When Can I Enroll In A Medicare Prescription Drug Plan

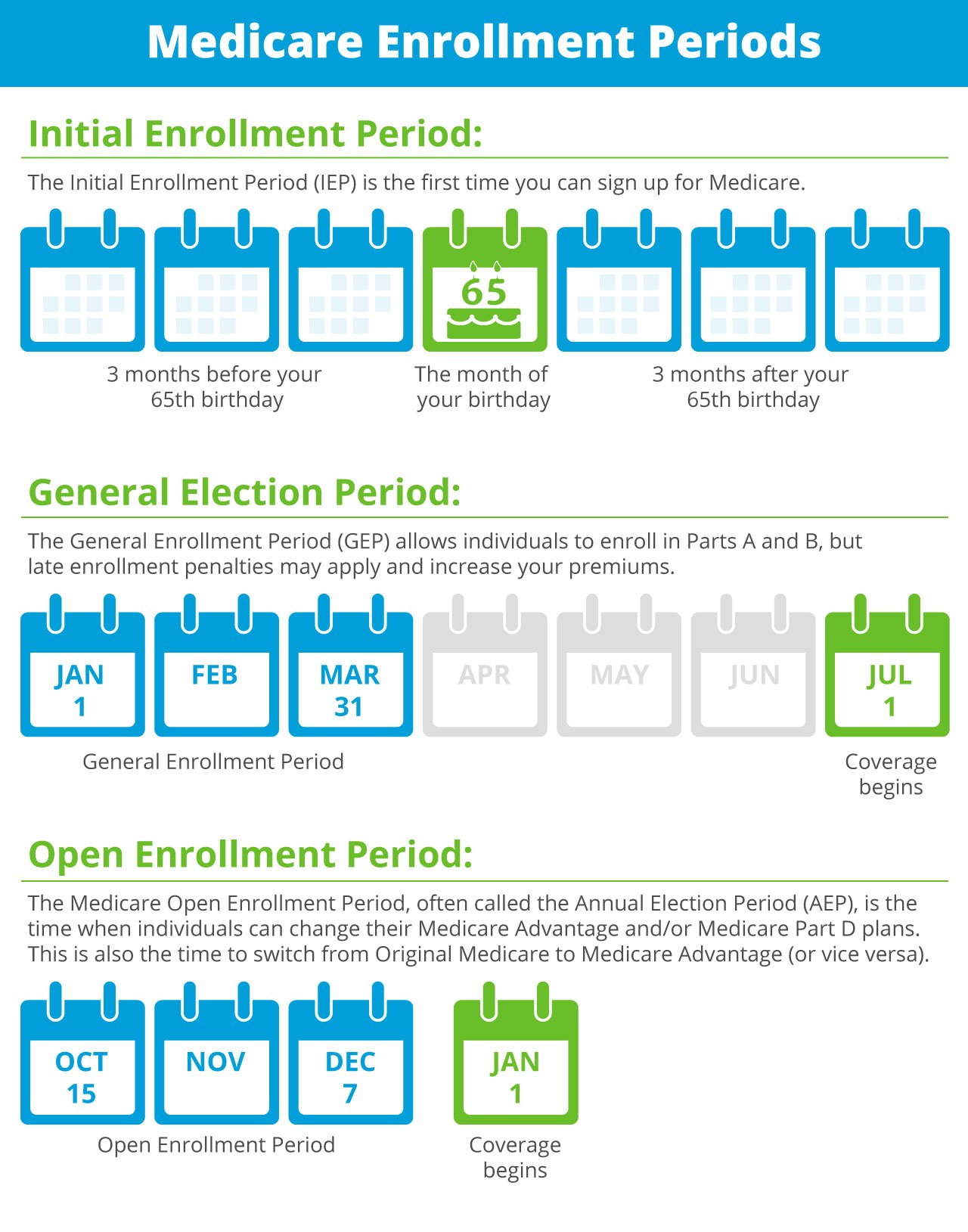

You can enroll in a plan at any time during your Medicare Initial Enrollment Period, which starts three months before your 65th birthday month, includes your birthday month, and extends for three additional months. If you get Medicare because of a disability, you can generally enroll in Medicare Part D after you are on Social Security disability for 24 months.

You can make changes to your prescription drug coverage each year during the Fall Open Enrollment Period . If you get Medicare Part D as part of your Medicare Advantage plan, you can also make changes during the Medicare Advantage Open Enrollment Period which runs from January 1st through March 31st.

Its important to enroll in a plan when you are first eligible if you want to avoid a late enrollment penalty with your monthly premium. If you go without creditable prescription drug coverage and you dont enroll in Part D when you are first able, youll pay a penalty of 1% of the national base premium for each month you go without coverage. You pay this penalty for as long as you have Medicare Part D coverage.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Medicare General Enrollment Period

If you don’t sign up during your Initial Enrollment Period and if you aren’t eligible for a Special Enrollment Period, the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

The General Enrollment Period lasts from each year.

You can only sign up for Part A and/or Part B during this period, and your coverage starts on July 1. You may have to pay a late enrollment period for Part A and/or Part B, as detailed below.

|

Part B Late Enrollment Penalty: If you do not enroll in Medicare Part B during your Initial Enrollment Period but decide to enroll later in life, you will have to pay a late enrollment penalty. Your Part B monthly premium could go up 10 percent for each 12-month period that you were eligible for Part B but didn’t sign up. You pay the Part B late enrollment penalty for the rest of your life as long as you remain enrolled in Part B. |

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

2 months after you sign up |

|

2 or 3 months after you turn 65 |

3 months after you sign up |

Read Also: How Can I Get My Medicare Card Number

How Much Does A Medicare Prescription Drug Plan Cost

These plans are private plans, which means each insurance company determines costs for its plans. Generally, you will pay a combination of the following out-of-pocket costs for your Medicare Part D coverage:

- Monthly premiums

- Annual deductible

- Copayments

- Coinsurance

Many Medicare Advantage plans include prescription drug coverage. If you enroll in a plan with Part D included, you typically wont pay a separate premium for the coverage. You generally pay one monthly premium for Medicare Advantage. You may, however, have a separate Part D deductible.

Plans set their own copayment amounts, which range between $0 and $10 for generic medications according to the Kaiser Family Foundation. Coinsurance amounts for expensive brand-name and specialty medications range between 25% and 50% of the actual medication costs.

If you and your plan spend more than $4,130 on prescription medications in 2021, special coverage rules kick in. Youll pay a percentage of your medication costs or a small copayment, whichever is higher, for covered medications for the rest of the year.

One thing to keep in mind: Medicare Supplement insurance plans sold today wont pay any Part D prescription drug costs.

How Do I Choose A Part D Plan

Perhaps the most important consideration when choosing a Part D plan is whether that plan covers the specific prescriptions you take. You can input the drugs you take and compare plan options using Medicares comparison tool. Otherwise, consider your priorities. Do you want:

- Protection from high drug costs?

- Coverage in case you need prescription drugs ?

- A low premium?

Select multiple plans to compare the star rating, premium, and deductible between plans. And click on Plan Details to see that plans costs by drug tier.

Read Also: How To Reorder Medicare Card

What New Part D Plan Should You Choose

In 2021, Medicare Part D plans are covered by every state, but the availability of plans varies by state. Narrowing so many choices down to your top contenders can be time-consuming. Medicares online plan finder tool makes plan comparison much easier. When youre searching for a new plan, consider these factors:

- What drugs are you currently taking? Look at each plans formulary to estimate costs.

- If you prefer generic drugs, find a plan with a tiered pricing system that offers low pricing on generic brands.

- If youre not currently taking many medications, a plan with a low monthly premium could be right for you. This way youll still have the peace of mind that your medications will be covered if you need them in the future.

- If you want to keep your drug costs steady throughout the year for budgeting reasons, opt for a plan with a low or no deductible.

What Is The Coverage Gap

The amount that you have to pay for drugs varies depending on the amount that youve already paid out-of-pocket. Once the total amount of drug costs reach $4,130 in 2021 on plan-covered drugs, you enter the Coverage Gap, also known as the donut hole and have to pay 25% of your drug costs.10

Once youve spent $7,050 out of pocket, you enter Catastrophic Coverage. For the rest of the year, youll pay 5% coinsurance or $3.95 for generic drugs and $9.85 for brand drugs, whichever is higher.11

Read Also: Does Medicare Pay For Bunion Surgery

Medicare Part D: Key Takeaways

- The only source of prescription drug plans is through private insurance companies.

- Most Medicare Advantage plans include prescription drug coverage.

- You can also purchase a stand-alone prescription drug plan if youre enrolled in a PFFS or MSA plan that doesnt include prescription coverage.

- Your first opportunity to enroll in Part D is when youre initially eligible for Medicare.

- You have the option of selecting an Advantage plan and using that in place of Medicare A, B, and D.

- In most cases, enrollment outside of your initial enrollment period is limited to an annual enrollment period.

- If you dont enroll in prescription drug coverage during your initial open enrollment and then enroll later during general open enrollment, a late enrollment penalty will be added to your premium.

As of mid-2021, nearly 49 million Medicare beneficiaries had prescription drug coverage through Medicare Part D. The total is split nearly equally between those who have Part D coverage in conjunction with a Medicare Advantage plan , and those who have stand-alone Part D prescription drug plans , most of which are purchased to supplement Original Medicare. But the balance has started to shift towards MAPD coverage, and it has recently surpassed albeit slightly the number of people with stand-alone PDP coverage.

What Is Medicare Part D

There are four parts to the Medicare program:

- Part A, which is your hospital insurance

- Part B, which covers outpatient services and durable medical equipment

- Part C, or Medicare Advantage, which offers an alternate way to get your benefits under Original Medicare

- Part D, which is your prescription drug coverage

Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

Recommended Reading: Does Medicare Cover Private Home Care

The Five Star Special Enrollment Period

Medicare Part D plans, along with Medicare Advantage plans and Medicare Cost plans, are rated on a scale of 1 to 5 stars based on quality and performance. A 5-star rating is the highest. If you want to switch to a 5-star plan, you can do so one time between December 8 and November 30 of the following year.

What If You Miss The Part D Initial Enrollment Period

If you miss your Part D initial enrollment period, you will have to pay for all prescription drugs out of pocket until you enroll in a plan and you could owe a penalty . But more importantly, when can you enroll? Thats easy you can apply during Medicares Annual Election Period every year, and your plan will start Jan 1.

*Notes:

- If your birthday falls on the first of the month both your Medicare part B and Part D can start the first of the month proceeding your 65th birthday

You May Like: What Is The Average Premium For Medicare Advantage Plans

The Medicare Catastrophic Coverage Act Of 1988

The Medicare Catastrophic Coverage Act of 1988 began with the 1984 report of the Social Security Advisory Council chaired by Otis Bowen, a physician and former Republican governor of Indiana. The council’s report did not focus on prescription drugs but on the limited hospital coverage provided by Medicare and the out-of-pocket expenses for both hospital and physician services. After Bowen was appointed as secretary of HHS by President Ronald Reagan in November 1985, he urged the White House to support the council’s reform proposals and successfully lobbied for an initial proposal in the 1986 State of the Union address. The combination of Bowen’s interest and changes in the political climatethe Iran/contra scandal in the White House and Democrats regain of control of the Senate after the 1986 election, along with their continuing control of the House of Representativessoon created the opportunity for new Medicare benefits, among them prescription drug coverage .

In the spring of 1988 the chairman of the Senate Finance Committee, Lloyd Bentsen , proved to be the final arbiter when he accepted a drug benefit scaled back to catastrophic coverage and not a routine benefit. Medicare would cover 80 percent of drug costs once the beneficiary met a $600 deductible. The administration, weakened by scandal, did not have the will to fight over prescription drugs, and it ultimately supported the final package .

Definition Of Medicare Part D

Part D is an optional Medicare benefit that helps pay for your prescription drug expenses. If you want this coverage, you will have to pay an additional premium. Private insurance companies contract with the federal government to offer Part D programs through the Medicare system. For this reason, different plans include different prescription drugs and have different associated costs. Its important to review multiple plans before deciding which plan to buyor if youll buy one at all.

You can buy Medicare Part D only if you also have either Medicare Part A and/or Medicare Part B.

To join a Medicare Advantage plan that offers prescription drug coverage, you must have both Part A and Part B. Not all Medicare Advantage plans offer drug coverage.

Don’t Miss: Does Medicare Cover Dexa Scan

When You First Get Medicare

- I’m newly eligible for Medicare because I turned 65.

-

What can I do?

Sign up for a Medicare Advantage Plan and/or a Medicare drug plan.

When?

During the 7-month period that:

- Starts 3 months before the month you turn 65

- Includes the month you turn 65

- Ends 3 months after the month you turn 65

If you join

When Does The Medicare Deductible Reset

Your Medicare deductible resets on January 1 of each year. The Medicare deductible is based on each calendar year, meaning that it lasts from January 1-December 31, and then it resets for the new year.

If youâre signing up for Medicare for the first time, and your coverage starts sometime during the middle or later-part of the year, your deductible will still reset on January 1.

This year, the Medicare Part A deductible is $1,408, and the Medicare Part B deductible is $198.

So, if youâre on Medicare, you would need to meet these deductibles before Medicare starts covering your medical bills.

There is a way to avoid paying Medicare deductibles, which is to have a Medicare Supplement â also called a Medigap plan.

There are 11 total Medicare Supplement plans, and each one varies in terms of price and benefits.

The 3 most popular plans are Plan F, Plan G, and Plan N, because they provide the most coverage.

Don’t Miss: What Age Can You Get Medicare Health Insurance

The Part D Standard Benefit

At a minimum, plan sponsors must offer a standard benefit package mandated by law. The standard benefit includes an annual deductible and a gap in coverage, previously referred to as the Donut Hole. Sponsors may also offer plans that differ from but are actuarially equivalent to the standard benefit. Finally, they may also offer enhanced plans that provide benefits in addition to the standard benefit. Typically, the enhanced plans offer some coverage during the Donut Hole.

The Standard Benefit is defined in terms of the financial structure of the cost-sharing, not the drugs that must be covered under the plan.

Medicare does not establish premium amounts for plans. Instead, premiums are established through an annual competitive bidding process and evaluated by CMS. Premiums vary from plan to plan and from region to region. Medicare does establish the maximum deductible amount, the Initial Coverage Limit, the TrOOP threshold, and Catastrophic Coverage levels every year. The table below shows the standard benefit for this year .

Standard Part D Benefit 2020-2021

Alternatives to the Standard Benefit

Income-Related Monthly Adjustment Amount Part D

Income-Related Adjustments 2021

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | $77.10 |

Drug Tiers

| Tier 1 | |

| $65 | 33% |

The Donut Hole

TrOOP

Once beneficiaries reach their out-of-pocket threshold costs), they move out of the Donut Hole and into Catastrophic Coverage.

EOBs

The Donut Hole Discount

| 63% | 75% |

Medicare Part D Prescription Drug Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Part D prescription drug plan.

If you want Medicare prescription drug coverage, you typically have two options:

- Enroll in a Medicare Advantage plan that includes prescription drug coverage

- Enroll in a Medicare Part D standalone prescription drug plan

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent.

You can also enroll in a prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

Recommended Reading: When Do You Receive Medicare Card

Situations That Dont Result In A Penalty

You can avoid the late enrollment fee if you have certain other types of prescription drug coverage. These are officially called plans and they include coverage from the following:

-

A current or former employer or union

-

TRICARE

-

The Department of Veterans Affairs

-

A Medicare Advantage plan

-

Other individual health insurance coverage

Your plan is required to tell you each year if itâs creditable coverage. If you have one of these types of coverage and then you leave it for 63 or more days before joining a Part D plan, you will have to pay the late enrollment penalty.

Enrolling In Original Medicare

If youre already receiving Social Security or Railroad Retirement Board benefits and youre a U.S. resident, the federal government automatically enrolls you in both Medicare Part A and Medicare Part B at age 65. Youll receive your Medicare card in the mail about three months before you turn 65, and your coverage will take effect the first of the month you turn 65.

Medicare Part B has a monthly premium, which will be deducted from your Social Security or Railroad Retirement check. The standard Part B premium is $148.50/month in 2021, and is expected to increase in 2022. For the upcoming year, CMS doesnt finalize the new Part B premium until fairly late in the year, but the Medicare Trustees Report projects a Part B premium of $158.50/month for 2022 .

You can opt out of Part B and avoid the premiums, but its generally only a good idea to do that if youve got health insurance from your current employer or your spouses current employer, and the employer has at least 20 employees.

If you are turning 65, but youre not yet receiving Social Security or Railroad Retirement benefits, you wont be automatically enrolled in Original Medicare. Instead, youll be able to enroll during a seven-month enrollment period that includes the three months before your birth month, the month you turn 65, and the three following months. So if youll be 65 on July 14, your open enrollment period will be April through October.

Read Also: Are Medicare Advantage Plans Hmos

National Bipartisan Commission On The Future Of Medicare

Following the failure of President Clinton’s health care reform proposal in 1994, Republicans captured majorities in both houses of Congress. In 1995 the main policy issue regarding Medicare was not how to improve benefits but how to restructure the program and limit the federal government’s financial liability for existing coverage. The Medicare Preservation Act, which Congress passed as part of the Balanced Budget Act of 1995 but President Clinton vetoed, included major reforms and reductions in spending in Medicare and other government programs as well as substantial tax cuts. Republican strategists miscalculated both the president’s willingness to accept the legislation and the public’s reaction . Nonetheless, reducing the budget deficit remained a high political priority, and two years later, the Balanced Budget Act of 1997 cut projected Medicare spending by $115 billion over five years and by $385 billion over ten years .

The Balanced Budget Act created a new Medicare+Choice program, which encouraged beneficiaries to choose among the traditional fee-for-service Medicare, HMOs, and preferred-provider organizations. It also created Medicare medical savings accounts, changed payment policies and formulas for providers and health plans, strengthened efforts to prevent and prosecute fraud and abuse by Medicare providers, and created the National Bipartisan Commission on the Future of Medicare.