What Is The Difference Between Medicare Advantage And Medigap

Medicare Advantage and Medicare Supplement are additional plans that pair with your original Medicare . They may offer you the customization you need to meet your individual healthcare needs.

Both plans are designed to offer coverage that other parts of Medicare may not. However, you may not purchase both Medicare Advantage and Medigap.

If you want additional Medicare coverage, you must choose either Medicare Advantage or Medigap.

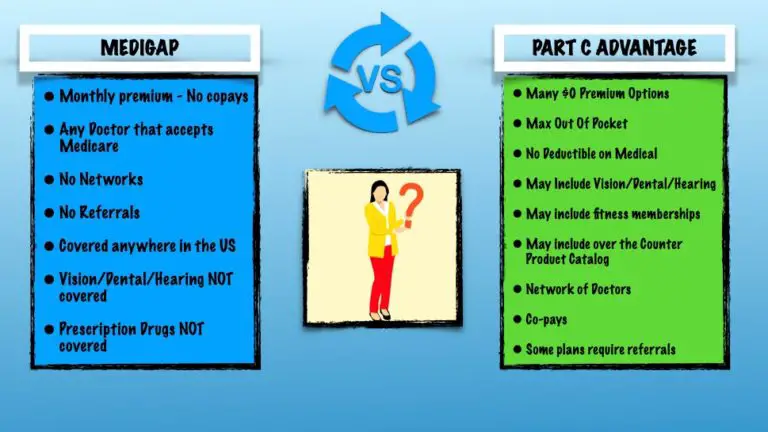

To help you compare, here are both plans side by side:

| Medicare Advantage |

|---|

- transportation to medical appointments

How Are Medigap And Medicare Advantage Different

Now that weve summarized each type of policy, lets examine some of the key differences between Medigap and Medicare Advantage. One key difference between the two is that Medigap is used with Original Medicare, while Medicare Advantage is used in place of Original Medicare.

Some other major differences include how these types of Medicare insurance are used, the variety of plans that are available, the types of costs they include and whether or not they cover prescription drugs.

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

Read Also: Does Humana Offer A Medicare Supplement Plan

Plans Are Required To Take You Regardless Of Your Health Condition

In many ways, Medicare Advantage started the health insurance revolution in America. President George W. Bush insisted that plans would not be able to turn down Medicare beneficiaries due to preexisting conditions. This feature, in my humble opinion, not the additional benefits, is what makes Medicare Advantage a good option. Preexisting health conditions prevent millions of people who would like to have a Medigap policy from being able to get one.

The only exception, a concession the Medicare program made to the insurance industry, is that a small number of health conditions that require extreme medical care, like ESRD , also known as kidney failure, is a condition that causes you to need dialysis or a kidney transplant. People with ESRD are eligible for Medicare coverage regardless of age….) and ALS , would be covered directly by Medicare due to the exceptional costs.

Coverage Outside The State Or Country

If you tend to travel a lot, Medigap has a clear bonus for you. It works anywhere that Medicare is accepted, whether you’re in or out of state. Many plans cover health care outside the U.S., as well, for certain emergencies.

Medicare Advantage may be limited for out-of-state travel, and it does not apply for travel outside the U.S.

Also Check: What Are The Advantages And Disadvantages Of Medicare Advantage

If You Have Both Medicare And Medicaid You May Be Able To Get Coverage For Almost No Cost

The Medicare Savings Program has been around for quite a while, but recently it has exploded with new Medicare Advantage Special Needs Plans .

There are four types of Medicare Savings Programs:

As a general rule, if you can answer yes to these 3 questions, to see if you qualify for assistance in your state:

If you qualify for the QMB program, SLMB, or QI program, you will automatically qualify to receive Extra HelpSocial Security’s Low-Income Subsidy program helps Medicare beneficiaries pay for their Medicare Part D prescription drugs by paying some of the costs. Also known as “Extra Help”, beneficiaries who qualify for LIS receive premium… through Social Security. The Extra Help program provides financial assistance for Medicare drug coverage through Medicare Part DMedicare Part D plans are an option Medicare beneficiaries can use to get prescription drug coverage. Part D plans provide cost-sharing on covered medications in four different phases: deductible, initial coverage, coverage gap, and catastrophic. Each….

Medicare Advantage Plans Coverage For Some Services And Procedures May Require Doctors Referral And Plan Authorizations

Medicare Advantage plans try to prevent the misuse or overuse of health care through various means. This might include prior authorization for hospital stays, home health care, medical equipment, and certain complicated procedures. Medicare Advantage plans often also require your primary care doctors referral to see specialists before they will pay for services.

Don’t Miss: How To Qualify For Oxygen With Medicare

Medicare Primer: Advantage Or Medigap

Traditional Medicare with a Medigap plan or Medicare Advantage? My Aunt Carol in Orlando wrestled with this decision for some five hours in sessions with her Medicare adviser, which she followed up with multiple phone calls and a raft of additional questions.

You have to ask these questions. You really have to think about it, she said. Its confusing.

Essentially every 65-year-old American enrolls in Medicare, and many get additional coverage. One form of additional coverage is through supplements to traditional Medicare, which include a Part D prescription drug plan and/or a Medigap private insurance plan to cover some or all of Medicares co-payments, deductibles, and other out-of-pocket costs. The other is through Medicare Advantage, a managed care option that typically provides prescription drug coverage and other services not included in the basic Medicare program.

So which to choose? Consumer choices have proliferated since private plans were added to Medicare 40 years ago. The typical beneficiary today has about 18 Medicare Advantage options, a multitude of Medigap plans for people who choose the traditional route, and 31 prescription drug programs, according to the Kaiser Family Foundation.

This primer is for new enrollees like my aunt. A future blog will provide suggestions from leading Medicare experts about ways to think about this important decision and the financial issues at stake.

Healthmarkets Helps With Medicare Advantage And Medigap Plans

HealthMarkets can quickly help you find the Medicare plan that best fits your needs. Need help deciding? Answer a few quick questions to see whether a Medicare Advantage or Medigap plan is a better choice for you.

Then, use FitScore® to help you find and apply for a Medicare Advantage plan that fits your needs. You can compare plans and choose plans that include your current providers. We can also help you find a Medigap plan that supplements your Original Medicare.

47036-HM-0221

Read Also: Does Social Security Disability Qualify You For Medicare

Best In Price Comparison: Aarp

AARP

For most people, cost is a key factor when it comes to purchasing insurance. AARP provides a single PDF document for your location with cost comparisons by age, gender, and zip code that allows you to know ahead of time how much your monthly charges may be.

-

Information for most plans is available on one PDF document for easy comparison

-

Customer-focused, with educational materials available on the site and for download

-

Quickly able to access personalized estimates

-

Monthly cost estimates broken down by age, gender, smoking status, location, and plan type

-

Not many extras or additional bonuses

-

Travel has $250 deductible, and then the plan pays 80%, while many other providers pay 100%.

AARP is nothing if not detailed. Before you even get to personalized estimates, AARP makes sure you know what youll get for your money and that you have an effective, comprehensive understanding of what each plan offers. Since it gives you such a thorough understanding upfront, you may not even need to enter your information.

If you know that you can find similar coverage for less money or that another provider has more benefits, youll be able to tell from a cursory glance through the document, and all you need to enter is your ZIP code.

Make sure you consider all aspects of your personal situation and how it may impact your premiums and deductibles. The older you are when you enroll, the more prices can go up.

Reason : They Make You Pay Multiple Copays For The Same Issue

This is true, but it is also true with Original Medicare. However, this complaint highlights the chief difference between Medicare Advantage and Original Medicare plus a Medicare supplement.

Medicare Advantage is a pay-as-you-go system. You pay your monthly Medicare Part BMedicare Part B is medical coverage for people with Original Medicare benefits. It covers doctor visits, preventative care, tests, durable medical equipment, and supplies. Medicare Part B pays 80 percent of most medically necessary healthcare… premium, and an additional premium for the plan , but the majority of your costs come when you use healthcare services. So, if you see your primary care doctor for an issue you pay a copay. If your doctor refers you to a specialist you pay another copay. And if your specialist orders lab tests or diagnostic tests you pay a copay for each of those, as well.

You May Like: Where Do I Send My Part B Medicare Application

Start With This Informational Video

Understand that this is a lengthy video, we like to joke around by recommending to grab some popcorn and enjoy at your own pace. When watching this video, write down any additional questions that come along. Then, hop on the phone with one of us to knock em’ out one by one. We have found this to be an extremely effective way to make sure you are educating yourself to make this choice when transitioning to Medicare.

Once you have made the decision that you need to sign up for Medicare part A and Part B, it is time to decide how you fill the financial holes present in original Medicare. It is important to note that this discussion will not include retiree coverage from a former employer, the government, or through military service. If you do not plan on receiving retiree benefits, you will have to turn to the private market to find the best plan to fit your healthcare needs. This Article will help you learn how each product type works, MedigapVs.Medicare Advantage.

There are two main ways to receive additional coverage when you are Medicare eligible. The first is Medigap . The second option is Medicare Advantage .

Medigap plans are offered by private insurance companies as secondary insurance to fill in the gaps that are left by original Medicare . To learn even more details about Medigap plans, watch this video.

Medigap Vs Medicare Advantage: Whats The Difference

If you have the Original Medicare Plan, you might find gaps in your coverage that you want to address. Luckily, there are options to help supplement your Medicare: Medigap and Medicare Advantage. However, Medigap and Medicare Advantage cant be used together. You have to decide which plan works for you. Discover what the difference between the two plans are and which option will best serve you.

Read Also: How To Apply For Medicare Through Social Security

Medicare Advantage Vs Medigap: Which Is Right For You

A Medicare Advantage plan might be best for you if:

- You enjoy the convenience of getting all your medical coverage from one source.1

- You want to pay less per month. Some plans have $0 premiums.9

- You wish to have additional benefits on the same policy such as dental, vision, or prescription drugs.1

A Medigap plan might be best for you if:

- You enjoy the freedom of being able to visit any physician or facility that accepts Medicare.8

- Youd rather pay more for your premium to lower out-of-pocket costs when receiving care.2

- You often travel outside the U.S.7 or live in more than one location throughout the year.

Take our online Medicare quiz now to help you determine which plan could be best for you.

How Are Medicare Advantage And Medigap Different

The biggest difference between Medicare Advantage and Medicare supplemental insurance is the way they work.

Medigap is intended simply to cover some of the gaps that Original Medicare doesnt pay for coinsurance, copayments and deductibles, for instance. Original Medicare only pays 80 percent for Medicare-covered services such as doctors services and outpatient medical services and supplies.

Medicare Advantage plans are an alternative to Original Medicare. Sold by private insurers, these plans cover everything that Original Medicare does but may offer extra benefits for things that Medicare doesnt, including dental and vision care.

You may have fewer choices in terms of doctors and health care providers in some cases with Medicare Advantage plans. With Medigap, you have access to any doctor or provider who accepts Medicare.

Legally, you cannot have Medigap coverage with a Medicare Advantage plan. However, you may be able to switch between the two plans.

Biggest Differences Between Medicare Advantage and MedigapPrepare for the Medicare Advantage Open Enrollment Period

Don’t Miss: What Is The Penalty For Not Enrolling In Medicare

Find Cheap Medicare Plans In Your Area

Both Medicare Advantage and Medicare Supplement allow you to fill the gaps in coverage that are found in original Medicare. However, Advantage and Supplement plans will vary depending on costs, coverage and the provider network . Therefore, you’ll need to compare these policies to choose the ideal combination of Medicare policies for your situation.

Why Should I Choose Medicare Advantage

Medicare Advantage covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patient’s situation worsens, it might be difficult or expensive to switch plans.

You May Like: Is Robotic Knee Replacement Covered By Medicare

Advantages Of Medicare Advantage Plans

Some of the advantages of Medicare Advantage plans include:

- Medicare Advantage plans include out-of-pocket spending limits and generally have lower monthly premiums than Medigap plans. . Medicare Advantage plans may also cover things you dont otherwise get through Original Medicare, which can allow you to bundle a variety of benefits under one plan without having to juggle multiple insurance policies for everything you need. One type of Medicare Advantage plan called a Special Needs Plan can even be customized to fit the needs of someone with a specific health condition or circumstance.

- One popular type of Medicare Advantage plan is a Health Maintenance Organization plan. With a Medicare HMO plan, your health care is typically coordinated by a team with the plan network, starting first with your primary care doctor. Many beneficiaries prefer this team approach to their health care.

Which Path You Take Will Determine How You Get Your Medical Care And How Much It Costs

by Dena Bunis, AARP, Updated October 12, 2021

Getty/AARP

En español | As you think about how Medicare will cover your health care needs, your first major decision should be whether you want to enroll in federally run original Medicare or select a Medicare Advantage plan, the private insurance alternative.

Think of it as choosing between ordering the prix fixe meal at a restaurant, where the courses are already selected for you, or going to the buffet , where you must decide for yourself what you want.

If you elect to go with original Medicare, your buffet will include Part A , Part B and Part D . If you decide to go with Part C, a Medicare Advantage plan, it will be more like a set menu, since a private insurer has already bundled together parts A and B and almost always D into one comprehensive plan.

Some aspects of your care will be constant whichever plan you choose. Under both choices, any preexisting conditions you have will be covered and you’ll also be able to get coverage for prescription drugs.

But there are significant differences in the way you’ll use Medicare depending on whether you pick original or Advantage. Here’s a comparison of how each works.

Recommended Reading: Is It Mandatory To Take Medicare At 65

The Freedom To Choose Your Own Doctors And Hospitals

Medicare Advantage: Your choice of physicians and facilities may be limited to the plans network, whether it is HMO or PPO. You might also need a referral from a primary care physician before seeing a specialist.6

Medigap: You are free to visit any doctor or facility that accepts Medicare, and you dont need referrals to see specialists.8

Pitfalls Of Medicare Advantage Plans

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

A Medicare Advantage Plan, also called a Part C or an MA Plan, may sound enticing. It combines Medicare Part A , Medicare Part B , and usually Medicare Part D into one plan. These plans cover all Medicare services, and some offer extra coverage for vision, hearing, and dental. They are offered by private companies approved by Medicare.

Still, while many offer low premiumssometimes as low as $0 per monththe devil is in the details. You will find that many plans unexpectedly won’t cover certain expenses when you get sickresulting in unforeseen out-of-pocket costs for youand what they pay can differ depending upon your overall health. Here’s a look at some of the disadvantages of Medicare Advantage Plans.

You May Like: How To Pay Medicare Premium

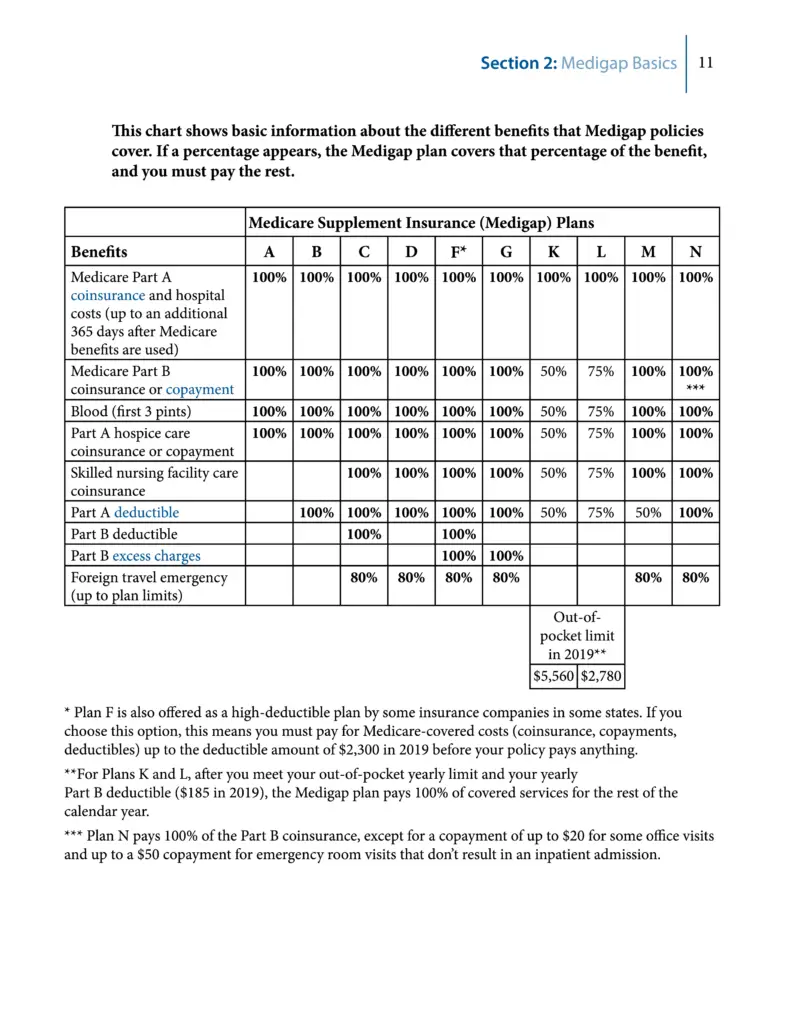

Is Plan F The Best Medicare Supplement Plan

If youre looking for the most coverage possible at a very affordable price tag, Plan F is the best Medicare supplement plan. If youre looking to save a little to get a little less, maybe not, or if you dont need the coverage Plan F providessuch as hospice or extended hospital stay coveragethen it may be better to look into other supplement plans. If you want to have all of your bases covered, though, Plan F is a good place to start.