Medicare Part B Covering Your Doctor Visits And Beyond

- What Medicare Part B covers: Part B pays for services like:

- Doctor visits

- Outpatient procedures

- Lab services

- other testing

Does Medicare Cover Tetanus Shots

Coverage includes shots of severe diseases such as tetanus, pertussis, and diphtheria. Without treatment, these diseases can become deadly. In some cases, even with the best treatment and medical attention it can kill those with the infection.

Before the development of vaccines, hundreds of tetanus cases were found each year in the United States. Now, we have vaccines to protect us from such diseases.

99% fewer examples of Diptheria are found each year due to the shot.

Lockjaw is a common nickname for this disease. Symptoms include a painful, widespread stiffness and tightening of the muscles.

When the head and neck muscles begin to stiffen and tighten, the ability to open your mouth becomes difficult. Likewise, it becomes challenging to swallow or even breathe.

Unlike the others, tetanus infections happen by bacteria entering the body through open scratches, wounds, or cuts. Part B coverage pays for tetanus shots when given as treatment for an injury or illness.

Part D covers vaccines given to prevent illness. Check with your plan for availability in your service area.

Part D plans are not all the same benefits may vary among insurance carriers. Finding a Top Part D plan is easy when you give us a call at the number above.

How Does A Medigap Plan Work With Medicare Part B

If you are signing up for a Medigap plan to go with your traditional Medicare Part A and B, you may be wondering how the plans will work together.

First and foremost, it is important to understand that Medicare is your primary coverage. The Medigap plan acts as a secondary coverage to regular Medicare.

A Medigap plan can be used anywhere that Medicare is accepted regardless of what Medigap company you use. Medigap plans are non-network plans, so if a doctor takes Medicare , they will also take the Medigap plan. Medigap claims are handled through the Medicare crossover system.

As far as coverage, Medigap plans are designed to fill in the gaps in regular Medicare, including Medicare Part B. Medicare Part B generally pays 80% after the Part B deductible, and the Medigap plans pay the remaining 20% with some plans also picking up that Part B deductible.

If you have other questions or wish to speak to someone directly, you can contact us online or call us at 877.506.3378.

Get a List of Medigap Plans via Email

Read Also: Can You Draw Medicare At 62

Can I Delay Enrolling In Medicare Part B

Some people may get Medicare Part A premium-free, but most people have to pay a monthly premium for Medicare Part B. Because Medicare Part B comes with a monthly premium, some people may choose not to sign up during their initial enrollment period if they are currently covered under an employer group plan .

If you are still working, you should check with your health benefits administrator to see how your insurance would work with Medicare. If you delay enrollment in Medicare Part B because you already have current employer health coverage, you can sign up later during a Special Enrollment Period without paying a late penalty. You can enroll in Medicare Part B at any time that you are still covered by a group plan based on current employment. After your employer health coverage ends or your employment ends , you have an eight-month special enrollment period to sign up for Part B without a late penalty.

Keep in mind that retiree coverage and COBRA are not considered health coverage based on current employment and would not qualify you for a special enrollment period. If you have COBRA after your employer coverage ends, you should not wait until your COBRA coverage ends to sign up for Medicare Part B. Your eight-month Part B special enrollment period begins immediately after your current employment or group plan ends . This is regardless of whether you get COBRA.

Medicare Doesn’t Cover Medical Care Overseas

Medicare usually doesnt cover care you receive while traveling outside of the U.S., except for very limited circumstances . But medigap plans C through G, M and N cover 80% of the cost of emergency care abroad, with a lifetime limit of $50,000. Some Medicare Advantage plans cover emergency care abroad. Or you could buy a travel insurance policy that covers some medical expenses while youre outside of the U.S. and may even cover emergency medical evacuation, which can otherwise cost tens of thousands of dollars to transport you aboard a medical plane or helicopter.

Also Check: How To Qualify For Oxygen With Medicare

Do I Have To Enroll In Medicare Part B

What if you have other medical coverage, like an employers plan? Do you still have to sign up for Part B?

You can choose to delay Part B enrollment, as some people do when theyre covered under an employers or union-based health insurance plan. However, when that coverage ends, be aware that if you dont sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty.

Heres one reason you might want to sign up for Medicare Part B. Suppose you decide youd like to buy a Medicare Supplement insurance plan. Or, you want to enroll in a Medicare Advantage plan. Both of these types of coverage require you to be enrolled in both Medicare Part A and Part B.

If you stay with Original Medicare and decide to sign up for a stand-alone Medicare Part D prescription drug plan, you need to be enrolled in Medicare Part A and/or Part B.

Please note that even if you decide to get your Original Medicare benefits through a Medicare Advantage plan, you still have to pay our monthly Medicare Part B premium. Of course, if the Medicare Advantage plan charges a premium, youll need to pay that as well. Some Medicare Advantage premiums are as low as $0.

Do you want to learn more about those Medicare coverage options we mentioned? Start comparing plans right away by typing your zip code where indicated on this page and clicking the button.

New To Medicare?

Medicare Doesn’t Cover Prescription Drugs

Medicare doesnt provide coverage for outpatient prescription drugs, but you can buy a separate Part D prescription-drug policy that does, or a Medicare Advantage plan that covers both medical and drug costs. You can sign up for Part D or Medicare Advantage coverage when you enroll in Medicare or when you lose other drug coverage. And you can change policies during open enrollment season each fall. Compare costs and coverage for your specific medications under either a Part D or Medicare Advantage plan by using the Medicare Plan Finder.

Don’t Miss: When Can I Change My Medicare Coverage

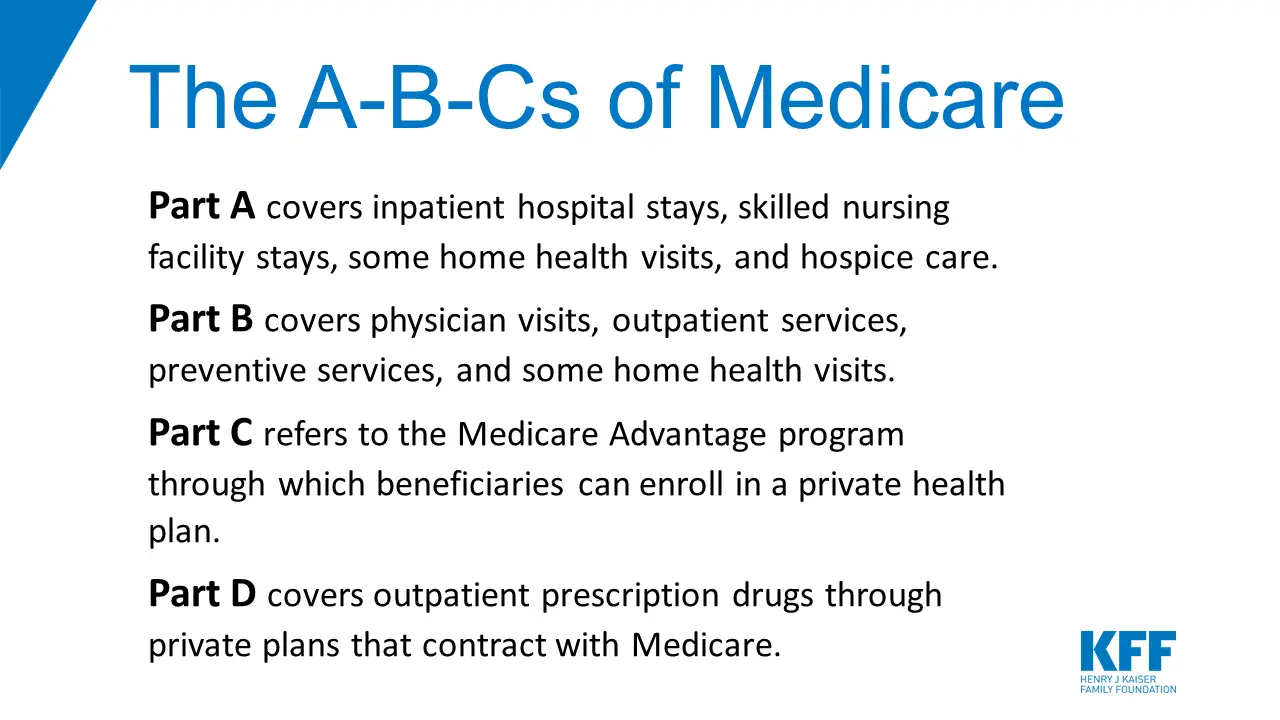

Medicare Part A: Hospital Insurance

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021.

Services covered under Part A may include surgeries, inpatient care in hospitals, skilled nursing facilities, hospice care, home healthcare services, and inpatient care in a religious non-medical healthcare institution.

This sounds straightforward, but it’s not. For example, Part A covers in-home hospice care but does not cover a stay in a hospice facility.

Additionally, if you’re hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each day’s expenses. If you’re admitted to the hospital multiple times during the year, you may need to pay a deductible each time.

Whos Eligible For Medicare Part B

Anyone whos eligible for Medicare is eligible for Part B, and thats anyone who is 65 or older, younger people with disabilities who have been receiving Social Security disability insurance benefits for 24 months and people with end-stage renal disease.3 Also, anyone who has Amyotrophic Lateral Sclerosis or Lou Gehrigs disease.

If youre not sure if youre eligible, try Medicares eligibility tool.

Don’t Miss: When Can You Start Collecting Medicare

When Can You Sign Up

Like Medicare Part A, typical Medicare Part B enrollment comes with a seven-month Initial Enrollment Period for signup. This includes the three months before and after the month you turn 65, plus the month of your birthday. Hence, if you turn 65 in April, your Initial Enrollment Period stretches from January through July.8

If you arent automatically enrolled, you can sign up for Part B any time during your Initial Enrollment Period. But if you wait until the month you turn 65 , your Part B coverage will be delayed.

If you miss your initial signup and you arent eligible for a Special Enrollment Period , you can enroll in Part B during the General Enrollment Period, between January 1 and March 31 each year. There are a variety of reasons you might get a SEP, including losing employer health coverage or moving back to the U.S. after living in another country.

What Is Medicare Part B

This part of Medicare covers doctors visits, lab tests, analytic screenings, clinical equipment, ambulance services, and other outpatient administrations. As compared to Part A, Part B includes more expenses, and you might need to concede pursuing it on the off chance that you are still working and have insurance through your work, or are covered by your life partners health plan. Be that as it may, in the event that you do not have other protection and do not go for Part B when you initially enroll for Medicare, you will probably need to pay a higher monthly charge however long you are in the program. The federal government sets the Part B monthly premium, which is $148.50 for 2021. It very well might be higher if your pay is more than $88,000. You will likewise be liable for a yearly deductible, set at $203 for 2021. Whats more, is that you will need to pay 20% of the bills for doctors visits and other outpatient administrations. On the off chance that you are gathering Social Security, the monthly premium will be deducted from your monthly benefit.

Recommended Reading: How To Apply For Medicare Through Social Security

Is Prolia Covered By Medicare

- Is Prolia covered by Medicare?’ Learn about the cost of this osteoporosis drug and how much you can expect to pay for it if your doctor prescribes it for you.

The National Osteoporosis Foundation reports that roughly 10 million Americans have osteoporosis and that an additional 44 million people suffer from decreased bone density and may develop the disease in the future. Osteoporosis puts you at an increased risk for debilitating fractures, but there are treatments available to lower the likelihood of injury due to a fall or other accident. Prolia is approved by the U.S. Food and Drug Administration to treat bone loss and minimize fracture risk. In many cases, Medicare covers Prolia to make treatment more affordable.

Medicare Part B Enrollment: How Do I Get Medicare Part B

To be eligible for Medicare, you must be a United States citizen or legal permanent resident of at least five continuous years and 65 years or older. You can also be eligible for Medicare before 65 if youve been receiving disability benefits from Social Security or the Railroad Retirement Board for at least two years, or if you have end-stage renal disease or amyotrophic lateral sclerosis .

Like other parts of Medicare, there are rules concerning when youre eligible and when you can sign up for coverage. If youre already receiving retirement benefits before you turn 65, you may be automatically enrolled in Medicare Part A and/or Part B the month that you turn 65. Youre also automatically enrolled in Medicare if youve been receiving Social Security or Railroad Retirement Board disability benefits for at least two years youll be automatically enrolled in the 25th month of disability benefits. Those who qualify for Medicare because of end-stage renal disease must manually sign up for Part B.

You can also sign up for Medicare Part B during the following periods:

You can enroll in Medicare Part B through Social Security in the following ways:

- Online at SSA.gov. If youre not yet ready to apply for retirement benefits, you can apply for Medicare only.

- In-person at a local Social Security office.

Recommended Reading: When Do You Receive Medicare Card

What Is Unique About Medicare Advantage When It Comes To Hospital Coverage

Medicare Advantage plans protect you with an annual out-of-pocket maximum a dollar amount specific to your plan that defines the most money you will have to pay out of your pocket for the plan year for healthcare. Original Medicare doesnt have an out-of-pocket maximum, although if you have Parts A and B, you can add one of the two standard Medigap plans that include an out-of-pocket max.

While Medicare Part A coverage is standard across the board, Medicare Advantage plans that replace Original Medicare come in all shapes and sizes. Some Medicare Advantage plans, for example, provide coverage for all hospital visits, regardless of their length or whether theyre considered to be inpatient or outpatient.

If you are looking for a specific level of coverage from a Medicare Advantage plan, a GoHealth licensed insurance agent can locate the right plan for your situation.

Dont Miss: Will Medicare Pay For Handicap Bathroom

What Doesnt Medicare Part B Cover

Medicare Part B doesnt cover every possible medical expense. Heres a partial list of what Part B doesnt generally cover.

- Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B.

- Some tests and services that your doctor might order or recommend for you. If your doctor wants you to have lab tests, or any services beyond your standard annual wellness visit, you might want to ask whether Medicare covers them. Medicare Part B might cover some of these services.

- Routine dental care

- Routine vision care

- Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting.

- Hearing aids

- 24-hour home health care

- Long-term care, such as you might get in a nursing home. If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesnt generally cover it.

Some of these services, such as routine dental and vision care, might be covered under a Medicare Advantage plan.

You May Like: Does Social Security Automatically Sign You Up For Medicare

Does Medicare Plan B Cover Dental

Part B does cover dental but it only covers the dental expenses that are a necessary part of another covered service. Such procedures could include oral exams in anticipation of a kidney transplant or reconstruction of teeth following an accident. It doesn’t cover the regular care, treatment, removal, or replacement of teeth. For example, the plan does not cover routine dental services such as cleaning, dentures, crowns, or fillings.

Whereas Part A does pay for inpatient hospital care if you need to have an emergency or complicated dental procedure, it doesnt cover dental care. On the other hand, some Medicare Advantage plans do include coverage for dental care.

Each plan has different costs and rules for how these benefits can be used. Therefore, for regular or preventative dental treatments, it’s better for Medicare beneficiaries to invest in separate dental plans. It’s also advisable to consider your future needs and family dental history before deciding on a plan. Outside of Medicare, there are also dental coverage plans such as standalone dental insurance, dental discount groups, or the Program of All-Inclusive Care for the Elderly .

Original Medicare: Part A And Part B

Medicare Part A and Part B make up the federal program known as Original Medicare. Learn more about how you qualify for Medicare.

- If youre eligible for Medicare Part A and Part B, you might be enrolled automatically.

- If youre getting Social Security benefits when you turn 65, youre typically enrolled without having to do anything.

- If youre under 65 and get disability benefits, you may be enrolled in Medicare Part A and Part B automatically. Read the details of when youll get enrolled in Part A and Part B if you qualify for Medicare due to disability.

Be aware, though, that sometimes youre not automatically enrolled, and you have to take steps to enroll in Medicare. For example:

- If you have end-stage renal disease , you might qualify for Medicare before youre 65, but you have to sign up through Social Security.

- If you live in Puerto Rico, even if youre automatically enrolled in Medicare Part A, you need to enroll manually in Medicare Part B.

- If you delayed enrollment in Medicare Part A and/or Part B beyond your Medicare Initial Enrollment Period, you need to enroll manually.

This might not be a complete list of occasions when you have to enroll manually.

Read Also: Does Medicare Cover Transportation To Physical Therapy

Medicare Part C Combining Your Coverage

Medicare Part C is also known as Medicare Advantage. It’s made up of plans approved by Medicare that are offered through private insurance companies. Before enrolling in a Medicare Advantage plan, you will still need to sign up for both Part A and Part B, and then choose a Medicare Advantage plan that is right for you. This means that to get a Medicare Advantage plan, you will have to sign up directly with the private insurer that offers the plan you want after youve enrolled in Part A and B.

- Dental, vision or hearing services

- Prescription drug coverage

- Fitness club memberships

Medicare Advantage plans can offer additional benefits because the plans are made up of networks of health care providers. Networks can be more efficient in delivering care. As a result, they reduce overall health care costs. Some Medicare Advantage plans require you to use their network of providers. Others allow you to go out-of-network, usually for a higher cost.