A Medicare Advantage Plan

How To Sign Up For Medigap Plans

Signing up for a Medigap plan is easy. Medicare supplements may be bought through an agent or from the carrier directly, says Corujo. Since theres no annual open enrollment period, you may join at any time.

To buy a Medigap policy, its best to enroll during your Medigap Open Enrollment period, which lasts six months. This period begins the first month you have Medicare Part B and are 65 or older. You can buy any Medigap policy sold in your state during this time, even if you have health problems.

Follow the steps below to purchase your Medigap plan:

- Enroll in Medicare Part A and Part B. This step is required to purchase a Medigap plan. Remember: Medicare and Medigap plans dont cover prescription drugs, so you may also want to consider enrolling in a Medicare Advantage plan or a plan that offers drug coverage. If you choose a Medicare Advantage plan, you cannot then enroll in a Medigap plan. If youre already enrolled in a Medicare Advantage plan, consider whether a Medigap plan would benefit you if so, drop your Medicare Advantage plan before buying a Medigap plan.

- Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.

- Compare costs between companies. Costs will vary depending on the company, state and other factors, but the coverage they offer will be the same.

- Select a Medigap plan that works best for you and purchase your policy.

What Is Supplemental Insurance

Find Cheap Health Insurance Quotes in Your Area

Supplemental health insurance provides an extra level of coverage by helping consumers meet out-of-pocket expenses and other costs not covered by their regular insurance.

Supplemental plans serve as secondary payers, filling in coverage gaps and complementing regular insurance. This mitigates, and in some cases eliminates, costs associated with copays, deductibles and other expenses depending on the extent of coverage of the supplemental insurance.

Read Also: Can I Cancel My Medicare

How Do Medicare Supplement Insurance Plans Work With Original Medicare

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as “Medigap”, are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits. The basic benefit structure for each plan is the same, no matter which insurance company is selling it to you. Note: The letters assigned to Medicare Supplement plans are not the same things as the parts of Medicare. For example, Medicare Supplement Plan A is not the same as Medicare Part A .

Learn When & How To Apply For Medicare Supplemental Health Insurance

How to Apply for Medicare Supplement Insurance1) In order to apply for a Medicare Supplement Insurance Plan, you must first know which plan you would like to purchase. If you are not sure which plan to purchase you can compare supplement plans on our website, or speak with one of our Expert Medicare Advisors who can assist you with the selection and application process. Call toll-free: 949-0698

2) Once you have decided on which plan you would like to purchase, then it comes down to selecting the best company, and best price. You can compare all rates and companies on our website as well by visiting our online quote comparison page.

3) The third and final step necessary to apply for Medicare Supplement Insurance is to either enroll online or speak with a licensed agent who will complete an application for you. In either method, you will need to physically speak with an agent first who will get the application process started for you. Currently, there are no Medicare Supplement Companies that will allow you to apply un-assisted. You must first speak with an agent to verify your authenticity and have him/her either send an application to you to complete, or they may be able to complete the application for you, and simply send it to you to sign, either via U.S. mail, or via email, using an online application.

You May Like: When Do I Qualify For Medicare Insurance

Don’t Miss: Do I Need Health Insurance With Medicare

Is It Better To Have A Medicare Advantage Plan Or Medicare Supplement Plan

: This plan is a great way to receive your Medicare Part A and Part B benefits. With Medicare Advantage, youâll get your coverage through a private Medicare-approved insurance plan instead of through the government. Here are a few things to consider when comparing Medicare Advantage Plans:

- You will need to sign up for Medicare Part A and Part B before receiving Medicare Advantage benefits.

- Many Medicare Advantage plans can cover prescription drugs, however Original Medicare does not cover prescription drugs unless it is a special situation.

- Many Medicare Advantage plans can offer benefits such as dental, hearing, vision, fitness benefits and more.

- Plans can restrict you to a specific provider network.

- Many Medicare Advantage plans offer a â$0 per monthâ premium, however they can typically have cost-sharing deductibles or copays.

- Keep in mind, you will still need to pay your Medicare Part B premium.

- Each Medicare Advantage plan has an out-of-pocket maximum to protect you from medical costs that could spiral out of control. This means that once you spend a certain amount per year, the plan will cover your medical costs for the rest of the year.

: These plans only work with Original Medicare, not any other type of health insurance such as Medicare Advantage. Medicare Supplement plans are meant to âsupplementâ any gaps in coverage that you may need after having Medicare Part A and Part B. Here are a few things to keep in mind:

A Note Regarding Pricing Methods

In the middle of this screen is a column called Pricing Method. This is how each insurance company sets its own premiums. This method can greatly influence the pricing of their policies. There are three rating systems:

- Community-Rated The same premium is charged to everyone, regardless of age.

- Issue-Age-Rated The premium is based on your age when you buy the policy.

- Attained-Age-Rated The premium is based on your current age, so it goes up as you get older.

You May Like: Is Eye Care Covered Under Medicare

How Does Medicare Supplement Insurance Work With Medicare

Medicare Supplement Insurance works with Original Medicare Parts A and B. If you choose to buy a standalone Part D Prescription Drug plan, Medicare Supplement works with that, too.

Medicare Supplement Insurance is different from Medicare Advantage. You can have either a Medicare Advantage Plan or a Medicare Supplement Plan, but not both at the same time.

How Does A Medigap Plan Work

In most policies, part of the agreement you will sign allows the Medigap carrier to receive your Medicare claim after the primary carrier processes it. This is sometimes known as piggyback coverage.

In this situation, the Medicare carrier pays their portion of the claim, then sends it directly to the Medigap carrier, who also pays the provider. This is most common for Part B claims, but some carriers also offer it for Part A claims as well.

Read Also: Does Medicare Cover Home Health Care Costs