What Is The Difference Between Medicaid And Medicare

Medicare and Medicaid are different programs. Medicaid is not part of Medicare.

Heres how Medicaid works for people who are age 65 and older:

Its a federal and state program that helps pay for health care for people with limited income and assets. A basic difference is that Medicaid covers some benefits or services that Medicare doesnt like nursing home care or transportation to medical appointments .

Visit your states Medicaid/Medical Assistance website or medicare.gov for more information. Learn more in the article, Can I get help paying my Medicare costs?

What Does Medicare Part A Not Cover

Its also important to know that Medicare Part A doesnt cover all hospital costs. Here are a few things that Part A wont cover:

- Your first 3 pints of blood. If a hospital receives blood from a blood bank, you may not have to pay anything. However, if a hospital has to get special blood for you, its possible you may have to pay for it out of pocket.

- Private rooms. While inpatient care includes a stay in a semiprivate room, you are not entitled to a private room during your care.

- Long-term care. Part A is only intended to provide care during an acute illness or injury. If you have long-term care needs, such as a nursing home, you will have to pay for your own residential care out of pocket.

What Is Part B Cost Sharing

Medicare Part B comes with an annual deductible of $233 for 2022. After you meet the deductible for the year, you typically pay 20% of the Medicare-approved amount for doctor services and other Medicare benefits. This holds true if you go to a provider that accepts assignment. This means that the provider will accept the Medicare payment amount.

Many Original Medicare enrollees also purchase Medicare Supplement Insurance to help pay out-of-pocket costs. Or, they can opt for Medicare Advantage.

A Word of Advice

Understanding Medicares components and costs can help you make the best decision for your health care needs now and in the future.

You May Like: Do You Have To Get Medicare When You Turn 65

How Medicare Part D Works

Meredith Mangan is the senior insurance editor for The Balance. She brings to the job 15 years of experience in finance, media, and financial markets. Prior to her editing career, Meredith was a licensed financial advisor and a licensed insurance agent in accident and health, variable, and life contracts. Meredith also spent five years as the managing editor for Money Crashers.

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequencesgood or bad.

Learn how it works, when and under what circumstances you can enroll, and what to consider when choosing a plan.

Medicare Doesn’t Cover Prescription Drugs

Medicare doesnt provide coverage for outpatient prescription drugs, but you can buy a separate Part D prescription drug policy that does, or a Medicare Advantage plan that covers both medical and drug costs. You can sign up for Part D or Medicare Advantage coverage when you enroll in Medicare or when you lose other drug coverage. And you can change policies during open enrollment season each fall. Compare costs and coverage for your specific medications under either a Part D or Medicare Advantage plan by using the Medicare Plan Finder.

Don’t Miss: When Does One Qualify For Medicare

Costs Not Covered By Medicare

Even if your outpatient procedure is paid for by Medicare, you might still owe some money as a co-payment or as a deductible. In these cases, you must pay any balance you owe before Medicare can assist with the rest of the bill. If you have a Medicare supplemental policy, which is a private insurance plan designed to work alongside your regular Medicare benefits, you must still pay for any unshared costs, after which Medicare benefits kick in and unpaid balances fall under your Medigap policy.

When Should You Apply For Medicare Part A

If you wont get Medicare Part A premium-free, try to sign up for it when youre first eligible, as you could face a late enrollment penalty. Your initial enrollment period begins when you become eligible for Medicare. You can also join during the Medicare open enrollment period, which runs annually from October 15 through December 7.

If youre looking to buy Part A premium and miss thewindow of when you’re first eligible, you may end up paying an extra 10% for monthly premiums and the penalty lasts more than a month or two. Medicare.gov states that youll be responsible for paying the higher premium for twice the number of years you could have had Part A but didn’t sign up.

You May Like: What Does Medicare Extra Help Pay For

Ways To Find Out If Medicare Covers What You Need

What Is The Alternative To Taking Prolia

The FDA has approved another brand-name version of denosumab, called Xgeva. Your Medicare Part D plan might not cover the medication. If it does, your out-of-pocket price for Xgeva injections may cost more or less than Prolia, depending on where the drugs are classified on the formulary.

Instead of Prolia, doctors may prescribe other drugs for people at risk of suffering fractures due to osteoporosis, such as:

- Bisphosphonates like alendronate, ibandronate, risedronate and zoledronic acid

- Bone-building medications like teriparatide, abaloparatide and romosozumab

- Hormone-related therapy like raloxifene

You May Like: When Can I Start Medicare Part B

What Does Prolia Do

Throughout your life, your body breaks down existing bone and builds new bone in its place to keep your skeleton strong. Osteoclasts are the cells that drive the process. As you age, the bone-building process slows down while the work of osteoclasts continues at the same pace. This leads to a loss of bone density. Prolia is an injectable medication that works by disrupting the activation of osteoclasts to slow down bone loss.

How To Decide If You Need Part D

If you need prescription drug coverage, selecting a Part D plan when you become eligible is often a good ideaespecially if you dont currently have what Medicare considers creditable prescription drug coverage.

Prescription drug coverage that pays at least as much as Medicares standard prescription drug coverage is usually considered creditable, and could be an existing plan you have through an employer or union.

If you dont elect Part D coverage during your initial enrollment periodand youdont have creditable prescription drug coverage, youll probably pay a late enrollment penalty if you decide you want it later. The late enrollment penalty permanently increases your Part D premium.

However, if you do have creditable coverage and keep it, you can generally enroll in Part D later without paying a penalty.

Recommended Reading: Who Is The Medicare Coverage Helpline

The Parts Of Medicare

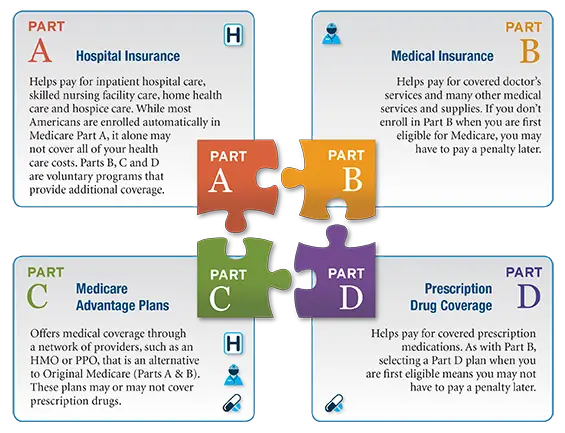

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

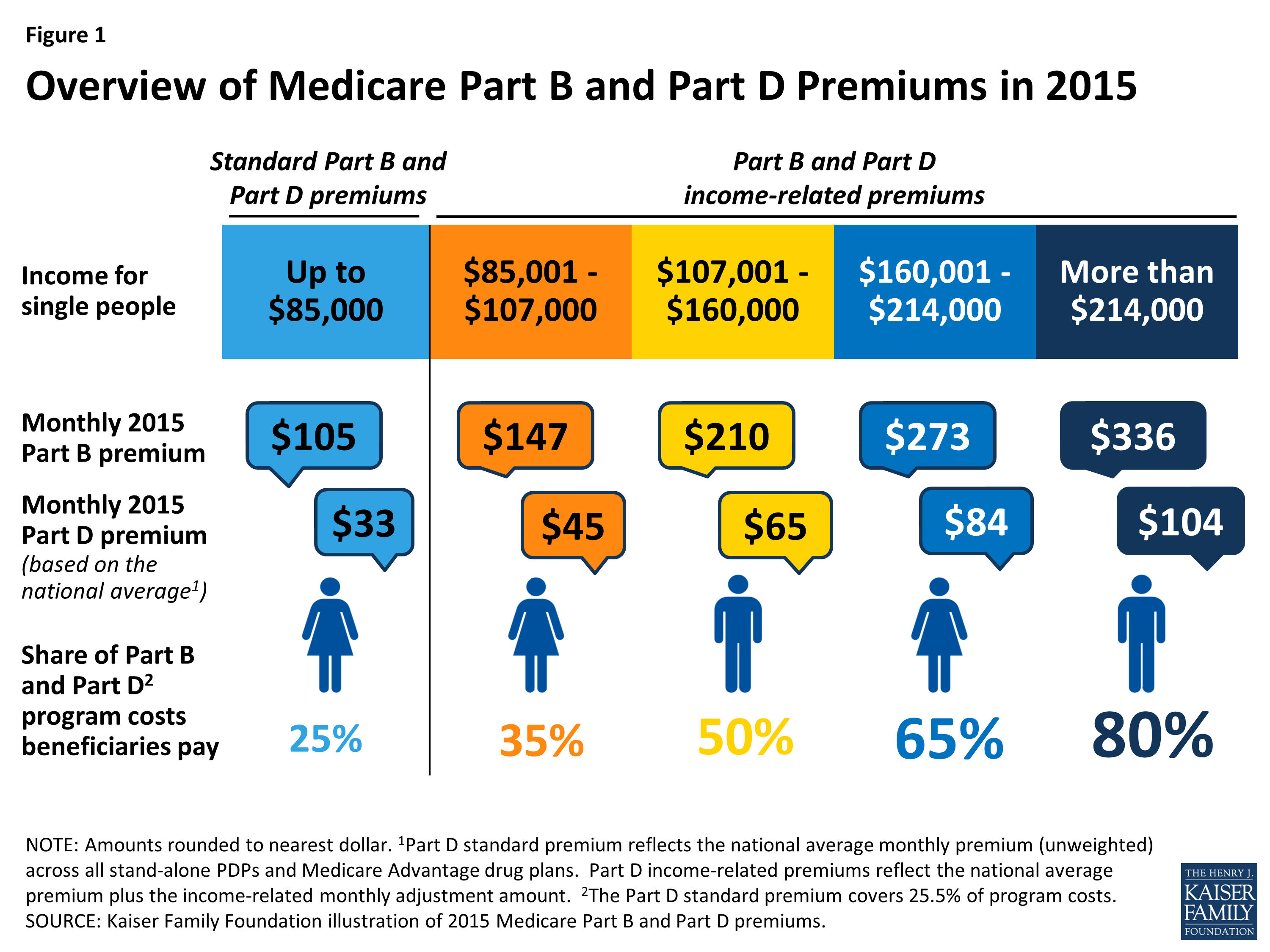

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Get Extra Help With Outpatient Costs

If you have an outpatient procedure planned but are not sure how to pay for benefits your Medicare Part B plan doesnât cover, you have several options for extra help. One of the most popular choices for seniors with low income is to add Medicaid as a supplemental policy to your benefits. Unlike Medicare, Medicaid plans do not generally split their coverage between inpatient and outpatient services. Instead, in most states, your necessary medical care is eligible for coverage on a licensed practitionerâs authorization. If you have both Medicare and Medicaid, your Medicare benefits are billed first, with Medicaid picking up the unpaid remainder.

Even with both Medicare and Medicaid, you might still have a share of cost attached to the outpatient procedure you need. If you have time to investigate different providers before your procedure, and if your healthcare network permits out-of-network care, you can choose a provider that offers reduced fees for seniors and people with limited means to pay. Many university and public hospitals offer steeply discounted care for people who need it, and many keep indigent care funds to help people pay some of the uncovered costs of various medically necessary procedures. These discounts and subsidies are generally compatible with your Medicare Parts A and B benefits, and most are compatible with any authorized Part C plan you may have.

Read Also: When Is Someone Medicare Eligible

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

What Is Part D Cost Sharing

Part D deductibles vary among plans. Some plans have no deductible while the maximum amount allowed is $480 in 2022.

Part D and Medicare Advantage plans with prescription drug coverage almost always charge a copayment or coinsurance for each of the medicines you purchase. Part D coverage uses a tiered cost-sharing structure. This means you will pay varying prices for different categories of drugs. In general, youll pay more in copays or coinsurance for brand-name drugs and less for generics.

You may also face more cost sharing when you hit the coverage gap, also known as the donut hole. In 2022, when you and your insurer have paid $4,430 in prescription drug costs, you are then responsible for 25% of all of your medicine costs. That 25% cost sharing will continue until you enter whats known as Medicare Part Dcatastrophic coverage.

When you spend a total of $7,050 for out-of-pocket costs for your prescription drugs, you will be eligible for catastrophic coverage. When you are in the catastrophic coverage phase, you will pay 5% of the cost of your drugs, or $3.95 for generics and $9.85 for brand-name drugs, whichever is greater. You pay this catastrophic rate for the remainder of the calendar year.

Read Also: Does Medicare Advantage Pay For Hearing Aids

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021 . If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 . If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259 . |

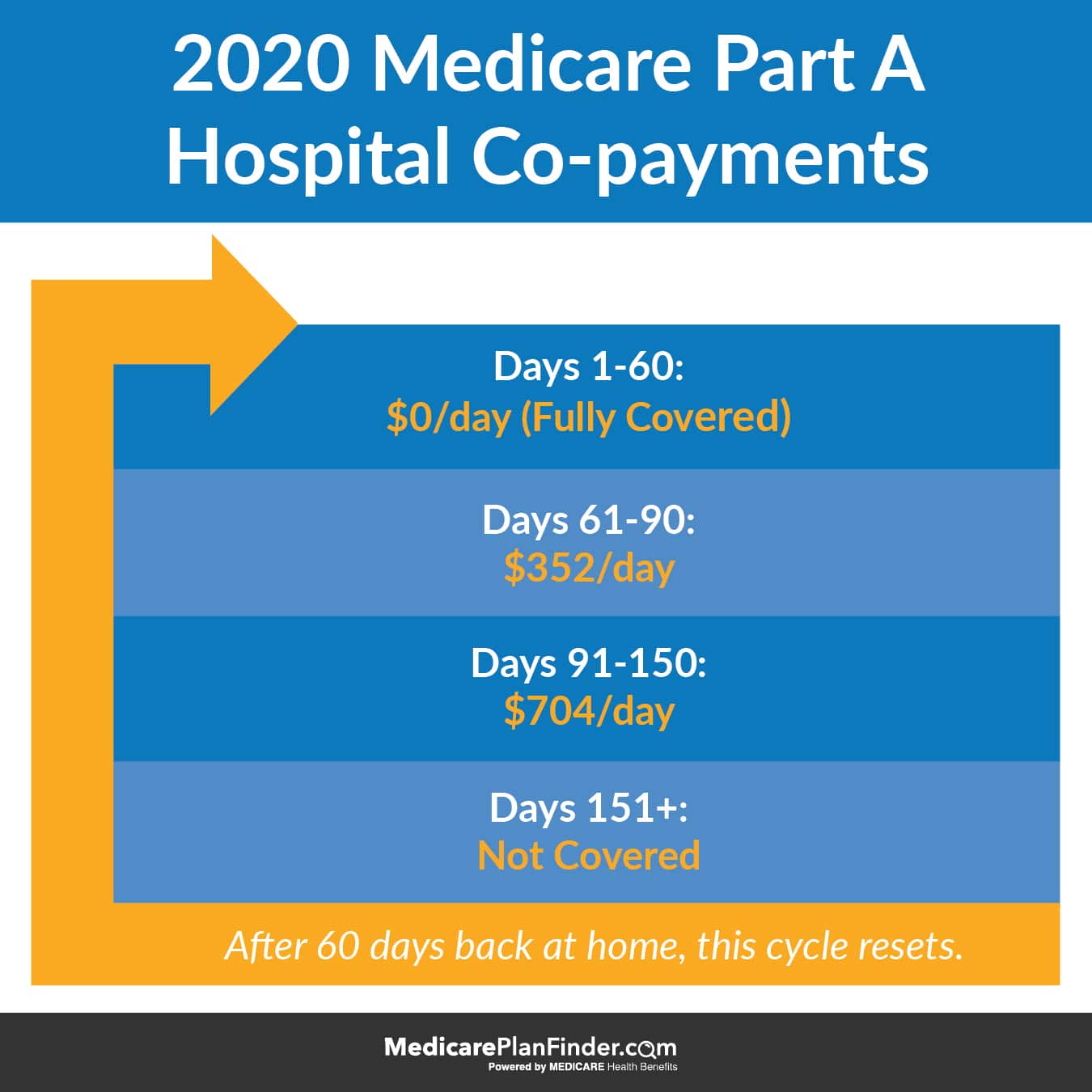

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203 . After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Where Can I Get Long

You may be able to get long-term care at home or at a long-term care facility.

Note that the costs listed below are national medians as reported by Genworth Financial in 2020. They could vary by state.

- You may be able to continue living at home with the help of a home health aide. Median monthly cost per Genworth Financial: $4,576.

- Adult day care centers provide a safe environment to be social and engage in activities during the day while family caregivers are otherwise occupied. Median monthly cost per Genworth Financial: $1,603.

Residential care includes:

- Retirement housing that may offer social activities and transportation

- Assisted living that offers meals, supportive services and health care. Median monthly cost per Genworth Financial: $4,300

- Nursing homes which can provide 24-hour care and medical treatment. Median monthly cost per Genworth Financial: $7,756 for a semi-private room, and $8,821 for a private room.

- Memory care units for Alzheimers and dementia patients which may be locked. This might be more expensive than a semi-private room.

- Continuing care retirement communities were residents can progress through levels of care as the need arises.

Read Also: How Much Does Medicare Pay For Ambulance

What Does Part B Of Medicare Cover

Medicare Part B helps cover medically-necessary services like doctors services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

The basic medically-necessary services covered include:

- Abdominal Aortic Aneurysm Screening

- Bone Mass Measurement

- Cardiac Rehabilitation

- Durable Medical Equipment

- EKG Screening

- Foot Exams and Treatment

- Glaucoma Tests

- Kidney Dialysis Services and Supplies

- Kidney Disease Education Services

- Outpatient Medical and Surgical Services and Supplies

- Pap Tests and Pelvic Exams

- Physical Exams

- Smoking Cessation

- Speech-Language Pathology Services

- Tests

- Transplants and Immunosuppressive Drugs

To find out if Medicare covers a service not on this list, visit www.medicare.gov/coverage, or call 1-800-MEDICARE . TTY users should call 1-877-486-2048.

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

You May Like: How To Order Another Medicare Card

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

Medicare Part A And Part B Leave Some Pretty Significant Gaps In Your Health

Medicare Part A and Part B, also known as Original Medicare or Traditional Medicare, cover a large portion of your medical expenses after you turn age 65. Part A helps pay for inpatient hospital stays, stays in skilled nursing facilities, surgery, hospice care and even some home health care. Part B helps pay for doctors’ visits, outpatient care, some preventive services, and some medical equipment and supplies. Most folks can start signing up for Medicare three months before the month they turn 65.

It’s important to understand that Medicare Part A and Part B leave some pretty significant gaps in your health-care coverage. Here’s a closer look at what isn’t covered by Medicare, plus information about supplemental insurance policies and strategies that can help cover the additional costs, so you don’t end up with unexpected medical bills in retirement.

Read Also: Will Medicare Pay For A Patient Lift