What Is Catastrophic Coverage

Catastrophic coverage refers to the point when your total prescription drug costs for a calendar year have reached a set maximum level . At this point, you are out of the prescription drug donut hole and your prescription drug coverage begins paying for most of your drug expenses.

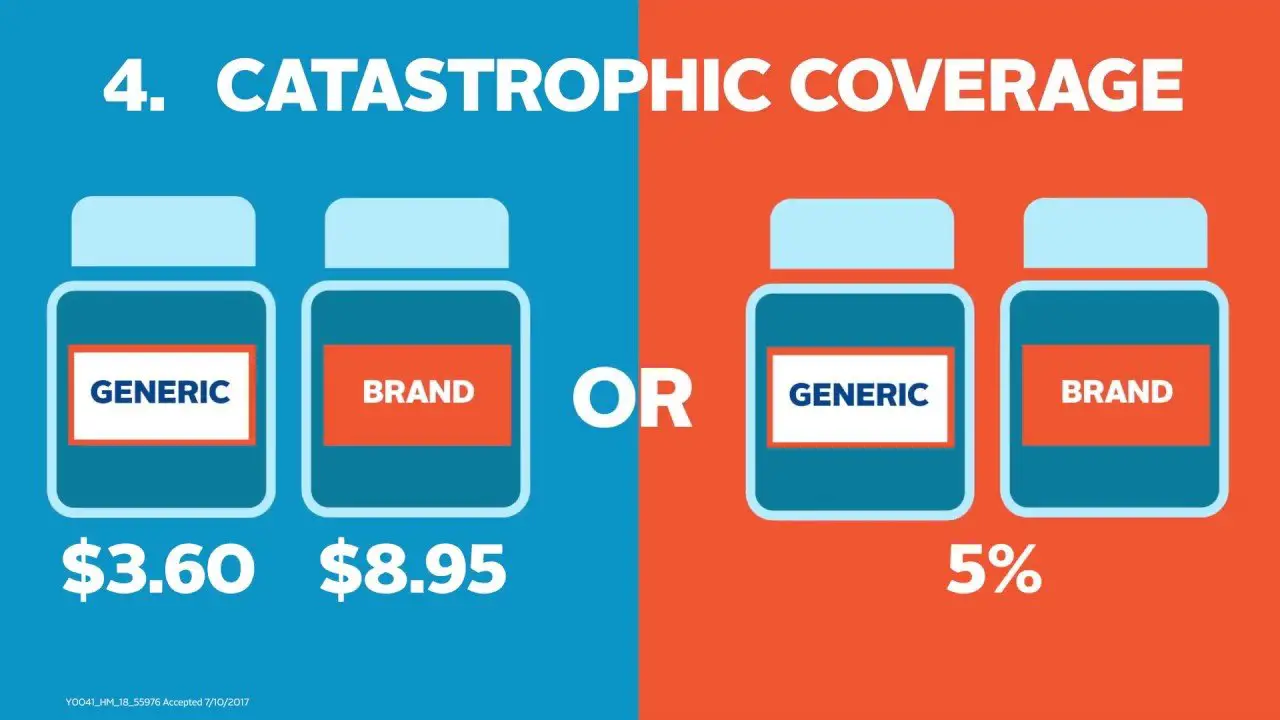

Once youve reached the catastrophic coverage threshold in 2021, youll pay $3.70 for generic drugs and $9.20 for brand-name drugs, or 5 percent of the total drug cost, whichever is higher .

But unlike most other types of health coverage, there is no out-of-pocket cap for Part D coverage . So although out-of-pocket costs drop to a much lower level once you hit the catastrophic threshold, they dont drop to zero. And if youre taking an expensive medication, even 5 percent of the cost can continue to add up to a significant amount of spending each month.

How Much Catastrophic Plans Cost

- Monthly premiums are usually low, but you cant use a premium tax credit to reduce your cost. If you qualify for a premium tax credit based on your income, a Bronze or Silver plan is likely to be a better value. Be sure to compare.

- Deductibles the amount you have to pay yourself for most services before the plan starts to pay anything are very high.

- For 2019, the deductible for all Catastrophic plans is $7,900.

- For 2020, the deductible for all Catastrophic plans is $8,150.

What Was The Medicare Catastrophic Coverage Act Of 1988

The Medicare Catastrophic Coverage Act of 1988 was a government bill designed to improve acute care benefits for the elderly and disabled, which was to be phased in from 1989 to 1993. The Medicare Catastrophic Coverage Act of 1988 was meant to expand Medicare benefits to include outpatient drugs and limit enrollees’ copayments for covered services.

Don’t Miss: Where Do I Get A Medicare Card

D Appeals And Grievances

Coverage Determinations and Exceptions

All Part D plans must have an appeal process through which members can challenge a denial of drug coverage. The Part D appeals process is based on and similar to the Part C appeals process.

Denials of drug coverage by a PDP or MA-PD are called coverage determinations. For example, a coverage determination may be issued by the plan if the drug is not considered medically necessary or if the drug was obtained from a non-network pharmacy. It is necessary to have a coverage determination in order to initiate an appeal. A doctors supporting statement is not required for this type of appeal, but it may be helpful to submit one. If the request for coverage is denied, the member may proceed to further levels of appeal, including redetermination by the plan, reconsideration by an Independent Review Entity , Administrative Law Judge review, the Medicare Appeals Council , or federal district court.

One type of coverage determination is called an exception request. An exception request is a coverage determination that requires a medical statement of support in order to proceed to appeal. There are two types of exceptions that may be requested:

Formulary Exceptions This type of exception is requested because the member:

- needs a drug that is not on the plans formulary,

- requests to have a utilization management requirement waived for a formulary drug).

What to do When a Drug is Denied at the Pharmacy

The Medical Statement

Grievances

What Is Part C Cost Sharing

Deductibles, copayments and coinsurance for Medicare Advantage plans can vary significantly and can be different than what you would pay in Original Medicare. Low or no-premium plans may charge more in cost sharing. You may pay additional charges if you receive treatment or services outside of your plans network. Medicare Advantage plans have a yearly limit on how much members will pay in out-of-pocket costs.

If you choose Medicare Advantage, its important to compare total costs including premiums, cost sharing, and out-of-network charges both among plans and versus Original Medicare. Cost sharing and benefits of the plan you choose can change from year to year so you need to evaluate coverage during every Medicare open enrollment period. Medicare.gov offers a tool to help compare Medicare Advantage Plans.9

Also Check: Does Medicare Pay For Private Duty Nursing

What Does That Mean

In the Catastrophic Coverage stage, youll pay only a coinsurance or copay for covered drugs for the remainder of the plan year. In the Catastrophic Coverage phase, you will pay the greater of a flat fee, or 5% of the plans negotiated retail drug cost for your formulary medications, depending on the type of drug.

On January 1st, your plan restarts again, and begins either at the Part D Annual Deductible stage, or in the Initial Coverage stage if your plan doesnt require a deductible.

Recent Articles And Updates

For older articles, please see our article archive.

References

The 2010 Medicare Part D $250 Donut Hole Rebate. Q1Group LLC, .

2020 Part D Income-Related Monthly Premium Adjustment. . .

2021 Medicare Part D Outlook. Q1Group LLC, .

2021 Part D Income-Related Monthly Premium Adjustment. . .

How Do Medicare Advantage Ppo Plans Work? Healthline Media, May 5, 2021, .

Analysis of Part D Beneficiary Access to Preferred Cost Sharing Pharmacies . . .

Announcement of Calendar Year 2021 Medicare Advantage Capitation Rates and Part C and Part D Payment Policies. . .

Assistance with Paying for Prescription Drugs. Center for Medicare Advocacy, November 30, 2015, .

How Medicare Part D Works. AARP, October 2016, .

Medicare Advantage Special Needs Plans . Healthline Media, May 3, 2021, .

Kirchhoff, Suzanne M. Medicare Coverage of End-Stage Renal Disease . . .

Read Also: How Much Does Dialysis Cost With Medicare

Eligibility For Part D

Anyone with Medicare is eligible to enroll in a Part D plan. To enroll in a PDP, the individual must have Part A OR Part B. To enroll in an MA-PD, the individual must have Part A AND Part B.

Enrollees must live in their plans service area. In the case of homeless persons, the following may be used as a permanent residence: a Post Office box, the address of a shelter or clinic, or the address where the person receives mail such as Social Security checks.

PDPs are usually national plans, but MA-PDs have delineated regions, sometimes by state, sometimes by counties within states ). For this reason, MA-PDs may not be appropriate for those who travel a great deal or who maintain summer and winter residences in different areas of the country. NOTE: Some MA-PDs offer passport plans that allow members to obtain benefits outside their normal service areas.

Individuals who reside outside the United States* are not eligible to enroll, but may do so upon their return to the country. Incarcerated individuals may not enroll in Part D, but they may enroll upon release from prison. Prior to 2021, people with end-stage-renal-disease could not enroll in an MA-PD. Starting in 2021, people with ESRD can enroll in Medicare Advantage plans during the annual Open Enrollment Period.

There are no other eligibility restrictions or requirements for Part D.

Can I Avoid The Donut Hole

The main way to not hit the coverage gap is to keep your prescription drug costs low so you dont reach the annual coverage gap threshold. And even if you do reach the gap, lower drug costs and forms of assistance may help you pay for prescriptions you still need, even if they arent covered at the time.

You May Like: What Insurance Companies Offer Medicare Supplement Plans

Can I Exceed Spending In Catastrophic Coverage

You will only pay 5% of the total cost of a drug while in the catastrophic coverage phase, a limit that can greatly reduce the co-payments for expensive brand-name drugs.

You cannot exceed spending once youve reached catastrophic coverage. This kind of health insurance is a way of letting you, the consumer, kick back on your heels a bit. Basically: Youve spent so much of your income on drugs this year why dont you sit back and let us take care of it until the new year?

What Are Medicare Part D Straddle Claims

In the context of Medicare prescription drug plans, straddle claims refer to circumstances in which someones cost for one prescription brings them from one phase of coverage to the next. Thus, the claim falls within two different coverage phases.

Because the donut hole is a coverage gap, a beneficiarys out-of-pocket costs arent so clear when theyre between phases. In these cases, your plan calculates what you owe for the prescription in question using the coverage gap discount and the prescription dispensing fee.

Also Check: Does Medicare Pay For A Rollator

How You Can End Up In Medicares Donut Hole And How You Get Out

Medicare prescription drug plans can have a coverage gapcalled the “donut hole”–which limits how much Medicare will pay for your drugs until you pay a certain amount out of pocket. Although the gap has gotten much smaller since Medicare Part D was introduced in 2006, there still may be a difference in what you pay during your initial coverage compared to what you might pay while caught in the coverage gap.

When you first sign up for a Medicare prescription drug plan, you will have to pay a deductible, which cant be more than $445 . Once youve paid the deductible, you still need to cover your co-insurance amount , but Medicare will pay the rest. Co-insurance is usually a percentage of the cost of the drug. If you pay co-insurance, these amounts may vary throughout the year due to changes in the drugs total cost.

Local Elder Law Attorneys in Your City

City, State

Once you and your plan pay a total of $4,130 in a year, you enter the coverage gap, aka the notorious donut hole. Previously coverage stopped completely at this point until total out-of-pocket spending reached a certain amount. However, the Affordable Care Act has mostly eliminated the donut hole. In 2021, until your total out-of-pocket spending reaches $6,550, youll pay 25 percent for brand-name and generic drugs. Once total spending for your covered drugs exceeds $6,550 , you are out of the coverage gap and you will pay only a small co-insurance amount. For more from Medicare on coinsurance drug payments, .

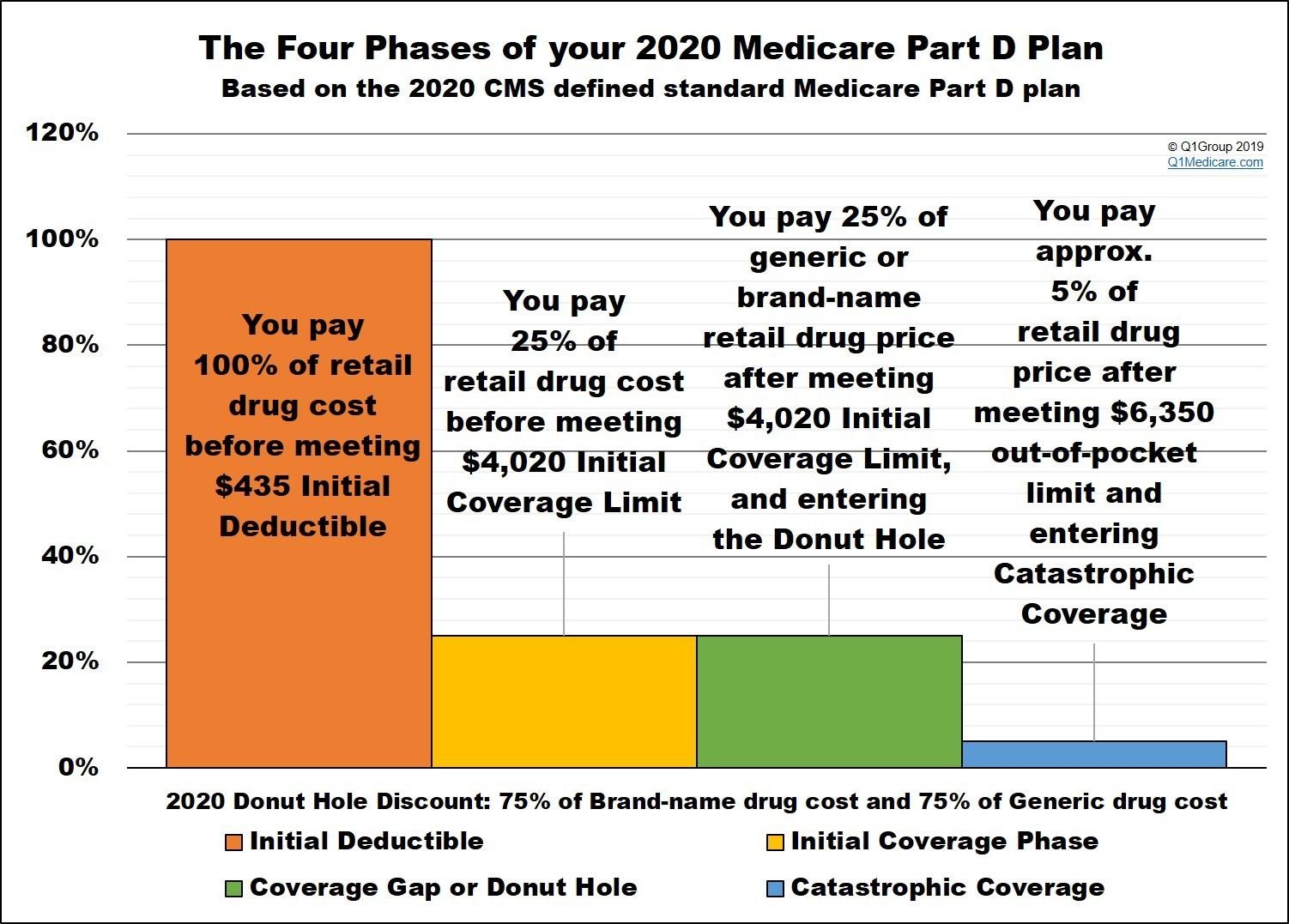

How Does The Medicare Donut Hole Work

Prescription drug coverage consists of multiple stages. The first stage starts when the year begins and involves reaching your deductible, which can be up to $445. You are responsible for paying 100% of this cost. Then, you reach the initial coverage stage, when youre only responsible for copayments. After the cost of drugs reaches $4,130, you fall into the donut hole.

While youre in the coverage gap, youll need to pay 25% of the cost of generic and brand-name drugs, until what you pay reaches $6,550. Catastrophic coverage kicks in when youre out of the gap, leaving you responsible for just 5% of your drug costs. This lasts until the end of the year when your coverage ends and your plan restarts. The monthly statements you obtain from your plan provider should show your current status regarding the donut hole.

- Consider Applying for Extra Help

Recommended Reading: How Do Zero Premium Medicare Plans Work

How Do You Choose A Medicare Part D Plan

The following factors may affect how you choose a Part D plan:

- Consider the medications you takehow many medications do you take, are they available as generics, do you have a chronic condition that requires specialty medications like insulin, nebulizers, etc.?

- If you want prescription drug coverage as part of a Medicare Advantage Plan, make sure you review the details of that drug coverageis it enough to cover your prescription needs?

- Standalone plans can differ among private insurers and offer various levels of drug coverage and different pharmacy networks.

- Review Part D plan options, considering monthly premium and other costs.

What Is Medicare Catastrophic Coverage

Catastrophic health coverage never had the best branding. It is, as its title suggests, available and helpful only in the case of true catastrophes. Ostensibly, catastrophic coverage should be used only rarely in the event of a major destructive life event like a cancer diagnosis or a car accident. Isnt it ironic, then, that Medicare Part D catastrophic coverage includes an increasing portion of Medicare Part D enrollees?

According to an analysis , the year 2019 saw 1.5 million Medicare Part D enrollees spend above the catastrophic coverage threshold. Over a ten-year period , 3 million Medicare Part D beneficiaries spent at least one year in catastrophic coverage.

Don’t Miss: What Is Humana Medicare Supplement Plan

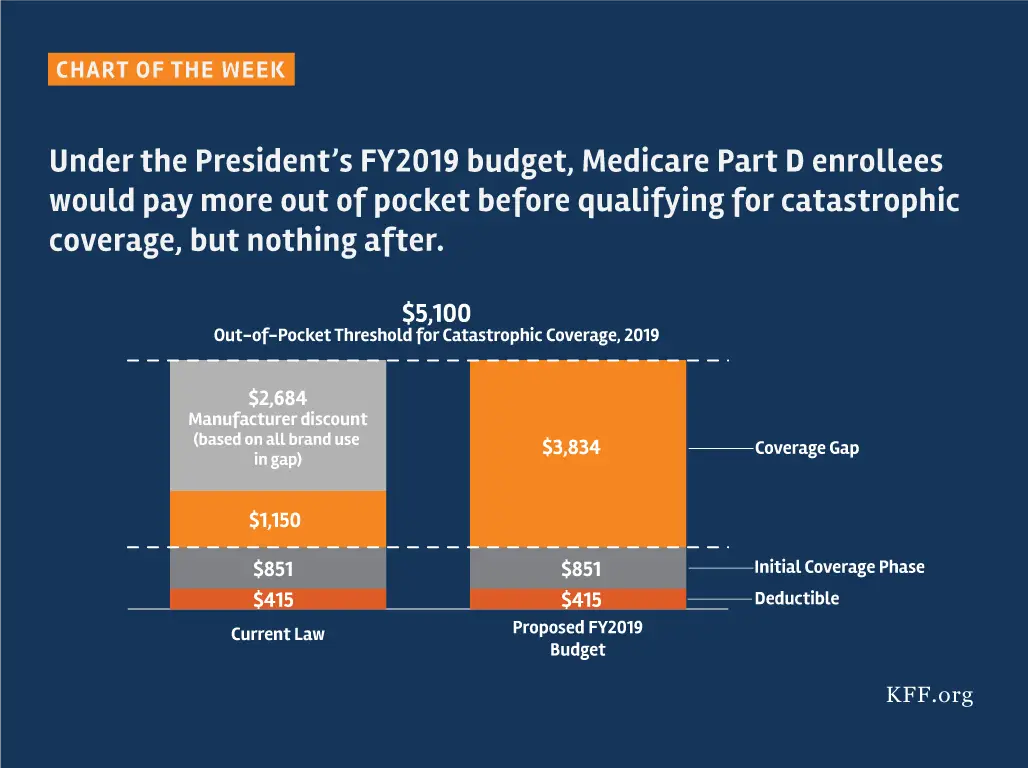

D Standard Benefit Design Parameters

| 2022 | |||

| Deductible –(after the Deductible is met, Beneficiary pays 25% of covered costs up to total prescription costs meeting the Initial Coverage Limit. | $405 | $480 | |

| Initial Coverage Limit – Coverage Gap begins at this point. . | $3,750 | ||

| Total Covered Part D Drug Spending including the Coverage Gap –Catastrophic Coverage starts after this point. | $7,508.75 | ||

| This is the Total Out-of-Pocket Costs including the Donut Hole. | $5,000 | $6,550 | $7,050 |

** Catastrophic coverage is when you will pay 5% of the cost of each drug, or $3.95 for generics and $9.85 for brand-name drugs .

How Do Medicare Part D Plans Work

A typical Part D plan has 3 phases and works like this:

- Deductible and Initial Coverage: The typical plan has an annual deductible. After you have paid costs equal to the deductible amount, then you have Initial Coverage. In this phase, you will only pay a copay or coinsurance on covered prescription drugs until you reach the Initial Coverage Limit, which starts the Coverage Gap.

- Coverage Gap: Also known as the donut hole. Here you pay a discounted amount for brand and generic drugs. Once your combined drug costs reach the upper level of the Coverage Gap, you move to Catastrophic Coverage.

- Catastrophic Coverage: You will pay a small amount for medications, typically not more than 5% of the cost. The plan pays most of the cost.

Also Check: How Do I Apply For Medicare In Ohio

How To Apply For Medicare Part D Drug Coverage

There are two ways you can get Medicare Part D coverage:

These plans, offered by private insurers, will add Part D drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee-for-Service plans, and Medical Savings Account plans.

In order to enroll in a separate drug plan, you must have Medicare Part A and/or Medicare Part B and live within the plans service area.

Once you choose to enroll in a drug plan, you can enroll with our Find a Plan tool – just enter your zip code and prescriptions to view Part D plans in your area. Other options include:

- On the plans website

- By completing a paper enrollment form

- By directly

- By

With an MA plan, youll get Part A, Part B and Part D coverage in one plan. MA plans offer the same coverage for services and supplies that Original Medicare does, as well as additional coverage such as dental, vision, hearing and prescription drug coverage.

You can also use our Find a Plan tool to compare your Medicare Advantage Prescription Drug plan options. Again, just enter your zip code and medications to view MA-PD plans in your area. You can also:

- Call the new plan and enroll over the phone

- Enroll on the plans website

- Complete a paper enrollment formNot all MA plans offer drug coverage, so be sure to do your research before selecting a plan.

Does Traditional Medicare Cover Cataracts

Cataract surgery is a common eye procedure. Its generally safe surgery and is covered by Medicare. While Medicare doesnt cover routine vision screening, it does cover cataract surgery for people over age 65. You may need to pay additional costs such as hospital or clinic fees, deductibles, and co-pays.

Recommended Reading: Must I Take Medicare At 65

After The Catastrophic Phase

Once a person meets the catastrophic threshold in their coverage, the cost of their prescription medications decreases for the rest of the year.

In 2021, individuals with Part D plans will pay a minimum of $9.20 for a brand-name medication and $3.70 for a generic drug , according to the Kaiser Family Foundation .

The above costs apply only to medications on a persons Part D plan drug list. People taking an uncovered medication will pay the drugs full cost, even in the catastrophic stage.

Some programs may provide assistance with costs. Different programs may have varied eligibility requirements, including income and asset limits.

Some programs that provide help and support include:

- State Pharmaceutical Assistance Programs: Individual states administer these programs. For this reason, programs work differently. For instance, some states provide help for people with certain conditions, such as HIV or AIDS, to pay for their prescription medications.

- Medicare Coverage Gap Discount Program: This program makes discounts from drug manufacturers available to people with Medicare Part D plans while in the coverage gap.

- Extra Help: The Extra Help program helps people with limited incomes pay for Part D costs, including deductibles, premiums, and coinsurance.

The Right Medicare Plan Can Save You Hundreds Of Dollars Each Month

See your options to find savings.

Key findings Among Medicare recipients 65 and older, men are more…

Updated: June 14th, 2021ByDan Grunebaum×

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Our mission is to provide information that will help everyday people make better decisions about buying and keeping their health coverage. Our editorial staff is comprised of industry professionals and experts on the ACA, private health insurance markets, and government policy. Learn more about our content.

Don’t Miss: How To Be Eligible For Medicare And Medicaid