Medicare And Medicaid Costs

Medicare is administered by the Centers for Medicare & Medicaid Services , a component of the Department of Health and Human Services. CMS works alongside the Department of Labor and the U.S. Treasury to enact insurance reform. The Social Security Administration determines eligibility and coverage levels.

Medicaid, on the other hand, is administered at the state level. Although all states participate in the program, they aren’t required to do so. The Affordable Care Act increased the cost to taxpayersparticularly those in the top tax bracketsby extending medical coverage to more Americans.

According to the most recent data available from the CMS, national healthcare expenditure grew 4.6% to $3.8 trillion in 2019. That’s $11,582 per person. This figure accounted for 17.7% of gross domestic product that year. If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE.

Find Cheap Medicare Plans In Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

How Social Security Determines You Have A Higher Premium

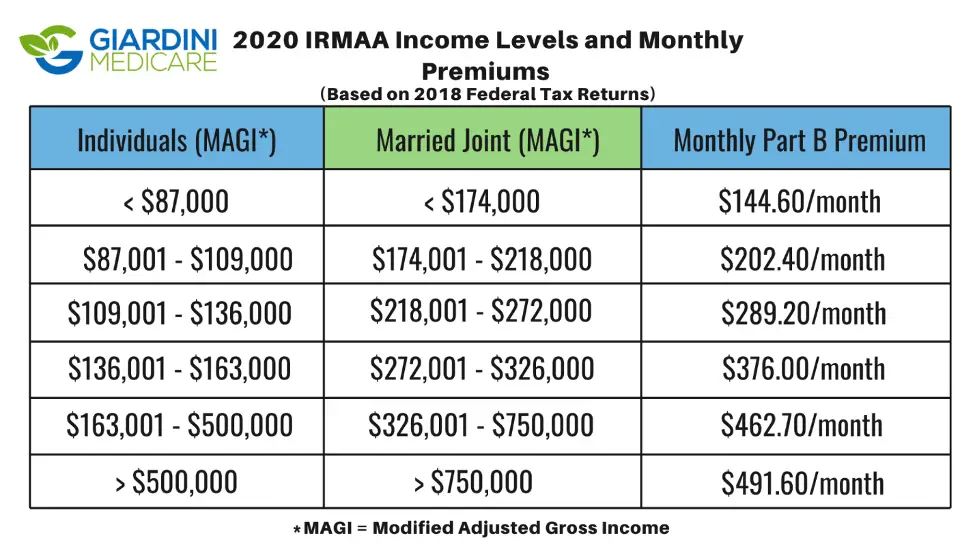

Social Security uses the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $176,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $88,000, youll pay higher premiums , for an idea of what you can expect to pay).

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, well apply an adjustment automatically to the other program when you enroll. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

You May Like: Is Medicare Plan F Still Available

Do They Inflation Adjust The Income Thresholds

The Affordable Care Act of 2011 eliminated inflation adjustments from 2011 to 2019. Thus the income threshold brackets will remain the same for a period of time longer. The end result being more and more Medicare recipients will potentially be forced to pay higher premiums as their income slowly increases via inflation and they are pushed into the higher Medicare income threshold brackets.

How Much Does Medicare Pay For Cataract Surgery

Cataracts are the leading cause of blindness in the world, and more than 50% more adults over 80 in the United States choose to have cataract surgery. Most of the people in this age group have Medicare insurance. Its important to know what aspects of your cataract surgery your Medicare coverage encompasses. This way, you wont get surprised with out-of-pocket expenses.

Defining Cataracts

Cataracts are a medical condition where your eyes natural lens clouds over. Once cataracts start to form, your lens will get more opaque, and light wont be able to reach your retina. You can develop cataracts in a single eye or both eyes at the same time.

As you develop cataracts, your perception of headlights, colors, and sunlight can start to change. Some people experience double vision. This may happen if cataracts begin to cause a difference in the opacity levels across the lens. Some people experience all of these symptoms, and some people wont experience anything but decreased vision.

To restore your vision, many people choose to have cataract surgery. This is an outpatient procedure that typically takes less than an hour from start to finish. Youll go home with an eye patch, and eye drops to help with any pain or itching you experience. When you go back to your doctor for the follow-up, theyll remove the eye patch. You should be able to see clearly again.

Types of Cataract Surgery Medicare Covers

Medicare Coverage and Cataract Surgery Costs

Medicare Insurance and Aftercare

You May Like: Does Medicare Pay For Eye Exams

How Much Will I Pay For Premiums In 2022

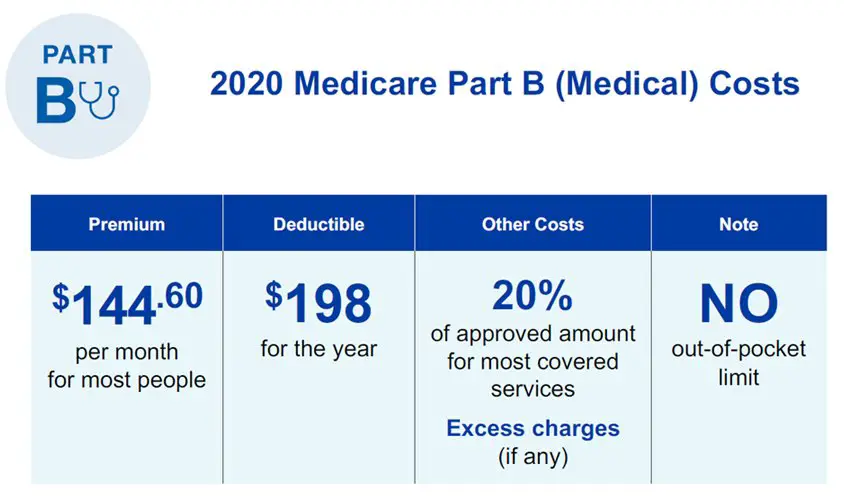

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $91,000 in a given year.

For Part D, youll pay the premium for the plan you select. Depending on your income, youll also pay an additional amount to Medicare.

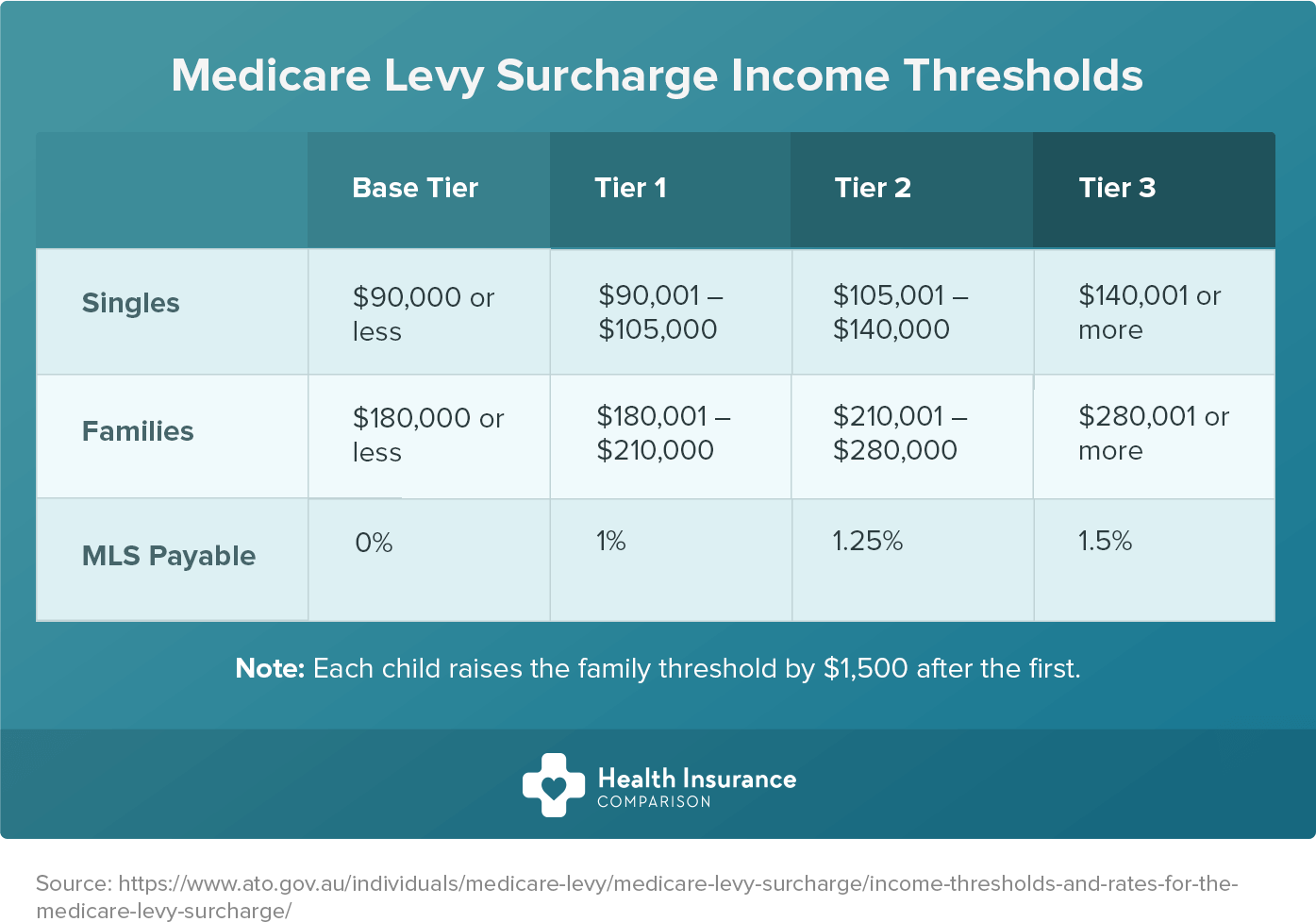

The following table shows the income brackets and IRMAA amount youll pay for Part B and Part D in 2022:

| Yearly income in 2020: single | Yearly income in 2020: married, joint filing | 2022 Medicare Part B monthly premium | 2022 Medicare Part D monthly premium |

|---|---|---|---|

| $91,000 | |||

| $578.30 | your plans premium + $77.90 |

There are different brackets for married couples who file taxes separately. If this is your filing situation, youll pay the following amounts for Part B:

- $170.10 per month if you make $91,000 or less

- $544.30 per month if you make more than $91,000 and less than $409,000

- $578.30 per month if you make $409,000 or more

Your Part B premium costs will be deducted directly from your Social Security or Railroad Retirement Board benefits. If you dont receive either benefit, youll get a bill from Medicare every 3 months.

Just like with Part B, there are different brackets for married couples who file separately. In this case, youll pay the following premiums for Part D:

- only the plan premium if you make $91,000 or less

- your plan premium plus $71.30 if you make more than $91,000 and less than $409,000

- your plan premium plus $77.90 if you make $409,000 or more

You can request an appeal if:

Additional Cares Act Funding

On March 27, 2020, former President Donald Trump signed the CARES Acta $2 trillion coronavirus emergency relief packageinto law. A sizable chunk of those funds$100 billionwas earmarked for healthcare providers and suppliers, including those that are Medicare and Medicaid enrolled for expenses related to COVID-19.

Below are some examples of what the additional funding covers:

- A 20% increase in Medicare payments to hospitals for COVID-19 patients.

- A scheduled payment reduction was eliminated for hospitals treating Medicare patients from May 1, 2020, through Dec. 31, 2020.

- An increase in Medicaid funds for states.

You May Like: What Is Step Therapy In Medicare

What If I Need Help Paying Medicare Costs

If you have limited income and assets, you may qualify for help with your Medicare costs, including those that you pay for care you receive. There are several programs that help pay Medicare costs. Many people who could qualify never sign up, so be sure to apply if you think you might qualify. Dont hesitate to apply. Income and resource limits vary by program.

What Is An Adjustable Bed

Adjustable bed is a general term for a bed that doesnt remain flat or stationary. Adjustable beds allow you to move or elevate different parts of the bed to suit certain needs.

ishonestNo.121 – Generate New Cells

One example is a hospital bed, which may allow you to elevate the head or foot of the bed.

Don’t Miss: How To Find A Medicare Doctor

Medicare Part A Premium

There is no Medicare Part A premium for most people. The hospital coverage is premium-free if you have worked and paid Medicare payroll taxes for at least 10 years measured as 40 quarters by the Centers for Medicare & Medicaid Services .

If you havent met that 10-year mark, you can buy Medicare Part A, but the premiums will cost you $499 per month in 2022. Only about one percent of Medicare beneficiaries have to pay for Part A coverage.

Medicare Part A Premiums

Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as youre eligible for Social Security or Railroad Retirement Board benefits.

You can also get premium-free Part A coverage even if youre not ready to receive Social Security retirement benefits yet. So, if youre 65 years old and not ready to retire, you can still take advantage of Medicare coverage.

Part A does have a yearly deductible. In 2022, the deductible is $1,556. Youll need to spend this amount before your Part A coverage takes over.

Also Check: Are Cancer Drugs Covered By Medicare

Deductibles And Hospital Coinsurance

With Medicare Part A, youll also pay a deductible and coinsurance costs for each benefit period. In 2022, these costs are:

- $1,556 deductible for each benefit period

- $0 coinsurance for days 1 through 60 in each benefit period

- $389 daily coinsurance for days 61 through 90 in each benefit period

- $778 daily coinsurance for days 91 and beyond in each benefit period

Each day beyond day 90 is considered a lifetime reserve day. You have up to 60 of these days to use in your lifetime. Once youve used all of your lifetime reserve days, you must pay all the costs for the rest of your stay.

Benefit periods reset once youve been out of inpatient care for 60 days or when you begin inpatient care for a new condition.

If you have trouble paying for these costs, you can apply for a Medicare savings program. These state programs help cover the costs of your Medicare deductibles and coinsurance.

How Much Does Medicare Advantage Cost

Medicare Advantage plans are private, Medicare-approved health insurance plans that provide Part A and Part B coverage, and may also include other types of coverage, such as vision or dental. The costs of these plans varies, depending on the benefits provided. Each plan offers different coverage and associated premiums, deductibles, and copay. Participants must also pay their Part B premium, along with the adjustment for high earners, if applicable.

Average premiums for 2022 are expected to drop to $19 a month.9

Also Check: Will Medicare Pay For Diapers

Medicare Part A Hospitalization

For most people, Part A will be provided to you at no charge. If you need to buy Part A, youll pay up to $499 each month.

A deductible amount of $1,556 must be paid for by the insurance policyholder for each benefit period.

Copayments are based on the number of days of hospitalization.

Late enrollment fees can be equal to 10 percent of your premium amount. The fees are payable for twice the number of years you were not enrolled.

Theres no out-of-pocket maximum for the amount you pay.

How Much Does Medicare Cost

The amount of money youll need to spend on Medicare depends on several factors, including the type of coverage you choose, when you enroll, your annual income, the amount of medical services you need, and whether you have other health insurance. Your costs include your premiums , deductible , and coinsurance or copayments .

- Late-enrollment penalty.

Read Also: Does Medicare Pay For Medical Alert Bracelets

What If I Experience A Life Event That Causes My Income To Go Down

On a case by case basis Social Security will consider reducing the monthly amount you pay over the base premium for certain life events. Those events are:

How Much Will A Medicare Plan Cost

If you choose a Medigap plan you will pay anywhere between $85-$150 per month, depending on where you live. This will provide you with nearly 100% coverage, protecting you against the high medical costs that come with just having Original Medicare and no plan.

If you choose a Medicare Advantage plan, expect a range between $0 $100 per month and these plans often include prescription coverage . Most plans are less than $50 per month and are often $0 premium.

Before you choose a plan it is important to compare rates. Contact us at for a no-obligation plan comparison. We offer both Medicare Advantage, Medicare Supplement plans and Part D plans.

Also Check: How To Get A Lift Chair From Medicare

What Does Medicare Mean On My Paycheck

When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act are to support both your Social Security and Medicare benefits programs. Your employer makes a matching contribution to the Medicare program.

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer. The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 and 2.90 percent regardless of the total amount you have earned. The benefit of placing funds into this program during your working career is the healthcare coverage you will receive at the time you become eligible for Medicare benefits.

Who Pays for Medicare?Every person who receives a paycheck is paying a Medicare tax. If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax. If you are self-employed, you are required to pay both the employee and employer tax for Medicare.

Related articles:

Medicare Coverage: What Health

So, how much does health care cost when you have a Medicare Advantage plan? To answer that question, heres a quick rundown on how the Medicare Advantage program works.

When you have a Medicare Advantage plan, you still have Medicare but you get your Medicare Part A and Part B benefits through the plan, instead of directly from the government. Private, Medicare-approved insurance companies offer Medicare Advantage plans.

But what about those health-care costs? Since Medicare Advantage plans include Part A and Part B benefits, you know the plans cover them as long as you follow plan rules and Medicare rules. But your cost-sharing portions may vary among plans. There may be an annual deductible, and typically there are copayments or coinsurance amounts as well.

Of course, theres also the plan premium to pay each month. Some plans have premiums as low as $0 per month. You must still pay your Medicare Part B premium every month, along with the plan premium .

Most Medicare Advantage plans include prescription drug coverage, and many plans offer extra benefits. Routine vision and dental services and acupuncture are examples of some of the benefits a Medicare Advantage plan might offer.

Unlike Original Medicare, Medicare Advantage plans have annual out-of-pocket spending limits. So, if your Medicare-approved health-care costs reach a certain amount within a calendar year, your Medicare Advantage plan may cover your approved health-care costs for the rest of the year.

You May Like: Is Mutual Of Omaha A Good Medicare Supplement Company

Medicare Part C Advantage Plans

The Part C monthly premiums vary based on your reported income for two years, the benefit options, and the plan itself.

The amount you pay for Part C deductibles, copayments, and coinsurance varies by plan.

Like traditional Medicare, Advantage Plans make you pay part of the cost for covered medical services. Your share of the bill typically ranges from 20 percent to 40 percent or more, depending on the care you receive.

All Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. The average out-of-pocket limit typically ranges from $3,400 to $7,550. In 2022, the maximum out-of-pocket limit is $10,000.

With most plans, once you reach this limit, youll pay nothing for covered services. Any monthly premium you pay for Medicare Advantage coverage does not count towards your plans out-of-pocket maximum.

Any costs paid for outpatient prescription drug coverage do not apply to your out-of-pocket maximum.

Medicare Part A Costs

Medicare Part A helps cover bills from the hospital. So, if you are admitted and receive inpatient care, Medicare Part A is going to help with those costs.

If youâve worked at least 10 years or can draw off a spouse who has, Medicare Part A is free to have.â¯That means you donât have any monthly costs to have Medicare Part A.

This doesnât mean that Medicare Part A doesnât have other costs like a deductible and coinsurance â because it does â but you wonât have to pay those costs unless you actually need care.

For most people, having Medicare Part A is free.

The Medicare Part A deductible, as well as the coinsurance for care, fluctuates slightly every year, but here are the current Part A costs for 2022:

- $1,556 deductible

- Days 1 â 60: $0 coinsurance

- Days 61 â 90: $389 coinsurance

- Days 91+: $778 coinsurance per âlifetime reserve day,â which caps at 60 days

- Beyond lifetime reserve days: You pay all costs

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $194.50 in 2022.

You May Like: Does Medicare Cover The Cost Of A Shingles Shot