Common Medicare Part D Expenses To Know

While prescription drugs costs under the majority of Medicare Part D plans are low, the amount youll pay will vary by the Part D provider. These are the most common expenses youll need to familiarize yourself with…

Premiums: This is the amount you pay each month to ensure your plan is active.

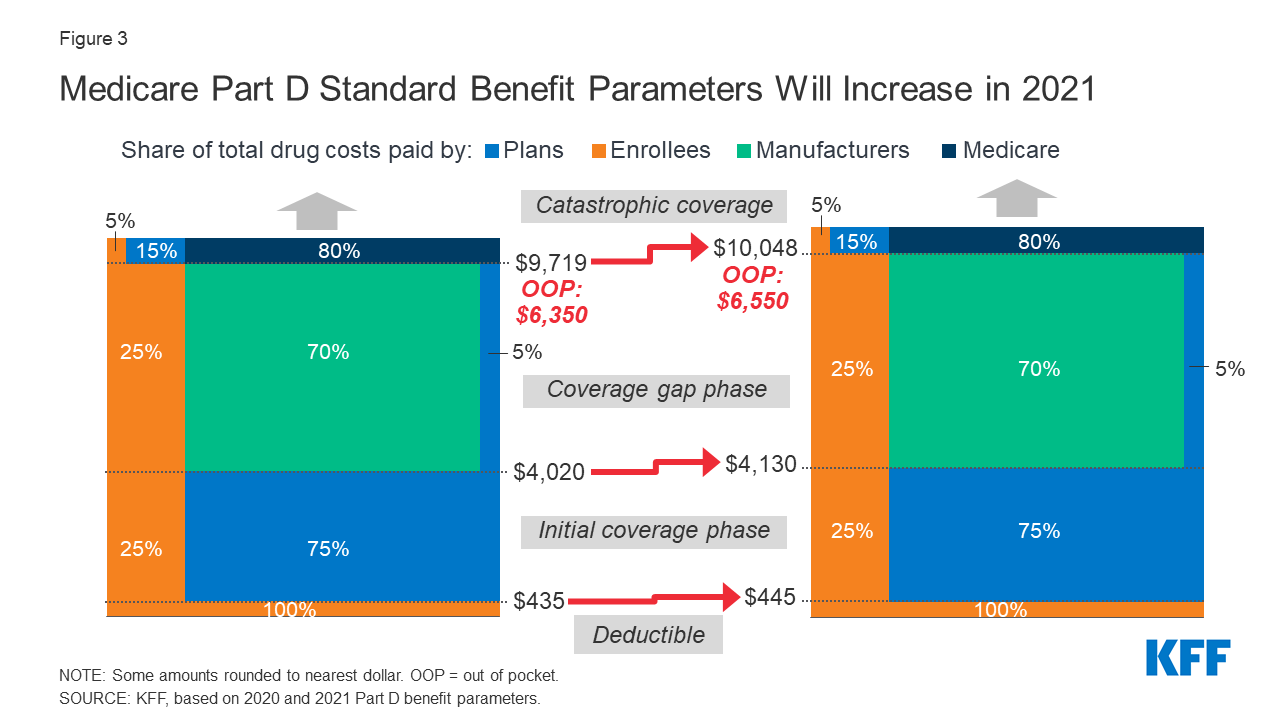

Annual deductible: The amount you pay before coverage begins. This amount is capped at $435 annually, but some Medicare Part D plans offer zero deductibles.

Copayments: This is the set amount youll pay each time you file a prescription.

Coinsurance: The percentage cost you have to cover.

Coverage gap costs: This applies once your Medicare Part D plan covers $4,020 in drugs. Of course, that also means youll have to cover higher out of pocket costs.

Need Help With Medicare Prescription Drug Plan Costs

If you are already enrolled in the Medicare prescription drug program, you may be able to receive extra help from the Social Security Administration . Eligible enrollees can get help paying for monthly premiums, annual deductibles, and copayments related to Medicare Part D. To find out if you qualify for extra help and to apply, please visit the SSA website.

How To Get Medigap Plan D4

Medigap plans are only sold through private insurance companies. The best time to get Medigap Plan D is during your Medigap Open Enrollment Period because you wont have to go through medical underwriting.

- Your Medigap OEP last for six months and begins the month you turn 65 and are enrolled in Part B.

- You can get any plan thats available in your area regardless of your health if you enroll during your OEP.

- If you enroll outside of your OEP, you may be denied a policy because of your health unless you have guaranteed issue rights.

Learn more about buying a Medicare Supplement plan that fits your needs.

Recommended Reading: Is It Too Late To Sign Up For Medicare Advantage

What Drugs Are Covered By Medicare Part D

The prescription drugs covered by Medicare Part D plans will vary based on what each individual insurance carrier covers.

A Medicare Part D plan will generally cover at least two drugs from every drug category. Plans are also required to cover almost every drug from the following classes:

Both generic and brand-name drugs are covered by Medicare Part D, but brand-name medications may cost more for beneficiaries. Drugs are placed into tiers by Medicare Part D plans, and drugs in different tiers will have different costs. Brand-name drugs may be placed into higher tiers that have a higher copay or coinsurance costs.

One thing to know about Medicare Part D is that it doesnt cover over-the-counter medications, prescription vitamins, and certain other medications. Talking with a healthcare provider or physician, and reviewing your plan options annually is the best way to determine if your Medicare Part D plan is the right plan for you based on your individual medical needs. You have the opportunity to switch plans to one that better suits your needs during Fall Open Enrollment. People with Medicare Advantage plans may be able to switch plans during the Medicare Advantage Open Enrollment Period.

Two Ways To Get Medicare Drug Coverage

Drug Plan with Original Medicare

If you choose Original Medicare, you can purchase a stand-alone Medicare Part D prescription drug plan through a private insurance company. For example, UnitedHealth Group, Humana, and CVS Health together insure about 56 percent of Medicare Part D enrollees. In 2021, half of Part D enrollees chose a stand-alone plan.3

Drug Plan with Medicare Advantage

If you enroll in a Medicare Advantage plan, most policies include prescription drug insurance. Half of Part D enrollees chose Medicare Advantage prescription drug plans .4 Aetna, Humana, and Blue Cross Blue Shield are some of the many insurance companies that offer Medicare Advantage plans with prescription drug coverage.

Don’t Miss: How Do I Enroll In Medicare Part A And B

When Can I Enroll In A Medicare Part D Prescription Drug Plan

Medicare prescription drug coverage is an optional benefit available to anyone who has Medicare. If you dont sign up for Part D when youre first eligible, you may have to pay a Part D late enrollment penalty. You may enroll in a Medicare Part D Prescription Drug plan:

- during your Initial Enrollment Period

- if you qualify for a Special Enrollment Period

- during the Medicare Open Enrollment, which runs from January 1 through March 31

- during the Medicare Advantage and Prescription Drug Annual Enrollment Period , held each year from October 15 through December 7

Part D Drug plans may have changes from year to year. Your plans benefits, formulary, pharmacy network, provider network, premium and/or co-payments/co-insurance may change on January 1st of each year. Therefore, its a good idea to talk to a licensed sales rep during the Medicare AEP timeframe each fall to understand any changes to your current plan and identify if you should switch to a different plan for the coming year.

Our licensed sales agents are equipped to help you determine what Medicare plans are available in your area and want to help you receive all the available benefits you deserve. The Medicare Helpline is ready to talk with you about Medicare Part D Plans just call or complete the online form today!

Cigna: Best Medicare Part D Plan Overall

Reasons to avoid

Cigna-HealthSpring is a well-priced and reliable option, making it our top pick in this best Medicare Part D plans. It has a decent selection of options that span a range of requirements for coverage, a large preferred pharmacy network and reasonable premiums.

The Healthy Rewards Program offers a selection of discounts, including at some 9,000 fitness centers nationwide, vision, hearing and nutrition programs plus there are discounts for acupuncture, massage and chiropractic services.

Plans don’t offer a $0 co-pay after deductible, like a lot of the competition does for Tier 1 drugs. But the advantage here is a whopping 63,000 preferred network pharmacies nationally. Also the access to over 3,000 medications including most of the common medications for people on Medicare, make this very appealing.

Excellent premiums, deductibles and co-pay options mean there is something for everyone.

You May Like: Does Cigna Have A Medicare Supplement Plan

How Do I Choose A Part D Plan

Perhaps the most important consideration when choosing a Part D plan is whether that plan covers the specific prescriptions you take. You can input the drugs you take and compare plan options using Medicares comparison tool. Otherwise, consider your priorities. Do you want:

- Protection from high drug costs?

- Coverage in case you need prescription drugs ?

- A low premium?

Select multiple plans to compare the star rating, premium, and deductible between plans. And click on Plan Details to see that plans costs by drug tier.

Can I Combine A Pdp Plan With Other Medicare Coverage

Yes, you can combine Medicare coverage parts with a Part D plan. A stand-alone PDP can work with Original Medicare and certain types of Medicare Advantage plans such as Medicare Medical Savings Account plans without drug coverage or Private Fee-for-Service plans.

You can have a stand-alone prescription drug plan with certain types of Medicare Advantage plans so long as the plan:

- Cant offer coverage for prescription drugs

- Chooses not to offer coverage for prescription drugs

If after the first time you enroll you decide to change your PDP, you can do so each year during the Medicare Annual Enrollment Period, which begins October 15 and ends December 7.

Part D prescription drug coverage is important to ensuring you can get all the medications you need to live your healthiest life.

Read Also: What Is Medicare For All

What Does Medicare Part D Cover

Under Medicare Part D, prescription drug plans are available from private, Medicare-approved insurance companies, so benefits and cost-sharing structures differ from plan to plan. However, the Center for Medicare and Medicaid Services sets minimum coverage guidelines for all Part D plans. These rules require all plans to cover medications to treat most illnesses and diseases.

Each Medicare prescription drug plan uses a formulary, which is a list of medications covered by the plan and your costs for each. Most plans use a tiered copayment system. Prescription drugs in the lowest tiers, usually generic medications, have lower copayments. Brand-name and specialty medications in the higher tiers cost more out-of-pocket.

Medicare Part D only covers prescription drugs that are FDA approved. Experimental medications are generally not covered.

The Medicare Part D Donut Hole Coverage Gap

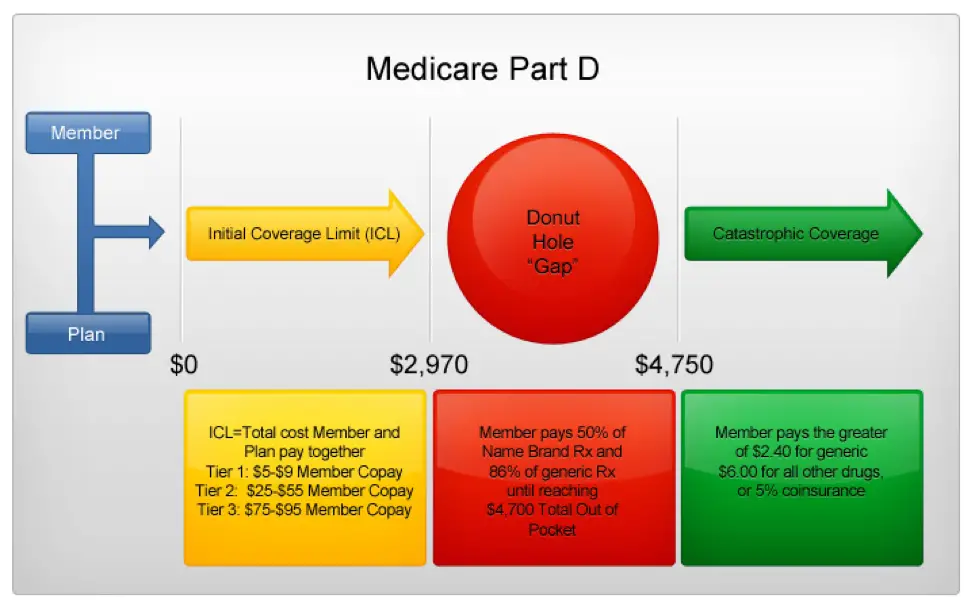

After 2020, Medicare Part D plans have a shrunken coverage gap, or donut hole, which represents a temporary limit on what the plan will cover for prescription drugs.

You enter the Part D donut hole once you and your plan have spent a combined $4,430 on covered drugs in 2022.

Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $7,050 for the year in 2022.

Once you reach $7,050 in out-of-pocket spending, you are out of the donut hole and enter catastrophic coverage, where you typically only pay a small copayment or coinsurance payment for the rest of the year.

Don’t Miss: Is Insulin Pump Covered By Medicare

Who Decides Which Drugs Will Be Covered On A Formulary

All Part D plans must meet formulary requirements set by Medicare. The formulary will include both generic and brand name drugs. Each plan must use a Pharmacy and Therapeutics Committee, which includes doctors and pharmacists, to establish its formulary. This process assures you that you’ll have access to a number of drugs, although not necessarily all drugs.

What Is The Coverage Gap Or Donut Hole

Medicare Prescription Drug Plans have a coverage gap, also known as the donut hole. Once you have received a certain level of benefits from your plan, you enter a coverage reduction period, where you will face higher out-of-pocket costs until you qualify for catastrophic coverage.

To better understand the donut hole, consider this example of how your Prescription Drug Plan coverage changes as your drug spending increases.

Phase 1: Meeting your deductible

Many Prescription Drug Plans have a deductible. In most cases only for brand name drugs.

Until you hit your deductible, youll be paying for 100% of the costs of your drugs. The maximum PDP deductible in 2019 is $415, but yours could be lower.

Phase 2: Initial coverage

Once you meet your deductible, you are only responsible for copayments until your total drug costs reach $3,820 for 2019. Total drug costs include what you pay out-of-pocket and the amount your PDP covers.

Phase 3: Coverage gap

During this period of reduced coverage, youre responsible for a significant portion of your drug expenses. Youre stuck in the donut hole until your total out-of-pocket drug costs for the year reach $5,100 .

While youre in the coverage gap, you qualify for discounts, which are funded by drug companies and the federal government. In 2019, youll pay no more than 25% of the cost of covered brand-name drugs, and no more than 37% of the cost of generics.

Phase 4: Catastrophic Coverage

The expenses that dont count include:

Recommended Reading: Do Any Medicare Supplement Plans Cover Dental

Medicare Supplement Plan D And Medicare Part D Differences

Although both Medicare Plan D and Medicare Part D are used to help fill coverage gaps in Original Medicare , these types of coverage serve different functions.

Heres a look at the differences between Medicare Supplement Plan D and Medicare Part D.

| Medicare Supplement Plan D | Medicare Part D |

|---|---|

|

|

Note: You can have Original Medicare, a standalone Part D plan, and Medicare Supplement Plan D all at the same time. But you cant enroll in Medicare Advantage and a Medicare Supplement plan at the same time.

Medicare Part D Plan Eligibility And Enrollment

You can enroll in a Medicare Part D prescription drug plan if youre enrolled in Medicare Part A and/or Part B, or a Medicare Advantage Private Fee-for-Service Plan that doesnt offer prescription drug coverage. You must be enrolled in Medicare Part A and B to join a Medicare Advantage Plan.

It pays to enroll in prescription drug coverage during your initial enrollment period, even if you dont take prescription medications. If you dont enroll during this period and have no creditable drug coverage, youll have a 1% penalty for each month you dont enroll, which will be added to your Part D monthly premium.

Part D enrollment is available during specific enrollment periods:

| Medicare Part D Enrollment Periods | |

| Enrollment period | |

| Enroll in a new plan, disenroll, or make a one-time switch from one plan to another. | |

| Medicare Advantage Open Enrollment | Switch to a different Medicare Advantage Plan with or without drug coverage. Go back to Original Medicare and enroll in a Part D plan. |

There are multiple ways to enroll in Medicare Part D prescription drug plans:

- Enroll on the Medicare Plan Finder or on the plans website.

- Complete a paper enrollment form.

When you join a Medicare drug plan, youll give your Medicare Number and the date your Part A and/or Part B coverage started. This information is on your Medicare card.

Recommended Reading: Is Any Dental Work Covered By Medicare

Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.com’s The Best States for Medicare report.

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Medicare has neither reviewed nor endorsed this information.

How To Decide If You Need Part D

If you need prescription drug coverage, selecting a Part D plan when you become eligible is often a good ideaespecially if you dont currently have what Medicare considers creditable prescription drug coverage.

Prescription drug coverage that pays at least as much as Medicares standard prescription drug coverage is usually considered creditable, and could be an existing plan you have through an employer or union.

If you dont elect Part D coverage during your initial enrollment periodand youdont have creditable prescription drug coverage, youll probably pay a late enrollment penalty if you decide you want it later. The late enrollment penalty permanently increases your Part D premium.

However, if you do have creditable coverage and keep it, you can generally enroll in Part D later without paying a penalty.

Recommended Reading: Does Medicare Pay For Mental Health Therapy

When Is Medicare Part D Enrollment

There are three different enrollment periods for Medicare Part D, as follows:

Initial enrollment period: This covers a total of seven months – three months before you turn 65, your birthday month itself, and then the three months directly after your 65th birthday. So seven months in total.

Annual Medicare Open Enrollment: October 15 through December 7

Medicare Special Enrollment: Under select circumstances, you can enroll in a Medicare Part D plan at any time.

What Does A Pdp Cover

Plans will vary by location and provider in terms of costs and specific drugs covered. Each plan will have a list of specific drugs it covers, known as a formulary, but all PDPs are required by law to cover certain common types of drugs.

Medicare Part D plans are required to cover the Shingles vaccine, but they may also cover other vaccines such as Tdap, for the flu and pneumonia. What vaccines are covered outside of Shingles will depend on your plan. You can learn more about Medicare and vaccine coverage from the Center for Medicaid and Medicare Services and by talking directly with the plans provider.

Also Check: Does Medicare Cover Eylea Injections

Mutual Of Omaha Medicare Part D Plans

There are two Mutual of Omaha Part D plans. They are the MOO Rx Value PDP and the MOO Rx Plus PDP.

The Value policy has no deductible on the first two tiers at preferred pharmacies. But, the Value plan has a $480 deductible on all other tiers.

The Plus Plan has a deductible of $480 that applies to all tiers. However, the Plus plan has a broader range of drugs that have coverage.

Mutual of Omaha Network Pharmacies

The Value plan allows you to get your tier 1 generics for $0 through mail order or a preferred pharmacy.

Further, this carrier includes an extensive pharmacy network like CVS, Walmart, and various local shops.

Mutual of Omaha Part D Reviews

Mutual of Omaha has been in the Supplement industry since Medicare began. Those looking for a reliable company could find benefits here.

While theyre new to the Part D sector, we dont doubt the quality of coverage. The top-rated insurance carrier helps many people each day, by incorporating Part D into their business plan, theyre able to assist even more.