How Is Epic Used With Medicare Part D

EPIC supplements Medicare Part D drug coverage for greater annual benefits and savings. When purchasing prescription drugs, the member shows both their EPIC and Medicare Part D drug plan cards at the pharmacy. After any Medicare Part D deductible is met, if the member has one, drug costs not covered by Part D can be submitted to EPIC for payment. The member will pay an EPIC co-payment ranging from $3 to $20 based on the cost of the drug. For example, if the EPIC member’s out-of-pocket drug cost is $100, the member will pay $20.

Please note that EPIC deductible members must first meet their EPIC deductible before they pay EPIC co-payments. This is in addition to meeting their Medicare Part D drug plan deductible should their Part D plan have one.

What Medicare Part D Plans Cover

Medicare drug plans cover both generic and brand-name drugs. All plans must meet a standard level of coverage set by Medicare. This means they must all cover the same categories of drugs, such as asthma or diabetes medicines, but plans can choose which specific drugs are covered in each drug category.

Each Medicare Part D plan lists the drugs it covers in whats called a formulary. This list will likely include both brand-name and generic drugs and includes at least two drugs in the most commonly prescribed categories. A specific formulary may not include your medicine but may include a similar option. Formularies change from year to year and even within the year, so its important to check regularly that the medicines you need are included in your Part D coverage.

You may also want to check the insurers you are considering for any restrictions they put on drug coverage. This may include prior authorization before a drug is prescribed, limits on the quantity of certain drugs and step therapy in which generic and lower cost brand-name drugs are required before the most expensive drug is used.

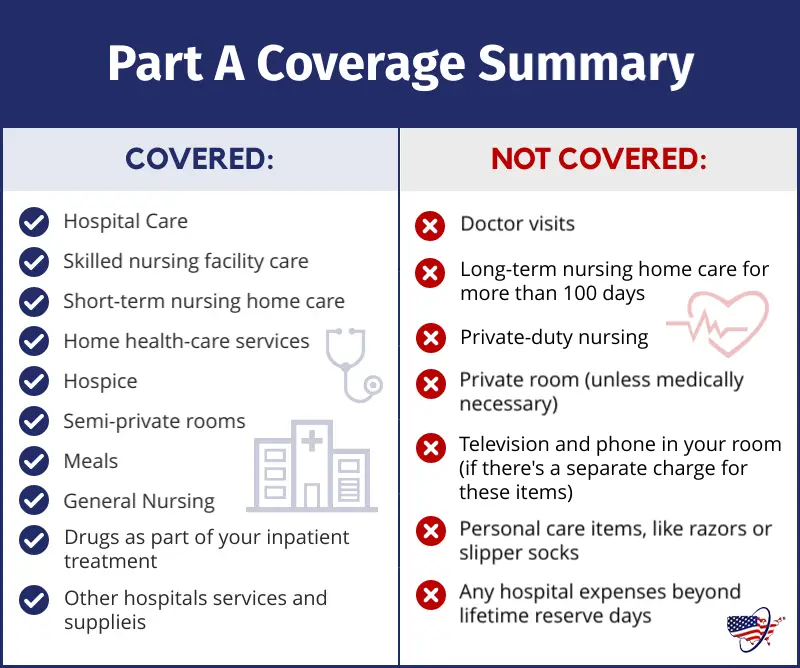

Its worth noting that Medicare Part D specifically covers self-administered prescription drugs. Prescription drugs administered by a doctor during a covered hospital stay, or in a doctors office, are typically covered by Medicare Part A or Part B.

What Are The Costs Of Medicare Part D Prescription Drug Coverage

Q: What are the costs of Medicare Part D prescription drug coverage?

A: When you enroll in Medicare Part D coverage, you will depending on your plan likely pay a monthly premium, an annual deductible, and coinsurance or copays.

Premiums vary by plan and by geographic region but the average monthly cost of a stand-alone prescription drug plan with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Premiums vary tremendously however, depending on location and the plan selected. In 2021, actual monthly premiums for stand-alone PDPs vary from under $6/month to over $200/month.

Want to make changes to your Part D coverage? Discuss your options with a licensed Medicare advisor at .

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020. But not all plans have deductibles, and some have deductibles that are lower than the maximum allowed .

After the deductible is met, PDP policyholders pay copays or coinsurance during their initial coverage period until the total of their prescription drug costs reaches $4,130 in 2021 . The deductible is included in the portion that the beneficiary pays, so if your deductible is $445, that counts towards the $4,130 initial coverage threshold.

Don’t Miss: How Much Is Premium For Medicare

Federal Employee Health Benefits Program

This is health coverage for current and retired federal employees and covered family members. These plans usually include creditable prescription drug coverage, so you dont need to get Medicare drug coverage . However, if you decide to get Medicare drug coverage, you can keep your FEHB plan, and in most cases, the Medicare plan will pay first. For more information, visit opm.gov/healthcare-insurance/healthcare, or call the Office of Personnel Management at 1-888-767-6738. If youre an active federal employee, contact your Benefits Officer. Visit apps.opm.gov/abo for a list of Benefits Officers. You can also call your plan if you have questions.

How Much Will You Pay For Drugs Once You Enter The Donut Hole

Once you enter the donut hole, hereâs what youâll pay for your prescription drugs in 2018:

- 35% of the plan’s cost for covered brand-name drugs

- 44% of the planâs cost for generic drugs

To give you an example of what these percentages could actually mean, weâve generated a sample using Medicareâs Plan Finder.

Recommended Reading: Does Medicare Part C Cover

How Copays Coinsurance And Deductible Work Together

With a Medicare Advantage plan, well track all the costs you pay deductible, copays and coinsurance. When you reach a certain amount, we pay for most covered services. This is called the out-of-pocket maximum.

Original Medicare doesnt have an out-of-pocket maximum. There’s no cap on what you pay out of pocket. And if you’re in the hospital or a skilled nursing facility, Original Medicare only pays for a certain number of days. After that point, you pay the full amount each day.

Medicare Prescription Drug Plan Availability In 2022

In 2022, 766 PDPs will be offered across the 34 PDP regions nationwide , a substantial reduction of 230 PDPs from 2021 and the first drop in PDP availability since 2017 .

The relatively large decrease in the number of PDPs for 2022 is primarily the result of consolidations of plan offerings sponsored by Cigna and WellCare resulting in the market exit of three national PDPs from each firm in each region. This accounts for just over 200 PDPs offered in 2021 that will no longer be offered in 2022. Enrollees in these non-renewing plans will be automatically switched to other plans offered by the same plan sponsors, although they can choose to switch into a different plan.

Despite the reduction in PDP availability for 2022, beneficiaries in each state will have a choice of multiple stand-alone PDPs, ranging from 19 PDPs in New York to 27 PDPs in Arizona . In addition, beneficiaries will be able to choose from among multiple MA-PDs offered at the local level for coverage of their Medicare benefits.

Don’t Miss: When Is Open Enrollment For Medicare

How Does The Medicare Part D Drug Plan Requirement Work

EPIC members are required to be enrolled in a Medicare Part D drug plan or a Medicare Advantage health plan with Part D . Enrolling in EPIC will give a member a Special Enrollment Period to join a Medicare Part D drug plan. Medicare Part D provides primary drug coverage for EPIC members. After a Part D deductible is met, if a member has one, EPIC provides secondary coverage for approved Part D and EPIC covered drugs. EPIC also covers approved Part D-excluded drugs such as prescription vitamins as well as cough and cold preparations after enrolling in a Part D drug plan.

The New York State EPIC program is not Creditable Coverage for members. This means that EPIC benefits are not as generous as Medicare Part D. If a member is not enrolled in a Medicare Part D drug plan, the member will not have any prescription coverage from EPIC or receive any EPIC benefits.

Because EPIC is a State Pharmaceutical Assistance Program, EPIC can provide:

- a Medicare Special Enrollment Period so that a new member may enroll in a Part D drug plan at any time during the year

- a Medicare one-time plan change per calendar year for existing members

- co-payment assistance after the Medicare Part D deductible is met, if the member has one. EPIC also covers approved Part D-excluded drugs once a member is enrolled in a Part D drug plan.

Issues For The Future

The Medicare drug benefit has helped to reduce out-of-pocket drug spending for enrollees, which is especially important to those with modest incomes or very high drug costs. But in the face of rising drug prices, more plans charging coinsurance rather than flat copayments for covered brand-name drugs, and annual increases in the out-of-pocket spending threshold, many Part D enrollees are likely to face higher out-of-pocket costs for their medications.

Policymakers are currently debating several proposals to control drug spending by Medicare and beneficiaries. Several of these proposals address concerns about the lack of a hard cap on out-of-pocket spending for Part D enrollees, the significant increase in Medicare spending for enrollees with high drug costs, prices for many drugs rising faster than the rate of inflation, and the relatively weak financial incentives faced by Part D plan sponsors to control high drug costs. Such proposals include allowing Medicare to negotiate the price of drugs, restructuring the Part D benefit to add a hard cap on out-of-pocket drug spending, requiring manufacturers to pay a rebate to the federal government if their drug prices increase faster than inflation, and shifting more of the responsibility for catastrophic coverage costs to Part D plans and drug manufacturers.

Topics

You May Like: How Much Do Medicare Plans Cost

Understanding Medicare Part D Prescription Drug Coverage

An animated white speech bubble appears over an animated character’s green and white head.

ON SCREEN TEXT: What is a Medicare Part D Plan?

The character and speech bubble separate and exit the screen on opposite sides. Blue text appears above a sheet of paper.

ON SCREEN TEXT: Medicare Part D plans are…

The paper and text slide up. Blue text appears, along with blue and white pill bottles.

ON SCREEN TEXT: Stand-alone plans that provide prescription drug coverage.

A bottle covers the text and turns over as pills pour out of it.

ON SCREEN TEXT: Part D plans cover certain common types of drugs as regulated by the federal government, but each plan may choose which specific drugs it covers.

The text disappears as the camera moves down to show another sheet of paper.

ON SCREEN TEXT: The list of drugs a plan covers is called a formulary.

Text appears on the paper.

ON SCREEN TEXT: Part D plans do not cover:

ON SCREEN TEXT: Drugs that aren’t on the plan’s formulary

ON SCREEN TEXT: Drugs that are covered under Medicare Part A or Part B

The text is crossed out with a blue line as the page scrolls down.

ON SCREEN TEXT: Drugs that are excluded by Medicare

More text is crossed out with a blue line. After the page scrolls down, the last chunk of text is crossed out with a blue line. The screen swipes down and white text appears on a blue background.

ON SCREEN TEXT: Medicare Made Clear® by UnitedHealthcare

Drug Utilization Rules That Affect Your Part D Coverage

Medicare allows drug plan carriers to apply certain rules for safety reasons and also for cost containment. The most common utilization rules that you may run into are:

Your overall Medicare prescription costs can be affected by these restrictions. Always check your medications in the plan formulary to see if restrictions apply to any of your important medications.

Related Article: Why Medicare Part D Will Drive You Nuts

Read Also: What Is The Medicare Supplement Plan

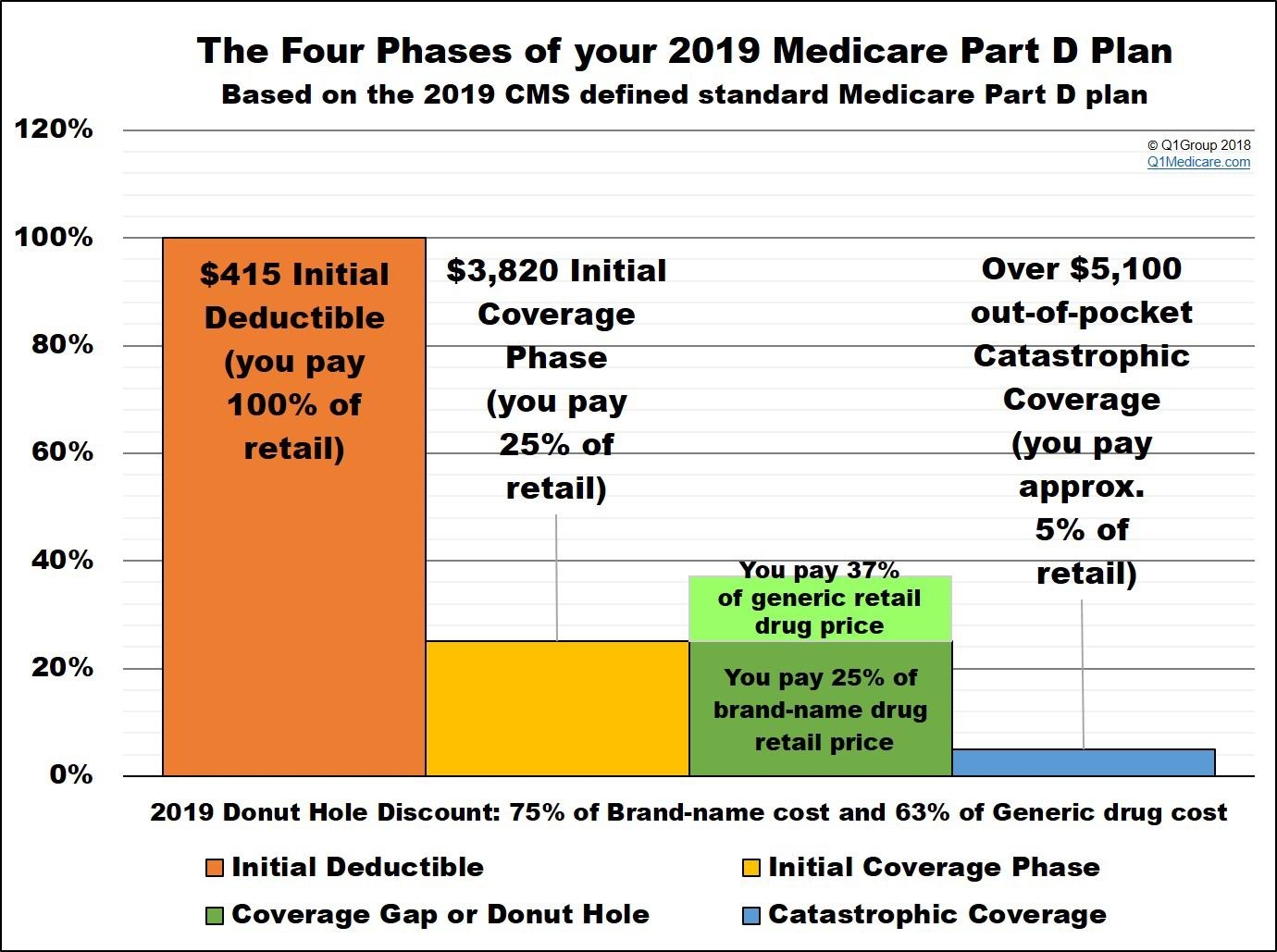

Phase 1 Annual Deductible

Some plans require you to pay a deductible, or 100% of the cost of prescription drugs, up to a certain limit before your plan starts to pay. The deductibles vary between plans and some Part D plans have no deductible. In 2021, the deductible cant be more than $445. Once you hit your deductible, your initial coverage kicks in.

How Much Does Medicare Part D Cost

The total cost of Medicare Part D depends on several factors: including your income, when you enroll, the number and type of drugs you take, and the pharmacy you use .5

Your costs include your premiums , deductible , and coinsurance or copayments .

A Word of Advice

Understanding how Medicare Part D works can help you estimate your expenses and make a plan for how youll cover them.

Read Also: Does Medicare Cover Bed Rails

How Do I Compare Medicare Part D Prescription Drug Plans

You should look at all three out-of-pocket expenses when you compare plans: Your Medicare Part D premiums, deductible, and copayment or coinsurance amounts. A plan with a higher deductible may have lower monthly premiums. If you dont use a lot of prescription medications, that may be the most cost-effective option for you. On the other hand, if you take daily medications, a lower deductible may be more important so you get help with your medications with less out-of-pocket expense.

If you take daily medications, its very important to look at each plans formulary. A formulary is simply the list of covered medications and your costs for each. Check to make sure the plans covers all your daily medications. Also remember a Medicare Supplement Insurance Plan doesnt cover any costs associated with Medicare Part D coverage.

Finally, compare pharmacy networks and benefits such as mail-order pharmacies. If you have a preferred pharmacy and its not in a plans network, you may be happier with a different plan. With many plans, you can save on your copayments and out-of-pocket costs by using the plans mail order pharmacy for medications you take regularly. If a plan offers this option, you may actually come out ahead even if the plan has a higher deductible or monthly premium, depending on the medications you use.

Limitations, copayments, and restrictions may apply. Premiums and/or copayments/co-insurance may change on January 1 of each year.

New To Medicare?

The Part B Deductible

Medicare Part B covers most of your regular medical expenses, such as doctor visits, preventative care, and lab work. Most people expect to use Part B more often than Part A, which is good because the Part B deductible is much lower and more straightforward.

The Part B deductible resets annually on January 1, so youll only ever pay it once per year. And, in 2020, the Part B deductible is just $198.2

After you meet the Part B deductible, you’ll pay a 20% coinsurance for covered services. Note that preventative services such as wellness checks are free, whether or not you’ve met your deductible.

Read Also: Who Do You Call To Sign Up For Medicare

D Enrollment Is Concentrated In 3 National Firms Unitedhealth Humana And Cvs Which Have A Combined 56% Of Total Enrollment

The top three firms UnitedHealth, Humana, and CVS Health cover close to 6 in 10 of all beneficiaries enrolled in Part D in 2021 , while the top five firms including Centene and Cigna account for three-quarters of Part D enrollment . With the exception of Kaiser Permanente, which exclusively offers MA plans, the top Part D plan sponsors offer both stand-alone PDPs and MA-PDs. For most firms, Part D enrollment is more concentrated in one market than the other for example, CVS Health, Centene, and Cigna have greater enrollment in PDPs than MA-PDs .

The Annual Medicare Open Enrollment Period Is Going On Now Through Dec 7 Its Your Yearly Chance To Switch Drop Or Add Coverage But How Does Medicare Work Anyway Whether Youre About To Turn 65 Or Youve Been Enrolled In The Program For Years Now Is A Great Time To Brush Up On This Federal This Was Originally Published On The Penny Hoarder Which Helps Millions Of Readers Worldwide Earn And Save Money By Sharing Unique Job Opportunities Personal Stories Freebies And More The Inc 5000 Ranked The Penny Hoarder As The Fastest

The annual Medicare open enrollment period is going on now through Dec. 7. Its your yearly chance to switch, drop or add coverage.

But how does Medicare work, anyway?

Whether youre about to turn 65 or youve been enrolled in the program for years, now is a great time to brush up on this federal health insurance program, what it offers, what it costs and how to make changes to your Medicare coverage.

Recommended Reading: What Age Does Medicare Eligibility Start

How Is Medicare Funded

Medicare is funded via payroll taxes, also known as FICA taxes, which are automatically withheld by your employer.

FICA includes a 6.2% Social Security tax and a 1.45% Medicare tax on your earnings or 7.65% total.

Self-employed people face a double whammy from the federal government because they pay both the employers and the employees share of FICA taxes a total of 15.3%.

No matter how much you make, 1.45% of your paycheck will be withheld for Medicare.

An additional 0.9% Medicare tax may apply to earnings over $200,000 for single filers, or $250,000 for married couples filing jointly.

How Does Medicare Work

Generally, you only need to sign up for Part A and Part B once. Each year, you can choose which way you get your health coverage .

Medicare is different from private insurance it doesnt offer plans for couples or families. You dont have to make the same choice as your spouse.

2 steps to set up your Medicare coverage:

Youll have Original Medicare unless you join a Medicare Advantage Plan.

Read Also: How Do I Get Dental And Vision Coverage With Medicare

What Is The Coverage Gap

The amount that you have to pay for drugs varies depending on the amount that youve already paid out-of-pocket. Once the total amount of drug costs reach $4,130 in 2021 on plan-covered drugs, you enter the Coverage Gap, also known as the donut hole and have to pay 25% of your drug costs.10

Once youve spent $7,050 out of pocket, you enter Catastrophic Coverage. For the rest of the year, youll pay 5% coinsurance or $3.95 for generic drugs and $9.85 for brand drugs, whichever is higher.11