Aarp Medigap Costs In States Where Age Affects Pricing

In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it’s $209 for those aged 85.

For Plan K, our recommendation for a cheap Medicare Supplement plan, the monthly costs range from $58 to $98.

AARP/UnitedHealthcare price increases are based on what it calls an enrollment discount.

- From age 65 to 68, policyholders are given a 39% discount.

- Then, the discount is reduced by three percentage points each year until age 81.

- After age 81, you’ll pay the standard rate without any additional age-related price changes.

This pricing structure is unique to AARP, and sample Medigap policies from Humana have a steady 3% increase each year.

Data notes:

- Plan G and Plan N have the standard benefits of their plan letter, but coverage is limited to in-network providers for some health care services, including hospitalization.

- Based on estimates for a female nonsmoker in Dallas, Chicago and Charlotte, N.C.

Medical Benefits Under Aarp Medicare Advantage Plans From Unitedhealthcare

While AARP Medicare Advantage Plans from UnitedHealthcare come in a variety of forms, most of them offer prescription drug coverage. Additionally, many AARP United Healthcare Medicare Advantage Plans offer the following medical benefits:

- $0 copays for in-network primary care provider visits

- $0 copay for many lab tests

- $0 prescription drug copays for most common prescription medications

- $0 copay to speak to an in-network healthcare provider using 24/7 telehealth services

These benefits are not available in all plans. You can check the specific plan details of the policies in your region using the official AARP website for Medicare plans.

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

Selecting a plan with a low or no annual premium can be important. But it’s also essential to check on copay and coinsurance costs, especially for expensive hospital stays and procedures, to estimate your possible annual expenses. Since care is often limited to in-network physicians and hospitals, the quality and size of a particular plans network should be an important factor in your choice.

Also Check: Does Medicare Offer Gym Memberships

Understanding Medicare Part D Prescription Drug Coverage

An animated white speech bubble appears over an animated character’s green and white head.

ON SCREEN TEXT: What is a Medicare Part D Plan?

The character and speech bubble separate and exit the screen on opposite sides. Blue text appears above a sheet of paper.

ON SCREEN TEXT: Medicare Part D plans are…

The paper and text slide up. Blue text appears, along with blue and white pill bottles.

ON SCREEN TEXT: Stand-alone plans that provide prescription drug coverage.

A bottle covers the text and turns over as pills pour out of it.

ON SCREEN TEXT: Part D plans cover certain common types of drugs as regulated by the federal government, but each plan may choose which specific drugs it covers.

The text disappears as the camera moves down to show another sheet of paper.

ON SCREEN TEXT: The list of drugs a plan covers is called a formulary.

Text appears on the paper.

ON SCREEN TEXT: Part D plans do not cover:

ON SCREEN TEXT: Drugs that aren’t on the plan’s formulary

ON SCREEN TEXT: Drugs that are covered under Medicare Part A or Part B

The text is crossed out with a blue line as the page scrolls down.

ON SCREEN TEXT: Drugs that are excluded by Medicare

More text is crossed out with a blue line. After the page scrolls down, the last chunk of text is crossed out with a blue line. The screen swipes down and white text appears on a blue background.

ON SCREEN TEXT: Medicare Made Clear® by UnitedHealthcare

What Is Not Covered By Medicare Part D Plans

The drugs you take may not be covered by every Part D plan. You need to review each plans drug list, or formulary, to see if your drugs are covered. The following will not be covered:

- Drugs not listed on a plan’s formulary

- Drugs prescribed for anorexia, weight loss or weight gain

- Drugs prescribed for fertility, erectile dysfunction, cosmetic purposes or hair growth

- Prescription vitamins and minerals

- Non-prescription drugs

- Drugs that are already covered by Medicare Part A and Part B

You May Like: How To Apply For Part A Medicare Only

No Surprises Just Great Coverage

Medicare Parts A and B only cover some of your health care costs. That’s where Medicare Supplement Insurance comes in. Medigap plans cover some of the costs not covered by Original Medicare, like coinsurance, copayments and deductibles.

96% of members surveyed are satisfied with the customer service.2

Endorsed by AARP

The only Medicare Supplement plans endorsed by AARP.

3 These offers are only available to insured members covered under an AARP Medicare Supplement Plan from UnitedHealthcare. These are additional insured member services apart from the AARP Medicare Supplement Plan benefits, are not insurance programs, are subject to geographical availability and may be discontinued at any time. None of these services should be used for emergency or urgent care needs. In an emergency, call 911 or go to the nearest emergency room. Note that certain services are provided by Affiliates of UnitedHealthcare Insurance Company or other third parties not affiliated with UnitedHealthcare.

Peace of mind, choice of my own doctors, reasonable cost.

Hugo H., AARP Medicare Supplement Planholder

Does Aarp/united Healthcare Insurance Offer Medigap Policies

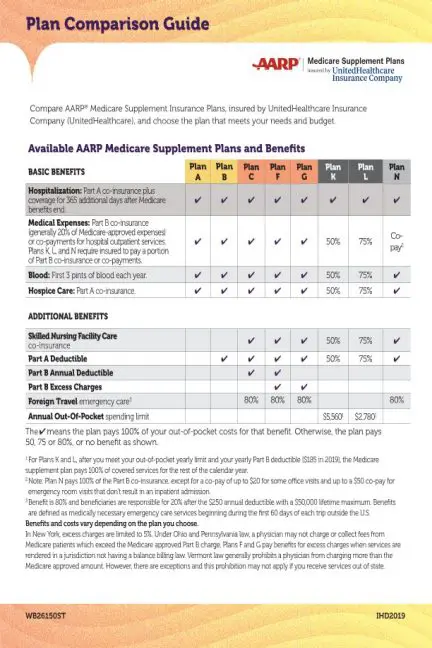

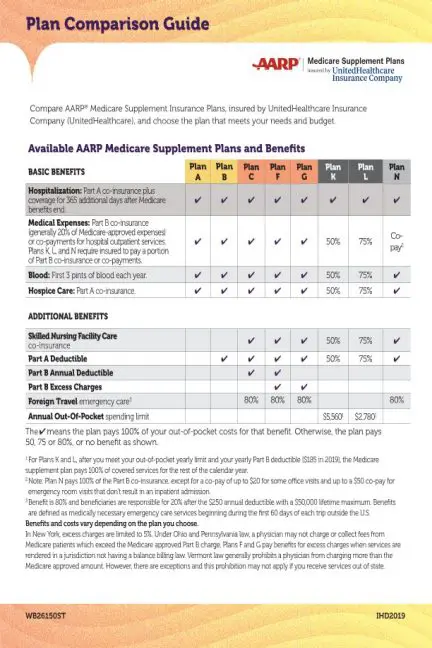

AARP/UnitedHealthcare Insurance sells all eight Medicare supplement plans, plus high deductible F and G). Not all plans are available in all states, territories or counties. You can plug your Zip Code into this AARP website and determine which plans are available to you and how much each will cost.4

You May Like: Will Medicare Pay For Cialis

Have Additional Questions Call Unitedhealthcare At 1

These are additional services, apart from the AARP Medicare Supplement Plan benefits, are not insurance programs, are subject to geographic availability, and may be discontinued at any time.

Administered by Optum for UnitedHealthcare. None of these programs should be used for emergency or urgent care needs. In an emergency, call 911 or go to the nearest emergency room. Participation is voluntary. The information provided through these services is for informational purposes only. Your health information is kept confidential in accordance with the law. None of these programs are a substitute for your doctors care. Nurses, wellness coaches, and other representatives from these programs cannot diagnose problems or recommend treatment. All decisions about medications, vision care, and health and wellness care are between you and your health care provider. Consult your physician before beginning an exercise program or making major changes in your diet or health care regimen. The YMCA or fitness center rates may vary by location.

These services are not an insurance program and may be discontinued at any time.

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance Company. UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

What Insurance Company Offers The Best Medicare Supplement Plan G For 2021

Medicare Supplement Insurance benefits are standardized by the federal government. That means Medigap Plan G purchased through AARP will feature the same basic benefits as a Plan G purchased through a different carrier.

The only thing that differentiates one Plan G from another is the cost and any extra incentives the carrier may offer in exchange for your enrollment such as SilverSneakers membership or discounts for multiple policyholders form the same house which some insurance companies may offer.

Recommended Reading: Does Aarp Medicare Supplement Insurance Cover Hearing Aids

Is An Aarp Plan Right For You

If the cost of copays, coinsurance, and deductibles not covered by Medicare causes you concern, an AARP plan may be the thing you need to help with your health care costs.

To enroll in AARP supplement plans, you must first become an AARP member. You can fill out the AARP application online.

If you have more questions about AARPs supplement plans, you can contact AARP to get answers.

Coverage Including Exclusions Or Limits

For an individual to qualify for a Medigap plan with the AARP, they must become a member. AARP membership $12 the first year, and then $16 annually.

When someone has an AARP Medigap plan, they can use any Medicare-approved doctor or healthcare provider across the U.S.

Medicare standardizes the coverage for each Medigap plan. The table below shows some of the benefits covered through the AARP Medigap plans. A person can check the complete coverage details for all AARP plans online.

| Benefit |

|---|

| 50%Plan K |

Plans K and L have annual limits that a person must reach before the insurer begins to pay. In 2021, Plan Kâs out-of-pocket limit is $6,220, and the out-of-pocket limit for Plan L is $3,110.

Read Also: What Age Do You Apply For Medicare

Medicare Plus Medigap Supplemental Insurance Policies

About two-thirds of the 61 million seniors and disabled Medicare beneficiaries choose Original Medicare, Parts A and B, which cover hospitals, doctors, and medical procedures. About 81% of these beneficiaries supplement their insurance with Medigap , Medicaid, or employer-sponsored insurance, and more than 25 million also pay for a stand-alone Medicare Part D prescription drug policy.

Medicare Supplement Insurance, or Medigap plans, are not connected with or endorsed by the U.S. government or the federal Medicare program.

While this may be the more expensive option, it has a few advantages. Both Medicare and Medigap insurance plans cover you for any hospital or doctor in the U.S. that accepts Medicare, and the great majority do. There is no need for prior authorization or a referral from a primary care doctor. Coverage includes the entire U.S., which may be important for anyone who travels frequently or spends part of the year in a different locale. This option is also attractive to those who have particular physicians and hospitals they want to use.

Alexa Just Turned 65 And Is Retiring From Her Job As A Banker She Lives In Hawaii And Doesnt Really Enjoy Traveling Out Of The State Alexa Is Very Healthy She Doesnt Have Any Major Health Conditions Alexa Is Also A Veteran And Has Va Benefits She Gets All Her Medications Filled Through Her Va Benefits

Alexa’s Medicare benefits wish list

- Access to a full range of health care services, including preventive care

- Access to specialists if she needs themshe’s comfortable with sticking to choices in a plan’s network

- Fitness, dental and vision benefits

- Wellness program and healthy habit rewards

Alexa’s Medicare coverage choice A Medicare Advantage plan with rewards for healthy habits.

- Fitness program at no additional cost

- Wellness rewards

- Network of local doctors and hospitals

- Out-of-pocket maximum of $3,200 in 2021 per year

Alexa’s Premium Costs

Don’t Miss: What Is Medicare Insurance Plans

General Features Of Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

- Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

- No network restrictions mean you can see any doctor who accepts Medicare patients.

- You don’t need a referral to see a specialist.

- Coverage goes with you anywhere you travel in the U.S.

- There is a range of plans available to fit your health needs and budget goals.

- Purchasing a Medigap plan and a Medicare Part D prescription drug plan could give you more complete coverage.

- Guaranteed coverage for life means your plan can’t be canceled.

As long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this plan.

For PA residents only: As long as you pay your premiums when due. You do not misstate one or more material facts when you apply for this plan. UnitedHealthcare has 2 years to act on misstatements. The 2 year limit does not apply to fraud.

Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs.

Karen Is About To Turn 65 And Is About To Retire She Doesn’t Take Any Prescription Drugs Currently And Is In Very Good Health Karen Also Likes To Travel Going To Different Us National Parks Every Summer And Fall She Is Retiring From Her Position As Ceo Of A Global Software Company With A Very Strong Savings And Annual Pension Karen Is Not Concerned About Out

Karen’s Medicare benefits wish list

- Access to doctors and hospitals throughout the United States

- Basic medical insurance

- Original Medicare

Karen’s Medicare plan features

- Access to doctors and hospitals throughout the United States

- Basic medical and hospital insurance

Karen’s Premium Costs

Monthly Part B premium

$148.50

|

Monthly Part B premium |

$148.50 |

|---|

Karen’s monthly premium costs will be $148.50 since she pays nothing for Part A.

Karen’s other costs & cost-sharing Karen’s Medicare coverage only works for health care items and services covered by Medicare Part A and Part B. Karen will be responsible for any out-of-pocket costs that are not covered by Medicare Part A or Part B per Original Medicare cost-sharing terms. And because Karen did not get a Part D prescription drug plan or any other additional coverage, she will be 100% responsible for any costs related to health items and services not covered at all by Medicare Part A or Part B.

Don’t Miss: Does Medicare Pay For A Caregiver In The Home

Matt Is About To Turn 65 And Lives In Texas He Is An Army Veteran With Veterans Administration Benefits Matt Enjoys Traveling Each Year To See His Four Grandchildren In Arizona And Wyoming He Is Retired With Good Savings But Wants To Make Sure He Leaves Each Of His Grandchildren Something Behind Matt Is In Good Health And Takes Only One Prescription Dailyfor Lowering His Cholesterol Matt Gets This Prescription And Any Others He Needs Through The Va

Matt’s Medicare benefits wish list

- Access to doctors and hospitals when he’s out of state

- Peace of mind knowing that he will have help paying for health care costs if they are high

Matt’s Medicare coverage choices

- Original Medicare

- Medicare supplement insurance plan

Matt’s Medicare and Medigap plan features

- Access to doctors and hospitals throughout the United States

- Help with costs not paid by Original Medicare

- A yearly out-of-pocket limit of $3,110 in 2021

Matt’s Premium Costs

|

Monthly Part B premium |

$148.50 |

|---|---|

|

Monthly Medicare supplement Plan L premium |

$110 |

|

Monthly Part B premium |

$148.50 |

|---|---|

|

Monthly Medicare supplement Plan L premium |

$110 |

|

Monthly total |

$258.50 |

Matt’s monthly premium costs will be $258.50 total.

Matt’s other costs & cost-sharingMatt’s Medicare supplement insurance plan will help with the costs of his Original Medicare services, but he will still have some out-of-pocket costs to cover. His costs will vary based on the service he receives. His Medicare supplement plan will pay 100% of covered services for the rest of the calendar year once the out-of-pocket limit is met. Matt will also be responsible for the costs of services and items not covered by Original Medicare or his Medicare supplement insurance plan.

Matt’s VA costs are not included as part of this example and will be separate from his Medicare costs.

Aarp Medicare Plans: Medicarecomplete Or An Aarp Medicare Supplement

The word is out. It just doesnt make sense to enroll in Medicare and not seek additional coverage. Whether you choose a Medicare Advantage Plan or go with a stand alone Part D Drug Plan and a Medicare Supplement, AARP Medicare Plans are worth taking a look at.

Original Medicare entails too much financial responsibility for most people. Medicare was never intended to provide 100% protection from financial exposure due to health related claims, but rather a safety net.

Medicare Part A offers protection from hospital stays, but your share of the cost is high.

- 2013 Part A hospital deductible is $1184 .

- 61st through 90th day requires a $296 per day co-pay.

- 91st day and after $592 per day co-pay.

- Once lifetime reserve days are used, Medicare pays nothing.

Your responsibility for out-patient charges is also steep. Medicare covers 80% of allowable charges and you are responsible for 20% of the charges. Keep in mind that most medical procedures today are performed on an out-patient basis.

Read Also: How Does An Indemnity Plan Work With Medicare

What Costs Does Medicare Supplement Plan G From Aarp Cover

Medicare Supplement Plan G is almost the same as a Plan F policy. Both plans offer you comprehensive coverage and are among the most robust of all supplements sold by AARP . The only difference is that Plan G makes you pay the Medicare Part B deductible out-of-pocket.

Here’s a quick look at what costs Plan G covers:

Most supplements do not cover Part B Excess Charges. This is one of many reasons to consider A Plan G, particularly if you frequently have medical care needs. Excess Charges are extra expenses in addition to the Medicare-approved charge. Because Plan G covers Part B Excess Charges, all of the out-of-pocket costs are covered.

Plan G coverage details are the same no matter who you get the policy from, although costs and availability will vary by carrier. We recommend shopping around to find a price that works best for you.