At What Age Can You Earn Unlimited Income On Social Security

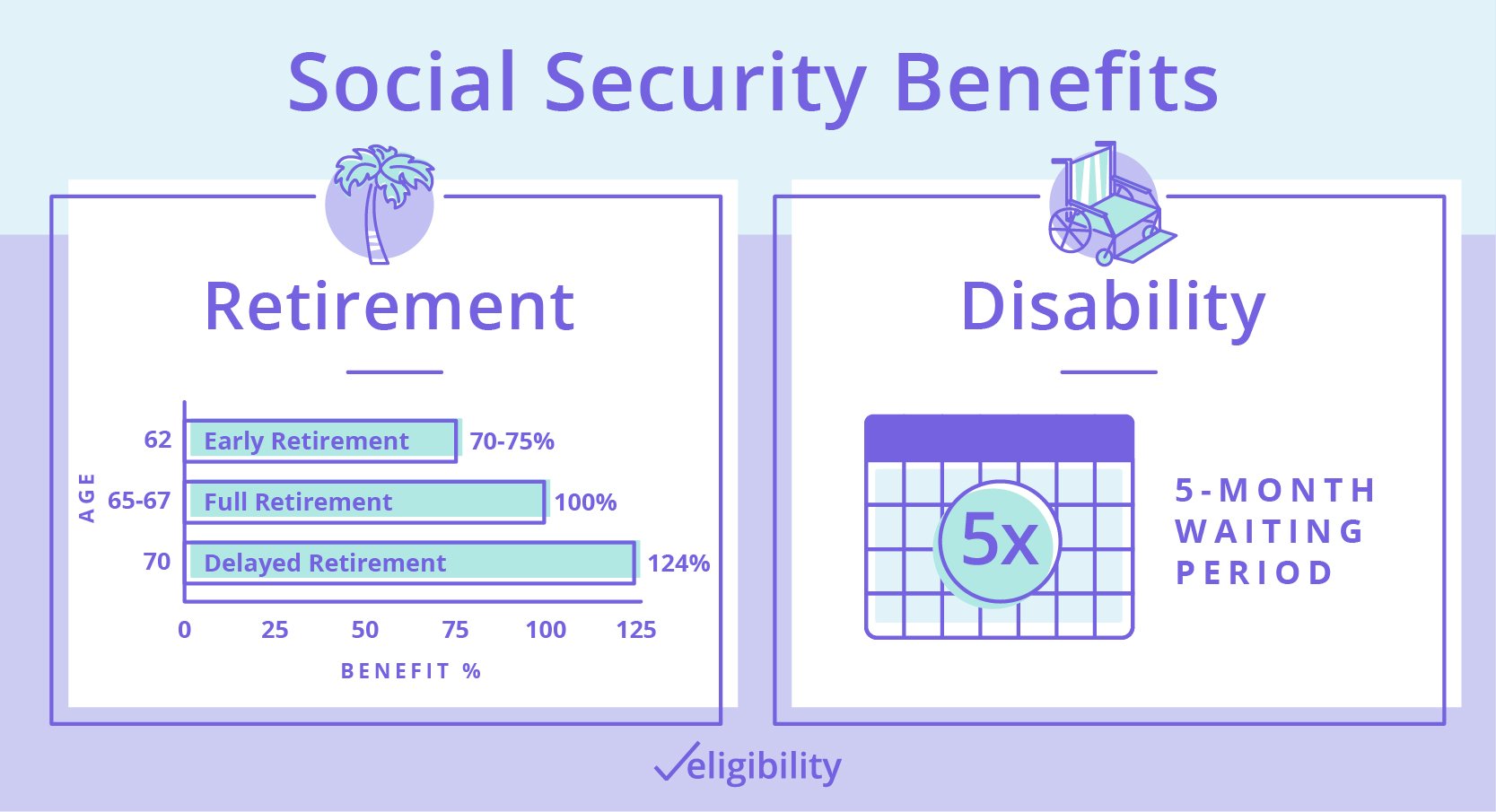

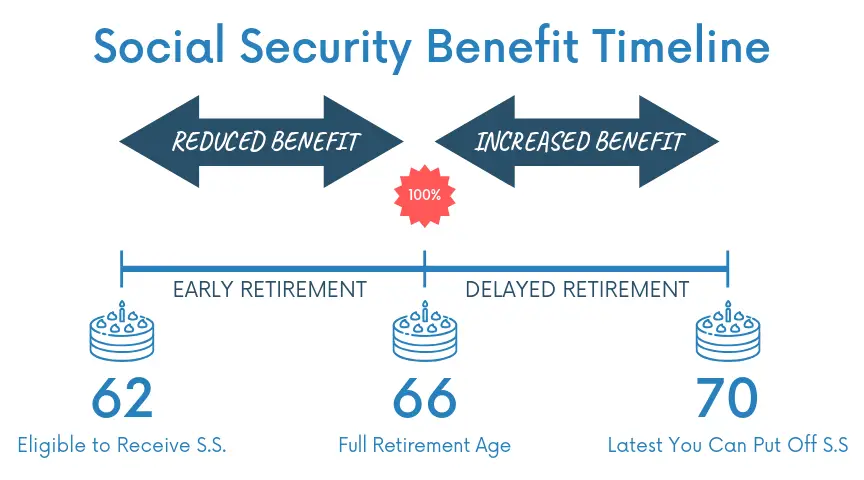

Upon reaching full retirement age, you can earn an unlimited income while still receiving Social Security. Full retirement age varies based on the year in which you were born. That age can range anywhere from 65 to 67 based on your birth year. For those born after 1960, you will have to wait until you are 67 to be considered full retirement age. However, for those born before that, you might be able to retire as early as 65.

December 21, 2018 By Danielle Kunkle Roberts

Social Security and Medicare are tied together in some ways, but in others they are separate. In this post, well go over what you need to know about how the two are tied. Many people think you must enroll in Social Security before you can take Medicare, and fortunately, thats not the case.

Keeping Your Medicare Card Safe

Keep your Medicare card in a safe place, and dont let anyone else use it. Always have your card handy when you call Medicare with questions.

You should take your Medicare card with you when you receive any health care services or supplies. Even if you havent reached your deductible, your doctor will need your card information to submit a claim. That claim will be applied to your deductible so you can use your benefits sooner. If you receive a new Medicare card, show it to your doctors office staff so they can make a copy of the updated information.

If you misplaced or lost your card, you can get a replacement Medicare card.

To learn about Medicare plans you may be eligible for, you can:

- Contact the Medicare plan directly.

- Contact a licensed insurance agency such as Medicare Consumer Guides parent company, eHealth.

- Or enter your zip code where requested on this page to see quote.

If You Get Medicare For Disability And Then Return To Work

If you get Medicare due to disability and then decide to go back to work, you can keep your Medicare coverage for as long as youre medically disabled.3 And, if you do go back to work, you wont have to pay the Part A premium for the first 8.5 years.

Part A is premium-free for those with a disability and under 65 only if you get Social Security or Railroad Retirement Board benefits for 24 months or have ESRD and meet certain requirements.4

If youre 65 or older, Part A is premium-free if you or your spouse worked and paid Medicare taxes for at least 10 years, you already get retirement benefits from Social Security or the Railroad Retirement Board, or youre eligible for these benefits but havent filed for them yet.5

You May Like: Is Medical Part Of Medicare

How Do I Enroll In Medicare If I Am Not Receiving Social Security

If you are not receiving Social Security benefits at least 4 months before you turn 65, you need to voluntarily enroll in Medicare in order to be covered. You can enroll online, in person, or over the phone.

- To enroll in Medicare online, apply online at the Social Security website

- To apply in person, visit your local Social Security office

- Too apply by phone, call Social Security at 1-800-772-1213 7 AM to 7 PM Monday through Friday

Social Security Mistakes That Can Cost You A Fortune

Whether you’re counting on Social Security to fund most of your retirement income or supplement it, you want to make sure you get all of the money you’re entitled to. However, with so many ways to claim benefits — especially if you’re married or used to be married — small mistakes could end up costing you a lot of money over the rest of your life.

You May Like: What Is Blue Cross Blue Shield Medicare Advantage

If You Already Receive Benefits From Social Security:

If you already get benefits from Social Security or the Railroad Retirement Board, you are automatically entitled to Medicare Part A and Part B starting the first day of the month you turn age 65. You will not need to do anything to enroll. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If your 65th birthday is February 20, 2010, your Medicare effective date would be February 1, 2010.

Donât Miss: When Can I Start Drawing My Social Security

When Older People Are Eligible For Medicare

Older people can qualify for traditional Medicare coverage as early as age 65. You must also:

- Be a U.S. citizen or permanent legal resident

- Meet the work credit requirement

You might also be eligible for Medicare if you are under age 65 and meet one of the following conditions:

- You have a disability.

- You have End-Stage Renal Disease, a permanent kidney failure that requires dialysis or a transplant.

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You have Lou Gehrig’s disease.

Once you qualify for Medicare, you are automatically enrolled in Medicare Part A. You can then choose to enroll in other parts of the program or to delay enrollment.

If you are over 65 and do not meet any of the above criteria, you still may be eligible to purchase coverage through Medicare Part A. If you are unsure whether you are eligible, you can check using the Medicare Eligibility & Premium Calculator.

The work credit requirement is an algorithm used to determine how long a worker paid into the system.

Also Check: What Is The Medicare Supplement Plan

Can I Get Medicare Coverage If I Don’t Sign Up For Social Security At 65

Who is this for?

If you’re not planning on signing up for Social Security right away, you can still enroll in Medicare. Learn how here.

These days, people are retiring later in life than their parents did. If youre still working, you might not want to start collecting Social Security benefits right when you turn 65.

But you can enroll in Medicare at 65 even if youre not getting Social Security. In some cases, signing up for Medicare as soon as youre eligible is better than waiting.

Heres why:

- Medicare might have better coverage than your health insurance plan through work.

- If you dont have a comparable health insurance plan and you wait to sign up for Medicare, your Medicare premiums will be higher when you do sign up.

The Mistake: Assuming Social Security Benefits Can Fully Cover Your Living Expenses

The average monthly Social Security benefit for retired workers was $1,471 per month as of June 2019. Although it might be possible to live off Social Security alone in some instances, it would likely require a big paring down of your lifestyle. For many people, however, it may not be feasible to live entirely off of Social Security benefits. Planning to live on Social Security alone — and then not being able to — puts you at risk for financial problems down the line.

Also Check: What To Do Before You Turn 65 Medicare

Some Basics Of Medicare Supplemental Insurance Plans

Supplemental plans fill the gap in medical expenses that Original Medicare does not fully cover.

For example, if you need care for a medical condition, Medicare Part B only covers 80 percent of those costs, and you are on the hook for the remaining 20 percent.

Using a supplemental plan, you can significantly reduce the out-of-pocket costs that can add up from medical care, including copayments, deductibles and coinsurance.

Private insurance companies offer supplemental plans, also known as Medigap.

If you cannot afford the out-of-pocket expenses you incur from Part B, then a supplemental policy may help you curb those costs.

You must pay a monthly premium for a supplemental plan, so it is imperative that you shop by comparison when you are searching for one.

Just like traditional health care, you should never decide on the first insurance company that you see.

This is especially true here, because Medigap plans are standardized into types, and plans of the same type offer the exact same coverage, no matter the private carrier.

In other words, the only difference between Medicare supplements plans of the same type is the monthly premium charged by the carrier.

There are several Medicare-approved private insurance companies that offer quality supplemental plans.

The cost of your monthly premium and the portion of your medical expenses a supplemental plan will cover are at stake, so thoroughly comparison shop private insurance companies offering supplemental plans.

Rules For Medicare Eligibility Based On Spouses Work History

To qualify for Medicare Part A benefits at age 65 based on your spouses work history, you must meet one of the following requirements:

- You have been married to your spouse who qualifies for Social Security benefits for at least 1 year before applying for Social Security benefits.

- You are divorced, but were married to a spouse for at least 10 years who qualifies for Social Security benefits. You must now be single to apply for Medicare benefits.

- You are widowed, but were married for at least 9 months before your spouse died, and they qualified for Social Security benefits. You must now be single.

If you arent sure you meet a certain requirement, you can contact the Social Security Administration by calling 800-772-1213. You can also visit Medicare.gov and use their eligibility calculator.

Don’t Miss: What Is Medicare Insurance Plans

What To Do: Do The Math Before Retiring

As you’re approaching retirement, check your earnings statement first to make sure you have enough credits to qualify for Social Security. If you don’t already have 35 years of earnings, consider whether working an additional year or two could help boost your Social Security benefits.

For example, if you worked a first career where you weren’t covered by Social Security, working for an extra year or two might ensure you qualify for Social Security benefits or boost your monthly benefit amount.

Earnings Limit For Social Security Disability Benefits

So far we have been mainly focused on income limits for those on Social Security retirement benefits. Many people on Supplemental Security Income and SSDI wonder how work affects your benefits as well. In fact, they often ask, How much can I earn while on Social Security Disability in 2021? When it comes to SSI and SSDI, the rules are a little different. Receiving SSDI or SSI benefits means that a person has been found to be disabled and unable to perform substantial gainful activity. This essentially means that they are unable to perform any type of full-time work and thus earn an income. For those qualifying for SSDI or SSI benefits, an earner can make no more than $1,310 per month. Any income above this amount, even from self-employment, will make them ineligible to receive SSI or SSDI benefits.

Remember that those receiving SSI or SSDI might have to worry about Social Security taxes on their Social Security earnings as well. Since the income limits and average benefits are lower, most people receiving disability benefits will not be required to pay any taxes on their benefits. Remember that the Social Security tax limits are adjusted almost every year too, so make sure that you are aware of the current rules. Recipients of SSI and SSDI are also automatically enrolled in Medicare after a certain period of time.

Don’t Miss: Does Costco Pharmacy Accept Medicare

Disabilities Or Medical Conditions

If a person has certain disabilities or medical conditions, they may be able to get premium-free Medicare Part A before they are aged 65 or older.

For example, a person with end stage renal disease may be eligible for premium-free Part A if they also meet one of the following conditions:

- they must also be on dialysis or have received a kidney transplant

- they qualify for Railroad Retirement Board benefits

- they qualify for Social Security retirement benefits

- they have a parent or spouse who is eligible for social security retirement benefits

A person with Lou Gehrigs disease is eligible for Part A coverage in the first month in which they get disability benefits.

A person can use this tool to check if they are eligible and the cost of premiums.

What Are Cases When Medicare Automatically Starts

Medicare will automatically start when you turn 65 if youve received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday.

Youll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks. According to the Social Security Administration, more than 30% of seniors claim Social Security benefits early.1 For those seniors, Medicare Part A and Part B will automatically start when they reach the age of 65.

When do You Get Your Medicare Card?

You can expect to receive your Medicare card in the mail three months before your birthday. Your Medicare card will come with a complete enrollment package that includes basic information about your coverage. Your card wont be usable until you turn 65, even though youll receive the card before that time.

What Are Your Costs?

Keep in mind that youll still have to pay the usual costs of Medicare, even though youre automatically enrolled. Once your Medicare is active, the cost of your Part B premium will be deducted from your Social Security or RRB benefits.

What If You Already Enrolled in Medicare?

What about Medicare Supplement ?

What If I Switch to Medicare Advantage?

And if you want to switch to Medicare Advantage , youll have a one-time Initial Enrollment Period for Medicare Advantage that begins 3 months before the month you turn 65 and lasts for 7 months.

What I Have Part A?

You May Like: Can I Get Medicare At Age 62

If You Are Approaching Or At Age 65

If you are approaching age 65 and you already receive Social Security or Railroad Retirement benefits through early retirement, you will be automatically enrolled in Medicare Parts A and B when you turn 65. Approximately 3 months prior to your 65th birthday, Medicare will send you an initial enrollment package containing general information about Medicare, a questionnaire and your red-white-and-blue Medicare card.

If you receive the initial enrollment package and you want both Medicare Part A and Part B , simply sign your Medicare card and keep it in your wallet.

If you are approaching age 65 and youre not receiving early retirement Social Security or Railroad Retirement benefits, you can apply for Medicare during your 7-month initial enrollment period . Your IEP begins 3 months before you turn 65, includes the month of your birthday and ends 3 months later. Note: To apply for Medicare Parts A and B, you must contact the Social Security Administration at ssa.gov or 1-800-772-1213. You will also need to sign up separately for a Part D plan to cover your prescription drug benefits. Learn more about Medicare Part D.

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Recommended Reading: How Do I Qualify For Medicare Low Income Subsidy

Documents To Include With Form Ss

Once youve completed the form, youll need to gather the documents youre required to submit along with it to prove your identity, age, and citizenship statusthose of the person youre applying for a card on behalf ofor both. These documents typically include the following:

- An original birth certificate or other permissible proof of age, such as a passport, final adoption decree, or religious record of birth.

- An unexpired drivers license, passport, or state ID card to prove your identity, or if you dont have one of those, a military ID, employee ID, or another identity card.

- Additional evidence of citizenship, if you are not submitting a birth certificate or ID. If you arent a U.S. citizen, youll need evidence of immigration status.

The Social Security Administration will only accept originals or copies that are certified by the agency that issued the original. You cant use photocopies, even notarized ones.

If you plan to mail your documents to the Social Security Administration, get a certified copy of your drivers license from your state department of motor vehicles instead of sending the original.

Basic Rules On Qualifying For Coverage

Workers who have contributed at least 40 quarters to Social Security are eligible for Medicare coverage at age 65 even if your Social Security “full retirement age” is over 65.

Individuals who are eligible for railroad retirement benefits, or who have worked long enough in a US federal, state, or local government job can also qualify for coverage.

Certain other categories of individuals may qualify for one or more parts of Medicare earlier than age 65 or under certain conditions.

For greater detail on qualifying for Medicare, see: faq.ssa.gov/link/portal/34011/34019/Article/3771/What-is-Medicare-and-who-can-get-it

A succinct overview of Medicare can be found at: www.socialsecurity.gov/pubs/10043.html#a0=2

General information on Medicare is available at: www.medicare.gov/people-like-me/new-to-medicare/getting-started-with-medicare.html

Read Also: Does Medicare Cover Ct Scans