How Do I Find A Doctor Who Accepts Medicare Advantage

Finding the right doctor who accepts Medicare Advantage can be difficult. However, there are plenty of ways to find the one who is right for you. If you are unhappy with your current plan or doctor, take advantage of the annual Medicare open enrollment period from October 15 to December 7.

Ultimately, your health circumstances should guide you in your decision. At Iora, we build practices and teams focused on caring for older adults and take a patient-centered approach to care. When considering your Medicare options and healthcare needs, we encourage you to check out our primary care practices. Most insurance companies have a provider directory that can be accessed online. They can support your search for a new doctor. You can also reach out to your insurance company. Ask for assistance via phone by calling the number on the back of your insurance card. You could even ask family and friends about doctors they use.

Can I Decline Medicare Altogether

Medicare isnt exactly mandatory, but it can be complicated to decline. Late enrollment comes with penalties, and some parts of the program are optional to add, like Medicare parts C and D. Medicare parts A and B are the foundation of Medicare, though, and to decline these comes with consequences.

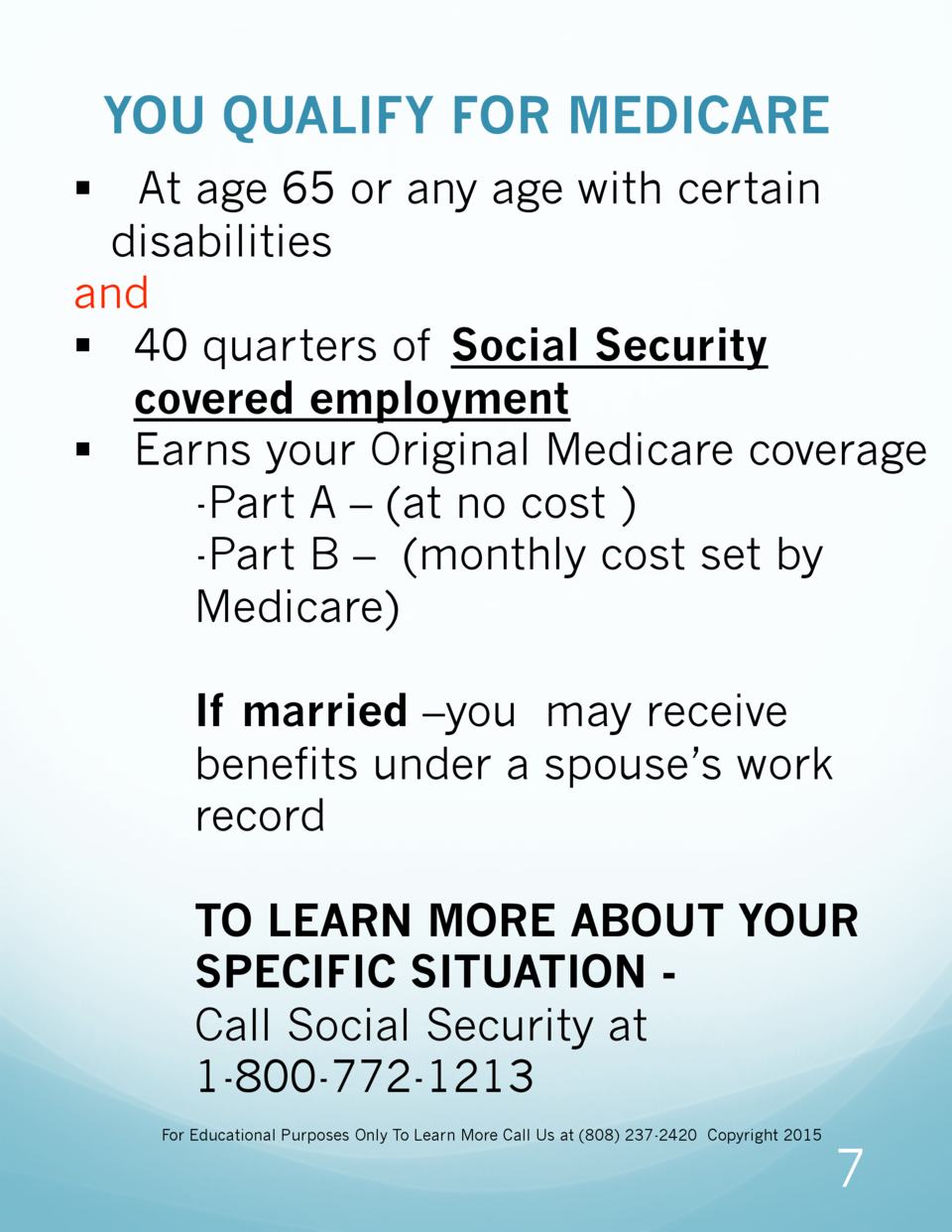

The Social Security Administration oversees the Medicare program, and recommends signing up for Medicare when you are initially eligible, even if you dont plan to retire or use your benefits right away. The exception is when you are still participating in an employer-based health plan, in which case you can sign up for Medicare late, usually without penalty.

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and wont cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so. This means you can no longer receive Social Security or RRB benefits, and must repay anything you have already received when you withdraw from the program.

Medicare Eligibility By Disability

Most Medicare recipients under the age of 65 reach eligibility during their 25th month receiving Social Security disability benefits. If you qualify for Medicare because of a disability, your Initial Enrollment Period will begin during the 22nd month you receive these benefitsthree months before youre eligible for coverage.

Recommended Reading: Does Medicare Cover Dupuytren’s Contracture

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

How To Qualify For Medicaid

Medicaid is a government-run healthcare program that is available in almost every state. However, if you earn between 100 and 200 percent of the federal poverty level and are pregnant, old, disabled, a parent/caretaker, or a child, there is almost certainly a program for you. And, depending on whether your state expanded Medicaid under Obamacare, there may be a program for you if your income is less than 133 percent of the federal poverty level. The federal poverty guidelines for 2019 are as follows:

In 2019, Alaskas federal poverty line ranges from $15,600 to $54,310 . Hawaiis federal poverty level ranges from $14,380 to $49,940 .

Also Check: Should I Get Medicare Part C

What If I Havent Worked Long Enough Or At All

If you havent worked enough in your lifetime to earn the necessary 40 credits, it may be possible to qualify for Medicare Part A benefits based on your spouses work history.

In order to qualify for this provision, you must be 65 or older and your spouse must be at least 62 or older. In some cases, you can still receive the benefits if you are 65 and divorced or if you are a widow.

If you are currently married and your spouse qualifies for social security benefits and Medicare Part A premiums, you can apply as long as you have been married for at least a year prior to submitting the application.

If you are divorced, you may be eligible if your former spouse is, as long as you were married for at least ten years. You must also be currently single.

You can also qualify if your spouse has passed away. You must have been married for at least nine months before the death of your spouse and you must be single.

How To Enroll In Medicare Disability

If you are eligible for Medicare disability, you may or may not need to take extra steps to enroll:

If you’ve been collecting SSDI benefits:

-

You’ll be automatically enrolled in Medicare Parts A and B at the beginning of your 25th month.

-

You should receive your Medicare card in the mail approximately three months prior to your coverage start date.

-

Your Part B premium (and Part A premium, if you owe one, will be deducted from your Social Security check.

If you’ve been diagnosed with ALS:

-

You’ll be automatically enrolled in Medicare the first month you start collecting SSDI benefits. The 24-month waiting period does not apply to those with ALS diagnosis.

-

If you’ve been collecting SSDI for another disability, and then are diagnosed with ALS within the 24-month waiting period, you can enroll in Medicare immediately.

If you have ESRD, the eligibility process is a little different:

-

You can choose whether or not to enroll in Medicare you are not automatically enrolled.

-

If you want to sign up, you can do so through your local social security office.

Medicare coverage is available to many people under the age of 65 with disabilities. Don’t let fear of a complicated eligibility process keep you from getting Medicare benefits.

Andrea Bonner is a healthcare writer with more than 10 years of experience covering senior health. She is from the Raleigh-Durham area in North Carolina.

Recommended Reading: Do I Have To Pay For Medicare On Ssdi

What Do I Need To Qualify For Medicaid

Medicaid eligibility is primarily based on state income guidelines. Each state has different income limits and they administer their plans differently. To qualify, youll need your social security number and those of your children . Youll also need proof of income and whether or not you receive other government assistance such as WIC or Food Stamps. Youll also want documentation of any disability you or your children may have.

You can apply for Medicaid either online through the Health Insurance Marketplace or through your states Medicaid agency. Medicaid also includes the CHIP program which is the program for children in low-income households. Even if you dont qualify based solely on income, certain disabilities, pregnancy, and the elderly may still qualify for aid.

What Is The Medicare Savings Program

There are four types of Medicare Savings Programs:

- Qualified Medicare Beneficiary Program

- Specified Low-Income Medicare Beneficiary Program

- Qualifying Individual Program

- Qualified Disabled and Working Individuals Program

If you answer yes to these 3 questions, to see if you qualify for assistance in your state:

If you qualify for the QMB program, SLMB, or QI program, you automatically qualify to get Extra Help paying for Medicare drug coverage.

Recommended Reading: What Weight Loss Programs Are Covered By Medicare

Who Is Eligible For Premium

Theres a monthly premium for Medicare Part A. You generally dont have to pay a Part A premium if either of these applies to you:

- You or your spouse worked long enough while paying Medicare taxes

- You or your spouse had Medicare-covered government employment or retiree who has paid Medicare payroll taxes while working but has not paid into Social Security.

Normally, you pay a monthly premium for Medicare Part B, no matter how many years youve worked. Read more about the Part A and Part B premiums.

Who Is Eligible For Medicare Part B

Part B medical insurance, the second piece of Original Medicare, covers outpatient services, such as doctors visits, lab work, and preventive care.

Here are the eligibility requirements to enroll in Medicare Part B.

- If youre entitled to Part A with no monthly premiums, then you qualify for Part B when youre eligible for Part A.

- If you have to buy Part A, then you can get Part B if:

- Youre an American citizen who lives in the country or a permanent resident who has lived here for five or more continuous years, and

- Youre 65 or older or under 65 and qualify for Medicare due to having a disability, ESRD, or ALS.

Your enrollment period for Part B is the same as Part A: during your Initial Enrollment Period when you first qualify for Medicare, or during the General Enrollment Period .

You May Like: Is Prolia Covered By Medicare Part B Or Part D

How Does Medicare Part C Work

Medicare Part C plans are sold by private insurance companies as an alternative to Original Medicare. Medicare Part C plans are required by law to offer at least the same benefits as Medicare Part A and Part B.

There are several different types of Medicare Advantage plans, such as HMO plans and PPO plans. Each type of plan may feature its own network of participating providers.

Reasons To Delay Medicare

If youre thinking about deferring Medicare, discuss the pros and cons with your current insurer, union representative, or employer. Its important to know how or if your current plan will work with Medicare, so you can choose the most comprehensive overage possible.

Some of the common reasons you may want to consider deferring Medicare include:

- You have a plan through an employer that you want to keep.

Recommended Reading: How To Apply For Part A Medicare Only

Can I Enroll In A Different Medicare Advantage Plan

Yes, you can enroll in different Medicare Advantage plans. Here are the times you can enroll:

| Enrollment Options |

| *see note |

*Note: After you ask to join a plan, your coverage will begin the first day of the month. If you join during one of the 3 months before you turn 65, your coverage will begin the first day of the month you turn 65. *

Medicare Eligibility For Part D

To be eligible for Medicare Part D you must be enrolled in Medicare Part A and/or Part B. You are not eligible for a Part D drug plan if you are enrolled in Medicare Part C. Medicare Part D plans are run by private insurance companies, so premium prices and covered drugs will vary by plan.

You should enroll in a Medicare Part D plan when you are first eligible for Medicare, or risk paying a late enrollment penalty.

Also Check: Is Medicare Medicaid The Same

Medicare Eligibility Requirements For 2020

Not sure if youre eligible for Medicare health insurance? The Social Security Administration enrolls some people automatically. But dont expect that or wait for your Medicare card to show up. Find out if youre eligible now so you can enroll at the right time and avoid any Late Enrollment Penalties .

Theres more than one way to qualify for Medicare, and enrolling in the different parts of Medicare differ as well. Plus, how you qualify may determine how you can receive coverage and what your premiums might be.

If youre looking for more of a crash course in the different parts of Medicare and how the program works as a whole, check out our Ultimate Medicare Guide. Otherwise, read on.

Call a Licensed Agent:

What If The Non

If the non-working spouse is older than the working spouse, the non-working spouse can qualify on on the working spouses work record if they are at least 62, since that is when qualification for Social Security begins. In this case, if the working spouse is still working, the non-working spouse should stay on the work health insurance and just take Part A, as Part A is premium free for most people. If the working spouse is no longer employed, the non-working spouse should go ahead and apply for coverage fully from Medicare. If the working spouse is younger than 62, the non-working spouse will not be able to claim on the record. In this case, when they are 65, and assuming they have lived in the US for 5 consecutive years, they can purchase Part A and Part B and pay full premiums until the working spouse turns 62. Purchasing Medicare is not cheap, Part A can be as much as $422 a month in 2018. Make sure to consult a qualified professional before making this decision.

Also Check: Does Medicare Part A Cover Doctors In Hospital

Medicaid The Underinsured The Uninsured

Having health insurance does not always mean you can afford to use it. There may be expensive deductibles to pay out of pocket before your insurance coverage kicks in. When insurance does pay for services, you could still be left to pay copays or coinsurance .

Not everyone is fortunate enough to afford health insurance. As many as 17% of adults between 60 and 64 are on Medicaid, and 8% are uninsured. States where Medicaid expansion did not occur tend to have higher rates of uninsured people.

Unfortunately, many people delay care due to concerns over cost. In 2019, 9.1% of people delayed getting the care they needed, and 8.3% chose not to get care at all. When it came to people who did not have insurance, those rates increased to 32.2% and 30.4%, respectively.

A study in the journal Cancerlooked at a national database of cancer diagnoses from 2014 to 2016. The researchers focused on uninsured adults between 61 and 64 years old and compared them to insured adults on Medicare from 65 to 69 years old.

Interestingly, there was a significant rise in cancer diagnoses at 65 years old, especially for colon cancer and lung cancer. The implication is that people delayed care until they qualified for Medicare.

Medicare at 60 could be an option for Americans who do not qualify for Medicaid or who cannot otherwise access affordable health care.

How Do You Receive Your Medicare Benefits When You Meet Medicare Eligibility Requirements For People Younger Than Age 65

- If you receive Social Security benefits for 24 months, usually you will automatically be enrolled in Medicare Part A and Part B at the beginning of the 25th month.

- If you have Lou Gehrigs disease, usually you will automatically be enrolled in Medicare Part A and Part B as soon as you receive the first month of Social Security disability benefits.

- If you have ESRD, you might be eligible for Medicare but you must apply for Medicare benefits by visiting your local Social Security office or contacting Social Security from 7AM 7PM Monday Friday, all U.S. time zones. Medicare coverage usually starts on the first day of the fourth month of your dialysis treatments.

Are you unsure whether you meet Medicare eligibility requirements? Contact me. I will be happy to help you.

- You can use the links below to reach me or have me send you customized information through an email.

If you wish to learn more about some of the Medicare plans where you live, use the Compare Plans button on this page.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Read Also: Does Medicare Cover Outpatient Physical Therapy

Medicare Part D Prescription Drug Coverage Eligibility

Like Medicare Advantage and Medicare Supplement, Part D prescription drug coverage is provided by Medicare-approved private insurance companies. These plans accompany Original Medicare. Generally, you cant have a standalone Part D plan if you have a Medicare Advantage plan.

To qualify for a Part D plan, you must meet the following requirements:

- You must have both Part A and B .

- You must live where plans are available.

- You must pay Part A, Part B, and Part D premiums, if applicable.

Retiree Health Plan Part B Reimbursement Options

If you’re retired and have Medicare and retiree group health plan coverage from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

You May Like: Does Medicare Cover Nursing Care At Home

C Plans Are An Alternative To Original Medicare

Medicare Advantage plans provide Part A and Part B benefits. Most plans have built-in Part D prescription drug coverage. Some also offer other benefits, such as vision and dental coverage. You must continue to pay your Part B premium when you join Medicare Advantage.

There are specific times when you can enroll in Medicare Advantage. These include:

- Your Initial Enrollment Period , which starts three months before your 65th birthday and ends three months afterward.

- The annual Open Enrollment Period from October 15 to December 7, when you can switch between Original Medicare and Medicare Advantage.12

- The Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31 each year. If youre already enrolled in a Medicare Advantage plan, you can switch to a different one or drop your plan and return to Original Medicare.