What Is Medicare And What Does It Cover

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare is the government health care program for people 65 and over, and its coverage plays an important role in containing medical costs as you age. But Medicare benefits dont pay for everything.

As you approach age 65, youll need to decide how to deal with some of those coverage gaps. For now, knowing the basics of how Medicare works can help you understand some of the expenses youll face.

Can You Have Medicare And Dual Residency

You can have Medicare while living in two states, but youll choose one location as your primary residence. There will be some Medicare plans that benefit you more than others when you have multiple homes.

Some retired people choose to reside in two different locations. An example is living in New York for half the year and staying in Florida for the colder half.

The last thing you want to worry about when enjoying the snowbird lifestyle is whether your health coverage is comprehensive. So, well walk you through what you need to know about Medicare while living in more than one state.

What Original Medicare Doesn’t Cover

Original Medicare doesn’t cover everything. With a few exceptions, Original Medicare doesn’t include coverage for prescription drugs. It also does not cover health care benefits you may have been used to getting with an employer plan such as dental, vision, hearing health care or wellness items like fitness memberships.

You May Like: What Is A Medicare Advantage Medical Savings Account

Does Medicare Coverage Include Vision And Dental Care

When it comes to vision and dental care, things can get a bit confusing concerning what coverage you have with your Medicare benefits. Because Original Medicare Part A and Part B provide coverage for care that is medically necessary, they do not help pay for routine vision and dental care such as regular examinations, teeth cleanings or fillings, tooth extraction, eyeglasses or contact lenses.

But not all vision and dental care is routine. Your Original Medicare insurance , or Medicare Advantage Plan , may offer coverage for certain preventive and diagnostic exams, treatments, surgeries, or some supplies. It is important to know what coverage you have regarding your vision and dental care. Having all the information about your Medicare benefits is essential for making the best decisions regarding your health care.How does Medicare cover vision care?

If you require vision care as a medical emergency or due to traumatic injury, Original Medicare Part A covers that care if you are treated as an inpatient in a hospital. You must be formally admitted as an inpatient at a Medicare-approved facility.

Medicare recipients who have Original Medicare Part B have coverage for the following preventive and diagnostic eye exams:

- Eye examinations for diabetics to test for diabetic retinopathy one time per year.

- Glaucoma tests once every 12 months if you are considered at high risk for glaucoma. People at high risk are:

Related articles:

The Independent Medicare Insurance Broker

A licensed insurance professional must be licensed in each state they do business, and also appointed to do business by each company they represent. Without going through this process, the insurance professional is not permitted, by law, to show prices or plans of those companies from which they are not appointed and states they are not licensed. The insurance professional that has gone through this process and can offer all Medicare Supplement plans and possibly even Medicare Advantage plans has the ability to represent your best interest. Because they consider your situation and budget then shop all the plans for the best Medigap plan and the best price, they can find and present to you the Medicare Supplement policy and company that is right for you. This is an independent Medicare insurance broker. They do not work for any insurance company. They may work for an insurance agency or for themselves, but their goal is to represent your best interest.

When it comes to shopping for the best plan and best price, the independent Medicare insurance broker represents your best interest. However, they must disclose all pertinent facts to the insurance company. Its that simple.

Don’t Miss: When Can I Start Medicare Part B

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Where Can You Get More Information

You can find out more about Medicare, whether you are eligible, and what it would cost you in your situation at www.medicare.gov. Or you can call 1-800-633-4227.

You can look at Medicare plans at www.medicare.gov/find-a-plan/questions/home.aspx.

The website www.cms.gov has information on both Medicare and Medicaid.

You also can get help to decide what plans might be best for you through your state’s Health Insurance Assistance Program. For more information, see www.shiptalk.org/Public/home.aspx.

You May Like: How Many Days Does Medicare Pay For Nursing Home

How To Find The Right Independent Medicare Insurance Broker

Now you know the first step in making certain the person you work with has your best interest in mind work with an independent insurance broker, not an agent working for an insurance company. In my opinion, throwing a dart and selecting any independent Medicare insurance broker will leave you better off than any agent employed by an insurance company. But, you can do better.

Not all independent Medicare insurance brokers are the same and it is in your best interest to find one that has the knowledge, wisdom, and experience to be your advisor. Here are a few bullet points I suggest to follow. Its not a difficult process, in fact, it can be completed in a moments time. These bullet points will you quickly sift out the below average and average insurance broker and find the ones that can add the most value and meet your needs. I might add that what you wont see is the old ask for referrals suggestion. Bernie Madoff built his Ponzi scheme business on referrals. Enough said.

Younger Than Age : Who Is Eligible For Medicare

As long as you meet the citizenship/legal residence requirements described above, you may be eligible for Medicare when you are younger than age 65 if one of the following circumstances applies to you:

- You have been receiving Social Security disability benefits for at least 24 months in a row

- You have Lou Gehrigs disease

- You have permanent kidney failure requiring regular dialysis or a kidney transplant. This condition is called end-stage renal disease .

Read more details about enrollment in Medicare when youre under 65.

Recommended Reading: Does Medicare Cover Handicap Ramps

What Will Medicare Part B Cost

Medicare Part B requires a monthly premium,4 which will be automatically deducted from any benefit youre receiving from Social Security, the Railroad Retirement Board or the Office of Personnel Management. Otherwise, youll get a bill.

Youll generally pay a standard premium amount unless your modified adjusted gross income is over a certain amount. For this calculation, Medicare uses your IRS tax return from two years prior to identify whether youre a higher-income beneficiary. If you are, youll pay an income-related monthly adjustment amount . Heres how it works.

If your yearly income in 2019 was:

| File taxes as an individual | File taxes as married filing jointly | File taxes as married, filing separately | Youll pay each month in 2021* |

| $88,000 or less | |||

| $504.90 |

In addition to your monthly premiums, Medicare Part B has a deductible of $203 in 2021. Once you hit your deductible during the year, youll usually be responsible for 20% of Medicare charges for all Part B services .

Although the costs above are standard, if you dont enroll in Part B when youre first eligible and you didnt have a valid reason to delay enrollment your premium may go up 10% for each 12-month period you couldve had it .5 In most cases, youll pay this late enrollment penalty for as long as you have Part B, so dont miss your window.

How Does Original Medicare Work

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them. Theres no limit on what youll pay out-of-pocket in a year unless you have other coverage . Get details on cost saving programs.

Services covered by Medicare must be medically necessary. Medicare also covers many preventive services, like shots and screenings. If you go to a doctor or other health care provider that accepts the Medicare-approved amount, your share of costs may be less. If you get a service that Medicare doesnt cover, you pay the full cost.

With Original Medicare, you can:

- Go to any doctor or hospital that takes Medicare, anywhere in the U.S. Find providers that work with Medicare.

- Join a separate Medicare drug plan to get drug coverage.

- Buy a Medicare Supplement Insurance policy to help lower your share of costs for services you get.

If you’re not lawfully present in the U.S., Medicare won’t pay for your Part A and Part B claims, and you can’t enroll in a Medicare Advantage Plan or a Medicare drug plan.

You May Like: Does Medicare Pay For Eyeglasses For Diabetics

How Do You Sign Up For Medicare

Most people are automatically enrolled in Part A and Part B if they:

- Get retirement benefits from Social Security or the Railroad Retirement Board. You are enrolled the first day of the month you turn 65.

- Are younger than 65 and have been getting disability benefits from Social Security or the Railroad Retirement Board for 24 months.

If you qualify for automatic enrollment, you will be sent your Medicare card 3 months before you turn 65 or your 25th month of disability.

You need to apply to get Part A and Part B benefits if you aren’t getting Social Security or railroad benefits.

You also need to sign up if you have end-stage renal disease. Medicare covers dialysis treatment for people who have permanent kidney failure.

You can get more information and sign up for Medicare by calling the Social Security office at 1-800-772-1213 or by applying online at www.socialsecurity.gov/medicareonly.

Penalty for late enrollment

If you don’t sign up for Parts A and B when you are first eligibleâby the first day of the month you turn 65âyou may pay a higher premium than if you had signed up then. A penalty also may apply for late enrollment in Part D, depending on how long you went without drug coverage.

Medicare Spending Now And In The Future

In 2017, Medicare benefit payments totaled $688 billion 21 percent was for hospital inpatient services, 14 percent for outpatient prescription drugs, and 10 percent for physician services 30 percent was for payments to Medicare Advantage plans for services covered by Part A and Part B .

Medicare spending is affected by a number of factors, including the number of beneficiaries, how care is delivered, the use of services , and health care prices. Both in the aggregate and on a per capita basis, Medicare spending growth has slowed in recent years, but is expected to grow at a faster rate in the next decade than since 2010 . Looking ahead, Medicare spending is projected to grow from $583 billion in 2018 to $1,260 billion in 2028. The aging of the population, growth in Medicare enrollment due to the baby boom generating reaching the age of eligibility, and increases in per capita health care costs are leading to growth in overall Medicare spending.

Figure 6: Actual and Projected Average Annual Growth Rates in Medicare and Private Health Insurance Spending, 1990-2027

Rising prescription drug costs are a particular concern in relation to Medicare spending. The average annual growth rate in per beneficiary costs for the Part D prescription drug benefit is projected to be higher in the coming decade than between 2010 and 2017 . This is due in part to projected higher Part D program costs associated with expensive specialty drugs.

Also Check: What Does Original Medicare Mean

You May Not Have The Same Va Coverage Forever

Another reason you may consider enrolling in Medicare is the possibility that you may lose your VA benefits at some point, leaving you without health insurance coverage.

VA health benefits depend on an annual appropriation of funds by Congress, and its unpredictable if enough funding will be approved in future years to care for all veterans. Those veterans in the lower priority groups are at particular risk to see a reduction or even a complete loss of their veterans benefits.

Medicare Supplement Plan G: What You Need To Know Before Enrolling

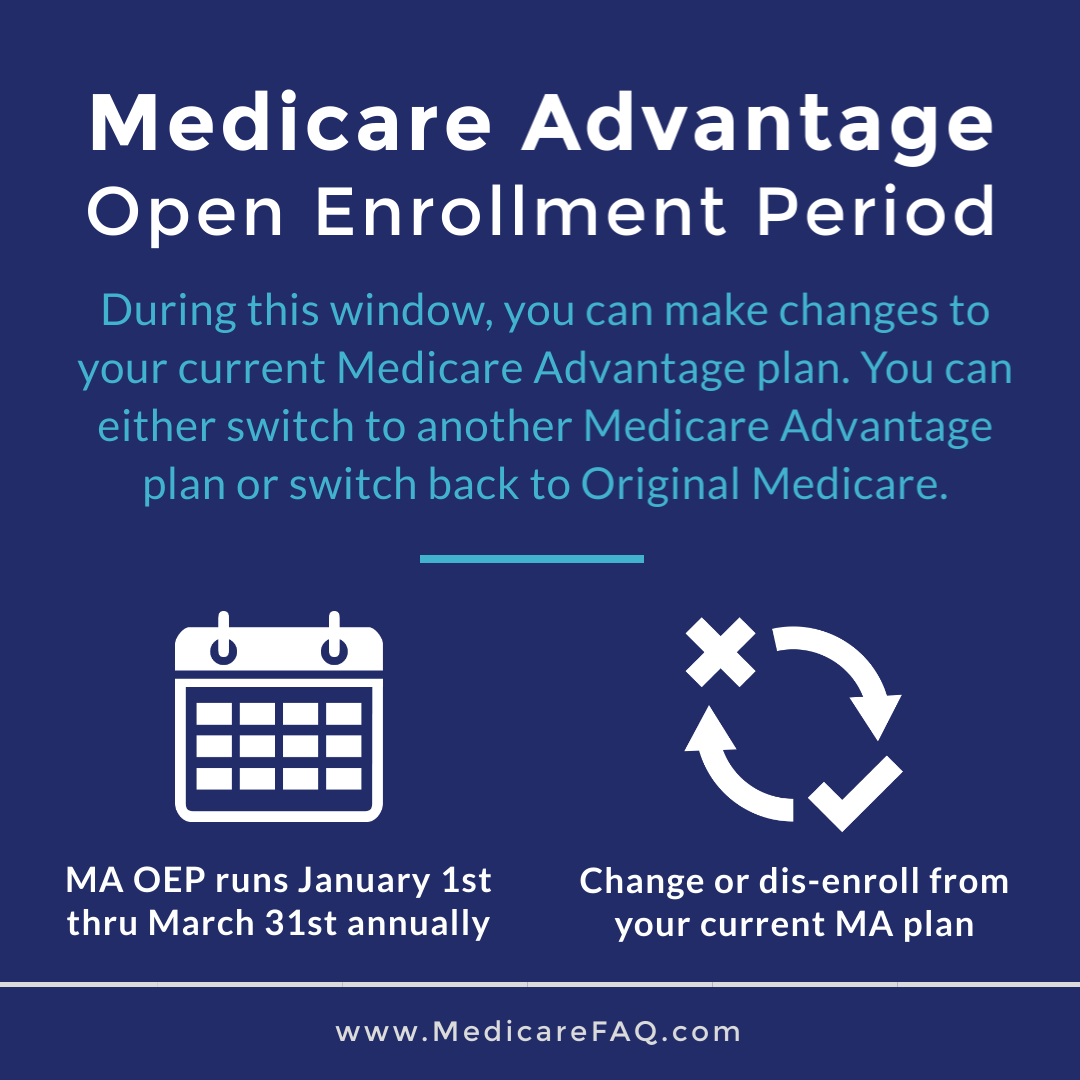

Before you can sign up for Plan G, you must enroll in both Medicare Part A and Part B. The best time to enroll in Plan G is during your Medigap Open Enrollment period. Thats the six months immediately after you turn 65 and sign up for Part B, when youre guaranteed by federal law to be accepted by any plan, regardless of health. You can enroll in or switch Medicare Supplement plans at other times, but the insurance companies can deny you or charge you more based on your health.

Most Medigap plans are standardized across the nation. However, if you live in Massachusetts, Minnesota, or Wisconsin, different types of plans are available. Contact one of our licensed insurance agents or your local state insurance department to help you understand your options.

You May Like: How To Change Primary Doctor On Medicare

Medicare Supplement Plan G

Plan G is a type of supplemental insurance for Medicare. Supplemental insurance plans help cover certain health care costs, such as deductibles, coinsurance, and copayments. Without a supplement plan, youd have to pay those expenses yourself.

Some people call Medicare supplement plans Medigap because they fill in the gaps that exist in Medicare. Plan G is one of 10 major Medicare supplement plans currently offered to new Medicare enrollees. The plans are named by letter, ranging from A to N.

Plan G is the second-most comprehensive Medicare supplement plan available, next to Plan F. Plan G is also growing in popularity.1

The Cares Act Of 2020

On March 27, 2020, former President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expanded Medicare’s ability to cover treatment and services for those affected by COVID-19, the novel coronavirus. The CARES Act also:

- Increased flexibility for Medicare to cover telehealth services.

- Increased Medicare payments for COVID-19-related hospital stays and durable medical equipment.

For Medicaid, the Families First Coronavirus Response Act clarified that non-expansion states can use the Medicaid program to cover COVID 19related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Recommended Reading: Is A Psa Test Covered By Medicare

How Much Does Medicare Cost At Age 65

The United States national health insurance program known as Medicare has been providing people with health care insurance coverage since 1966. Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

The U.S. government has set the age of eligibility for Original Medicare Parts A and B at 65. And, while most people enroll at this age, others continue working and choose to stay on their employers insurance plan until the time they retire.

If your 65th birthday is coming up and you are planning to enroll for your Medicare benefits, you may be wondering what your costs will be. Here is a look at what you pay for Medicare insurance at the age of 65.

What Medicare costs do you have at age 65?The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

Part A

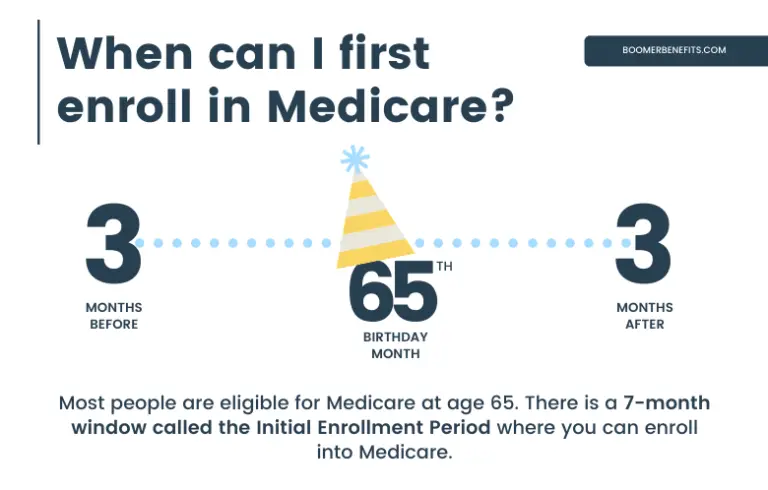

If you are not receiving Social Security benefits three months before your 65th birthday, you must sign up for Part A during your initial enrollment period which lasts for a period of seven months based on your 65th birth month.

There is no monthly premium for Part A if you meet the following requirements for premium-free Part A:

You are currently receiving retirement benefits from either the SSA or the RRB.

You have not applied for SS or RRB benefits yet, but you are eligible for them.

Days 1 60: $0 coinsurance per benefit period

Part B