Discontinued Medigap Plans Through The Years

Home / FAQs / Medigap Plans / Discontinued Medigap Plans Through the Years

Through the years, Medicare has discontinued several Medigap plans. Some of these plans have been notoriously popular among enrollees. One of the primary things to know about Medigap plans is that the different plan options vary by letters. The letter plans are A through N. Over the years, several letter plans are no longer available.

Get Medicare Part A In Ohio Kentucky & Indiana

If you live in Ohio, Kentucky, or Indiana, our advisors in Medicare are available to help you with your health coverage. We offer guidance on your unique situation and can help you enroll in the right plan at the right time. To get started, call us at 1-866-600-5638 or to schedule a call.

If you are a client of RetireMEDiQ and have questions about the costs or covered services with your plan, you can call your client advisor team at 1-877-222-1942.

What Medicare Part B Covers In 2022

- Fact-Checked

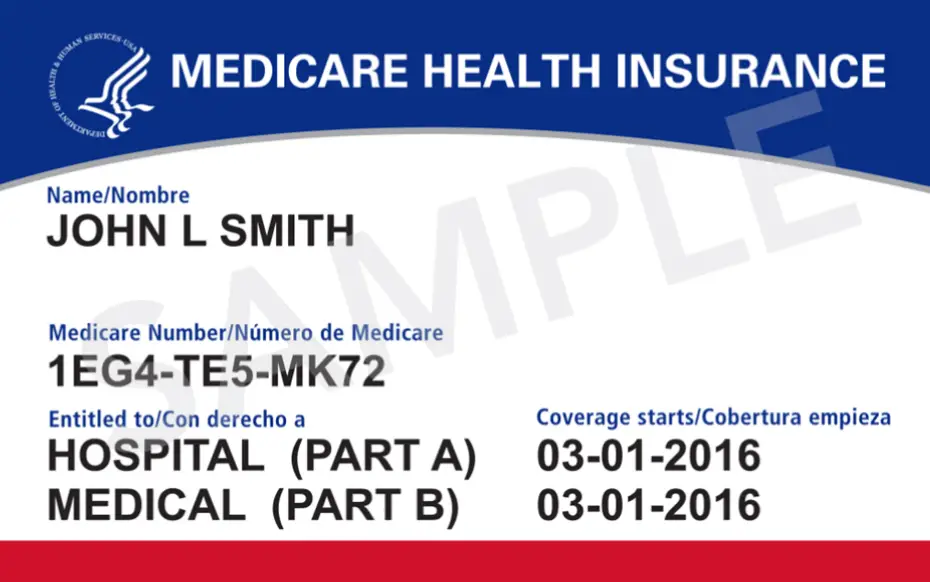

Original Medicare is the federal health insurance program for seniors . Medicare Part A is the hospital insurance portion, covering inpatient services , while:

Medicare Part B is the medical insurance portion of Original Medicare, and covers outpatient services .

In this certified mumbo-jumbo-free guide, well cover four questions:

You May Like: Do Walk In Clinics Take Medicare

Is There Another Medicare Supplement Plan That May Be Comparable

If you became eligible for Medicare in 2020 or later, although you may not be able to buy Medicare Supplement Plan F or Plan C, you may be able to buy a very similar plan.

Medicare Supplement Plan G generally has the same basic benefits as Plan F, except for the Part B deductible. Theres also a high-deductible version of Plan G So, you might want to look into Plan G. If you live in Massachusetts, Minnesota, or Wisconsin, contact your state health insurance assistance program to learn about Medicare Supplement plan details in those states. Go to and select your state.

If youd like to compare Medicare Supplement plans, just click the Browse Plans button on this page to get started.

The product and service descriptions, if any, provided on these eHealth web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

What Is Medicare Supplement Insurance

Medicare Supplement insurance is sold by private companies. Sometimes called “Medigap,” it can help you pay for out-of-pocket health care expenses that Medicare doesn’t cover, such as deductibles, coinsurance, copayments, or outpatient services.

Medicare Supplement insurance policies through Bankers Life are not available in MA and are underwritten by Colonial Penn Life Insurance Company. Medicare Supplement insurance policies in NY are underwritten by Bankers Conseco Life Insurance Company.

You May Like: Does Medicare Have Open Enrollment

About Medicare Supplement Plans

Medigap plans are standardized by the federal government. This means that plans of the same letter offer the same benefits, no matter who you buy it from. But keep in mind that insurance companies are allowed to offer additional benefits, so compare plans carefully before you purchase a policy. You are eligible to purchase a Medicare supplement insurance plan if you are 65 years old or older and enrolled in Medicare Part B. If you are under 65 and disabled, you will likely be limited as to which Medigap plan you can purchase.

There are 10 Medigap plan options in total. But we are going to focus on Medicare Supplement Plan N.

Common Services That Medicare Does And Doesnt Cover

Heres general info about what Medicare does or doesnt cover for common health care needs. Visit medicare.gov/coverage for more detail. Also, check a Medicare health plans Summary of Benefits to learn whats covered.

Medicare has some coverage for acupuncture and it is limited to treatment of chronic low back pain. Some Medicare Advantage plans have benefits that help pay for acupuncture services beyond Medicare such as treatment of chronic pain in other parts of the body, headaches and nausea.

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesnt cover costs to live in an assisted living facility or a nursing home.

Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

The federal Medicaid program can help pay costs for nursing homes or services to help with daily living activities.

Medicare Part B covers outpatient surgery to correct cataracts. It also pays for corrective lenses if an intraocular lens was implanted. Coverage is one pair of standard frame eyeglasses or contact lenses as needed after the surgery.

Medicare Part B covers a chiropractors manual alignment of the spine when one or more bones are out of position. Medicare doesnt cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Recommended Reading: Does Medicare Pay For Stem Cell Knee Replacement

What Does Medicare Supplement Plan N Cover

Medigap Plan N has coverage for four basic areas:

Additionally, Medicare Supplement Plan N pays for skilled nursing facility care and the Medicare Part A deductible for hospitalization.

Mippa Reduction Of Standardized Plans

Beginning on June 1, 2010, Plans E, H, I, and J became no longer available. This came as a result of the Medicare Improvements for Patients and Providers Act of 2008 . The Act reduces the number of available plans. The federal government standardizes all Medigap plans.

Plans H, I, and J are no longer available due to the addition of a prescription drug benefit, Part D, to Medicare after a 2003 act became a law. They went away because they duplicated existing letter plans but added a drug benefit. The drug benefit became unnecessary with the availability of Part D.

Plan E was essentially the same as Plan D but with preventive care. This plan is no longer available per MIPPA, as MIPPA also got rid of preventive care as a benefit available through Medigap plans.

An additional result of MIPPA was the introduction of Plan M and Plan N. Plan N remains one of the most popular Medigap plans today.

Also Check: Does Medicare Cover Plantar Fasciitis

How Much Does Medicare Part F Cost

Medicare premiums, deductibles and out-of-pocket costs are established each year by the government. Since Medicare Part F is the is the most comprehensive Medigap policy, the premium can be costly. Typically, these range from $120 to $140 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, and age and gender. For this reason, it is vital to compare rates for the same Medicare policies across different health insurance companies.

What Options Do I Have

Given that the original Medicare coverage – Parts A and B – does cover your food whilst at hospital but not in terms of meal delivery services, if you want this to be included you will need to opt for the Medicare Advantage plan in order to benefit.

By purchasing Medicare Advantage – Medicare Part C – you will get this through a private insurance company and then be able to benefit from additional coverage beyond what is offered in the original, so you could get more help when it comes to your vision, dental and hearing needs.

Depending on which Medicare Advantage plan you select, you could get meal delivery as one of your benefits. However, it’s important to note that this is not included in every plan. If you are specifically looking for this option, make sure if it is included in the plan before you select it.

Also Check: Will Medicare Pay For Liposuction

Does Medicare Supplement Plan E Cover Prescriptions

Medigap Plan E does not cover prescription drugs. Medigap plans can only help cover certain out-of-pocket Medicare costs, such as deductibles and copayments.

If you want to get Medicare prescription drug coverage, you have two options:

- You can enroll in a Medicare Advantage Prescription Drug plan . These plans cover all of the same hospital and medical insurance benefits that are covered by Original Medicare, as well as prescription drug costs. Many plans also offer benefits such as routine hearing, vision and dental

- You can enroll in a standalone Medicare Part D Prescription Drug plan .

Please note that Medigap plans and Medicare Advantage plans are very different things. You cannot have a Medicare Supplement Insurance plan and a Medicare Advantage plan at the same time.

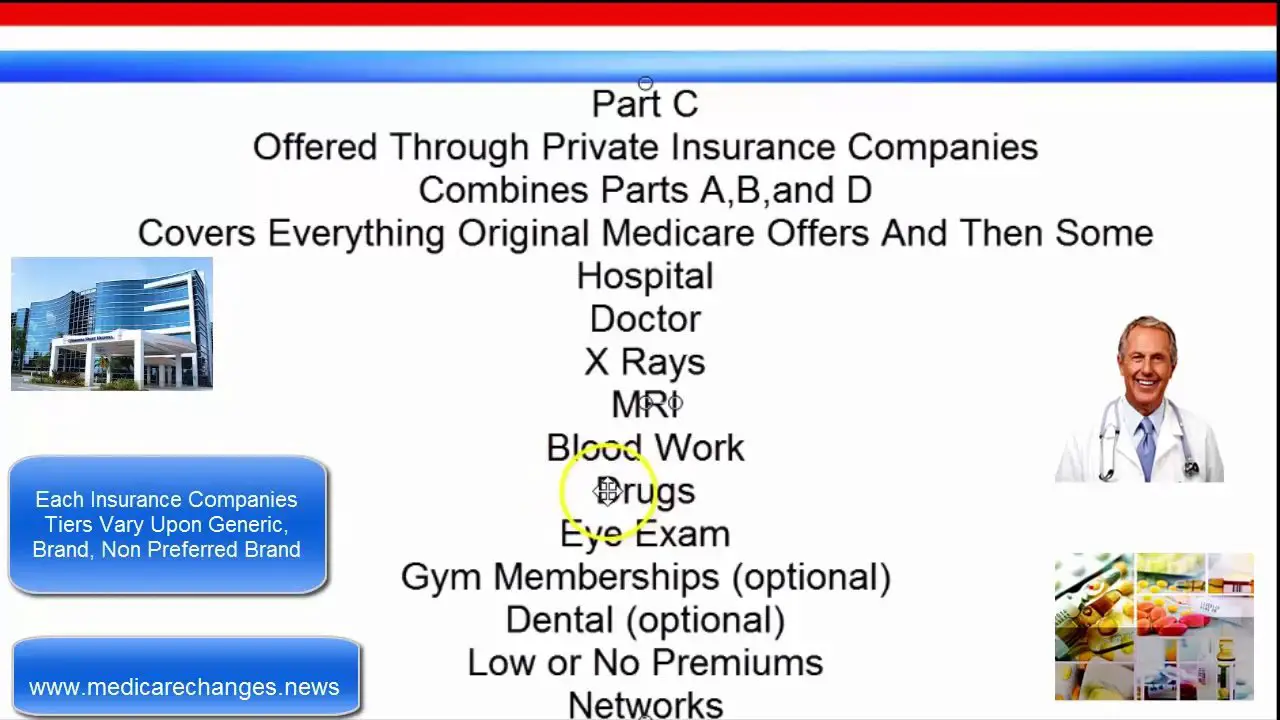

Medicare Part C Coverage

As an alternative to purchasing Part A and Part B, some participants receive Medicare benefits through Part C, which is commonly known as Medicare Advantage. Instead of the federal government providing healthcare coverage, Medicare Advantages benefits are offered through private insurance companies that have been pre-approved by Medicare.

One of the benefits of choosing Medicare Part C is that many of these plans provide Part D coverage as well. This enables participants to have all of their healthcare needs covered under one healthcare plan.

Although each plan provides different coverages, another benefit is that all Part C plans must provide the same coverages offered under Original Medicare parts A and B. However, some will offer additional benefits related to services and supplies not typically covered by Medicare .

MORE ADVICE Discover more tips for comfortably aging in place

Also Check: How To Qualify For Medicare And Medicaid

Ways To Find Out If Medicare Covers What You Need

Does Medicare Part A Cover 100 Percent

For a qualifying inpatient stay, Medicare Part A covers 100 percent of hospital-specific costs for the first 60 days of the stay after you pay the deductible for that benefit period. Part A doesnt completely cover Days 61-90 or the 60 lifetime reserve days you can use after Day 90. After 60 days, you must pay coinsurance that Part A doesnt cover.

For hospital expenses covered by Part B, you have to pay 20 percent coinsurance after meeting your annual deductible. Part A and B are collectively known as Original Medicare and work hand-in-hand to help cover hospital stays. Alternatively, some people opt to use Part A in conjunction with employer medical insurance for hospital coverage.

Recommended Reading: Why Is My Medicare So Expensive

What Is Covered Under Medicare A

Medicare Part A is commonly referred to as hospital insurance because its primary function is to help older adults manage the cost of hospital bills. Medicare Part A covers some expenses you incur at what you think of as a traditional hospital, but it also covers similar inpatient services in semi-private rooms at similar facilities, including:

- Acute care hospitals.

- Long-term care hospitals.

- Inpatient care as part of a qualifying clinical research study.

Regardless of the facility used, hospice care is covered by Medicare Part A if you are terminally ill and accept palliative care for comfort instead of treatment for your illness. Some home health care is covered as well.

Short-term care in a skilled nursing facility or nursing home may also be covered by Medicare Part A if its a doctor-approved treatment for a medical condition stemming from an inpatient hospital stay.

As a part of treatment in Medicare-approved facilities, Medicare Part A covers meals, general nursing and drugs that are part of your inpatient treatment as well as surgery and lab tests.

What does Medicare Part A cover and not cover based on your status as a patient? If, for example, you need chemotherapy, Part A will cover it if its administered as a part of an inpatient hospital stay if its done on an outpatient basis, Part A wont cover it .

How To Enroll In Medicare Part A

If you believe you would benefit from Part A coverage and qualify for it, the final step is the Part A enrollment process. If you are near the Medicare eligibility age of 65, its crucial to understand how your Initial Enrollment Period works.

Your IEP begins three months before the month you turn 65. The IEP is open for a total of seven months and allows you to enroll in Medicare Part A and Part B. During your IEP, and after you enroll in Part A and Part B, you can choose to add coverage like Part D or enroll in a Medicare Advantage plan that replaces Parts A and B.

What extra benefits and savings do you qualify for?

Also Check: Does Medicare Cover Any Weight Loss Programs

What Does Medicare Supplement Plan F Pay For

Medicare Supplement Plan F is the only plan that covers all Medicare Supplement insurance benefits. The following are the benefits available with Medicare Supplement plans. Yes means that Plan F covers 100% of this benefit.

| Medigap Benefits | ||

|---|---|---|

| This plan covers the annual Part B medical insurance deductible, which is $203 in 2021.3 | ||

| Part B excess charge | Yes | A provider who doesnt accept the Medicare-approved amount for a covered service as full payment can charge you extra. Medicare Supplement Plan F is one of the few plans that covers this charge |

| Foreign travel exchange up to plan limits | 80% | This benefit has a lifetime limit of $50,000 to help pay the costs for certain emergency care you receive outside the U.S. after youve paid a $250 annual deductible. |

| Out-of-pocket limit | N/A | Some Medigap plans have an annual out-of-pocket limit that you must meet before the plan begins to pay all the costs for covered services. This doesnt apply to Medigap Plan F. An out-of-pocket limit is different from a deductible. |

How Do Medicare Part A Premiums Work

Once you turn 65, youll either be eligible for premium-free Part A, or you can choose to pay Part A premiums if you havent worked long enough to earn premium-free coverage.

The amount you owe will depend on how long you or your spouse worked and paid Medicare taxes:

| $471 per month |

You have the ability to go without buying Part A and only purchase Part B. But, often, if you decide to buy Part A, you will need to have Part B and to pay monthly premiums for Parts A and B.

Also Check: How Do I Change Medicare Supplement Plans

How Much Does Medicare Supplement Plan N Cost

The premiums associated with Medicare Supplement plans differ by location and insurance company. As a general reference, in 2021, a non-smoking 65-year-old woman living in Floridas 32162 ZIP code would pay between $124 and $182 for Medicare Supplement Plan N monthly premiums.1

But how do companies set these prices? They use one of three price rating systems to set premiums:

There can be a wide variance in cost. Differences may exist based on whether or not the insurance company selling the policy offers discounts or uses medical underwriting.

Pro Tip: When shopping for a Medicare Supplement policy, always compare apples to apples. You want to be make certain you are comparing a Medigap Plan N from one company to a Medicare Plan N from another company. You dont want to compare Plan N at one company to Plan B at another because you wont get a clear comparison between the prices and benefits.

Want an easy way to shop for Medicare Plan N prices? Start comparing Medigap plans with HealthMarkets!

Do You Need More Than Part A For Hospital Coverage

While Part A covers a significant portion of a typical hospital bill and usually provides coverage for U.S. citizens age 65 and older without a monthly premium, your bill could still be costly without other coverage.

Part B of Original Medicare helps cover the medical portion of hospital bills. Part B usually does require a monthly premium.

Enrolling in Part A and B of Original Medicare opens the options for you to add a Medigap supplemental plan to help with Part A deductibles and coinsurance.

Those with Part A and B can switch to a Medicare Advantage plan from a private insurance company that replaces Original Medicare and provides the same coverage as Parts A and B while offering additional coverage.

Also Check: Does Medicare Supplement Cover Drugs

Home Health Care Benefits

Home health care provides a range of health care services in your home for an illness or injury. Services could include wound care, patient and caregiver education, intravenous or nutrition therapy, injections, or monitoring serious illness and unstable health.

Home health care can help you regain your independence, become as self-sufficient as possible, maintain your current condition or level of function, get better, or slow decline.

It is also usually less expensive, more convenient, and as effective as the care you receive in a hospital or Skilled Nursing Facility . Usually, a home health care agency coordinates the care your doctor orders for you.

Your home health care is Medicare-eligible when you:

- You have Medicare Part A.

- You are under the care of a doctor and are receiving services under a plan of care created and reviewed regularly by a doctor.

- Your doctor must certify that you need intermittent skilled nursing caresuch as blood drawn. Or physical therapy, speech-language pathology, or continued occupational therapy. Read the additional criteria for when youre eligible for these services and when Medicare covers them.

- The home health agency caring for you is Medicare-certified.

- A doctor certifies that you are homebound. This means that you cannot leave your home without substantial effort. Or it is medically unadvised that you leave home without the help of another person, transportation, or special equipment.

What Home Health Care is Covered?