What Should I Do If My Medicare Part C Plan Doesnt Cover Something I Need

If you are denied coverage for something you need, the first thing you may be able to do is file an appeal. You can appeal for a health care service, supply, item, or prescription drug that you think you should be able to get or that you already got. You also can appeal to pay less than you originally were requested to pay.

If your appeal is denied or if you have other frustrations with your plan, you can switch Medicare Advantage plans during the Open Enrollment Period which is October 15 â December 7 every year.

Do you want to begin looking for Medicare Advantage plans in your area? Just enter your zip code on this page.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Medicare Spends Its Way Out Of Trouble: 20032010

The 2003 Medicare Modernization and Improvement Act established a larger role for private health plans in Medicare largely based on a shift away from a focus on cost containment and regulation and toward the accommodation of private interests and an ideological preference for market-based solutions that stemmed from the Republican control of both the executive and legislative branches of government . The MMA enacted the most significant changes to the Medicare program since its inception, and the emphasis of these reforms was the use of private plansincluding, we note parenthetically, in Part D. The generosity afforded to private plans via the MMA was in large part an attempt by the Bush administration and Congress to increase the private sector’s role in Medicare.

The MMA also created two more Part C plans: regional PPO plans and Special Needs Plans . Regional PPOs are like local PPO plans except that they cover regions comprising a whole state or several states . Regional PPOs were created mainly to give rural beneficiaries better access to a broader set of private plans. SNPs were created for Medicare beneficiaries who also were eligible for Medicaid and other vulnerable populations and were intended to provide the focused, specialized care particularly suited to these populations.

What Isn’t Covered By Medicare Part C

Medicare Advantage plans must provide at least the same amount of coverage as Original Medicare. Once a plan meets the minimum requirements, its up to the insurer to determine if additional services are covered.

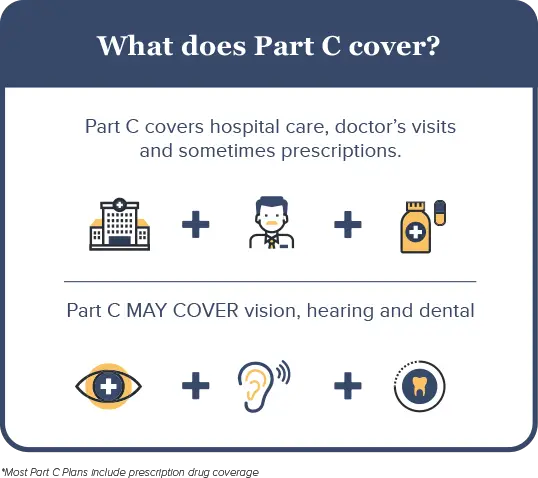

Depending on the plan selected, Medicare Part C may not cover prescription medications. If it doesnt, you must have other prescription drug coverage. If you have a HMO or PPO, you are not allowed to purchase a separate Part D prescription drug plan. Although insurers are allowed to cover more services than Original Medicare does, not all Part C plans pay for routine dental care, hearing aids, or routine vision care.

If you are in need of inpatient care, Medicare Part C may not cover the cost of a private room, unless its deemed medically necessary. A private room is medically necessary if putting you in a semi-private room would endanger your health or the health of someone else. For example, if you have an infectious disease, Medicare Part C will cover a private room to ensure you remain isolated and prevent the disease from spreading to other patients.

Also Check: What To Do Before You Turn 65 Medicare

When Can I Enroll

You should know that you dont have to enroll in Medicare Part C coverage. If youre on Medicare and you choose not to enroll in Part C, you will continue to receive your Medicare Part A and/or Part B benefits, as well as any drug coverage you may have from a stand-alone drug plan. If you do decide to enroll in Medicare Advantage, there are different enrollment periods in which you may do so. These include specific dates during the year, when you turn 65, or when you are under 65 and have a disability. Below are 4 types of enrollment periods for Medicare Advantage plans.

How Does The Government Rate Medicare Advantage Plans

Medicare beneficiaries who have Medicare Advantage plans are more likely to pick a plan with a higher star rating than one with one or two stars according to recent findings. Ratings have a significant impact on the plans that are most popular for Medicare recipients they also help members pick plans with better offerings.

Studies also show that ratings make a difference to consumers because quality matters. With the creation of the online plan quality and ratings finder on Medicare.gov, anyone can quickly find top-rated Medicare Advantage plans for their service areas. However, its important to understand how these plans are rated and what the government looks for when determining the quality of a health insurance plan. Ratings for Medicare plans are based on the following:

- Screenings, tests and vaccines

- Member complaints, improvements, plan performance and issues getting service

- Customer service

Medicare drug plans that are separate from Medicare Advantage are rated slightly differently. These plans are rated according to the following:

- Patient safety and drug pricing accuracy

- Drug plan customer service

- Member complaints, problems with getting drugs and improvements in performance

- Member experiences with the plan

Don’t Miss: How Do You Get Dental Insurance On Medicare

Trailing The Private Sector 19851997

In the Medicare program, Part C plans were required to offer a minimum set of benefits equivalent to that provided by Medicare Parts A and B. The plans were paid by capitation, and Medicare uses formal risk adjustment, setting a per-member-per-month payment for each beneficiary, which is called the average adjusted per-capita cost and is calculated by a formula based on costs in TM and some beneficiary demographic characteristics such as age and gender. The rates are county specific and based on a five-year moving average lagged by three years . The resulting amount was reduced to 95 percent of the Medicare average, thereby returning a savings to the Medicare program . The presumption was that private Part C plans could, and would, economize on care and that by reducing by 5 percent the amount that Medicare paid the plans, the government would share in the savings.

In principle, paying 95 percent of the local risk-adjusted TM average cost could achieve the goals of both expanding choice and reducing program cost. Any supply of HMOs at the regulated price would increase the options for at least some beneficiaries, relative to those before 1985. And if the risk-adjusted formula captured the average costs for those beneficiaries who actually enrolled in MA, as opposed to the beneficiaries remaining in TM, the 95 percent rule would save Medicare money.

What Isn’t Covered By Original Medicare

Original Medicare doesn’t cover all of the health care services older people are likely to need in retirement. For example, original Medicare generally won’t pay for glasses, contact lenses or routine eye examinations. Dental care and hearing aids are also common services that aren’t covered. Perhaps most significantly, while short-term nursing home stays might be covered under specific circumstances, original Medicare does not pay for long-term care.

Recommended Reading: How To Qualify For Oxygen With Medicare

What Does Medicare Advantage Cover

The exciting feature of Medicare Part C is that most Medicare Advantage plans offer additional benefits, above and beyond what Original Medicare covers. Since Part C plans have narrower networks and are privately managed, they have lower monthly premiums. However, the monthly costs for services can be more, such as $395 a day for the first five days of hospitalization.

Depending on the plan you choose, Medicare Advantage may cover:

- Hearing aids

- Acupuncture and chiropractic care and/or

- Other health-related benefits.

Medicare Advantage plans are required to cover all of the benefits that Original Medicare covers. Essentially, if you want all your basic health needs covered, you can either go with Original Medicare or go with Medicare Part C.

Prescription Drugs: Most Medicare Advantage insurers offer some form of coverage for prescription drugs. However, the costs of medications are not limited by your annual out-of-pocket maximum.

Changes May Happen Every Year: Unlike Original Medicare, the benefits offered by your plan may change every year. Part C enrollees will receive a notice in the mail before any changes take effect. You can also review your plans star rating each year to help you make coverage decisions.

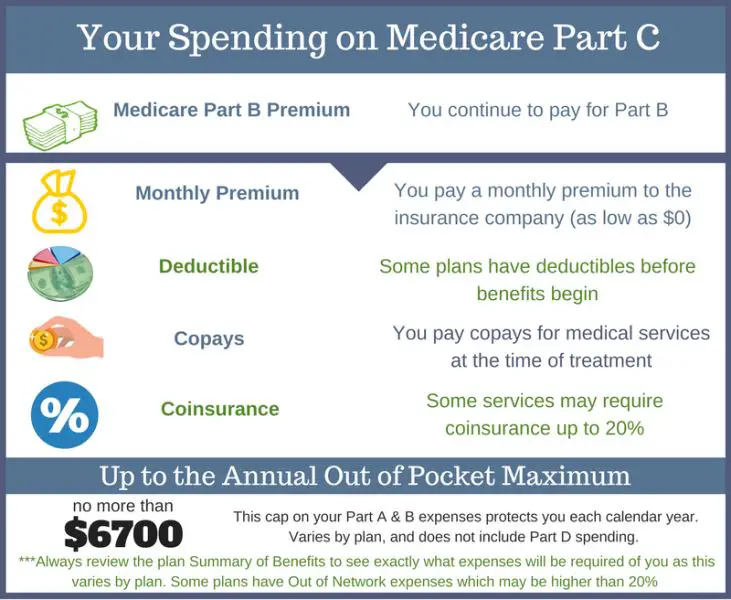

Consider Premiumsand Your Other Costs

To see how a Medicare Advantage Plan cherry-picks its patients, carefully review the copays in the summary of benefits for every plan you are considering. To give you an example of the types of copays you may find, here are some details of in-network services from a popular Humana Medicare Advantage Plan in Florida:

- Hospital stay$175 per day for the first 10 days

- Ambulance$300

- Diabetes suppliesup to 20% copay

- Diagnostic radiologyup to $125 copay

- Lab servicesup to $100 copay

- Outpatient x-raysup to $100 copay

- Renal dialysisup to 20% copay

As this non-exhaustive list of copays demonstrates, out-of-pocket costs will quickly build up over the year if you get sick. The Medicare Advantage Plan may offer a $0 premium, but the out-of-pocket surprises may not be worth those initial savings if you get sick. The best candidate for Medicare Advantage is someone who’s healthy,” says Mary Ashkar, senior attorney for the Center for Medicare Advocacy. “We see trouble when someone gets sick.”

Read Also: Does Medicare Pay For Blepharoplasty

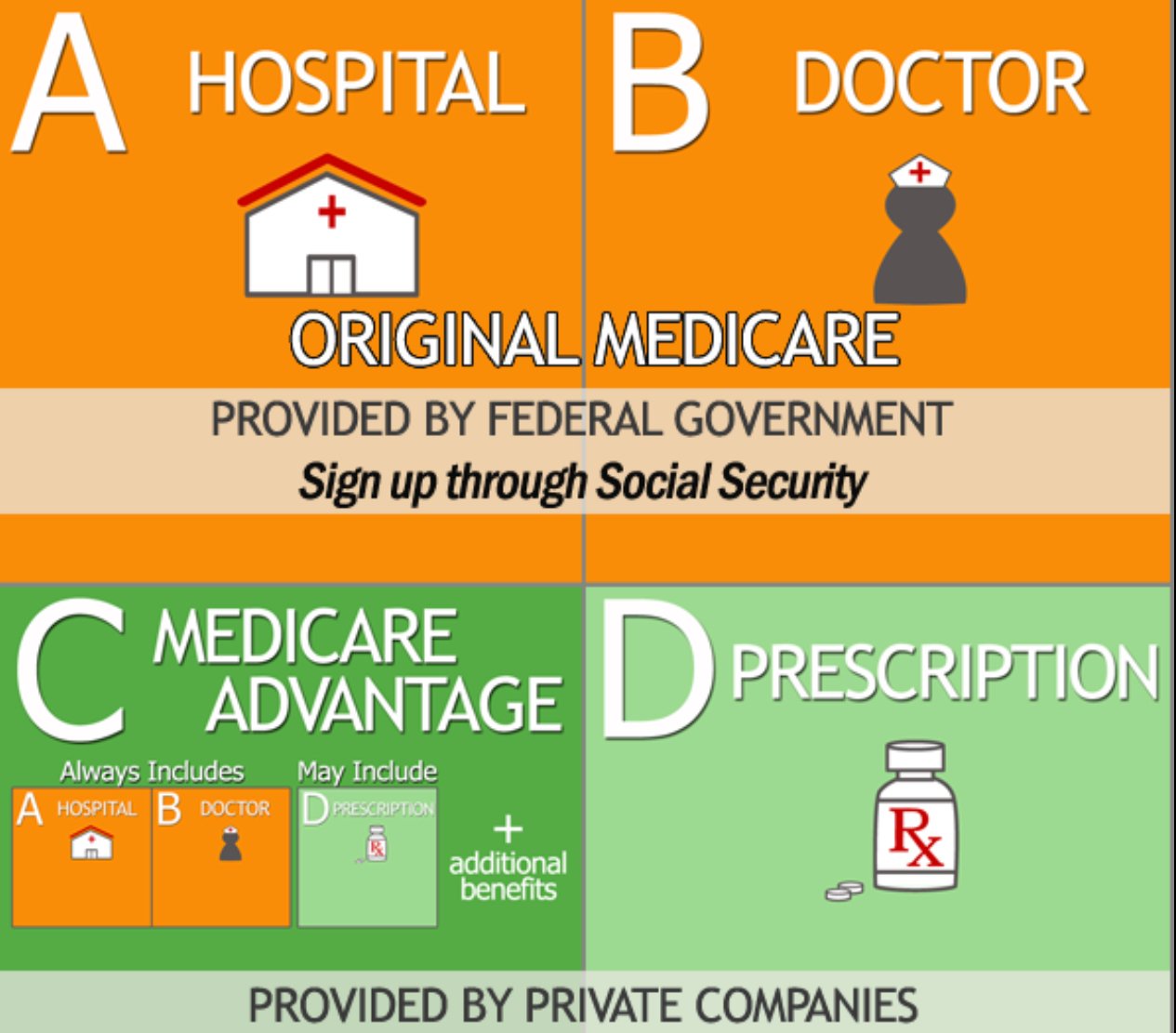

How Do Medicare Advantage Plans Work

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

Pros Of Medicare Advantage Plans

With Medicare Advantage plans, you can get personalized, coordinated medical care at a lower cost, depending on your plan. There are many advantages of enrolling in a Medicare Advantage plan. You can get:

- All of your coverage bundled together in 1 convenient plan.

- Costs that may be lower than Original Medicare.

- Extra benefits such as coverage for vision, hearing, dental, wellness programs, and discounts on health-related items.

- Prescription drug coverage .

- All the rights and protections offered through the Medicare program.

- Help paying for premiums , if you qualify.

- All the benefits of Medicare Part A and Part B plans, without buying supplemental insurance.

Also Check: How To Get Medicare For Free

Costs For Medicare Advantage Plans

What you pay in a Medicare Advantage Plan depends on several factors. In most cases, youll need to use health care providers who participate in the plans network. Some plans wont cover services from providers outside the plans network and service area. Learn about these factors and how to get cost details.

B Doctor And Outpatient Services

This part of Medicare covers doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation and other outpatient services.

Unlike Part A, Part B involves more costs, and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouses health plan. But if you dont have other insurance and dont sign up for Part B when you first enroll in Medicare, youll likely have to pay a higher monthly premium for as long as youre in the program.

The federal government sets the Part B monthly premium, which is $170.10 for 2022. It may be higher if your income is more than $91,000.

Youll also be subject to an annual deductible, set at $233 for 2022. And youll have to pay 20 percent of the bills for doctor visits and other outpatient services. If you are collecting Social Security, the monthly premium will be deducted from your monthly benefit.

Recommended Reading: Does Medicare Pay For A Registered Dietitian

Why Is Medicare Part C Separate

Medicare Advantage plans are not separate from Medicare. Medicare Advantage is private insurance required to meet all of Medicares regulations. You have Medicare rights and protections, even though private insurance companies manage your benefits. Medicare Advantage plans can offer additional benefits like Part D, vision, dental, and hearing.

Are you eligible for cost-saving Medicare subsidies?

Medicare Advantage Plan Types

Medicare Advantage HMO Plans: As of 2022, 59% of MA plans offered are HMOs.4 Receiving care through an HMO is usually limited to in-network providers, unless you have a medical emergency or need urgent care and cant get to an in-network provider. You usually need to get all your basic healthcare through your primary care physician and need a referral from your PCP to see a specialist. Many plans also include Part D drug coverage. If you have such a plan, you cant enroll in a stand-alone prescription drug plan .

Medicare Advantage PPO Plans: One of the main differences between HMO and PPO plans is that PPO plans are more flexibleyou can go outside the plans network for care. But the downside to going out of network is that the plan covers less of your healthcare costs. You usually dont need to choose a PCP or get a referral to see a specialist. Like HMO plans, Medicare Advantage PPO plans usually include drug coverage, and you cant enroll in a PDP if your Part C plan already provides drug benefits. In learning more about what is Medicare Part C and its plan types, you should know that there are two types of Medicare Advantage PPO plans.

Read Also: Do Medicare Advantage Plans Cover Annual Wellness Visits

Medicare Advantage Special Enrollment For 5

You can switch to a 5-star Medicare Advantage plan or other supplemental plan offered by a private health insurance company during a Special Enrollment Period from November 30 to December 8 each year. Many plans are rated just under 5 stars but still offer great benefits and have excellent customer satisfaction.

Plans should also be compared based on their customer satisfaction and reviews. You can read reviews and compare plans based on customer service, pricing, benefits, extra services and ease of use.

Medicare Part C: How Do I Enroll

First, youll need to enroll in Original Medicare . You can apply online for Original Medicare on the Social Security website, or over the phone by calling the Social Security Administration at 1-800-772-1213.

Once youve enrolled in Original Medicare, you can choose a Medicare Advantage plan using HealthCare.coms plan selector.

Don’t Miss: When Does One Qualify For Medicare

Preferred Provider Organization Plans

A Medicare Advantage PPO offers more flexibility than an HMO because your insurance will usually cover out-of-network providers. It will cost you more than what you would pay if you went in-network, though. PPOs also donât require a primary care physician and they allow you to see a specialist without a referral.

Choosing Between Medicare Advantage And Medicare Part D

You are not allowed to be enrolled in a Medicare Advantage plan that offers prescription drug coverage and a Part D plan at the same time.

If you do not take any prescription drugs but want the additional benefits offered by a Medicare Advantage plan , or if you take prescription medication and your drugs are covered by a Medicare Advantage plan, you might consider applying for a Medicare Advantage plan.

You might choose to enroll in a Part D plan if you have no need for the extra services that might be provided by a Medicare Advantage plan but you want prescription drug coverage.

If your Medicare Advantage plan does not offer prescription drug coverage, you can enroll in a Medicare Prescription Drug plan as well.

Don’t Miss: Does Medicare Pay For Licensed Professional Counselors

How Much Does Medicare Part C Cost

Medicare Advantage prices vary greatly by plan, so how much you pay really depends on your individual plan. There are some particular costs you should pay attention to, though. In particular, letâs cover the basics of your monthly premiums, copays, annual deductible, coinsurance, and maximum out-of-pocket limit.

What Are The Drawbacks Of Medicare Part C

Medicare Part C is a Medicare insurance program that covers outpatient hospital services. It is available to people who are 65 years or older and have low incomes.

Though Medicare Part C has many benefits, there are also some drawbacks. Some of the drawbacks include the fact that it is not always affordable, and it may not cover all of your medical needs. Additionally, if you stop receiving Medicare Part C coverage, you may have to pay back the money you have already paid for services.

Recommended Reading: What Is The Monthly Premium For Medicare Plan G