Qualified Disabled And Working Individual Program

To be eligible for QDWI coverage, a person must:

be under 65 years of age

be entitled to benefits under Medicare Part A

not otherwise be eligible for Medicaid

have a monthly income equal to or less than 200% of the federal poverty level and

have no more than twice the countable resources allowed under the Supplemental Security Income program, as described in §1611 of the Social Security Act .

A person’s QDWI eligibility begins in accordance with the coverage period described in §1818A of the Social Security Act ).

How To Get Help Paying Your Medicare Premiums And Other Costs

When you first sign up for Medicare, be prepared for some sticker shock. Because youve been paying Medicare taxes all through your working life, you may have assumed that once you retire, all your health care costs will be covered.

It can come as a rude awakening to learn that all those taxes you paid only cover one part of your Medicare costs Medicare Part A, or hospital insurance. You must continue to pay premiums for Medicare Part B and Part D , as well as other expenses like deductibles, copayments, and coinsurance.

All these expenses can add up to quite a sizable sum. According to a 2020 AARP analysis, people using traditional Medicare spent an average of $5,801 on health care costs in 2017. For about 1 in 10 people, total costs extended to five figures.

For many senior citizens, especially those on fixed incomes, this amount of money is a serious financial burden. According to AARP, half of all people on traditional Medicare in 2017 spent at least 16% of their income on health care. For 1 in 10 beneficiaries, health care costs ate up more than half their income.

Fortunately, there are several federal and state programs to help Medicare recipients with these unmanageable costs. If youve crunched the numbers and found that the total out-of-pocket cost for Medicare looks like more than you can afford, its worth looking into whether one of these programs can help you.

Applying For Supplementary Benefits

MSP enrolment must be complete for you to qualify for supplementary benefits. To complete MSP enrolment, submit the MSP Application for Enrolment form and obtain a Photo BC Services Card by visiting an Insurance Corporation of BC driver licensing office. You can book an appointment to visit an ICBC driver licensing office at a location and time that suits you. For more information, please visit icbc.com/appointment.

In addition, to be eligible for supplementary benefits, you must:

- be a resident of British Columbia as defined by the Medicare Protection Act

- have resided in Canada as a Canadian citizen or holder of permanent resident status for at least the last 12 months immediately preceding this application and

- not be exempt from liability to pay income tax by reason of any other act

Eligibility for supplementary benefits is based on your net income from last year as confirmed by the Canada Revenue Agency , less deductions for:

- Your age

- Family size

- Disability and

- Any income from the Universal Child Care Benefit and Registered Disability Savings Plan

The amount left is called “adjusted net income.” If it is less than $42,000, your family may qualify for supplementary benefits.

You only need to apply once if you:

- Remain eligible for MSP coverage and

- File your taxes every year

You May Like: Is Bevespi Covered By Medicare

Applying For Extra Help

Extra Help enrollment is simple. If you are enrolled in Medicare and also receive Medicaid, SSI, or help with Part B premiums from an MSP, youll automatically receive Extra Help benefits.

Otherwise, you can apply for Extra Help through the SSA. You can apply online, at your local Social Security office, or by calling Social Security at 1-800-772-1213 .

After you apply, Social Security will review your application and send you a letter to let you know if you qualify. If you do, you can select a Medicare Part D plan or let the Centers for Medicare and Medicaid Services choose one for you.

The sooner you choose a plan, the sooner you can start receiving benefits.

If you dont qualify for Extra Help, you can reapply to the program at any time if your income and resources change. In the meantime, you can look for other state programs that could help you with your Medicare prescription drug costs.

Contact your state Medicaid office or SHIP for information.

Medicare Savings Program: Prescription Drug Coverage

While MSPs will help pay for Part A and/or Part B premiums, it does not pay for any costs related to prescription drugs.

However, the good news is that if you are over 65 and qualify for any of the three MSP programs available to you QMB, SLMB, or QI you automatically qualify for Extra Help, also known as the Low-Income Subsidy program. Medicare Extra Help is a federal program that pays for your Medicare Part D premiums, deductibles, and copayments.

Also Check: Does Social Security Disability Qualify You For Medicare

Who Qualifies For Medicare Extra Help

You will automatically qualify for Medicare Extra Help if you have Medicare and also meetany of these conditions:

-

You have full Medicaid coverage.

-

You use a Medicare Savings Program to help pay your Part B premiums.

-

You get Supplemental Security Income benefits.

To learn more about whether or not you qualify for Medicaid, check our state-by-state guide to Medicaid.

If you are a part of any Medicare Savings Programs, or MSPs, to help pay for your Medicare Part A and B costs, you will automatically receive Medicare Extra Help.

If you donât qualify for Extra Help based on the criteria above, you may still qualify if you are at least 65 years old, live in the U.S., have Medicare Part A and Part B, and your annual income is within the annual income and total asset limits.

Income and asset limits are based on the federal poverty guidelines . The poverty guidelines change each year, so make sure to check again around February or March.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

Also Check: Does Medicare Pay For Licensed Professional Counselors

What Is Included In The Medicare Savings Programs Assets Definition

When determining your eligibility for MSP, the following resources are counted:

- Bank accounts

- Money received for housing assistance

- Furniture

- Household and personal items

The eligibility rules vary from state to state. Some do not even apply resource limits. However, just like income limits, the resource limits change yearly, so its essential to stay up to date on whether you still qualify.

Don’t Miss: Does Medicare Cover Annual Gyn Exam

% California Working Disabled

California offers qualifying residents the 250% California Working Disabled program. To qualify, you must be working, disabled and have income too high to qualify for free Medi-Cal. If eligible, you may be able to receive Medi-Cal coverage by paying a small monthly premium, ranging from $20-$250 per month for an individual or from $30-$375 for a couple.

How to Qualify

To qualify for CWD, you must:

- Meet the medical requirements of Social Securitys definition of disability

- Be working and earning income

- Have assets worth less than $2,000 for an individual or $3,000 for a couple

- Have countable income less than 250% of the federal poverty level . These income calculations are different from those for the Medicare Savings Programs . Disability income does not count toward the 250% CWD programs income limit, including:

Specified Low Medicare Beneficiary

The SLMB program provides payment of Medicare Part B premiums only for individuals who would be eligible for the QMB program except for excess income. Income for this program must be more than 100% of the FPL, but not exceed 120% or 135% of the FPL. There is a standard $20 deduction from income, before it is compared to the Federal Poverty Level. Refer to the Adult Standards chart for the current QMB income standards.

Also Check: What Is Medicare Plan G Supplement

Help Paying For Medicare

Medicare is not free there are premiums and deductibles. If you dont qualify for Medicaid and cant afford a Medigap policy, you may be able to get help paying for the costs of Medicare.

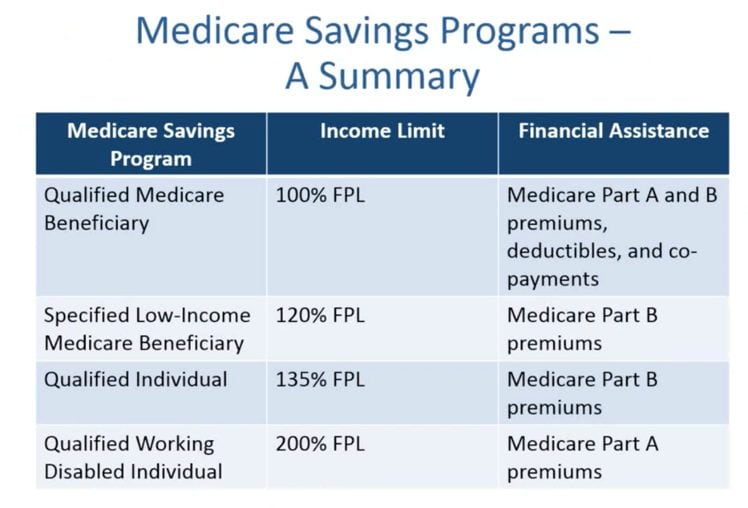

There are four Medicare assistance programs, called Medicare Savings Plans:

- Qualified Medicare Beneficiary : The QMB program pays for Medicare Part A deductibles, Medicare Part B premiums and deductibles, and coinsurance and deductibles for Part A and Part B.

- Specified Low-income Medicare Beneficiary : The SLMB program pays for Medicare Part B Premium.

- Qualifying Individual Program: The QI-1 program is an expansion of the SLMB program that you must apply for each year. It pays for Medicares Part B Premium.

- Qualified Disabled and Working Individuals Program: The QDWI Program helps pay for Medicares Part A premium.

To qualify for these programs, you must be eligible for Medicare Part A and have limited income and resources. The income and resource requirements can vary from state to state, so check with your state before applying. In general the following limits are applied.

City, State

In 2021, personal assets, including cash, bank accounts, stocks and bonds must not exceed $7,970 for an individual and $11,960 for married couples . Your house and car do not count as personal assets. Some states allow additional resources above these figures for example, New York has no resource limits for the QI-1 Program.

Related Articles

Recommended Reading: What Is Medicare Part A B C And D

Is There Help For Me If I Cant Afford Medicares Premiums

Medicare Savings Programs can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets.

Reviewed by our health policy panel.

Q: Is there help for me if I cant afford Medicares premiums?

A: Yes. Medicare Savings Programs can help with premiums and out-of-pocket costs.

Also Check: Does Medicare Cover Orthotic Shoe Inserts

Don’t Miss: How To Qualify For Medicare Part B

Qualified Medicare Beneficiary Program

Home / FAQs / General Medicare / Qualified Medicare Beneficiary Program

If youre a Medicare beneficiary, you know that health care costs can quickly add up. These costs are especially noticeable when youre on a fixed income. If your monthly income and total assets are under the limit, you might be eligible for a Qualified Medicare Beneficiary program, or QMB. Below, well explain all you need to know about what the QMB program pays for, whos eligible, and how to sign up.

Changes To Your Eligibility

Based on your income tax information from the CRA, your eligibility for supplementary benefits may change. For example, if your net income for the previous year was higher than usual , it could affect your eligibility for supplementary benefits for a period of time.

If your tax return has been reassessed and you think this might change your eligibility, send a copy of the Notice of Reassessment for you to Health Insurance BC. If you dont think the information about your Notice of Assessment or Notice of Reassessment from CRA is correct, contact Health Insurance BC.

Read Also: What Is The Cost Of Medicare Part C For 2020

Other Things To Know About The Qmb Program:

Medicare providers arent allowed to bill you for services and items Medicare covers, including deductibles, coinsurance, and copayments, except outpatient drugs. Pharmacists may charge you up to a limited amount for prescription drugs covered by Medicare Part D.

- If you get a bill for Medicare charges: Tell your provider or the debt collector that youre in the QMB Program and cant be charged for Medicare deductibles, coinsurance, and copayments.

- If you already made payments on a bill for services and items Medicare covers: You have the right to a refund.

- If you have a Medicare Advantage Plan: Contact the plan to ask them to stop the charges.

In some cases, you may be billed a small copayment through Medicaid, if one applies.

Make sure your provider knows you’re in the QMB program

The SLMB Program is a state program that helps pay Part B premiums for people who have Part A and limited income and resources.

Who Qualifies For Medicare Savings Programs

The Qualified Medicare Beneficiary program provides the most benefits. It helps in paying for Medicare Part A premiums, as well as your Medicare Part B premiums and out-of-pocket costs .

The QMB program requires your income to be 100% of the Federal Poverty Line or lower. Specifically, your income and resource are below the following limits:

- If you are single:

- The monthly income limit is $1,094 for most states

- The asset limit is $7,970

The monthly income threshold is slightly higher in states like Alaska and Hawaii.

You May Like: What Is The Yearly Deductible For Medicare

Billing Requirements For The Qualified Medicare Beneficiary Program

Providers cant bill QMB members for their deductibles, coinsurance, and copayments because the state Medicaid programs cover these costs. There are instances in which states may limit the amount they pay health care providers for Medicare cost-sharing. Even if a state limits the amount theyll pay a provider, QMB members still dont have to pay Medicare providers for their health care costs and its against the law for a provider to ask them to pay.

How Do I Screen Qualified Medicare Beneficiary Medical

To screen an S03 Assistance Unit , take the following steps:

- Applicant Name field – Enter the .

- Residential Address section – Enter the .

- ACES attempts to verify both the Residential and Mailing Addresses, in real time, through a United States Postal Services software program called Finalist when the street address, city, state, and zip code are entered.

- In the Programs section, click the checkbox next to Medical.

- In the Program Determination Criteria section, click the checkbox next to Medicare Part A Eligible.

- Click the Next button.

You May Like: How Much Does Ss Deduct For Medicare

How Do I Determine Eligibility For A Married Couple When One Or Both Clients Receive Supplemental Security Income

When a Qualified Medicare Beneficiary Assistance Unit contains a married couple who are both entitled to Medicare with income type SSI Benefits entered on the Unearned Income page, both are S03 eligible.

When an S03 AU contains a married couple who are both entitled to Medicare however, only one is receiving SSI Benefits income and the other is receiving SSA Retirement/Disability income:

- Clients with SSI income are approved for S03.

- Clients with Social Security Administration income are approved for S03 when their income and resources are below the S03 standard .

- Clients with SSA income who have income or resources exceeding the S03 standard are closed or denied for the appropriate Reason Code 301 – Exceeds Income Standard or 401 – Over Resources.

Note:Non-Member

- If the head of household has income or resources exceeding the S03 standard, but the AU contains another member who is S03 eligible, the HOHs Financial Responsibility code flips to Non-Member with the appropriate reason code.

See ACES Screens and Online Pages for an example of pages or screens used in this chapter.

Medicare Cost Savings Programs

The Qualified Medicare Beneficiary and Specified Low Income Medicare Beneficiary programs are commonly referred to as Medicare Cost Savings Programs. The purpose of these programs is to assist individuals by paying:

- Medicare premiums and by making payments to medical providers for coinsurance and deductibles for Medicare services or

- Medicare Part B premiums only.

To qualify for the QMB/SLMB program, applicants must meet three general eligibility requirements:

Additionally, QMB/SLMB applicants must also meet the MHABD general eligibility requirements of:

- Social Security number

Recommended Reading: How To Opt Back Into Medicare

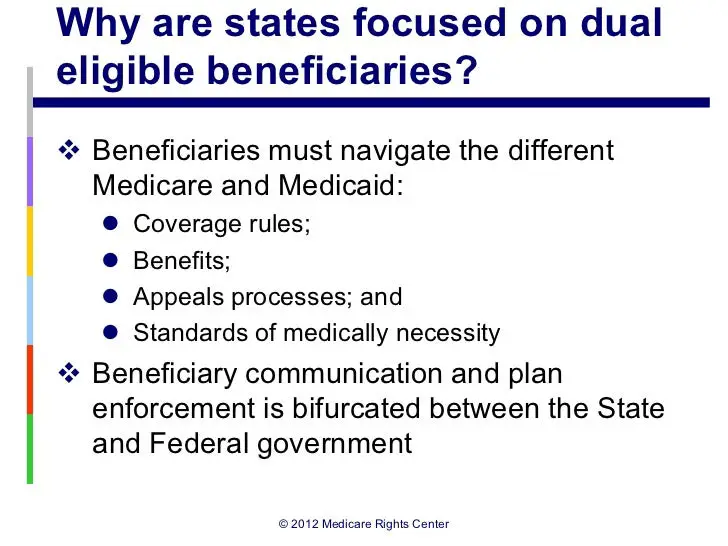

How Do I Apply For Medicare Savings Programs

Eligibility for MSPs is determined by your state Medicaid office, as the funding for MSPs comes from the Medicaid program. Medicaid is jointly run by the federal and state governments. If you think you might be eligible, you can apply for an MSP at your Medicaid or social services office .

Medicare urges beneficiaries to apply for MSP benefits if theres any chance they might be eligible, even if they initially think that their income or resources are too high to qualify. This is particularly important given that states can have more lenient eligibility rules than the federal guidelines. So depending on the state, a person might end up being eligible for an MSP even if they assumed they wouldnt after looking at the federal eligibility rules.

This page explains what documentation is needed for the MSP application process, and what to expect when youre applying for benefits.

Its important to understand that you have to reapply and re-qualify for your MSP benefits each year. You may get a renewal notice in the mail from your state Medicaid office explaining what you need to do. If not, youll need to reach out to your state Medicaid office to see what needs to be done to qualify for ongoing MSP benefits in the coming year.

You can also contact your State Health Insurance Assistance Program with questions related to MSPs.