Medicare Supplement Insurance Plan Enrollment And Eligibility

To be eligible to enroll in a Medicare Supplement insurance plan, you must be enrolled in both Medicare Part A and Part B. A good time to enroll in a plan is generally during the Medigap Open Enrollment Period, which begins on the first day of the month that you are both age 65 or older and enrolled in Part B, and lasts for six months. During this period, you have a guaranteed-issue right to join any Medicare Supplement insurance plan available where you live. You may not be denied basic benefits based on any pre-existing conditions** during this enrollment period . If you miss this enrollment period and attempt to enroll in the future, you may be denied basic benefits or charged a higher premium based on your medical history. In some states, you may be able to enroll in a Medigap plan before the age of 65.

Best For Bonuses: Aarp

AARP Medicare Advantage plans include extra benefits, from dental, vision, and hearing, to over-the-counter benefits and fitness programs. AARP offers lots of additional support to help members stay healthy or manage health conditions.

-

Plenty of added bonuses, like annual ear/eye exams and $0 copay dental work

-

Low copays and prescription drug copays

-

Automatic deduction from Social Security benefits available

-

No mobile app for payments

-

Higher out-of-pocket maximums

Nearly all of the Medicare Advantage plans offered by AARP come with plenty of extras, such as dental exams, vision and eyewear coverage, and foot coverage. There is also Renew Active, a Medicare fitness program with a gym membership, and an online brain health program.

AARP offers low copays for specialist visits, like oncologists or cardiologists, provided theyâre in-network, and a variety of Medicare Advantage plans . It also has an incredible amount of detailed educational information about Medicare and Medicare Advantage plans on its website, including the option to receive a free Medicare guide via email. However, the out-of-pocket maximums can be a bit on the high side, usually several thousand dollars.

Dont Miss: Does Medicare Cover Outside Usa

Does Plan F Cover Dental

Original Medicare doesnt cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you want dental coverage, you need to purchase a separate dental insurance plan. Also, many Medicare Advantage plans, which private insurance companies offer, provide dental coverage, so thats another option.

You May Like: Where To Get Medicare Information

What Is Medigap Plan K What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.

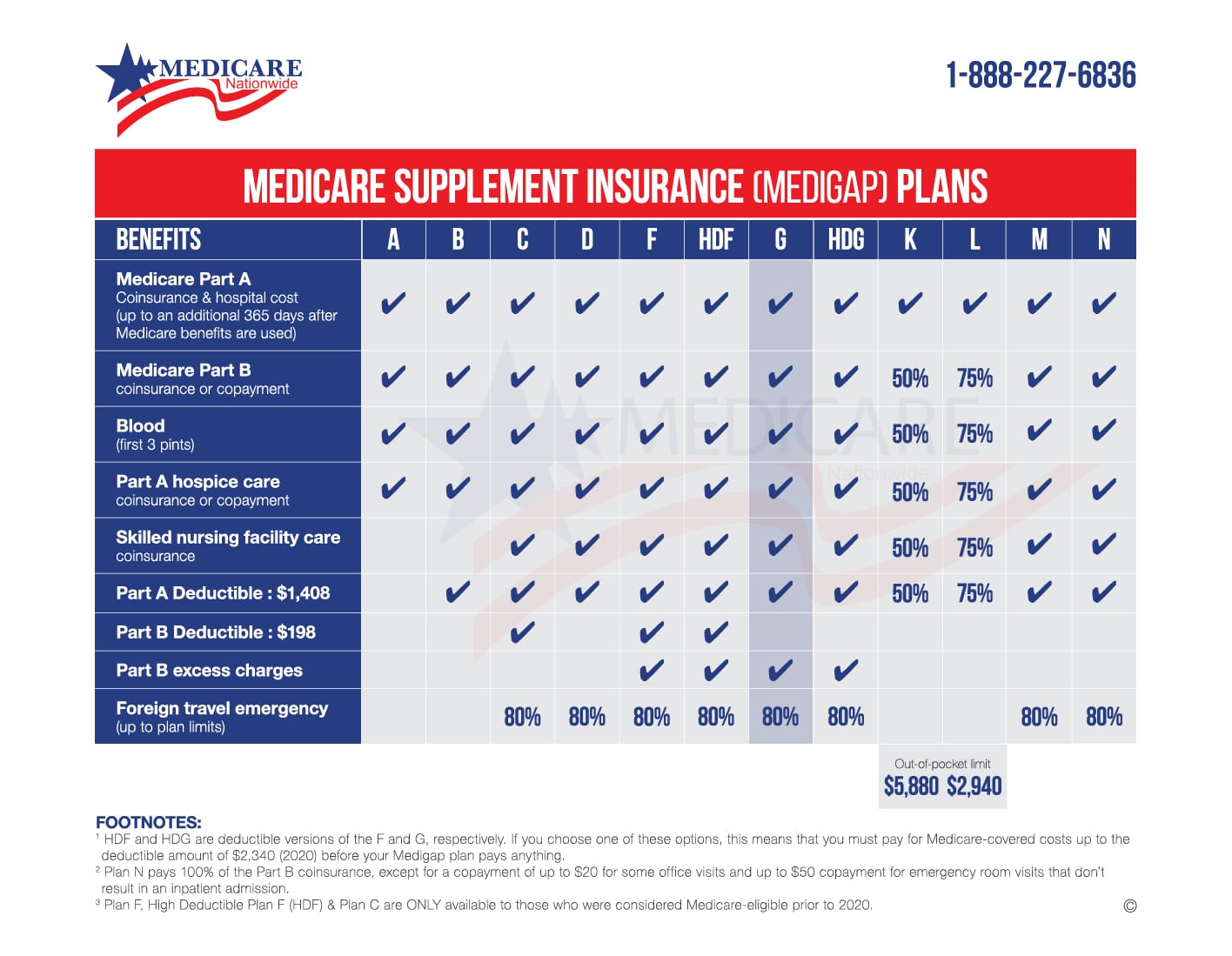

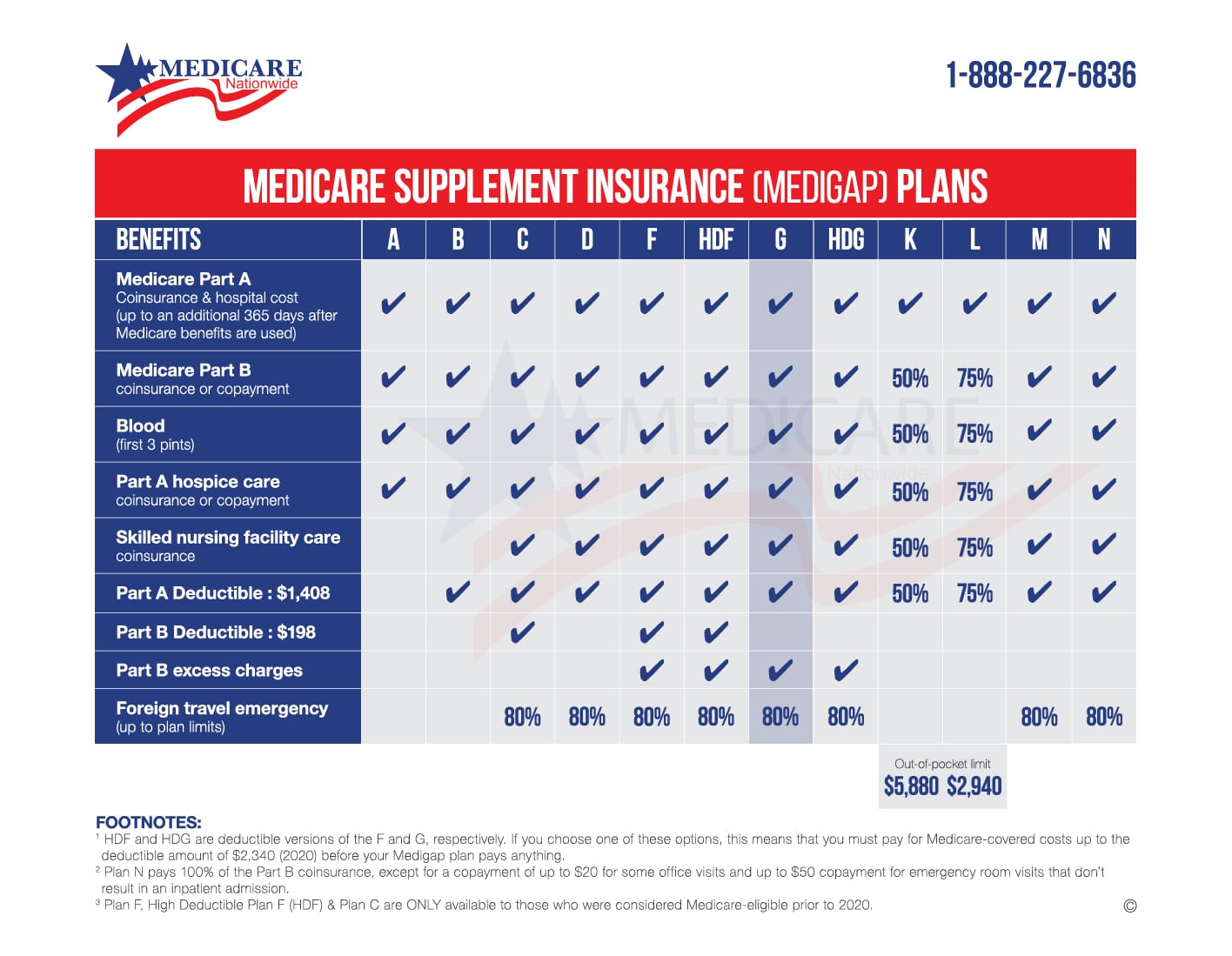

Medigap Plan K is a Medicare Supplement Insurance plan that covers certain out-of-pocket expenses associated with Medicare Part A and Part B coverage. Plan K differs from most other Medigap plan options because it pays only part of the cost of the services it covers, but that reduced coverage also helps keep premium costs down.

When Do You Enroll In Medigap

This Medigap Open Enrollment Period is a one-time enrollment opportunity after you are 65 or older and first enroll in Medicare Part B. If you determine that a Medicare Supplement plan is not right for you now and decide to apply later, you could be turned down for coverage. You would go through a process called underwriting to determine if you are acceptable to the insurance company.

Generally, though, you will want to purchase a Medicare Supplement plan during the one-time Medigap Open Enrollment Period to take advantage of the guaranteed issue. You wont have to worry later on about qualifying for coverage.

Your Medicare Supplement plan is also guaranteed renewable which means the insurance company cannot drop your coverage as long as you pay your premium on time. This is a great comfort to have knowledge that youre covered if the worst happens.

Recommended Reading: What Does Humana Medicare Advantage Cover

What Does Medicare Supplement Plan A Cover

Medicare Supplement Plan A is not the same as Medicare Part A, but is one of the Medicare Supplemental insurance plans available to Medicare beneficiaries. It is a basic plan that covers:

- Medicare Part A coinsurance payments up to an additional 365 days after Original Medicare benefits are exhausted

- Medicare Part B copayment or coinsurance expenses

- The first three pints of blood used in a medical procedure

- Part A hospice care coinsurance expense or copayment

Medicare Supplement Plan A has the fewest individual benefits of the ten standardized Medicare Supplement insurance plans available in most states.

Among the Medicare out-of-pocket costs not covered is the Part A deductible for inpatient hospital stays.

In 2021, the Medicare Part A deductible is $1,484. Medicare Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and certain home health-care services. If you expect to use many of these services and want to avoid the deductible, you may want to consider a Medicare Supplement plan that covers the Part A deductible. Out of the 10 standardized Medigap plans, Medicare Supplement Plans B, C*, D, F^, G, and N fully cover the Medicare Part A deductible. Medicare Supplement Plans K, L, and M also provide partial coverage for the deductible.

If a health insurance company wishes to offer Medigap coverage, then it must at least offer the basic Medigap Plan A and its benefits.

Medicare Supplement Insurance Plan Benefits

There are 10 Medigap insurance plans available in most states, and each plan type is designed by a different letter . Coverage is standardized across each plan letter, which means youll get the same basic benefits for Medicare Supplement coverage within the same letter category, no matter which insurance company you purchase from. However, even if basic benefits are the same across plans of the same letter category, premium costs may vary by insurance company and location. If you live in Massachusetts, Minnesota, or Wisconsin, keep in mind that these three states standardize their Medigap plans differently from the rest of the country.

Medigap plans cover out-of-pocket costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles. Some plans may help pay for other benefits Original Medicare doesnt cover, such as emergency health coverage outside of the country or the first three pints of blood. Medigap plans dont include prescription drug benefits. If you dont already have creditable prescription drug coverage , you should consider buying a separate stand-alone Medicare Part D Prescription Drug Plan to cover the costs of your prescription medications. Also, Medicare Supplement insurance plans generally dont offer extra benefits like routine dental, vision, or hearing coverage beyond whats already covered by Medicare.

Also Check: Does Medicare Pay For Penile Pumps

Does Medicare Supplement Insurance Cover Prescription Drugs

Medicare Supplement insurance plans sold today donât include prescription drug coverage. But you can sign up for a stand-alone Medicare Part D prescription drug plan to get that benefit.

So, your coverage could consist of:

- Medicare Part A, hospital coverage

- Medicare Part B, medical coverage

- Medicare Supplement insurance

- Prescription drug coverage under Medicare Part D

Medicare Supplement Plan Cost

Even though Medicare supplement plans are standard in terms of the benefits they offer, they can vary in price based on the insurance company that sells them.

Its kind of like shopping at a sale: Sometimes, the plan you want costs less at one store and more at another, but its the same product.

Insurance companies usually price Medigap policies in one of three ways:

- Community rated. Most people pay the same, regardless of age or sex. This means if a persons insurance premium goes up, the decision to increase it is related more to the economy than a persons health.

- Issue-age rated. This premium is related to a persons age when they bought it. As a general rule, younger people pay less and older people pay more. A persons premium may increase as they get older due to inflation, but not because theyre getting older.

- Attained-age rated. This premium is lower for younger people and goes up as a person gets older. It may be the least expensive as a person first buys it, but it can become the most expensive as they age.

Sometimes, insurance companies will offer discounts for certain considerations. This includes discounts for people who dont smoke, women , and if a person pays in advance on a yearly basis.

Don’t Miss: Does Medicare Cover Lung Cancer Treatment

What Are Medigap Plans

Medigap plans are Medicare Supplement Insurance offered by Medicare-approved private insurance companies to help cover cost sharing requirements of Original Medicare Parts A and B.

While Medicare pays for a large percentage of the health care services and supplies you may need, you are still responsible for a portion of the costs in the form of deductibles, copays, and coinsurance. Medigap policies help with these costs and sometimes offer more coverage for excess charges and foreign travel health emergencies.

Medigap plans are standardized by Medicare and regulated by state laws and insurance commissioners. You pay a monthly premium for Medigap. Costs and availability of Medigap plans vary depending on several factors including your age and gender, the insurer, and your state of residence. Learn about Medigap in New Hampshire so you can determine which plan best meets your needs.

- In 2019, there were nearly 100,000 Medicare Supplement enrollees in New Hampshire.

- Plans F and N are the most popular Medigap plan types in New Hampshire. Plan F is no longer available to people who are eligible for Medicare after December 31, 2019.

- Monthly premiums for Plan G for a 65 year old female who doesnt use tobacco range from $113 to $302.

- New Hampshire requires Medigap insurers to offer plans to disabled Medicare beneficiaries under age 65, however monthly premiums are generally higher.

What Do Medicare Supplement Plans Cost

The costs of Medicare Supplement plans vary by state and by insurance company. The main factors that determine cost are your location and age. Keep in mind that a policy that looks less expensive at age 65 could become the most costly at age 85, so ask the insurance company how they set their premium pricing.

Policy prices are determined in three ways:

- Community-rated: The same monthly premium is charged to everyone who has the Medigap policy, regardless of age.

- Issue age-rated: The premium is based on your age at the time of the Medigap policy purchase. The younger your age, the lower the premium. The premium costs for this type of rating wont go up due to your age, but may increase because of inflation or other factors.

- Attained age-rated: The premium is based on your current age and will increase as you get older. Though premiums in this form of rating may start at the lowest price, they have the potential to reach the highest price eventually and can also be impacted by inflation and other factors.

Not all companies offer all Medigap plans. Rates may vary depending on the company, and some plans may be provided with a high-deductible option.

Also Check: Can I Have Medicare Part B Without Part A

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best. While prices vary by person and location, here are three top insurance providers to consider as you start your search for the best plan for you. Each of them offers coverage nationwide and holds an A.M. Best rating of A- or higher.

Your Health Care Needs

- Do you take prescription drugs?

- Do you wear eyeglasses or hearing aids?

- Do you visit the dentist regularly?

If so, you might consider the benefits of enrolling in a Medicare Advantage plan.

- Do you have a health condition that requires frequent trips to the doctor or the use of medical equipment in your home?

- Do you expect to undergo surgery or other major procedures in your near future?

- Do you frequently travel outside of the U.S.?

If so, certain types of Medicare Advantage plans might be a good choice for you.

Don’t Miss: Is Mutual Of Omaha A Good Company For Medicare Supplement

What Is A Medicare Supplement Plan

A Medicare Supplement plan is a supplemental insurance plan sold by a private company. This kind of insurance helps cover the costs that Original Medicare doesnt, like deductibles, copayments, or coinsurance.

Want to learn more about Medigap vs Medicare Advantage? Check out the last video in our Medicare Prepared series.

Best Medicare Supplement Companies

Unlike with traditional health insurance, where policies differ among providers, Medicare Supplement plans are standardized so that the benefits for each plan letter are the same for each company. This means that Medicare Supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna.

However, rates will change from company to company since each provider will choose a different pricing structure for its Medicare Supplement plans. It’s important that you take this into account along with each providerâs financial strength and history of rate increases. Some companies may offer cheap rates but will increase your rates more quickly as you age.

- Medigap plans offered: A, F, G, N and high-deductible F

- Average cost of Plan G: $179

Cigna, like UHC and Aetna, currently has an AM Best rating of A, meaning that it has the financial strength to continue to pay health insurance claims in the future. Cigna plans are widely available, and Cigna stands out for its high-deductible Plan F, which is an affordable way to protect yourself if you need expensive medical care. Cigna’s Medicare Supplement plans are generally priced higher than plans from some other companies, but using the company’s household premium discount can help you to get a better deal. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

Recommended Reading: How To Get Medicare For Free

Medicare Advantage Vs Medicare Supplement Insurance Plans

Are you trying to decide between Medicare Advantage vs. Medicare Supplement insurance? Heres a rundown of the two types of coverage.

While Original Medicare covers many health-care expenses, it doesnt cover everything. Even with covered health-cares services, beneficiaries are still responsible for a number of copayments and deductibles, which can easily add up. In addition, Medicare Part A and Part B also dont cover certain benefits, such as routine vision and dental, prescription drugs, or overseas emergency health coverage. If all you have is Original Medicare, youll need to pay for these costs out-of-pocket.

As a result, many people with Medicare enroll in two types of plans to cover these gaps in coverage. There are two options commonly used to replace or supplement Original Medicare. One option, called Medicare Advantage plans, are an alternative way to get Original Medicare. The other option, Medicare Supplement insurance plans work alongside your Original Medicare coverage. These plans have significant differences when it comes to costs, benefits, and how they work. Its important to understand these differences as you review your Medicare coverage options.

Types Of Medigap Plans In New Hampshire

Every standardized type of Medigap plan is offered in New Hampshire, but Plans F and G offer the most comprehensive coverage and are the most popular. Plans F and G also come in a high-deductible version. Here are some highlights and differences among some of the plans:

| Plan F |

| N/A | N/A |

* Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs up to the deductible amount of $2,490 in 2022 before your policy pays anything.

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that dont result in inpatient admission.

Recommended Reading: How To Sign Up For Medicare Part D

The Cost Of Medicare Supplement Plans In Mississippi

The cost of Medicare Supplemental Insurance varies by the plan and the insurance company you choose. Aetna is the cheapest Medigap insurance company in Mississippi for Plans A, B, G and N. However, Blue Cross Blue Shield of Mississippi is the cheapest for Plans C and D, Cigna for Plan F and UnitedHealthcare for Plans K and L.

When it comes to insurance quotes, insurance companies typically assess them in one of three ways:

- Attained-Age: This is the most often used pricing method in the state. Your current age will decide your premium, and it will rise as you become older using this process.

- Issue-Age: The cost of your insurance is determined by your age when you first became eligible for Medicare. Using this method, your premiums will not increase as you age.

- Community-Rated: As per this method, except for Plan D and Plan M, all policyholders in a specific plan type pay the same monthly price.

Average Cost of Medicare Supplement in Mississippi

Sort by Plan Letter:

How To Apply For A Medicare Supplement Plan

The best time to apply for a Medicare Supplement plan is during your six-month open enrollment period. Open enrollment begins during the first month youre 65 and enrolled in Medicare Part B. After this one-time open enrollment, you may not be able to purchase a Medigap plan or you might pay a lot more.

If you or your spouse already have group health care coverage and arent ready to enroll in Part B, you can apply for Part B without penalty during a Special Enrollment Period after your Initial Enrollment Period has ended. Call the Centers for Medicare & Medicaid Services for details if you think you may be eligible.

There are a few steps involved when applying for a Medicare supplement plan.

to see which one meet your needs. Consider your current and future health statusand keep in mind your familys health history, as it may be difficult to switch plans later.

Research which insurance companies in your state sell Medicare Supplement plans and which ones offer the plan you want. Visit Medicare.gov to search by ZIP code to find companies in your area.

Contact that insurance company to request a quote and purchase your Medicare Supplement plan.An agent can assist the process, or a client can deal directly with the carrier. You can typically complete an application via phone, online or on paper, says Corujo.

You May Like: What Does Medicare Part E Cover