Should I Enroll In Another Plan Or Take Additional Prescription Coverage

In most circumstances, the coverage provided by Medicare and whatever supplemental or secondary plan you select will provide sufficient coverage to meet your needs. Typically, the benefits payable with a third medical plan are not sufficient to justify the premiums paid. The savings realized by not paying premiums for the third coverage will usually cover any deductible and co-insurance you may owe for Medicare Part A and B and your supplemental or secondary plan.

Medicare Part D Prescription Drug Coverage Eligibility

Like Medicare Advantage and Medicare Supplement, Part D prescription drug coverage is provided by Medicare-approved private insurance companies. These plans accompany Original Medicare. Generally, you cant have a standalone Part D plan if you have a Medicare Advantage plan.

To qualify for a Part D plan, you must meet the following requirements:

- You must have both Part A and B .

- You must live where plans are available.

- You must pay Part A, Part B, and Part D premiums, if applicable.

A Late Enrollment Penalties

If you cant receive premium-free Part A, youll have to pay a late enrollment penalty if you dont buy Part A when youre first eligible. In this case, your monthly premium can go up by 10 percent.

Youll be subject to this higher premium for double the amount of years that you were eligible but didnt enroll. For example, if you enroll 1 year after you were eligible, youll pay the higher monthly premium for 2 years.

You May Like: Which Is Better Original Medicare Or Medicare Advantage Plan

What Are The Income Limits For Medicare 2021

Medicare insurance coverage plans and costs almost change every year. Although the medicare plans are available to all people of age 65 years or above, a persons income can also affect how much you have to pay for a certain Medicare coverage plan.

As mentioned above, how much you have to pay for a certain medicare plan depends on how much you earn or in other words it depends on your income. If you have a higher income, you will have to pay more for the medicare premium plans but the medicare coverage or benefits will be the same. In contrast to this, if you have a low income you might get the assistance to pay your premiums .

Given below is a brief summary of income limits for each medicare coverage plan or in other words the required costs for buying the medicare premium plans:

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Recommended Reading: How Old Before Eligible For Medicare

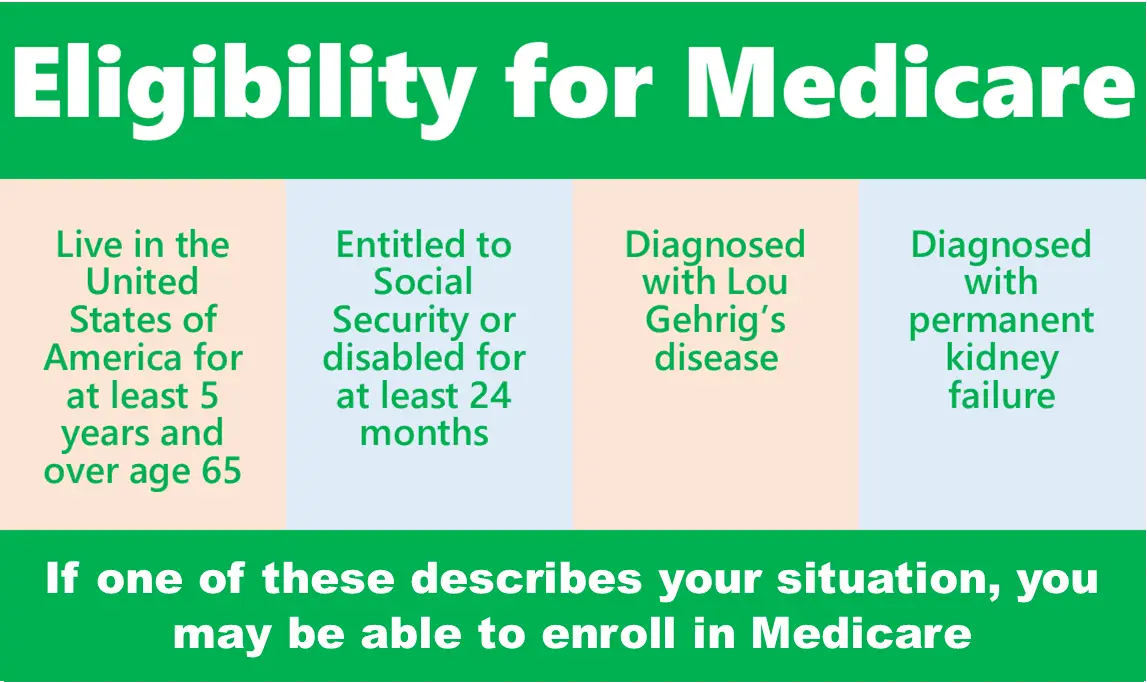

You Have Lou Gehrigs Disease

If you have amyotrophic lateral sclerosis , youll be eligible for Medicare and automatically enrolled in Medicare Part A and Part B on the first day of the month that you start receiving disability benefits. Unlike other disabilities, you dont have to wait 24 months to be eligible for Medicare benefits.

Who’s Eligible For Medigap

If youre enrolled in both Medicare Part A and Part B, and dont have Medicare Advantage or Medicaid benefits, then youre eligible to apply for a Medigap policy. These plans are standardized, and are designed to cover some or all of the out-of-pocket costs that are incurred when you have a Medicare-covered claim .

You have a federal right to buy a Medigap plan during the six months beginning when youre at least 65 years old and have enrolled in Part B. This is known as your Medigap open enrollment period. After this time runs out, you will have only limited chances to purchase one down the road.

Some states allow people of any age or health status to purchase Medigap coverage at any time without medical underwriting, but most dont. In many states, Medigap plans may not be available for people who have Medicare before age 65. There are 33 states that require Medigap plans to be guaranteed issue in at least some circumstances when an applicant is under age 65, but the rules vary from one state to another you can click on a state on this map to see details about state-based Medigap rules.

If youre enrolling in Medicare due to your age, the primary factor that will affect your ability to purchase a Medigap policy regardless of your health will be whether you enroll during your Medigap Open Enrollment Period.

Don’t Miss: Is Wellcare The Same As Medicare

What Are The Income And Resource Limits For Extra Help In 2021

In 2021, the annual income limit for Extra Help for an individual is $19,140. For a married couple who is living together, the limit is $25,860. When your income is calculated, governmental assistance such as food stamps, housing assistance, and home energy assistance arent counted.

Even if your income is higher than the limits, you should still apply for Extra Help if you think you qualify. Some scenarios where youd still be eligible for Extra Help even though your income is over the limit include if you and/or your spouse:

- Provide financial support for other family members currently living with you

- Earn money by working

- Reside in Alaska or Hawaii

Resource limits also apply when determining your eligibility for Extra Help. Your resources must be equal to or below $14,610 as an individual or $29,160 as a married couple who are living together.

The following examples count as resources:

- Real estate

- Money in bank accounts

- Interest on money slated for use as burial expenses

Contact Social Security for a comprehensive list of excluded resources.

Medicare Part A Eligibility

Medicare Part A is considered hospital insurance. It covers inpatient stays at:

- hospitals

- home healthcare

- religious nonmedical healthcare institutions

But who exactly is eligible for Part A? Continue reading as we delve deeper into this part of Medicare and how to know if youre eligible for coverage.

To meet the basic eligibility requirements, you must be a citizen or permanent resident of the United States and also be one of the following:

- age 65 or older

- diagnosed with end stage renal disease or amyotrophic lateral sclerosis

To receive coverage under Part A, you must be admitted as an inpatient at the hospital or other treatment center. If youre not formally admitted as an inpatient, the services received will be considered outpatient care, which is covered under Part B.

Because of this, its always important to ask your doctor or caregiver if youre an inpatient or an outpatient during your stay. Your inpatient or outpatient status can affect how long your stay will be covered and how much you may pay in deductibles and coinsurance costs.

Typically, many people who enroll in Part A are age 65 and older. However, some specific groups of people younger than 65 years old may also be eligible for Part A. These groups include people with:

- a disability

Also Check: How To Qualify For Oxygen With Medicare

Medicare Part B Premiums

For Part B coverage, youll pay a premium each year. Most people will pay the standard premium amount. In 2022, the standard premium is $170.10. However, if you make more than the preset income limits, youll pay more for your premium.

The added premium amount is known as an income-related monthly adjustment amount . The Social Security Administration determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago.

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income.

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. Youll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Healthmarkets Can Answer Your Medicare Eligibility Questions

If you are eligible for Medicare and are ready to shop for a plan, HealthMarkets can help. We make it easy to compare plans, get free Medicare quotes, and enroll. Answer a few short questions and to see what kind of Medicare plan might work best for your lifestyle, and which plans make the best fit. Get started now.

46253-HM-0920

Recommended Reading: Does Medicare Pay For Bunion Surgery

Important Information Regarding If You Enroll In Other Medical Coverage At A Future Date:

Once you enroll in another medical plan with Part D prescription coverage, Employee Benefits will receive notification from the plan administrator. After confirmation is received of your enrollment in another Part D prescription plan, Employee Benefits will automatically dis-enroll you from the medical plan you have with the City of Oklahoma City.

General Fund Revenue As A Share Of Total Medicare Spending

This measure, established under the Medicare Modernization Act , examines Medicare spending in the context of the federal budget. Each year, MMA requires the Medicare trustees to make a determination about whether general fund revenue is projected to exceed 45 percent of total program spending within a seven-year period. If the Medicare trustees make this determination in two consecutive years, a “funding warning” is issued. In response, the president must submit cost-saving legislation to Congress, which must consider this legislation on an expedited basis. This threshold was reached and a warning issued every year between 2006 and 2013 but it has not been reached since that time and is not expected to be reached in the 20162022 “window”. This is a reflection of the reduced spending growth mandated by the ACA according to the Trustees.

You May Like: Does Medicare Have Life Insurance

Who Is Eligible For Medicare Part D

To enroll in Medicare Part D, you must be eligible for Medicare. Medicare Part D includes prescription drug coverage. You are eligible for Medicare if you meet one of the following qualifications:

-

You are age 65 or older

-

You have a qualifying disability for which you have received Social Security Disability Insurance for more than 24 months

-

You have been diagnosed with end-stage renal disease

-

You are entitled to Medicare Part A and/or enrolled in Medicare Part B

-

You are eligible for social security benefits

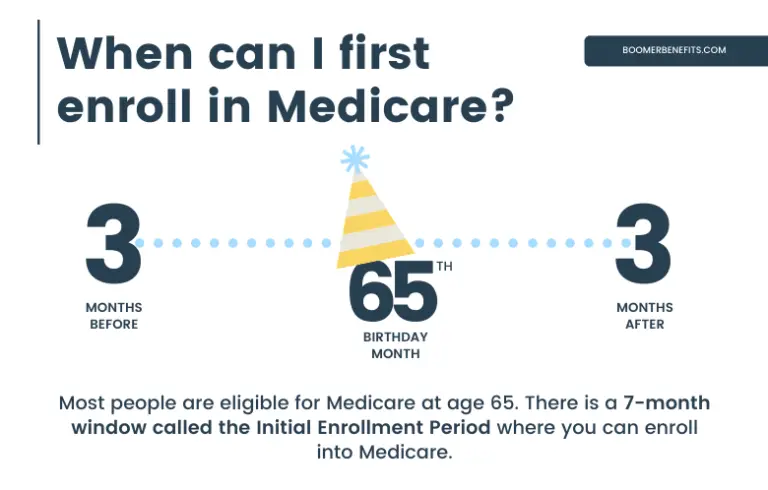

The Initial Enrollment Period is a seven-month time frame that begins three months before the month you turn 65 and ends three months afterward. During this period you can enroll into Medicare Part D. If you miss the Initial Enrollment Period then you can sign up during the General Enrollment Period, which runs every year from January 1 to March 31.Once you are eligible, the first step to enrolling is to review the private plan offers available in your location. You can call 1-800-MEDICARE or visit the Medicare’s Plan Finder tool on medicare.gov to compare plans and enroll. Call the plan you wish to enroll in and a representative can help you.

Danetha Doe is an entrepreneur, journalist, and economist from the San Francisco Bay Area who specializes in writing about finance.

I’m On Disability When Will I Be Eligible For Medicare

You may be eligible for Medicare before age 65 if you have a qualifying disability. Eligibility usually starts after you’ve received disability benefits for 24 months. You will be automatically enrolled in Medicare Parts A and B. You may make other coverage choices during your IEP. Your 7-month IEP includes the month you receive your 25th disability check plus the 3 months before and the 3 months after.

You May Like: Does Medicare Pay For Ensure

Important Information Regarding The Medicare Advantage Plan:

All participants in the Medicare Advantage Plan must be enrolled in Medicare Parts A & B. If you are enrolled in Medicare Parts A & B but your spouse is not, you may only enroll in this plan by removing your spouse from City medical coverage. If your spouse is enrolled in Medicare Parts A and B but you are not, you may not enroll in the MAPD Plan.

The MAPD plan incorporates Medicare Part D prescription drug coverage. You will be disenrolled from the MAPD plan if you enroll in another Part D plan.

What If You Still Work

You can work and receive Medicare disability benefits for a transition period under Social Security’s work incentives and Ticket to Work programs.

There are three timeframes to understand. The first, the trial work period, is a nine-month period during which you can test your ability to work and still receive full benefits. The nine months don’t have to be consecutive. The trial period continues until you have worked for nine months within a 60-month period.

Once those nine months are used up, you move into the next time framethe extended period of eligibility. For the next 36 months, you can still receive benefits in any month you aren’t earning “substantial gainful activity.”

Finally, you can still receive free Medicare Part A benefits and pay the premium for Part B for at least 93 months after the nine-month trial periodif you still qualify as disabled. If you want to continue receiving Part B benefits, you have to request them in writing.

If you’re disabled, you may incur extra expenses that those without disabilities do not. Expenses such as paid transportation to work, mental health counseling, prescription drugs, and other qualified expenses might be deducted from your monthly income before the determination of benefits, which mayallow you to earn more and still qualify for benefits.

Also Check: How To Sign Up For Medicare And Tricare For Life

Effective Date Of Coverage

Once an individual is determined eligible for Medicaid, coverage is effective either on the date of application or the first day of the month of application. Benefits also may be covered retroactively for up to three months prior to the month of application, if the individual would have been eligible during that period had he or she applied. Coverage generally stops at the end of the month in which a person no longer meets the requirements for eligibility.

Medicare Part B Premiums 2021

| File individual tax return | File married & separate tax return | Monthly Total |

| $88,000 and less than $412,000 | $475,20 |

Source: Medicare.gov

Some senior rights organizations like the Senior Citizens League worry that with inflation hitting record highs, many social security recipients could see almost all of their 2022 COLA increase go towards the increased premium. A recent statement released by the organization noted that “an estimated 39 million Medicare beneficiaries spend up to 29 percent of their Social Security benefits on healthcare costs.” The average beneficiary in 2021 received a social security payment of $1,543 each month, which means that around $447 are spent on their healthcare needs, leaving a little $1,000 to cover other costs.

Don’t Miss: Does Medicare Cover Long Term Health Care

Who Is Eligible For Medicare Part C

The first step is to enroll in Medicare Part A and Part B . If you are 65 and have paid the Medicare tax for the last 10 years through your payroll taxes, then you are automatically enrolled into the Original Medicare through your federal retirement benefits.

If you are 65 and not enrolled into your federal retirement benefits, you will need to enroll into original Medicare through your local Social Security office, calling 1-800-772-1213 or by filling out a form online.

Once you are enrolled, then you can shop for your preferred Medicare Advantage plan, also known as Medicare Part C, through the Medicare website. Depending on the advantage plan you choose, you may need to reside within a specific service area.

Keep in mind there are designated enrollment periods. If you are a new Medicare recipient, you have seven months to enroll beginning three months prior to your 65th birthday. This is known as your Initial Enrollment Period.

After your Initial Enrollment Period, you have two other options.

-

Option one: The Open Enrollment Period, October 15 through December 7 every year

-

Option two: The Special Enrollment Period, which occurs after a relocation such as moving to another state or the loss of health coverage

How To Get Medicare Part A And Part B Coverage

- If you receive SSDI for 24 months, you will automatically be enrolled in Medicare Parts A and B at the beginning of the 25th month.

- If you have ALS, you will automatically be enrolled in Medicare Parts A and B as soon as you receive the first month of SSDI benefits.

- If you have ESRD, you must apply for Medicare benefits. Medicare eligibility depends on a variety of factors, including whether or not you are receiving dialysis, have had a kidney transplant, and/or have paid Medicare taxes sufficiently.

You May Like: How Do I Cancel Medicare Part A