Medigap Plans Can Help Cover Your Medicare Costs

Keeping up with exactly how much Original Medicare will cover and not cover can be stressful, especially if youre worrying about keeping medical costs down.

Medigap plans can help fill in the coverage gaps left behind by Original Medicare and help you pay less out of pocket for medical costs.

Some Medigap plans even offer coverage for services not covered by Original Medicare at all, such as emergency health care while traveling abroad.

There are 10 standardized Medigap plans available in most states. You can use the 2019 Medigap plans comparison chart below to compare the benefits of each type of plan.

Learn About Additional Medicare Insurance

Medigap and Medicare Advantage help you cover what Medicare leaves out.

Related Articles:

- Medigap Overview You may already know that Medicare covers you up to 80%. A Medigap plan will take care of the remaining 20%. This means that whatever Medicare covers, Medigap will cover too.

- New to Medicare: Everything you need to know. Medicare is the United States federal health insurance program for Americans 65 and older, as well as people with certain disabilities or End Stage Renal Disease .

- Medicare Advantage Overview Medicare Advantage is fairly similar to Original Medicare. The main difference is that when it comes to MA, your coverage is now offered by private companies. These plans are required to offer at least what Medicare does, and usually cover quite a lot more.

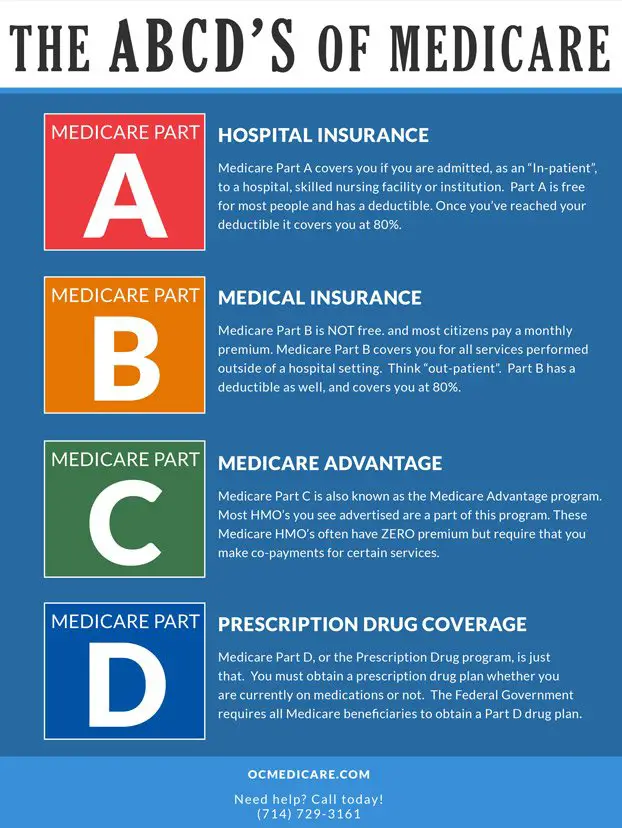

Do Medicare Parts C And D Cover What Original Medicare Does Not

Because of the limitations of Original Medicare, many enrollees choose to boost their coverage by signing up for a Medicare Supplement plan. Supplements come in many different forms, each having their own levels of coverage and costs. Two options for covering services that Medicare Parts A and B do not cover are Medicare Parts C and D.

Don’t Miss: How To Know If I Have Medicare

Does Medicare Part A Cover 100 Percent

For a qualifying inpatient stay, Medicare Part A covers 100 percent of hospital-specific costs for the first 60 days of the stay after you pay the deductible for that benefit period. Part A doesnt completely cover Days 61-90 or the 60 lifetime reserve days you can use after Day 90. After 60 days, you must pay coinsurance that Part A doesnt cover.

For hospital expenses covered by Part B, you have to pay 20 percent coinsurance after meeting your annual deductible. Part A and B are collectively known as Original Medicare and work hand-in-hand to help cover hospital stays. Alternatively, some people opt to use Part A in conjunction with employer medical insurance for hospital coverage.

Does Medicare Cover Cataracts

Cataracts cloud the lens of the eye, making it difficult to see. Surgery is generally needed to correct the condition, and under original Medicare, you have two choices in this regard.

First, you can receive a basic lens replacement, paid in full by Medicare up to $2,000. Or, you can apply that amount to a replacement lens that not only addresses the cataract, but also corrects for near or farsightedness, and then pay the difference. Additionally, Medicare will pay for a pair of corrective eyeglasses or contacts that are necessary following cataract surgery.

As is the case with other medical procedures, with cataract treatment, youll still be responsible for your Part B deductible and 20 percent coinsurance. If you have a Medigap plan, it can pick up some or all of these out-of-pocket costs. And if youre on Medicare Advantage, your out-of-pocket costs may be lower, depending on what plan you have.

You May Like: Will Medicare Pay For An Inversion Table

What Is Medicare Part A

Medicare Part A is hospital insurance. It may cover your care in certain situations, such as:

- Youre admitted to a hospital or mental hospital as an inpatient.

- Youre admitted to a skilled nursing facility and meet certain conditions.

- You qualify for hospice care.

- Your doctor orders home health care for you and you meet the Medicare criteria. Medicare Part A may cover part-time home health care for a limited time.

Even when Medicare Part A covers your care:

- You may have to pay a deductible amount and/or coinsurance or copayment.

- There may be some services you get in a hospital or other setting that Medicare doesnt cover.

- Its possible that your Part A coverage will run out for example, if you stay in the hospital for more than 90 days in a row, you might have to pay all costs. Learn more about Medicare Part A

- Medicare typically wont pay for a private room or non-medical items such as toiletries or a television in your room.

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

Don’t Miss: What Age Can You Start To Collect Medicare

Does Medicare Cover Wigs For Cancer Patients

According to the National Institute of Health , some types of chemotherapy cancer treatment cause the hair on the head and other parts of the body to fall out. You could wear a hat or scarf to cover your head, but some people may prefer a wig of natural-looking hair. Wig prices vary based on how long the wig is and whether the wig is made of synthetic materials or human hair, but they could cost hundreds of dollars and up to thousands of dollars. Unfortunately Medicare does not typically does not cover wigs for cancer patients who are undergoing cancer treatment. However, you may be able to get help from a non-profit to obtain a low-cost or free wig. Some non-profits, such as Friends Are by Your Side work with local salons to schedule wig consultations. You may have to provide documentation of your hair loss as a side-effect of chemotherapy and inability to independently afford a wig for organizations such as Lollys Locks. The American Cancer society may also accept and distribute new wigs at no cost through its local chapters.

If you or someone youre caring for is undergoing cancer treatment, adequate coverage can help you manage your health costs and make sure youre able to get the care you need. If you have any questions, were here to help. To get help over the phone or by email, use the links below to have me contact you. If youd like to browse Medicare plan options on your own, just use the Compare Plans buttons on this page.

New To Medicare?

General Fund Revenue As A Share Of Total Medicare Spending

This measure, established under the Medicare Modernization Act , examines Medicare spending in the context of the federal budget. Each year, MMA requires the Medicare trustees to make a determination about whether general fund revenue is projected to exceed 45 percent of total program spending within a seven-year period. If the Medicare trustees make this determination in two consecutive years, a “funding warning” is issued. In response, the president must submit cost-saving legislation to Congress, which must consider this legislation on an expedited basis. This threshold was reached and a warning issued every year between 2006 and 2013 but it has not been reached since that time and is not expected to be reached in the 20162022 “window”. This is a reflection of the reduced spending growth mandated by the ACA according to the Trustees.

Recommended Reading: Does Medicare Cover Dexcom G6 Cgm

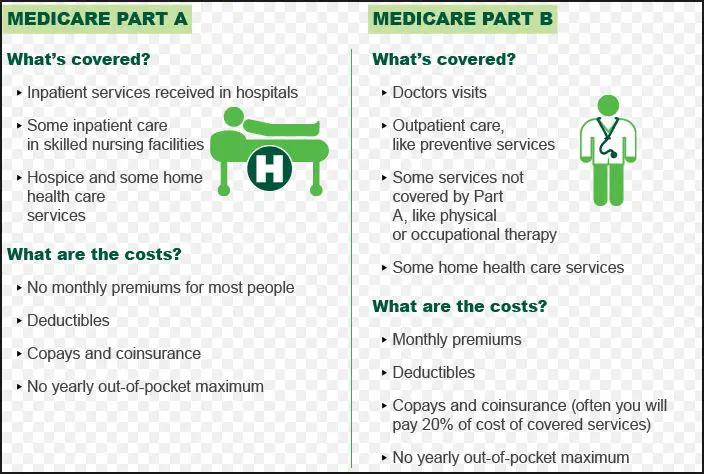

Whats The Difference Between Medicare Part A And Medicare Part B

Part A is the hospital services part of Medicare. This benefit covers inpatient care, hospital stays, skilled nursing facility care, hospice care, and medically needed home health care services.

Part B is the medical services part of Medicare. It covers many of the medically necessary services not covered in Part A, such as outpatient and preventive services. This involves things like x-rays, bloodwork, doctors visits, and outpatient care. It will also cover other medical items such as diabetic test strips, nebulizers, and wheelchairs.

How Much Does It Cost To Get A Full Mouth Of Denture Implants

An average full mouth implant costs $34,000 on average. It is possible to spend anywhere from $3,500 to $30,000 on a top or bottom set of dentures. The strength and security of full mouth dental implants make them ideal. In contrast to traditional dentures, they do not require adhesives to be applied.

Don’t Miss: How To Find A Medicare Doctor

What Do Medicare Part A And Part B Have In Common

Medicare Part A and Part B share some characteristics, such as:

- Both are parts of the government-run Original Medicare program.

- Both may cover different hospital services and items.

- Both may cover mental health care .

- Both may cover home health care.

- Both have annual deductibles, as well as coinsurance or copayments, that may apply to certain services.

- Both have monthly premiums, although many people dont have to pay the Part A premium .

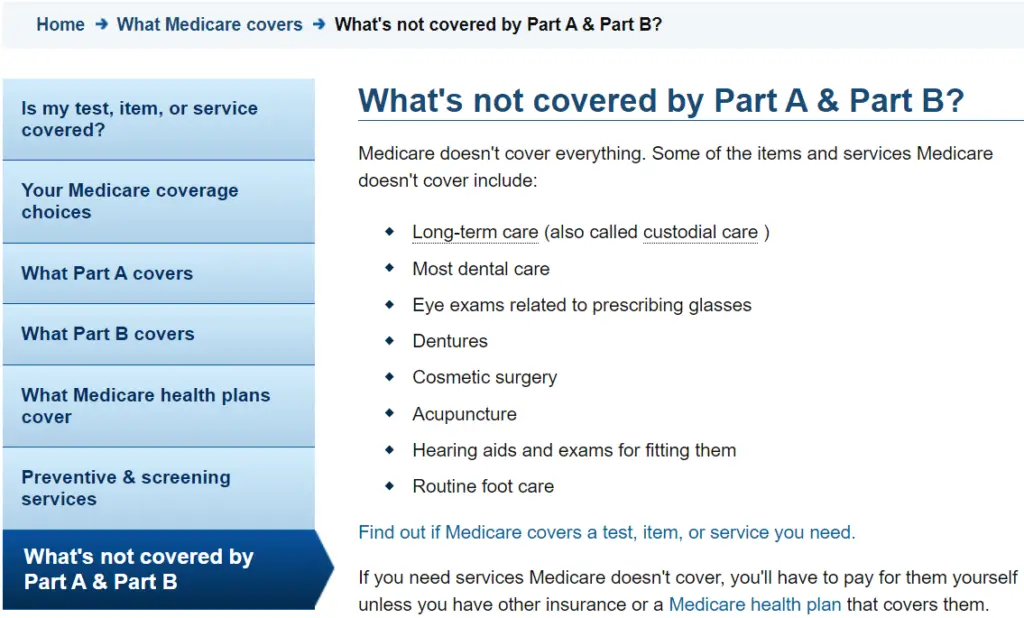

Original Medicare And Non

Medicare Part B only covers non-emergency ambulance services to the nearest medical facility that is able to provide you with appropriate care if you have a written order from your doctor saying that it is medically necessary.

If you go to a facility that is farther away, Medicares coverage will be based on the charge to the closest facility, and you must pay the difference.

If the ambulance company thinks that Medicare might not cover your non-emergency ambulance service, they should provide you with an Advance Beneficiary Notice of Noncoverage.

Recommended Reading: How To Change Primary Doctor On Medicare

Does Medicare Ever Pay For Dental Implants

In addition to cleanings, fillings, dentures, and tooth extractions, Medicare does not cover dental care or services. In addition, dental implants are included. In addition to covered procedures, Medicare covers services such as the reconstruction of your jaw after an injury, which are also covered.

What Is Not Covered Under Medicare Part A

Even in the case of an inpatient stay that Medicare Part A covers, Part A wont cover:

- A private room .

- Private-duty nursing.

- Television and phone in your room .

- Personal care items .

Being surprised that a couple of items on your bill arent covered by Part A is one thing discovering that the stay isnt covered by Part A at all is quite another thing.

Medicare literature on what qualifies as a covered stay states, An inpatient admission is generally appropriate for payment under Medicare Part A when youre expected to need 2 or more midnights of medically necessary hospital care, but your doctor must order this admission and the hospital must formally admit you for you to become an inpatient.

Don’t Miss: Does Medicare Cover Oral Surgery Biopsy

The Advantages Of Medicare Part B

Medicare Part B covers essential medical care and supplies for the diagnosing, treating, and preventing of serious medical conditions. It expands upon Part A by covering care and treatments beyond those provided at a hospital.

When you should enroll in Medicare Part B depends on whether you or a spouse has a job-based or retirement insurance that can act in place of Part B. Once you lose such coverage, often around the age of 65 for most retirees, youll want to sign up for Part B. While you have your job-based or retirement insurance, the premiums for Part B will be waivHowever, if. However, if you do not have such insurance at all, it is usually recommended that you enroll in Medicare Part B right when you are eligible.

Does Medicare Cover Prescription Drugs

Original Medicare alone does not cover the cost of prescription drugs.

If you want Medicare prescription drug coverage, there are two options you may be able to consider:

Part D plans and Medicare Advantage plans are sold by private insurance companies. Plan availability and the drugs they cover may vary.

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

Recommended Reading: Is It Mandatory To Have Medicare Part D

How It Compares To Other Parts Of Medicare

Part A of Medicare is hospital coverage. If you apply for Medicare, you will automatically be enrolled in Part A. It primarily covers hospital visits, with some nursing care and hospice care included. Most people dont pay a premium for Part A. However, there is a hefty deductible that has to be paid each time you visit the hospital. Part A is an essential part of healthcare coverage but is automatically applied once a person meets eligibility requirements and thus doesnt need to be thought about beyond that.

Medicare Part C covers Medicare Advantage, which is the private health insurance alternative to federal medicare. This is coverage on top of both Part A and B, meaning youll have to pay the premium for B still. Then, youll be adding private insurance on top of that. This primarily covers dental and vision care. It can cover extras such as wheelchair ramps or shower grips for the home, meal delivery, and healthcare transportation. Most Part C plans also cover some prescription drugs but not a lot.

Medicare Part D is a fuller coverage of prescription drugs. This is covered by a private insurer and covers copays for each medication or a percentage of the prescription cost. However, You will still be responsible for 25 percent of the cost of your drugs if their total cost of the drugs is above $4,430 in 2022.

What Medicare Plans Cover Transportation

The only types of private Medicare plans that provides coverage for transportation are certain Medicare Advantage plans.

Medicare Advantage plans provide the same benefits as Medicare Part A and Part B combined into one simple plan.

Many Medicare Advantage plans may also offer additional benefits such as coverage for prescription drugs, and some plans may also cover things like dental and vision care.

In April 2018, the Centers for Medicare & Medicaid Services announced it expand the list of benefits private insurance companies are allowed to cover as part of a Medicare Advantage plan.

The expanded Medicare Advantage benefits can include things like:

- Transportation to doctors offices

- Wheelchair ramps

- Handrails installed in the home

- More coverage for home health aides

- Air conditioners for people with asthma

These extra benefits are offered as part of an aim to focus on more preventive health and aging-in-place benefits.

Read Also: Does Medicare Cover End Of Life Care

Medicare Prescription Drug Coverage For Cancer Treatment

Medicare Part B may cover limited prescription drugs, including some cancer prescription drugs taken by mouth that may be administered to you. You also may be covered for anti-nausea drugs to treat symptoms caused by chemotherapy cancer treatment. In these situations, you usually pay 20% of the Medicare-approved amount, after the annual Medicare Part B deductible is applied. If youre admitted to a hospital, Medicare Part A typically covers prescription drugs given to you as part of your inpatient cancer treatment.

For medications that arent covered under Original Medicare, youll need Medicare Part D coverage, or you may have to pay the full cost of those prescription drugs. You can get this optional coverage through a stand-alone Medicare Part D Prescription Drug Plan or a Medicare Advantage Prescription Drug plan. Keep in mind that not every cancer treatment medication is covered by each Medicare Prescription Drug Plan or each Medicare Advantage Prescription Drug plan. Check the formulary of the plan you have or are considering to see if the medications you need are included. A plans formulary may change at any time. You will receive notice from your plan when necessary.

Its important to review your prescription drug coverage every year, as Medicare Part D Prescription Drug Plans and Medicare Advantage Prescription Drug plans can make formulary and cost changes that affect how much you pay.

Is Medicare Part B Free

Medicare Part B premiums may change from year to year, and the amount can vary depending on your situation. For many people, the premium is automatically deducted from their Social Security benefits.

The standard monthly Part B premium: $148.50 in 2021.

If your income exceeds a certain amount, your premium could be higher than the standard premium, as there are different premiums for different income levels.

See below for more details about the Medicare Part B premium.

If you are receiving Social Security, Railroad Retirement Board, or federal retirement benefits, your Part B premium will be deducted directly from your monthly benefit. If not, you will be sent a bill every three months.

The chart below shows the Medicare Part B monthly premium amounts, based on your reported income from two years ago . These amounts may change each year. A late enrollment penalty may be applicable if you did not sign up for Medicare Part B when you were first eligible. Your monthly premium may be 10% higher for each 12-month period that you were eligible, but didnt enroll in Part B.

| Medicare Part B monthly premium in 2021 |

| You pay |

| $412,000 or more |

You May Like: Can You Get Medicare Advantage Without Part B