S Of Medicare Basics Part B

The best place to start learning about Medicare is with the basics with Parts A, B, C and D. The second in a four-part series, this Medicare Basics article will focus on Medicare Part B.

Medicare Part B is one part of what is known as Original Medicare, which is administered by the federal government and also includes Medicare Part A. Part B covers your doctor visits, most doctor services you receive as a hospital inpatient, most routine and emergency medical services, and some preventative care items.

Your Coverage Options For Medicare In Idaho

Traditional Medicare, also called Original Medicare, includes Medicare Part A and Part B . You generally have to be enrolled in Original Medicare before you choose other Medicare coverage options. This is true in Idaho as well as the other states.

Medicare Advantage plans and stand-alone Medicare Part D Prescription Drug Plans are offered by private insurance companies that contract with Medicare to offer Medicare insurance plans.

There are different types of Medicare Advantage plans. Some examples include Medicare Advantage HMOs and PPOs . Often Medicare Advantage plans include prescription drug coverage.

For those who stay with Original Medicare Part A and/or Part B, a stand-alone Medicare Prescription Drug Plan may be a good option for prescription drug coverage. You might also want to buy a Medicare Supplement insurance plan to help pay your Medicare coinsurance/copayments and possibly other costs, like deductible amounts.

Not every Medicare plan may be available in all areas of Idaho. Itâs also important to compare the costs and benefits of local Medicare plans each year. Be aware that premiums may vary among plans. Other costs may vary too, like coinsurance, copayments, and deductibles. Some Medicare Advantage plans have premiums as low as $0. You still need to pay your Part B premium along with any plan premium.

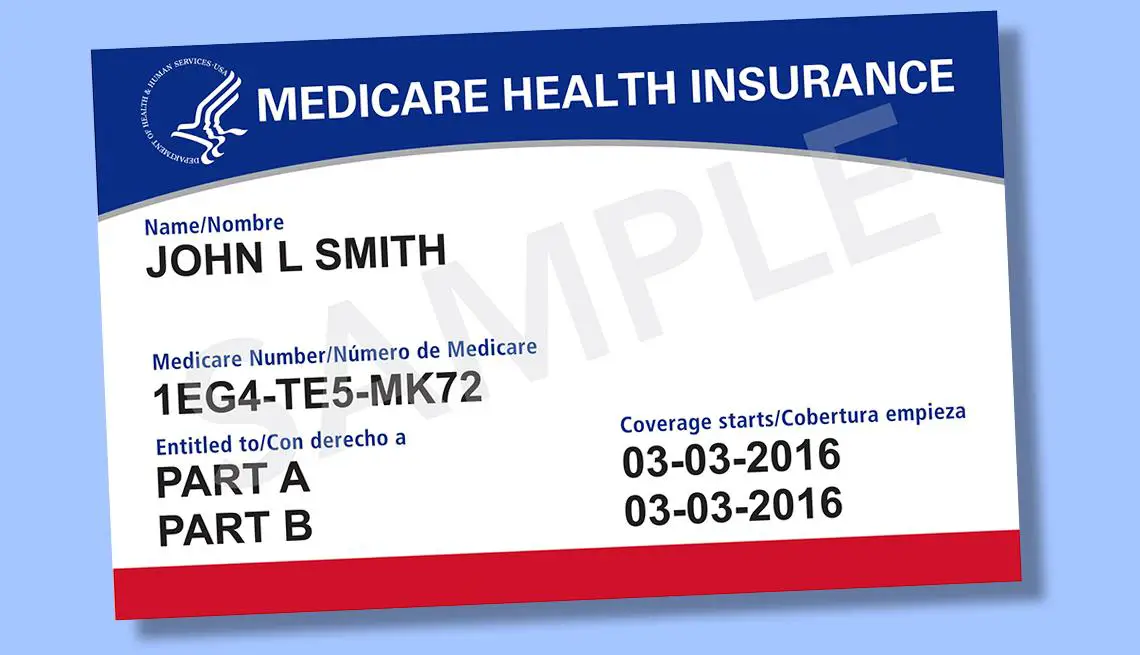

What Is The Purpose Of My Medicare Number And Card

Bring your Medicare card with you to any doctors appointment or hospital visit with any healthcare

practitioner. Similarly, whether or not you intend to see a doctor, please keep it on hand.

For claim and billing purposes, a beneficiarys Medicare number is used to identify them. Furthermore,

keeping the red, white, and blue Medicare card on hand will make an emergency health issue easier.

Also Check: Can You Get Medicare Advantage Without Part B

A Historically High Part B Premium Increase In 2022

Medicare beneficiaries got hit with an ugly surprise last year: The biggest year-over-year Part B premium increase in the federal programs history was on its way.

Medicare Part B which covers doctor visits, outpatient surgery, durable medical equipment and other services jumped a whopping $21.60 at the beginning of 2022 to $170.10 a month.

Why?

Government officials said part of the 14.5% jump was due to an expensive new Alzheimers disease treatment called Aduhelm.

The Centers for Medicare & Medicaid Services wasnt sure if it would cover Aduhelm when 2022 Part B premiums were announced in November.

While Medicare Part D covers prescription drugs, Part B covers some medications that are administered in a doctors office like Aduhelm, which is delivered intravenously.

The complex infusion treatment is extremely expensive, with an initial price tag of $56,000 a year.

At the time, CMS said it must plan for the possibility of coverage for this high cost Alzheimers drug because it could lead to significantly higher expenditures for the Medicare program.

The new drug is also controversial in the medical community. Aduhelm received special accelerated FDA approval last summer despite widespread concerns from health care professionals over limited testing data and unproven effectiveness.

Does My Part B Plan Cover My Spouse

No even though your monthly Part B premium payment is decided by factoring in both of your incomes, Medicare is an individual health policy only. There are no family plans as there are with regular health insurance. You and your spouse will need to enroll in, and pay for, your Part B policies separately.

Also Check: How To Pick A Medicare Plan

What You Need To Know

Previous changes to the Medicare ID format will be required beginning January 1st, 2020. These requirements will affect physical therapists that submit claims to Medicare Administrative Contractors for services provided to Medicare beneficiaries. In this article, well discuss these requirements and what you need to be aware of.

How To Replace Your Medicare Card

Call 1-800-MEDICARE and follow the automated prompts for reporting and replacing a lost or stolen card. You may also print a temporary copy of your card through your MyMedicare.gov account.

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage.

Christians work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. His articles are read by thousands of older Americans each month. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care.

Christians passion for his role stems from his desire to make a difference in the senior community. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result.

A current resident of Raleigh, Christian is a graduate of Shippensburg University with a bachelors degree in journalism.

Read Also: How To Check My Medicare Coverage

What Does Medicare Part A Cover

Medicare Part A covers the hospital charges and most of the services you receive when you’re in the hospital.

What is covered by Medicare Part A

Hospital stays and inpatient care, including:

Medications for pain and symptom management:

Up to $5 per prescription

Durable medical equipment used at home and respite care:

Home hospice patients may pay a small coinsurance amount for inpatient respite care or durable medical equipment used at home.

*Lifetime reserve days are a set number of covered hospital days you can draw on if youre in the hospital longer than 90 days. You have 60. Each lifetime reserve day may be used only once, but you may apply the days to different benefit periods. Lifetime reserve days may not be used to extend coverage in a skilled nursing facility.

How Do You Apply For A Medicare Card

You apply for your Medicare card when you first enroll in Medicare Part A, Part B or both. There are four different options for manually enrolling in Medicare.

How to Apply for a Medicare Card

- You can apply in person at your local Social Security office.

- Railroad workers can apply by calling the Railroad Retirement Board at 1-877-772-5772 .

Also Check: Do You Have To Pay Medicare Part B

What Medicare Part B Covers

First, lets take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications: medically necessary services and preventive services. What qualifies something as medically necessary? In general, medically necessary services must be medical treatments that are required to treat a recognized medical condition or illness. Necessary services and items might include the following:

- Diagnostic equipment

- Supplies, such as walkers or wheelchairs

- Surgeries

For example, diabetics need regular doctor visits to ensure appropriate blood levels, as well as appropriate diagnostic coverage to ensure accurate readings.

Medicare Part B beneficiaries also gain access to preventive services, like yearly screenings for the flu or certain cancers. In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

As of the 2019 plan year, the Centers for Medicare and Medicaid Services has lifted coverage caps on critical services covered under Medicare Part B. These include physical therapy, speech language pathology and occupational therapy.

But original Medicare doesnt cover everything. You may need to obtain supplemental insurance, such as Medigap, if you need coverage for the following:

Medicare Part C: Medicare Advantage

Also known as Medicare Advantage, Part C is an alternative to traditional Medicare coverage. Coverage normally includes all of Parts A and B, a prescription drug plan , and, depending on your choice of a Medicare Advantage plan, other possible benefits.

Part C is administered by Medicare-approved private insurance companies that collect your Medicare payment from the federal government.

Depending on the plan, you may or may not need to pay an additional premium for Part C. You still need to pay your Medicare Part B premium. You don’t have to enroll in a Medicare Advantage plan, but for many people, these plans can be a better deal than paying separately for Parts A, B, and D. Beneficiaries will still pay separate premiums if they don’t choose to have the Part “C/D” premium taken out of their Social Security check.

If you’ve been pleased by the coverage of a Health Maintenance Organization , you might find similar services using a Medicare Advantage plan.

Don’t Miss: Does Medicare Pay For Mental Health Therapy

Some Services Not Covered By Part B

- Routine vision, routine hearing screening exams, routine chiropractic care, prescription drugs, first 3 pints of blood

- Chiropractic services

- Cosmetic surgery

- Dental care and dentures

- Eye care , eye refractions, and most eyeglasses

- Routine foot care

- Health care while traveling outside the United States, except in limited cases

- Hearing aids and exams for the purpose of fitting a hearing aid

- Hearing tests that haven’t been ordered by a doctor

- Long-term care

- Orthopedic shoes

- Prescription drugs

- Syringes or insulin, unless the insulin is used with an insulin pump

What Is Medicare Part B

Medicare Part B helps cover medical services like doctors’ services, outpatient care, and other medical services that Part A doesn’t cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem.

Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount. Social Security will contact some people who have to pay more depending on their income. If you don’t sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

For more information about enrolling in Medicare, look in your copy of the “Medicare & You” handbook, call Social Security at 1-800-772-1213, or visit your local Social Security office. If you get benefits from the Railroad Retirement Board , call your local RRB office or 1-800-808-0772.Learn More:

Read Also: Is Medicare Part B Necessary

Delaying Your Part B Enrollment

You may be able to delay your Medicare enrollment if youre receiving group health benefits through an employer when you turn 65. If youre still working when your IEP comes around, sticking with your employers plan may be more cost-effective. If so, you can stay on the plan and enroll in Medicare when it ends. When this happens, a Special Enrollment Period will open. This will give you eight months to enroll in Original Medicare without incurring a Medicare late enrollment penalty.

The decision to delay your enrollment is more complicated than whether you can afford your current plan. Once you turn 65, your employers plan and Medicare will decide which side should pay the majority of your medical bills as the primary payer and which should pay the rest. Depending on the size of your company, letting Medicare pay its portion may provide more financial flexibility for all sides.

Employers with 20 or more employees generally take the role of primary payer when covering workers aged 65 and older. If you work for a larger employer like this, it may make the most sense to delay your enrollment until you lose your coverage.

Employers with fewer than 20 employees are generally the secondary payer behind Medicare, which helps relieve some of the cost burdens for smaller companies. If your group plan is the secondary payer, it will start covering what Part B does not. While you can delay your enrollment, it may not make sense if you work for a company with fewer than 20 employees.

Medicare Part B Enrollment And Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed later, you dont have to enroll in Part B, particularly if youre still working when you reach age 65.

However, if you dont qualify for a Special Enrollment Period , then you may incur penalty charges. These penalty charges are indefinite for as long as you keep Medicare Part B. When should you enroll in Medicare Part B? If youre not automatically enrolled because of the aforementioned conditions, then here are your enrollment options:

- You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B.

- If you delay enrollment, then you have to wait until the next general enrollment period begins. For Medicare Part B, you have from January 1 through March 31 to enroll. Coverage doesnt begin until July.

You May Like: Will Medicare Cover Lasik Surgery

How Do You Keep Your Card And Information Safe

If you dont want to carry the card with you when youre not going to the doctor, you should keep it in a safe place at home, such as a locked desk drawer or a fireproof safe.

Be sure to put it back in the same place every time once youre done using it. If you forget where you put it, you may need to get a replacement card.

Before 2018, Medicare cards used a subscribers Social Security number as their ID, which led to problems of identity theft. Now that your Medicare number is no longer your SSN, its less risky to lose the card. Nonetheless, you should still be careful about giving out your Medicare number to anyone other than a doctor, pharmacist, insurer or other healthcare professional. Protect it as you do your credit cards, since con artists are always trying to get Medicare beneficiaries personal information.8

What Else Is On My Medicare Card And Why Is It Important

In addition to your Medicare number, your Medicare card lists other vital information pertaining to your Medicare enrollment status, including your possible enrollment in Medicare Part A, the standard hospital insurance portion of Medicare Medicare Part B, the standard medical insurance portion of Medicare Medicare Part C , which may offer additional coverage tailored specifically to you or Medicare Part D, which includes coverage for any Medicare drug plan you may be enrolled in.

In addition, your Medicare card will state your name and sex. The card also lists your Medicare start date under the various parts of Medicare you may be enrolled in .

Prior to use, you must sign your name to your Medicare card.

Don’t Miss: How Is Medicare Cost Calculated

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment for its services, some people may find it difficult to pay for the monthly costs associated with this portion of Medicare. Those with limited incomes, in particular, may wonder if there are cost assistance programs in place to help mitigate the financial burden.

In fact, there are a few ways that you can reduce your monthly premiums, or at least make your healthcare more affordable using different programs. One such way is to enroll in a Medicare Savings Program. Run by individual states in conjunction with Medicare, Medicare Savings Plans help you pay for medical costs associated with deductibles, coinsurance and copayments, in some cases. There are four Medicare Savings Programs available, but only three of them relate to Medicare Part B. They are:

The Qualified Medicare Beneficiary Program

- The Qualifying Individual Program

- The Specified Low-Income Medicare Beneficiary Program

Each program has its own eligibility requirements. For example, members of the QI Program must apply every year for assistance. Acceptance is based on a first-come, first-served basis, with priority given to past recipients. You also wont qualify for the QI Program if you receive Medicaid benefits. If you think that you qualify for one of these programs or need financial assistance, then you should contact the Medicaid program in your state to find out more information.

Long Term Care Options

Paying for long-term care

Long-term care includes non-medical care for people who have a chronic illness or disability. This includes non-skilled personal care assistance, like help with everyday activities, including dressing, bathing, and using the bathroom. Medicare and most health insurance plans, dont pay for this type of care, sometimes called custodial care. You may be eligible for this type of care through Medicaid, or you can choose to buy private long-term care insurance. Long-term care can be provided at home, in the community, in an assisted living facility, or in a nursing home. Its important to start planning for long-term care now to maintain your independence and to make sure you get the care you may need, in the setting you want, in the future.

Also Check: How To Apply For Medicare In Hawaii